- Nvidia achieved record quarterly revenue driven by significant growth in data center and AI products, with impressive year-over-year increases in earnings per share.

- The company is positioned for substantial growth in 2024, fueled by the expanding AI market and increasing adoption of its advanced GPU platforms.

- Nvidia anticipates robust financial performance and continued revenue growth, particularly in the data center and AI factory segments.

- The upcoming stock split (10-for-1) is aimed at increasing stock accessibility and potentially boosting trading volume and price growth.

- Technical indicators suggest a strong upward trend for Nvidia's stock, with optimistic price targets reflecting continued investor confidence.

I. Nvidia Q2 2024 Performance Analysis

A. Nvidia Key Segments Performance

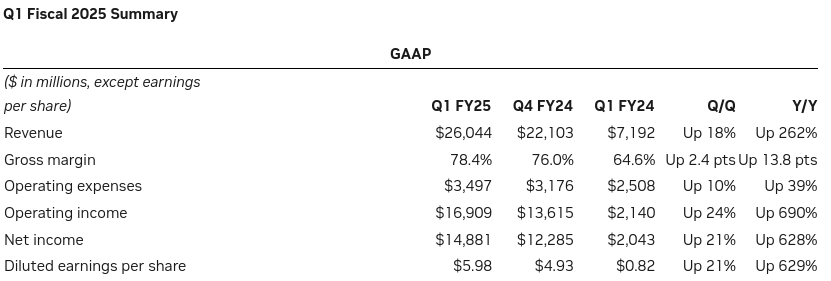

Nvidia reported a record quarterly revenue of $26.0 billion, marking an 18% increase from Q4 and a staggering 262% rise compared to the same quarter last year. This dramatic revenue surge is primarily attributed to the burgeoning demand for Nvidia's data center products and AI solutions. On a non-GAAP basis, EPS was $6.12, reflecting a 19% increase from the prior quarter and 461% year-over-year. This highlights the company's ability to generate substantial profit margins.

Source: Q1 Fiscal 2025 Earnings

The data center segment was a standout performer with revenue hitting $22.6 billion, a 23% increase from the previous quarter and a phenomenal 427% year-over-year growth. This surge was driven by the adoption of Nvidia's Hopper GPU platform for AI training and inference. Gaming revenue reached $2.6 billion, down 8% from Q1 but up 18% year-over-year. The dip from the previous quarter reflects seasonal trends.

Professional Visualization segment generated $427 million in revenue, down 8% sequentially but up 45% from the prior year. The growth was driven by the introduction of new RTX GPUs for professional workstations and the expanding adoption of Nvidia's Omniverse platform for industrial digital twins and simulation technologies. Automotive revenue was $329 million, a 17% sequential increase and 11% year-over-year growth. This was fueled by the ramp-up of AI cockpit solutions and Nvidia DRIVE platforms.

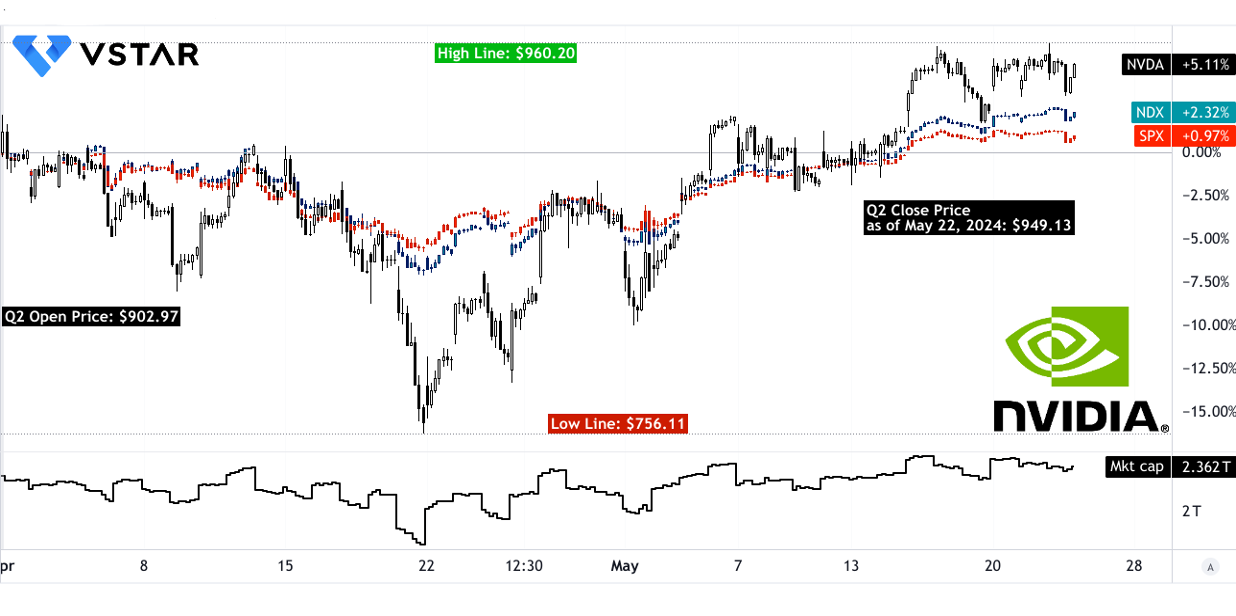

B. NVDA Stock Price Performance

As of May 22, 2024, NVIDIA (NASDAQ: NVDA) has demonstrated robust stock performance, with a market cap reaching $2.362 trillion. In Q2, NVDA's stock opened at $902.97 and closed at $949.13, reflecting a 5% price return, significantly outperforming major indices. The stock hit highs of $960.20 and lows of $756.11. In comparison, the S&P 500 (SPX) and NASDAQ-100 (NDX) posted modest returns of near 1% and over 2%, respectively.

Source: tradingview.com

II. Nvidia Stock Forecast 2024: Outlook & Growth Opportunities

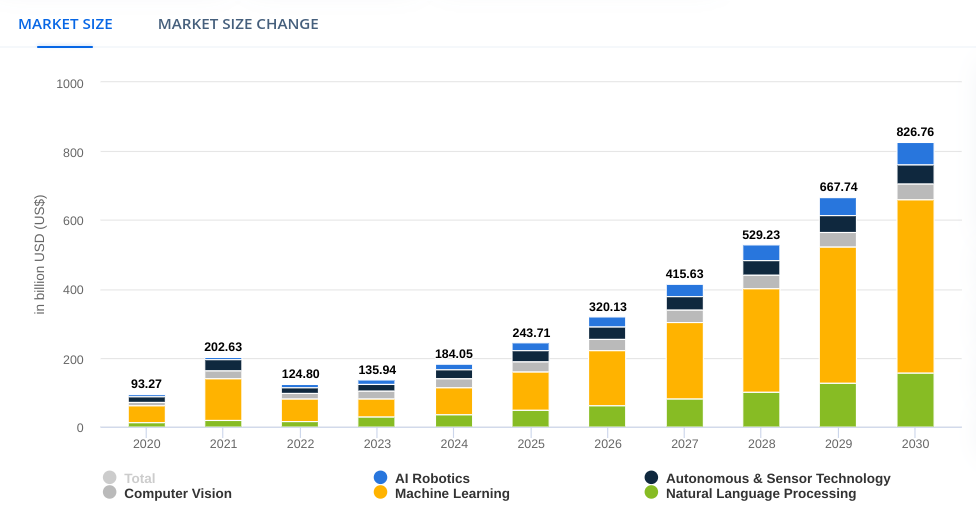

NVIDIA (NASDAQ:NVDA) is poised for significant growth in 2024, driven primarily by the booming AI market, projected to reach $184 billion with a CAGR of 28.46% from 2024 to 2030 (statista.com). The largest AI market will be in the United States, expected to hit $50.16 billion in 2024.

Source: statista.com

A. Segments with growth potential

NVIDIA projects strong financial performance for Q2 FY2025 with expected revenue of $28 billion, a robust gross margin around 75%, and significant operating expenses growth, suggesting a bullish trend. The company's mid-70% gross margin target highlights its profitability amidst rising costs.

Data Center revenue, driven primarily by NVIDIA's Hopper GPU platform, is expected to continue its upward trajectory. Also, as AI model complexity increases, the need for large-scale AI factories will grow. NVIDIA's advanced GPU clusters will support these factories, driving substantial revenue from customers like Tesla and Meta. Significant projects in Japan, France, Italy, and Singapore are leveraging NVIDIA's end-to-end technologies. This diversification into sovereign AI infrastructures is expected to contribute significantly to revenue, potentially reaching high single-digit billions.

B. Expansions and strategic initiatives

Mergers and Acquisitions

Acquiring Mellanox has significantly strengthened Nvidia's networking capabilities, crucial for high-performance computing and AI workloads. Mellanox's InfiniBand and Ethernet solutions complement Nvidia's GPUs, enabling faster data transfer and more efficient AI processing.

Partnerships and Collaborations

Nvidia continues to deepen its relationships with AWS, Google Cloud, Microsoft, and Oracle, enhancing its position in the cloud AI market. Partnerships with Tesla for AI infrastructure and Meta for large language model (LLM) training have been particularly impactful. Nvidia is working with governments and national organizations, like Japan's KDDI and France's Scaleway, to build AI infrastructure tailored to local needs. Collaborations with companies like Johnson & Johnson MedTech and various automotive OEMs (e.g., BYD, XPENG) underscore Nvidia's role in transforming these sectors through AI.

C. Nvidia Stock Split (10-for-1) in June

Nvidia announced a ten-for-one stock split to make shares more affordable and accessible to a broader range of investors. Current investors receive nine additional shares for each share they hold, effectively multiplying their shares by ten while maintaining the same total value. The split can increase investor interest and trading volume, potentially driving stock price growth over time.

III. Nvidia Stock Price Prediction 2024

A. Nvidia Price Prediction: Technical Analysis

The average NVDA price target by the end of 2024 is projected to be $1,400. This projection is based on the momentum of change-in-polarity over the mid- to short-term, which has been analyzed using Fibonacci retracement/extension levels. These levels are commonly used in technical analysis to predict potential price movements by identifying possible support and resistance levels. An optimistic Nvidia price target is set at $1,636.00. This scenario assumes that the current upward price momentum continues, again using Fibonacci retracement/extension levels to forecast this higher price point. Conversely, the pessimistic NVDA price target stands at $806.00, indicating a potential downturn in price momentum over the same mid- to short-term period.

Source: tradingview.com

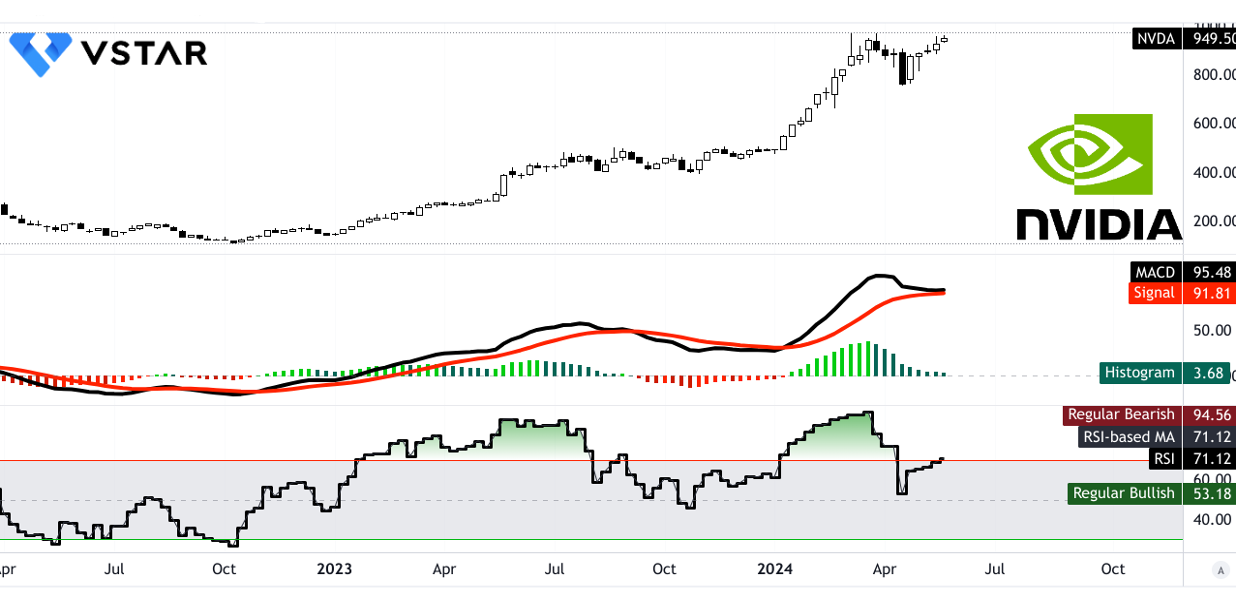

The stock is currently trading at $949.50, indicating a strong market presence and investor confidence. The trendline, set at $776.57, and the baseline at $760.01, both derived from modified exponential moving averages, show a positive upward trend. This trend suggests that the stock has been consistently gaining value, setting a foundation for further potential increases by the end of 2024. NVIDIA's primary support level is identified at $785, providing a strong foundation where the stock might stabilize in the event of a decline. The pivot of the current horizontal price channel is $640.14, serving as a critical marker for any potential price reversals. Core resistance is marked at $1,165.91, highlighting a significant hurdle that the stock must overcome to achieve higher valuations. In scenarios of heightened volatility, the support level is significantly lower at $494.82. This wide range between primary support and core support indicates potential for considerable price fluctuations.

The Relative Strength Index (RSI) for NVIDIA is currently at 71.12, suggesting that the stock is in an overbought condition. Typically, an RSI above 70 indicates that a stock may be overvalued, potentially leading to a price correction. However, the regular bullish level is at 53.18, and the regular bearish level is at 94.56, with a current bearish divergence indicating that despite the strong upward trend, there might be some underlying weaknesses. The Moving Average Convergence/Divergence (MACD) indicator further supports the bullish outlook with a MACD line at 95.48 and a signal line at 91.81. The MACD histogram at 3.680 indicates positive momentum, albeit with decreasing strength. This decreasing strength in the trend might signal a potential slowing down of the bullish momentum, warranting cautious optimism.

Source: tradingview.com

B. NVDA Stock Prediction: Fundamental Analysis

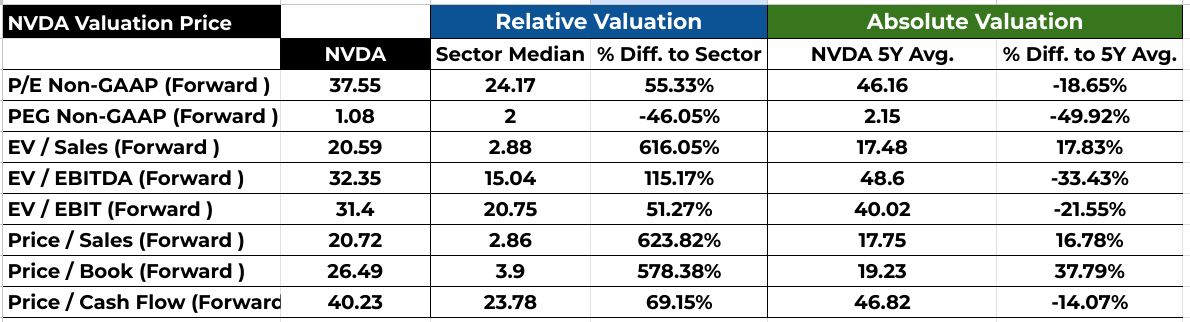

Nvidia's forward P/E ratio of 37.55 is significantly higher than the sector median of 24.17, indicating a premium valuation. However, it's lower than its 5-year average of 46.16, suggesting some relative undervaluation compared to its historical norms. The PEG ratio of 1.08, which is well below the sector median of 2 and Nvidia's 5-year average of 2.15, indicates that Nvidia's high earnings growth rate is not fully priced into the stock, suggesting potential undervaluation in terms of growth.

Source: Analyst's compilation

C. Nvidia Stock Prediction: Market Sentiment

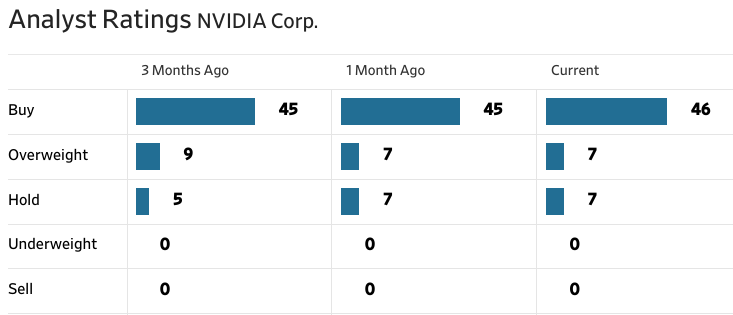

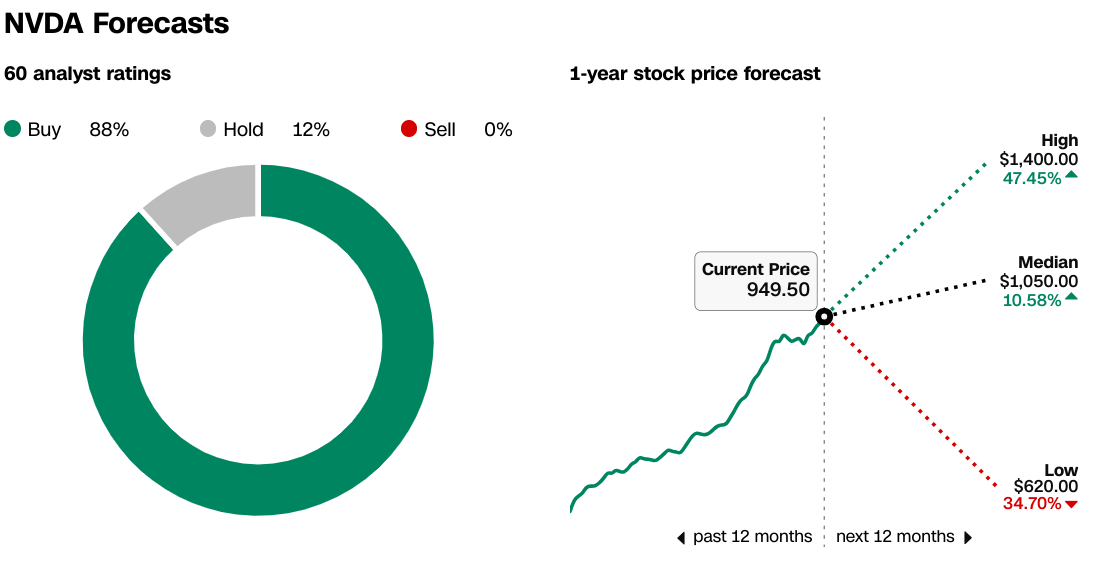

Analysts are overwhelmingly positive on Nvidia, with 46 out of 60 analysts recommending a "Buy" or "Overweight" rating (WSJ). The high Nvidia target price of $1,400 and median target of $1,050 reflect strong bullish sentiment. The current price of $949.50 is already near the median NVDA target price, suggesting moderate upside potential (as per CNN).

Source:WSJ.com

Source:CNN.com

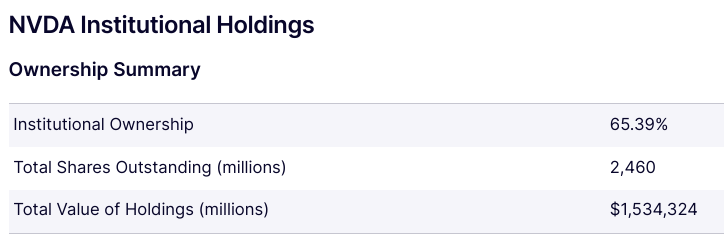

High institutional ownership at 65.39% demonstrates strong confidence from large investors (smart money). Low short interest at 1.14% indicates a lack of bearish sentiment among investors, further supporting a positive outlook.

Source:Nasdaq.com

Source:Benzinga.com

IV. NVDA Stock Forecast 2024: Challenges & Risk Factors

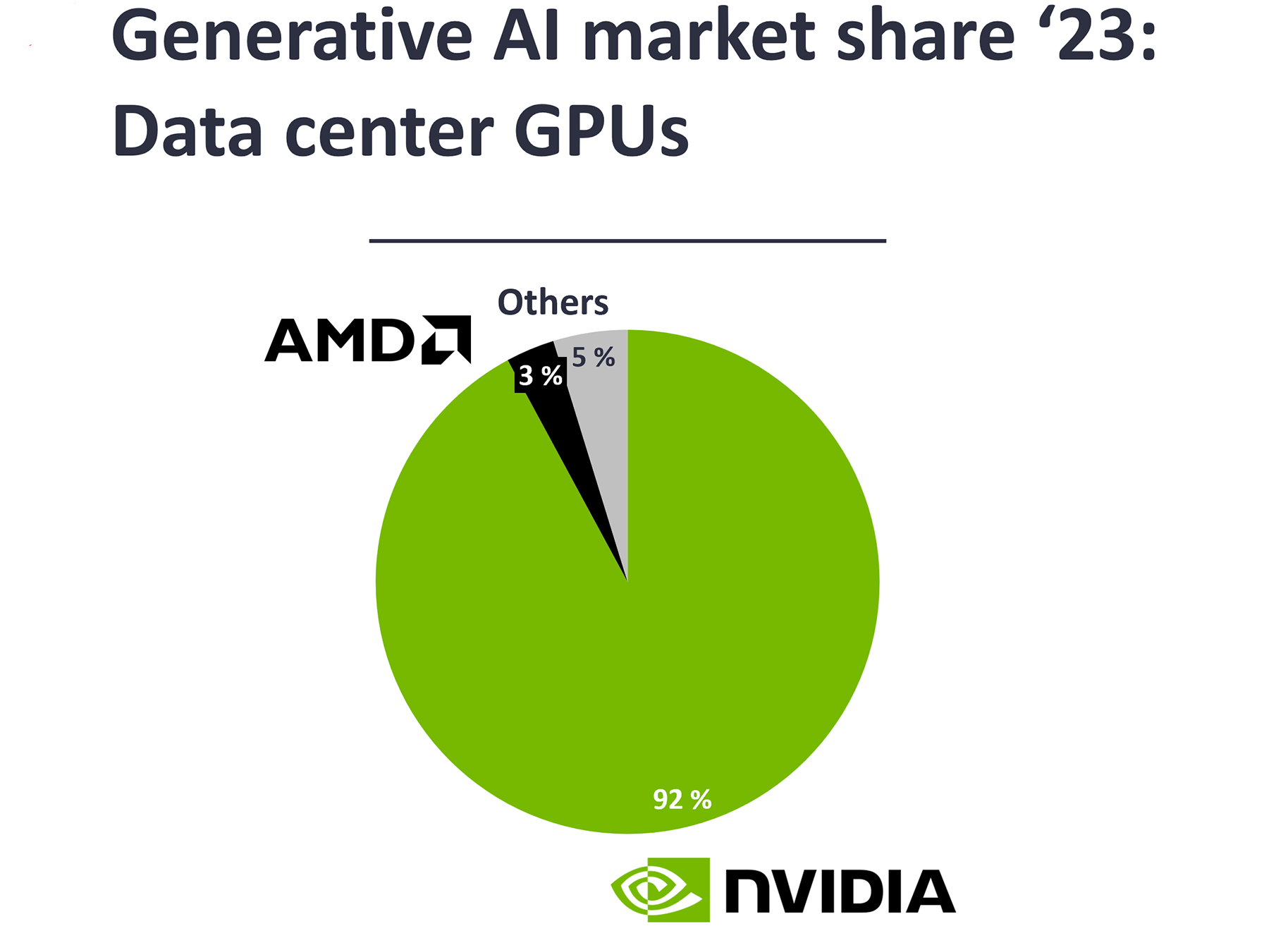

Nvidia leads the data center GPU market with 92% market share. It faces developing competition from other technology giants like AMD (Advanced Micro Devices) and Intel offering alternative solutions.

Source: IOT Analytics

Geopolitical tensions, particularly between the U.S. and China, could impact Nvidia's ability to operate and sell in key markets. Moreover, regulatory changes and export controls could aggressively restrict its business operations.

In conclusion, Nvidia Stock (NVDA) is a buy. Its robust Q2 2024 performance, marked by record revenues driven by data center and AI product demand, positions it strongly for future growth. The stock has shown substantial gains, outperforming major indices. Technical analysis indicates further potential, with optimistic price targets reaching $1,636 by the end of 2024. Despite competition from AMD and Intel and geopolitical risks, Nvidia's strategic acquisitions, partnerships, and a stock split enhance its market position. VSTAR offers a cost-effective, regulated platform for trading Nvidia CFDs, providing deep liquidity, fast execution, and a user-friendly interface, suitable for both novice and professional traders.