- UnitedHealth Group reported Q2 2024 revenues growth despite cyberattack impacts, with solid operating earnings.

- UNH showed robust stock performance, with a 10.8% return in Q2, outpacing the S&P 500, driven by strong financial health and strategic initiatives.

- Technical indicators show bullish momentum with an average price target of $615, while fundamental metrics like P/E ratio and EV/Sales suggest relative undervaluation and strong sales performance.

- Faces competition from major players like Anthem and regulatory risks, including potential policy changes impacting healthcare sector dynamics.

I. UnitedHealth Group Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

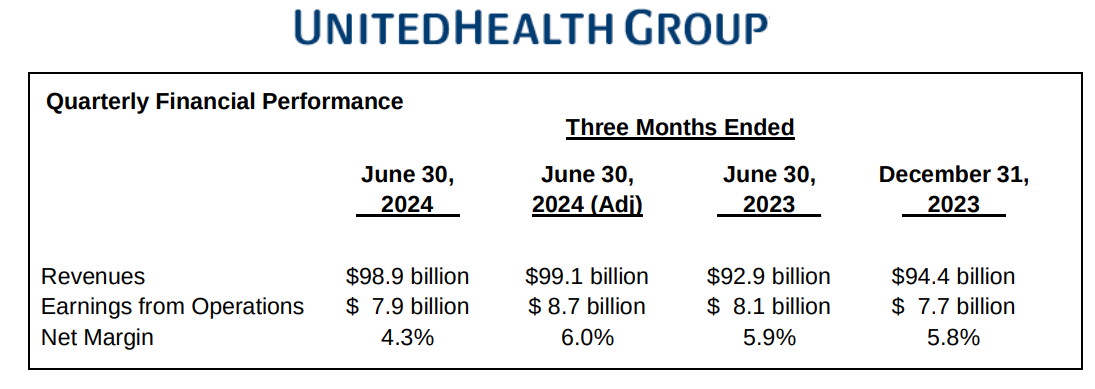

- Revenue Growth: UnitedHealth Group reported revenues of $98.9 billion in Q2 2024, an increase of nearly $6 billion year-over-year. Optum and UnitedHealthcare were the primary contributors to this growth.

Source: UNH-Q2-2024-Release

- Net Income and Earnings Per Share (EPS): Net income was robust. Adjusted EPS stood at $6.80 per share, accounting for $0.28 in business disruption impacts but excluding South American and direct response costs.

- Profit Margins: Operating earnings from operations were $7.9 billion, including $1.1 billion in unfavorable impacts from a cyberattack. Adjusted earnings from operations were $8.7 billion.

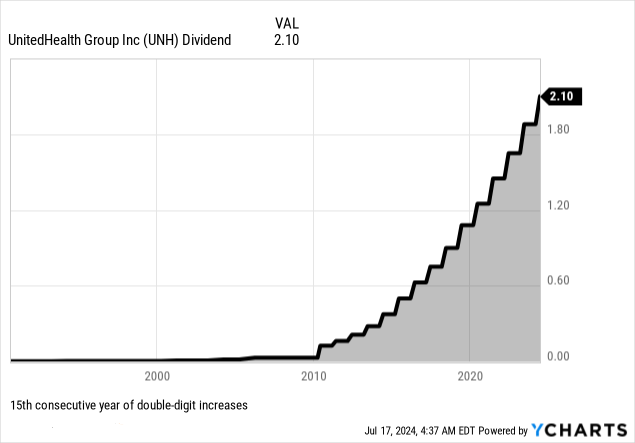

- Balance Sheet and Cash Flow: Cash flows from operations were $6.7 billion, or 1.5 times net income. The company increased its annual dividend rate by 12%, marking the 15th consecutive year of double-digit increases.

Source:Ycharts.com

Operational Performance

- Product Sales Breakdown: UnitedHealthcare's commercial domestic offerings grew by 2.3 million consumers year-to-date, reaching a total of 29.6 million. The number of seniors and people with complex needs served grew to 9.4 million, while state-based community offerings served 7.4 million people.

- Operating Cost: The operating cost ratio was 13.3%, down from 14.9% in 2023, indicating improved cost efficiency.

- Expenses: The medical care ratio was 85.1%, impacted by accommodations for care providers and South American actions.

Technological Advancements and Innovations

- New Product Launches: UnitedHealth Group continued to bring practical innovation to market through new products and services. Surest, for example, differentiated itself and saw substantial growth.

- Research and Development Investments: The company invested in modernization of legacy technology and new emerging technologies, including AI, which is expected to generate significant efficiencies over the next several years.

- Technological Achievements: The company's AI portfolio, consisting of hundreds of practical use cases, aims to improve consumer experience, enhance provider find and price care capabilities, and improve clinical back-office execution.

B. UNH Stock Price Performance

UnitedHealth (NYSE: UNH) has demonstrated robust stock performance with a 10.8% price return (open-to-close) over Q2. Opening at $459.60 and closing at $509.26, it saw highs of $528.16 and lows of $436.38. This performance outpaced the broader market as indicated by the S&P 500's (SPX) 4.9% price return during the same period. UnitedHealth's substantial market capitalization of $469 billion underscores its stability and influence in the healthcare sector, contributing to investor confidence. The company's strong financial health, strategic initiatives in healthcare services, and likely benefits from sector-specific tailwinds such as healthcare reform and aging demographics have likely bolstered its stock performance. Investors may view UnitedHealth as a defensive play with growth potential, given its resilience and ability to navigate regulatory changes and market dynamics effectively.

Source:tradingview.com

II. UNH Stock Forecast: Outlook & Growth Opportunities

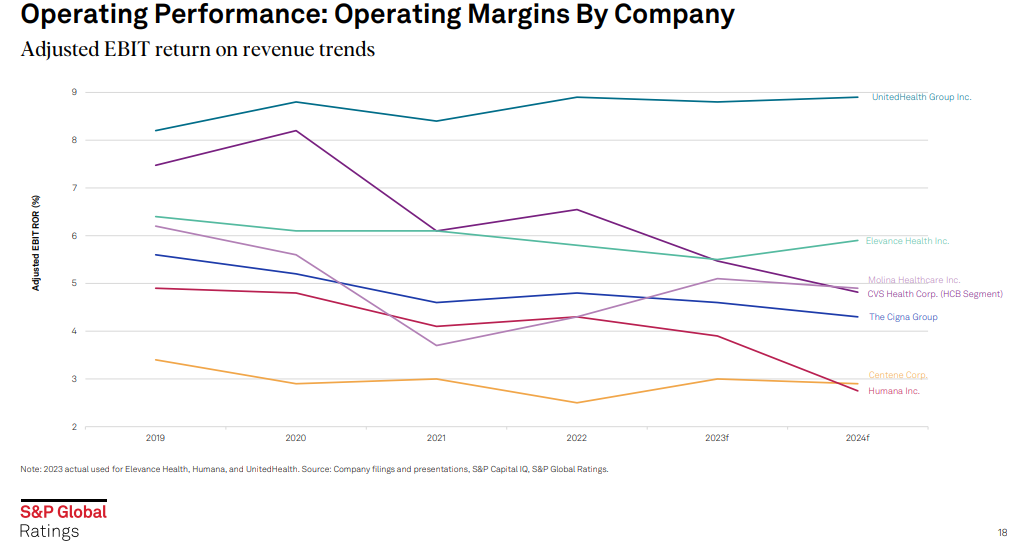

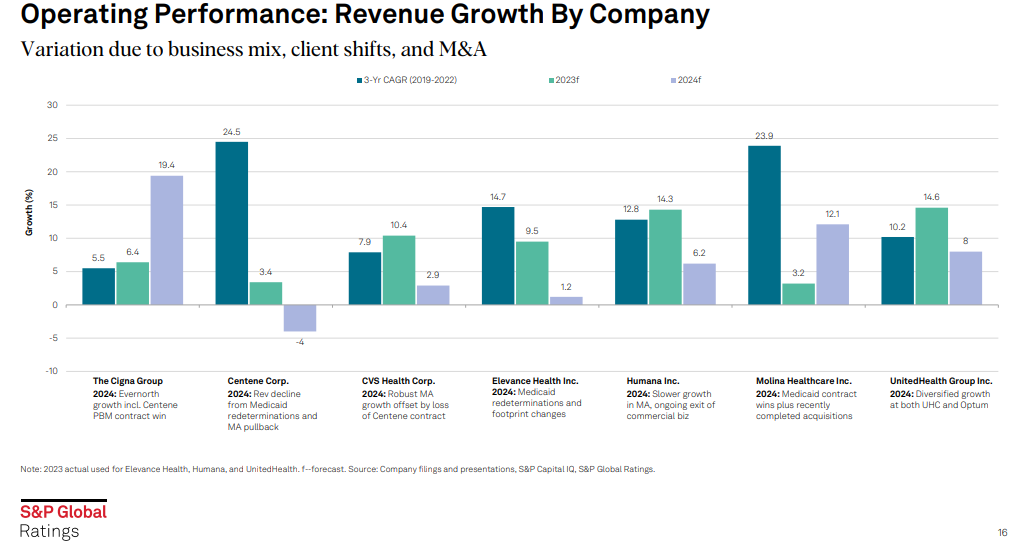

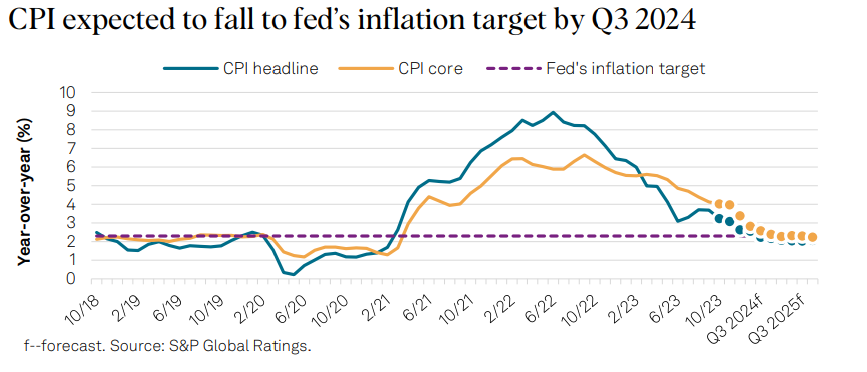

S&PGlobal forecasted UnitedHealth Group (UNH) revenue growth of approximately 8% for 2024, stable margins (Operating Margins around 9%) and efficient management of Medical Loss Ratios (around 84%) underline its resilience in the healthcare insurance sector.

Source: spglobal.com

A. Segments with growth potential

UnitedHealth Group operates through two primary segments: UnitedHealthcare (UHC) and Optum. Within UnitedHealthcare, growth opportunities are evident in its domestic commercial membership, which expanded by 2.3 million in the first half of the year. This growth reflects robust demand for its managed care, pharmacy services, and Medicare Advantage plans, all of which cater to a wide array of customers including large employers, unions, states, and seniors. The Medicare Advantage segment is particularly promising, offering cost-effective solutions and additional benefits like dental, vision, and hearing services, not covered under traditional Medicare fee-for-service plans. This appeals to seniors seeking comprehensive healthcare options and is expected to drive continued growth.

Optum, the healthcare services arm, shows significant potential with revenues growing by 13% to $27 billion, driven by its expanding footprint in value-based care models. Optum aims to reach 5 million patients under value-based care by year-end, emphasizing improved health outcomes and patient engagement. Additionally, OptumRx, which saw revenues grow by 13% to over $32 billion, continues to attract customers with its cost-effective pharmacy services and clinical expertise, ensuring strong momentum going forward.

B. Expansions and Strategic Initiatives

UnitedHealth Group's strategic initiatives include mergers and acquisitions (M&A), research and development (R&D) investments, and partnerships designed to enhance its service offerings and operational efficiency. The acquisition of Change Healthcare underscores its commitment to bolstering healthcare technology and analytics capabilities, despite facing temporary disruption due to cyberattacks. The company has invested over $9 billion to support healthcare providers through loans and advance payments, demonstrating resilience and support during challenging times.

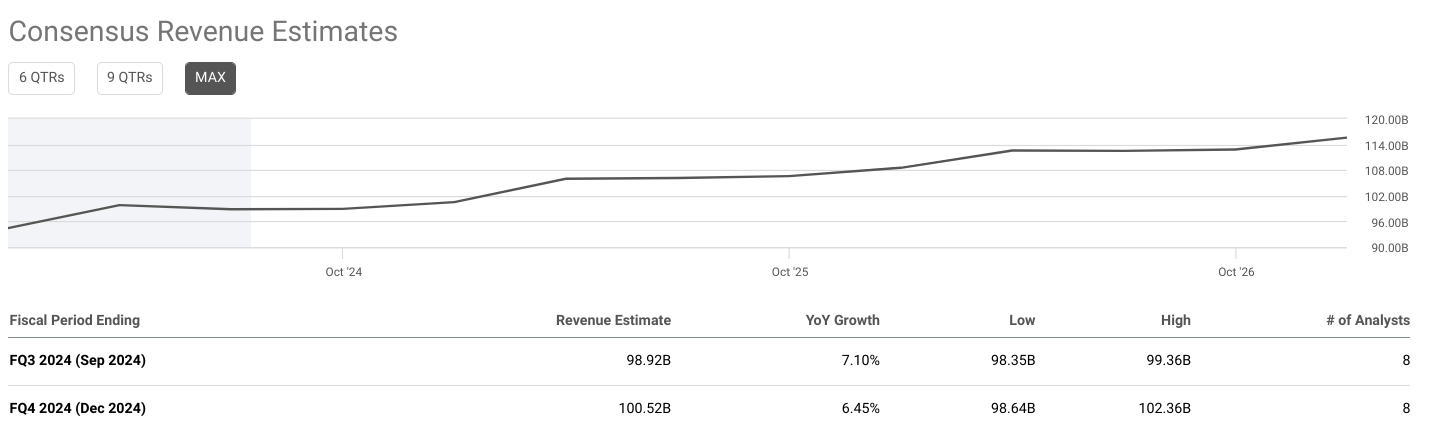

Financially, UNH forecasts consistent revenue growth, with estimates indicating a 7.10% and 6.45% year-over-year increase for fiscal Q3 and Q4 2024, respectively. Similarly, EPS growth projections underscore steady financial performance, reinforcing UNH's position as a robust investment choice in the healthcare sector.

Source:seekingalpha.com

III. UNH Stock Forecast 2024

A. United Healthcare Stock Forecast: Technical Analysis

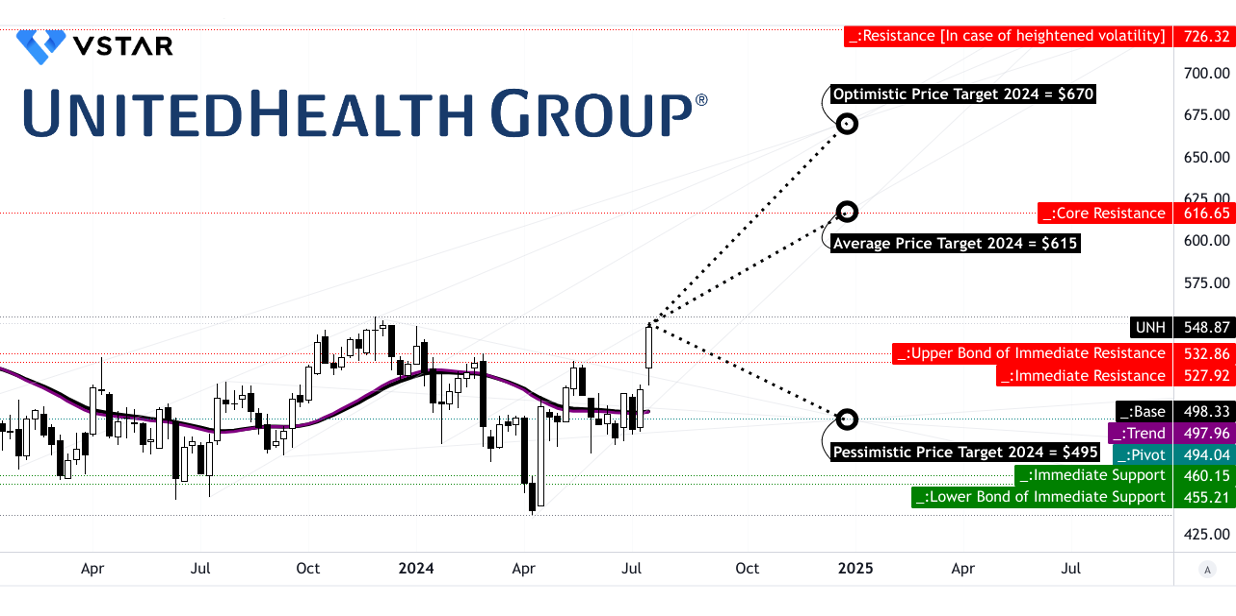

The stock of UnitedHealth Group (UNH) is currently trading at $548.87, showing an upward trend from its modified exponential moving average baseline of $498.33. The stock has demonstrated bullish momentum with a Relative Strength Index (RSI) of 63.47, indicating a positive sentiment though not yet in overbought territory.

Price Targets for 2024

- Average UNH Price Target: Analysts project an average price target of $615.00 by the end of 2024. This forecast is based on the momentum of change-in-polarity observed over the mid- to short-term, aligned with Fibonacci retracement and extension levels.

- Optimistic UNH Stock Price Target: There's an optimistic outlook with a target of $670.00. This is supported by the current upward price momentum projected over Fibonacci levels, suggesting potential for continued growth.

- Pessimistic UNH Target Price: The pessimistic scenario forecasts a price of $495.00 by year-end. This considers possible downward momentum, particularly if there are market corrections or adverse economic conditions affecting healthcare stocks.

Support and Resistance Levels

- Primary Support: $532.86 serves as the primary support level, indicating where buying interest could increase if the stock retraces.

- Resistance Levels: The core resistance is identified at $616.65, suggesting a significant hurdle based on historical price action. This level might pose challenges for further upward movement unless significant bullish catalysts emerge.

Technical Indicators

- RSI: Currently at 63.47, the RSI trend is upward, indicating strengthening momentum. This suggests that while not in overbought conditions, buyers are still active.

- MACD: With the MACD line at 1.88 and the signal line at -2.46, the MACD histogram of 4.35 supports a bullish trend with increasing strength. This aligns with the overall positive momentum seen in the stock.

Source:tradingview.com

Volume Analysis

- Volume Delta: A positive volume delta of 797,656 (in thousands) indicates higher buying volume compared to selling volume.

- Up and Down Volume: Up volume stands at 1.291 million, while down volume is at -493,713 thousand, highlighting a predominance of buying pressure.

Source:tradingview.com

B. United Health Stock Forecast: Fundamental Analysis

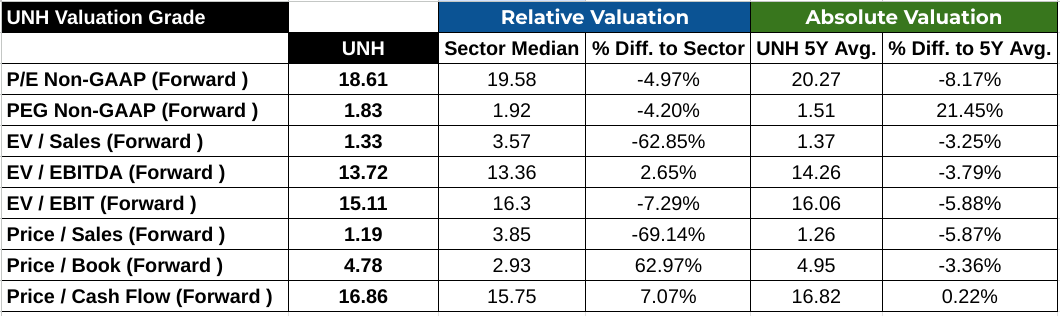

- P/E Ratio: UNH has a forward P/E ratio of 18.61, slightly lower than the sector median of 19.58, indicating it is moderately undervalued relative to its peers. The 5-year average P/E of 20.27 also suggests current valuation is lower, providing a potential upside.

- PEG Ratio: The forward PEG ratio of 1.83 is lower than the sector median of 1.92 but higher than its 5-year average of 1.51. This implies that while UNH is expected to grow, its growth is not overpriced.

- EV/Sales: The EV/Sales ratio of 1.33 is significantly lower than the sector median of 3.57, indicating that UNH generates higher sales relative to its enterprise value, making it attractive from a sales perspective.

- EV/EBITDA: At 13.72, this is slightly above the sector median of 13.36, showing a slight premium but still within a reasonable range.

- Price/Sales: The forward price/sales ratio of 1.19 is markedly lower than the sector median of 3.85, suggesting that UNH's stock price is low relative to its revenue.

- Price/Book: The forward price/book ratio of 4.78 is higher than the sector median of 2.93, indicating a higher premium on the book value but slightly below its 5-year average of 4.95.

Source: Analyst's compilation

C. UNH Forecast: Market Sentiment

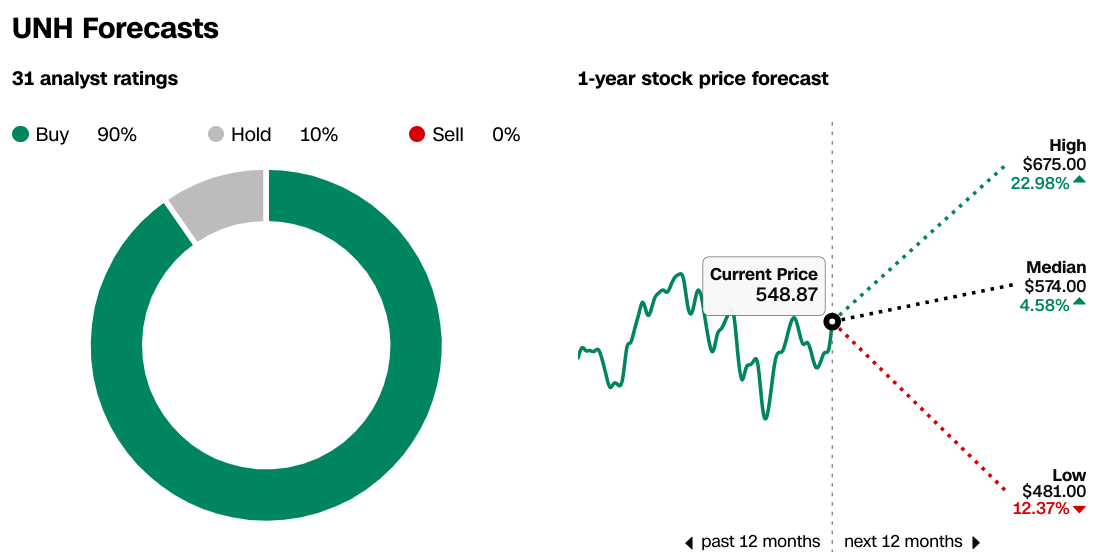

- UNH Price Target: Analysts' 12-month price targets range from a low of $481 to a high of $675, with a median of $574. The current price of $548.87 suggests moderate potential for appreciation towards the median target.

Source:CNN.com

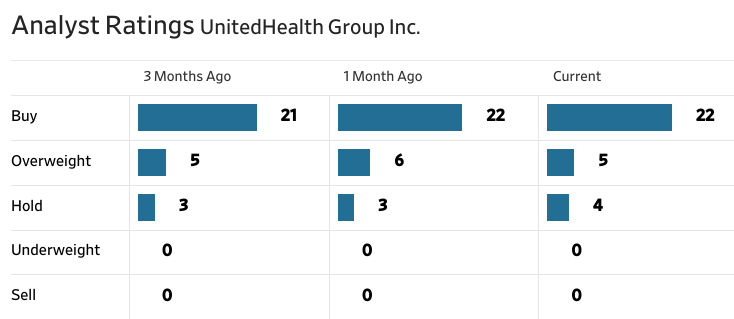

- Analyst Recommendations: The overwhelming majority of analysts (90%) rate UNH as a "Buy", with no "Sell" ratings, indicating strong confidence in the stock's performance.

Source:WSJ.com

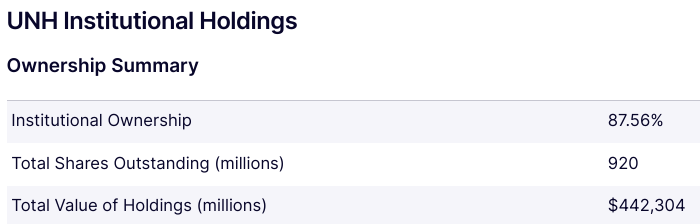

- Institutional Holdings: Institutional ownership is high at 87.56%, demonstrating strong institutional confidence in UNH.

Source:Nasdaq.com

- Short Interest: Short interest is relatively low at 0.84%, suggesting limited bearish sentiment.

Source:benzinga.com

IV. UNH Stock Prediction: Challenges & Risk Factors

UnitedHealth Group (NYSE: UNH) faces significant competition in the healthcare sector, which presents a critical challenge to its stock prediction. Key competitors include:

- Elevance Health (NYSE:ELV): This company is a major player in the health insurance market and provides medical benefits to approximately 46.8 million members as of 2023. Anthem's broad portfolio of services and strong market presence make it a formidable competitor.

- Cigna Corporation (NYSE: CI): Cigna's diversified business model, which includes health insurance and various other health services, poses a significant challenge. Cigna's global reach and comprehensive health services contribute to a competitive market environment for UnitedHealth.

- Humana Inc. (NYSE: HUM): Specializing in Medicare Advantage plans, Humana competes directly with UnitedHealth in the senior market. With a significant number of members in Medicare Advantage plans, Humana's growth strategies and market share gains can impact UnitedHealth's performance.

- CVS Health Corporation (NYSE: CVS): Through its Aetna segment, CVS Health has become a major competitor in the health insurance market. The integration of health services, pharmacy benefits, and retail clinics provides CVS Health with a unique competitive advantage.

Source: spglobal.com

Other Risks

The healthcare sector is heavily regulated, politically targeted in 2024 elections (“Repeal & Replace the ACA” and “Medicare-for-All.” ), and any changes in healthcare policies, such as modifications to the Affordable Care Act (ACA), Medicare, or Medicaid, can significantly affect UnitedHealth's operations and profitability. For example, reductions in Medicare Advantage funding or stricter regulations (under Trump Presidency) on insurance practices can impact the company's margins. Also, health insurers like UNH are facing inflationary pressures based on payor mix shifts, heightened labor and supply-chain costs.

Source: spglobal.com

In conclusion, UnitedHealth Group (NYSE:UNH) has shown robust Q2 2024 performance reflecting resilience despite challenges like cyberattacks. With strong operational efficiency and technological advancements, UNH's stock price rose in Q2, outpacing the S&P 500. UNH may have revenue growth for 2024, supported by expansions in Medicare Advantage and Optum's healthcare services. Technicals project a bullish sentiment with price targets averaging $615. UNH's resilience amid regulatory changes and sector-specific tailwinds like healthcare reform underscores its appeal to the Street. Consider trading UNH stock CFDs on VSTAR, offering institutional-grade trading with low costs and a user-friendly app for both beginners and pros, supporting global markets and regulatory compliance.