- Nio's Q2 2024 revenue increased substantially to RMB17.45 billion, driven mainly by vehicle sales.

- Despite a large net loss, Nio's gross profit and margin saw dramatic improvements.

- Nio delivered a record 57,373 vehicles, capturing over 40% of China's premium BEV market.

- The stock price showed volatility with a closing price trailing its quarterly high by over 30%.

- Growth opportunities are evident in the expanding EV market and international presence, though competitive pressures and supply chain risks remain significant.

I. Nio Q2 2024 Performance Analysis

A. Key Segments Performance

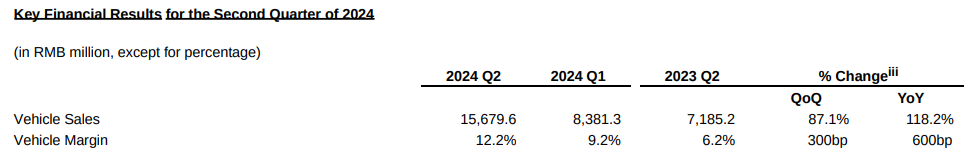

Financial Highlights: In Q2 2024, Nio's total revenue surged to RMB17.45 billion (US$2.40 billion), a 98.9% year-over-year increase and a 76.1% rise from Q1 2024. Vehicle sales, the largest contributor, amounted to RMB15.68 billion (US$2.16 billion), an increase of 118.2% year-over-year. Despite strong revenue growth, Nio reported a net loss of RMB5.05 billion (US$694.4 million), although this loss decreased by 16.7% year-over-year. Gross profit rose to RMB1.69 billion (US$232.4 million), a staggering 1,841% jump from Q2 2023, improving gross margins to 9.7% from 1.0% the prior year. Earnings per share (EPS) remained negative at RMB2.50 (US$0.34) per share, but adjusted EPS improved from Q1. Cash reserves stood at RMB41.6 billion (US$5.7 billion), ensuring liquidity for future expansion.

Source: ir.nio.com

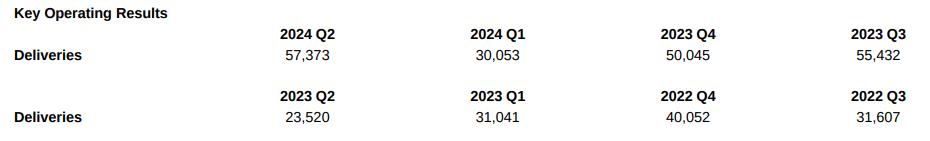

Operational Performance: Nio delivered 57,373 vehicles in Q2 2024, a record-breaking 143.9% year-over-year increase. This includes 32,562 premium electric SUVs and 24,811 sedans. Nio secured over 40% market share in China's BEV market segment priced above RMB300,000. The company introduced key technological advancements, including its proprietary intelligent driving chip and SkyOS, an in-house vehicle operating system. Nio also announced the launch of its mass-market ONVO brand, debuting the L60 model, and marking a push into a broader customer base. Nio's expanding infrastructure includes over 2,561 battery swap stations and 23,000 chargers globally, bolstering its market presence and user experience.

Source: ir.nio.com

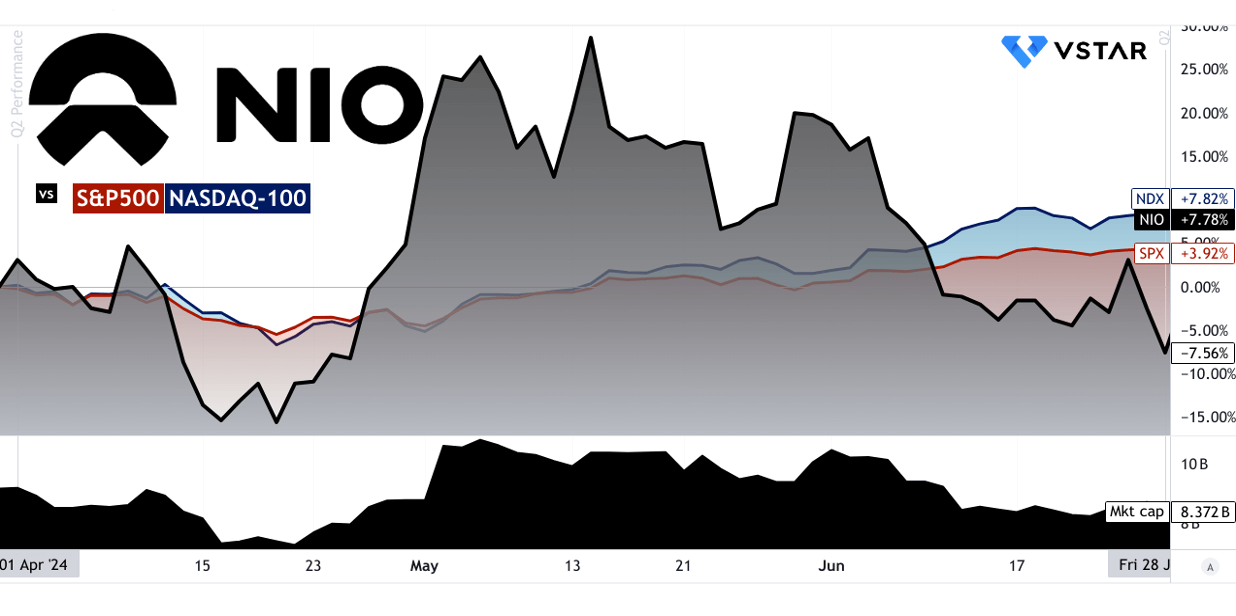

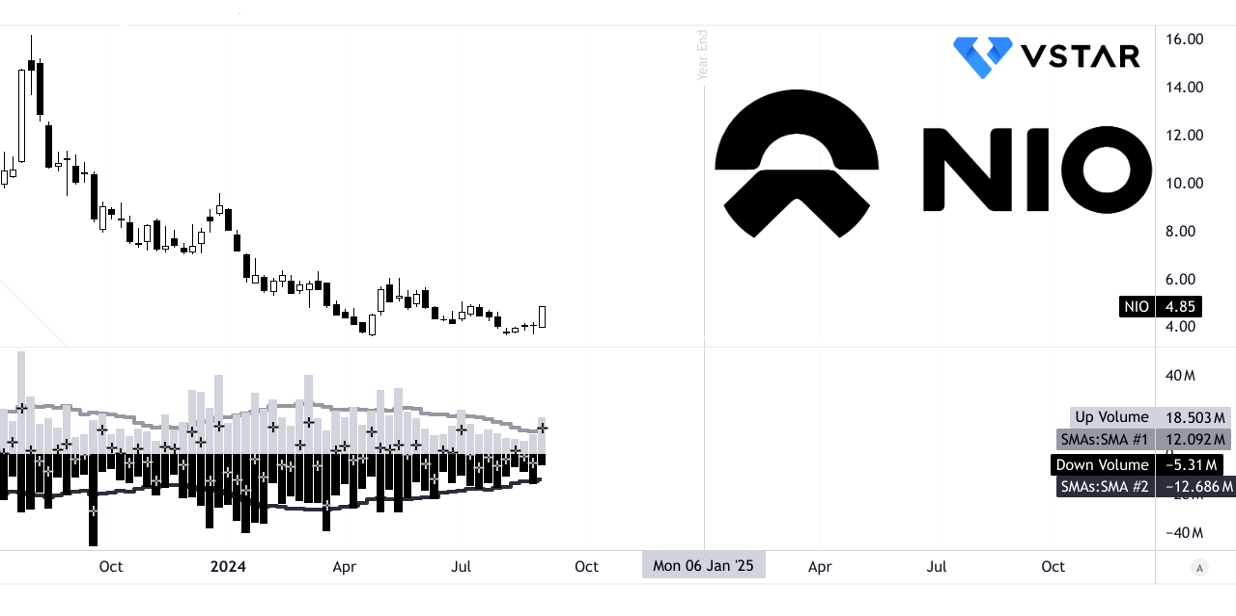

B. NIO Stock Price Performance

NIO's market cap is $8.372 billion, with an opening price of $4.63 and closing at $4.16. The stock peaked at $6.05 and hit a low of $3.61 during the quarter. It saw a negative 7.78% price return, underperforming against NASDAQ's 7.82% return and the S&P 500's 3.92%. During Q2, its closing price still trailed the quarter's high by 31.35%.

Source:tradingview.com

II. NIO Stock Prediction: Outlook & Growth Opportunities

A. Segments with Growth Potential

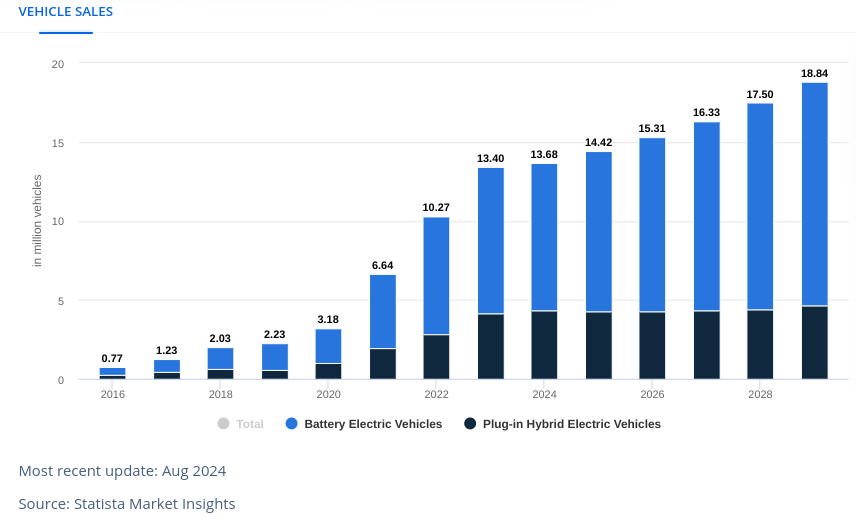

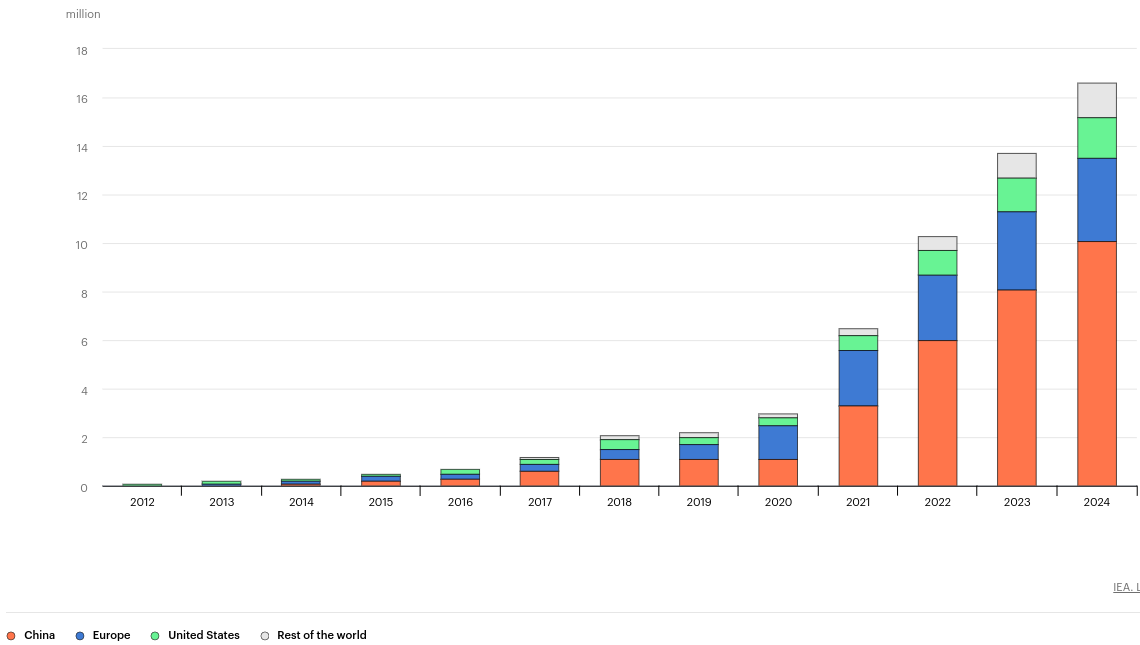

NIO operates in the rapidly growing electric vehicle (EV) market, where revenue is projected to reach $786.2 billion globally by 2024. China will dominate this market, contributing $376.4 billion. The EV market is expected to grow at a 6.63% CAGR (2024-2029), positioning NIO well in this expanding landscape. A key segment for NIO is the premium EV sector in China, where it held a 40% market share in Q2 2024 among battery electric vehicles (BEVs) priced above RMB 300,000. Additionally, with sales surpassing 57,373 units in Q2 2024, NIO's delivery growth rate of 143.9% signals strong future demand. Another area of growth is its burgeoning international presence, with recent market entry in the UAE and planned expansions to other global markets in 2024.

Source: statista.com

[Electric car sales, 2012-2024]

Source:iea.org

B. Expansions and Strategic Initiatives

Research and Development (R&D): NIO's cumulative R&D investment continues to grow, evidenced by the recent unveiling of the SkyOS operating system and the Shenji NX9031 chip for autonomous driving. These innovations will likely bolster NIO's technological edge in the smart EV space.

Partnerships and Collaborations: NIO is expanding its Power Up Partner Plan, with over 2,561 power swap stations deployed globally. This effort, combined with collaborations on infrastructure projects, aims to enhance EV charging accessibility and attract new customers. Additionally, NIO's collaboration with various international markets, like the UAE, underscores its focus on becoming a global player.

Source: nio.com

III. NIO Stock Forecast 2024

A. NIO Price Prediction 2024: Technical Analysis

As of now, NIO stock price is $4.85, closely aligned with its trendline of $4.63 and baseline of $4.71. These values, derived from modified exponential moving averages, indicate a current consolidation phase. By the end of 2024, the average Nio price target is projected at $6.70. This estimate relies on momentum analysis and Fibonacci retracement levels, suggesting moderate bullish sentiment if the stock maintains its current trajectory.

In a more optimistic scenario, the price could reach $8.50, driven by strong upward momentum and positive Fibonacci extensions. Conversely, a pessimistic outlook places the NIO target price at $4.70, reflecting potential downward pressure and negative trend adjustments.

Resistance and Support Levels:

The primary resistance level is at $5.23, with a pivot point for the current horizontal price channel at $4.68. In a volatile market, resistance could spike to $8.47, while core resistance is identified at $6.68. On the support side, the immediate support level is $4.04, though no core support is specified. Increased volatility may push support levels further down.

Source:tradingview.com

Momentum Indicators:

The Relative Strength Index (RSI) is at 54.61, above the regular bearish threshold of 47.87, indicating a neutral to mildly bullish trend with no significant bullish or bearish divergence observed. The RSI line shows an upward trend, suggesting potential for further gains if momentum continues.

The Moving Average Convergence/Divergence (MACD) reveals a bullish trend with the MACD line at -0.44 and the signal line at -0.58. The histogram's positive value of 0.14 indicates increasing bullish strength.

Source:tradingview.com

Volume Analysis:

The Price Volume Trend (PVT) line stands at 3.64 billion, slightly above its moving average of 3.63 billion, indicating bullish price volume momentum. However, the moving average of up volume is at 12.09 million, compared to a down volume of -12.69 million, resulting in a negative volume delta of -0.59 million, which suggests bearish volume momentum despite the overall bullish PVT.

Source:tradingview.com

Source:tradingview.com

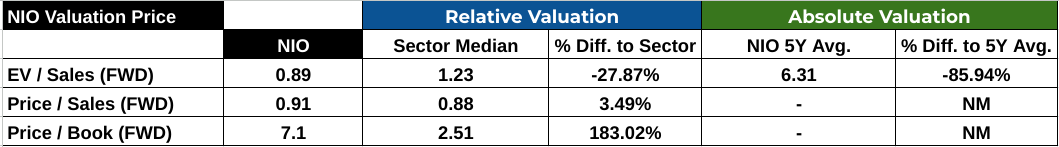

B. NIO Stock Price Prediction: Fundamental Analysis

Financial ratios play a pivotal role in predicting NIO stock price. As of its forward-looking EV/Sales ratio of 0.89, NIO is trading at a significant discount compared to the sector median of 1.23, reflecting a -27.87% difference. Historically, NIO's 5-year average EV/Sales ratio was much higher at 6.31, indicating an 85.94% contraction from its historical norm. NIO's Price/Sales (FWD) of 0.91 is close to the sector median of 0.88, with only a 3.49% deviation. However, its Price/Book (FWD) ratio of 7.1 far exceeds the sector median of 2.51, representing a 183.02% premium, suggesting the stock might be overvalued compared to its peers on this metric. Collectively, these ratios suggest a mixed outlook, with some metrics showing NIO as undervalued while others point to overvaluation.

Source: Analyst's compilation

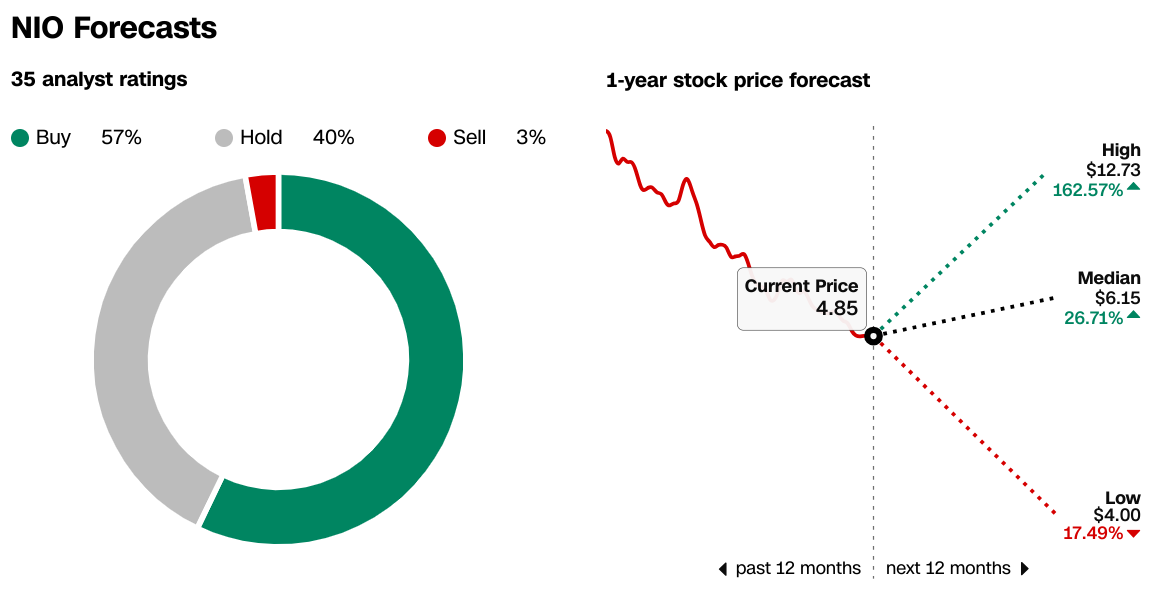

C. NIO Stock Forecast: Market Sentiment

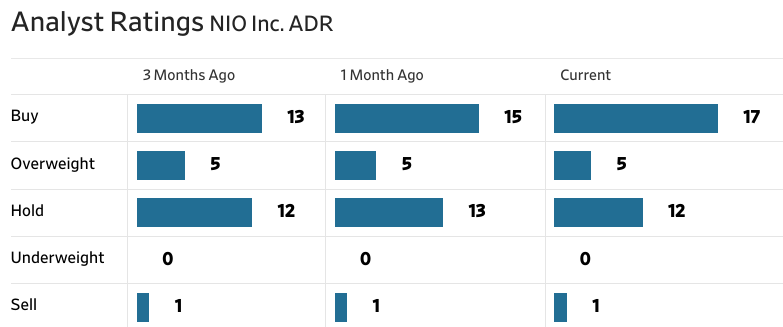

Market sentiment around NIO is moderately optimistic, with analysts showing increased interest. Analyst ratings have shifted positively over the past three months, with 17 "Buy" ratings (54% analysts on CNN) currently compared to 13 three months ago. Price targets for NIO range from $4 (low) to $12.73 (high), with a median NIO stock price target of $6.15, notably higher than its current price of $4.85.

Source:CNN.com

Source:WSJ.com

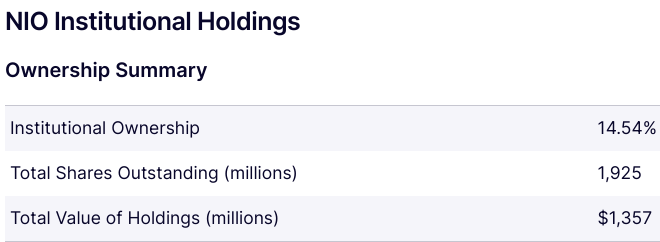

Institutional ownership is relatively low at 14.54%, while short interest stands at 191.34M shares, indicating some bearish sentiment. However, with a moderate days-to-cover ratio of 4.99, short-interest pressure might not be extreme.

Source:Nasdaq.com

Source:Benzinga.com

IV. Nio Stock Forecast: Challenges & Risk Factors

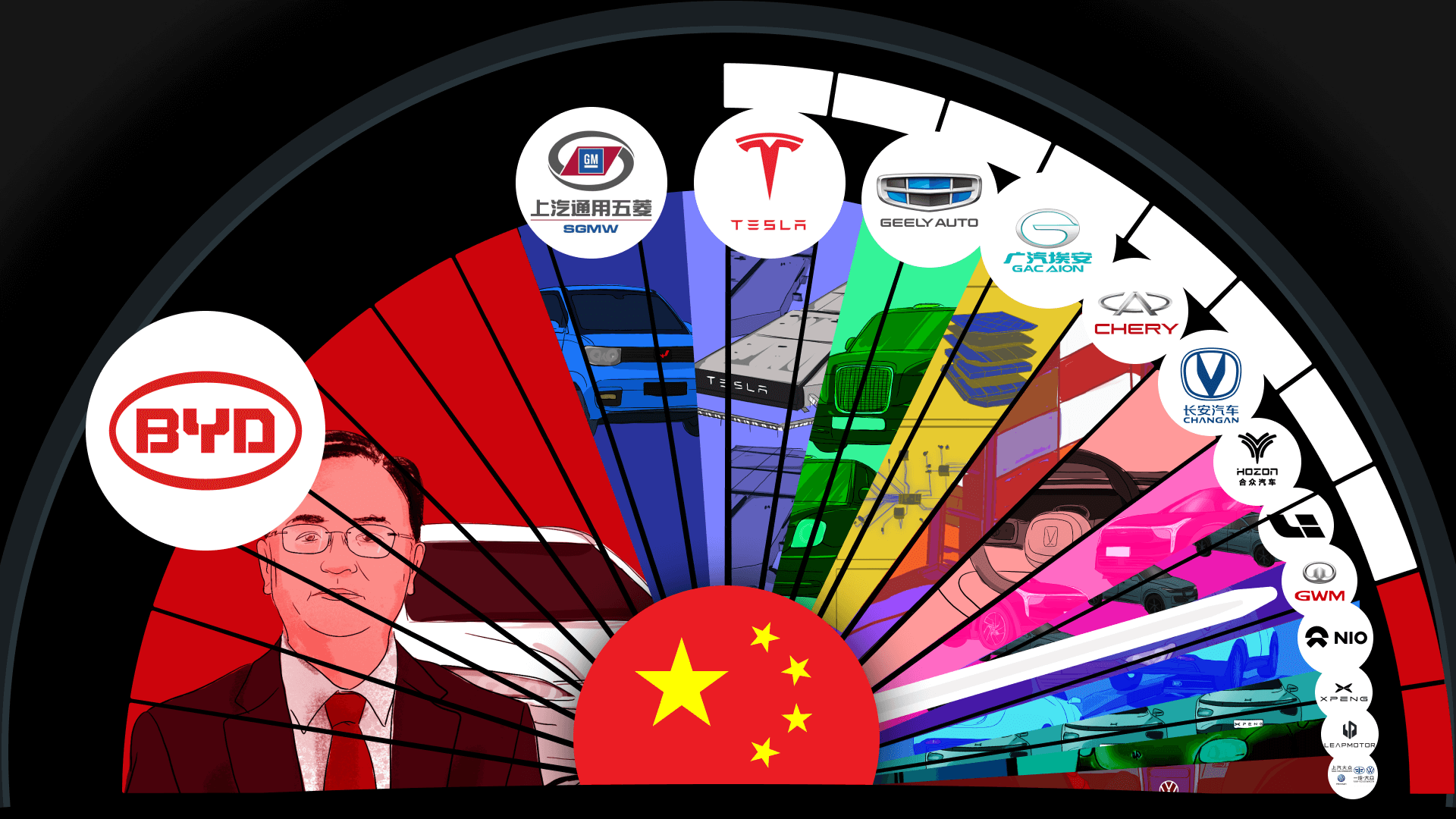

Nio faces intense competition in the global electric vehicle (EV) market, particularly from both domestic and international players. Tesla is its most significant global competitor, with the Model Y being a direct rival to Nio's offerings like the ES6 and EC6. Tesla's established brand and aggressive pricing strategies, particularly in China, pose a challenge for Nio. In addition, local competitors such as XPeng and Li Auto also target the same mid-to-high-end EV market. XPeng's G6 and P7 models have gained traction, boasting advanced autonomous driving features and competitive pricing. Li Auto, with its hybrid EV models like the L7 and L8, appeals to consumers not ready to fully commit to pure EVs. BYD, China's largest EV manufacturer, has dominated the affordable EV segment, with a broad range of models like the Qin and Han that are becoming increasingly competitive in the premium space as well. This intense competition forces Nio to innovate continuously and manage its pricing strategy carefully, especially with the release of new models like the L60.

[Leading EV companies in China]

Source: thechinaproject.com

Other Risks:

Supply chain disruptions, particularly in battery production, could hinder Nio's growth. Fluctuations in lithium prices and chip shortages further exacerbate these risks, affecting production timelines and profit margins. Additionally, regulatory changes, particularly in export markets like Europe, and potential tariff increases could pose financial and operational hurdles.

In conclusion, Nio stock outlook shows a mixed picture. Despite impressive Q2 2024 revenue, a 1X increase year-over-year, and record vehicle deliveries, the company reported a net loss. Technically, Nio stock is attached with a projected target of $6.70 by year-end. CFDs on NIO stock can be traded on platforms like VSTAR, known for tight spreads. CFDs allow traders to speculate on price movements without owning the stock. However, Nio's high volatility, competition, and regulatory risks warrant cautious trading.