Circle Internet Financial is a leading fintech company that has become a key player in the digital currency revolution. The company has become widely familiar with the digital landscape for its USDC (USD coin) development, as USDC is one of the most used stablecoins. Circle Internet Financial has a vision to bridge blockchain technology and traditional finance. The company was founded in 2013, and it has become a prominent player in the digital finance and payment infrastructure as it provides seamless payment solutions and enables digital asset storage and investments.

Recent optimism about Circle IPO triggered many investors, as the company already positioned itself as a prominent player in the Fintech industry. The company is leveraging the increasing global demand for stablecoins, establishing a dynamic ecosystem with USDC as its core, facilitating daily billions of dollars in transactions, and driving blockchain technology's rapid adoption in global commerce.

Global finance is rapidly embracing digital transformation, which is visible. Circle Internet Financial's mission to create an open and inclusive financial system highlights its role in reshaping global finance. With its strategic vision, solid foundation, and proven track record, the company continues to attract investors' attention as a pioneer force in the future of global finance.

I. What is Circle Internet Financial

Circle Internet Financial is a Fintech company emphasizing blockchain technology and digital payment solutions. It offers crypto treasury management solutions for businesses and digital asset management and serves financial technology companies, asset managers, and financial institutions.

Circle Internet Financial, founded in 2013, has played a significant role in the blockchain-based technology, fintech, and digital payment solutions industries. The company's founders are Jeremy Allaire (who previously founded a video platform company named Brightcove) and Sean Neville. It is headquartered in Boston, Massachusetts, and has additional offices in New York, London, Dublin, and Hong Kong.

Key Statistics

- Circle Internet Financial is a Private Company

- Facilitates billions of dollars in transactions

- Primary industry: Financial Software

- Financing Status: Venture Capital-Backed

- Raised fund: $1.199B

- Number of employees: 1,000

Core Services And Business Model

Circle Internet Financial leverages blockchain technology to transform the global financial system and focuses on creating a bridge between traditional finance and blockchain technology. Its vision is to enhance transparency, efficiency, and accessibility in digital asset management. The company's core product is the USD coin (USDC), which is pegged in a 1:1 ratio to the United States Dollar and facilitates secure, instant, and low-cost transactions across cross-border payments.

The company ensures USDC's trustworthiness by maintaining reserves backed by short-term U.S. Treasury bonds and cash, enabling third-party audits for transparency and stability assurance. The company allows businesses and individuals to fund transfers affordably and seamlessly, supporting cross-border payments.

Services from the company extend beyond USDC issuance as it offers crypto capital market solutions that enable users to lend, trade, and borrow digital assets.

Key Customers

The company offers infrastructure and API solutions for merchants to integrate digital currency capabilities into their platforms. So, Circle Internet Financial serves large enterprises, crypto exchanges, fintech companies, and traditional financial institutions, highlighting its expansive and diverse customer base.

Circle Internet Financial customers include individual users, financial institutes, developers, and businesses leveraging USDC for global remittances, payments, and treasury operations.

Ownership

Circle Internet Financial is a privately owned company with significant involvement from founders Jeremy Allaire and Sean Neville. It is the issuer of USDC and has diverse ownership, including various financial institutes such as Marshall Wace LLP, Goldman Sachs, BlackRock Inc., Fidelity Management and Research.

The company also has a prominent partnership with Coinbase, a significant crypto exchange that drives the adoption and growth of USDC.

II. Circle Financials

Circle Internet Financial is a leading player in the fintech industry, mainly because of its role as a USD coin (USDC) issuer. USD coin is one of the widely regulated and adopted stablecoins. Recent reports reveal massive adoption and robust performance metrics about the company.

The company's revenue growth is usually related to the transaction and adoption volume of USDC. The company facilitated $197 billion in transfers between blockchain technology and traditional finance, underscoring its role in bridging crypto and fiat currency ecosystems.

Detailed profitability metrics remain undisclosed as the company is privately owned, but institutional partnerships and transaction fees drive the company's financial health.

USDC is currently the second-largest dollar-pegged stablecoin with a market capitalization of $39.91 B.

Key Metrics

- USDC Transactions: Since launching in 2018, USDC has contributed over $12 trillion in transactions. Wallets containing a minimum of $10 surged by 59% in 2023, reaching approximately 2.7 million active holders.

- Transaction Volume: USDC processed transactions of 595 million in 2023, declaring its efficiency in various use cases, from institutional transfers to individual payments.

- Market Share: Despite the challenge in 2022, USDC's market share is rapidly growing in the stablecoin sector, boosted by remittances, payments, and DeFi. For instance, in 2022, the company recorded inflows of $130 billion in the Asia Pacific Region.

Compliance and programmability make USDC a favorable asset in the Defi ecosystem, enabling seamless liquidity and trading across Defi platforms. Circle Internet Financial's focus on expanding in Latin America and Asia has fueled this adoption. Circle Internet Financial has seventy-five investors, and the top among them include Jonathan Simmons, Alt Option Return, CE Innovation Capital, Clear Fir Partners, and Coinbase Global. The company likely has sixty-nine competitors, which includes

Dwolla, AZA Finance, Paxos, Blockchain.com, and Corefy. USDC has competitor assets like Tether, DAI, and Binance USD.

III. Circle IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

- The stablecoin market is the core of the cryptocurrency ecosystem and continues to grow rapidly, with assets like USDC facilitating liquidity in the volatile market. As of 2024, stablecoins accounted for approximately 90% of the daily trading volume of cryptocurrencies, underlining their crucial role in cross-border payments, remittances, and DeFi.

- Circle Internet Financial differentiates USDC from competitors like Tether (USDT), DAI, Binance USD (BUSD), etc., by having robust backing from the U.S. treasury holdings and cash reserves. Strategic partnerships with institutes such as Moneygram and Visa bolster the company's future growth. On the other hand, Tether faced transparency issues, where USDC offered audits, and the algorithm model of DAI and Binance USD (BUSD) faced regulatory challenges, providing an edge for USDC.

- Circle Internet Financial is expanding with exclusive partnerships, like SBI holdings in Japan and Nubank in Brazil. This indicates the company's commitment to global adoption and the massive opportunity for success in access to stablecoin.

- The company's re-domiciliation in the United States and anticipation of an IPO underscore its integration strategy with traditional finance structures. Strategic partnerships with financial institutes, Fintech, and payment platforms could bridge the gap between blockchain technology and traditional finance.

- The utility improvements in cross-border payments, DeFi, and remittances reflect broader use cases of stablecoins, which is favorable for USDC's further growth.

B. Weaknesses & Risks

- Circle Internet Financial can face regulatory risks, as many governments don't support the frequent trading of crypto assets, which could negatively impact the company's future growth. The Security and Exchange Commission (SEC) review process in the United States is already delaying the approval of Circle Internet Financial's IPO, reflecting regulatory challenges.

- Circle Internet Financial highly depends on USDC, which has significant competitors like Tether, DAI, etc. The company might have to overcome these competitive pressures to maintain its growth and capture market share.

- Circle Internet Financial highly depends on the utility and adoption of USDC for revenue growth, which could negatively impact the company if stablecoin adoption and usage decline. Additionally, as the company grows, it can face operational risks to maintain its prominent infrastructure, ensure compliance, and mitigate cybersecurity threats.

IV. Circle IPO Details

A. Circle IPO Date

There is no exact date for Circle Internet Financial's IPO, but several reliable sources confirmed it could occur in 2024. Circle Internet Financial has already filed for an IPO with the United States Security Exchange Commission.

According to Coinmarketcap data, Circle Internet Financial USDC's core product is the second-largest stablecoin and the sixth-largest crypto by market capitalization, which makes the Circle Internet Financial IPO a potentially attractive investment.

B. Circle Internet Financial Valuation

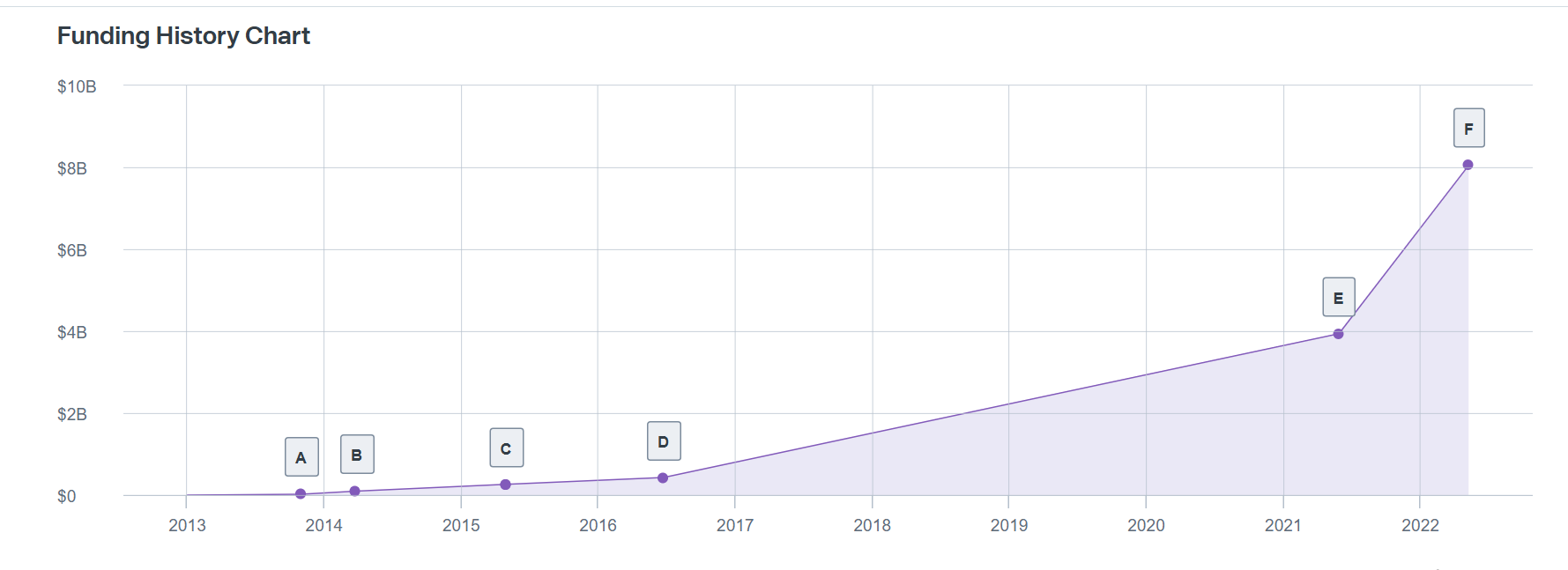

Circle Internet Financial has raised $1.14 billion from twelve rounds of funding and made the most of series E and F, respectively, in 2021 and 2022.

The valuation soared to $9 billion in 2022, when it attempted to go public for the first time but declined, and the estimated amount is now between $5-5.5 billion. The decline followed a failed merger deal, FTX failure collapse, and the SEC's approval delay. The company filed a draft S-1 form with the SEC in January, formally moving for public offerings.

Major Funding Rounds & Total Funding

Circle Internet Financial has successfully raised approximately $1.19 billion from twelve rounds. The funding data are in the table below.

|

Funding Date |

Series |

Amount |

Investors |

|

05/09/2022 |

Series F |

$401MM |

Blackrock, Fidelity |

|

05/28/2021 |

Series E |

$598.34MM |

Accel, Atlas Merchant Capital, Bitmain Technologies, Blockchain Capital, Breyer Capital, Digital Currency Group, Fidelity, Ftx, General Catalyst Partners, Idg Capital, Intersection Fintech Ventures, Marshall Wace, Pantera Capital, Pillar Vc, Tusk Ventures, Valor Capital Group, Willett Advisors |

|

06/23/2016 |

Series D |

$64.15MM |

Accel Partners, Baidu, Breyer Capital, China Everbright, China International Capital, CreditEase, General Catalyst Partners, Idg Capital Partners, Wanxiang Group |

|

04/30/2015 |

Series C |

$42.04MM |

Accel Partners, Blockchain Capital, Breyer Capital, Digital Currency Group, Fenway Summer Ventures, General Catalyst Partners, Idg Capital Partners, Oak Investment Partners, Pantera Capital, The Goldman Sachs Group |

|

04/30/2015 |

Series C-1 |

$10MM |

Accel Partners, Blockchain Capital, Breyer Capital, Digital Currency Group, Fenway Summer Ventures, General Catalyst Partners, Idg Capital Partners, Oak Investment Partners, Pantera Capital, The Goldman Sachs Group |

|

03/26/2014 |

Series B |

$17MM |

Accel Partners, Bitcoin Opportunity Fund, Breyer Capital, Fenway Summer Ventures, General Catalyst Partners, Oak Investment, Pantera Capital, Society For Worldwide Interbank Financial Telecommunications |

|

10/31/2013 |

Series A |

$9MM |

Accel Partners, Breyer Capital, General Catalyst Partners |

C. Share Structure & Analyst Opinions

No authentic or official report is currently available on Circle IPO details, such as share price and number of shares. The company has many prominent investment partners, including Blackrock, Fidelity, Accel Partners, Blockchain Capital, Breyer Capital, Digital Currency Group, etc. The share price and amount should be equivalent to the anticipated $5- $5.5 billion valuation.

No official analysis report has yet been published on Circle Internet Financial's IPO. Still, most professional investors and analysts anticipate that the Circle IPO might be an attractive investment option based on the global financial context, digitalization, company growth, performance, and progress.

V. How to Invest in Circle IPO & Circle Stock

How to Buy Circle IPO Shares

When considering participation in Circle IPO, the first step is to monitor announcements about its listing platform. According to reports, Goldman Sachs will likely be a key partner in facilitating Circle's IPO.

Investors should establish an account with Goldman Sachs or other banks, brokerages, or financial institutions offering IPO access. Validating the account is essential to unlocking full investment features.

Trading Strategies for Circle IPO

Once Circle stock is publicly traded, investors can explore diverse strategies to optimize their returns:

- Momentum Trading: Investors may capitalize on heightened interest in Circle's fintech leadership and stablecoin dominance. They can identify short-term profit opportunities driven by volatility by tracking early price swings and market enthusiasm.

- Short-Term Trading: Day trading or swing trading during Circle's initial market days can help leverage price fluctuations as investor sentiment stabilizes.

- Long-Term Investment: Circle's robust market position, regulatory compliance, and potential to expand its USDC infrastructure make it a strong candidate for long-term investment. Holding its stock could yield growth as the company scales its operations globally and integrates further into traditional finance.

Alternative Trading Methods for Circle Stock

- ETFs: Gain indirect exposure by investing in exchange-traded funds focusing on fintech, crypto, or payment innovation. These funds offer diversification to reduce individual stock risk.

- Options Trading: Use options to hedge against volatility or secure favourable pricing for future transactions, benefiting from potential price swings post-IPO.

- CFD Trading: Contracts for Difference (CFDs) allow speculative trading on Circle stock price without ownership. Platforms like VSTAR enable flexible positions to align with varying market dynamics.

Investors should align their strategy with financial goals and risk tolerance, staying informed about Circle's performance and broader industry trends to navigate this dynamic opportunity.