- Adobe achieved record revenue in Q2 fiscal 2024, showing a 10% year-over-year growth.

- Adobe's integration of AI, including the Firefly generative AI models, has significantly enhanced its product offerings.

- Adobe stock is projected to increase moderately by the end of 2024, with mixed signals from technical indicators.

- Strong market sentiment, high institutional ownership, and favorable analyst ratings suggest a positive outlook for Adobe stock.

- Adobe faces competition from companies like Corel, DocuSign, and Salesforce, along with risks related to technological innovation and regulatory challenges.

I. Adobe Q2 2024 Performance Analysis

A. Key Segments Performance

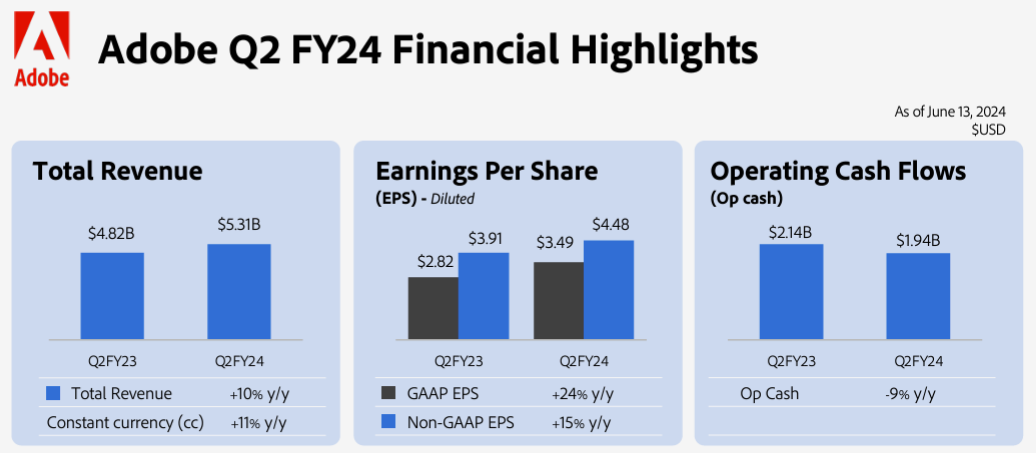

Financial Highlights

Adobe reported record revenue of $5.31 billion for Q2 fiscal 2024, marking a 10% year-over-year growth, or 11% in constant currency terms. GAAP diluted earnings per share (EPS) were $3.49, while non-GAAP EPS stood at $4.48, showing a 15% year-over-year increase. The company's GAAP operating income was $1.89 billion, and its non-GAAP operating income was $2.44 billion. Net income on a GAAP basis was $1.57 billion, with a non-GAAP net income of $2.02 billion. Cash flows from operations totaled $1.94 billion, and Adobe repurchased approximately 4.6 million shares during the quarter.

Source: Q2 2024 Investor Datasheet

Operational Performance

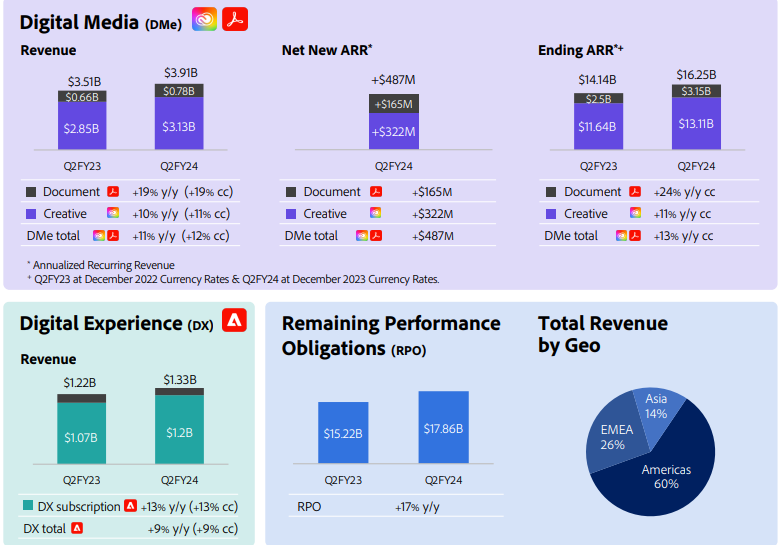

Digital Media Segment: This segment generated $3.91 billion in revenue, an 11% increase year-over-year (12% in constant currency). Within this segment, Creative revenue rose to $3.13 billion, a 10% year-over-year increase (11% in constant currency), and Document Cloud revenue surged by 19% to $782 million. The segment's Annualized Recurring Revenue (ARR) grew to $16.25 billion, with a net new ARR of $487 million.

Digital Experience Segment: This segment reported $1.33 billion in revenue, reflecting a 9% year-over-year growth. Subscription revenue within this segment was $1.20 billion, a 13% increase year-over-year.

Source: Q2 2024 Investor Datasheet

Technological Advancements and Innovations

Adobe's focus on AI and product innovation has been pivotal. The company has integrated AI capabilities across its offerings, such as the Firefly family of creative generative AI models within Creative Cloud tools like Photoshop and Illustrator. Firefly has generated over 9 billion images, underscoring its popularity and utility. In Document Cloud, the Acrobat AI Assistant enhances document productivity by enabling conversational interactions with PDFs, significantly improving workflow efficiency.

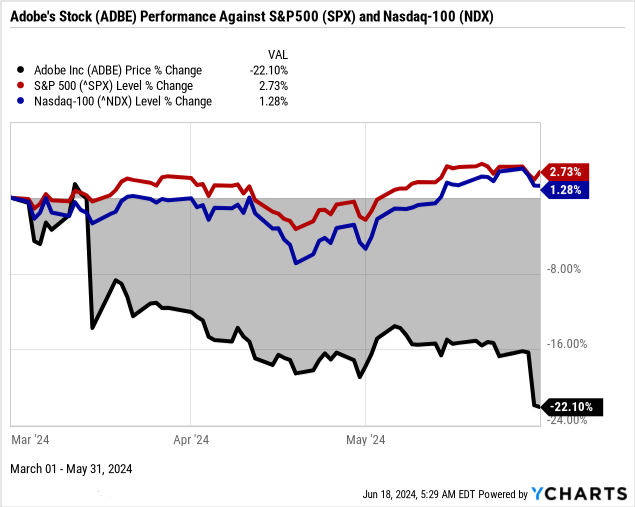

B. ADBE Stock Price Performance

Adobe's (NASDAQ: ADBE) stock performance over the quarter has been notably poor, with a significant decline of 22.1% from its opening price of $561.11 to a closing price of $444.76. This contrasts starkly with the broader market indices, as the S&P 500 saw a modest gain of 2.7% and the NASDAQ 100 increased by 1.3%. Adobe's high of $585.35 and low of $433.97 during the quarter indicate substantial volatility. Despite a market capitalization of $199.25 billion, the steep drop in Adobe's stock suggests underlying issues or market concerns.

Source: Ycharts.com

II. Adobe Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

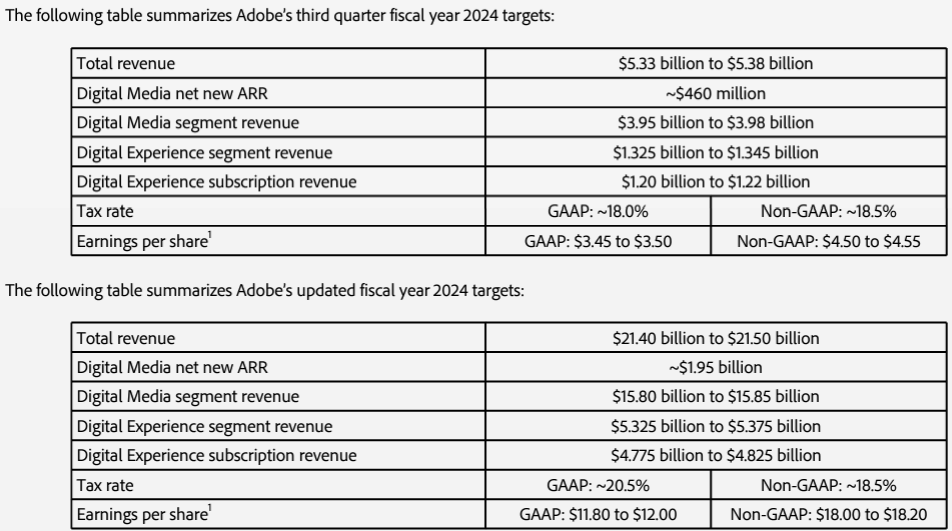

Adobe's fiscal 2024 outlook highlights robust growth expectations across its key segments: Digital Media and Digital Experience. These segments are poised to capitalize on innovative technologies and strategic expansions to drive future revenues.

Source: Q2 2024 Earnings

Digital Media Segment:

Creative Cloud: Expected revenue of $3.95 billion to $3.98 billion for Q3 fiscal 2024, with continued growth driven by new AI features like Firefly. Net new ARR target approximately $460 million, reflecting sustained customer acquisition and retention. Adobe's Creative Cloud suite, including flagship applications like Photoshop, Illustrator, and Premiere, is continually enhanced with new features powered by generative AI (e.g., Firefly models). The expansion of Adobe Express, which simplifies design for communicators using AI, is also driving significant user growth. The integration of AI tools like Generative Fill and Text to Vector in these applications is anticipated to attract more users and drive higher subscription rates.

Document Cloud: Projected revenue growth to $1.20 billion to $1.22 billion for Q3 fiscal 2024, fueled by Acrobat AI Assistant's adoption. Achieved $782 million in Q2 fiscal 2024, marking a 19% year-over-year increase. The PDF format continues to be a global standard for documents. Innovations like Acrobat AI Assistant, which leverages AI for tasks such as document summarization and data extraction, significantly enhance productivity. The broad adoption of Acrobat across different platforms (desktop, web, mobile) and its integration into business workflows contribute to steady growth.

Digital Experience Segment:

Adobe Experience Platform (AEP): Revenue target of $1.325 billion to $1.345 billion for Q3 fiscal 2024, with subscription revenue reaching $1.20 billion to $1.22 billion. AEP innovations driving 60% year-over-year growth in subscription revenue in Q2 fiscal 2024. The Adobe Experience Platform (AEP) celebrated its fifth anniversary and continues to grow, with new AI-powered features like AEP AI Assistant enhancing marketing productivity. Adobe's technological achievements include the launch of Adobe Express as an AI-first application and the integration of AI capabilities in various products, facilitating greater user engagement and operational efficiency.

B. Expansions and Strategic Initiatives

Adobe's growth strategy for fiscal 2024 includes significant investments in AI, strategic acquisitions, and partnerships to expand market reach and enhance product offerings.

Mergers and Acquisitions:

Adobe has a history of strategic acquisitions to bolster its product portfolio and market position. Acquisitions like Magento for e-commerce capabilities and Workfront for project management have expanded Adobe's reach into new markets and enhanced its existing offerings.

Research and Development Investments:

Adobe's commitment to R&D is evident in its continuous roll-out of innovative features across its product suite. Significant investments are directed towards AI and machine learning, as demonstrated by the development of the Firefly family of creative generative AI models and the Acrobat AI Assistant.

Partnerships and Collaborations:

Strategic partnerships enhance Adobe's ecosystem and expand its market reach. Collaborations with major tech companies, such as Microsoft for integrating Adobe Sign into Office 365, boost Adobe's visibility and adoption. Other key partnerships with major companies such as AstraZeneca, Chevron, and FedEx have bolstered Adobe's market share and operational effectiveness.

Geographic Expansion:

Adobe is focused on expanding its presence in emerging markets. The growth of Creative Cloud and Document Cloud subscriptions in regions like Asia-Pacific and Latin America presents significant revenue opportunities. Localization of products and targeted marketing campaigns are key strategies in these regions.

III. ADBE Stock Forecast 2024

A. Adobe Stock Forecast: Technical Analysis

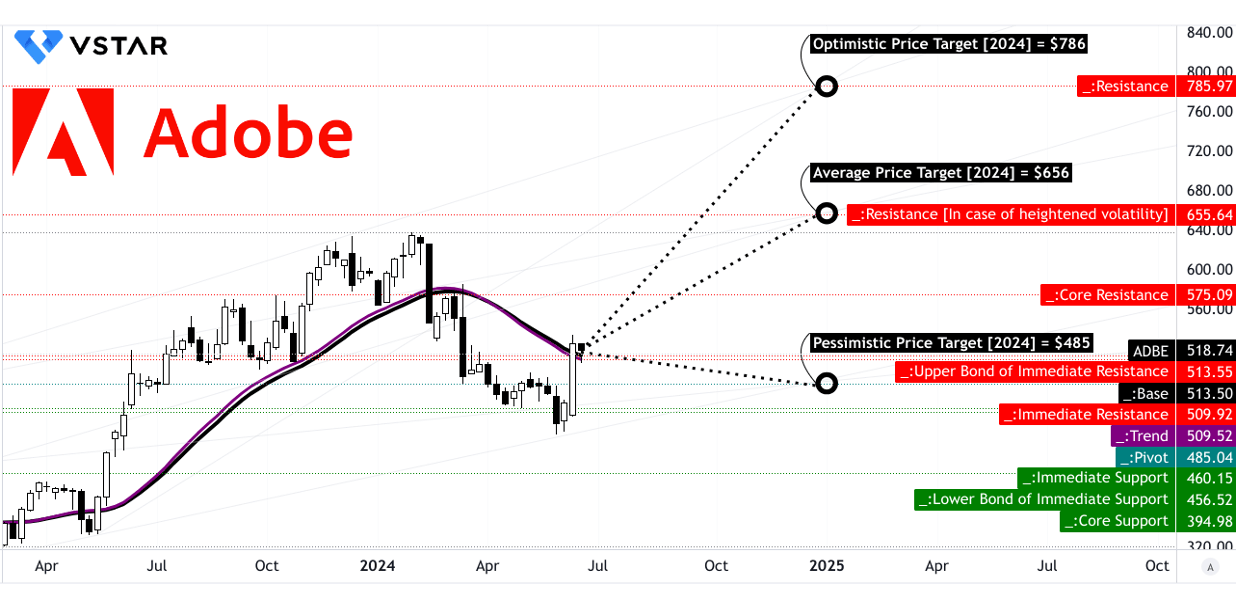

Trend and Moving Averages: The trendline, based on a modified exponential moving average, is at $509.52, while the baseline is slightly higher at $513.50. These close values indicate stability in the stock's recent performance, with a slight upward direction noted.

Price Targets:

- Average Price Target: The average ADBE price target by the end of 2024 is set at $656.00. This projection is grounded in the momentum of change-in-polarity over mid- to short-term trends, utilizing Fibonacci retracement and extension levels.

- Optimistic Price Target: The optimistic forecast suggests a peak of $786.00, reflecting potential strong upward momentum if current trends continue favorably.

- Pessimistic Price Target: On the downside, Adobe target price of $485.00 is anticipated if downward momentum dominates, using similar Fibonacci-based analysis.

Source: tradingview.com

Support and Resistance: Key support and resistance levels include:

- Primary Support: $513.55

- Core Support: $395.00

- Core Resistance: $575.09

- Resistance in High Volatility: $655.64

These levels provide crucial benchmarks for traders to monitor potential breakout or breakdown points.

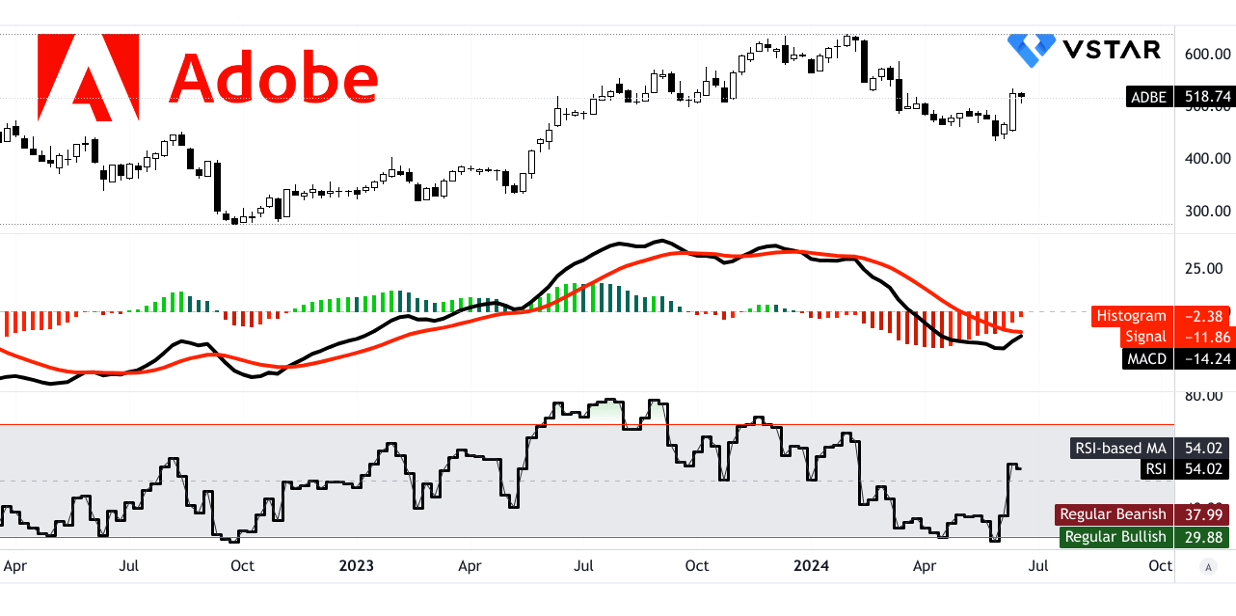

RSI and MACD Analysis:

- Relative Strength Index (RSI): Currently at 54.02, the RSI indicates a neutral position, neither overbought nor oversold. The trend is upward, yet without significant bullish or bearish divergence.

- Moving Average Convergence/Divergence (MACD): The MACD line is at -14.24, below the signal line at -11.86, with a histogram value of -2.380, all pointing to a bearish trend that is weakening over time.

Source: tradingview.com

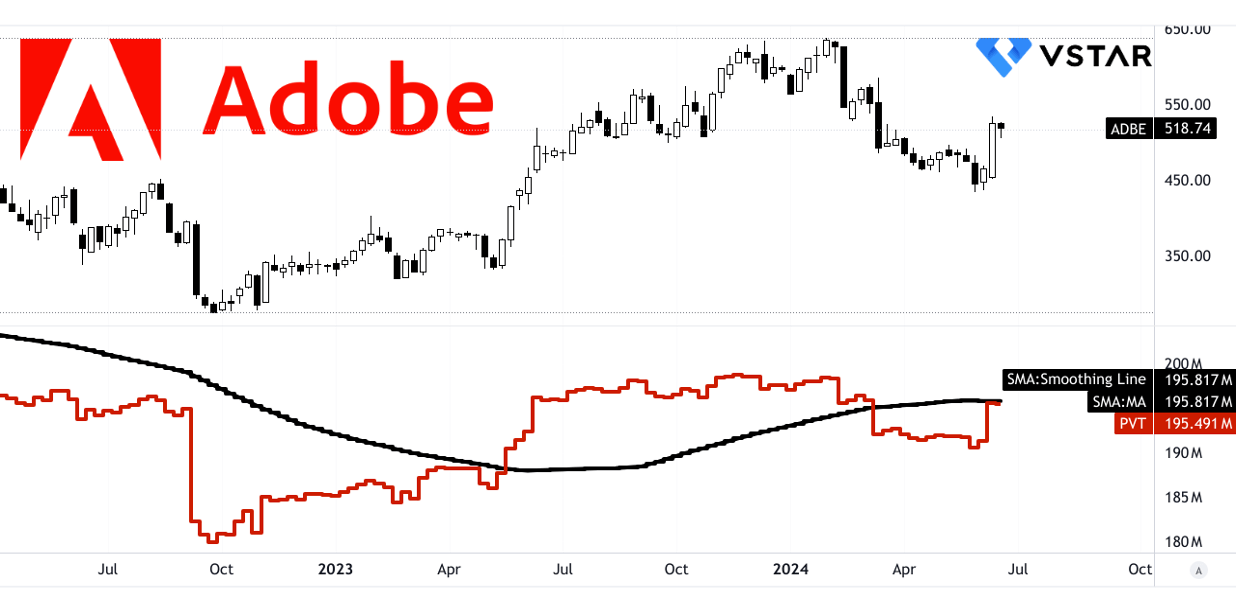

Price Volume Trend (PVT): The PVT stands at 195.491 million, slightly below the moving average of 195.817 million, indicating prevailing bearish momentum.

Source: tradingview.com

B. ADBE Stock Forecast: Fundamental Analysis

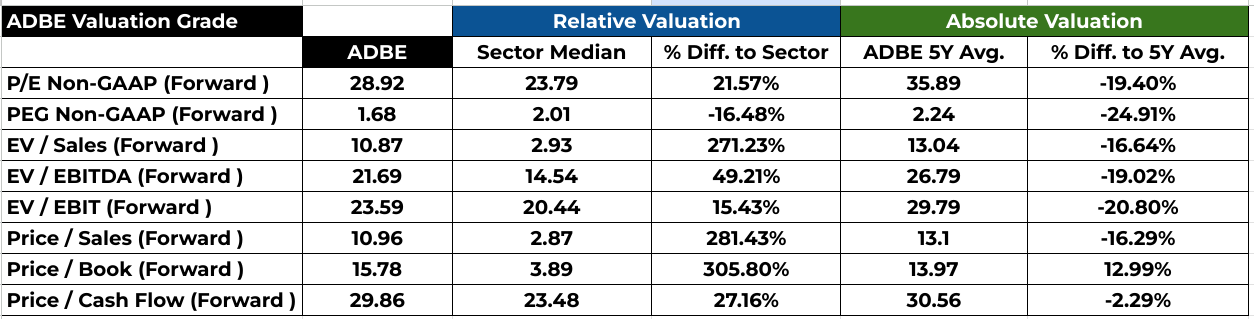

The forward P/E ratio of 28.92 suggests that Adobe is trading at a premium compared to the sector median of 23.79, reflecting a 21.57% higher valuation. This premium, while significant, is still below Adobe's 5-year average P/E of 35.89, indicating a potential undervaluation relative to its historical levels. The forward PEG ratio of 1.68, lower than the sector median of 2.01, highlights Adobe's strong growth prospects relative to its price, making it an attractive investment compared to its sector peers.

Source: Analyst's compilation

C. Adobe Share Price Forecast: Market Sentiment

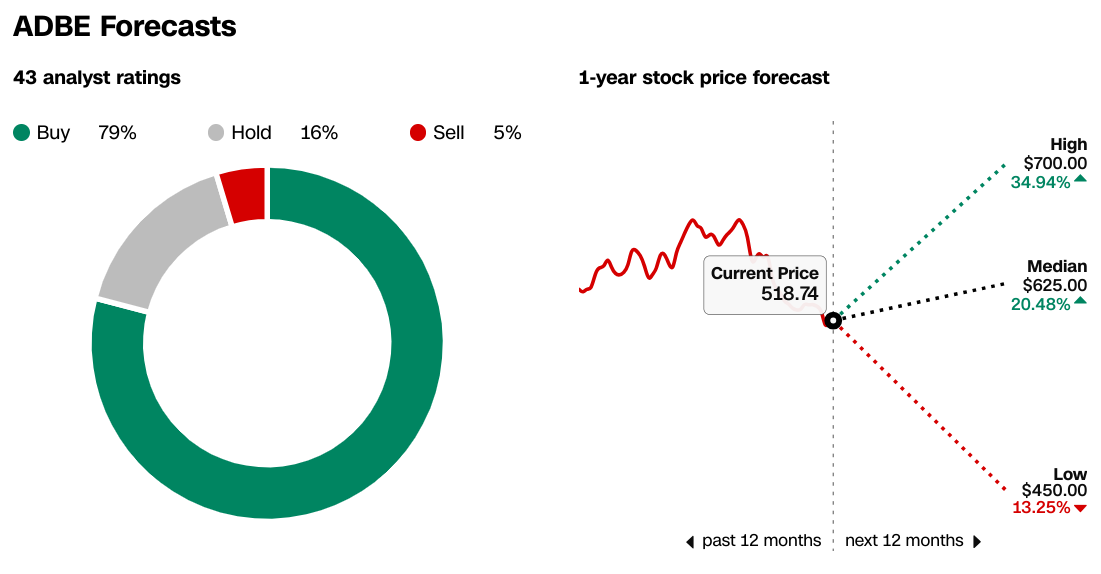

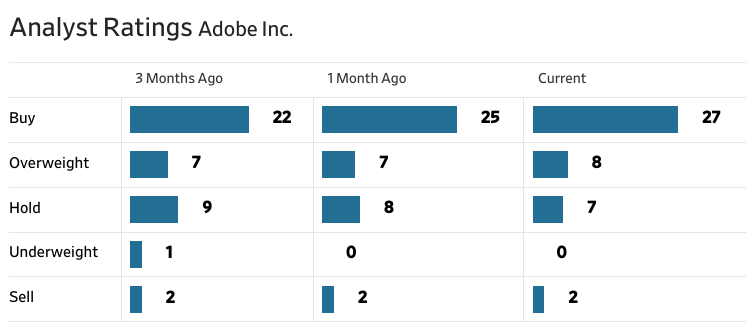

Market sentiment towards Adobe is generally positive, as evidenced by analyst ratings and price targets. According to CNN, 79% of analysts rate Adobe as a buy, with price targets ranging from $450 to $700. The median target of $625 suggests a potential 20.48% upside from the current price of $518.74. This optimism is echoed by WSJ data, showing an increase in buy ratings over the past three months, with the current high Adobe price target of $700 aligning with CNN's projection.

Source:CNN.com

Source:WSJ.com

Smart money's confidence is further demonstrated by high institutional ownership at 82.01%, indicating strong institutional support. The short interest of 1.58%, with a days-to-cover ratio of 2.34, is relatively low, suggesting minimal bearish sentiment. This combination of favorable analyst recommendations, high institutional holdings, and low short interest points towards a positive outlook for Adobe's stock in 2024.

Source:Nasdaq.com

Source:Benzinga.com

IV. Adobe Share Price Forecast: Challenges & Risk Factors

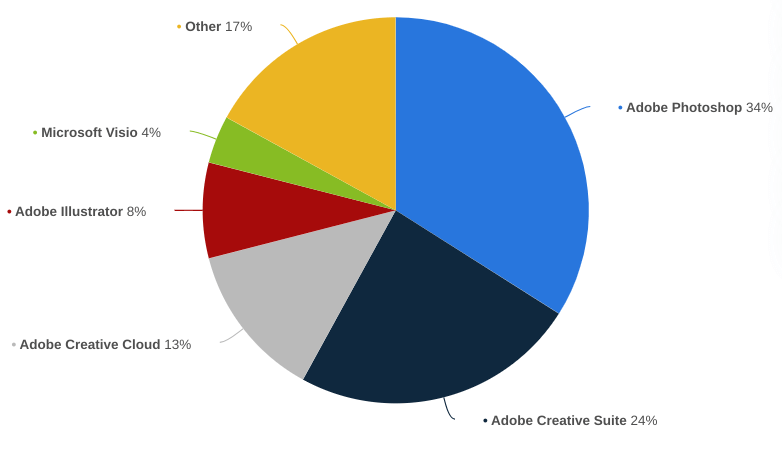

Adobe faces considerable competition from various companies across its product lines. In the Creative Cloud segment, rivals include Corel (with CorelDRAW and Painter) and Affinity (with Affinity Designer and Affinity Photo), which offer cost-effective alternatives. In the document management space, Adobe Document Cloud competes with DocuSign and Microsoft, which have robust digital signing and document management tools. Additionally, in the digital experience arena, Adobe Experience Cloud contends with Salesforce Marketing Cloud, Oracle Marketing Cloud, and HubSpot, which provide comprehensive marketing automation and customer relationship management solutions.

[Computer graphics and photo editing software market share worldwide in 2023, by product]

Source: statista.com

Moreover, Adobe's reliance on continuous innovation, particularly in AI and machine learning, presents a significant risk. If Adobe fails to stay ahead in technological advancements, it could lose market share. Economic fluctuations can also pose risks, as enterprises may cut back on software spending during downturns.

In conclusion, Adobe stock saw record revenue in Q2 FY2024, driven by Digital Media and Digital Experience segments. The integration of AI, particularly Firefly generative AI, boosted Adobe's offerings. Analysts forecast a moderate stock price increase by year-end 2024, with mixed technical indicators. Positive sentiment, high institutional ownership, and favorable analyst ratings suggest a promising outlook despite competition and innovation risks. The ADBE stock can be considered as a Buy.

For traders interested in CFDs, platforms like the VSTAR trading app offer trading in ADBE stock CFDs, enabling access to Adobe's market performance with institutional level experience, potentially lower costs and higher liquidity.