- Tesla reported solid revenue, with key growth drivers being the energy generation and storage business, Cybertruck deliveries, and regulatory credit revenue.

- The company achieved positive net income, despite a decline in operating income due to reduced ASPs, restructuring charges, and increased AI project expenses.

- Tesla made significant investments in AI and FSD technologies, aiming to enhance customer experience and drive demand.

- TSLA stock price increased during Q2 2024, significantly outperforming broader market indices with a positive technical outlook.

I. Tesla Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

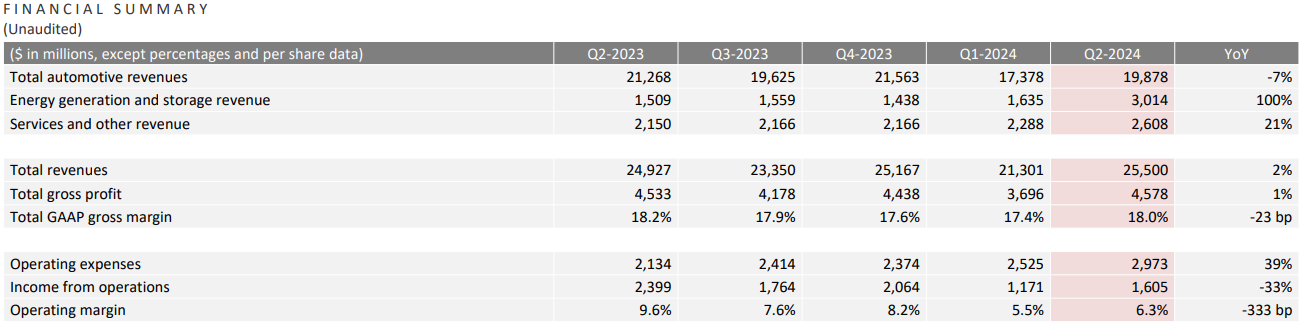

Tesla reported a total revenue of $25.5 billion for Q2 2024, a 2% year-over-year increase. This growth was driven by the energy generation and storage business, Cybertruck deliveries, and higher regulatory credit revenue. The company achieved a GAAP net income of $1.5 billion and a non-GAAP net income of $1.8 billion. Operating income decreased to $1.6 billion, resulting in a 6.3% operating margin (down 3.33% YoY). This decline was attributed to reduced average selling prices (ASP) for S3XY vehicles, restructuring charges, and increased operating expenses due to AI projects.

Source: 2024 Q2 Quarterly Update Deck

At the bottom-line, Q2 net income stands at $1.8 billion (-42% YoY) with an EPS of 52 cents (-43% YoY). This is due to heavy CapEx spending. On the positive side, the bottom-line has improved sequentially. Moreover, operating expenses increased, driven largely by AI project investments. However, Tesla managed to reduce costs per vehicle, including raw material costs and freight duties. Further, Tesla's cash, cash equivalents, and investments grew by $3.9 billion sequentially, reaching $30.7 billion at the end of Q2 2024. Operating cash flow was $3.6 billion, with a free cash flow of $1.3 billion, despite $0.6 billion in AI infrastructure capital expenditures.

Operational Performance

Tesla saw a sequential rebound in vehicle deliveries in Q2, with notable contributions from new Model 3 and Model Y trims. The Cybertruck became the best-selling EV pickup in the U.S. during this quarter. Global EV penetration increased, taking market share (near 4% as of Q2) from internal combustion engine (ICE) vehicles. Tesla's strategic focus on cost reduction and core functionality positions it well for long-term growth in competitive markets like China and Europe. Tesla's AI and FSD (Full Self-Driving) initiatives included offering free trials to boost adoption rates. The expansion of the Supercharging network and opening it to non-Tesla EVs demonstrates Tesla's commitment to increasing EV penetration.

Source: 2024 Q2 Quarterly Update Deck

Technological Advancements and Innovations

Tesla introduced new trims and paint options for the S3XY lineup. The Cybertruck's production ramped significantly, aiming for profitability by the end of the year. Significant investments were made in AI infrastructure, with $0.6 billion allocated in Q2. The development of the Optimus robot and advancements in FSD technology were notable. Tesla produced over 50% more 4680 cells than in Q1, achieving major cost reduction milestones. The first prototype Cybertruck with in-house dry cathode 4680 cells entered vehicle testing validation, marking a significant achievement in cost efficiency.

B. TSLA Stock Price Performance

During Q2 2024, Tesla's (NASDAQ:TSLA) stock price demonstrated strong performance, closing at $197.88, up from an opening price of $176.17, marking a 12.3% increase. The stock reached a high of $203.20 and a low of $138.80 within the quarter. This performance significantly outpaced broader market indices, with the S&P 500 (SPX) returning 3.9% and the NASDAQ-100 (NDX) returning 7.7% in the same period. Tesla's robust financial results, record energy storage deployments, and strategic advancements in AI and vehicle technology contributed to investor confidence, leading to the notable rise in stock price and a market cap of $631 billion.

Source: tradingview.com

II. Tesla Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

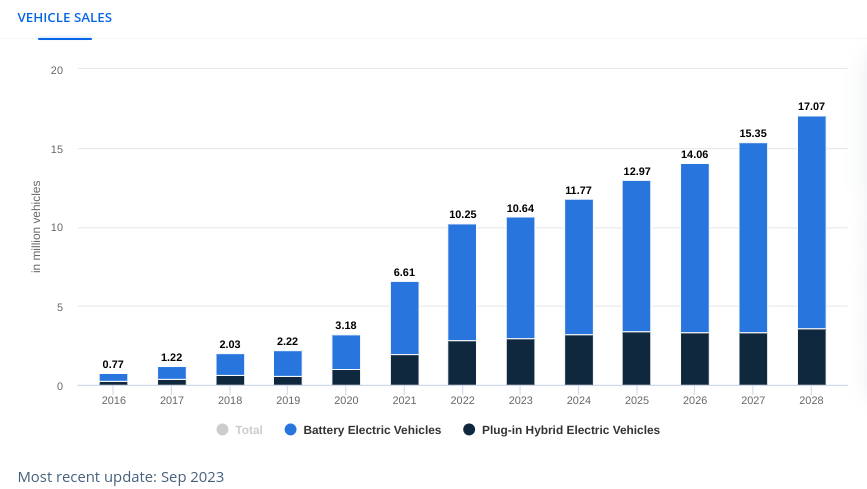

Electric Vehicles (EVs): Tesla remains a leader in the EV market, with significant growth potential as global adoption of electric vehicles increases. The company's focus on affordability, seen with plans to deliver a more affordable model in the first half of next year, positions it well to capture a larger market share. Despite short-term challenges from competitors discounting their EVs, Tesla's long-term prospects are strong due to its efficiency and scale economies. As per statista.com, in 2024, the revenue in the EV market may hit $623 billion. The pace may continue to have an annual growth rate of 9.82% (2024-2028).

[EV Market-wide Vehicle Sales]

Source: statista.com

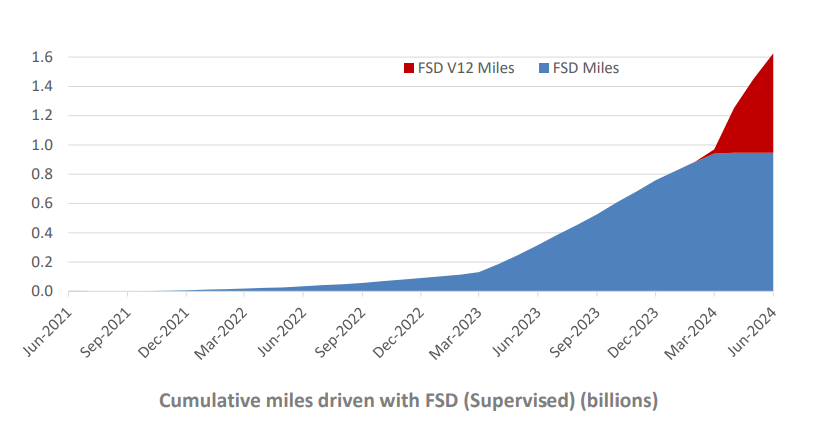

Autonomous Driving: Tesla's advancements in Full Self-Driving (FSD) technology present substantial growth opportunities. With the rollout of version 12.5, which merges highway and city stacks, Tesla aims to enhance customer experience and drive demand. The transition to unsupervised full self-driving will unlock massive potential, making Tesla's fleet a giant autonomous network.

Energy Storage and Generation: Tesla's energy business is rapidly growing, with energy storage deployments reaching record levels in Q2 2024. The expansion of Megapack production, especially with the new factory in China, aims to meet rising demand. Tesla's energy products, including Powerwall, have a strong backlog and the potential to significantly contribute to revenue and profits.

AI and Robotics: Tesla's investments in AI training and inference are critical for future growth. The development of Optimus, an autonomous humanoid robot, is progressing with plans for limited production starting next year. This innovation could revolutionize labor in Tesla's factories and eventually be offered to external customers by 2026, creating a new revenue stream.

Source: 2024 Q2 Quarterly Update Deck

Battery Technology: Tesla's focus on battery advancements, particularly with the 4680 cells, aims to reduce costs and enhance performance. This technology is crucial for Tesla's new vehicle models, including the Cybertruck, and supports the company's goal of making EVs more affordable and efficient.

B. Expansions and strategic initiatives

Mergers and Acquisitions: While Tesla has not announced specific M&A plans, it continues to explore opportunities to enhance its technology and manufacturing capabilities. Strategic acquisitions could further strengthen its position in the EV and energy markets.

Research and Development Investments: Tesla's significant R&D investments are evident in its advancements in FSD, battery technology, and AI. The development of a large AI training cluster in Giga Texas highlights the company's commitment to leading in autonomous technology and AI applications.

Source: 2024 Q2 Quarterly Update Deck

Partnerships and Collaborations: Tesla's collaboration with other OEMs, particularly in opening its Supercharging network to non-Tesla EVs, aims to increase EV adoption and utilization of its infrastructure. Partnerships in battery production and energy projects also enhance Tesla's capabilities and market reach.

Global Expansion: Tesla continues to expand its production capacity globally. The completion of the South expansion of Giga Texas and increased production at Gigafactory Shanghai and Berlin-Brandenburg enable Tesla to meet growing demand across different regions. This global footprint is crucial for Tesla's strategy to localize production and reduce costs.

Product Innovations: Tesla's roadmap includes introducing new models, such as a more affordable EV and the Cybertruck, which are expected to drive volume growth. The focus on high-range EVs and expanding the supercharging network addresses key customer concerns and supports market penetration.

III. Tesla Stock Predictions 2024

A. Tesla Stock Prediction: Technical Analysis

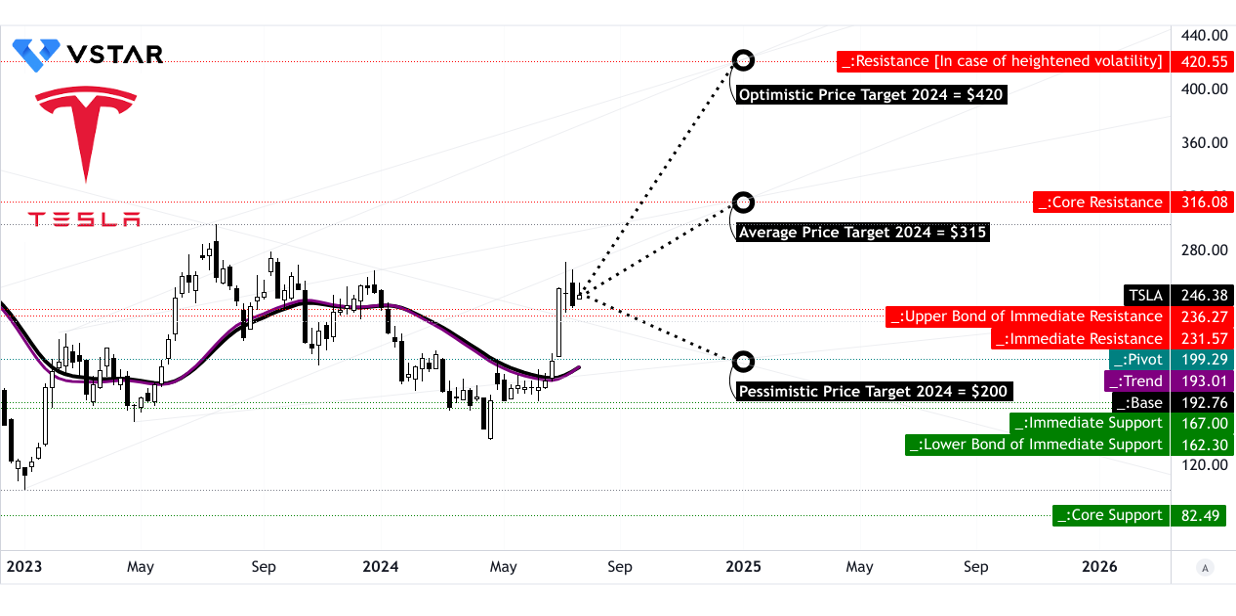

Tesla (NASDAQ: TSLA) is currently trading at $246. Technical analysis indicates a solid upward trend, with the stock price moving above the trendline of $193 and the baseline of $192, both derived from a modified exponential moving average.

The average TSLA price target by the end of 2024 is $315. This target is based on the momentum of change in polarity over the mid- to short-term, projected using Fibonacci retracement/extension levels. The optimistic Tesla price target is set at $420. This is based on the upward price momentum of the current swing over the mid- to short-term, projected using Fibonacci levels. This scenario assumes that Tesla will experience significant bullish momentum, pushing the stock price to new highs. The pessimistic Tesla target price is $200, based on the downward price momentum of the current swing over the mid- to short-term, projected using Fibonacci levels. This reflects a scenario where bearish forces dominate, leading to a substantial drop in the stock price.

TSLA Stock Forecast 2024 - Support and Resistance Levels:

- Primary Support: Tesla's primary support level is at $236. This is a critical level where buying interest might prevent further declines.

- Pivot of Current Horizontal Price Channel: The pivot point is $199, serving as a key level for potential price reversals.

- Resistance Levels: Core resistance is identified at $316, with an upper resistance level in case of heightened volatility at $421. These levels indicate where selling pressure might emerge, capping the stock's upward movement.

- Support Levels: Additional support levels include $167 and core support at $83, where the stock might find buying interest if the price drops significantly.

Source: tradingview.com

Tesla Forecast 2024 - Relative Strength Index (RSI):

The RSI for Tesla is currently at 69.98, indicating overbought conditions as it approaches the upper threshold of 70. This suggests that the stock might be due for a pullback. Regular bullish levels are at 29.72, while bearish levels are at 42.84. The RSI line trend is upward, showing bullish divergence without bearish divergence, suggesting potential for further upward movement despite the overbought status.

Tesla Stock Forecast 2024 - Moving Average Convergence/Divergence (MACD):

MACD Line: 7.63

Signal Line: -3.85

MACD Histogram: 11.480

The MACD trend is bullish, with the strength of the trend increasing. The positive MACD line and histogram values indicate strong upward momentum, supporting the case for potential stock price gains.

Source: tradingview.com

Tesla Stock Prediction 2024 - Volume Analysis:

- Moving Average of Up Volume: 24.458 million

- Moving Average of Down Volume: -21.636 million

- Moving Average of Volume Delta: 2.822 million

The prevailing stock volume momentum is bullish, with the up volume exceeding the down volume. This indicates strong buying interest, which can support price increases.

Source: tradingview.com

B. Tesla Stock Price Prediction: Fundamental Analysis

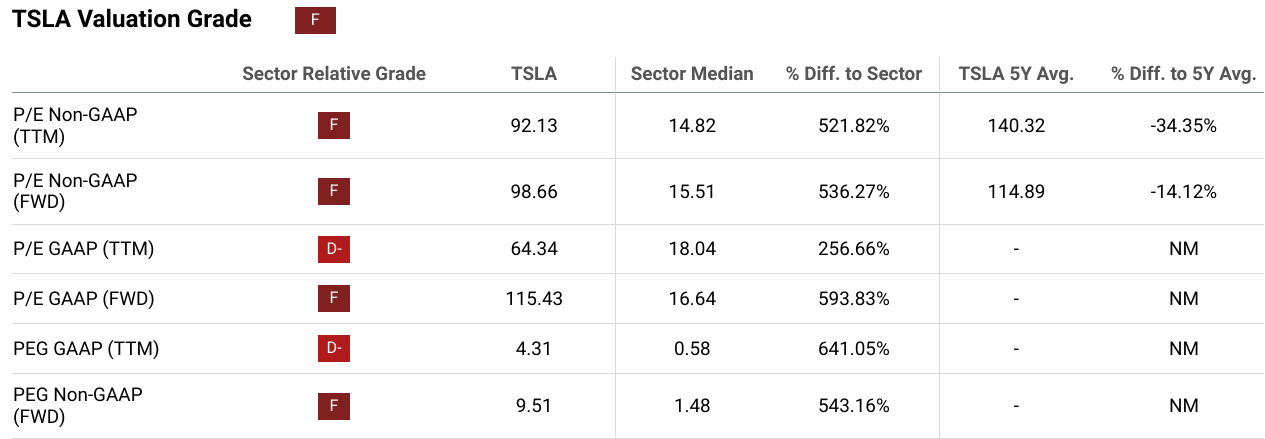

Tesla (NASDAQ: TSLA) stands out in the automotive sector due to its impressive growth trajectory and innovative edge. However, its financial ratios, particularly the Price-to-Earnings (P/E) and Price/Earnings to Growth (PEG) ratios, reveal a different story.

P/E Ratio (Non-GAAP FWD): The forward P/E ratio is 98.66, compared to the sector median of 15.51, showing a 536.27% difference. Despite being lower than its five-year average of 114.89, it remains substantially elevated, highlighting continued optimism about future earnings growth.

PEG Ratio (GAAP TTM): Tesla's PEG ratio stands at 4.31, compared to the sector median of 0.58, a 641.05% difference. A higher PEG ratio typically indicates that the stock is overvalued relative to its growth potential, implying that Tesla's high valuation may not be fully justified by its expected earnings growth.

Source: seekingalpha.com

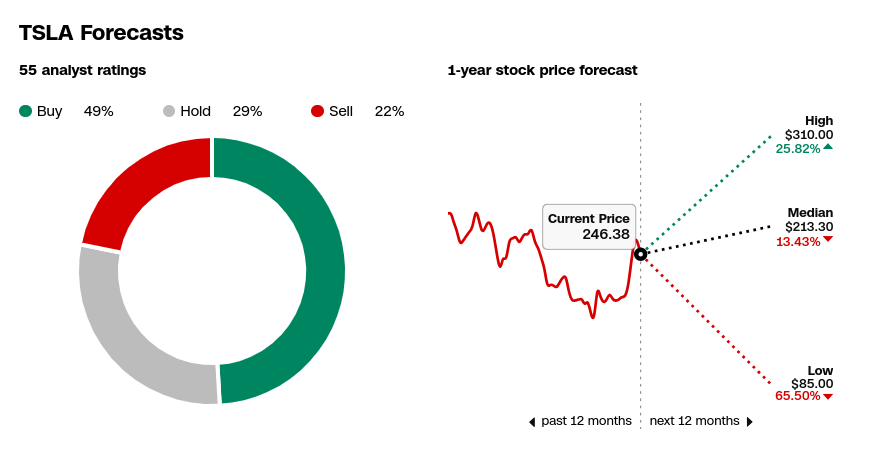

C. Tesla Price Prediction: Market Sentiment

According to CNN, out of 55 analysts, 49% rate Tesla as a "Buy," 29% as a "Hold," and 22% as a "Sell." This distribution shows a cautious optimism, with nearly half expecting positive returns, while a significant portion remains neutral or negative. Analysts' 1-year price targets for Tesla vary widely. The high estimate is $310 (25.82% above the current price of $246.38), the median is $213.30 (13.43% below the current price), and the low is $85.00 (65.50% below the current price). This wide range reflects uncertainty about Tesla's future performance, driven by its ambitious growth plans and market challenges.

Source: CNN.com

Tesla has a substantial institutional ownership of 43.96%, with total institutional holdings valued at approximately $345.403 million. High institutional ownership typically indicates confidence in the stock's long-term prospects. As of June 28, 2024, Tesla's short interest is 105,201,302 shares, with an average daily share volume of 76,021,373, resulting in a days-to-cover ratio of 1.38. This relatively low ratio suggests that while there is some skepticism about Tesla's stock price, the overall market sentiment remains positive.

Source: Nasdaq.com

IV. TSLA Stock Prediction: Challenges & Risk Factors

Tesla Competitors

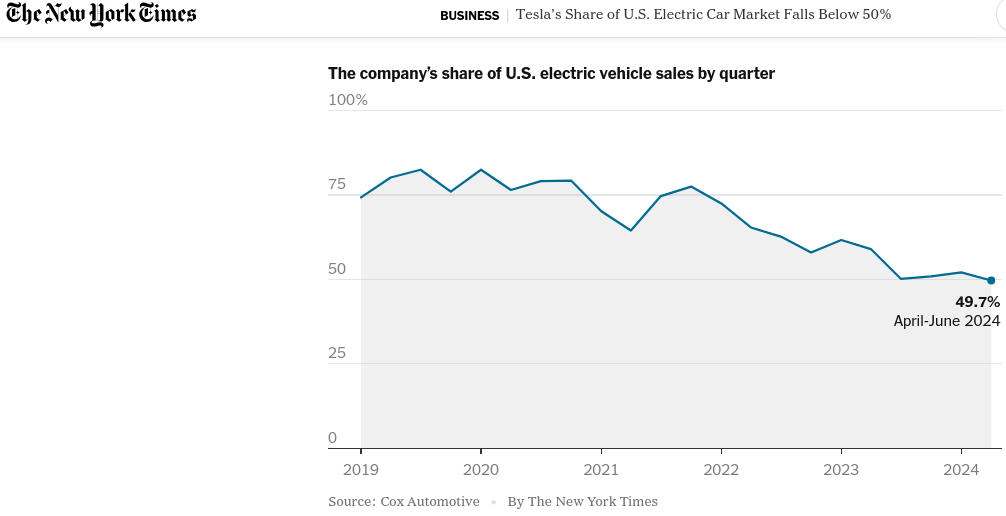

Tesla faces increasing competition from both established automakers and new entrants in the electric vehicle (EV) market. General Motors (GM) and Ford are key competitors, with GM recently launching the Chevrolet Equinox EV and using U.S.-made batteries from its joint venture with LG Energy Solution. Ford's Mustang Mach-E and F-150 Lightning are significant contenders in the EV space. Hyundai and Kia are also notable competitors, offering more electric models than Tesla, with newer designs and competitive prices. Additionally, luxury brands like BMW are entering the EV market, leveraging their extensive dealer networks for maintenance and repairs. This intensifying competition is leading to price pressure and impacting Tesla's market share, which fell below 50% in the U.S. for the first time in the second quarter of 2024.

Source: nytimes.com

Other Risks:

- Aging Lineup: Tesla's Model Y, its best-selling vehicle, launched in 2020, is considered dated by industry standards, which could affect its appeal compared to newer models from competitors.

- Service Network: Tesla's relatively small network of service centers has been a point of contention for consumers who face challenges in getting their cars repaired, unlike competitors with extensive dealer networks.

- Political Factors: Elon Musk's public political stance might alienate Tesla's traditionally liberal customer base, potentially impacting sales.

In conclusion, Tesla's Q2 2024 performance demonstrates resilience and strategic growth, with robust revenue and innovative advancements in AI and vehicle technology. Technical analysis suggests an average price target of $315 by the end of 2024, with potential highs of $420 and lows of $200. Tesla's long-term prospects are bolstered by its leadership in the EV market, advancements in autonomous driving, and expanding energy business. However, increasing competition, an aging vehicle lineup, and political factors present risks. For traders, Tesla stock CFDs can be traded on platforms like VSTAR trading app, regulated by ASIC, offering opportunities to capitalize on TSLA stock price movements.