- Super Micro Computer's Q2 2024 saw a 143% revenue increase with an EPS of $6.25.

- Operating margin fell due to rising costs and Q2 inventory increased indicating growth preparation.

- SMCI forecasts substantial revenue growth for FY25, between $26B to $30B based on solid AI servers demand.

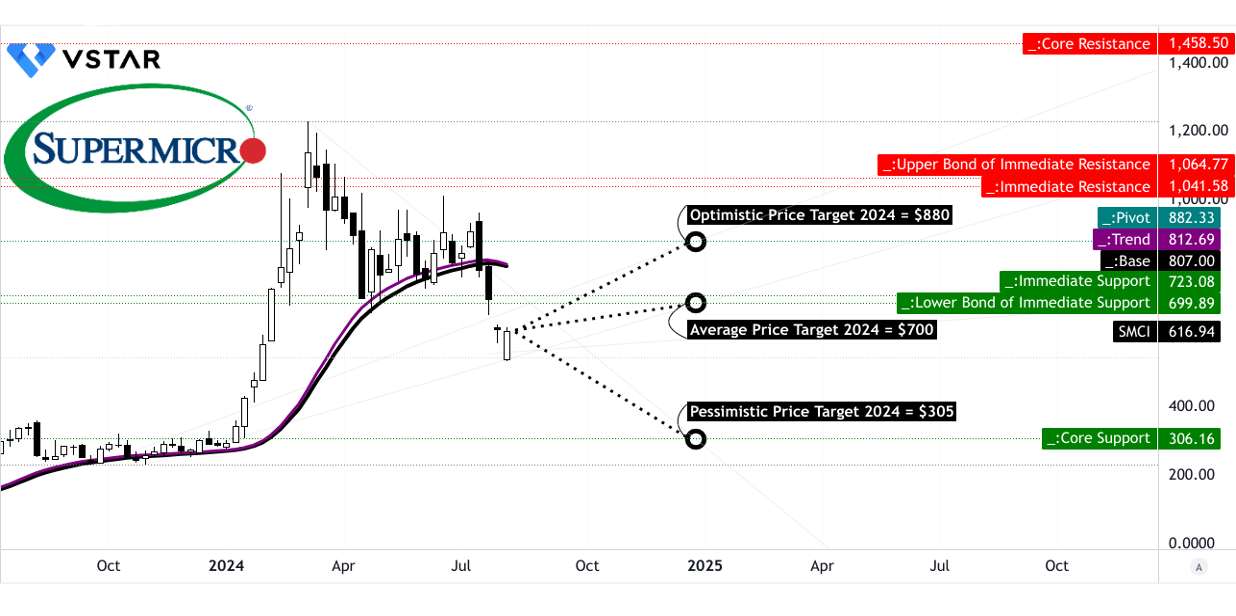

- SMCI Stock price dropped sharply despite strong revenue growth and technical analysis showing mixed signals with price targets ranging from $305 to $880.

I. Super Micro Computer Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

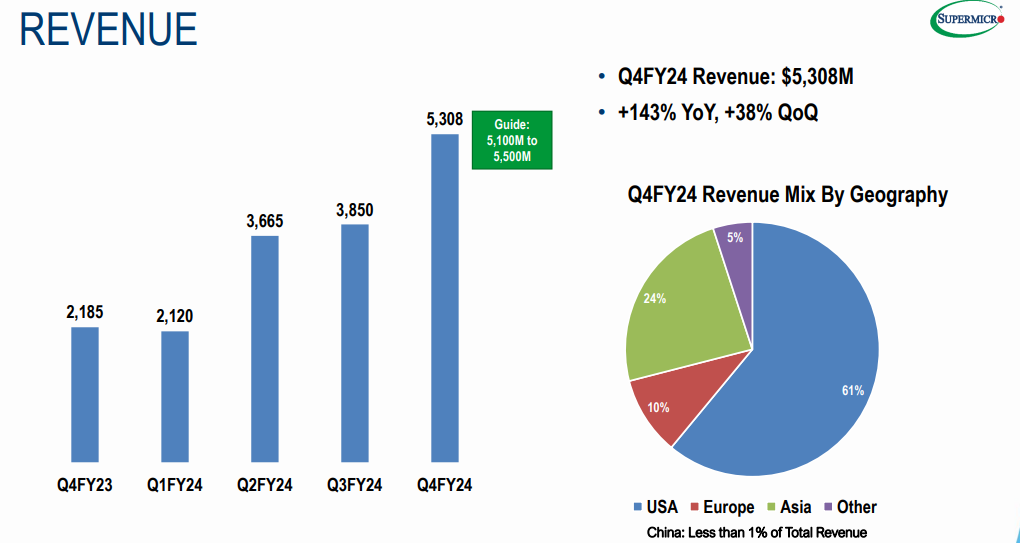

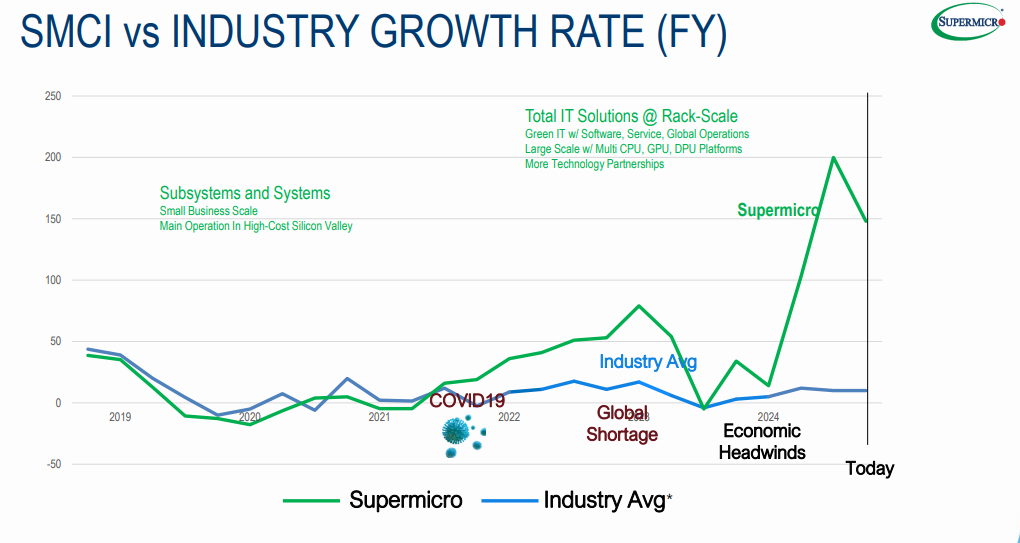

Super Micro Computer's (NASDAQ:SMCI) performance in Q2 2024 has demonstrated remarkable growth, reflecting a robust expansion in revenue and net income. For the period ending June 30, 2024, the company reported a substantial revenue of $5.31 billion, marking a 143% year-over-year increase. This impressive growth was fueled by strong demand for its AI infrastructure solutions, notably in Generative AI training and inferencing. The net income for Q2 reached $336 million, which translates to earnings per share (EPS) of $6.25, up 78% from the previous year.

Source: Q4 2024 Presentation

The operating margin for Q2 was 7.8%, slightly below expectations due to increased costs associated with DLC liquid cooling components and a higher proportion of hyperscale datacenter business. Despite this, the gross margin stood at 11.3%, reflecting a decline from the previous quarter's 15.6% due to product and customer mix and initial high costs in scaling new AI GPU clusters. Operating expenses saw a significant rise, reaching $253 million, up 75% year-over-year, driven by higher compensation and headcount.

The balance sheet shows a closing inventory of $4.4 billion, indicating preparations for future growth. Cash flow used in operations was $635 million, with a negative free cash flow of $662 million for the quarter. Capital expenditures totaled $27 million for Q2, contributing to the increased investment in global facilities, including a new plant in Malaysia. The company's net cash position was negative $504 million, reflecting a shift from a positive cash position in the prior quarter.

Operational Performance

Super Micro's operational performance in Q2 2024 highlights significant advancements and challenges. The company experienced robust product sales, with the majority coming from server and storage systems, which constituted 95% of Q4 revenue. The OEM appliance and large datacenter segment surged by 192% year-over-year, representing 64% of Q4 revenue, underscoring strong demand from major customers.

Market share analysis reveals that the U.S. remained the largest revenue contributor, accounting for 61% of Q4 sales. Asia saw a remarkable 437% increase, while Europe and the Rest of the World also experienced significant growth. Super Micro's new product innovations include advanced DLC liquid cooling solutions, which are gaining traction in the datacenter market. These solutions offer improved performance, reduced operational costs, and environmental benefits compared to traditional air-cooled systems.

The company is focusing on scaling its production capabilities and addressing supply chain bottlenecks. Despite short-term constraints, Super Micro is positioned for future growth with an expanding portfolio of innovative products and strategic global expansions. The introduction of the Datacenter Building Block Solutions (DBBS) aims to expedite datacenter deployment and transformation, reflecting the company's commitment to enhancing efficiency and performance in the AI infrastructure space.

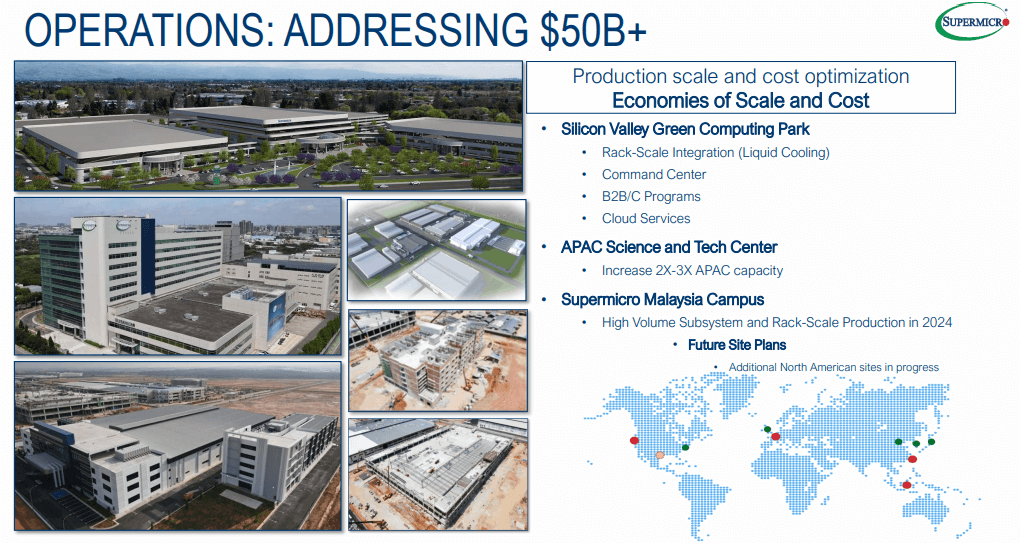

Source: Q4 2024 Presentation

B. SMCI Stock Price Performance

In Q2 2024, SMCI stock price fell significantly. Opening price was $1,010. Closing price dropped to $819.35. The stock reached a high of $1,069. It also fell to a low of $671. The percentage change in stock price was -18.9%. Compared to market indices, SMCI underperformed. The S&P 500 rose by 3.9%. NASDAQ showed a 7.7% gain. SMCI's decline contrasts sharply with positive returns in broader markets.

[Q2 2024 SMCI stock performance]

Source: tradingview.com

II. SMCI Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

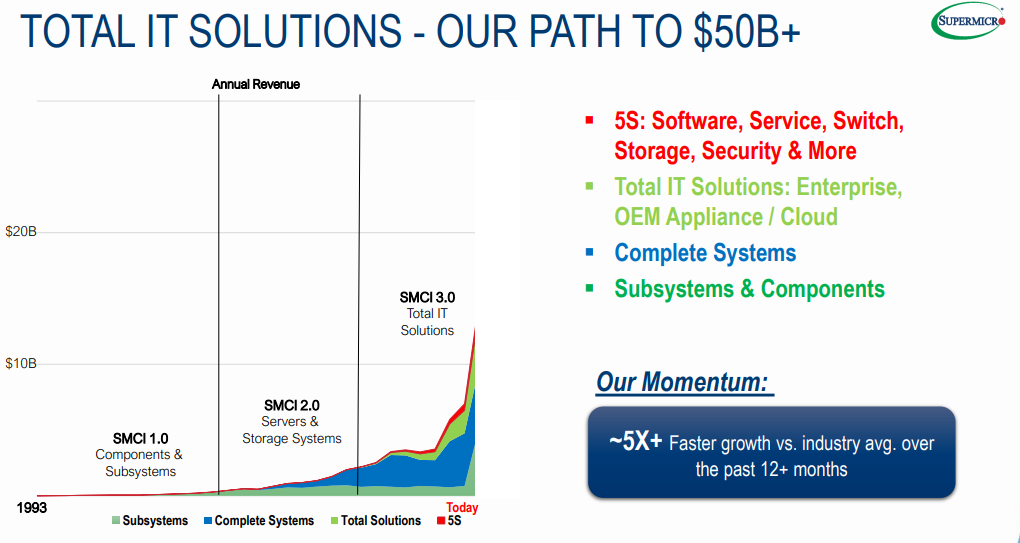

Super Micro Computer (SMCI) shows strong growth in the AI infrastructure market. The company's revenue guidance for Q1 FY25 is $6.0B to $7.0B. This represents a 183% to 230% YoY growth. For FY25, SMCI projects revenue of $26.0B to $30.0B, a 74% to 101% increase YoY. Key growth areas include Liquid Cooling Solutions and Data Center Building Block Systems (DCBBS). Liquid cooling is targeted for 25% to 30% of global new data center deployments within the next 12 months. The DCBBS architecture aims to enhance AI solutions' speed and efficiency.

SMCI's focus on generative AI training and inferencing drives robust growth. The company deploys some of the largest AI SuperClusters globally. Their DLC liquid cooling technology improves time-to-deployment (TTD) and time-to-online (TTO). This technology also lowers total cost of ownership (TCO) for AI solutions. The rapid adoption of SMCI's AI and liquid cooling technologies underpins its growth potential.

Despite short-term margin pressures, long-term investments provide competitive advantages. The company forecasts Q1 FY25 revenue between $6 billion to $7 billion. Fiscal 2025 revenue is projected between $26 billion to $30 billion. These forecasts reflect SMCI's strategic initiatives and market leadership.

Source: Q4 2024 Presentation

B. Expansions and strategic initiatives

SMCI is positioned as a leader in AI infrastructure solutions. They leverage system building blocks and rack-scale solutions. This approach helps customers achieve the best time-to-market with new technologies. SMCI's 4.0 DCBBS reduces new data center build time significantly. Smaller facilities or transformations can be completed in less than a year.

The new Malaysia campus will ramp up shipping volume and improve cost structure. Expansion in the US near Silicon Valley headquarters will boost DLC liquid cooling capacity. Global manufacturing expansion strengthens SMCI's market position. They enter fiscal 2025 with record-high backorders and strong product demand.

Research and Development Investments:

SMCI's R&D investments focus on DLC liquid cooling and AI infrastructure. These investments ensure continuous innovation and product leadership. SMCI's Malaysia facility, opening later this year, will enhance profitability. The company expects a significant increase in DLC liquid cooling deployments. They target 25% to 30% of new data center deployments using DLC solutions within the next 12 months.

Source: Q4 2024 Presentation

III. SMCI Stock Forecast 2024

A. SMCI Stock Price Target: Technical Analysis

Super Micro Computer's (SMCI) current stock price stands at $617.00. The trendline, based on a modified exponential moving average, is at $813.00. The baseline, also a modified exponential moving average, is at $807.00. These trend lines indicate the stock's general direction and stability.

SMCI Prediction - Price Targets for 2024

The average SMCI stock price target by the end of 2024 is $700.00. This target is based on the momentum of change-in-polarity projected over Fibonacci retracement and extension levels. The optimistic SMCI target price is $880.00, reflecting strong upward price momentum. The pessimistic SMCI stock price target is $305.00, indicating potential downward price momentum.

Resistance and Support Levels

Primary resistance is identified at $723.00. The pivot of the current horizontal price channel is $882.00. In case of heightened volatility, resistance could reach $1,041.00. The core resistance level is set at $1,458.00. Core support is established at $306.00, providing a critical lower boundary.

Source: tradingview.com

SMCI Stock Price Prediction - Relative Strength Index (RSI)

The current RSI value is 37. A regular bullish level is considered at 49, while a bearish level is at 59. There are no current bullish or bearish divergences. The RSI line trend is downward, indicating potential weakening momentum.

Moving Average Convergence/Divergence (MACD)

The MACD line is at 19.36, while the signal line is at 70.59. The MACD histogram shows a value of -51.23, signifying a bearish trend. The strength of this bearish trend is increasing, suggesting further downward pressure.

Source: tradingview.com

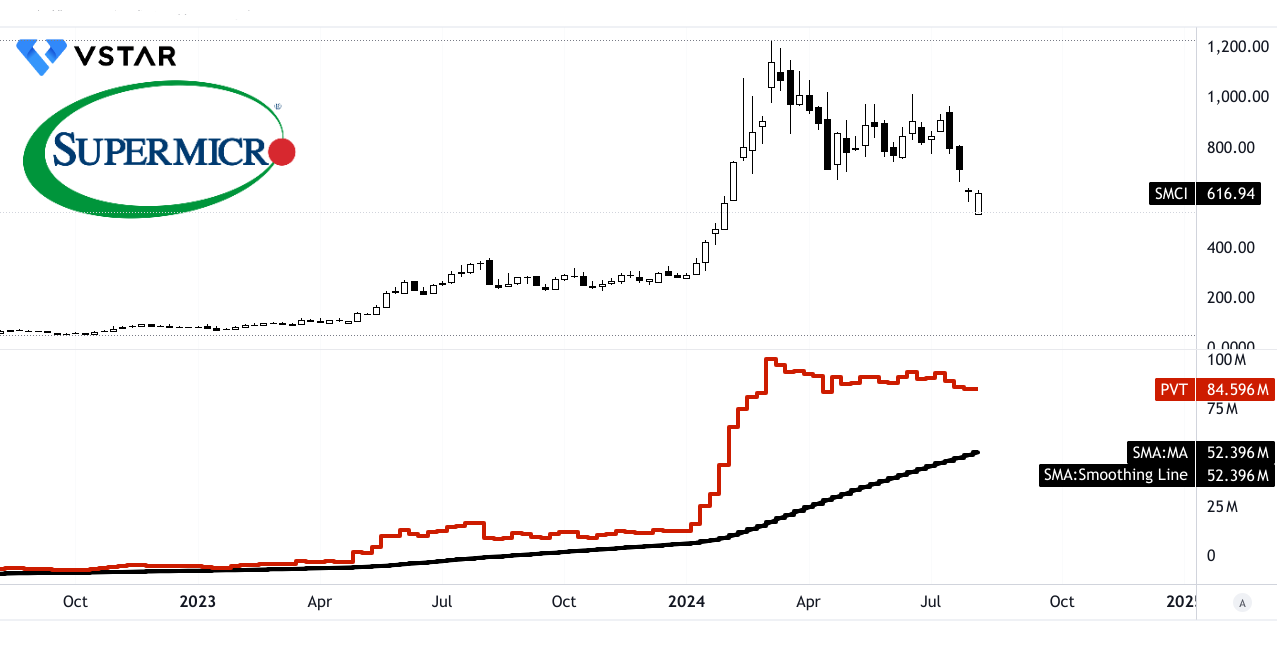

Price Volume Trend (PVT)

The PVT line, in millions, is 84.60. The moving average of the PVT is 52.40 million, showing a bullish price volume trend. This indicates buying pressure is stronger than selling pressure in recent trading sessions.

Source: tradingview.com

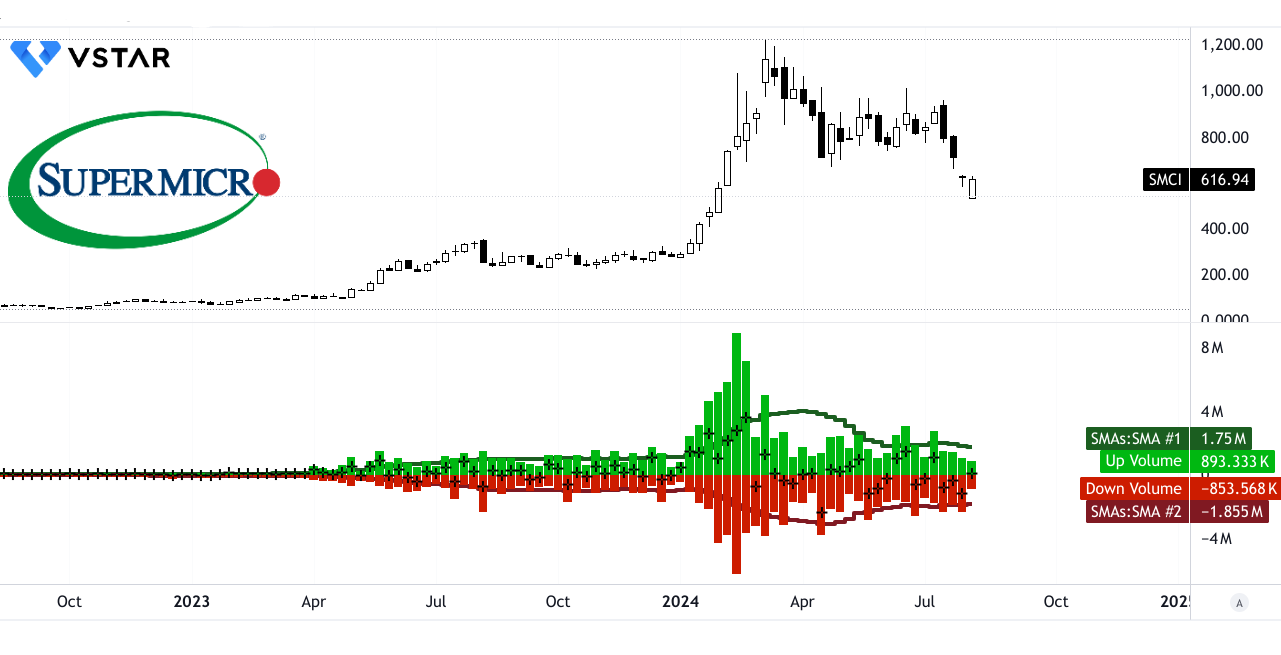

Volume Analysis

The moving average of up volume is 1.75 million. The moving average of down volume is -1.86 million. The moving average of the volume delta is -0.11 million, indicating bearish volume momentum. This suggests more selling activity compared to buying activity.

Source: tradingview.com

The mixed signals in technical indicators suggest caution. One should monitor key resistance and support levels closely. The MACD's bearish trend and RSI's downward trend indicate potential short-term challenges. However, the PVT's bullish momentum and price targets suggest possible long-term growth.

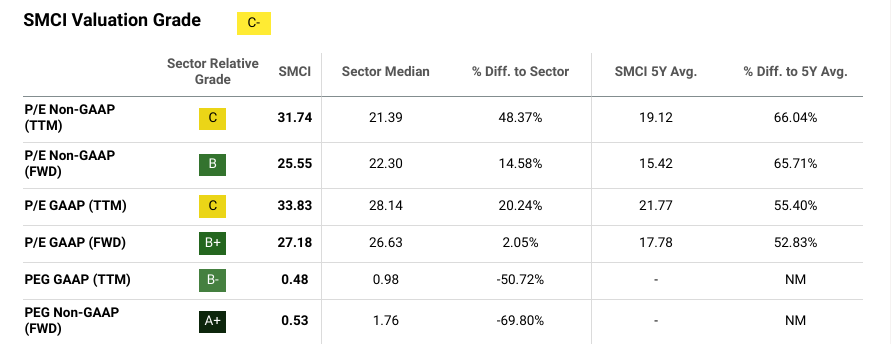

B. Super Micro Computer Stock Forecast: Fundamental Analysis

Super Micro Computer (SMCI) has a P/E Non-GAAP (TTM) of 31.74. This is higher than the sector median of 21.39, showing a 48.37% difference. The P/E Non-GAAP (FWD) is 25.55, 14.58% higher than the sector median of 22.30. Compared to its five-year average P/E Non-GAAP (TTM) of 19.12, SMCI shows a 66.04% increase. The five-year average P/E Non-GAAP (FWD) is 15.42, which is 65.71% lower than the current ratio. The PEG Non-GAAP (FWD) is 0.53, significantly lower than the sector median of 1.76, indicating a -69.80% difference.

These ratios suggest SMCI is trading at a premium compared to its historical averages and sector peers. The high P/E ratios reflect investor optimism about future growth. However, the low PEG ratio indicates that the expected growth rate justifies the higher price.

Source: seekingalpha.com

C. SMCI Stock Prediction: Market Sentiment

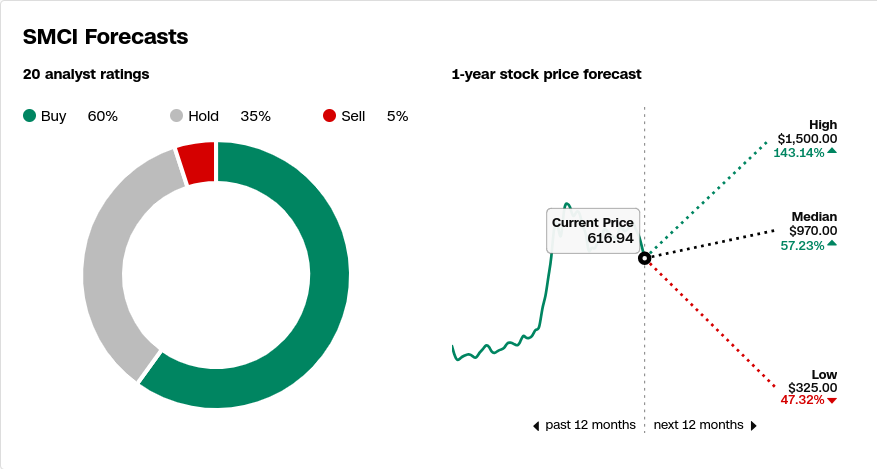

SMCI has mixed analyst ratings. According to CNN.com, 60% of analysts rate SMCI as a "Buy," 35% as a "Hold," and 5% as a "Sell." The 1-year stock price forecast ranges from a high of $1,500 (143.14% increase) to a low of $325 (47.32% decrease), with a median of $970 (57.23% increase). These varied ratings and price targets indicate differing opinions on SMCI's potential performance.

Source: cnn.com

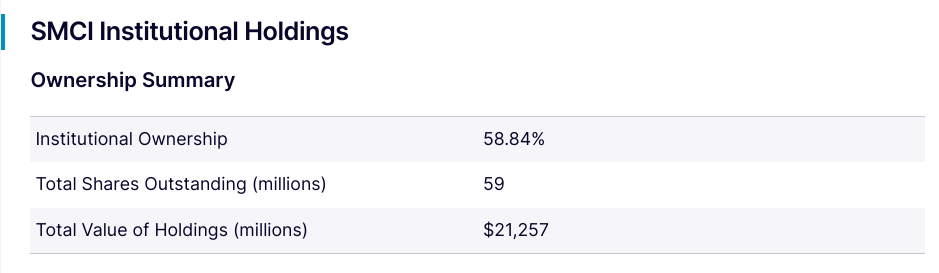

Institutional Holdings

Institutional investors own 58.84% of SMCI's outstanding shares, totaling 59 million shares. The total value of these holdings is $21,257 million, according to Nasdaq.com. High institutional ownership typically signifies confidence in the company's prospects. These large stakeholders can also stabilize the stock price through their substantial positions.

Source: nasdaq.com

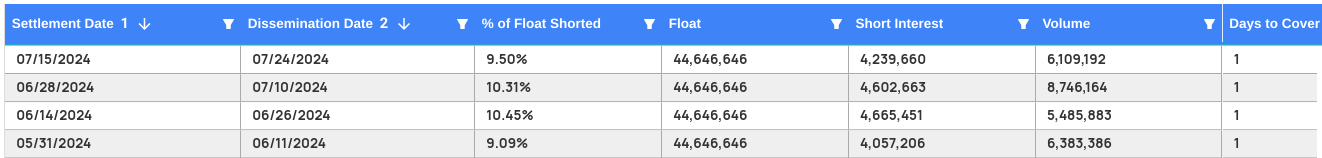

Short Interest

Short interest in SMCI has recently decreased from 4.60 million to 4.24 million shares. This represents 9.5% of the company's publicly available shares. The days-to-cover ratio is one, indicating that it would take one day for short sellers to cover their positions. The decrease in short interest suggests that fewer investors are betting against SMCI. This trend can be seen as a positive signal, indicating improving market sentiment.

Source: benzinga.com

IV. SMCI Stock Forecast: Challenges & Risk Factors

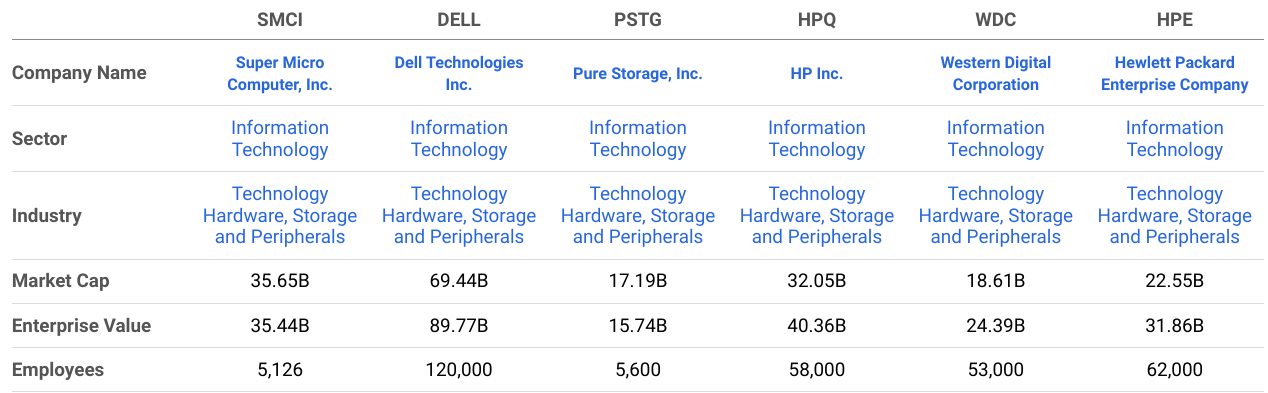

Super Micro Computer faces intense competition. Key competitors include Dell Technologies and Hewlett Packard Enterprise. These firms have larger market shares and broader product lines. NVIDIA and AMD also pose competitive threats with their advanced technologies. Furthermore, Lenovo and IBM offer strong enterprise solutions. Each competitor has substantial financial resources. They invest heavily in R&D. This drives innovation and competitive pricing. SMCI needs continuous innovation to stay ahead. Market dynamics constantly shift due to rapid technological advances. Competitors' alliances and partnerships could pose additional challenges.

Source: seekingalpha.com

Other Risks

SMCI is vulnerable to supply chain disruptions. Recent DLC liquid cooling component shortages delayed $800 million in revenue. Future delays could impact earnings and growth projections. Rapid scaling poses operational risks. The company's ability to manage new facilities is crucial. Margin pressure is another concern. Earnings misses hurt SMCI's stock considerably. Higher costs for new technologies can reduce profitability. Environmental regulations may also impact DLC liquid cooling adoption. Compliance costs and potential fines pose risks. Finally, the competitive landscape in AI infrastructure could shift rapidly. New entrants or technological breakthroughs could challenge SMCI's position.

Source: tradingview.com

In conclusion, Super Micro Computer (SMCI) has demonstrated impressive growth in Q2 2024, with revenue and net income soaring. Despite this, its stock fell significantly, reflecting investor concerns. The company's outlook for 2024 remains positive, with substantial revenue growth projections. However, technical indicators suggest potential volatility. CFD trading on platforms like VSTAR, with tight spreads, provides opportunities for investors to trade SMCI stock CFDs amidst these fluctuations.