- TSMC's Q2 2024 revenue surged considerably, based on strong performance in advanced technologies.

- TSMC's 3nm and 5nm technologies are key growth drivers, while 2nm technology is set for production in 2025.

- Technical outlook is positive with TSM stock price rose outpacing major indices like S&P 500 and NASDAQ.

I. TSMC Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

TSMC reported consolidated revenue of NT$673.51 billion (US$20.82 billion) for Q2 2024, marking a 40.1% increase year-over-year and a 13.6% sequential growth. In USD terms, this represents a 32.8% year-over-year rise. Net income stood at NT$247.85 billion (US$7.68 billion), with diluted earnings per share (EPS) at NT$9.56 (US$1.48 per ADR unit), reflecting a 36.3% increase year-over-year. Gross margin was 53.2%, operating margin was 42.5%, and net profit margin was 36.8%, highlighting stable profitability despite rising costs.

Operational Performance:

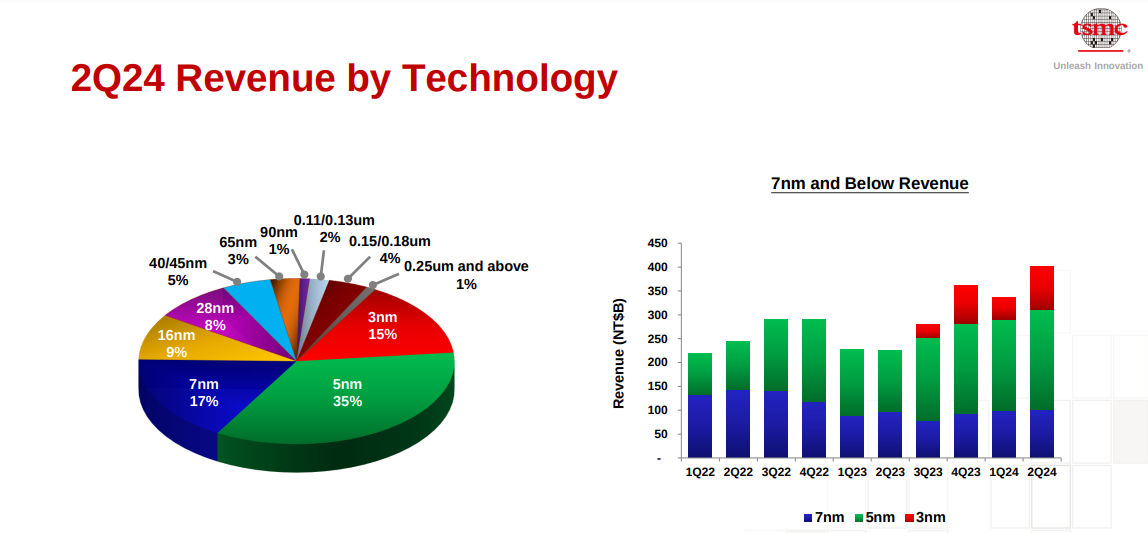

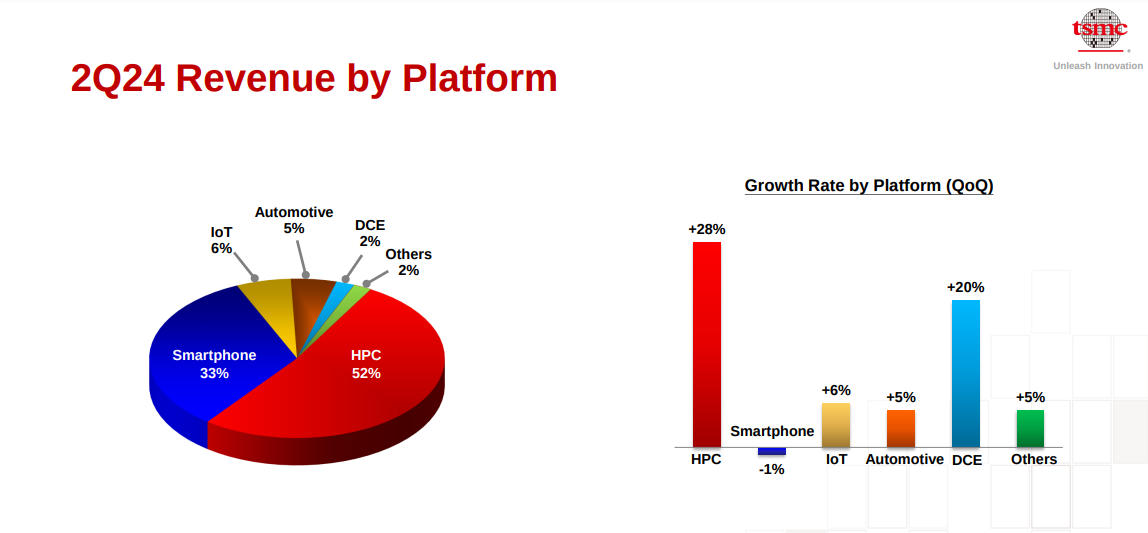

3-nanometer technology contributed 15% to total wafer revenue. Whereas, 5-nanometer technology represented 35%. Meanwhile, 7-nanometer technology accounted for 17%. To be specific, Advanced technologies (7nm and below) comprised 67% of wafer revenue. TSMC's High-Performance Computing (HPC) segment surged by 28% quarter-over-quarter, making up 52% of Q2 revenue. The smartphone segment declined by 1%, while IoT and automotive segments grew by 6% and 5%, respectively.

Source: Q2 2024 Presentation

TSMC ended the quarter with NT$2 trillion (US$63 billion) in cash and marketable securities. Its current liabilities rose by NT$23 billion, with long-term debt increasing by NT$9 billion. Accounts receivable turnover days decreased to 28 days, and inventory days fell to 83 days.

Technological Advancements and Innovations

TSMC's R&D focus remains strong, with continued advancements in 3nm and 5nm technologies. The company is also progressing with its 2nm technology, expected to enter volume production in 2025. The N2 technology is set to deliver significant performance and power benefits, with N2P and A16 further enhancing TSMC's technology portfolio. These technologies are poised to offer 10-15% speed improvement at the same power and 25-30% power reduction at the same speed.

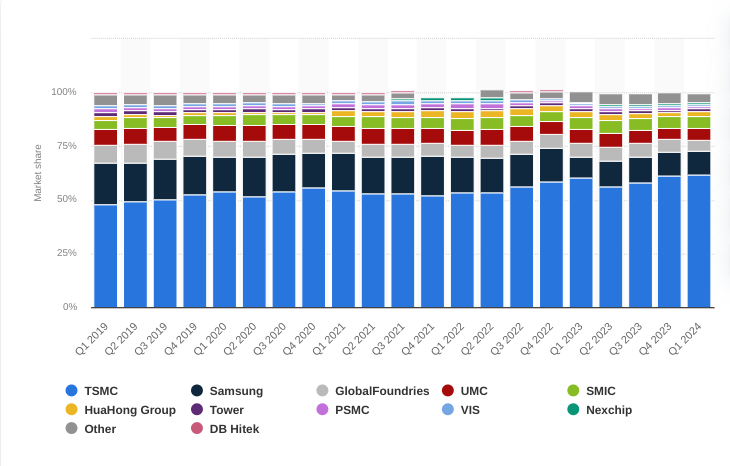

B. TSM Stock Price Performance

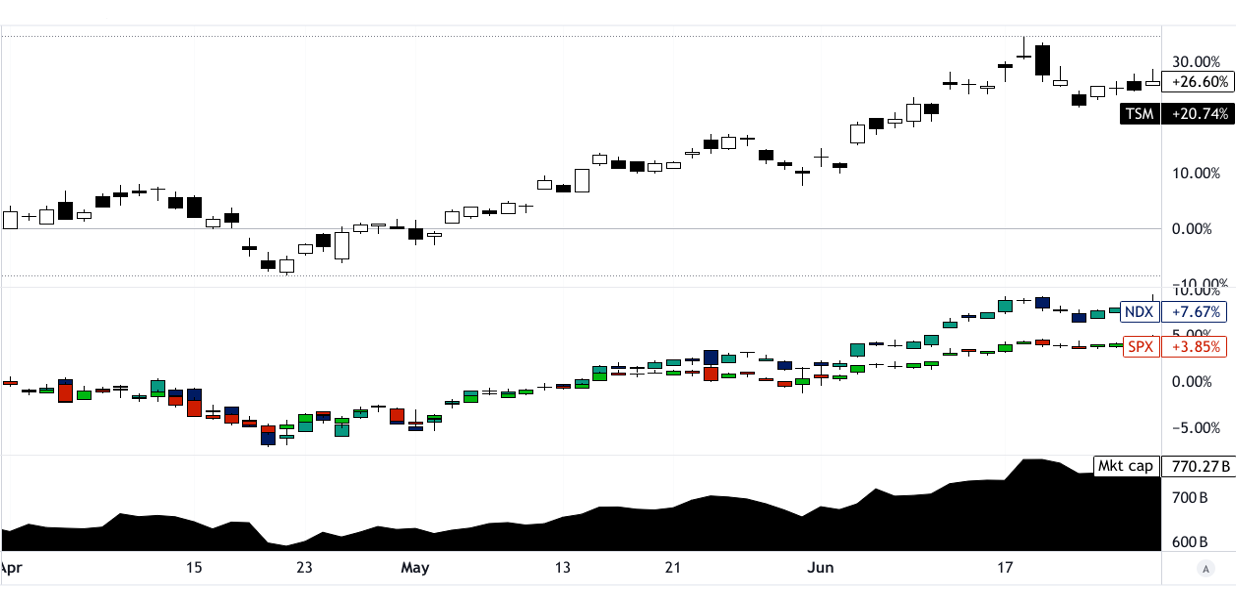

Taiwan Semiconductor (NYSE:TSM) demonstrated robust stock price performance over the quarter, with a significant percentage change of 26.6% (open-to-close), rising from an opening price of $137.29 to a closing price of $173.81. The stock reached a high of $184.86 and a low of $125.78, indicating substantial volatility. This performance far outpaced major stock market indices, with the S&P 500 increasing by only 3.9% and the NASDAQ by 7.8%. TSM's strong market cap of $770 billion underscores its Street dominance

Source: tradingview.com

II. TSM Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Taiwan Semiconductor Manufacturing Company (TSMC) continues to demonstrate robust growth across several segments. The company's advanced technology processes, particularly in the 3-nanometer and 5-nanometer ranges, have seen strong demand, contributing significantly to its revenue. High-Performance Computing (HPC) now accounts for 52% of TSMC's revenue, a 28% increase quarter-over-quarter, driven by AI and data center needs. Automotive and IoT segments are also growing, with automotive increasing by 5% and IoT by 6%. These segments are poised for further expansion as demand for semiconductor components in electric vehicles and smart devices rises. The company projects Q3 2024 top-line to be between $22.4 billion and $23.2 billion. At the midpoint, This is a 9.5% sequential increase and 32% year-over-year boost.

Source: Q2 2024 Presentation

TSMC's market forecast for 2024 projects a 10% growth in the semiconductor market excluding memory, driven by AI, HPC, and 5G technologies. The company's share of the foundry industry is expected to grow to 28%, supported by its technology leadership and expanding customer base. The N2 technology is on track for production in 2025, with N2P and A16 enhancing TSMC's leadership in energy-efficient computing and high-performance applications. The A16 technology, designed for HPC products, promises additional speed and power benefits, with production slated for the second half of 2026.

B. Expansions and Strategic Initiatives

Mergers and Acquisitions:

TSMC has not focused heavily on mergers and acquisitions but instead has concentrated on organic growth and strategic investments in its core capabilities.

Research and Development Investments:

TSMC's commitment to R&D is evident with its significant capital expenditure. For 2024, TSMC has allocated between $30 billion and $32 billion for capital investments, with 70-80% earmarked for advanced process technologies. This substantial investment underpins TSMC's leadership in developing next-generation semiconductor technologies, such as the 2-nanometer and the upcoming A16 nanosheet technology.

Partnerships and Collaborations:

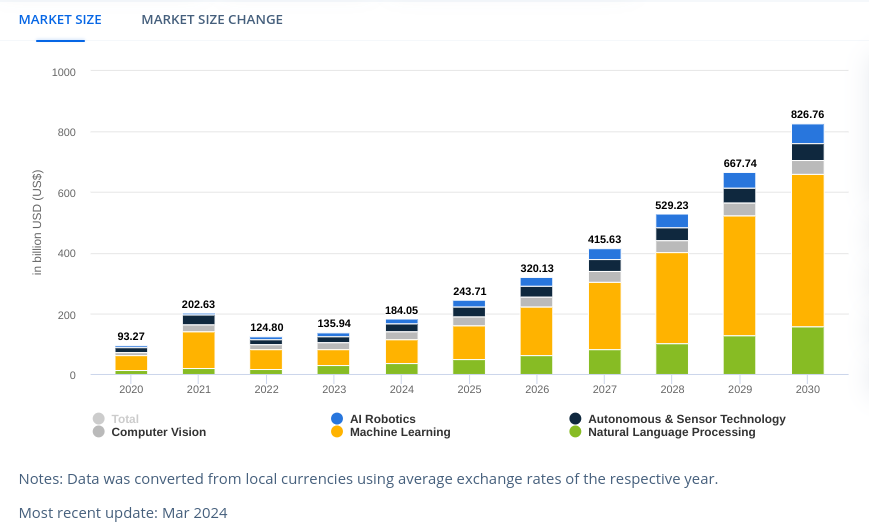

Strategic partnerships play a crucial role in TSMC's growth strategy. Collaborations with leading AI and high-performance computing firms ensure TSMC stays at the forefront of technological advancements. These partnerships are vital for developing cutting-edge technologies that meet the increasing demands of AI applications and high-end smartphones. The revenue in the AI market may hit $184 billion in 2024. The market may have an annual growth rate of 28.46% (2024-2030).

Source: statista.com

III. TSM Stock Forecast 2024

A. Taiwan Semiconductor Stock Forecast: Technical Analysis

As of now, Taiwan Semiconductor (NYSE: TSM) is trading at $165.77. The trendline, calculated using a modified exponential moving average, stands at $150.56, while the baseline is at $148.20. This indicates a downward trajectory for the stock in the near term.

TSM Stock Forecast - Price Targets

The average TSM stock price target by the end of 2024 is projected at $200.00. This target is derived from the momentum of change-in-polarity over mid- to short-term periods, using Fibonacci retracement and extension levels for projection. The optimistic scenario places the stock at $222.00, assuming upward price momentum persists in the current swing. Conversely, the pessimistic target is set at $177.00, anticipating continued downward momentum.

TSMC Stock Forecast - Resistance and Support Levels

Primary resistance for TSM is identified at $168.92, with a pivot point in the current horizontal price channel at $176.56. In cases of heightened volatility, the resistance could rise to $222.27, with core resistance at $200.69. Additional resistance is noted at $184.20. On the support side, the primary level is at $169.89, core support at $152.43, and in extreme volatility scenarios, support could drop to $130.85.

Source: tradingview.com

TSM Stock Forecast - Relative Strength Index (RSI)

The RSI for TSM stands at 56.47, indicating a neutral zone with no bullish or bearish divergence. The RSI line is trending downward, suggesting weakening momentum.

TSMC Stock Prediction - Moving Average Convergence/Divergence (MACD)

The MACD line is at 14.53, with the signal line at 12.58 and the histogram at 1.950, showing a bullish trend. However, the strength of this trend is decreasing, indicating potential upcoming bearish momentum.

![]()

Source: tradingview.com

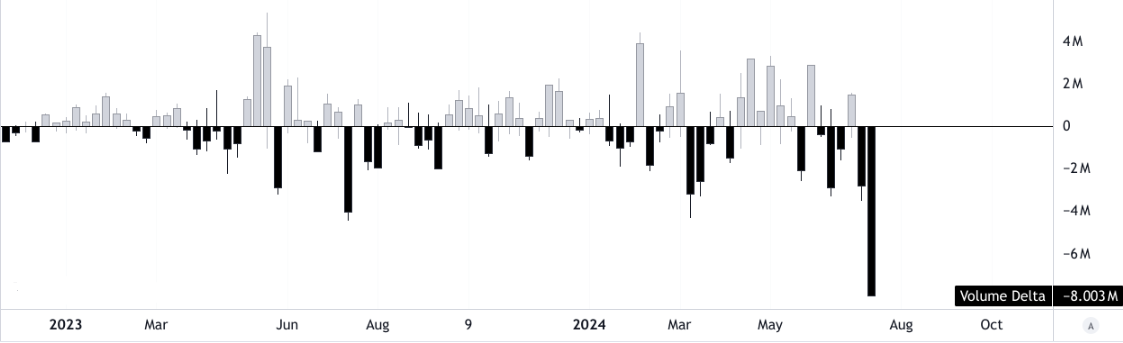

TSM Stock Price Prediction - Price Volume Trend (PVT)

The PVT line at 267.561 million, above its moving average of 246.301 million, indicates bullish momentum in stock price. However, with a volume delta of -8.003 million (up volume at 4.502 million and down volume at -12.504 million), there is significant selling pressure, which might affect future price movements.

Source: tradingview.com

B. TSM Stock Prediction: Fundamental Analysis

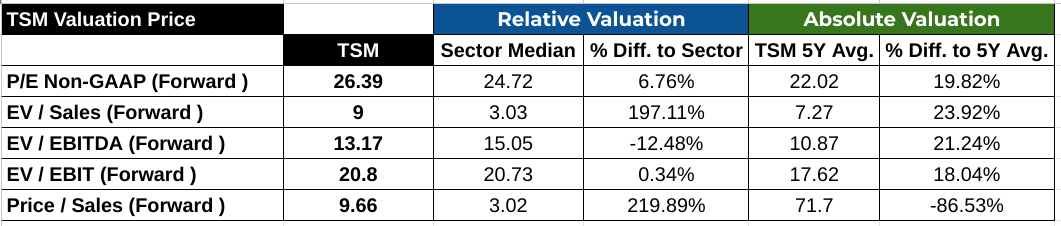

P/E Ratio (Forward): TSM's forward P/E ratio stands at 26.39, which is 6.76% higher than the sector median of 24.72. This suggests that the market is willing to pay a premium for TSM's earnings relative to its peers. However, compared to its five-year average P/E ratio of 22.02, TSM is trading at a 19.82% higher multiple, indicating potential overvaluation based on historical standards.

EV/Sales (Forward): The company's forward EV/Sales ratio is 9, significantly higher than the sector median of 3.03 by 197.11%. This reflects a higher enterprise value per unit of sales, which might indicate expectations of higher growth or profitability. Compared to its five-year average of 7.27, the current ratio represents a 23.92% increase.

Price/Sales (Forward): TSM's forward Price/Sales ratio is 9.66, which is 219.89% higher than the sector median of 3.02. This substantial difference highlights the market's high expectations for TSM's revenue generation capabilities. Compared to its five-year average, this ratio has decreased by 86.53%, showing a significant divergence from its historical norm.

Source: Analyst's compilation

C. TSM Forecast: Market Sentiment

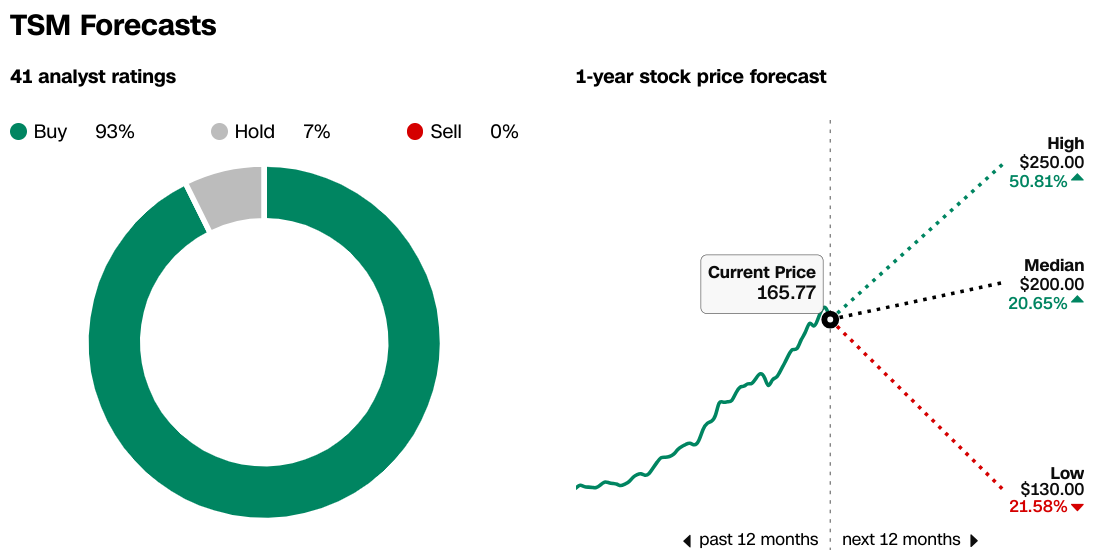

TSM Price Target: Market sentiment towards TSM remains highly positive, as evidenced by strong analyst ratings and price targets.

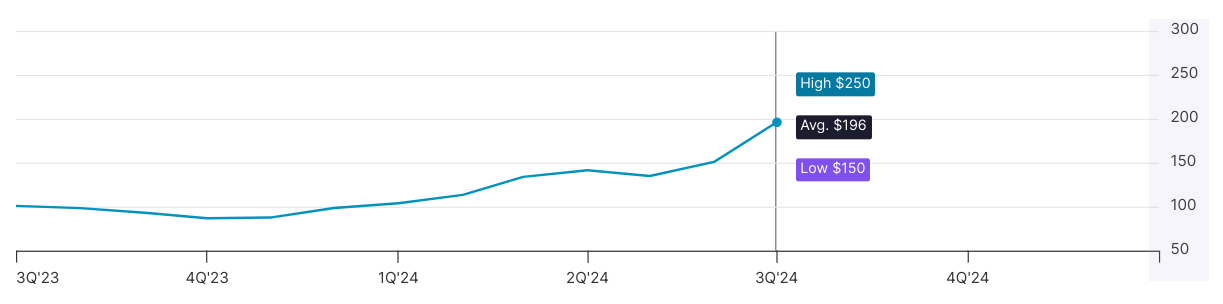

According to CNN, out of 41 analysts, 93% recommend a "Buy," 7% suggest "Hold," and none recommend selling the stock. This overwhelming consensus towards buying reflects high confidence in TSM's future performance.

Source:CNN.com

Analysts have set a high TSM target price of $250, a median of $200, and a low of $130. With the current price at $165.77, the median target represents a 20.65% upside potential, while the high target indicates a 50.81% potential increase, signaling strong growth expectations.

According to Nasdaq.com, analysts have set a consensus 12-month TSM price target at $196. The TSM price prediction range spans from a high of $250 to a low of $150, based on evaluations over the last three months.

Source:Nasdaq.com

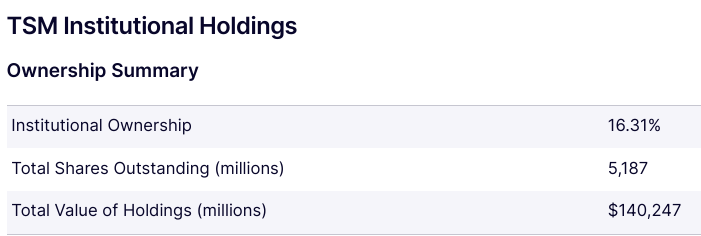

Institutions hold 16.31% of TSM's total shares outstanding, amounting to 5,187 million shares valued at approximately $140,247 million. This substantial institutional ownership underscores confidence in TSM's long-term value proposition.

Source:Nasdaq.com

TSM Stock has a short interest of 27.86 million shares, with 1.55 days to cover. While the short interest data is modest, it suggests a relatively low level of bearish sentiment among investors, reinforcing the overall positive market outlook.

Source:Benzinga.com

IV. TSMC Stock Forecast: Challenges & Risk Factors

TSMC Competitors

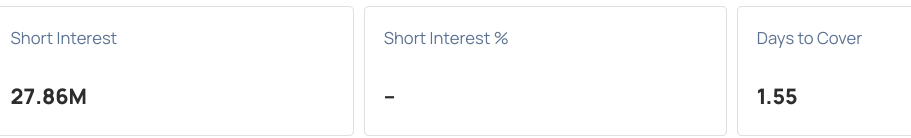

TSMC faces significant competition from several key players in the semiconductor foundries industry, which can impact its market share (61.7%) and profitability. Notable competitors include:

Samsung Electronics: As a leading player (11% market share) in the semiconductor foundry business, Samsung competes directly with TSMC in advanced nodes such as 5nm and 3nm.

GlobalFoundries: Although not competing at the very leading edge, GlobalFoundries still represents competition (5.1% market share) in more mature nodes. Its focus on specialized processes and cost-effective manufacturing solutions makes it a formidable competitor in the mid-range semiconductor market.

SMIC: China's Semiconductor Manufacturing International Corporation (SMIC) is rapidly advancing its technological capabilities, despite facing challenges due to U.S. sanctions. With significant government backing, SMIC is striving to catch up in advanced node technologies (5.7% market share), aiming to reduce China's dependence on foreign semiconductor manufacturing.

UMC: United Microelectronics Corporation (UMC) focuses on mature and specialty technologies, offering competitive alternatives (5.7% market share) to TSMC's offerings in certain segments.

Intel: Traditionally a leader in semiconductor manufacturing for its processors, Intel is now aggressively entering the foundry business with its Intel Foundry Services (IFS).

[Semiconductor foundries revenue share worldwide 2019-2024, by quarter]

Source: statista.com

Other Risks

Geopolitical Tensions: TSMC's operations are heavily concentrated in Taiwan, making it vulnerable to geopolitical tensions, particularly between China and Taiwan. Any escalation in these tensions could disrupt its manufacturing operations and supply chains, impacting global semiconductor supply.

Economic Uncertainty: Global economic fluctuations, including inflation, changes in consumer demand, and shifts in trade policies, can affect TSMC's financial performance. Economic downturns may lead to reduced capital spending by clients, impacting TSMC's revenue growth.

In conclusion, Taiwan Semiconductor Manufacturing Company (TSMC) demonstrated robust financial performance in Q2 2024, with significant revenue growth and strong profitability margins. Advanced technologies, particularly 3nm and 5nm processes, have been pivotal in driving this growth. High-Performance Computing (HPC) emerged as the dominant segment, reflecting rising demand in AI and data center markets. Despite volatility, TSM stock may perform well, making it a buy.

For traders and investors looking to trade TSMC stock through CFDs, platforms like the VSTAR trading app offer a secure, institutional level, and user-friendly experience. VSTAR, regulated by CySEC, provides access to various markets, including TSMC stock CFDs, allowing traders to capitalize on TSMC's strong market position and growth potential with minimal trading costs and deep liquidity.