- Walmart's Q1 2024 performance demonstrates robust growth across key segments, operational highlights include significant eCommerce sales growth, increased market share, and strategic marketplace expansions.

- Growth potential lies in eCommerce expansion, private brands, and international markets, fueled by strategic initiatives like mergers, acquisitions, and technological investments.

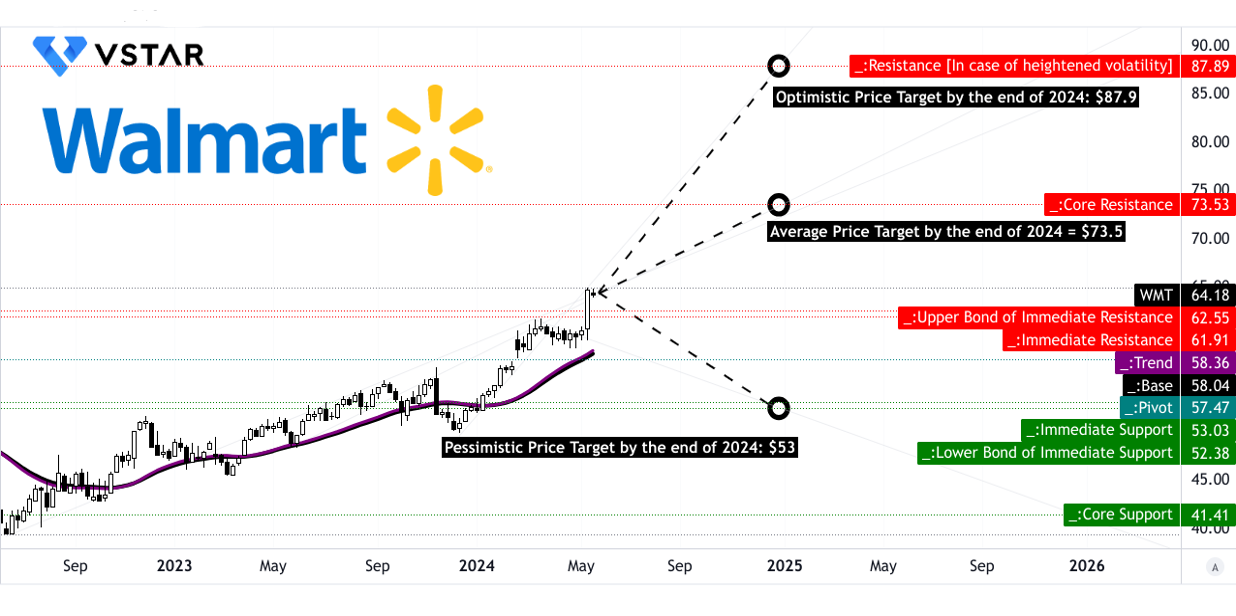

- Technical analysis forecasts an upward trend in Walmart stock price, with an average price target of $73.5 and potential upside.

- Competitive pressures from rivals like Amazon, Kroger, Costco, and Albertsons pose challenges to Walmart's market dominance.

I. Walmart Q1 2024 Performance Analysis

A. Walmart Key Segments Performance

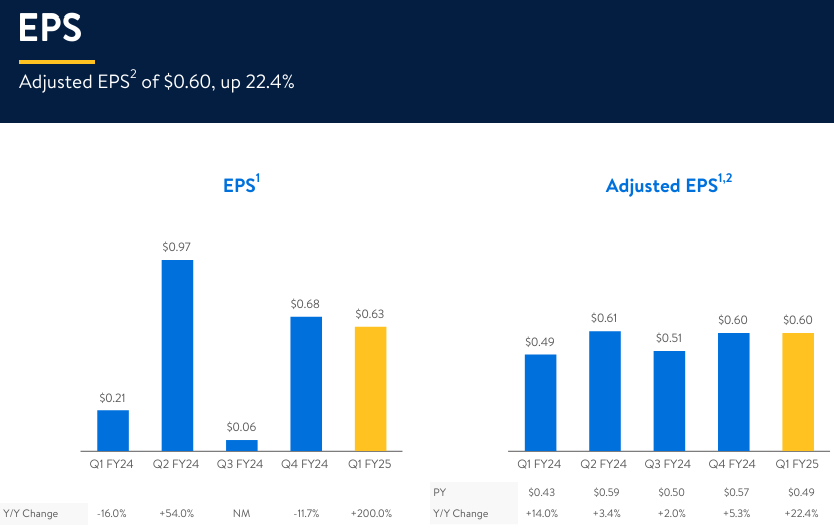

Financially, Walmart reported a 6.0% increase in consolidated revenue, reaching $161.5 billion, driven by strong sales across all operating segments. The company's operating income grew even faster at 9.6%, indicating improved operational efficiency and cost management. Adjusted EPS stood at $0.60, reflecting a solid performance despite challenges in the operating environment.

Source: Earnings Presentation (FY25 Q1)

Operational performance highlights include significant growth in eCommerce sales, up 21% globally, fueled by store-fulfilled pickup & delivery services and marketplace offerings. Walmart's focus on providing value and convenience resonates well with customers, leading to increased market share, particularly among upper-income households. The company's strategic emphasis on expanding its marketplace ecosystem, evidenced by a 36% increase in marketplace sellers in the U.S. and over 50% growth in Mexico, contributes to enhanced customer engagement and sales growth.

Under technological advancements, the introduction of Walmart Luminate, a data analytics and insights product, into Mexico and Canada underscores the company's commitment to leveraging technology for business expansion and customer-centric decision-making. Additionally, innovations such as generative AI-driven product search facilitate a more intuitive shopping experience for customers, driving higher conversion rates and customer satisfaction.

Walmart's balance sheet and liquidity position remain strong, with cash and cash equivalents of $9.4 billion and total debt of $50.1 billion. Inventory levels decreased globally, reflecting efficient inventory management practices and sustained strong sales performance. In Walmart U.S., sales growth was fueled by transaction counts and unit volumes, supported by a value-convenience proposition that resonates with customers. The company's emphasis on everyday low prices and a large number of rollbacks drives customer engagement and market share gains.

Walmart International witnessed double-digit sales growth, led by key markets such as Walmex, China, and Flipkart. Sam's Club U.S. demonstrated solid comp sales growth, driven by food and consumables categories, alongside increased membership income. Innovations such as Computer Vision-powered exit technology enhance operational efficiency and customer convenience, reflecting Walmart's commitment to leveraging technology for continuous improvement across its retail formats.

B. WMT Stock Price Performance

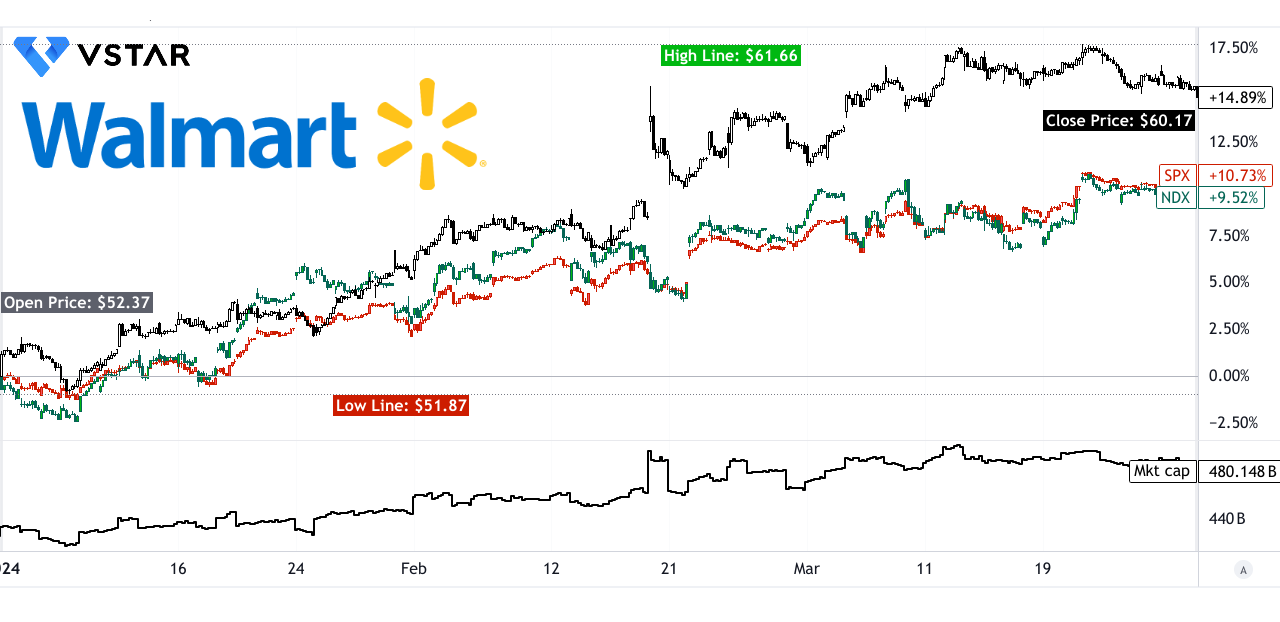

In Q1 2024, Walmart (NYSE: WMT) displayed robust performance, reflecting a 15% price return in its stock. With a market capitalization of $480.15 billion, Walmart opened at $52.37 and closed at $60.17, reaching highs of $61.66 and lows of $51.87 during the quarter. Comparatively, Walmart outperformed major stock market indices, with the S&P 500 (SPX) returning 11% and NASDAQ-100 (NDX) returning 10% over the same period.

Source: tradingview.com

II. Walmart Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with growth potential

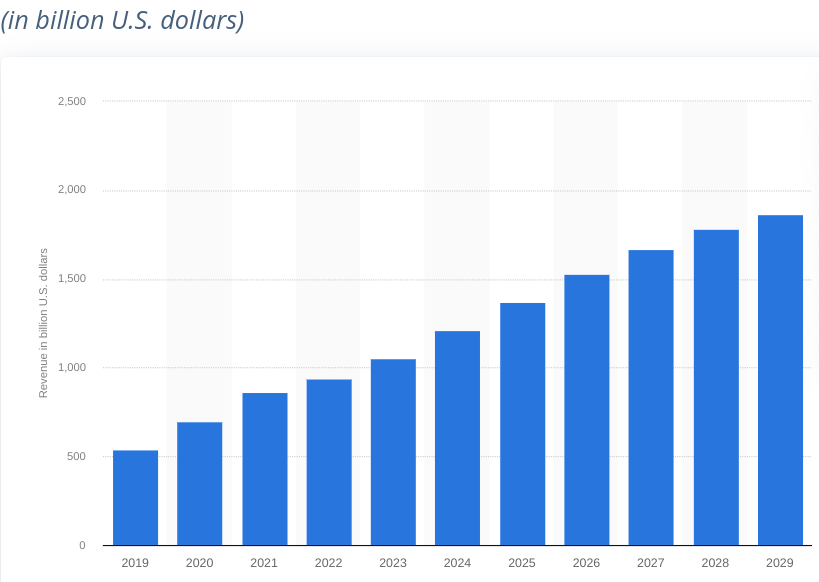

E-commerce Expansion: With the continuous growth of the e-commerce market, Walmart is poised to benefit from the increasing consumer shift towards online shopping. The company's strong e-commerce presence, highlighted by a 22% growth in the U.S. in Q1, demonstrates its ability to capture a significant portion of this expanding market.

[Revenue of the e-commerce industry in the U.S. 2019-2029]

Source: statista.com

Private Brands and Innovation: Walmart's focus on private brands, exemplified by the introduction of Better Goods, signifies its commitment to offering quality products at competitive prices. The emphasis on innovation, such as generative AI-driven product search and automated storage systems, enhances customer experience and operational efficiency, driving both sales and cost savings.

International Expansion: Walmart International's double-digit growth in sales and profit, driven by markets like Walmex, China, and Flipkart, showcases its global growth potential. The company's investment in same-day delivery services and marketplace expansions further solidify its position in key international markets.

B. Expansions and strategic initiatives

Mergers and Acquisitions: Walmart's acquisition of Flipkart and strategic partnerships in international markets underscore its commitment to expanding its global footprint and tapping into emerging market opportunities. Additionally, the expansion of data analytics and insights product Walmart Luminate into Mexico and Canada enhances its capabilities and competitiveness.

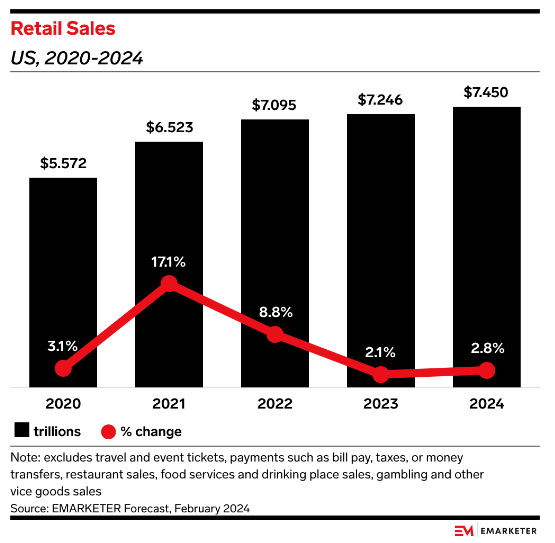

Investments in Technology and Automation: The implementation of automated storage and retrieval systems and AI-powered solutions not only improves operational efficiency but also enhances customer experience. These investments align with Walmart's goal of driving innovation and staying ahead in the rapidly evolving retail landscape. Here, EMARKETER projects US retail sales to hit $7.450 trillion. It is a 2.8% increase YoY.

Source: emarketer.com

Focus on Membership Programs: Walmart's focus on membership programs, such as Walmart+ and Sam's Club memberships, reflects its strategy to build customer loyalty and drive recurring revenue streams. The continued growth of these programs indicates their success in attracting and retaining customers, further bolstering Walmart's financial performance.

Expansion of Marketplace: Walmart's marketplace expansion, highlighted by a 36% increase in sellers in the U.S. and strong growth in international markets, diversifies its product offerings and drives incremental sales. The integration of marketplace fulfillment services and initiatives like same-day delivery for marketplace orders enhances customer convenience and satisfaction.

III. Walmart Stock Price Prediction 2024

A. WMT Stock Forecast: Technical Analysis

The average Walmart price target by the end of 2024 is $73.50, based on the momentum of change-in-polarity projected over Fibonacci retracement/extension levels. This suggests a potential increase in value. The optimistic WMT price target of $87.90 is even more bullish, relying on the upward price momentum of the current swing over the mid- to short-term, projected over Fibonacci levels. Conversely, the pessimistic WMT price target of $53.00 is based on the downward price momentum of the current swing projected over Fibonacci levels, suggesting a potential decline.

The current stock price of Walmart stands at $64.18, with a trendline and baseline of $58.36 and $58.04 respectively, indicating an upward direction in the stock price. The primary support at $62.55 and the pivot of the current horizontal price channel at $57.47 indicate levels where buying pressure could potentially increase. Conversely, the core resistance at $73.53 and support at $52.38 indicate levels where selling pressure could increase, potentially driving the stock price in either direction.

Source: tradingview.com

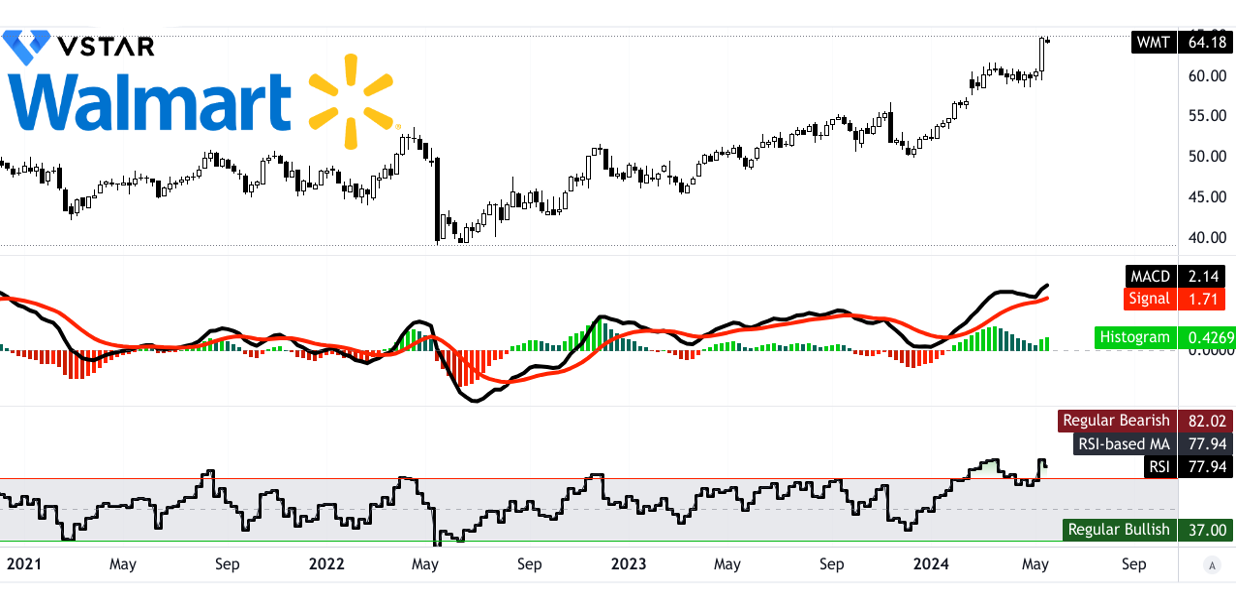

The Relative Strength Index (RSI) value of 77.94 suggests that the stock is currently overbought. While the RSI line trend is upward, the bearish divergence indicates a potential reversal in price. This signifies a cautious stance, as the stock might be due for a correction in the near future. The Moving Average Convergence/Divergence (MACD) indicator further supports the bullish trend, with the MACD line exceeding the signal line and a positive histogram indicating increasing strength in the trend.

Source: tradingview.com

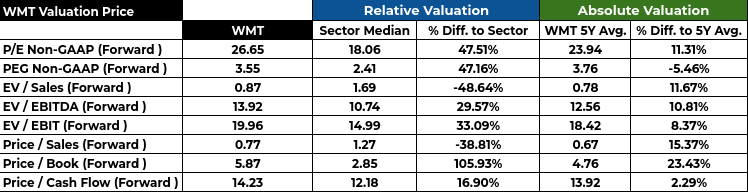

B. Walmart Stock Projection: Fundamental Analysis

Fundamental analysis assesses Walmart's intrinsic value using financial ratios. The Price-to-Earnings (P/E) ratio, comparing stock price to earnings per share, indicates that Walmart's forward P/E of 26.65 exceeds the sector median of 18.06, suggesting a premium valuation. Similarly, the Price/Earnings to Growth (PEG) ratio, comparing P/E to growth rate, highlights a similar overvaluation. Other metrics like EV/EBITDA and Price/Book also suggest Walmart is relatively overvalued compared to its historical averages and industry peers.

Source: Analyst's compilation

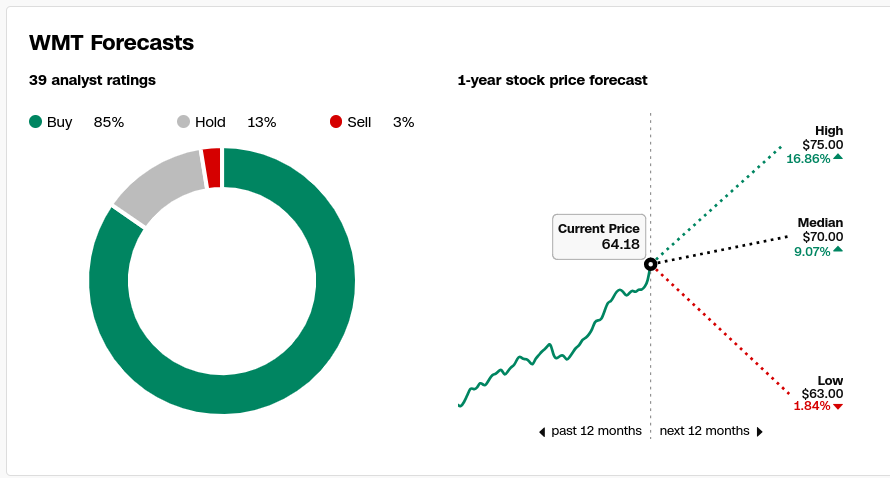

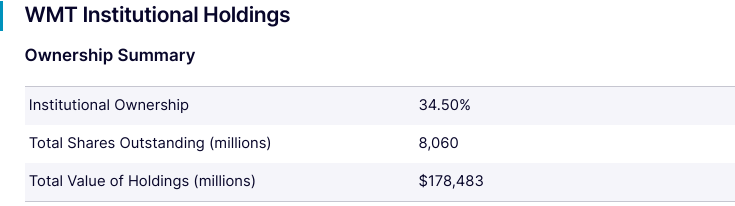

C. Walmart Stock Prediction: Market Sentiment

Market sentiment, as gauged by analyst recommendations and price targets, provides additional insights. Analyst ratings show a predominantly positive outlook, with a majority favoring 'Buy' or 'Overweight' ratings. The median Walmart price target of $70.00 exceeds the current price of $64.18, indicating potential upside. Additionally, institutional holdings reflect continued confidence in Walmart, with institutions holding a significant portion of outstanding shares (34.50%) still retail investors control the majority of the holdings. This signifies the volatility in the stock price.

Source: CNN.com

Source: Nasdaq.com

Short interest, representing investors betting against Walmart stock, is relatively low at 0.78% of total shares outstanding, suggesting limited negative sentiment among investors. The low days to cover ratio implies any short squeeze potential is minimal.

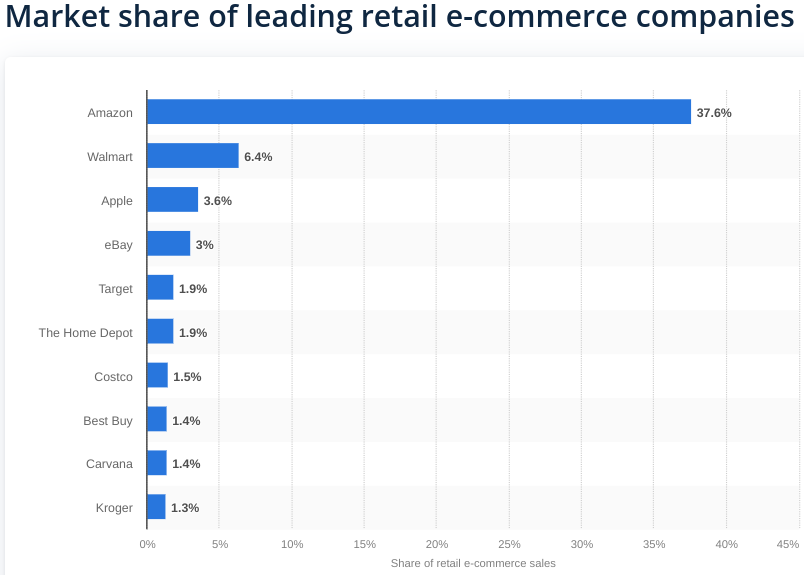

IV. Walmart Stock Predictions 2024: Challenges & Risk Factors

One of the primary challenges facing Walmart is its competition with e-commerce giant Amazon. Despite Walmart's significant market share in retail, Amazon's dominance in the online space poses a threat. Amazon's extensive reach and technological innovations continually reshape consumer expectations, making it essential for Walmart to invest in its e-commerce capabilities to remain competitive. With Amazon capturing 37.6% of the U.S. online retail market in 2023 compared to Walmart's 6.4%, Walmart must navigate strategies to bolster its online presence to counter Amazon's influence.

[Market share of leading retail e-commerce companies in the United States in 2023]

Source: Statista.com

Moreover, Walmart faces rivalry from traditional brick-and-mortar competitors like Kroger, Costco, and Albertsons. While Walmart has managed to increase its grocery market share in recent years (21.9% in 2021, 22.6% in 2022, and 23.6% in 2023), competitors like Kroger have experienced declines. However, Walmart cannot afford to be complacent, as these competitors may implement strategies to regain lost market share or introduce innovations that attract consumers away from Walmart. For instance, Costco has steadily increased its market share over the past three years.

Furthermore, there are other risks inherent in the retail industry that Walmart must address. Economic uncertainties, such as fluctuations in consumer spending and macroeconomic conditions (high inflation and interest rates), impacts Walmart's financial performance.

In conclusion, Considering Walmart's robust performance in Q1 2024, strong revenue growth, and strategic initiatives, including expansions in eCommerce, private brands, and international markets, Walmart stock is a buy. Trading Walmart stock CFDs through VSTAR could be a viable option for investors seeking exposure to Walmart's performance without owning the underlying asset. CFDs allow investors to speculate on price movements, potentially benefiting from both rising and falling prices.