Plaid, a notable financial technology company, is known for its crucial role in connecting consumer bank accounts to financial applications. The company recently drew significant investors' attention as it has been planning an IPO for several years. The company's managing body has appointed experts in recent years to lay the groundwork for a successful IPO. The potential Plaid IPO gained significant attention due to its notable position in the Fintech ecosystem.

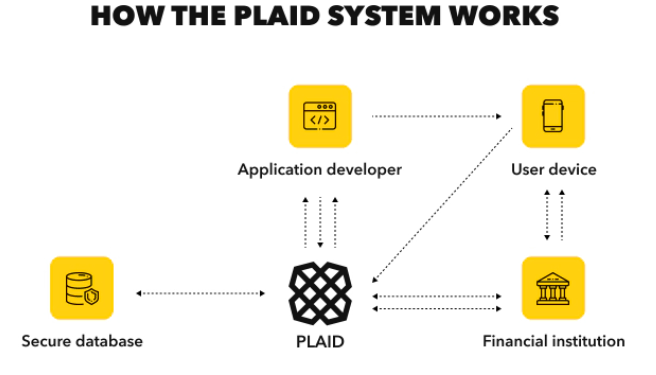

Plaid works as a key intermediary between a wide range of digital applications and financial institutions, powering popular services used by millions around the globe. This indispensable role drives the company to capture the attention of significant investors who can determine Plaid's services in the growing digital economy.

The anticipation of Plaid's potential IPO highlights its significance in Fintech. The innovative approach, strategic partnerships, and strong leadership suggest the company has the potential to deliver a successful IPO by capturing sufficient investor attention. The company hasn't published the exact timeline, but several sources confirmed that the company is approaching public offerings.

I. What is Plaid

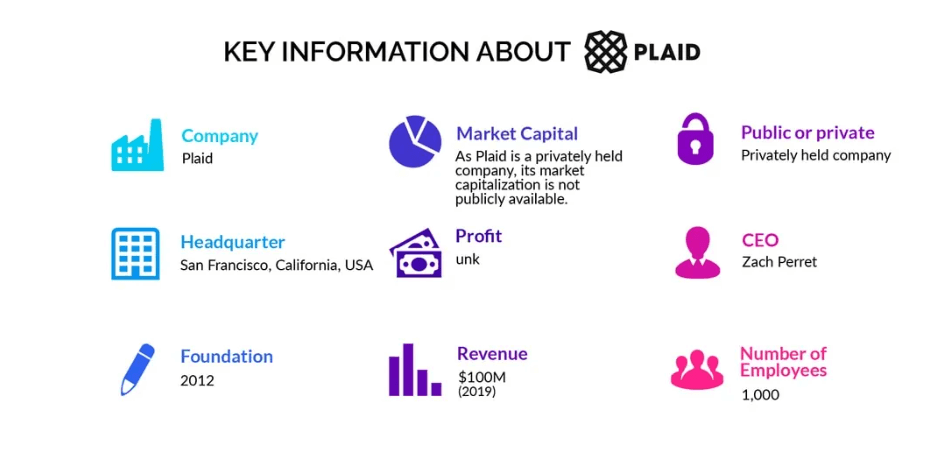

Plaid Inc. is a leading fintech company specializing in bridging financial institutes and digital applications. The company is reshaping how businesses and consumers access and manage financial data. Plaid was founded in 2013 by Zach Perret and William Hockey. It is headquartered in San Francisco, California, and has become a key player in the Fintech space.

Plaid employs a usage-based pricing model, generating revenue through three primary streams: fees for each account connection, charges based on API call usage, and subscription fees for specialized offerings such as its Liabilities and Investments APIs. The company serves over 8,000 customers and operates in multiple countries, including the United States, Germany, Denmark, Canada, the Netherlands, the United Kingdom, Portugal, France, Poland, and Italy.

Business Model And Core Services

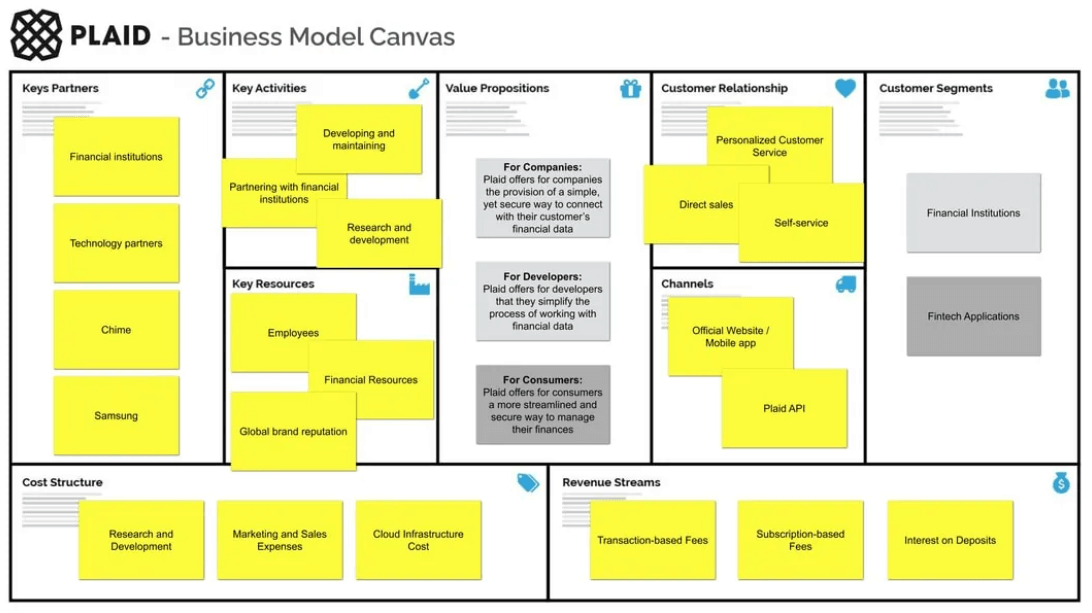

Plaid operates under a SaaS (Software as a Service) business model, providing digital infrastructure that enables developers to create personalized financial tools. Plaid is a key developer of application programming interfaces (APIs) that are usually designed to streamline banking data integration.

The company provides solutions for accessing bank transaction data, simplifying ACH authentication by connecting accounts for seamless payments, and categorizing transactions efficiently. Its services include fraud prevention, user identity verification, and compliance management. Beyond these, Plaid delivers advanced capabilities in payments, personal finance insights, credit underwriting, and open finance solutions.

Plaid makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Disruptive banking

- Alternative currencies and banking

- Data as a Service (DaaS)

- Innovative retail banking model

- Software as a Service (SaaS)

- Digital transformation

- Easy and low-cost money transfer and payment

- Cross-selling

- Customer data

- Subscription

- Crowdsourcing

- Peer to Peer (P2P)

- Customer relationship

- Disintermediation

- Microfinance

- Transaction facilitator

- On-demand economy

- Crowdfunding

- Platform as a Service (PaaS)

- Open innovation

- Tiered service

- Pay as you go

- P2P lending

- Ecosystem

Key Customers And Ownership

Plaid serves many customers, including traditional finance companies and notable FIntech companies. Major company customers include Robinhood, Venmo, Coinbase, SoFi, and Wise. These companies leverage laid APIs to facilitate secure connections between their platform and user's bank accounts. Besides these companies, several enterprises such as Carvana, Zillow, and CarMax use Plaid services, highlighting that the company is expanding services beyond the Fintech industry.

Customer Segments

- Startups

- Corporations

- Investors

Plaid has remained a privately owned company since its inception. The company captured $425M from the series D funding round, and the valuation reached $13.4B. Significant investors include Altimeter Capital, Index Ventures, Andreessen Horowitz, and Kleine.

Key Partners

- Deutsche Bank

- Amex

- Venmo

- Community members

- Fintech applications

- New Enterprise Associates

- 3rd party developers

- Homebrew

- Financial institutions (Banks and Credit Unions)

- Catalyst

- Battery Ventures

- Issuers

- Series A led by Spark Capital

- Acquirers

- Series B led by Google Ventures

- Technology partners

- Felicis Ventures

- Opus Capital

- Goldman Sachs

- Sponsors

II. Plaid Financials

Plaid Revenue Growth

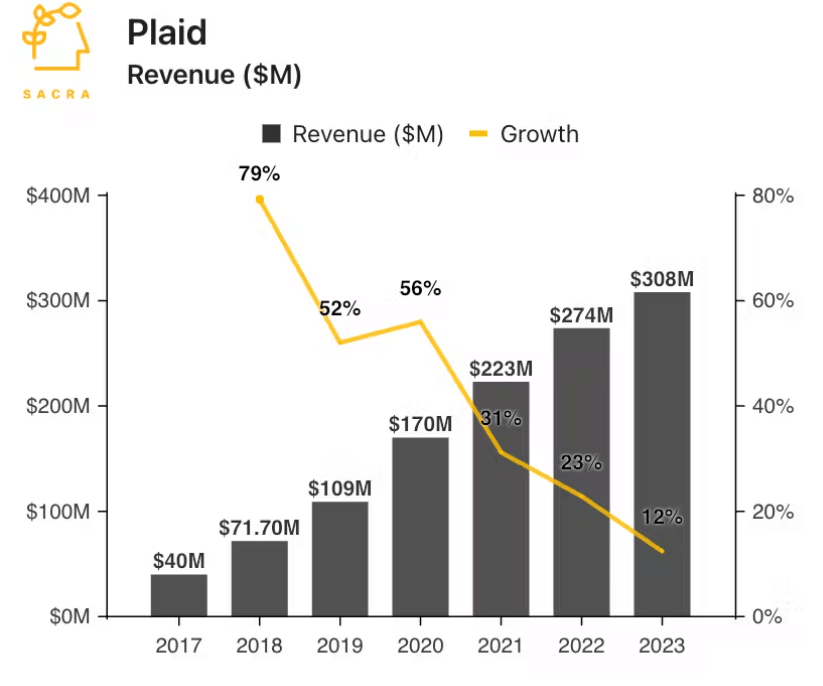

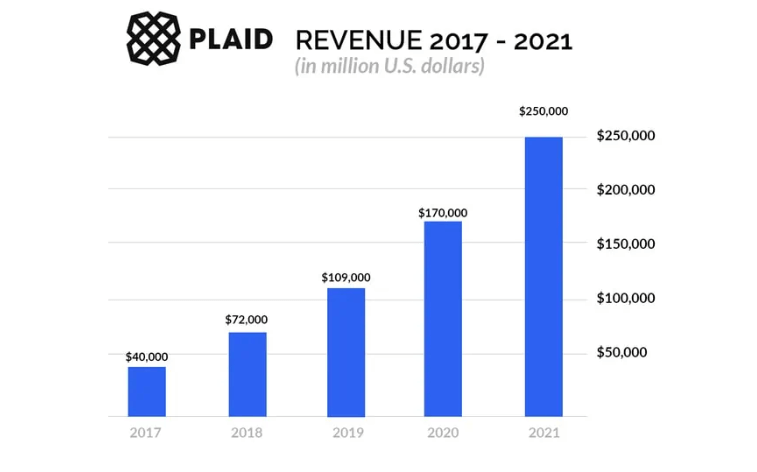

According to expert estimation, Plaid's revenue for 2023 was $308M, an increase of 12% compared to the previous year, 2022. The company achieved $250M in revenue in 2021, a growth of 47% compared to the previous year, 2020.

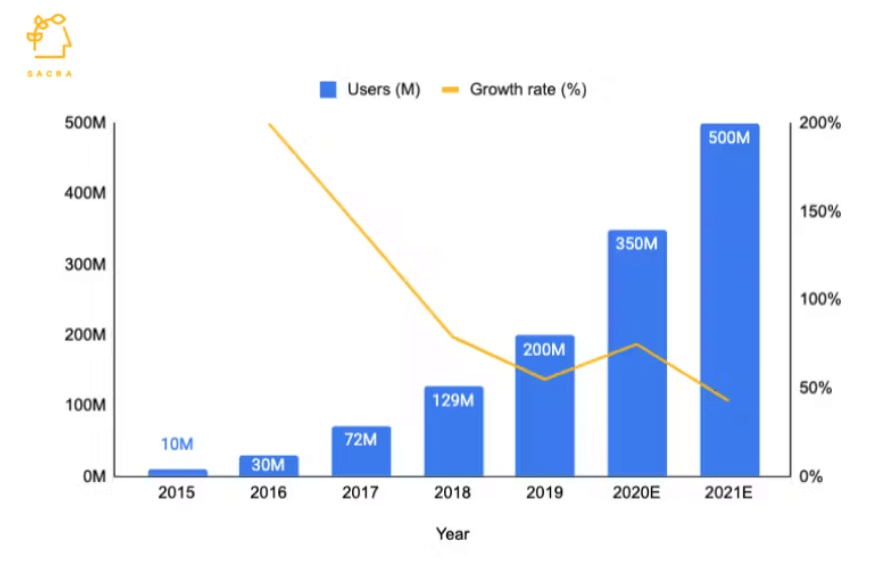

The company continues to expand beyond fintech and recently added 100+ customer enterprises, highlighting real traction beyond the fintech industry.

The annual revenue is gradually improving, indicating the company is progressing gradually.

Profitability and Margins

Plaid maintains a solid gross profit margin, indicating substantial growth. The company's gross profit margin stood at 73.85% in March 2023, demonstrating robust revenue growth potential. However, the company is still facing challenges in terms of profitability; as the fiscal year ended in September 2023, the company reported a net loss of $14.2M, demonstrating a significant income decline.

User engagement is increasing over time, reflecting adaptivity. The company maintains $140M cash and an 80% gross margin, surpassing typical B2B software margins. It has solid revenue growth and a substantial gross margin, but elevated expenses negatively impact its financial performance.

III. Plaid IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

The open banking sector is notably growing driven by technological advances and regulatory initiatives. Open banking allows third-party payment service providers to have access to clients' data through APIs maintaining financial service competitions and innovation. The valuation reached approx. $25.14B in 2023 and projected to surge at a compound annual growth rate (CAGR) of 27.4% from 2024 to 2030.

The company faces competition from major competitors in the sector including TrueLayer, Yodlee, and Tink. The Robust data infrastructure, a wide range of services, and strong partnerships, besides compliance and security focus, give Plaid a competitive edge over other competitors.

Future Growth Opportunities

- Secure Platform: Plaid is committed to ensuring safeguarding customer safety through substantial investments in security infrastructure. It employs enhanced encryption techniques to protect user data and implements multifactor authentication to protect data through an additional security layer. Regular auditor strict access control ensures only authorized personnel have access to the sensitive data, highlighting trust for customers.

- User-friendly Interface: The APIs that Plaid provides are designed for seamless integration, making it easier for developers to incorporate into applications. Its user-friendly dashboard enables individual users to track transaction histories, manage linked financial accounts, and categorize spending by type or purpose, offering an adequate financial management experience.

- Expansive Network of Services: Plaid has partnerships with over 11000 financial institutions including credit card issuers, banks, and investment firms. This comprehensive network supports informed decisions around credit, risk management, and other crucial operational areas.

- Global Market Expansion: With the worldwide demand surge in financial data access, Plaid can capture the opportunity and utilize it in the best way. The company can expand in different regions to grow its customer base, diversify revenue streams, and address the evolving needs of businesses and consumers worldwide.

- Strategic Partnerships: Plaid can amplify its global reach and expertise by partnering with other fintech giants. These collaborations allow accessing cutting-edge technologies and new user networks, allowing the company to introduce innovative services or improve its existing solutions to address customer demands.

B. Weaknesses & Risks

- Third-party Dependencies:Plaid highly depends on third-party or financial institutes data for operating, which makes it vulnerable. Especially, in terms of restricting user policy or higher fees can impact Plaid revenue growth and operation negatively.

- Competitive and Geographic Challenges: Plaid already facing competitive challenges as it operates a highly competitive marketplace competing with giants like MX and Finicity. These competitors' offers similar to Plaid make it challenging to grow more rapidly. Currently, the company operates in the US, Canada, and parts of Europe, the geopolitical challenge is another obstacle to overcome for Plaid to sustain growth.

- Security, Regulation, and Technological Disruption: Plaid operates in highly secure measures, but is still vulnerable to cyber threats. Regulatory challenges such as GDPR and CCPA require ongoing investigations and data privacy laws. Another significant factor is emerging technology like Artificial Intelligence could push challenges by enabling competitors to offer more innovative and efficient solutions.

IV. Plaid IPO Details

A. Plaid IPO Date

As of January 2025, Plaid hasn't published any official announcements for an IPO date. In March 2024, Zach Perret, the CEO said the company had no plan to go public that year. But Plaid appointed its first president Jen Taylor, a former Cloudflare executive, for IPO preparation.

Although the official timeline is still confirmed yet by the governing body, recent developments suggest that the company is preparing the groundwork for going public.

B. Plaid Valuation

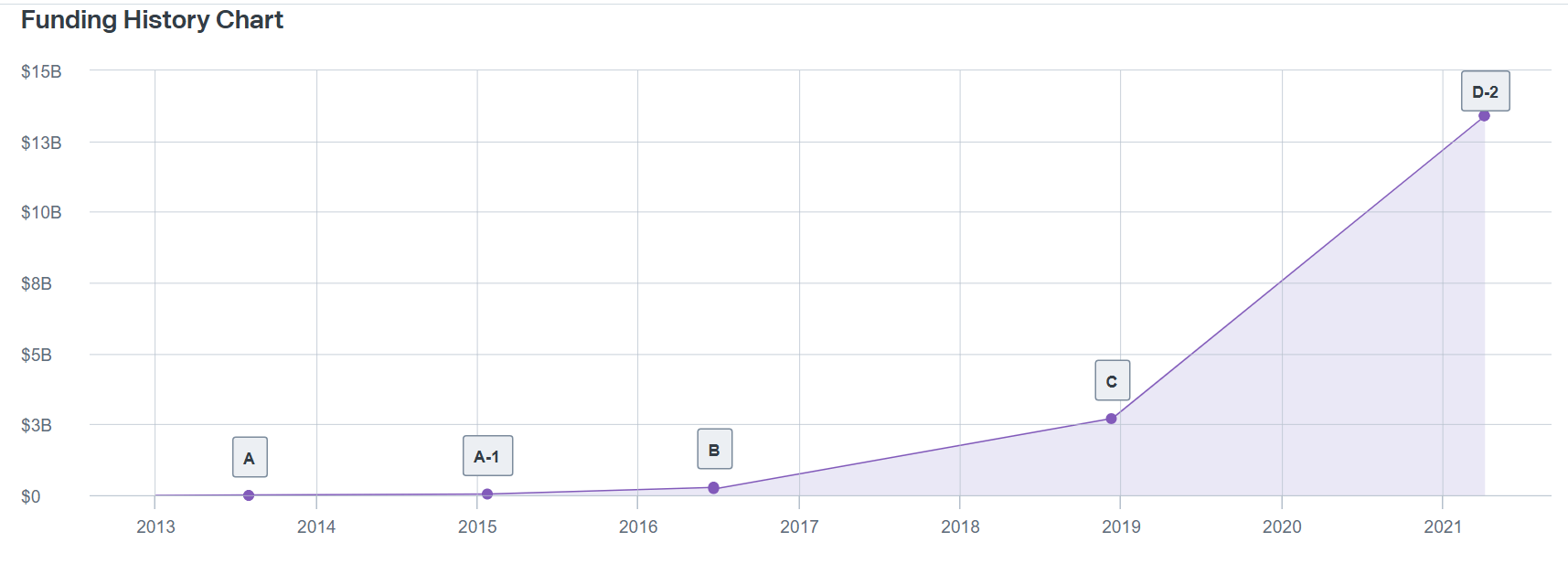

In April 2021, Plaid raised $425M from its latest funding round of D series and the valuation increased to $13.4B.

Since the company was founded, the company raised $734.3M from several funding rounds. The company reported $250M in revenue back in 2021 and is backed by several significant investors which include American Express, Goldman Sachs, Mastercard, and J.P. Morgan, alongside venture capital firms Index Ventures and Kleiner Perkins.

Major Funding Rounds & Total Funding

The fintech company has successfully raised significant capital since its inception. The chart below contains all the basic info on funding rounds that Plaid went through.

|

Funding Date |

Funding Round |

Funding Amount |

Investors |

|

04/05/2021 |

Series D-2 |

$50MM |

Altimeter Capital, Andreessen Horowitz, Index Ventures, Kleiner Perkins, New Enterprise Associates, Ribbit Capital, Silver Lake |

|

04/05/2021 |

Series D-1 |

$7.47MM |

Altimeter Capital, Andreessen Horowitz, Index Ventures, Kleiner Perkins, New Enterprise Associates, Ribbit Capital, Silver Lake |

|

04/05/2021 |

Series D |

$449.99MM |

Altimeter Capital, Andreessen Horowitz, Index Ventures, Kleiner Perkins, New Enterprise Associates, Ribbit Capital, Silver Lake |

|

12/11/2018 |

Series C |

$256MM |

Andreessen Horowitz, Goldman Sachs Investment Partners, Index Ventures, Kleiner Perkins, New Enterprise Associates, Norwest Venture Partners, Spark Capital |

|

06/20/2016 |

Series B |

$42.01MM |

American Express Ventures, Citi Ventures, Goldman Sachs Investment Partners, New Enterprise Associates |

|

06/20/2016 |

Series B-1 |

$2.12MM |

American Express Ventures, Citi Ventures, Goldman Sachs Investment Partners, New Enterprise Associates |

|

01/23/2015 |

Series A-1 |

$11.84MM |

New Enterprise Associates, Spark Capital |

|

07/31/2013 |

Series A |

$2.86MM |

Amit Avner, Benjamin Cirlin, Box Group, David Tisch, Felicis Ventures, Google Ventures, Homebrew Capital, Nat Turner, New Enterprise Associates, Spark Capital, Zachary Weinberg |

V. How to Invest in Plaid IPO & Plaid Stock

Where to Buy Plaid IPO Shares

To participate in Plaid IPO, investors should monitor official announcements to identify the preferred platforms for the process. It is anticipated that financial institutions, brokers, or other authorized platforms will facilitate the IPO. Once the details are confirmed, investors must create an account on the designated platform. After registering, they will need to validate their account by providing the required personal information to access all features. Once the account is verified, investors can deposit funds to purchase shares and participate in Plaid IPO.

Plaid IPO Trading Strategies

Once Plaid becomes publicly traded, investors can explore various approaches to optimize returns:

- Momentum Trading: Take advantage of the initial enthusiasm surrounding Plaid's leadership in financial data services by monitoring early price trends for short-term profit opportunities.

- Short-Term Trading: Engage in day or swing trading to benefit from price volatility during the initial trading period before the stock stabilizes.

- Long-Term Investment: Plaid's innovative platform, strong market position, and growth potential through global expansion and partnerships make it an attractive option for long-term investors as demand for financial data solutions continues to grow.

Alternative Ways to Trade Plaid Stock

- ETFs: Gain diversified exposure by investing in ETFs that focus on fintech or technology sectors, including companies like Plaid.

- Options Trading: Use options to manage volatility or establish strategic entry points after the IPO.

- CFD Trading: Platforms like VSTAR allow investors to trade Plaid stock price through CFDs, providing flexible market positioning without the need for direct ownership.

Adopt trading strategies that align with your financial objectives and stay updated on Plaid's developments and industry trends to make informed decisions.