Anduril Industries first proposed an IPO plan in late 2023, with founder Palmer Luckey expressing intentions to take the company public. The decision to IPO stems from Anduril's rapid growth, innovative defense technology, and the need for additional capital to scale its operations. The company's unique business model, combining SaaS-like recurring revenue from its Lattice platform with high-margin hardware sales, has generated significant investor interest. With $2.7 billion in funding and a valuation nearing $10 billion as of December 2023, Anduril's alignment with U.S. defense priorities, such as autonomous systems and AI, further enhances its appeal. The IPO is seen as a strategic move to solidify its position as a disruptor in the defense sector.

Source: anduril.com

I. What is Anduril

Anduril Industries, founded in 2017 by Palmer Luckey, Brian Schimpf, Joseph Chen, Matt Grimm, and Trae Stephens, is a defense technology company headquartered in Costa Mesa, California. It operates in the military defense and border surveillance industry, leveraging advanced AI and hardware solutions to modernize defense infrastructure. As of December 2023, Anduril has raised $2.7 billion in funding and is valued at nearly $10 billion, according to Yahoo Finance. Key investors include Founders Fund, General Catalyst, and Valor Equity Partners, among others. While founder Palmer Luckey has expressed intentions to take Anduril public, no formal IPO plans have been confirmed.

Business model and core services

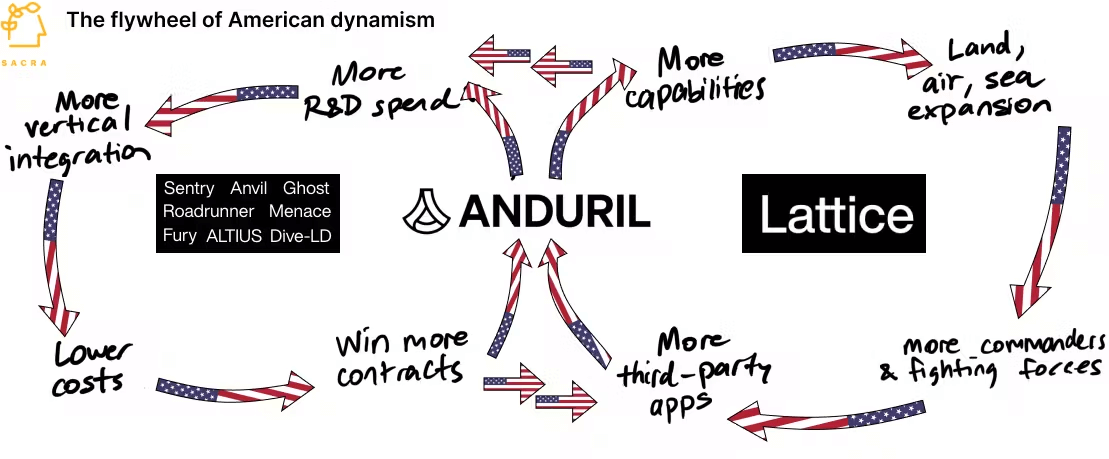

Anduril's business model combines a SaaS platform, Lattice, with AI-powered hardware products, creating a synergistic ecosystem. Lattice, the core of its offerings, is an AI software platform that integrates and analyzes data from sensors and systems in real-time, providing capabilities like object detection, tracking, and data fusion. It is sold as a subscription-based service to defense and security customers. Complementing Lattice, Anduril offers hardware products such as Sentry Towers for automated border surveillance and Ghost UAS for aerial reconnaissance. These hardware solutions are cross-sold and upsold to enhance the platform's functionality, enabling Anduril to capture a larger share of the value chain.

Source: sacra.com

This integrated approach ensures optimal performance and compatibility, which is critical in defense applications where reliability is paramount. Anduril's key customers include US and allied government agencies and military organizations, though specific names are often undisclosed due to the sensitive nature of its contracts.

Source: anduril.com

Who Owns Anduril

The company's ownership is distributed among its founders, employees, and a diverse group of investors, including prominent venture capital firms like Andreessen Horowitz, Lux Capital, and 8VC. This broad investor base underscores the confidence in Anduril's innovative approach to defense technology and its potential to disrupt traditional defense contracting models.

II. Anduril Financials

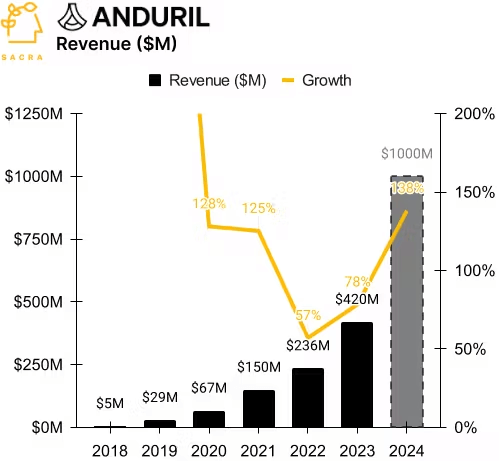

Anduril Revenue Growth

Anduril Industries has demonstrated remarkable revenue growth, driven by its ability to secure significant government contracts. According to Sacra estimates, Anduril generated $420 million in revenue in 2023, a 78% increase from $236 million in 2022. This growth was fueled by $670 million in new government contracts in 2023, surpassing the company's initial projection of $625 million. For 2024, Anduril anticipates reaching $1 billion in revenue, reflecting its expanding market presence and contract pipeline. The company's strong financial position is further underscored by its $750 million cash balance as of Q1 2024, providing ample liquidity to support its ambitious growth plans.

Source: sacra.com

Profitability and Margins

Anduril's profitability and margins are a standout feature, particularly when compared to traditional defense contractors. The company operates with gross margins of 40-45%, significantly higher than the 8-10% margins typical of traditional defense primes. This disparity stems from Anduril's commercial business model, which involves selling products at firm fixed prices negotiated with the government, as opposed to the cost-plus model that caps margins. According to Scott Sanders, chief growth officer at Forterra and an early Anduril employee, this approach enables "SaaS-like margin profiles" even on hardware, thanks to low hardware costs and efficient production processes. This model not only enhances profitability but also positions Anduril as a disruptive force in the defense sector.

While Anduril does not disclose customer acquisition costs, the defense industry's lengthy sales cycles—typically 18-24 months—require substantial upfront investment in R&D, prototyping, and field testing. However, once contracts are secured, they often yield large, predictable multi-year revenue streams. Anduril's ability to raise significant capital, including $2.7 billion to date, has been instrumental in navigating these long sales cycles and sustaining its growth trajectory. This financial strategy, combined with its innovative product-centric approach, positions Anduril as a formidable player in the defense technology landscape.

III. Anduril IPO: Opportunities & Risks

Anduril operates in the defense technology sector, offering cutting-edge solutions like the Lattice AI platform and a suite of autonomous hardware systems. The company's innovative approach and rapid growth present significant opportunities for profitability and expansion, but it also faces notable risks in a highly competitive and regulated industry.

Source: anduril.com

Profitability Potential & Growth Prospects

Anduril operates in a defense industry dominated by traditional primes like Lockheed Martin, Northrop Grumman, and General Dynamics, which account for over 80% of aerospace and defense revenues. These incumbents benefit from entrenched relationships, massive scale, and political influence, but their reliance on cost-plus contracting models often stifles innovation and efficiency. Anduril's competitive advantage lies in its product-centric approach, where it invests heavily in R&D upfront and sells its systems at fixed prices, achieving gross margins of 40-45%—far exceeding the 8-10% margins typical of traditional contractors. This model, combined with its focus on AI and autonomy, positions Anduril as a disruptor in the defense sector.

Source: sacra.com

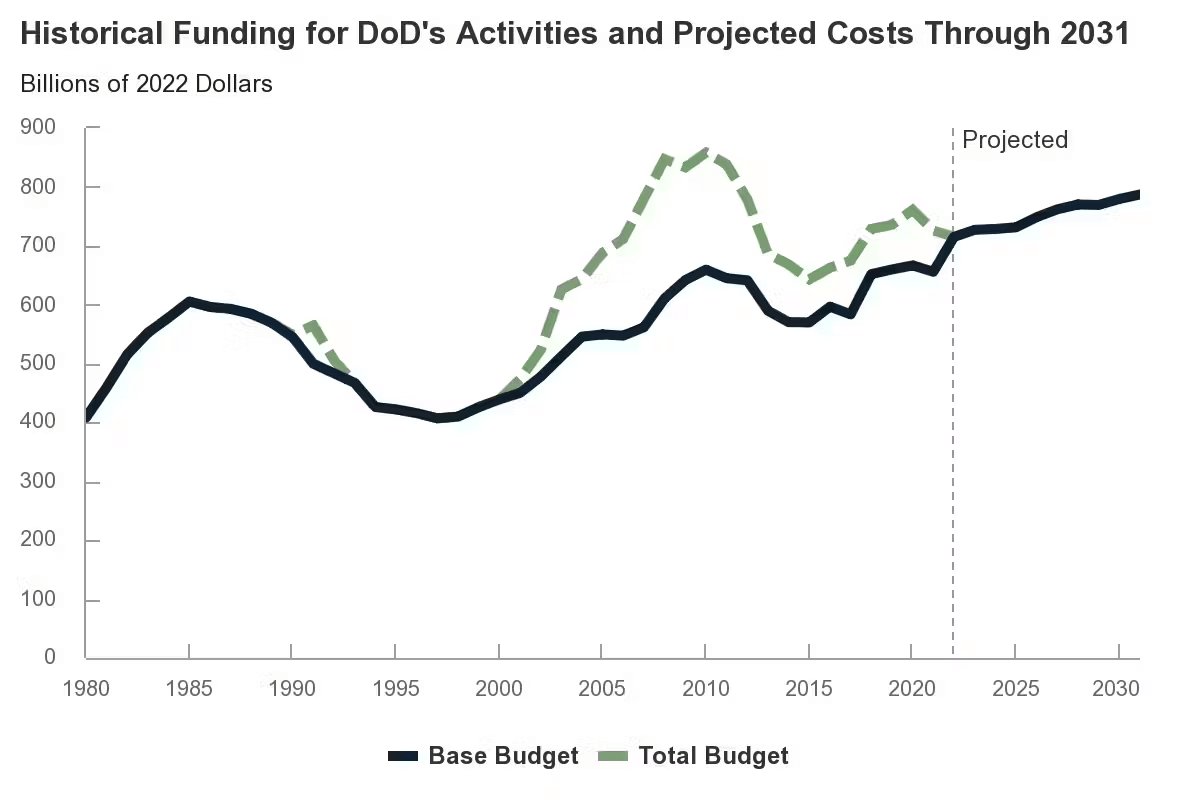

The company's growth prospects are bolstered by several factors. First, the U.S. defense budget, which reached $727 billion in 2022, is increasingly prioritizing autonomous systems and AI, with $1.7 billion allocated to autonomous technologies in FY2021 alone. Anduril's Lattice platform and hardware ecosystem, including Ghost UAS and Anvil counter-drone systems, align perfectly with these priorities. Second, geopolitical shifts, such as the rise of near-peer competitors like China and Russia, are driving demand for advanced defense solutions. Anduril's ability to deliver rapidly deployable, cutting-edge technologies positions it to capitalize on this trend. Additionally, the company has significant potential for international expansion, as allied nations seek to modernize their militaries.

Anduril's diversification of its product portfolio, including underwater autonomous vehicles like Dive-LD and ground-based sensors like Dust, further enhances its growth potential. The company's “phrasing as a service” model, which ensures continuous software updates, also creates recurring revenue streams and reduces the risk of product obsolescence. With $2.7 billion in funding and a $10 billion valuation as of December 2023, Anduril is well-capitalized to pursue these opportunities.

Weaknesses & Risks

Despite its strengths, Anduril faces significant challenges. The defense industry's procurement practices are notoriously rigid and favor established primes, creating barriers to entry for newer players. The Department of Defense's tendency to spread contracts across multiple contractors for political and supply chain reasons could limit Anduril's ability to dominate the market. Additionally, the long sales cycles in defense contracting—often 18-24 months—require substantial upfront investment in R&D and prototyping, which could strain resources if contracts are delayed or lost. Finally, competition from other defense startups like Shield AI, as well as in-house innovations from primes like Boeing's MQ-28 Ghost Bat, poses a threat to Anduril's market share.

Source: 18theses.com

IV. Anduril IPO Details

A. Anduril IPO Date

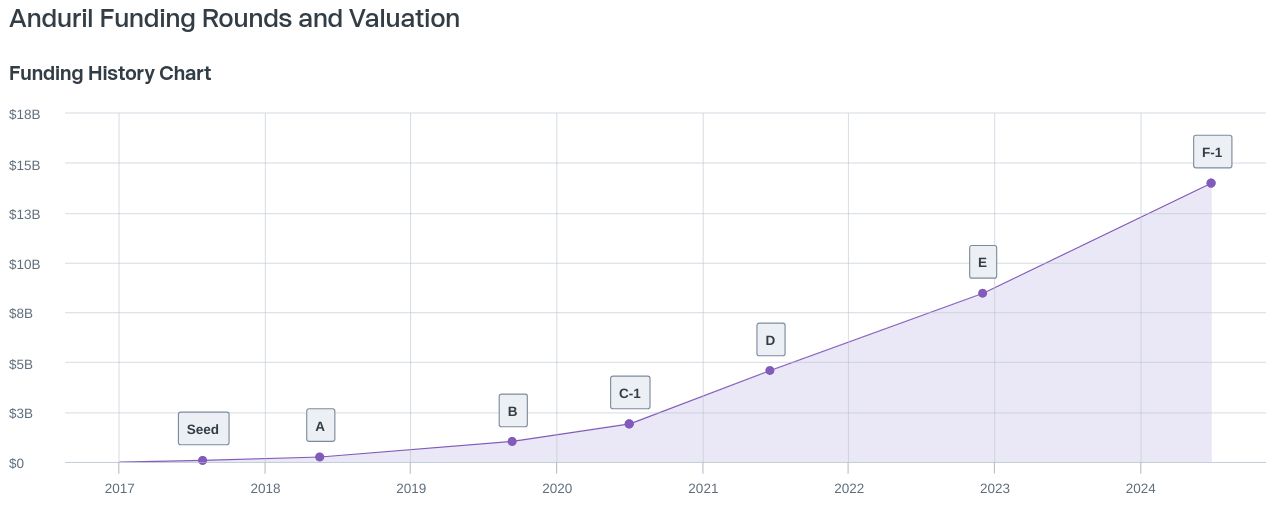

Anduril Industries has not yet announced a specific IPO date, but founder Palmer Luckey has expressed intentions to take the company public. As of December 2023, Anduril has raised $2.7 billion in funding and is valued at nearly $10 billion, according to Yahoo Finance. The company's latest funding round, Series F, closed in June 2024, raising $1.12 billion at a post-money valuation of $14 billion. This marks a significant increase from its Series E round in December 2022, which raised $1.48 billion at an $8.48 billion valuation. Anduril's consistent valuation growth reflects investor confidence in its innovative defense technology solutions and its ability to disrupt traditional defense contracting models.

B. Anduril Valuation

The estimated valuation range for Anduril's IPO is expected to be between $10 billion and $14 billion, based on its most recent funding rounds. The company's total funding to date includes $1.12 billion from Series F, $1.48 billion from Series E, $580.33 million from Series D, and $200 million from Series C, among others. This substantial capital has enabled Anduril to invest heavily in R&D, expand its product portfolio, and pursue long-term government contracts, positioning it as a strong candidate for a successful IPO.

Source: forgeglobal.com

C. Share Structure & Analyst Opinions

In terms of share structure, Anduril has issued multiple share classes across its funding rounds, with Series F shares priced at $21.7366 and Series F-1 shares at $17.3893 in June 2024. The number of shares to be offered in the IPO and their pricing will depend on market conditions and investor demand. Analysts anticipate that Anduril's IPO could achieve a market capitalization in the range of $10 billion to $14 billion, given its strong revenue growth, high gross margins (40-45%), and alignment with U.S. defense priorities. Investment research reports highlight Anduril's unique business model, which combines SaaS-like recurring revenue from its Lattice platform with high-margin hardware sales, as a key driver of its valuation.

Analyst perspectives on Anduril's IPO are generally positive, citing its disruptive potential in the defense sector and its ability to address modern warfare challenges with AI and autonomous systems. However, some caution that the company's success will depend on its ability to navigate the defense industry's complex procurement processes and compete with entrenched primes like Lockheed Martin and Northrop Grumman. Overall, Anduril's IPO is poised to attract significant investor interest, given its innovative technology, strong financials, and growth prospects.

Source: forbes.com

V. How to Invest in Anduril IPO & Anduril Stock

Where to Buy Anduril Industries IPO Shares

To invest in Anduril IPO, retail investors can open a brokerage account with platforms like VSTAR, which offers access to global markets, including IPOs, stocks, and CFDs. VSTAR provides a user-friendly interface, low trading fees, and deep liquidity, making it suitable for both beginners and experienced traders. Investors can fund their accounts via VISA, Mastercard, or bank wire, with a minimum deposit of $50. For those unable to access IPO shares directly, trading Anduril stock post-IPO is an alternative. VSTAR also supports CFDs, allowing traders to speculate on Anduril stock price movements without owning the underlying asset.

Anduril IPO Trading Strategies

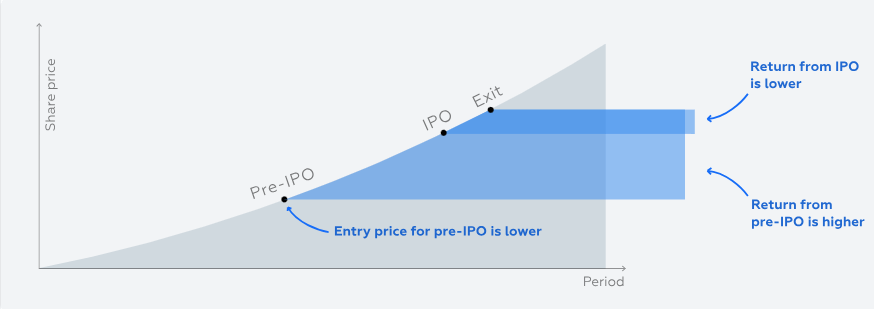

Anduril IPO trading strategies include pre-IPO investing, which involves purchasing shares through private markets or venture capital funds before the IPO, and day trading, which focuses on short-term price fluctuations post-listing. Pre-IPO investing offers potential high returns but carries higher risk due to limited liquidity. Day trading requires careful analysis of market trends and volatility, particularly in the early days of Anduril's public trading.

Source: unitedtraders.io

Ways to Trade Anduril Industries Stock

For diversified exposure, investors can consider ETFs that include Anduril stock once it becomes available. Options trading is another strategy, allowing investors to hedge or speculate on price movements. VSTAR's platform supports CFD trading, offering low-cost trading and real-time market data. With its regulatory compliance and institutional-grade features, VSTAR is a reliable platform for trading Anduril stock and other global assets.