AMC Stock Forecast 2024: Q1 Performance and Outlook

- AMC Entertainment reported stable revenues but improved cost management in Q1 2024.

- The stock experienced a significant decline in price, underperforming compared to major indices.

- AMC's stock growth prospects are buoyed by premium formats, innovative offerings, and strategic expansions.

- AMC Entertainment stock technical analysis suggests potential price recovery with key support and resistance levels identified.

- Institutional sentiment remains mixed with high short interest indicating skepticism.

I. AMC Q1 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

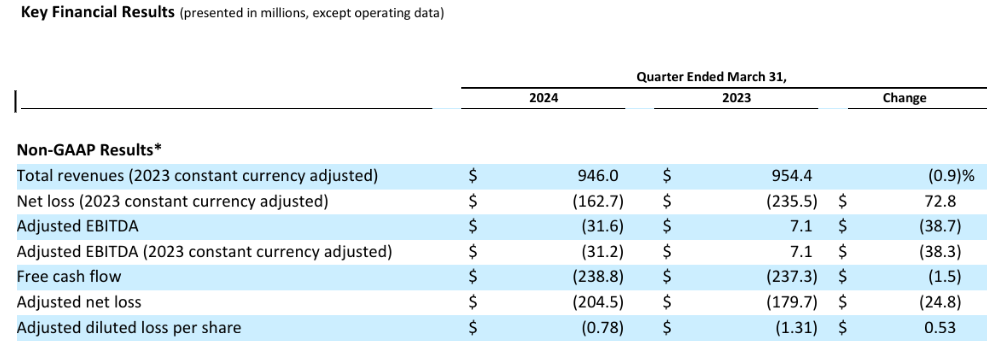

AMC Entertainment Holdings (NYSE:AMC) reported several key financial metrics for Q1 2024 that indicate both challenges and areas of improvement. Total revenues were $951.4 million, marginally down from $954.4 million in Q1 2023, reflecting a stable revenue stream despite external pressures. The net loss improved significantly to $(163.5) million from $(235.5) million in Q1 2023, indicating better cost management and operational efficiency.

Source: 10-Q Q1 2024

Moreover, The net loss per diluted share was reduced to $(0.62) compared to $(1.71) in Q1 2023, showing a substantial improvement in per-share performance. Adjusted EBITDA was $(31.6) million, a decline from $7.1 million in Q1 2023. This metric was affected by a $16.7 million benefit in the prior year related to an early lease termination. Net cash used in operating activities was $(188.3) million, nearly consistent with $(189.9) million in Q1 2023. The company maintained a strong cash position with $624.2 million in cash and cash equivalents.

Operational Performance

Despite a 6% decline in the North American box office and 3% drop in Average screens, AMC grew its domestic market share, demonstrating effective competitive strategies. Both revenue and profit per patron reached record levels for Q1, with a revenue per patron increase of almost 36% compared to pre-pandemic Q1 2019. This indicates success in extracting more value per customer through enhanced experiences and premium offerings. The company reported solid attendance growth in its European segment and revenue growth per patron due to innovative food and beverage offerings.

Technological Advancements and Innovations

The introduction of new food and beverage items, such as donut holes and expanded dine-in theater menus, catered to diverse consumer tastes and boosted per-patron spending. AMC capitalized on partnerships with high-profile musical artists. The success of AMC's Dolby Cinema offerings for special events like the Billie Eilish album launch underscores the integration of advanced audio-visual technology to enhance the theater experience.

B. AMC Stock Price Performance

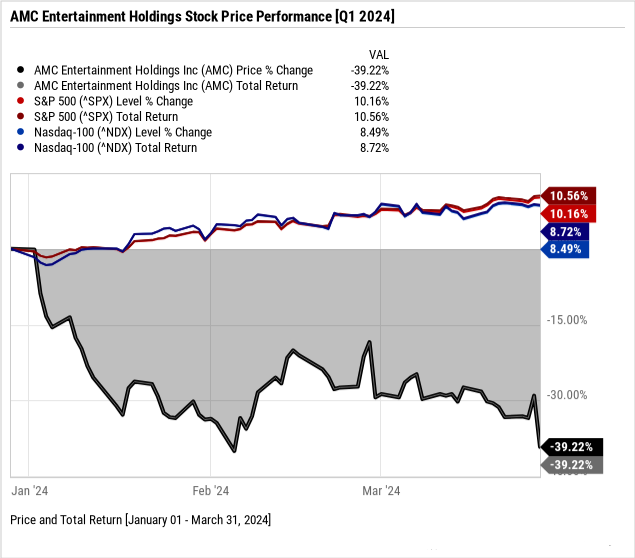

AMC Entertainment (NYSE:AMC) experienced a significant decline in its stock price over the quarter, with a market cap of $981 million and a price drop from $6.09 to $3.72. The stock's high and low within the quarter were $6.33 and $3.59, respectively, resulting in a substantial -39.2% price return and an identical total return.

In contrast, major stock market indices performed robustly during the same period. The S&P 500 (SPX) achieved a 10.2% price return and a 10.6% total return, while the NASDAQ-100 (NDX) posted an 8.5% price return and an 8.7% total return. This stark disparity underscores AMC's underperformance relative to the broader market.

Source: Ycharts.com

II. AMC Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

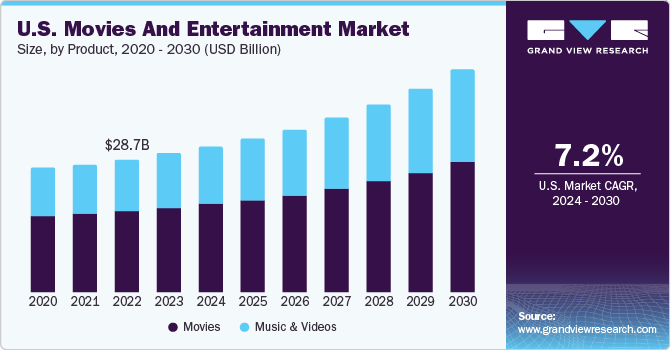

AMC Entertainment is positioned within a recovering global movies and entertainment market, which was estimated at USD 100.38 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030, potentially reaching USD 106.20 billion in 2024 (as per grandviewresearch.com). The U.S. market, specifically, anticipates a CAGR of 7.2%, indicating robust growth prospects for AMC within its primary operational region.

Source: grandviewresearch.com

AMC Entertainment shows significant growth potential across several segments. Firstly, the premium large format screens such as IMAX, Dolby Cinema, and Prime, where AMC has a leadership position, offer high revenue per patron opportunities. With moviegoers showing a willingness to pay more for an enhanced viewing experience, these premium formats are set to drive future growth. Secondly, the innovative food and beverage offerings have proven highly profitable, with AMC outselling competitors in this area. The introduction of fresh donut holes, artisan pizzas, and new chicken sandwiches, among other items, highlights the company's potential to further capitalize on in-theater dining.

Additionally, AMC's retail popcorn initiative, now available at 6,500 points of distribution, has shown remarkable growth. Expansion into more grocery chains and online platforms could sustain this momentum. Finally, AMC's international segment, though impacted by country-specific market conditions, still shows potential for growth, particularly in markets with strong local content offerings.

B. Expansions and strategic initiatives

Mergers and Acquisitions

AMC continues to strategically manage its theater portfolio by closing underperforming locations and opening new high-performing ones. Since the pandemic, AMC has reduced its number of locations but added 60 new ones, which outperform the closed locations. This targeted approach ensures that only profitable locations remain, contributing positively to the bottom line.

Research and Development Investments

Investments in research, particularly in enhancing the guest experience and food and beverage innovation, have been central to AMC's strategy. The continuous introduction of new menu items and improvement in service quality not only increases patron satisfaction but also boosts per capita spending. AMC's exploration of new concepts like branded large-format screens (XL) in Europe shows a commitment to innovation that could be expanded globally.

Partnerships and Collaborations

Collaborations with major artists and content creators are another key area of growth. AMC's partnerships with artists like Taylor Swift, Beyoncé, and Billie Eilish to release concert films and special events exclusively in their theaters have proven highly successful. These collaborations leverage AMC's distribution capabilities and offer unique, exclusive content to attract audiences. The AMC Theatres Distribution arm is set to further capitalize on such partnerships, bringing more innovative content to their screens.

Source: thewrap.com

Moreover, AMC's retail popcorn success, with major retail partners like Walmart, Amazon, Publix, and Kroger, indicates the effectiveness of their collaborative strategies. Expanding these partnerships will further diversify AMC's revenue streams and strengthen its market position.

III. AMC Stock Predictions 2024

A. AMC Price Prediction: Technical Analysis

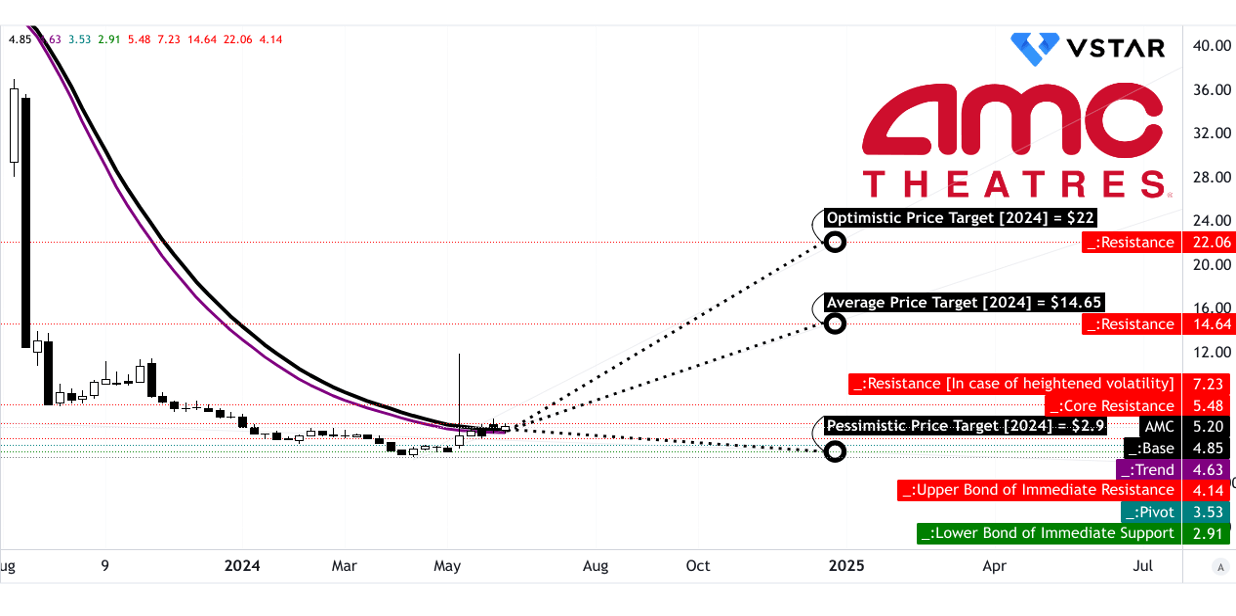

AMC Entertainment (NYSE: AMC) stock currently trades at $5.20. Using a modified exponential moving average, the trendline is $4.63, while the baseline is $4.85, indicating an upward direction. The average AMC price target by the end of 2024 is $14.65, with optimistic projections at $22.00 and pessimistic projections at $2.90, based on momentum changes and Fibonacci retracement/extension levels.

Key support levels include $4.15 and $2.91, with primary support at $4.15 offering a crucial safety net against downward trends. The pivot of the current horizontal price channel is $3.53, highlighting a critical level for traders to watch. Core resistance is identified at $5.48, with heightened volatility resistance at $7.23. These levels suggest that while AMC has strong support, overcoming resistance, especially in a volatile market, will be challenging but essential for a sustained upward trend.

Source: tradingview.com

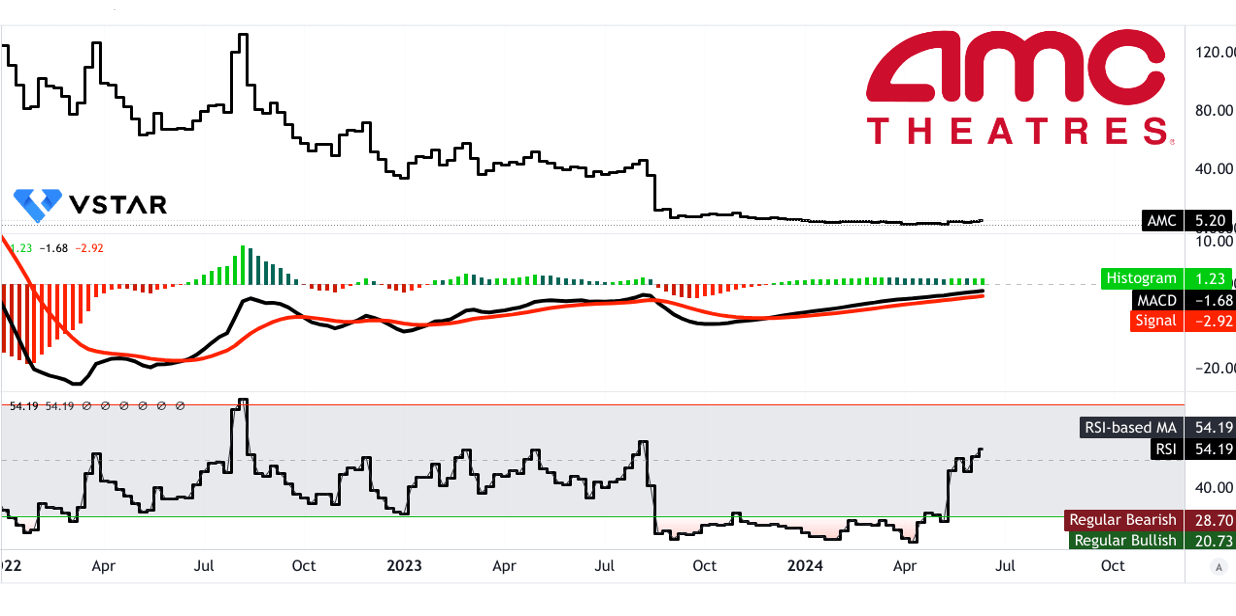

Relative Strength Index (RSI):

The RSI stands at 54.19, indicating a neutral to slightly bullish position. With no bullish or bearish divergence and the RSI line trending upward, it signals potential for further price increases, assuming continued positive momentum. Regular bullish and bearish levels at 20.73 and 28.7, respectively, indicate the need for caution if these thresholds are approached, as they might signify overbought or oversold conditions.

Moving Average Convergence/Divergence (MACD):

The MACD line at -1.68, with the signal line at -2.92 and a histogram reading of 1.230, indicates a bullish trend with increasing strength. This is a positive sign for investors, suggesting that the stock's momentum is gaining traction and could lead to higher price levels if the trend continues.

Source: tradingview.com

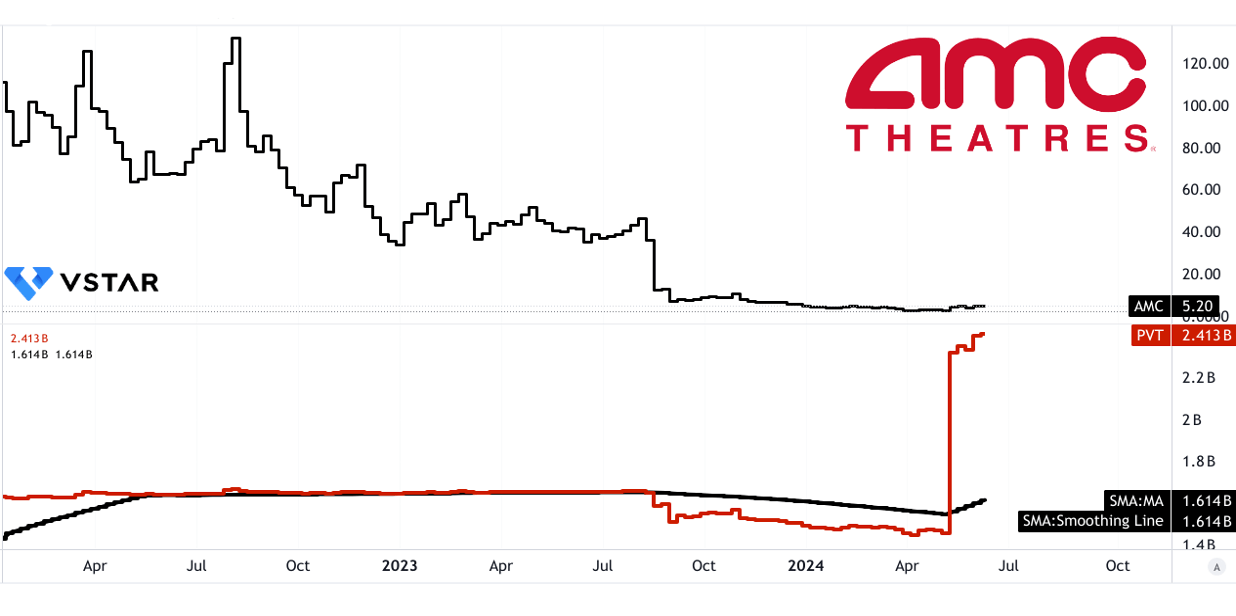

Price Volume Trend (PVT):

The PVT line at 2.413 billion, with a moving average of 1.614 billion, reinforces the bullish momentum. This metric shows that higher volumes are associated with price increases, a positive indicator of sustained upward movement in AMC's stock price.

Source: tradingview.com

B. AMC Stock Price Prediction: Fundamental Analysis

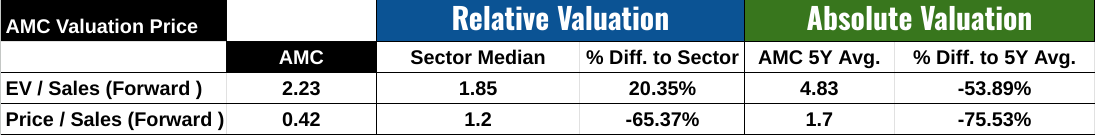

EV/Sales (Forward) and Price/Sales (Forward)

Evaluating AMC's valuation through its EV/Sales (Enterprise Value to Sales) and Price/Sales ratios offers a broader perspective. AMC's forward EV/Sales ratio of 2.23 is 20.35% higher than the sector median of 1.85, suggesting it might be overvalued compared to its industry peers. However, this is significantly lower than its 5-year average of 4.83, indicating a substantial decline and potential undervaluation if the company's sales recover. Similarly, the forward Price/Sales ratio of 0.42 is notably lower than the sector median of 1.2 and its 5-year average of 1.7, suggesting that the market might be undervaluing AMC based on its sales performance.

C. AMC Stock Prediction: Market Sentiment

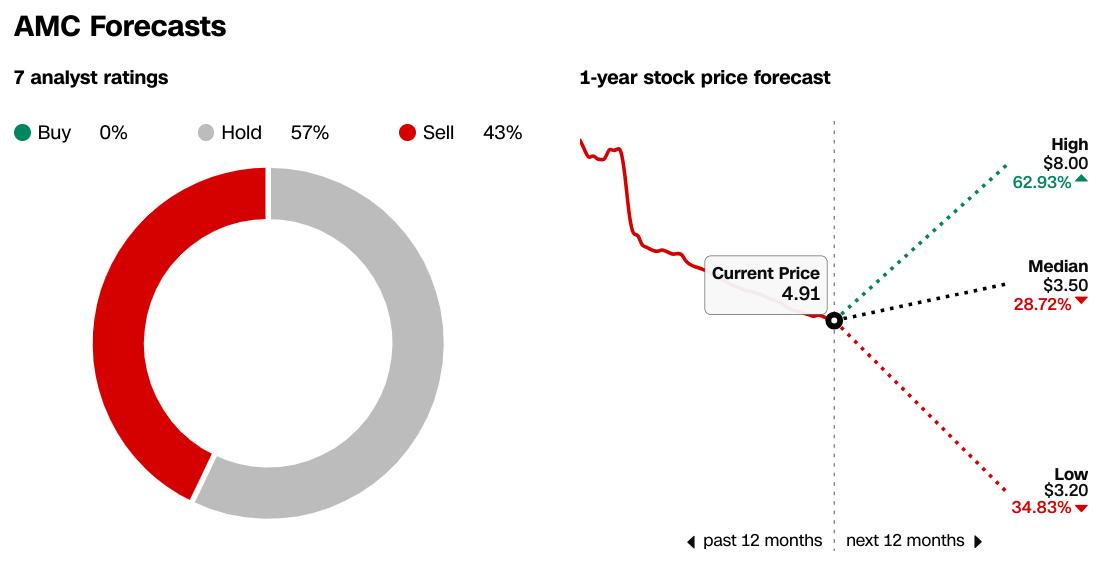

As per CNN.com, AMC has mixed analyst ratings with no 'Buy' recommendations, 57% 'Hold,' and 43% 'Sell' ratings. The 1-year price forecast shows a high of $8.00, a median of $3.50, and a low of $3.20, with the current price at $4.91.

Source:CNN.com

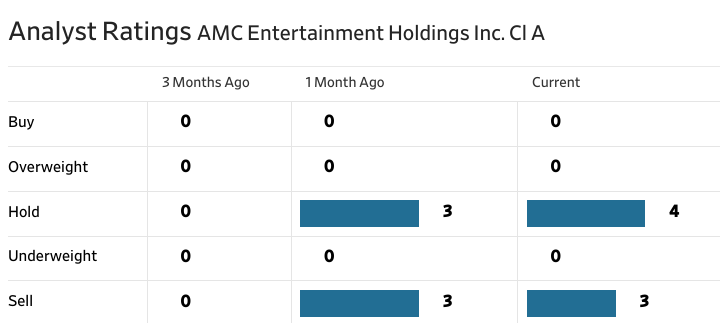

The Wall Street Journal provides a similar sentiment with no 'Buy' or 'Overweight' ratings, a shift towards 'Hold,' and equal 'Sell' ratings.

Source:WSJ.com

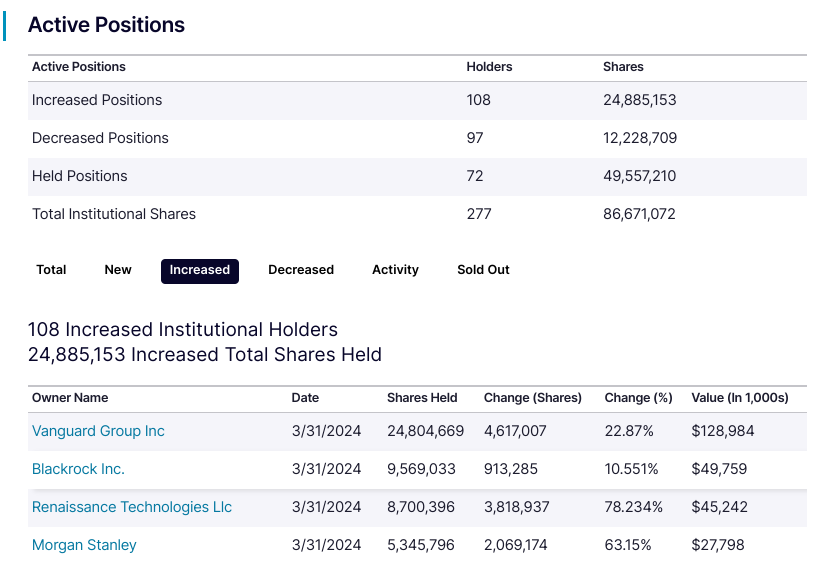

Institutional ownership stands at 29.32%, which is relatively modest, indicating limited confidence from large, professional investors. Institutional holdings total 426 million dollars across 296 million shares. This level of institutional investment suggests some skepticism about AMC's future performance, as institutional investors often seek more stable and profitable ventures. There is a boost in institutional position during Q1 2024 most leads are Vanguard, Blackrock, Renaissance Technologies, and Morgan Stanley.

Source:Nasdaq.com

AMC's short interest stands at 58.2 million shares, which is 19.8% of its total shares outstanding. This high level of short interest indicates that a significant portion of investors expects the stock price to decline. The 'Days to Cover' metric, which is at 1, suggests a high turnover rate for the shorted shares, implying heightened volatility and bearish sentiment.

Source:Benzinga.com

IV. AMC Forecast: Challenges & Risk Factors

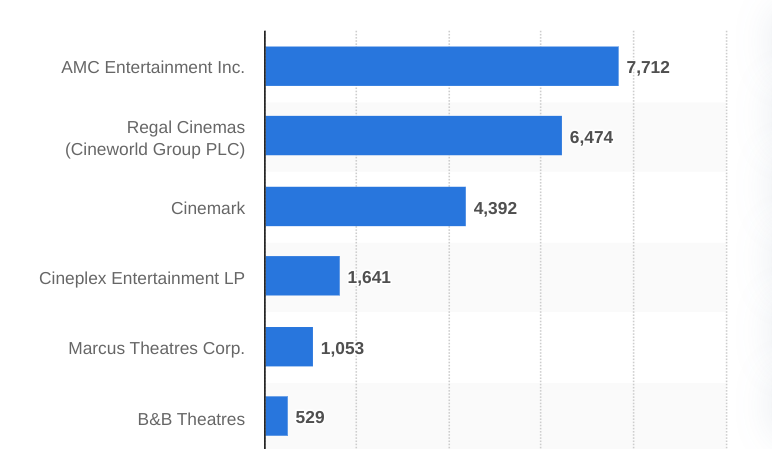

AMC Entertainment faces significant competition from other major theater chains and entertainment platforms. Key competitors include Cinemark Holdings (NYSE:CNK) and Regal Cinemas. Also, streaming services like Netflix (NASDAQ:NFLX), Disney+ (NYSE:DIS), and Amazon (NASDAQ:AMZN) Prime Video present a substantial threat as they increasingly release high-quality, exclusive content directly to consumers. This trend, accelerated by the COVID-19 pandemic, has changed consumer habits, drawing potential moviegoers away from theaters.

[Leading cinema circuits in the United States and Canada as of March 2023, by number of screens]

Source: statista.com

Additionally, AMC's substantial debt, with significant maturities looming in 2026, poses a financial risk. While efforts are underway to refinance and manage this debt, the outcome remains uncertain, potentially affecting AMC's financial stability and investment capacity. The broader economic environment, including inflation and potential recessions, can impact discretionary spending on entertainment. High inflation rates can increase operational costs (e.g., staffing, maintenance, and concessions), further squeezing profit margins.

In conclusion, AMC Entertainment's Q1 2024 performance showed stable revenues, a significant reduction in net loss, and strong cash reserves. Despite a challenging market, AMC improved its domestic market share and revenue per patron. Technological innovations and partnerships have enhanced customer experiences, driving higher spending per visit. The AMC stock forecast suggests a cautious bullish outlook.

For traders interested in AMC stock, CFD trading offers opportunities to leverage price movements without owning the underlying asset. Platforms like VSTAR trading app facilitate easy access to AMC stock CFDs, allowing traders to capitalize on both upward and downward price trends.