- Palantir (PLTR) showed a 27.2% increase in quarterly earnings to $678.10 million in Q3.

- Palantir's machine learning and artificial intelligence capabilities have the potential to boost growth as businesses prioritize integrating AI significantly.

- Palantir Stock (PLTR) is trading within a bullish trend, where the ongoing buying pressure might extend above the 50.00 level by the end of 2024.

- Over 50% of Palantir's revenue comes from the government, signaling that changes in government policy and politics could affect its revenue.

I. Palantir Q3 2024 Performance Analysis

A. Key Segments Performance

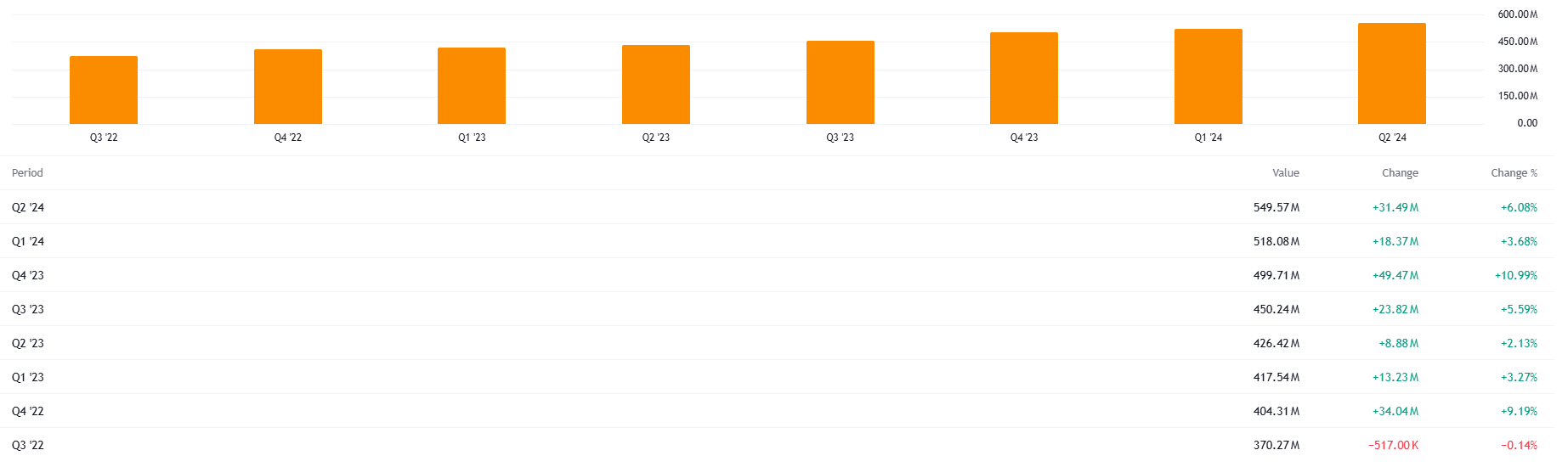

In the latest quarter, Palantir reported quarterly revenue of $678.10 million, a 27.2% increase from the same quarter in the previous year. Moreover, the quarter saw an analyst beat on billing estimates and remarkable guidance for the next quarter.

Earnings per share came at $0.09, beating the analyst's estimate of $0.08, representing an 11.81% growth.

The average EPS growth for the last 6 quarters was 11.58%, whereas the latest report was above the average growth.

The average GP Margin for the last 6 quarters was 24.21%, whereas the latest quarter showed a 31.49% increase in the EPS, which is above the average growth.

As per the latest report, Palantir reported a 20% year-over-year increase in revenue, reaching $500 million in Revenue in a single quarter.

In the revenue segment, the top contribution came from the Foundry section, which represents 60% of the total sales. Apart from this, there was significant growth in the commercial sector, resulting in 40 new customers and 300 total.

In the industry, Palantir holds the 10% market share of the data analysis business, indicating a moderate position against key competitors like Alteryx, IBM, Tableau, Splunk Inc., and Amazon Web Services (AWS).

B. PLTR Stock Price Performance

Palantir Technologies (PLTR) is a leading company that builds and deploys software platforms on operating systems. The company has commercial and government segments, which signals stable earnings momentum. Its current market capitalization is $92.74 billion, and it has over 3K employees worldwide.

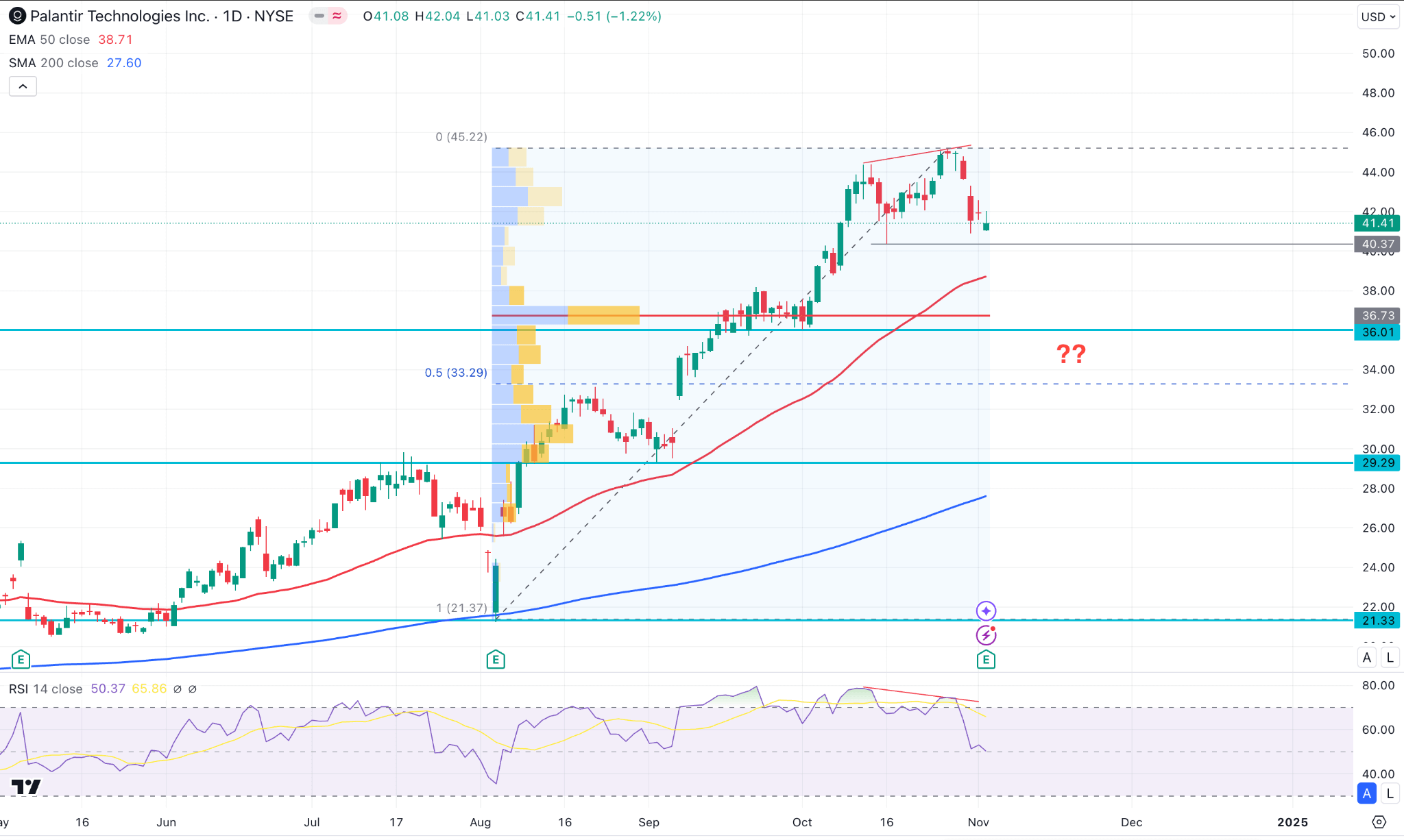

Looking at the stock price, the 3rd quarter showed a decent recovery, taking the price higher from $25.12 to $37.15 line.

PLTR experienced a time of volatility during Q3, peaking at $38.25 and falling to $21.33, but it eventually trended upward.

Over the quarter, the stock rose roughly 47.88%, demonstrating powerful investor confidence driven by encouraging prospective growth and revenue reports.

In contrast to stock market indices, PLTR performed better than the S&P 500, which witnessed gains of about 43.22% over the same time period. This superior performance highlights investor confidence regarding Palantir's growth plans and market position.

In comparison to the main market indices, PLTR had a strong third quarter of 2024, with notable stock price growth and a positive outlook.

II. PLTR Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

Analysts anticipate a year-over-year increase in the company's highest range in the upcoming quarter, fueled by robust business from new and existing clients, bolstering the Government and Commercial sections.

Under the revenue segment, Palantir's Foundry structure is becoming increasingly popular in the business community, especially in sectors like logistics, healthcare, and finance. Palantir is in a strong position to increase its market share as companies look for insights based on data to improve operations and make choices.

On the other hand, Palantir has strong growth prospects due to the ongoing need for its services in the defense and intelligence fields. Given the increasing expenditures in defense and national security technology, the company's solid ties with government organizations may result in more contract extensions and new initiatives. More than 50% of the company's revenue comes from the government segment, which signals a stable business. In 2023, the revenue from the commercial segment came to $1.00 billion, while the government segment provided $1.22 billion in revenue.

Palantir's machine learning and artificial intelligence capabilities have the potential to boost growth as businesses prioritize integrating AI significantly. Thanks to their capacity to offer sophisticated data analysis and integration solutions, they have an advantage over rivals in the tech sector.

Entering foreign markets, especially those in Europe and Asia, offers great room for growth. Palantir's product line and distribution network can also be expanded through strategic alliances with tech behemoths and business titans. Partnerships in cybersecurity and cloud computing can further strengthen its competitive edge.

B. Expansions and strategic initiatives

Palantir's AI Platform will be integrated with L3Harris' software-defined and sensor structures. The company recently announced an alliance with L3Harris Technologies Inc. LHX to improve target recognition and contextual awareness by expanding AI-driven security technology capabilities and supporting U.S. Army programs.

III. Palantir Stock Forecast 2024

A. PLTR Stock Forecast: Technical Analysis

Palantir Stock (PLTR) is trading within a bullish trend, where the ongoing buying pressure might extend above the 50.00 level by the end of 2024.

In the daily chart of PLTR, a bullish impulsive wave has been seen since August 2024, making five consecutive bullish months. Moreover, the latest buying pressure in September 2024 was significant, as it broke the previous all-time high level.

In the main price chart, a clear bullish trend is visible, as the dynamic 200-day SMA and 50-day EMA are below the current price. Moreover, the high volume line since August 2024 is below the 50-day EMA line, suggesting a confluence of bullish factors.

Despite the buying pressure based on dynamic lines, the Relative Strength Index (RSI) failed to follow the momentum and created a divergence. In that case, an early bearish signal might come once there is a valid candlestick formation from the top.

Based on the Palantir Stock Forecast 2024, investors should monitor how the price trades at the 40.37 support level. Any immediate selling pressure below this line could open a long opportunity from the 40.00 to 36.00 area. In that case, a valid bullish reversal with a candlestick formation is needed before aiming for the 50.00 psychological line. Overcoming the 45.22 line might extend the gain above the 55.00 to 60.00 area.

On the bearish side, the 36.73 static level could work as a solid bottom as a break below this line might extend the selling pressure to the 200 day SMA line.

B. Palantir Stock Prediction: Fundamental Analysis

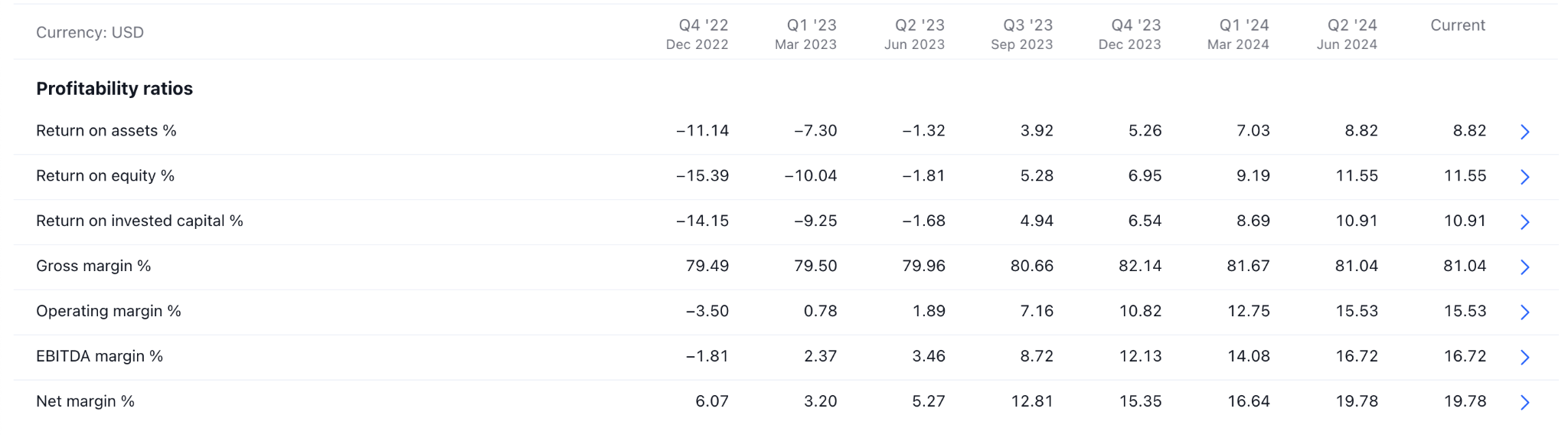

Palantir (PLTR) showed a stable position in the profitability segment, as the Return on Equity showed moderate growth from 5.28 to 11.55 within a year. Also, the operating margin, gross profit margin, and Return on Capital Employed showed an upward recovery, as shown in the image below:

On the other hand, AI momentum fueled the 40X P/S ratio and a remarkable price surge in 2024. Investors might monitor how the Apollo and AIP segments perform under government and commercial partnerships to maintain the valuation.

The 12-month EV to EBITDA is 387.07X, above the industry average of 50.29X. Moreover, the forward P/E ratio is 103.67X, which is above the industry average of 39.9X.

C. PLTR Forecast: Market Sentiment

Palantir Inc (PLTR) was founded in 2003 with 2.14 billion market shares. Of this, 2.01 billion (93.99%) shares are free float, while 128.70 million (6.01%) are closely held.

Analysts predict that Palantir's sales will expand by 26.1% year over year to $703.7 million this quarter, which is better than the 16.8% increase seen in the same quarter last year. Adjusted earnings are anticipated to be $0.09 per share.

Over the past 30 days, most analysts who follow the company have reaffirmed their projections, indicating that they expect the company to continue on its current trajectory as it enters results. Over the past two years, Palantir has exceeded top-line expectations by an average of 1.6% and has only missed Wall Street's revenue estimates once.

IV. PLTR Stock Prediction: Challenges & Risk Factors

Let's see companies to look at as Palantir competitors:

- Snowflake (SNOW): Snowflake is an analytics and data warehouse company with a market cap of $38.13 billion.

- IBM (IBM): IBM offers cognitive solutions, global business services, cloud and technology services. The company is an industry leader in the cloud computing sector, with a market cap of $190.77 billion.

- Microsoft (MSFT): With a market cap of $3.04 trillion, Microsoft offers advanced analytics and AI solutions, leveraging its Azure cloud platform.

Let's see the associated risks of investing in Palantir Stock (PLTR):

- Government policy: Over 50% of Palantir's revenue comes from the government. Investors should monitor how the government's policy and politics change, as it could directly affect Palantir's revenue.

- Scalability problem: Palantir's business model is complex, while the higher cost could make it hard for small companies to adopt.

Overall, Palantir Stock (PLTR) is more likely to move up, driven by government ties and commercial revenue.

Following the volatility, investors might consider CFDs to benefit from upward and downward movements. Investors can benefit from the Palantir stock price change, without actually owning the particular asset.