- Despite facing a Gulf of Mexico outage, Occidental Petroleummaintained production and exceeded guidance in key segments.

- Exceeded production expectations with robust performance in Permian Basin and Rockies, with record production in Oman North, indicating growth potential.

- Moderately bullish outlook technical signifies average price target of $73 by year-end.

- Uncertainties related to strategic acquisition of CrownRock and regulatory approvals may impact performance.

I. Occidental Petroleum Q1 2024 Performance Analysis

A. Occidental Petroleum Key Segments Performance

Financially, the company derived a substantial operating cash flow of $2 billion and a cash flow from operations before working capital of $2.4 billion. Despite capital spending of $1.8 billion and contributions from noncontrolling interests of $57 million, Occidental achieved a quarterly free cash flow before working capital of $720 million. Net income attributable to common stockholders stood at $718 million, with earnings per diluted share of $0.75 and adjusted earnings per diluted share of $0.63.

Source: Q1 2024 Earnings

In terms of operational performance, Occidental's total company production reached 1,172 thousand barrels of oil equivalent per day (Mboed), close to the midpoint of guidance despite challenges like the extended third-party outage in the eastern Gulf of Mexico. The company's Midstream and Marketing segment exceeded expectations, reflecting a pre-tax loss of $33 million but outperforming by approximately $100 million when adjusted. OxyChem also surpassed guidance, earning pre-tax income of $260 million, driven by improved demand for polyvinyl chloride and vinyl chloride monomer alongside lower ethylene costs.

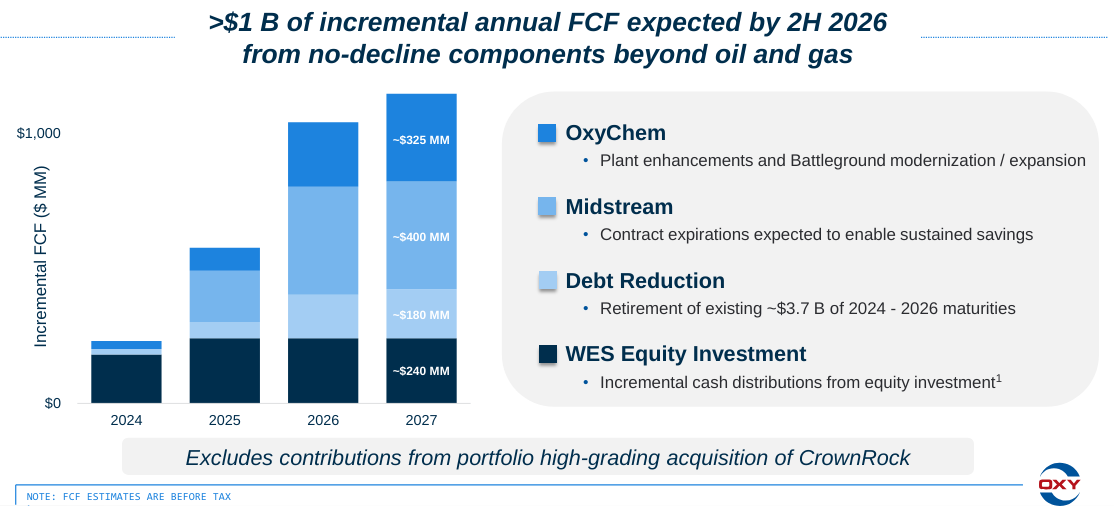

Looking at key partnerships and collaborations, Occidental Petroleum's strategic ownership stake in Western Midstream is expected to enhance financial results, with WES contributing over $240 million of additional cash flow per year. Furthermore, ongoing projects like the Battleground Project and the completion of the OxyChem plant enhancement projects are anticipated to drive incremental cash flow, strengthening the company's position in the market.

Moving to technological advancements, the company's strategic initiatives included enhancing operational efficiency through innovative well designs and execution practices, resulting in tangible cost reductions in various basins. Additionally, Occidental deployed a fully electric well service rig, marking a significant milestone in its sustainability and emission reduction efforts.

B. OXY Stock Price Performance

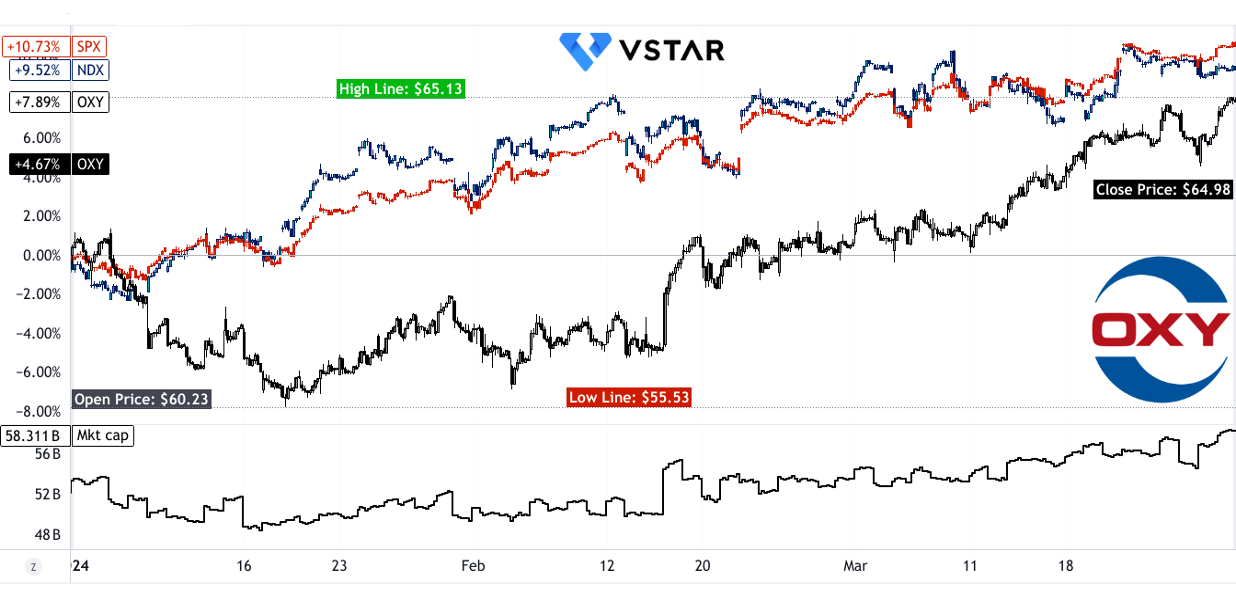

Occidental Petroleum's (NYSE:OXY) stock performance during the quarter reveals a modest 8% price return. Despite the positive growth, it lags behind the S&P 500 and NASDAQ indices, which both experienced 11% and 10% price returns, respectively. The company's market capitalization of $58.311 billion as of March 31, 2024, reflects its significance in the energy sector. While the opening and closing prices suggest an upward trajectory from $60.23 to $64.98, the range between highs and lows, $65.13 and $55.53 respectively.

Source: tradingview.com

II. Occidental Petroleum Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with Growth Potential:

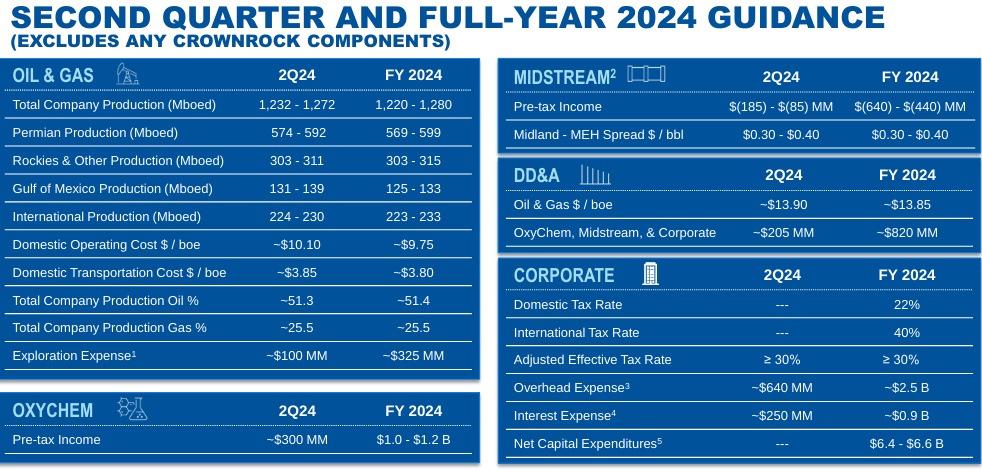

Permian Production: Occidental Petroleum's projection for Permian production is indicative of its focus on harnessing the potential of this prolific basin. With anticipated production ranging from 574 to 592 thousand barrels of oil equivalent per day (Mboed), the Permian segment remains a linchpin of the company's operations. This forecast reflects not only the company's existing capabilities but also its strategic efforts to optimize output in one of the most significant oil-producing regions globally.

OxyChem: Within its chemical segment, OxyChem, Occidental Petroleum anticipates significant growth potential. The forecasted pre-tax income of $300 million for the second quarter and $1.0 to $1.2 billion for the full year 2024 underscores the segment's resilience and profitability. Factors such as improved demand for key products like PVC and vinyl chloride, coupled with operational efficiencies and cost optimization, position OxyChem as a vital contributor to Occidental Petroleum's financial performance.

Midstream: Despite facing challenges in the first quarter, Occidental Petroleum's midstream segment is poised for growth and improvement. The company's ability to leverage market intelligence and optimize transportation capabilities highlights its competitive advantage in the midstream sector. The projected pre-tax income improvements and enhanced cash flow underscore Occidental Petroleum's focus on capitalizing on market opportunities and strengthening its position in the midstream landscape.

Source: Q1 2024 Earnings

B. Expansions and Strategic Initiatives:

Strategic Acquisitions: Occidental Petroleum's acquisition of CrownRock in late 2023 represents a strategic move aimed at enhancing its portfolio in the Midland Basin. This acquisition is not merely a transaction but a strategic initiative designed to drive free cash flow accretion, optimize the company's asset portfolio, and ultimately enhance shareholder returns. By integrating CrownRock's assets and leveraging synergies, Occidental Petroleum aims to accelerate its growth trajectory and unlock additional value for its shareholders.

Research and Development (R&D) Investments: The completion of OxyChem plant enhancement projects, including the Battleground Project, underscores Occidental Petroleum's focus on innovation and operational excellence. Axis Energy Services is integral to OXY's strategy of enhancing operational edge. The deployment of the first fully electric well service rig in the Permian Basin signifies a significant milestone. Electric rigs offer several advantages over traditional diesel-powered rigs, including lower operating costs, reduced emissions, and enhanced safety. The projected cash flow improvement of approximately $725 million per year signifies the tangible outcomes of the company's R&D investments.

Partnerships and Collaborations: Occidental Petroleum's partnership with Western Midstream Partners (WES) is poised to drive additional cash flow through increased distributions. The recent announcement of a significant distribution increase by WES underscores the value of this partnership for Occidental Petroleum and its shareholders. Additionally, collaborations in low carbon ventures, such as the construction of the STRATOS direct air capture plant, exemplify the company's focus on sustainability and diversification beyond traditional oil and gas operations.

III. OXY Stock Forecast 2024

A. OXY Stock Predictions: Technical Analysis

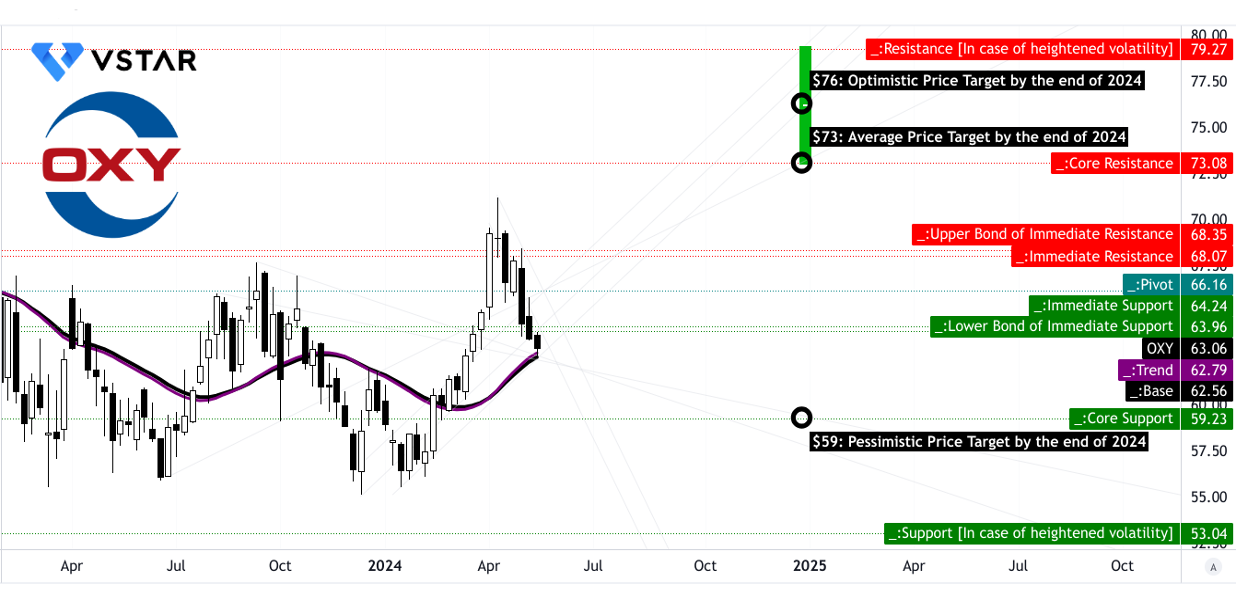

The forecast offers an average OXY price target of $73 by the end of 2024, derived from the momentum of change-in-polarity over the mid- to short-term and projected over Fibonacci retracement/extension levels. This indicates potential growth but doesn't guarantee it. The optimistic target of $76 and pessimistic target of $59 provide a range of potential outcomes, acknowledging the uncertainty inherent in forecasting financial markets.

The current price of Occidental Petroleum (OXY) stands at $63.06, with a trendline of $62.79 and a baseline of $62.56, both indicating a downward trajectory. The primary resistance at $63.96 and the core resistance at $73.08 suggest barriers that the stock may encounter on its upward trajectory. Conversely, core support at $59.23 and potential support during heightened volatility at $53.04 offer floors against significant downward movements.

Source: tradingview.com

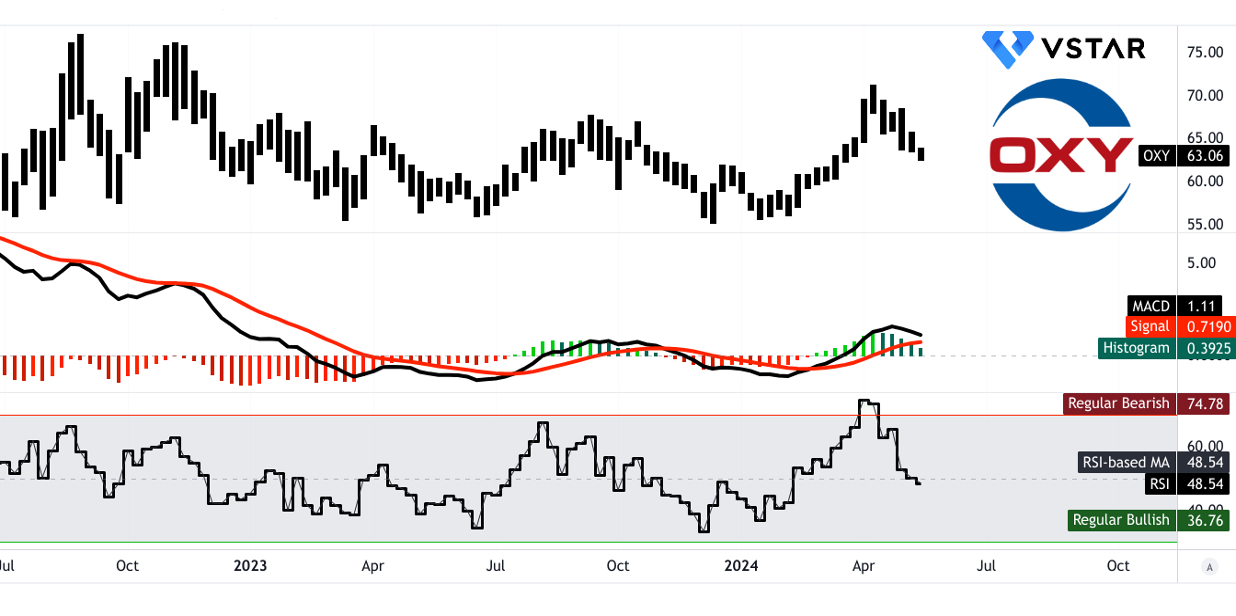

On the other hand, the RSI value of 48.54 suggests a neutral stance. RSI levels above 70 typically indicate overbought conditions, while levels below 30 indicate oversold conditions. The absence of bullish or bearish divergence indicates that the current price trend is not accompanied by corresponding shifts in RSI, suggesting a lack of confirmation for potential trend reversals. The downward trend in the RSI line further supports the notion of a weakening bullish momentum.

Moreover, the MACD indicator provides insight into the relationship between two moving averages of an asset's price. A bullish trend is indicated by the MACD line crossing above the signal line, while a bearish trend is signaled by the MACD line crossing below the signal line. The MACD line of 1.11, signal line of 0.719, and positive MACD histogram of 0.393 suggest a bullish trend. However, the decreasing strength of the trend indicates a potential weakening in bullish momentum.

Source: tradingview.com

B. OXY Stock Price Forecast: Fundamental Analysis

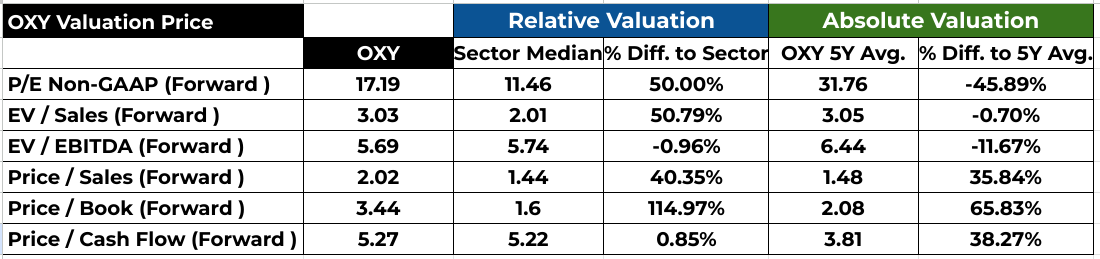

When considering financial ratios, particularly the Price/Earnings (P/E) ratio and its variants, OXY appears moderately valued compared to both its sector median and its own 5-year average. The P/E Non-GAAP (Forward) ratio of 17.19 suggests a 50.00% premium compared to the sector median, but a 45.89% discount compared to its own 5-year average.

Source: Analyst's compilation

C. OXY Stock Price Prediction: Market Sentiment

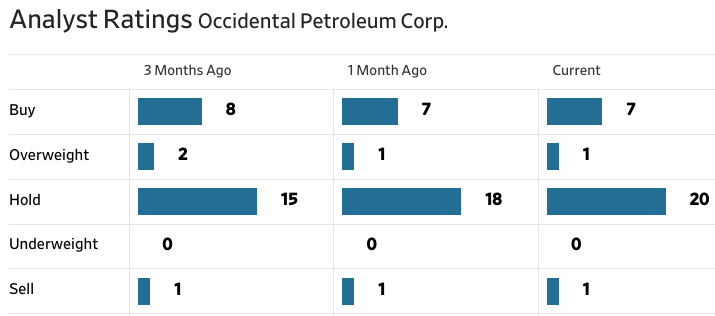

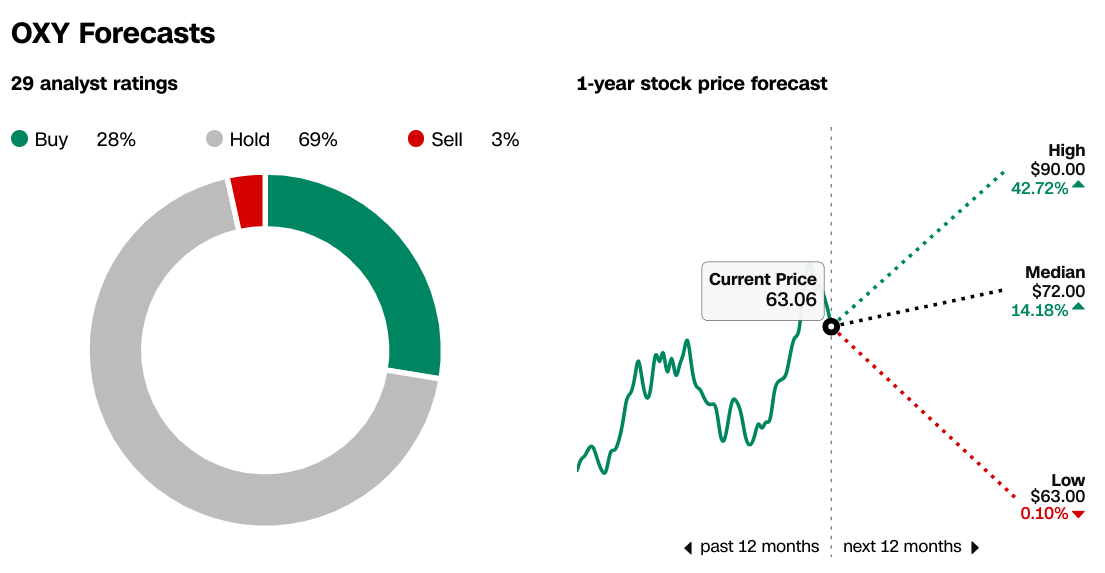

Analyst sentiment, as per WSJ.com and CNN.com, portrays a mixed outlook. While the majority of analysts recommend a "Hold" position, there are significant numbers advocating for "Buy" positions. The stock price targets also vary, with a median target of $72.00, indicating a potential upside of 14.18% from the current price. However, it's essential to note that there is divergence in the targets provided by different sources, which might reflect differing methodologies or interpretations of market trends.

Source: WSJ.com

Source: CNN.com

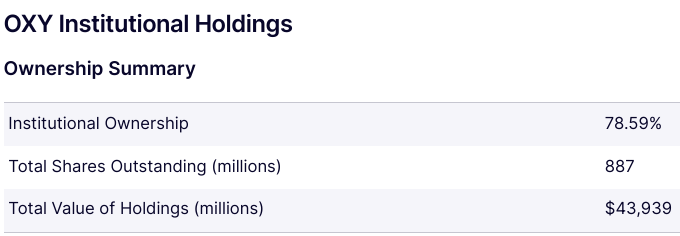

Institutional holdings indicate a strong level of confidence in OXY, with institutional ownership standing at 78.59% of total shares outstanding. Short interest, as per Benzinga.com, stands at 51.4 million shares, which represents 11.3% of the total shares outstanding. The days to cover this short interest is approximately 5.66 days. This high short interest indicates bearish sentiment among investors, suggesting that there is a sizable portion of the market betting against the stock's performance.

Source: nasdaq.com

Source: benzinga.com

IV. OXY Stock Forecast 2024: Challenges & Risk Factors

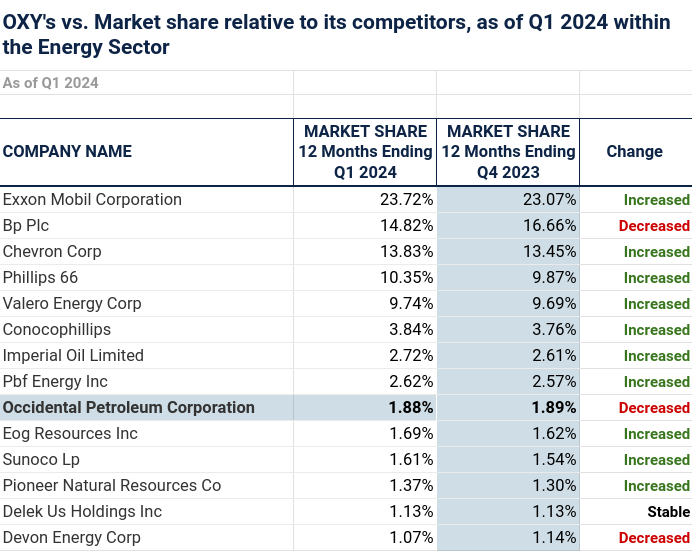

OXY's market share within the energy sector has seen fluctuations, with notable competitors like Exxon Mobil, BP, and Chevron either increasing or decreasing their shares. Despite these shifts, OXY's market share decreased slightly, sequentially in Q1 2024, indicating potential challenges in maintaining competitiveness within the sector.

Source: Analyst's compilation (data: csimarket.com)

OXY's high level of indebtedness poses significant risks, making it more vulnerable to economic downturns and adverse developments in its businesses. Downgrades in credit ratings or increases in interest rates could negatively impact OXY's cost of capital and ability to access capital markets. Similarly, the completion of the CrownRock Acquisition is subject to regulatory approvals and other conditions, with potential delays or failure to obtain necessary approvals posing risks to OXY's financial performance.

In conclusion, Occidental Petroleum has showcased a resilient performance in Q1 2024. With strong operating cash flow, technological innovations reflect the company's focus on efficiency and sustainability. Looking ahead, Occidental Petroleum anticipates growth opportunities in key segments like its onshore U.S. operations and international ventures. Strategic initiatives such as the CrownRock acquisition underscore the company's proactive approach to expansion.

The OXY stock forecast for 2024 suggests a moderately bullish outlook, with an average OXY stock price target of $73 by year-end. Risks to OXY forecast include competition from industry peers, financial vulnerabilities due to high indebtedness, and uncertainties related to strategic acquisitions and regulatory approvals. As for investment recommendations, individuals interested in trading OXY stock or CFDs may consider leveraging platforms like VSTAR, offering access to global markets with low trading costs, institutional-grade trading experiences, and regulatory compliance for investor protection.