Netskope, a dominant player in the cybersecurity industry, is gaining attention for its innovative approach to data protection solutions and cloud security. Besides positioning itself as a prominent player addressing modern digital security challenges, the company distinguishes itself for its cutting-edge solutions and adaptability. Netskope has a Secure Access Service Edge (SASE) platform and enhanced data protection services that drive the company to the forefront of the data security space as the sector is boosting rapidly.

Netskope achieved a significant milestone in the early 2023 funding, raising over $400M and boosting the company valuation, reaching $7.5B. The funding round reflects the company's strategic vision, increasing demand for cloud-based services and cybersecurity solutions. Enterprises continue to migrate into the cloud-based ecosystem, so it is no wonder that the ability of Netskope to integrate AI-driven analytics and enhanced thread protections makes it a prominent choice for businesses that seek solutions for cloud-based or cybersecurity challenges.

The trajectory of Netskope is further boosted by leadership enhancements and its commitment to innovations. The company serves one-third of the Fortune 100 companies, reflecting its robust market penetration. The governing body hints at an IPO possibility for Netskope that is gaining investors' attention. The company addresses increasing complexities in the cybersecurity space and leverages cutting-edge technologies. So, the company solidifies its position to enterprises as a trusted partner for business. Netskope focuses on data-driven security and zero-trust architecture, which gains notable investors' attention when setting new benchmarks in the sector.

I. What is Netskope

Netskope is a leading cybersecurity service provider that usually delivers threat protection, real-time visibility, and data security for cloud services, websites, and private applications. The company was founded in 2012 by Sanjay Beri and Lebin Cheng. Netskope is headquartered in Santa Clara, California. The company is renowned for its innovative approach to addressing modern cybersecurity challenges, especially in the era of remote workforces and cloud-based operations.

Business Model And Core Services

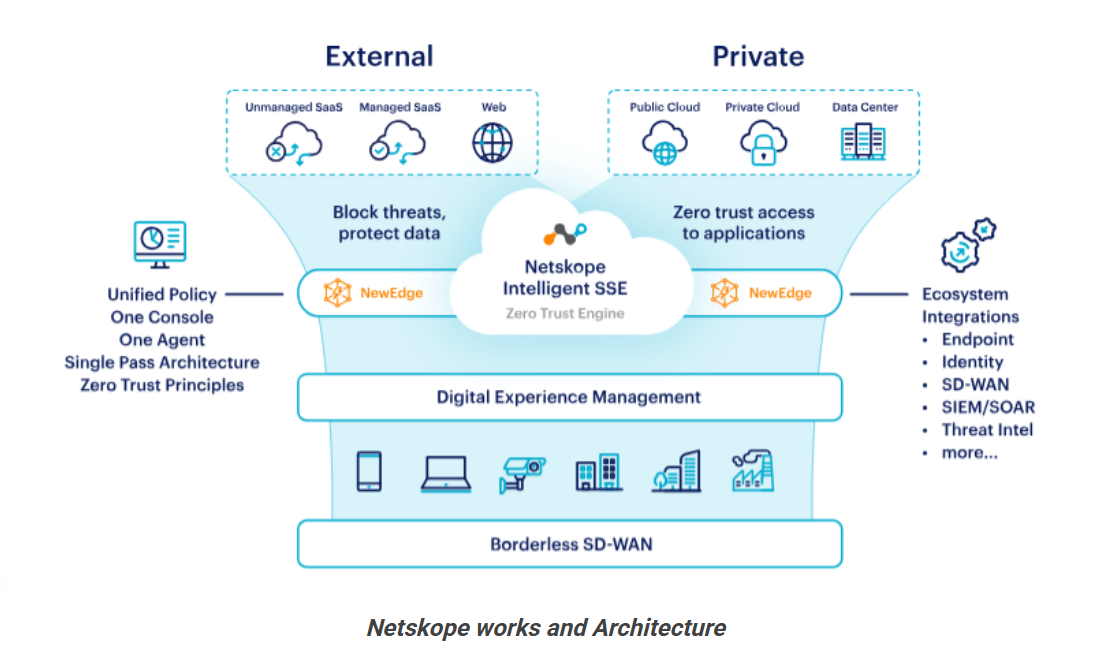

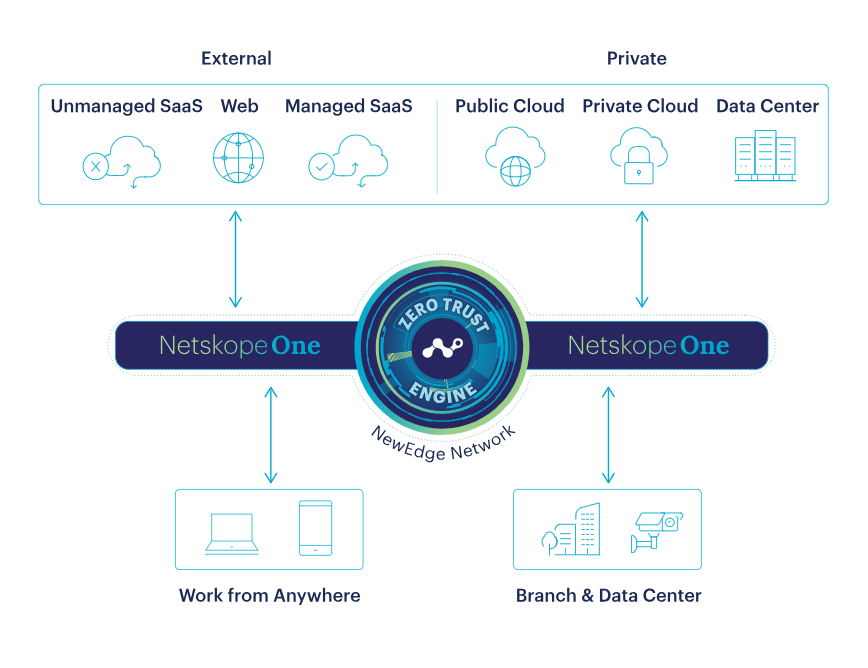

Netskope can provide control over web traffic and granular visibility, enabling clients to have an efficient understanding of and effective risk management. By leveraging advanced analytics, artificial intelligence, and machine learning, the company allows real-time data protection, threat detection, and policy enforcement across diverse sectors, including web browsing, cloud applications, and user activities.

Netskope operates a subscription-based business model that delivers cutting-edge security solutions tailored to cloud-based infrastructures. The secure Access Service Edge (SASE) platform is the company's primary offering, integrating secure cloud access, intelligent threat prevention, and enhanced data protection into a unified solution. The infrastructure is designed to help businesses maintain compliance, safeguard their data, and provide secure remote workforces in the rapidly growing cloud-driven and digital world.

Customers in the subscription-based business model usually pay recurring fees to access the cybersecurity platform and associated features. The Cloud Access Security Broker (CASB) Approach of Netskope enables acting as an intermediary between cloud service providers and organizations.

Core Services of Netskope

- Secure Access Service Edge (SASE) Platform: The SASE platform is the core product of Netskope that combines multiple security functions into a unified framework. Besides ensuring constant protection in multi-cloud and hybrid environments, the platform enables seamless and secure access to networks, cloud applications, and data.

- Zero Trust Network Access (ZTNA): Ensures secure and seamless access to critical business applications.

- Data Loss Prevention (DLP): Helps organizations prevent sensitive data from being leaked or misused.

- Cloud Security: Protects enterprise data across multiple cloud applications and platforms.

- AI-Driven Threat Detection: Combines artificial intelligence and machine learning to identify and neutralize threats in real time.

Key Customers

The customer base of Netskope includes a wide range of organizations and reflects a strong presence among various organizations. Notably, one-third of Fortune 100 companies rely on Netskope for data security and cloud services requirements, highlighting trust and credibility in the corporate sector. These client companies include healthcare, finance, technology, manufacturing, and retail, reflecting Netskope's ability to deal with various complex security challenges.

Ownership

Netskope has remained a private company since it was founded. Founders, investors, and employees have shared the company's ownership. The company has significant investors, including ICONIQ, Sequoia Capital, Lightspeed Venture Partners, PSP Investments, Accel, Geodesic Capital, Base Partners, the Canada Pension Plan Investment Board, New York Life Ventures, Social Capital, and Sapphire Ventures.

II. Netskope Financials

Netskope Revenue Growth

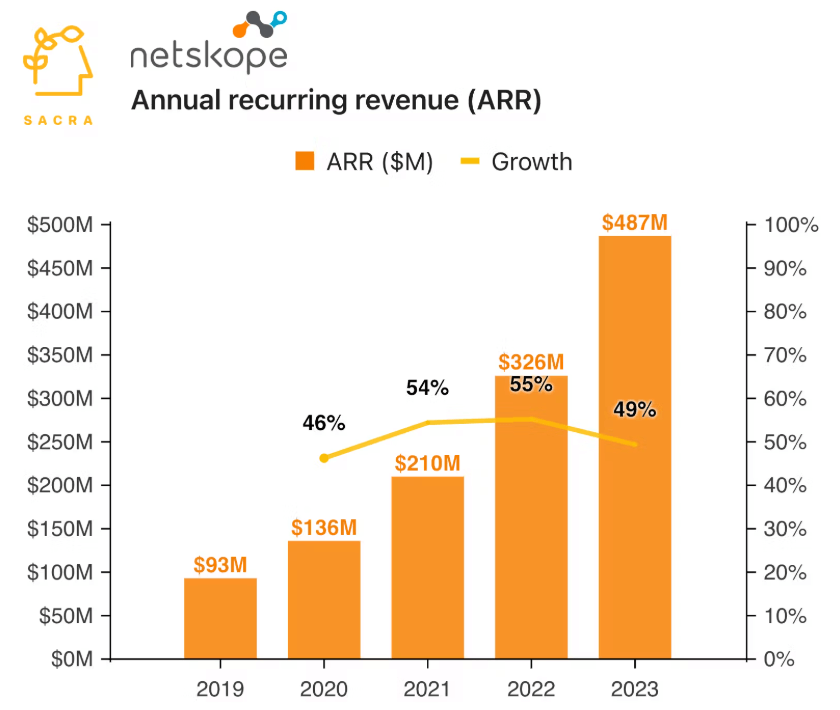

Netskope has already demonstrated notable growth since its inception in 2012. The annual recurring revenue (ARR) hit $487M in 2023, a considerable jump compared to $221.3M in 2022 and $186.7 in 2021. The company announced the ARR surpassing $500M in June 2024, exceeding the average growth rate of the industry.

According to Gartner, the Secure Access Service Edge (SASE) market is expanding rapidly, which may hit $25B by 2027. Netskope is a key player to capitalize on the demand. With a sustainable strategic focus and robust growth trajectory, Netskope has become a prominent player providing scalable and seamless cloud transformation solutions.

Profitability and Margins

The global cloud security market value was approx. $58.6B in 2022, which might hit $122.8B by 2030. Netskope crossed $500M in subscription revenue and currently has an estimated annual revenue of $795.5M annually. The company has 2727 employees worldwide, and the estimated revenue per employee is $291,720. The employee count increased by 14% last year.

Netskope currently has a gross margin of around 75%, and this high margin allows the company to reinvest its profits in several areas, such as enhancing customer support and infrastructure improvements.

Customer Growth

Since its inception, Netskope has captured a wide range of customer base as a key player in the cyber security space. As of June 2024, the customer base reached over 3,400 worldwide, which includes more than 30 companies on the Fortune 100 list. Customer companies are from various sectors, including financial services, telecommunications, healthcare, and retail, highlighting the company's capabilities to address various complex infrastructures.

III. Netskope IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

Netskope operates in a robust cybersecurity space with a core focus on the Secure Access Service Edge (SASE) market. This segment is experiencing notable growth due to rapid adoption in cloud applications, hybrid work models, and the rising adoption of zero-trust architectures. The SASE market will hit $25B by 2027, as Gartner anticipates, due to a solid demand surge in scalable, integrated, and cloud-native security solutions. Netskope has remained adequately positioned to capture most of the SASE market's share.

Competitive Advantages

Netskope operates with a cloud-native SASE platform capable of seamlessly integrating data protection, zero-trust network access (ZTNA), secure web gateway services, and enhanced threat detection. These give the company a competitive edge over competitors like Zscaler, Palo Alto Networks, Cisco Umbrella, and McAfee.

- Zscaler usually excels in cloud security but lacks Netskope's unified capabilities.

- Palo Alto Networks is strong in hybrid and traditional security but has been slower in fully embracing cloud-native innovations.

- Cisco Umbrella generally focuses on DNS-layer security but falls short in comprehensive cloud security features.

- McAfee is primarily known for endpoint security but is less competitive in advanced cloud and zero-trust solutions.

Future Growth Potential

- Netskope continues to invest in enhancing its structure to serve the emerging cybersecurity space. Using extended detection and response (XDR), adaptive security frameworks and AI-powered threat analytics positioned the company as a key player in the industry. These innovations provide the company with a competitive edge.

- Netskope continues to expand in various regions to enhance its services. The company already has a presence in several areas, such as Asia-Pacific (APAC), Europe, Africa (EMEA), the Middle East, and Latin America. The company deployed more than twenty data centers globally to enhance its services for international clients.

- Several strategic acquisitions like endpoint security, identity and access management (IAM), or AI-driven threat prevention could further boost Netskope's market penetration, innovation, and expansion.

- Netskope Solutions already serves highly regulated sectors like finance, healthcare, government, technology, etc., reflecting trust and capabilities.

- The company has yet to reach profitability, but Netskope has a promising growth trajectory. The company already made $500M in AAR in 2024. The company already has over 3400 global customers, including one-third of the Fortune 100 companies, which reflects mass adoption. So, Netskope can benefit from its scalable and subscription-based revenue model in the long run.

B. Weaknesses & Risks

- Netskope is not yet profitable, although it posted attractive revenue growth. The ongoing investments in market expansion, innovation, and customer acquisition may delay generating sustainable profits, which can be a red flag for potential investors.

- Netskope operates in a highly competitive market environment. Established players Zscaler, Palo Alto Networks, and Cisco Umbrella possess extensive market influence and resources, which could negatively impact the company's growth and maintain market share.

- The success of Netskope highly depends on broader cloud security adoption and the Secure Access Service Edge (SASE) market. Any market shift from these sectors could negatively impact the company's growth.

IV. Netskope IPO Details

- IPO Timeline: Second half of 2025

- Current Valuation: $7.5 billion

- Annual Revenue: $500+ million

- Total Funding: $1.44 billion

A. Netskope IPO Date

No exact date has been published yet for the Netskope IPO, but many sources confirm that it can occur in the second half of 2025. According to the governing body of the company, specifically Sanjay Beri, the CEO hinted at the timeline and said that it would occur depending on the market condition and investors' interests.

B. Netskope Valuation

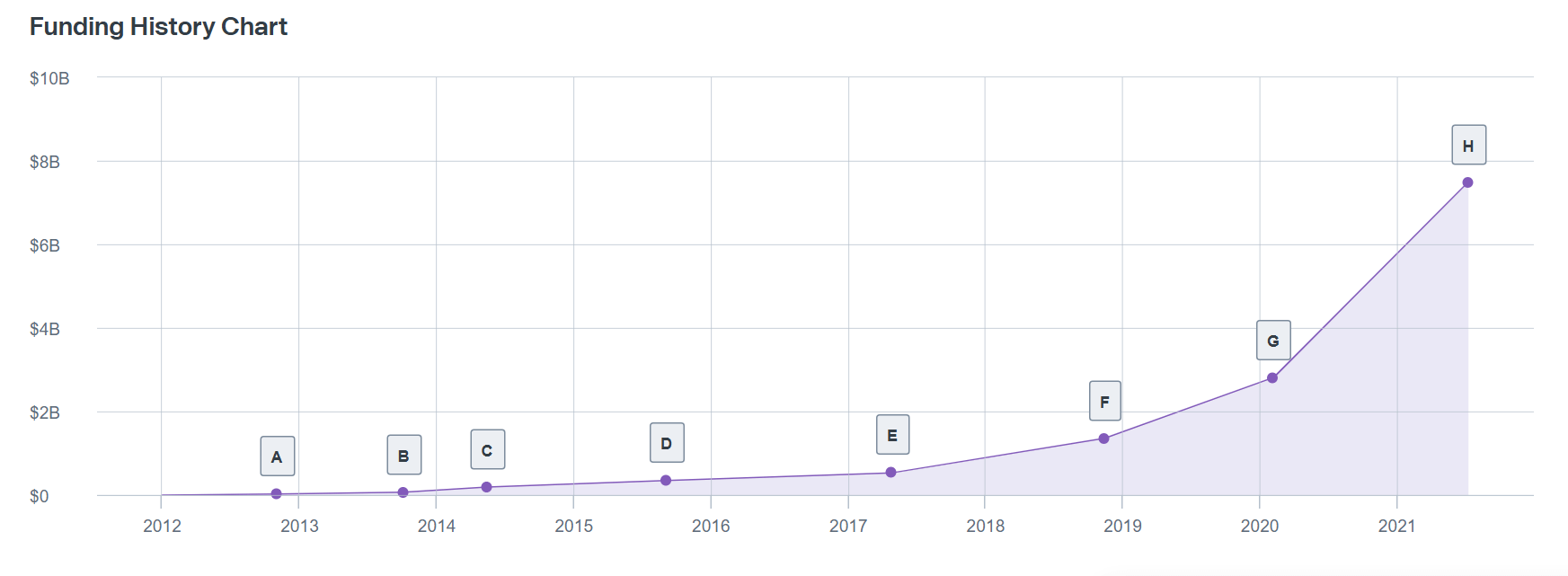

Netskope's valuation stands at $7.5B, following the latest funding round led by Morgan Stanley. The company raised $1.4B from twelve rounds of funding.

The most recent financing was $401M in the convertible note round that occurred in 2021.

Major Funding Rounds & Total Funding

The latest funding round occurred in July 2021, when the company raised $300M. The valuation reached $7.5B after twelve successful funding rounds.

|

Funding Date |

Funding Series |

Funding Amount |

Investors |

|

07/09/2021 |

Series H |

$300MM |

Accel, Base Partners, Geodesic Capital, Iconiq Capital, Lightspeed Venture Partners, Sapphire Ventures, Sequoia Capital |

|

02/06/2020 |

Series G |

$349.82MM |

Accel, Base Partners, Canada Pension Plan Investment Board, Geodesic Capital, Iconiq Capital, Lightspeed Venture Partners, Sapphire Ventures, Sequoia Capital, Social Capital |

|

11/13/2018 |

Series F |

$168.7MM |

Accel, Base Partners, Geodesic Capital, Iconiq Capital, Lightspeed Venture Partners, Sapphire Ventures, Social Capital |

|

04/27/2017 |

Series E |

$100MM |

Accel, Dell Technologies Capital, Geodesic Capital, Iconiq Capital, Lightspeed Venture Partners, Sapphire Ventures, Social Capital |

|

09/03/2015 |

Series D |

$75MM |

Accel, Iconiq Capital, Lightspeed Venture Partners, New York Life Ventures, Social Capital |

|

05/15/2014 |

Series C |

$35.01MM |

Accel, Lightspeed Venture Partners, Social Capital |

|

10/03/2013 |

Series B |

$15.9MM |

Lightspeed Venture Partners, Social Capital |

|

11/02/2012 |

Series A |

$5.5MM |

Undisclosed Investors |

C. Share Structure & Analyst Opinions

The anticipated period for Netskope IPO is the second half of 2025. The estimated valuation would be $8-$10B by that time, and the projected valuation per share is $25–$35. Note that the share amount and price should be equivalent to the company valuation by the time of IPO.

There is no official analysis report on Netskope IPO as the company remains private, but many analysts share their opinions about its potential success. Several factors, such as SASE market growth and $1.44 billion funding, highlight a strong position for Netskope IPO. However, investors should consider influencing factors, such as profitability, competitive pressures, and overall market dynamics, when evaluating investment opportunities.

V. How to Invest in Netskope IPO & Netskope Stock

Where to Buy Netskope IPO Shares

To invest in Netskope IPO, investors should closely follow official updates regarding the platforms facilitating the process. Once details are confirmed, investors must create an account with an authorized broker, bank, or financial institution. They can deposit funds after completing the registration and verifying their account with the necessary personal information. This will enable them to purchase shares and participate in Netskope's highly anticipated IPO.

Netskope IPO Trading Strategies

Once Netskope goes public, investors can adopt strategies to maximize returns:

- Momentum Trading: Leverage early enthusiasm around Netskope's leadership in the cybersecurity and SASE markets by tracking initial price movements for short-term gains.

- Short-Term Trading: Day and swing traders can take advantage of price volatility during the initial trading period before the stock price stabilizes.

- Long-Term Investment: Netskope's strong position in the growing SASE market, innovative platform, and global expansion potential make it a compelling long-term investment as demand for advanced cloud security solutions continues to rise.

Alternative Ways to Trade Netskope Stock

- ETFs: Gain diversified exposure by investing in ETFs focused on cybersecurity or cloud technology, which may include Netskope's sector.

- Options Trading: Use options to navigate post-IPO volatility or secure strategic entry points.

- CFD Trading: Trade Netskope stock price without direct ownership through CFDs on platforms like VSTAR, offering flexible market strategies.

Align these strategies with your financial objectives and remain informed about Netskope's progress and industry developments to make well-informed investment decisions.