- Broadcom's Q3 fiscal 2024 performance showcases significant revenue and profit growth, driven by infrastructure software and semiconductor segments, despite a net GAAP loss.

- AVGO stock showed notable gains, significantly outperforming the S&P 500 and NASDAQ, despite market volatility.

- Broadcom's growth is anchored in its AI-focused semiconductor solutions and infrastructure software, particularly VMware's integration.

- Technical and fundamental analyses suggest potential stock price growth, although challenges like competition and geopolitical risks remain.

I. Broadcom Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights [Q3 Fiscal 2024]: Broadcom's Q3 2024 financials demonstrate substantial growth, driven by key segments. Consolidated net revenue reached $13.1 billion, a robust 47% increase from the previous year. Operating profit surged by 44% to $7.9 billion, with an operating margin of 61%. Gross margins for the quarter stood at 77.4%, bolstered by high-margin contributions from infrastructure software. However, the company's net income revealed a GAAP loss of $1.9 billion, influenced by integration and restructuring costs related to VMware. Non-GAAP net income was significantly higher at $6.1 billion, reflecting the operational strength excluding one-time charges. Earnings per share (EPS) showed a loss of $0.40 on a GAAP basis, but non-GAAP diluted EPS was $1.24. Free cash flow for the quarter was strong at $4.8 billion, representing 37% of revenue, indicating healthy cash generation despite substantial capital expenditures of $172 million. Broadcom's balance sheet showed $10 billion in cash against $72.3 billion in gross debt, with ongoing efforts to replace high-cost debt with more favorable fixed-rate instruments.

Source: Q3 fiscal 2024 Financial Results

Operational Performance: Broadcom's operational performance highlights continued momentum in its core segments. The infrastructure software segment, which now includes VMware, saw revenues of $5.8 billion—up 200% year-over-year. This growth was driven by VMware's $3.8 billion contribution and a strong uptake of VMware Cloud Foundation (VCF), which represented 80% of VMware's bookings for the quarter. In the semiconductor segment, networking revenue reached $4 billion, a 43% increase from the previous year, largely due to heightened demand for AI-specific networking solutions. Ethernet switching and optical components also experienced significant growth. Notably, non-AI semiconductor revenues stabilized, showing a 17% sequential increase despite a 41% decline year-on-year. The wireless segment grew marginally by 1% year-on-year to $1.7 billion, while broadband faced a 49% decline, reflecting persistent weakness in telco spending. Industrial resales showed a 31% drop, but a modest recovery is anticipated in Q4.

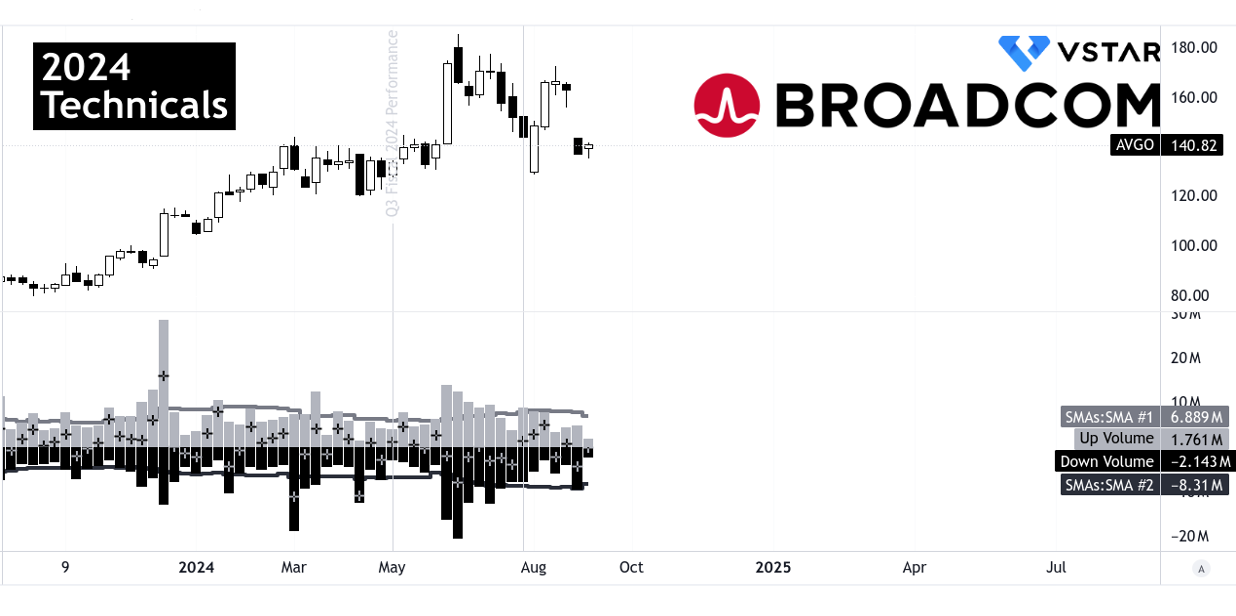

B. AVGO Stock Price Performance

In Q3 Fiscal 2024, Broadcom (AVGO) exhibited notable stock price performance, with its market capitalization reaching $670 billion. The stock opened at $128.62 and closed at $143.82, reflecting a substantial increase of 11.8%. AVGO's high point during the quarter was $185.16, while its low dipped to $130.25, showing significant intra-quarter volatility. This 11.8% price increase sharply outperformed key indices: the S&P 500, which gained only 3.2%, and the NASDAQ, which rose by 1.9%.

Source: tradingview.com

II. AVGO Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Broadcom Inc. (AVGO) exhibits significant growth potential across several segments. The most promising is its AI-focused semiconductor solutions, which have shown extraordinary growth. For example, custom AI accelerators in networking grew 3.5 times year-on-year in Q3 2024. This sector alone has driven a substantial increase in total semiconductor revenue, projected to reach $12 billion for fiscal year 2024. The rapid expansion is attributed to strong demand from hyperscalers for advanced AI infrastructure, underscoring the segment's pivotal role in Broadcom's future growth. Gartner forecasted AI Chips revenue to hit 33% YoY growth in 2024.

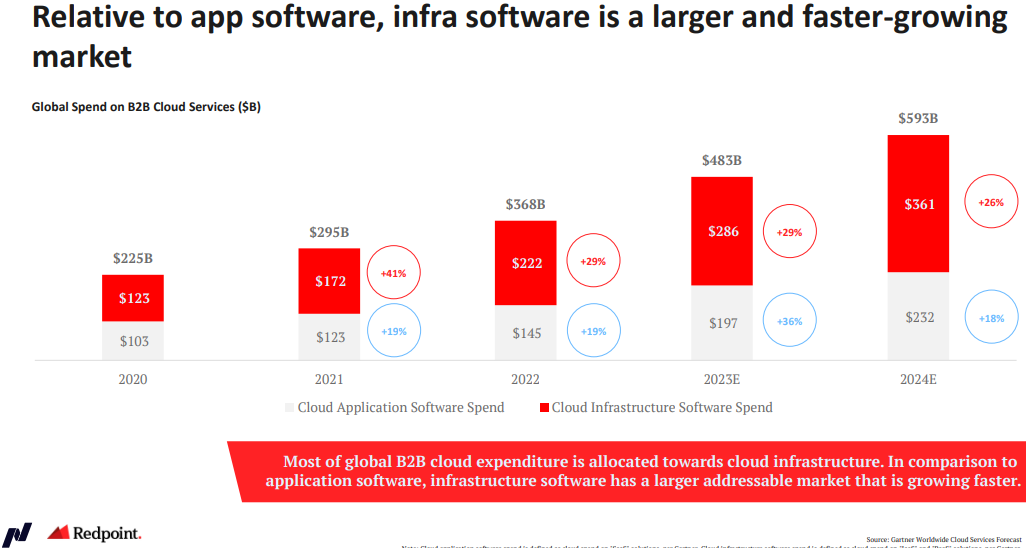

The infrastructure software segment also represents a critical growth area, largely due to the integration of VMware. VMware's contribution has resulted in a massive revenue increase for this segment. This growth reflects Broadcom's successful transition of VMware into a key component of its product lineup, with VMware Cloud Foundation (VCF) seeing a 32% increase in annualized booking value to $2.5 billion. The robust performance in infrastructure software is indicative of the segment's continued expansion and its strategic importance in Broadcom's portfolio. The infrastructure software market revenue may hit $361 billion with 26% YoY growth.

Source: indexes.nasdaqomx.com

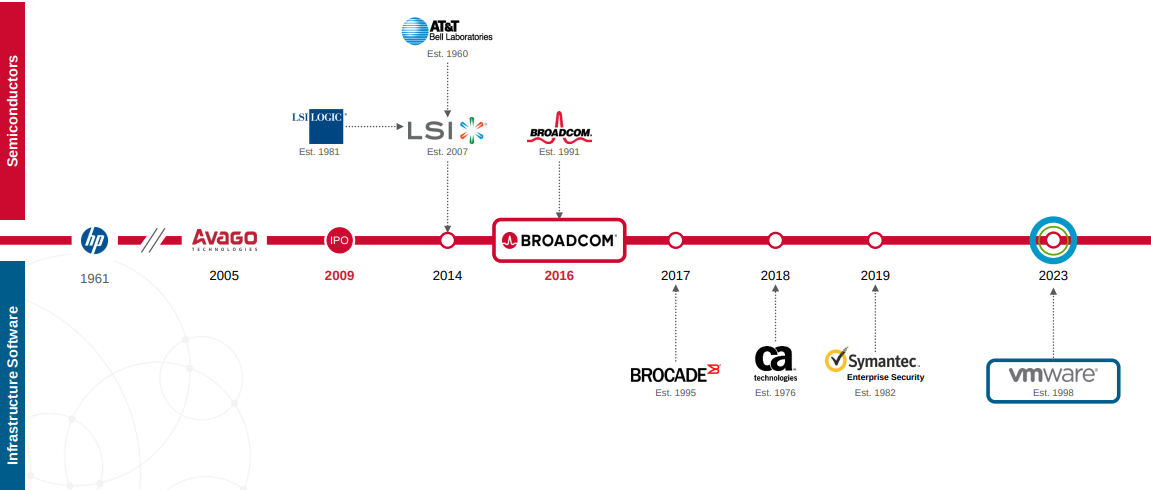

B. Expansions and Strategic Initiatives

Broadcom's strategic expansion efforts include mergers and acquisitions, research and development investments, and partnerships. The acquisition of VMware has been a cornerstone of Broadcom's strategy, enhancing its software capabilities and driving revenue growth. The successful integration of VMware, including cost reductions and revenue synergies, has positioned Broadcom to exceed its adjusted EBITDA targets for the acquisition within the projected timeline.

Source: Broadcom Inc. Q3'24 Company Overview

Research and development (R&D) remains a focal point for Broadcom, with $1.5 billion allocated in Q3 2024, a notable increase that supports continued innovation in semiconductor and AI technologies. This investment is crucial for maintaining competitive advantages and developing cutting-edge solutions in an evolving tech landscape.

Partnerships, particularly with hyperscalers and leading technology firms, have been instrumental in Broadcom's growth. These collaborations facilitate the deployment of advanced networking and AI solutions, thereby driving demand and expanding market reach.

III. Broadcom Stock Prediction 2024

A. AVGO Stock Prediction 2024: Technical Analysis

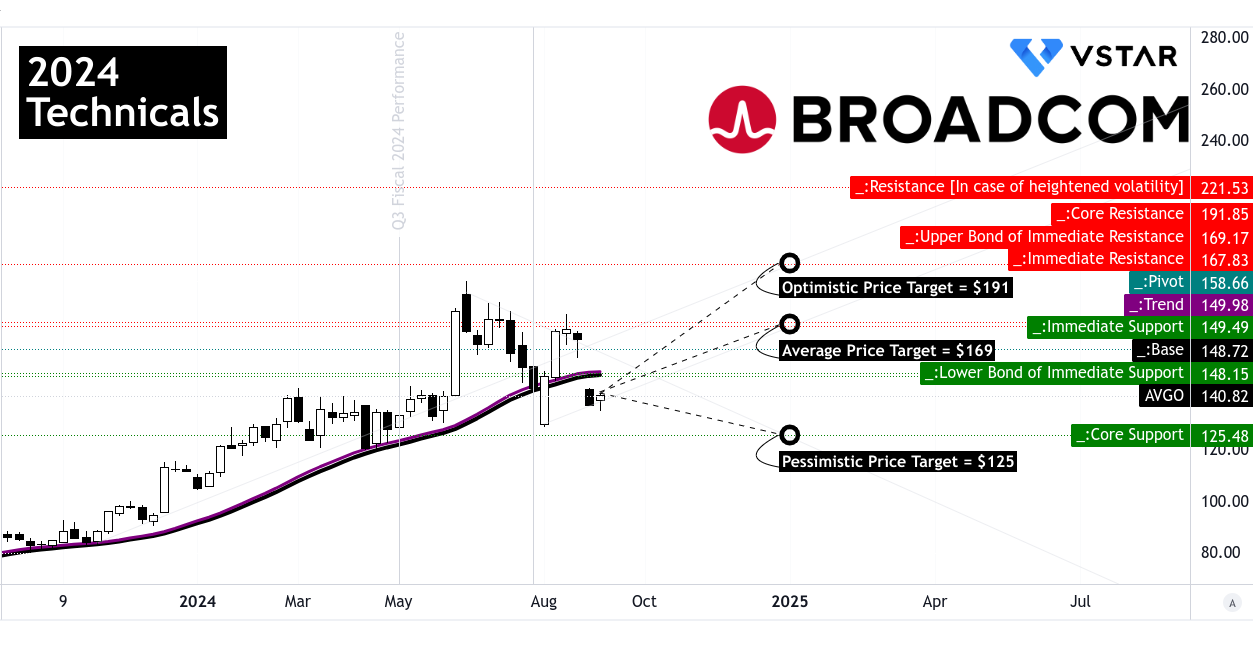

Broadcom (AVGO) stock is currently priced at $141, against a trendline of $150 and a baseline of $149, calculated using a modified exponential moving average. These levels indicate the stock is trading below key technical indicators, showing weakness in the near-term price action.

Broadcom's average price target by the end of 2024 is $169, driven by a momentum-based projection using Fibonacci retracement levels. The optimistic scenario forecasts $191, reflecting strong upward momentum, while a pessimistic scenario could see the stock drop to $125, based on downward price swings and similar technical projections.

Technical resistance levels provide critical insights. The primary resistance at $148.15 is slightly below the trendline, suggesting a major hurdle to overcome. The core resistance at $191.85 aligns with the optimistic AVGO price target, while core support at $125.48 aligns with the pessimistic scenario, offering solid support in the case of a downturn.

Source: tradingview.com

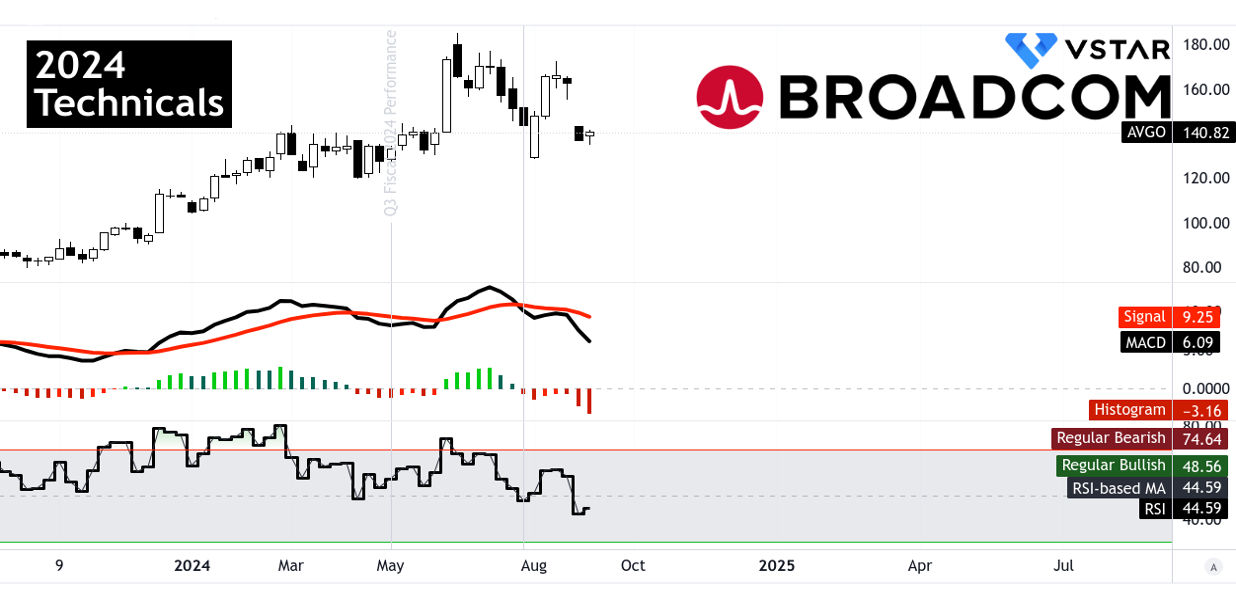

Momentum indicators are mixed. The Relative Strength Index (RSI) is currently at 44.59, signaling that the stock is neither oversold nor overbought. Both bullish and bearish divergences are present, indicating potential price reversals. The Moving Average Convergence Divergence (MACD) shows a bearish trend, with a histogram value of -3.16 and increasing trend strength.

Source: tradingview.com

Volume indicators also provide conflicting signals. The Price Volume Trend (PVT) is bullish, with a line of 709 million above its moving average of 660 million, but overall stock volume momentum remains bearish due to a negative moving average volume delta of -1.42 million, indicating more selling than buying.

Source: tradingview.com

Source: tradingview.com

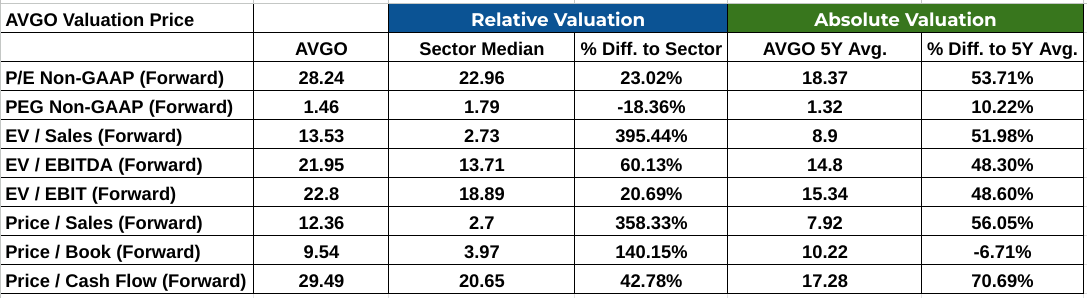

B. AVGO Stock Price Prediction: Fundamental Analysis

Broadcom Inc. (AVGO) exhibits strong valuation metrics compared to its sector and historical averages. The forward P/E ratio of 28.24 is 23.02% above the sector median but 53.71% higher than its 5-year average of 18.37, indicating elevated market expectations. The PEG ratio of 1.46, 18.36% below the sector median, suggests growth expectations are more modest than its historical norm of 1.32. EV/Sales and EV/EBITDA ratios are substantially higher than the sector medians (395.44% and 60.13%, respectively), reflecting a premium valuation due to growth prospects. Conversely, Price/Book and Price/Cash Flow ratios are lower relative to historical averages, suggesting undervaluation in these areas.

Source: Analyst's compilation

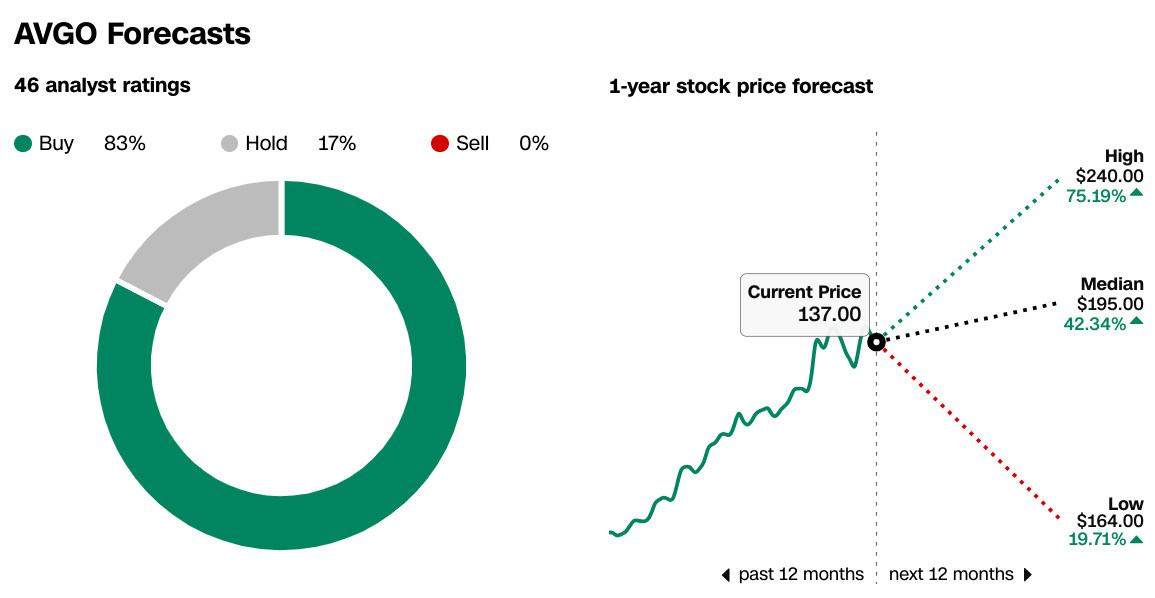

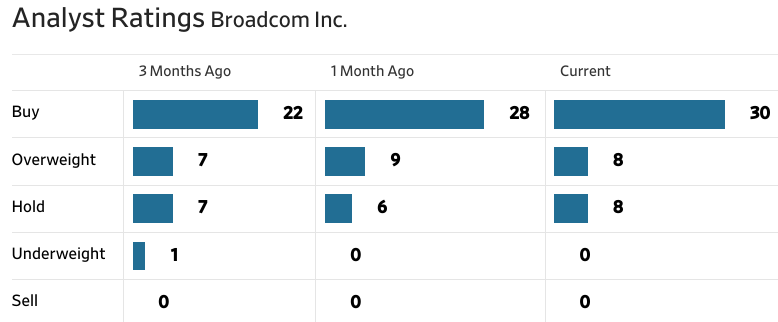

C. AVGO Forecast: Market Sentiment

Analyst sentiment for AVGO is predominantly positive, with 30 Buy ratings, an increase from 22 three months ago, and no Sell ratings. The average Broadcom price target of $195 represents a 42% upside from the current price of $137.

Source:CNN.com

Source:WSJ.com

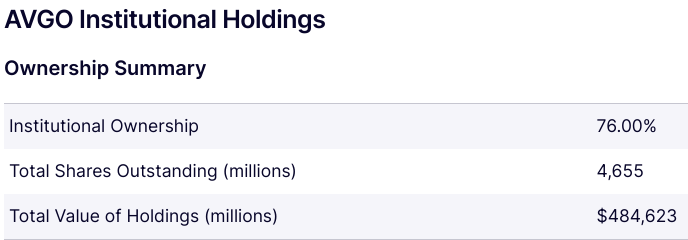

Institutional ownership is robust at 76%, holding $484.6 billion worth of shares, indicating strong confidence in the company's future. Short interest is low at 1.26%, with 50.86 million shares shorted, reflecting minimal bearish sentiment. Overall, market sentiment and institutional support suggest optimistic long-term expectations for AVGO.

Source:Nasdaq.com

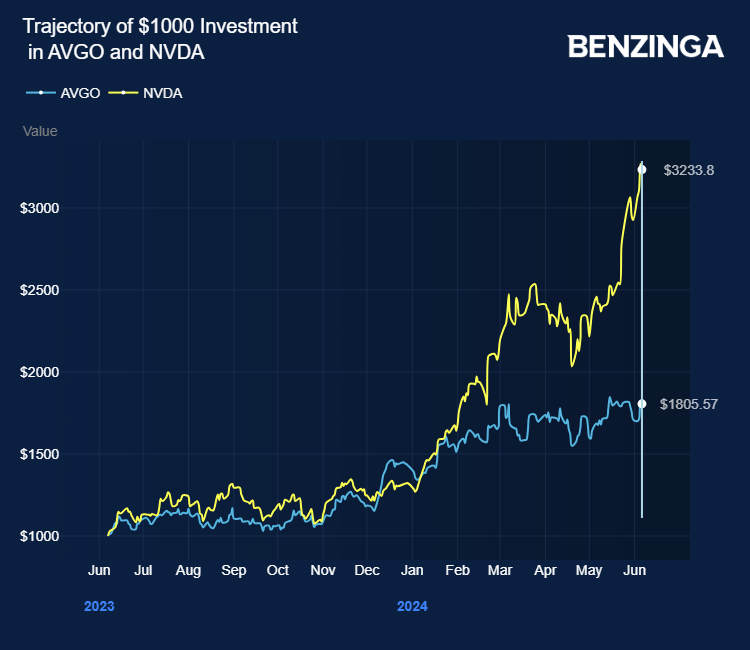

Source:Benzinga.com

IV. Broadcom Stock Forecast: Challenges & Risk Factors

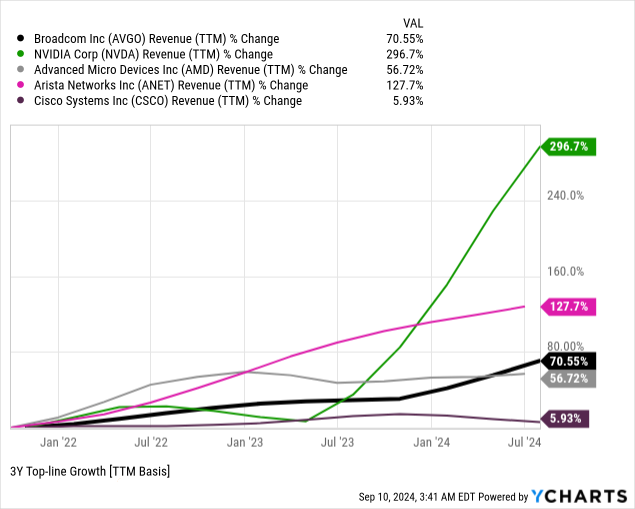

Broadcom faces significant competition across its diverse technology portfolio. In the AI semiconductor space, notable competitors include NVIDIA and AMD. NVIDIA, a leader in AI accelerators, recently saw its massive GPU revenue growth due to its advancements in AI and deep learning technologies. AMD, another key player, is capitalizing on its high-performance computing products, with its EPYC processors and Radeon GPUs increasingly adopted in AI and data center applications.

Source: Benzinga.com

In networking and data center solutions, Cisco Systems and Arista Networks are principal competitors. Cisco's revenue from its networking segment emerged from robust demand for its data center and enterprise networking solutions. Arista Networks, known for its high-performance networking switches solid increase in revenue, reflecting its expanding market share in cloud and data center networks.

Source: Ycharts.com

Other Risks

Broadcom's risks include supply chain disruptions and geopolitical tensions. Recent semiconductor shortages have affected production timelines, and ongoing trade tensions, especially with China, could impact Broadcom's operations and cost structures.

In conclusion, the outlook for AVGO stock remains strong, with robust growth in AI-driven semiconductors and infrastructure software, especially through its VMware acquisition. Despite risks from supply chain issues and competition, Broadcom's market position is solid, backed by favorable fundamentals and technical indicators. CFD trading of AVGO stock, particularly on platforms like VSTAR, offers traders an opportunity to benefit from tight spreads and institutional-grade experiences. VSTAR allows CFD trading of AVGO stock, providing access to leverage and flexibility. For those looking to capitalize on AVGO's price movements, stock CFDs via VSTAR are a sharp tool for both short- and long-term strategies.