I. Introduction

A. Overview of the USD/JPY currency pair

The USD/JPY currency pair represents the exchange rate between the United States dollar (USD) and the Japanese yen (JPY). It is one of the most actively traded currency pairs in the foreign exchange (forex) market and is often referred to as the "Gopher" or "Ninja" pair.

B. Importance of fundamental analysis

Fundamental analysis plays a crucial role in understanding the factors that drive currency movements. It involves examining economic, political, and social factors that can impact a country's currency value. By analyzing these factors, traders can make informed decisions about whether to buy or sell a particular currency.

C. A brief explanation of the U.S. dollar and Japanese yen

Source: zawya.com

The U.S. dollar is the world's dominant reserve currency and is widely used in international trade and finance. It is issued by the Federal Reserve and is influenced by various economic indicators, such as GDP growth, inflation, interest rates, and employment data. The U.S. dollar is considered a safe-haven currency during times of global uncertainty.

The Japanese yen, on the other hand, is the currency of Japan and is issued by the Bank of Japan. Japan is known for its export-oriented economy, and the yen is influenced by factors such as Japanese GDP growth, trade balance, monetary policy decisions, and geopolitical events in the region. The yen is also considered a safe-haven currency due to Japan's stable economy and low inflation.

II. Macroeconomic Overview: United States

A. Economic Indicators Review

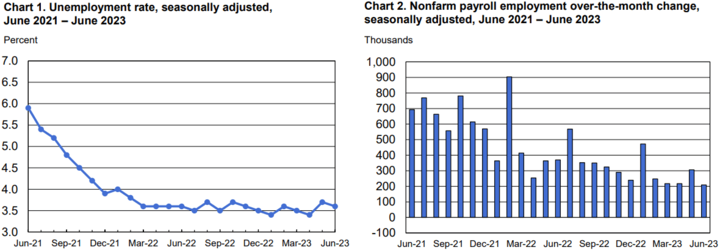

1. GDP and Unemployment Rate

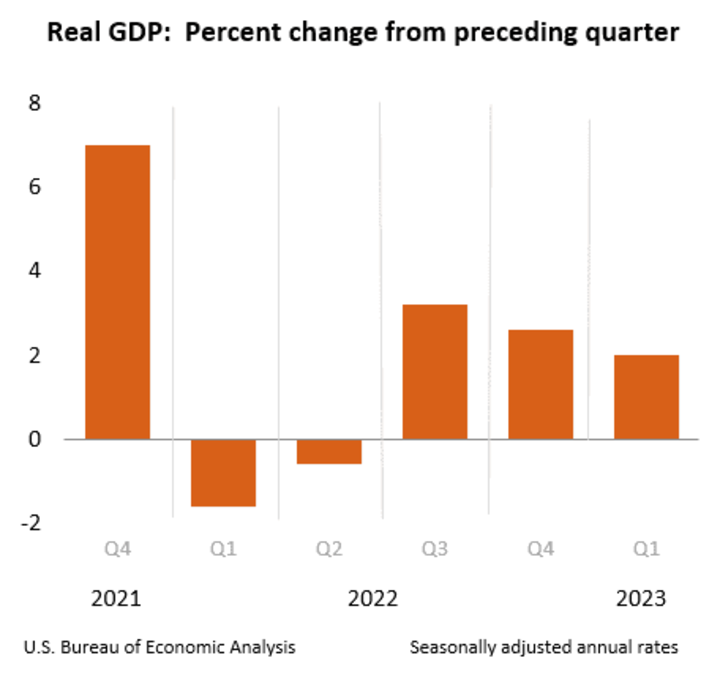

Gross Domestic Product (GDP) is a crucial economic indicator that measures the value of all goods and services produced within a country. A higher GDP indicates economic growth, which can strengthen the currency. For example, in Q1 2023, the U.S. real GDP grew by 2.0%, signifying upward revisions to exports and consumer spending. This positive GDP growth contributed to the strengthening of the U.S. dollar against the Japanese yen.

Source: bea.gov

The unemployment rate is another important indicator of economic health. A low unemployment rate indicates a strong labor market and consumer spending. In June 2023, the U.S. unemployment rate decreased to 3.6%, reaching pre-pandemic levels. The decline in unemployment contributed to increased consumer confidence and economic stability, further supporting the strength of the U.S. dollar.

Source: bls.gov

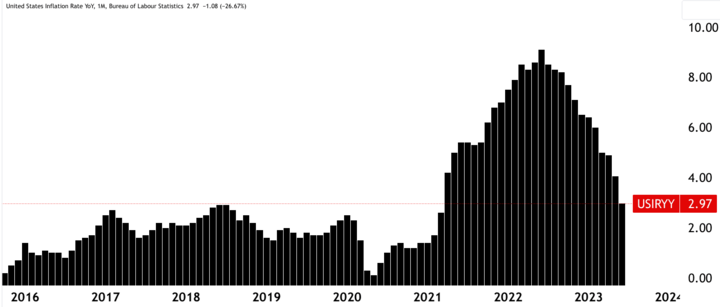

2. Inflation Rates

Inflation is the rate at which the general level of prices for goods and services is rising, eroding purchasing power. Central banks closely monitor inflation rates when formulating monetary policy decisions. In the United States, the Federal Reserve targets an inflation rate of around 2%.

If inflation rises above the target, the Federal Reserve may adopt a more hawkish stance by increasing interest rates, which can strengthen the U.S. dollar. Conversely, if inflation remains below the target, the Federal Reserve may adopt a more accommodative monetary policy, potentially weakening the U.S. dollar.

The current inflation rate is 2.97% as of June 2023, forcing the Federal Reserve to keep interest rates higher.

Source: tradingview.com

3. Business and Consumer Confidence

Business and consumer confidence measures the sentiment and expectations of businesses and consumers regarding the economy's future. High confidence levels indicate optimism and a willingness to spend and invest, which can drive economic growth. In the United States, the Conference Board Consumer Confidence Index and the Institute for Supply Management's Manufacturing Purchasing Managers' Index (PMI) are commonly used indicators.

Positive business and consumer confidence in the United States can attract foreign investors seeking higher returns, leading to a stronger U.S. dollar. For example, if the ISM Manufacturing PMI shows expansion in the manufacturing sector, it indicates economic strength and can contribute to the appreciation of the U.S. dollar against the Japanese yen.

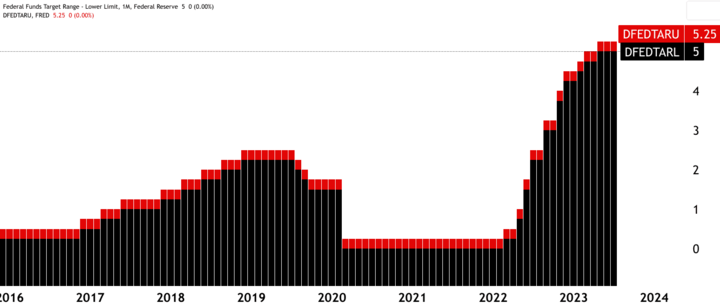

B. Monetary Policy

1. The Federal Reserve's Monetary Policy

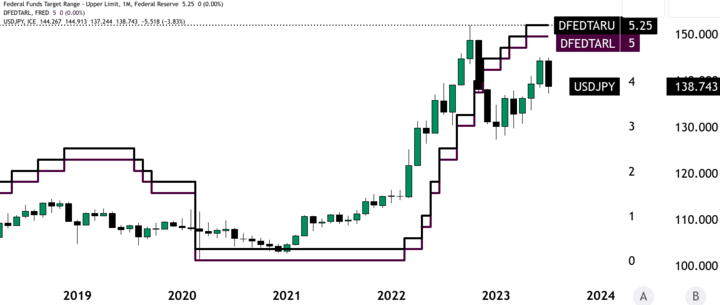

The Federal Reserve plays a crucial role in shaping the U.S. dollar's value through its monetary policy decisions. The Federal Open Market Committee (FOMC) determines the target range for the federal funds rate, which influences short-term interest rates in the United States. Changes in the federal funds rate can impact the USD/JPY exchange rate.

For example, if the Federal Reserve adopts a hawkish stance by raising interest rates, it can attract foreign investors seeking higher returns, leading to a stronger U.S. dollar relative to the Japanese yen. Conversely, if the Federal Reserve adopts a more accommodative monetary policy by lowering interest rates, it can weaken the U.S. dollar. As of June 2023, federal funds rates were at elevated levels, that is, 5.00%–5.25%.

Source: tradingview.com

2. Interest Rate Expectations

Market expectations regarding future interest rate changes can significantly impact currency exchange rates. Central banks often provide forward guidance, indicating their future policy direction. If market participants anticipate higher interest rates in the United States, it can lead to an appreciation of the U.S. dollar.

For instance, if the Federal Reserve hints at raising interest rates shortly due to strong economic growth and rising inflation, it can lead to increased demand for the U.S. dollar, strengthening it against the Japanese yen.

C. Political Climate

1. Economic policies of the government

Government policies and initiatives can have a significant impact on a country's economy and its currency. For example, fiscal policies such as tax reforms, infrastructure spending, and deregulation can stimulate economic growth and strengthen the U.S. dollar. Conversely, policies that hinder economic growth or increase geopolitical tensions can weaken the currency.

2. Current U.S. and international trade policies

Trade policies, including tariffs and trade agreements, can affect currency exchange rates. The U.S. and Japan have a significant trade relationship, and any changes in trade policies between the two countries can impact the USD/JPY exchange rate.

For instance, if the U.S. imposes tariffs on Japanese imports, it can weaken the Japanese yen as it reduces demand for Japanese goods. Conversely, if the U.S. and Japan enter into a trade agreement that promotes economic cooperation, it can strengthen the yen.

III. Macroeconomic Overview: Japan

A. Economic Indicators Review

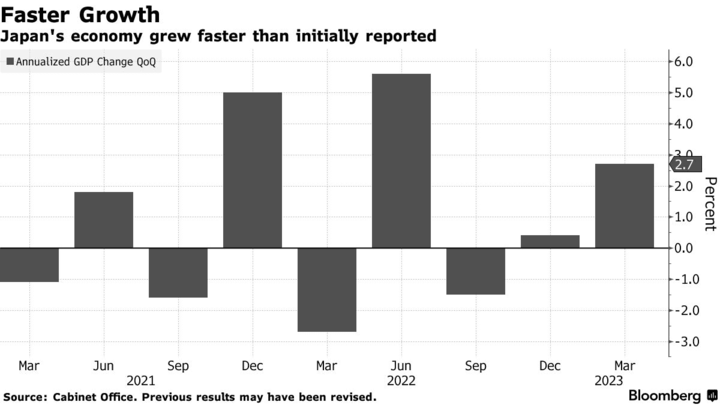

1. GDP and Unemployment Rate

Gross Domestic Product (GDP) is a key indicator of economic performance. In Japan, GDP growth has been relatively moderate in recent years. For example, in Q1 2023, Japan's GDP QoQ growth rate was 2.7% based on ramped-up business spending. The slower growth rate compared to other major economies can influence the value of the Japanese yen against the U.S. dollar.

Source: bloomberg.com

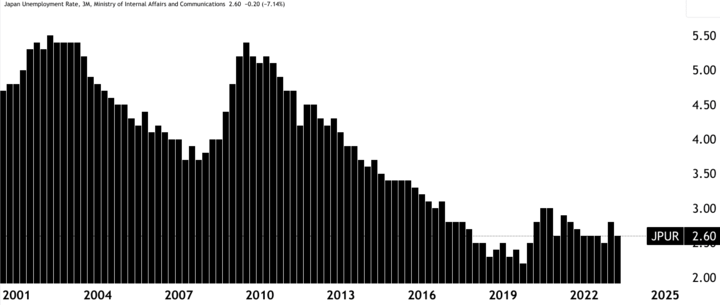

The unemployment rate in Japan is another important indicator. In May 2023, Japan's unemployment rate stood at 2.6%, which is relatively low. A low unemployment rate indicates a tight labor market and can contribute to increased consumer spending and economic stability, potentially strengthening the Japanese yen.

Source: tradingview.com

2. Inflation Rates

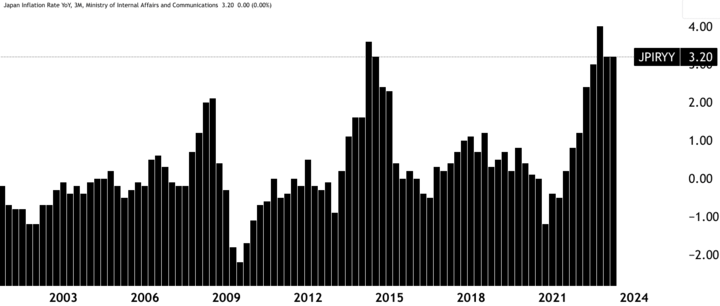

Japan has been battling deflationary pressures for an extended period. The Bank of Japan has set an inflation target of 2% to combat deflation and stimulate economic growth. However, achieving this target has been challenging. In recent years, Japan has experienced relatively low inflation rates, ranging from 0% to 1%.

Low inflation can have mixed effects on the Japanese yen. On one hand, it can be seen as a sign of weak economic activity, which may lead to a depreciation of the currency. On the other hand, low inflation can also be viewed positively by investors seeking stability, which can support the value of the yen.

In May 2023, the annual Inflation pace in Japan was 3.2%, which is comparatively high.

Source: tradingview.com

3. Business and Consumer Confidence

Business and consumer confidence are crucial indicators of economic sentiment and expectations in Japan. The Tankan survey, conducted by the Bank of Japan, measures business sentiment among major Japanese corporations. Additionally, consumer confidence indexes, such as the Consumer Confidence Index published by the Cabinet Office, provide insights into consumer sentiment.

Positive business and consumer confidence can contribute to economic growth and strengthen the Japanese yen. Higher confidence levels indicate increased spending and investment, which can boost the economy and support the currency.

B. Monetary Policy

1. The Bank of Japan's Monetary Policy

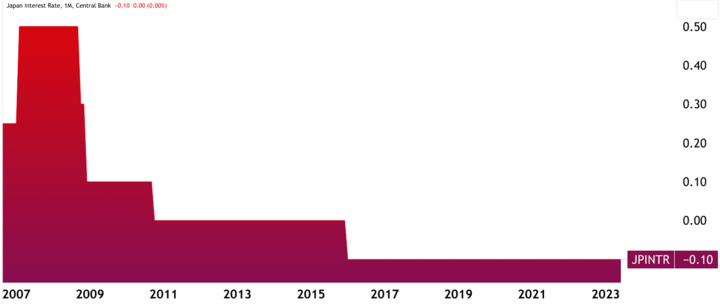

The Bank of Japan (BoJ) plays a significant role in shaping monetary policy and influencing the Japanese yen. The BoJ has implemented unconventional measures, such as negative interest rates and quantitative easing, to stimulate the economy and combat deflation.

The BoJ's monetary policy decisions can impact the Japanese yen's value. For example, if the BoJ adopts an accommodative policy by implementing further monetary stimulus, it can weaken the yen. Conversely, if the BoJ signals a shift towards a more hawkish stance by reducing stimulus or normalizing interest rates, it can strengthen the yen.

2. Interest Rate Expectations

Expectations regarding future interest rate changes in Japan can influence the Japanese yen's value. Market participants closely monitor the BoJ's forward guidance and any indications of potential interest rate adjustments.

If market expectations suggest a tightening of monetary policy in Japan, such as increasing interest rates, it can lead to an appreciation of the yen. Conversely, if expectations point to further easing or prolonged low-interest rates, it can weaken the yen. Generally, interest rates in Japan hover around 0%.

Source: tradingview.com

C. Political Climate

1. Economic policies of the government

Government economic policies and initiatives can have a significant impact on Japan's economy and its currency. For example, fiscal policies, such as stimulus packages and structural reforms, can stimulate economic growth and potentially strengthen the Japanese yen. Conversely, policies that hinder economic growth or result in increased debt levels can weaken the currency.

2. Impact of global trade tensions on the Japanese yen

Japan is heavily reliant on exports, and global trade tensions can affect its economy and the Japanese yen. For instance, if there are escalating trade disputes between major economies, such as the United States and China, it can create uncertainty and lead to a depreciation of the yen as investors seek safer assets.

On the other hand, if trade tensions ease or if Japan benefits from trade agreements, it can strengthen the yen. For example, the signing of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) contributed to increased optimism and appreciation of the yen.

IV. Analysis of the USD/JPY Currency Pair

A. Relevant Economic Indicators

1. Correlation between the U.S. and Japanese economies

The U.S. and Japanese economies are closely interconnected, and their performance can have a significant impact on the USD/JPY currency pair. Both countries are major global economic powers, and their economic indicators often reflect broader global trends.

For example, during times of global economic uncertainty, investors tend to seek safe-haven assets, including the Japanese yen. This increased demand for the yen can lead to its appreciation against the U.S. dollar. Conversely, when there is optimism about global economic growth, investors may be more willing to take risks, leading to a weakening of the yen relative to the U.S. dollar.

2. Impact of GDP growth, inflation rates, and interest rates on the currency pair

Gross Domestic Product (GDP) growth, inflation rates, and interest rates are key economic indicators that can significantly impact the USD/JPY currency pair.

Higher GDP growth in the United States compared to Japan can lead to a stronger U.S. dollar against the Japanese yen. For example, if the U.S. economy experiences robust growth while Japan's economy remains relatively stagnant, investors may prefer to invest in the U.S., leading to a stronger U.S. dollar.

Inflation rates also play a role in currency movements. Higher inflation in the United States compared to Japan can lead to a depreciation of the U.S. dollar relative to the Japanese yen. This is because higher inflation erodes the purchasing power of a currency and reduces its attractiveness to investors.

Interest rates set by central banks, such as the Federal Reserve and the Bank of Japan, also influence the USD/JPY exchange rate. Higher interest rates in the United States can attract foreign investors seeking higher returns, leading to an appreciation of the U.S. dollar against the Japanese yen. Conversely, lower interest rates in the United States can weaken the U.S. dollar.

B. Factors Supporting a Bullish or Bearish Stance

1. Impact of the Federal Reserve's monetary policy on the currency pair

The monetary policy decisions of the Federal Reserve, including changes in interest rates and quantitative easing programs, can have a significant impact on the USD/JPY currency pair. For example, if the Federal Reserve adopts a more hawkish stance by raising interest rates or reducing stimulus measures, it can attract investors seeking higher returns, leading to a stronger U.S. dollar against the Japanese yen.

Source: tradingview.com

Conversely, if the Federal Reserve adopts a more dovish stance by lowering interest rates or increasing stimulus measures, it can weaken the U.S. dollar relative to the Japanese yen. Market participants closely monitor statements and actions by the Federal Reserve to assess their impact on the currency pair.

2. Impact of the Bank of Japan's monetary policy on the currency pair

Similarly, the monetary policy decisions of the Bank of Japan can influence the USD/JPY exchange rate. The Bank of Japan has implemented unconventional monetary policies, including negative interest rates and quantitative easing, to stimulate the economy and combat deflation.

If the Bank of Japan continues to maintain an accommodative monetary policy or hints at further easing measures, it can weaken the Japanese yen. On the other hand, if the Bank of Japan signals a shift towards a more hawkish stance or hints at tapering its stimulus measures, it can strengthen the yen.

3. Impact of U.S. and international trade policies on the currency pair

Trade policies, including tariffs and trade agreements, can have a significant impact on the USD/JPY currency pair. Both the United States and Japan are major players in global trade, and any changes in trade policies between the two countries can influence the currency pair.

For example, if the United States imposes tariffs on Japanese imports, it can weaken the Japanese yen as it reduces demand for Japanese goods. Conversely, if the United States and Japan enter into a trade agreement that promotes economic cooperation, it can strengthen the yen.

C. Potential Risks to the Currency Pair

1. Sudden changes in global economic growth

Global economic growth is a critical factor influencing the USD/JPY currency pair. Sudden shifts in global economic conditions, such as a slowdown in major economies or unexpected events like financial crises, can create volatility and impact the currency pair.

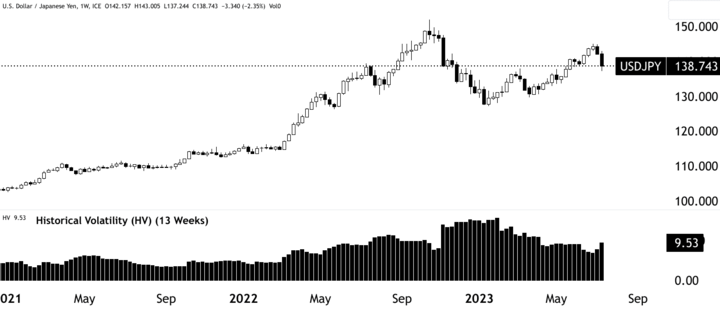

For instance, during 2022–2023, the USD/JPY exchange rate experienced significant fluctuations as investors sought safe-haven assets in USD against macroeconomic uncertainties. Similarly, the economic impacts of the COVID-19 pandemic led to increased volatility in the currency pair.

Source: tradingview.com

2. Unpredicted changes in U.S. or Japanese monetary policies

Monetary policy decisions by the Federal Reserve and the Bank of Japan can have unforeseen consequences for the currency pair. If central banks make unexpected policy shifts or fail to meet market expectations, it can lead to market volatility and impact the USD/JPY exchange rate.

For example, if the Federal Reserve raises interest rates more aggressively than anticipated, it can strengthen the U.S. dollar against the Japanese yen. Conversely, if the Bank of Japan unexpectedly reduces stimulus measures, it can strengthen the yen.

3. Geopolitical risks

Geopolitical events and tensions can create uncertainty and impact the USD/JPY currency pair. For instance, North Korea's nuclear program and tensions on the Korean Peninsula have historically led to periods of risk aversion, leading to an appreciation of the Japanese yen.

Tensions between the United States and China, two major economies, can also affect the USD/JPY exchange rate. Trade disputes and geopolitical conflicts can create uncertainty, leading to currency fluctuations.

V. Trading Strategies for USD/JPY

A. Technical Analysis

Technical analysis is a commonly used approach in forex trading that involves analyzing historical price data to identify patterns, trends, and potential trading opportunities. Traders utilize various tools and indicators to make informed decisions about the USD/JPY currency pair.

1. Identifying trends and patterns

Traders often look for trends in the price movements of the USD/JPY pair, such as uptrends (higher highs and higher lows) or downtrends (lower highs and lower lows). Trend lines can be drawn to visually identify and confirm the direction of the trend. Breakouts above or below key levels can indicate potential trading opportunities.

Source: tradingview.com

Additionally, traders use chart patterns, such as triangles, heads, and shoulders, or double tops and bottoms, to identify potential trend reversals or continuation patterns. These patterns can provide entry and exit points for trades.

2. Use of indicators such as moving averages and Fibonacci retracements

Indicators are mathematical calculations applied to price data to provide additional insights into market trends and potential turning points. Traders commonly use indicators like moving averages, which smooth out price fluctuations and help identify trend directions.

Source: tradingview.com

Fibonacci retracements are another tool used in technical analysis. They help identify potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to determine entry and exit points for trades.

B. Risk Management

Risk management is crucial in forex trading to protect against potential losses and preserve capital. Traders employ various risk management techniques when trading the USD/JPY currency pair.

1. Setting Stop-Loss and Take-Profit levels

Stop-loss orders are placed to limit potential losses by automatically closing a trade if the price reaches a certain predetermined level. Take-profit orders, on the other hand, allow traders to lock in profits by automatically closing a trade when the price reaches a specified target.

Source: tradingview.com

By setting appropriate stop-loss and take-profit levels, traders can manage their risk and protect their trading capital.

2. Determining position size based on risk tolerance

Traders assess their risk tolerance and determine the appropriate position size for each trade. Position sizing involves calculating the number of lots or units to trade based on the trader's risk appetite and the distance between the entry point and the stop-loss level.

Proper position sizing ensures that potential losses are within an acceptable range, given the trader's risk tolerance.

C. News Trading

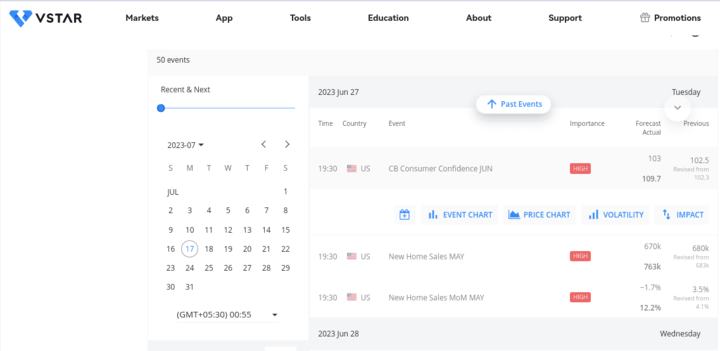

News trading involves trading based on the impact of economic events, data releases, and news announcements on the currency markets. Traders monitor economic calendars and news sources for key events that can influence the USD/JPY currency pair.

Source: vstar.com (Economic Calendar)

1. Following economic events and data releases

Important economic events and data releases, such as GDP reports, interest rate decisions, employment data, and inflation figures, can significantly impact currency exchange rates. Traders pay close attention to these events and analyze their potential implications for the USD/JPY pair.

2. Trading based on market reactions to news

Traders react to news events by analyzing the market's response and identifying potential trading opportunities. For example, if a positive U.S. employment report is released, it may strengthen the U.S. dollar against the Japanese yen. Traders may look for entry points to go long on the USD/JPY pair based on the positive market sentiment.

However, news trading carries risks, including volatility and unpredictable market reactions. Traders should exercise caution and implement proper risk management strategies when trading based on news events.

Trade USDJPY with VSTAR

Trading USD/JPY with VSTAR provides several advantages. Firstly, VSTAR offers competitive leverage of up to 1:200, allowing traders to participate in more trading opportunities with less capital. This leverage enables traders to amplify their potential profits, but it also increases the risk of losses.

Additionally, VSTAR boasts top-tier deep liquidity, ensuring that traders can quickly enter and exit trades at any time. Deep liquidity is crucial in forex trading as it ensures that there are sufficient buyers and sellers in the market, reducing the likelihood of slippage and providing better pricing.

VSTAR also offers spreads starting at 0 pips, which means traders can access the most competitive pricing on major products like USD/JPY. Tight spreads reduce trading costs and allow traders to maximize their potential profits.

Moreover, VSTAR emphasizes best execution, ensuring that traders' orders are filled at the best available market prices and executed within milliseconds. This enables traders to take advantage of fast-moving market conditions and capitalize on favorable price movements.

VI. Conclusion

A. Recap of the fundamental analysis of the USD/JPY currency pair

In the fundamental analysis of the USD/JPY currency pair, several key factors were discussed. Economic indicators, such as GDP growth, inflation rates, and unemployment rates, provide insights into the health of the U.S. and Japanese economies. Monetary policies set by the Federal Reserve and the Bank of Japan have a significant impact on the exchange rate. Additionally, trade policies and geopolitical events can influence the USD/JPY currency pair.

B. Overview of bullish or bearish stance based on analysis

Based on the fundamental analysis, the bullish or bearish stance on the USD/JPY currency pair depends on various factors. Positive economic indicators, higher interest rates, and favorable trade policies can support a bullish stance. Conversely, weak economic indicators, lower interest rates, and trade tensions can contribute to a bearish stance.

C. Final thoughts on trading the USD/JPY currency pair based on fundamental analysis and trading strategies

Trading the USD/JPY currency pair requires a comprehensive understanding of fundamental analysis and the implementation of appropriate trading strategies. Traders should carefully assess economic indicators, central bank policies, and geopolitical events to make informed trading decisions.

Combining fundamental analysis with technical analysis techniques, such as identifying trends and using indicators, can enhance trading strategies. Risk management is crucial to protect against potential losses, and traders should set stop-loss and take-profit levels while determining appropriate position sizes.

However, it is important to note that forex trading involves inherent risks, and traders should be prepared for market volatility and unexpected events. Monitoring economic calendars and news releases is essential for trading the USD/JPY currency pair based on market reactions to news events.