- TSMC's Q3 2024 performance was bolstered by strong demand in smartphones and AI applications, resulting in a 12.8% sequential revenue growth.

- TSMC's 31.2% QoQ net income increase, driven by 57.8% gross margin improvements, reflects enhanced operational efficiency.

- Advanced technologies, such as the 3nm process, contributed 69% of wafer revenue, with significant growth in AI processors forecasted.

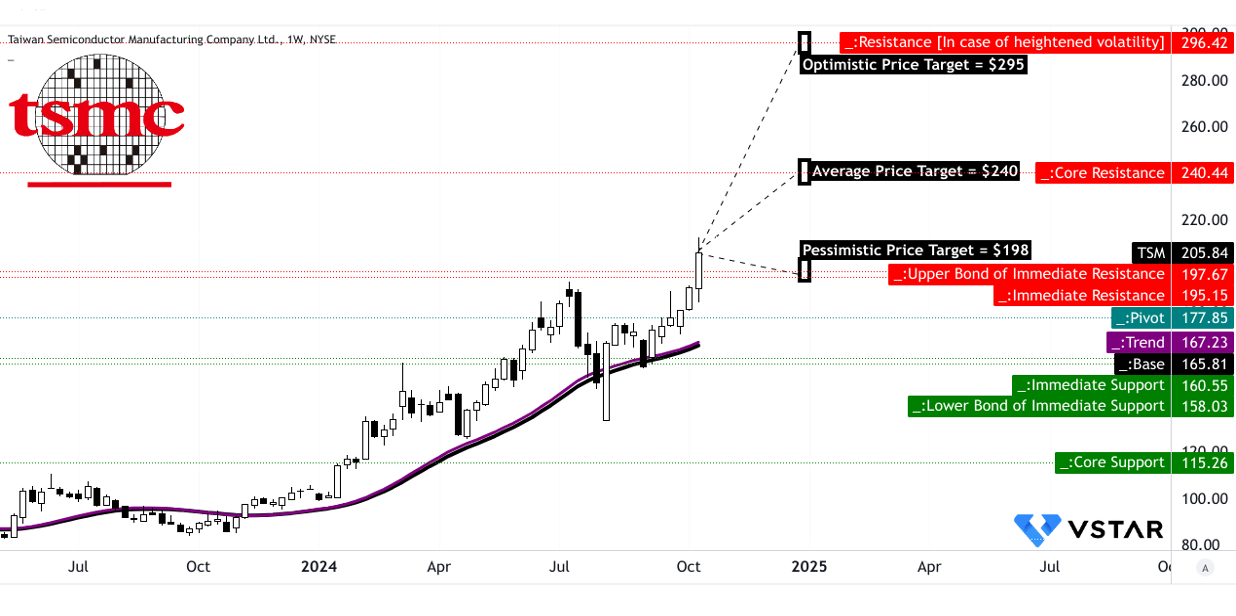

- For TSM stock, the average price target for 2024 is $240, with an optimistic target of $295.

I. TSMC Q3 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

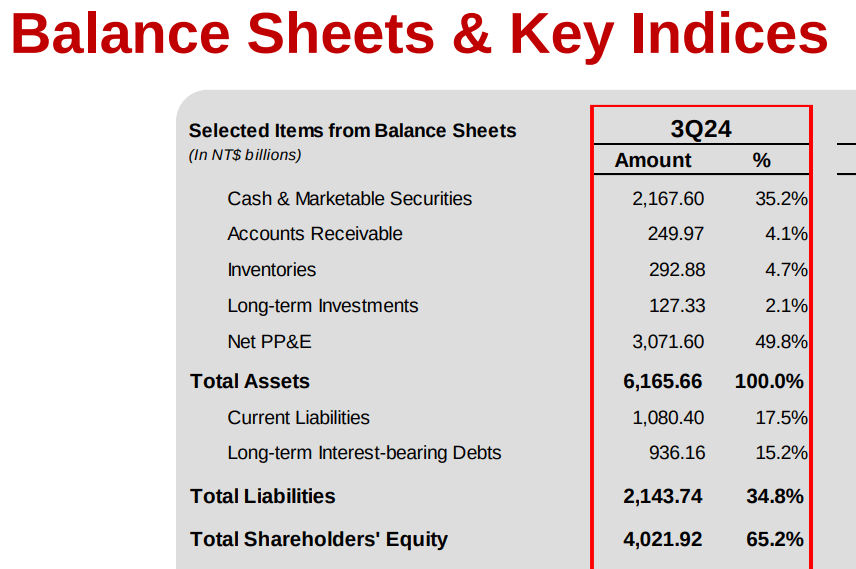

TSMC's financial performance in Q3 2024 showcased strong growth, with total revenue reaching NT$621.1 billion ($23.5 billion), marking a 12.8% sequential increase. The company benefited from heightened demand for smartphones and AI-driven applications. Net income surged to NT$325.26 billion ($12.3 billion), reflecting a 31.2% increase from the previous quarter and a substantial 54.2% year-over-year (YoY) growth. Earnings per share (EPS) stood at NT$12.54, while gross margin improved significantly to 57.8%, driven by increased capacity utilization and cost-efficiency efforts. Operating margin also saw a 5% QoQ rise, reaching 47.5%. TSMC maintained a robust balance sheet with cash reserves of NT$2.2 trillion, while reducing long-term debt by NT$38 billion. Cash flows were strong, with NT$392 billion generated from operations and NT$207 billion invested in capital expenditures, leaving the company with a cash balance of NT$1.9 trillion at the end of the quarter.

Source: TSMC 3Q24 Presentation

Operational Performance

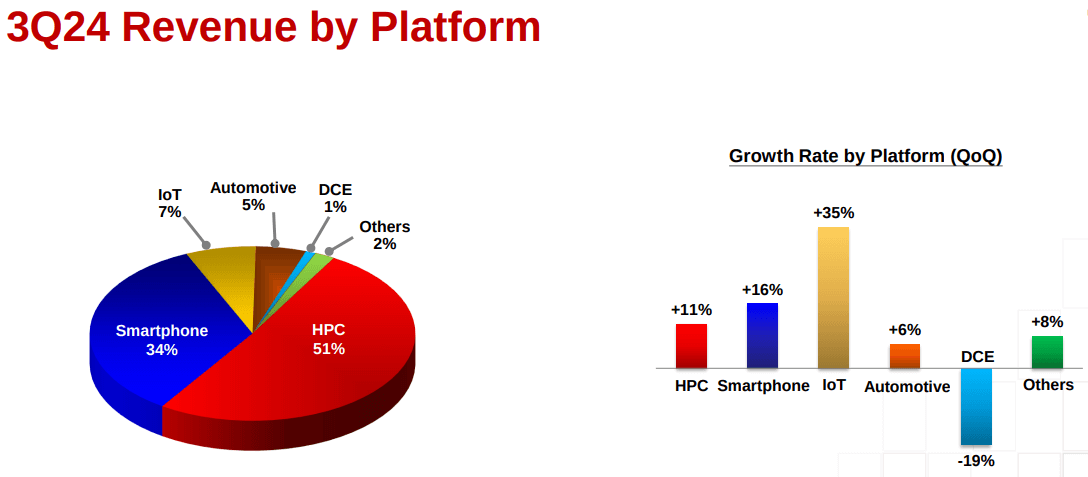

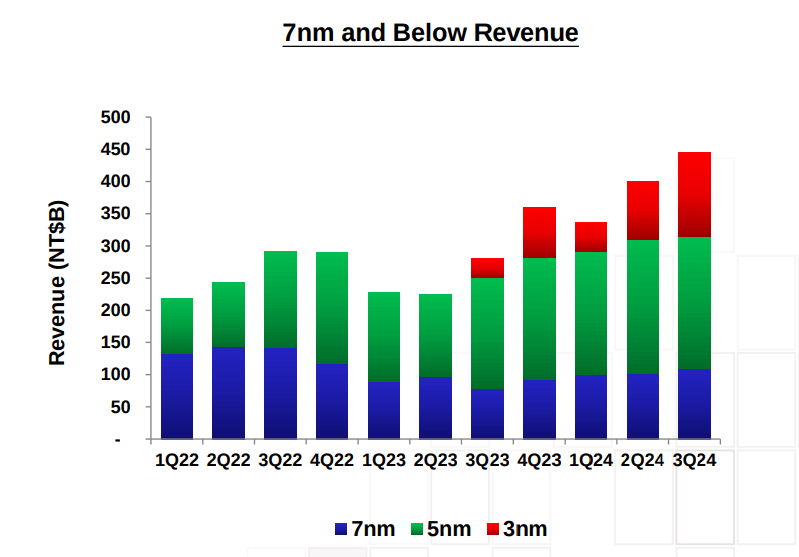

Operationally, TSMC's product mix continued to be dominated by advanced technologies. The 3nm process contributed 20% of wafer revenue, while the 5nm and 7nm processes accounted for 32% and 17%, respectively. In total, 69% of wafer revenue came from advanced technologies (7nm and below). By platform, High-Performance Computing (HPC) contributed 51% of revenue, smartphones 34%, Internet of Things (IoT) 7%, and automotive 5%. Geographically, North American clients provided the bulk of TSMC's revenue, accounting for 71%, followed by China (11%), Asia Pacific (10%), Japan (5%), and EMEA (3%). TSMC also strengthened its key partnerships, including an expanded collaboration with Amkor for advanced packaging in Arizona.

Source: TSMC 3Q24 Presentation

Technological Advancements and Innovations

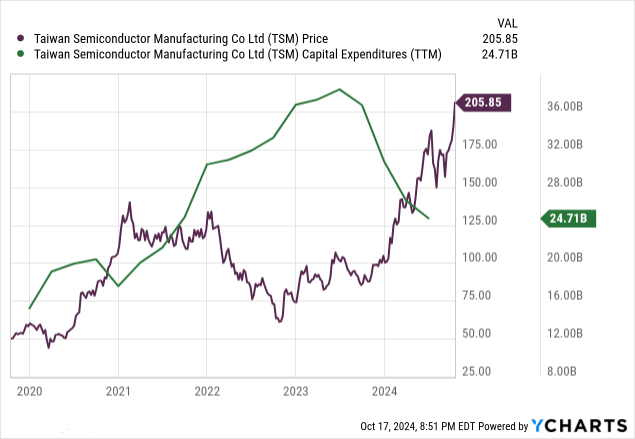

Technologically, TSMC made significant strides with its advanced manufacturing processes, especially in AI-related fields. The company's 3nm and 5nm nodes were pivotal in addressing the surging demand for AI processors, including GPUs and AI accelerators, a segment expected to triple its revenue share in 2024. TSMC continued its aggressive capital investment, with CapEx projected to exceed $30 billion, 70-80% of which will be directed toward advanced process technologies. These investments align with TSMC's strategic goal of maintaining its leadership in semiconductor innovation and scaling its operations to meet future AI and HPC demands.

B. TSM Stock Price Performance

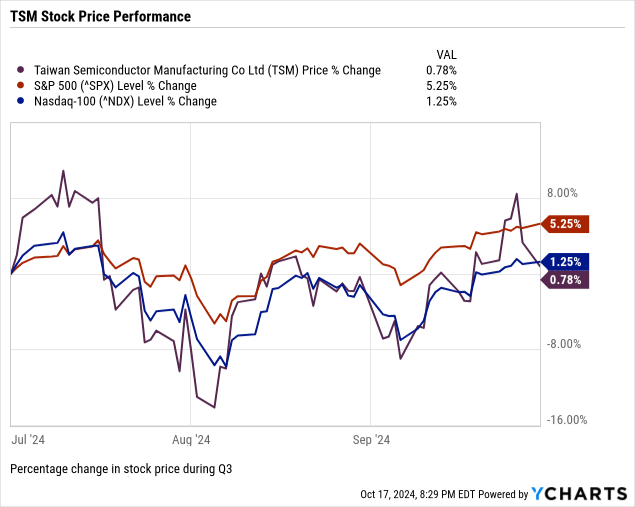

TSM stock price experienced modest movement in Q3 2024, opening at $174.24 and closing at $173.67, with a 0.78% decline. The stock peaked at $193.47 and hit a low of $133.57 during the quarter. TSM underperformed compared to broader indices, with the S&P 500 up 5.25% and the NASDAQ-100 rising 1.25%, reflecting weaker market sentiment despite strong company fundamentals.

Source: Ycharts.com

II. TSM Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

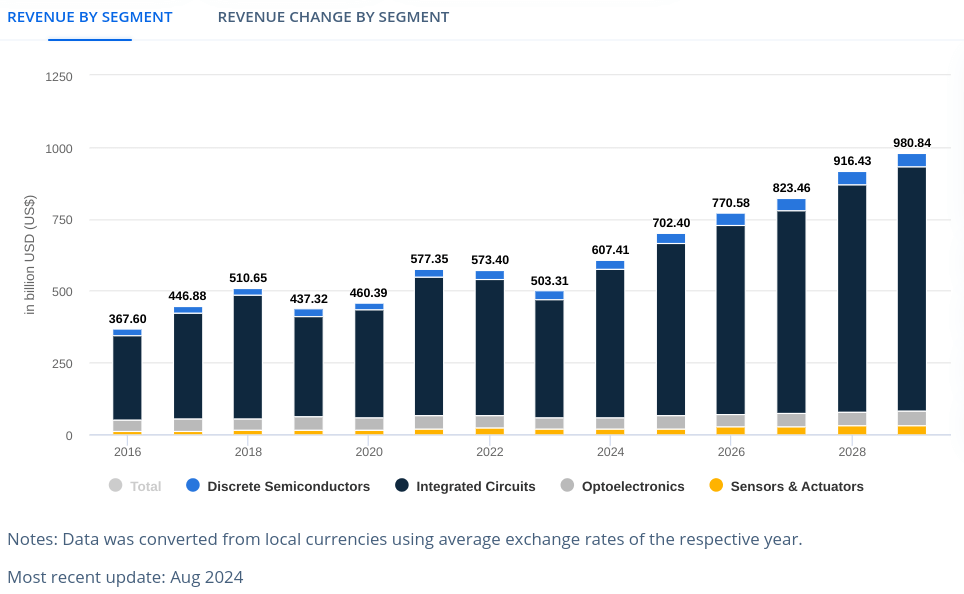

TSMC's future growth is expected to be driven by its leadership in advanced process technologies, particularly its 3-nanometer (N3) and 5-nanometer (N5) nodes. TSMC forecasts that revenue from server AI processors (GPUs, AI accelerators, and CPUs) will triple in 2024, contributing to mid-teens of total revenue. This surge in AI-driven demand is a result of growing AI adoption in industries such as data centers, healthcare, and automotive. Furthermore, the semiconductor market, expected to grow at a compound annual growth rate (CAGR) of 10.06% through 2029 (with AI market CAGR 2024-2030 is 28.46%), aligns well with TSMC's growth outlook. Segments such as high-performance computing (HPC), automotive applications, and AI-related technologies will be key drivers, with AI-related semiconductors alone projected to create a 30% demand increase for upstream components by 2026.

Source: statista.com

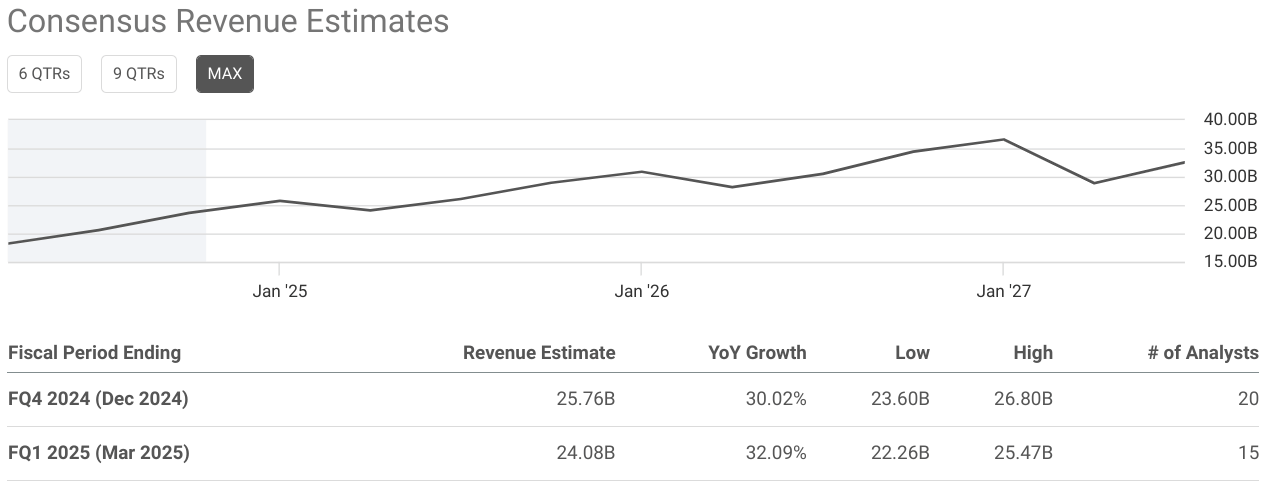

TSMC's Q4 2024 revenue guidance is between $26.1 billion and $26.9 billion, a sequential increase of 13% and a year-over-year rise of 35%. Gross margins are expected to improve slightly to 58%, and operating margins between 46.5% and 48.5%. Over the next several years, analysts' expect TSMC's robust revenue growth fueled by its advanced technologies, particularly from AI processors and HPC applications, projecting close to 30% revenue growth in Q4 2024 and Q1 2025.

Source: seekingalpha.com

B. Expansions and strategic initiatives

TSMC is expanding its global manufacturing footprint with several high-profile initiatives. Its Arizona fabs will utilize N4 and future N3 technologies, with the first fab set to begin production in early 2025, followed by the second and third fabs later in the decade. The Kumamoto fab in Japan will target specialty technologies for automotive and industrial clients, while the Dresden fab in Germany focuses on 12nm and 28nm technology for automotive and industrial applications. These expansions align with TSMC's strategy to secure a geographically diversified manufacturing base to support its growing customer demand globally.

Source: TSMC 3Q24 Presentation

TSMC is deepening its partnerships and collaborations to further strengthen its market position. The company recently expanded its collaboration with Amkor Technology to enhance advanced packaging capabilities in Arizona. In terms of R&D, TSMC is committing more than 70% of its fiscal 2024 capital expenditures—estimated at over $30 billion—toward advanced technologies, including N3, N5, and AI-related innovations, ensuring it maintains a competitive edge in cutting-edge chipmaking.

Source: Ycharts.com

III. TSM Stock Forecast 2024

A. Taiwan Semiconductor Stock Forecast: Technical Analysis

TSM is currently priced at $206, trading significantly above its trendline and baseline values of $167 and $166, respectively, based on a modified exponential moving average. The stock shows strong upward momentum, supported by a bullish trend in key technical indicators. The Relative Strength Index (RSI) sits at 70, approaching overbought territory, but neither bullish nor bearish divergences are evident. The MACD line of 11.20, above the signal line of 10.20, along with a positive histogram of ~1, signals a strengthening bullish trend.

Source: tradingview.com

Key support levels are established at $195 and $197, while the core resistance lies at $241, with potential for resistance at $296 during heightened volatility. The average TSM price target by the end of 2024 is $240, driven by mid- to short-term momentum, while an optimistic TSM stock price target of $295 reflects upward momentum within Fibonacci retracement levels. The pessimistic outlook estimates a drop to $198, based on potential downside momentum.

Overall, technical indicators support a bullish short- to mid-term outlook, although the RSI nearing overbought conditions and strong resistance at $241 may signal potential consolidation or correction if volatility increases.

Source: tradingview.com

B. TSM Stock Prediction: Fundamental Analysis

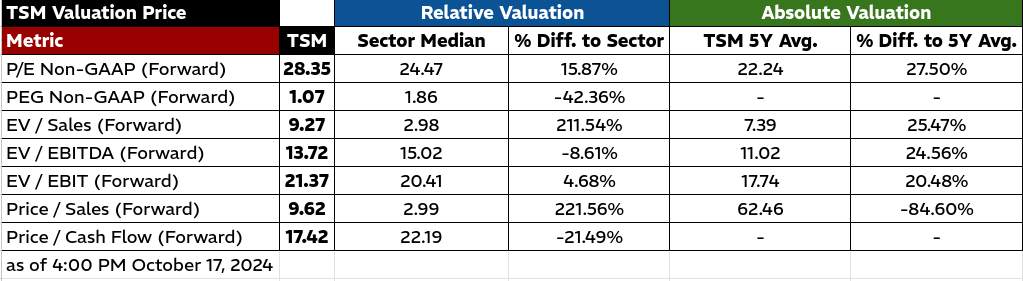

TSMC's financial ratios indicate both strengths and some valuation concerns:

TSMC's forward Price-to-Earnings (P/E) ratio stands at 28.35, higher than both the sector median of 24.47 (a 15.87% difference) and its five-year average of 22.24, reflecting a premium valuation driven by robust growth expectations. However, TSMC's Price-to-Earnings-Growth (PEG) ratio is 1.07, significantly lower than the sector median of 1.86, indicating that despite its higher P/E, the stock offers strong growth potential relative to its earnings growth. TSM's forward EV/Sales ratio of 9.27 surpasses the sector median of 2.98 by 211.54%, signaling a higher valuation relative to revenue. Its EV/EBITDA of 13.72, below the sector median of 15.02, indicates relatively better profitability compared to industry peers.

Source: Analyst's compilation

C. TSM Forecast: Market Sentiment

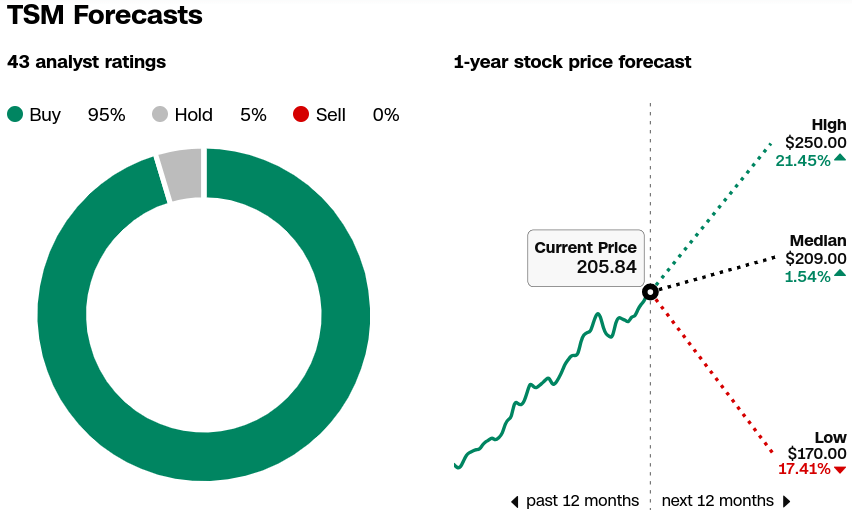

Analysts maintain a bullish outlook on TSM:

- Analyst Recommendations: Out of 43 analysts, 95% recommend a “Buy,” with 0% suggesting a “Sell.” The median price target is $209, an 2% upside from the current price of $205.84. The high target is $250, indicating a potential 21% gain, while the low target of $170 reflects a conservative downside of 17%.

Source: CNN.com

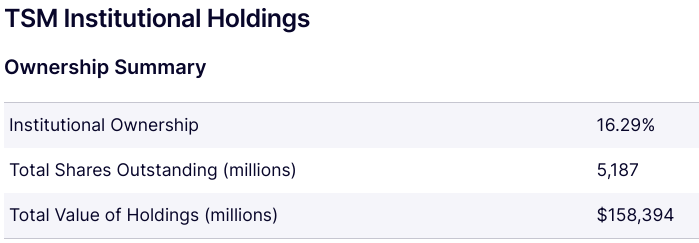

- Institutional Holdings: Institutional investors hold 16.29% of shares, valued at $158.4 billion, signaling confidence in long-term growth.

Source:Nasdaq.com

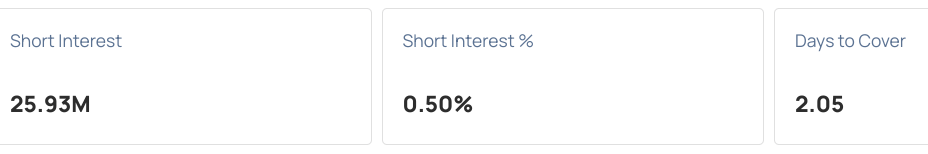

- Short Interest: At 25.93 million shares and a low 0.50% of total float, short interest remains minimal, suggesting a lack of bearish sentiment. The 2.05 days to cover is not alarming, reinforcing stability in investor sentiment.

Source: Benzinga.com

IV. TSMC Stock Forecast: Challenges & Risk Factors

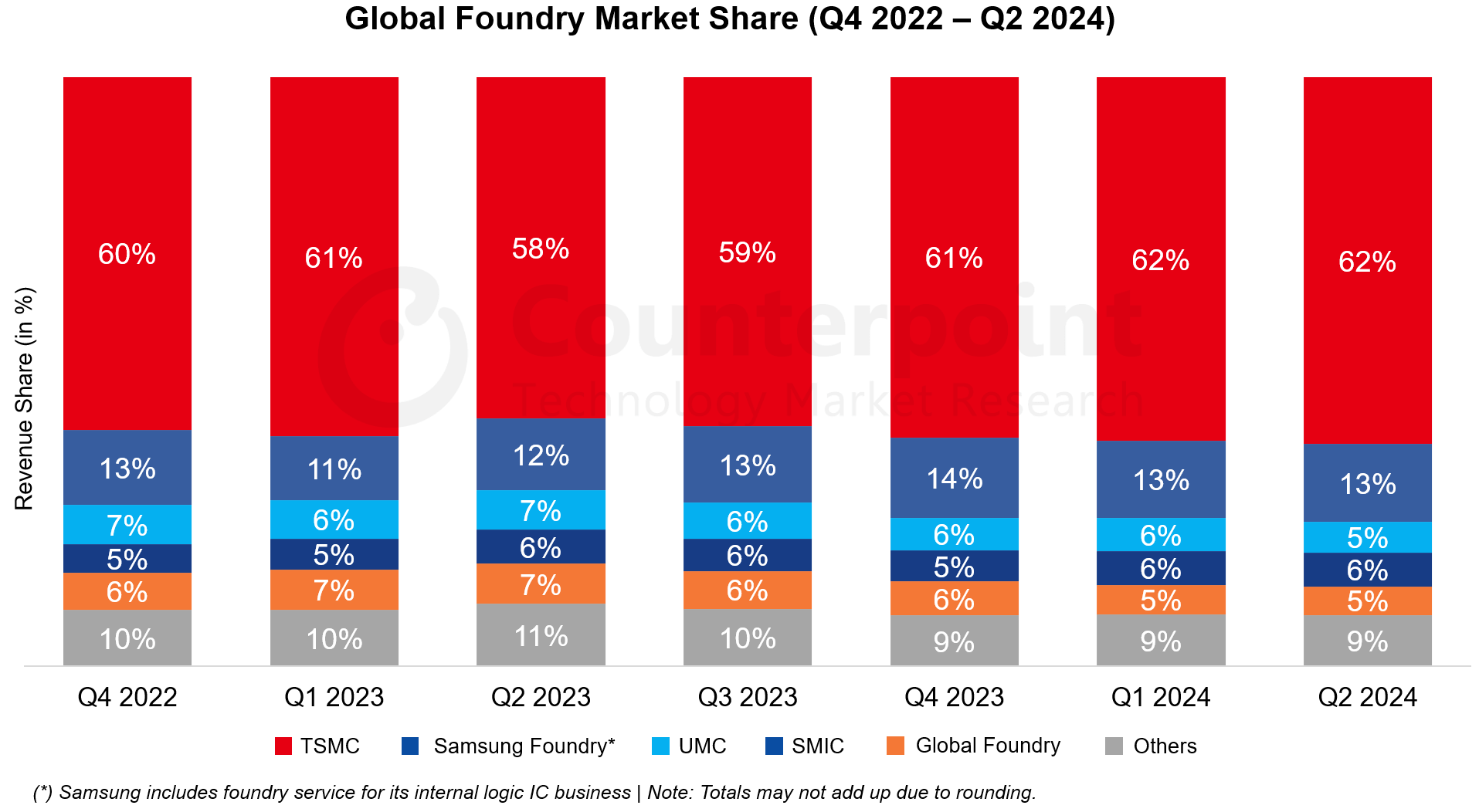

Competitors: TSMC faces significant competition from Samsung Electronics and Intel, both of which are heavily investing in advanced chip-making technologies. Samsung is TSMC's primary competitor in leading-edge nodes (3nm and 5nm), while Intel is working to reclaim its position in the foundry market with its Intel Foundry Services (IFS). These competitors are aggressively pushing for technological advancements and expanding production capacities, which may challenge TSMC's dominance in the semiconductor industry.

Source: counterpointresearch.com

Other Risks: TSMC's reliance on geopolitical stability is a major risk, given its manufacturing base in Taiwan and the growing tensions with China. Supply chain disruptions, rising production costs, and potential export restrictions also pose risks to TSMC's global operations. Furthermore, shifts in global semiconductor demand—particularly in consumer electronics and automotive sectors—could affect revenue growth.

In conclusion, TSMC remains a market leader in semiconductor manufacturing, driven by strong demand for its 3nm and 5nm technologies. With a projected revenue of $26.1–$26.9 billion for Q4 2024 and gross margins expected between 57%–59%, the TSM stock outlook is robust. However, competition and geopolitical risks could temper growth. For investors interested in CFD trading, platforms like VSTAR offer access to TSMC stock CFDs, enabling traders to speculate on TSMC stock price movements without owning the underlying asset.