I. Sea Limited Q1 2024 Performance Analysis

A. Sea Limited Key Segments Performance

Financial Highlights:

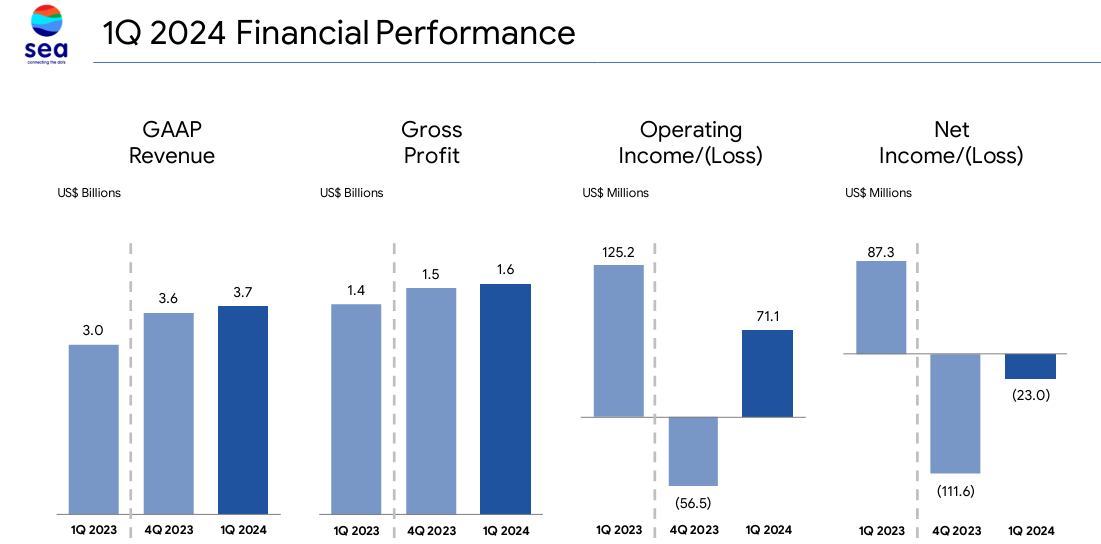

Sea Limited witnessed significant revenue growth in Q1 2024, with total GAAP revenue reaching $3.7 billion, marking a substantial increase of 22.8% year-on-year. Despite this positive trend, the company reported a net loss of $23 million, contrasting with a net income of $87.3 million in Q1 2023. The adjusted EBITDA declined to $401.1 million from $507.2 million in the previous year, reflecting operational challenges and increased expenses. Notably, the total cost of revenue rose to $2.2 billion from $1.6 billion in Q1 2023, indicating a significant impact on profitability.

Source: Q1 2024 Earnings

Operational Performance:

e-Commerce:

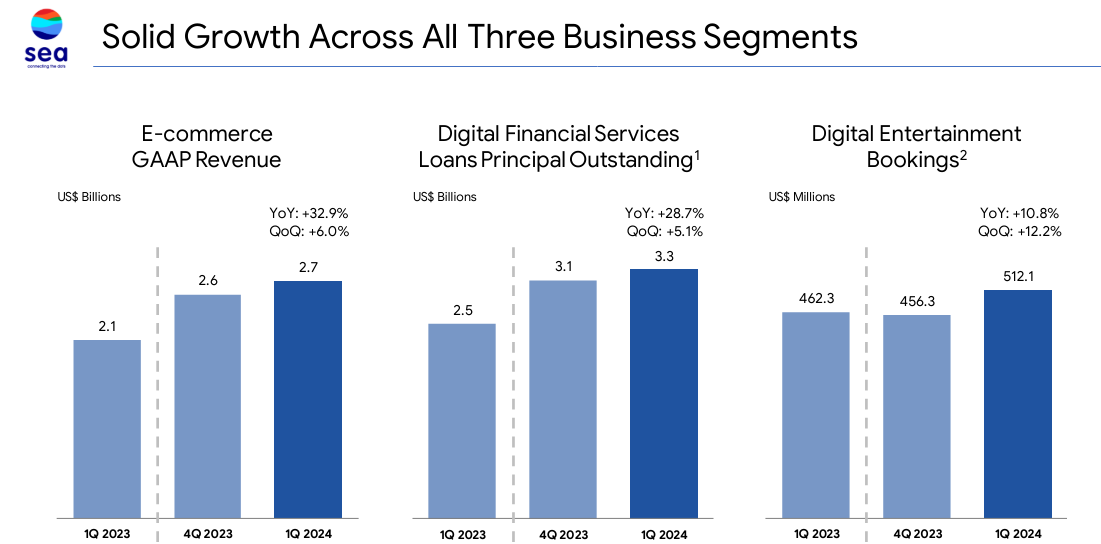

Shopee, Sea's e-commerce platform, exhibited robust growth, achieving record-high quarterly orders, GMV, and revenue. However, despite the revenue growth, the adjusted EBITDA loss widened to $22 million, primarily due to increased expenses in logistics. Notably, the cost of revenue for e-commerce and other services combined rose to $1.7 billion in Q1 2024 from $1.2 billion in Q1 2023, driven by higher logistics costs as order volume increased.

Digital Financial Services:

SeaMoney, Sea's digital financial services arm, demonstrated strong growth and profitability in Q1 2024, with revenue increasing by 21% year-on-year and adjusted EBITDA by 50%. Prudent risk management practices contributed to stable non-performing loans, maintaining at 1.4% of total loans outstanding. The credit business, a primary driver of SeaMoney's revenue and profit growth, benefited from Shopee's transaction volume and user base. Efforts to expand off-Shopee loans, including cash loans and pay-later consumption loans, contributed to over 40% of total loans outstanding.

Source: Q1 2024 Earnings

Digital Entertainment:

Garena, Sea's digital entertainment division, reported positive growth driven by Free Fire's performance. Despite a decline in GAAP revenue, bookings and adjusted EBITDA increased, indicating healthy user engagement and monetization strategies.

Technological Advancements and Innovations:

For e-commerce, initiatives such as SPX Express aimed to reduce delivery times and costs, contributing to improved customer satisfaction. Integration of technology into the e-commerce platform facilitated initiatives to enhance price competitiveness, strengthen content ecosystems, and improve service quality for buyers.

SeaMoney leveraged technology to drive Innovations in credit product offerings and risk modeling contributed to sustained growth in consumer and SME loans outstanding. Prudent risk management practices, including credit limit adjustments and continuous fine-tuning of risk models, supported stable non-performing loans, ensuring sustainable growth in digital financial services.

Garena's frequent introduction of new features and gameplay modes, supported by technological advancements, enhanced user experience and monetization opportunities. Interactive gameplay elements, such as the Chaos and Mechadrake updates in Free Fire, demonstrated Garena's commitment to understanding user needs and delivering compelling content experiences.

B. SE Stock Price Performance

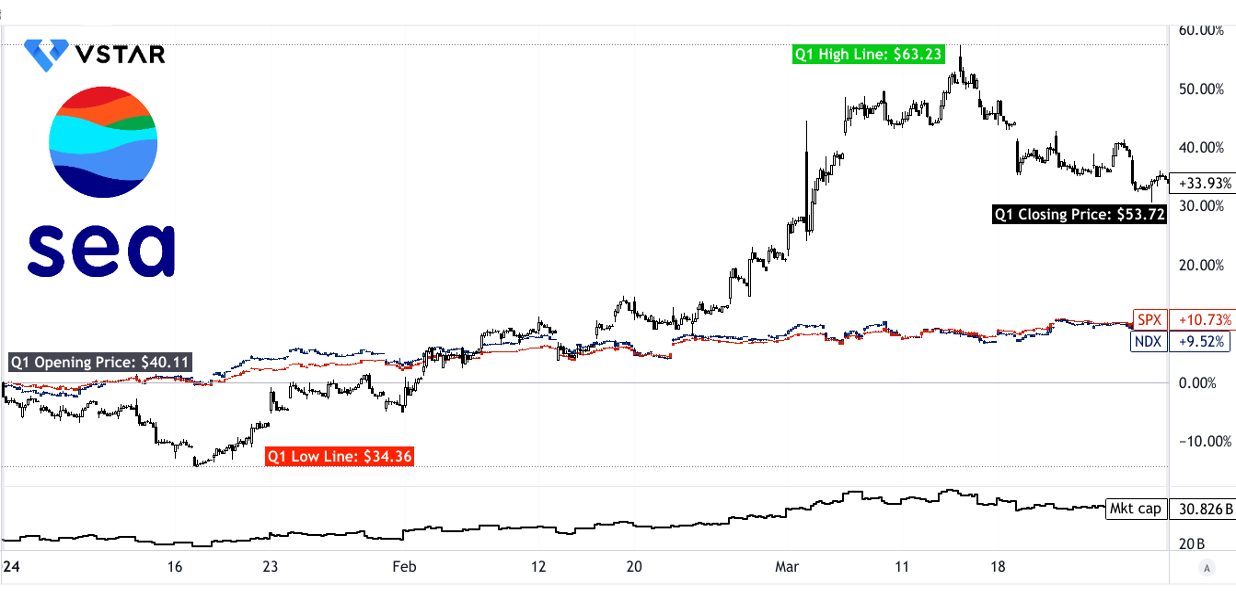

Sea Limited (NYSE: SE) showcased a robust performance in Q1 2024, evidenced by its significant stock price fluctuations. With a market capitalization of $30.826 billion, SE experienced a notable surge from an opening price of $40.11 to a closing price of $53.72. Throughout the quarter, the stock reached highs of $63.23 and lows of $34.36, reflecting a considerable price volatility. Notably, SE's price return of 34% surpassed the performance of major stock market indices like the S&P 500 (11%) and NASDAQ (10%). This suggests that Sea Limited outperformed broader market trends.

Source: tradingview.com

II. Sea Limited Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with growth potential

Sea Limited operates across multiple high-growth sectors, including eCommerce, FinTech, and Digital Entertainment.

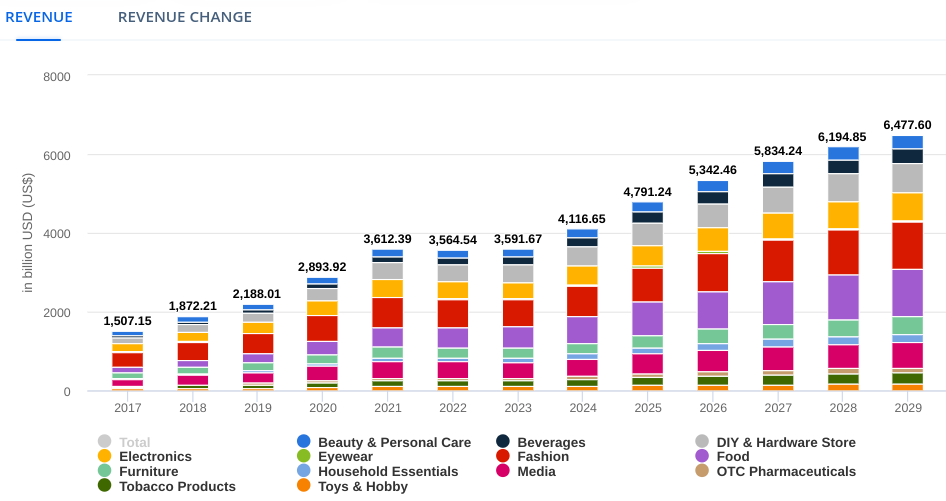

Sea Limited operates in dynamic markets with substantial growth prospects. The eCommerce sector, forecasted to reach a staggering US$4,117 bn in revenue by 2024, represents a significant growth avenue. With an estimated 3.6 billion users by 2029, Sea's eCommerce platform, Shopee, stands to benefit from robust user penetration and increasing average revenue per user (ARPU). With that, Sea's flagship eCommerce platform, Shopee, has already demonstrated impressive performance, achieving record-high quarterly orders, GMV, and revenue.

Source: statista.com

In China's FinTech landscape, Digital Investment emerges as a lucrative market with an AUM of US$1,492.00m projected for 2024. McKinsey's research underscores the rapid growth trajectory of the FinTech industry, outpacing traditional banking sectors by nearly threefold. With a focus on digital payments and investments, SeaMoney, Sea's financial services arm, is well-positioned to capitalize on this trend, driving revenue growth and expanding its user base.

The Digital Media market presents another avenue for growth, with revenue expected to reach US$560.70bn in 2024. Within this market, Video Games stand out as the largest segment, with substantial revenue potential. With a global focus and strategic initiatives to enhance user engagement, Sea's digital entertainment division, Garena, is poised to capitalize on the growing demand for interactive gaming experiences. For instance, Free Fire's average monthly active users (MAU) increased by 24% year-on-year, cementing its position as a dominant force in the gaming industry.

B. Expansions and strategic initiatives

Notably, Shopee, the company's eCommerce platform, has witnessed remarkable expansion, achieving record-high quarterly orders, GMV, and revenue. Operational priorities for 2024 include enhancing price competitiveness, strengthening the content ecosystem, and improving service quality, with initiatives such as assisting sellers with supply chain access and optimizing logistics through SPX Express.

In digital financial services, SeaMoney has sustained robust growth momentum, driven by strategic user acquisition efforts and prudent risk management. The credit business, supported by Shopee's transaction volume, has emerged as a primary revenue driver. Moreover, SeaMoney's focus on off-Shopee loans underscores its commitment to diversifying revenue streams and expanding market penetration.

Sea's digital entertainment arm, Garena, has demonstrated positive growth, propelled by the success of Free Fire. Operational priorities for Free Fire in 2024 include enhancing user acquisition, engagement, and retention through frequent content updates and innovative gameplay features. The introduction of interactive features like Chaos and Mechadrake has resonated well with users, contributing to sustained high player engagement and global recognition.

III. SE Stock Forecast 2024

A. SE Stock Forecast: Technical Analysis

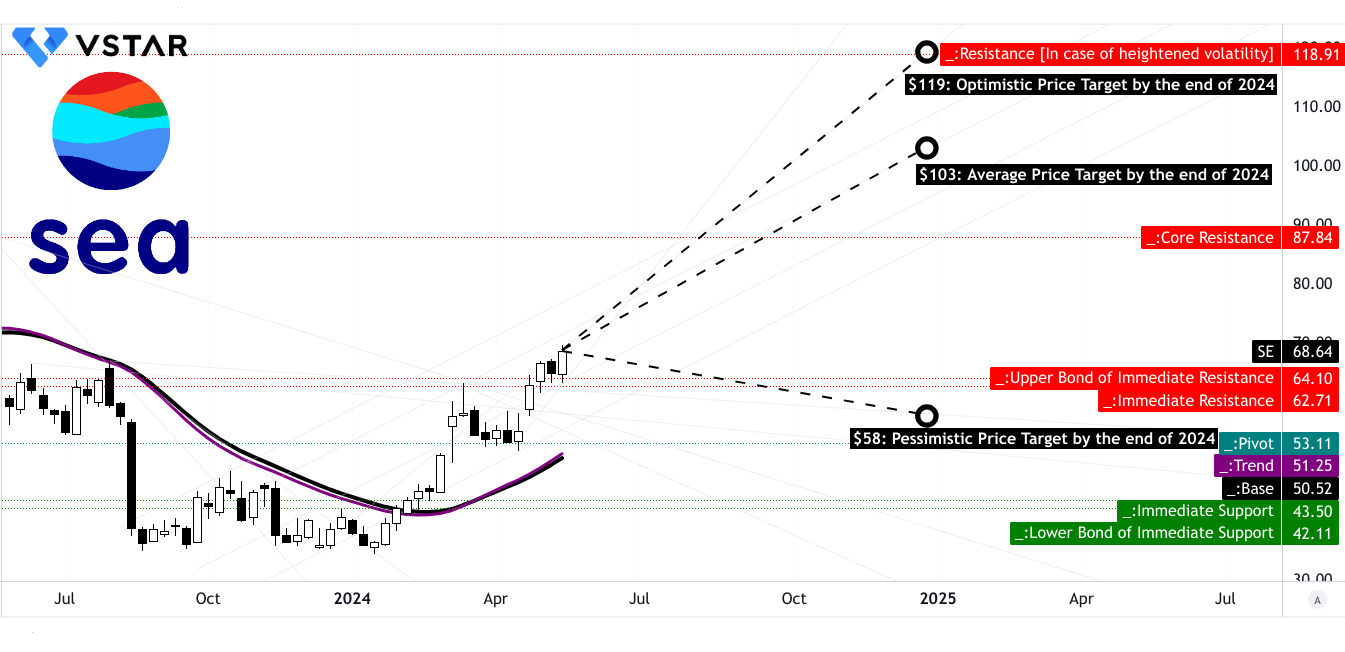

The average SE price target by the end of 2024 is projected at $103, supported by the momentum of change-in-polarity over mid- to short-term periods, extrapolated using Fibonacci extension levels. This target signifies a substantial potential upside. Moreover, the optimistic SE stock price target of $119 and the pessimistic target of $58 provide a range that encapsulates potential fluctuations. These targets are derived from analyzing the price momentum of the current swing over mid- to short-term periods, factoring in Fibonacci retracement/extension levels.

The current Sea stock price of $68.64 stands notably above the trendline ($51.25) and the baseline ($50.52), indicative of positive movement. This suggests an existing bullish sentiment in the market. The primary support level is identified at $64.10, while the pivot of the current horizontal price channel is $53.11. Core resistance lies at $87.84. These levels act as significant barriers influencing price movement.

Source: tradingview.com

In terms of technical indicators, the Relative Strength Index (RSI) stands at 75.17, indicating a bullish trend with the RSI line trending upwards. However, it's important to note that it approaches the regular bearish level, suggesting a possibility of overbought conditions. Similarly, the Moving Average Convergence/Divergence (MACD) indicator exhibits a bullish trend with a stabilized strength. The MACD histogram is positive, indicating bullish momentum.

Source: tradingview.com

B. Sea Stock Forecast: Fundamental Analysis

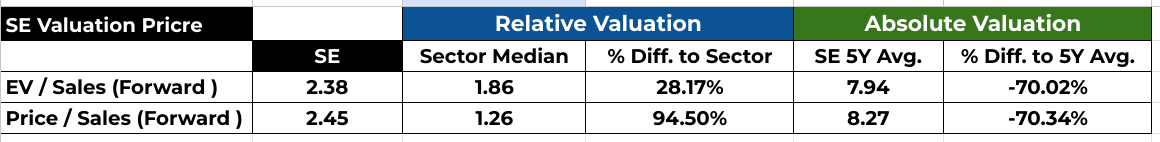

The EV/Sales and Price/Sales ratios, both forward-looking, reflect a premium compared to sector medians, indicating potentially high investor expectations. However, concerning the company's historical averages, Sea Limited appears massively undervalued, suggesting market mispricing or a shift in market sentiment.

Source: Analyst's compilation

C. Sea Limited Stock Forecast: Market Sentiment

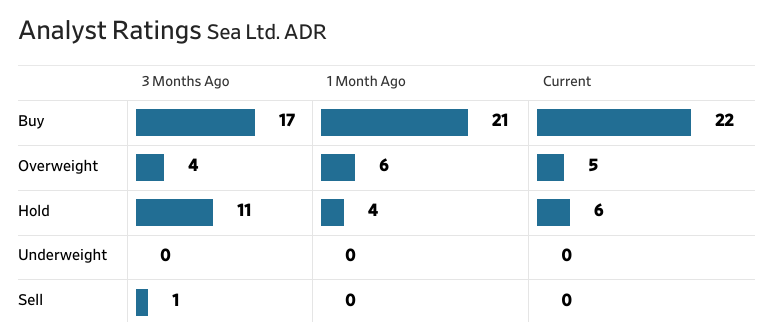

Analyst ratings available on WSJ.com show a bullish sentiment, with a consistent increase in Buy and Overweight ratings over the past months. Moreover, the price targets provided by analysts suggest an optimistic outlook, with a median target of $79.19, reflecting a potential upside of approximately 15% from the current price.

Source: WSJ.com

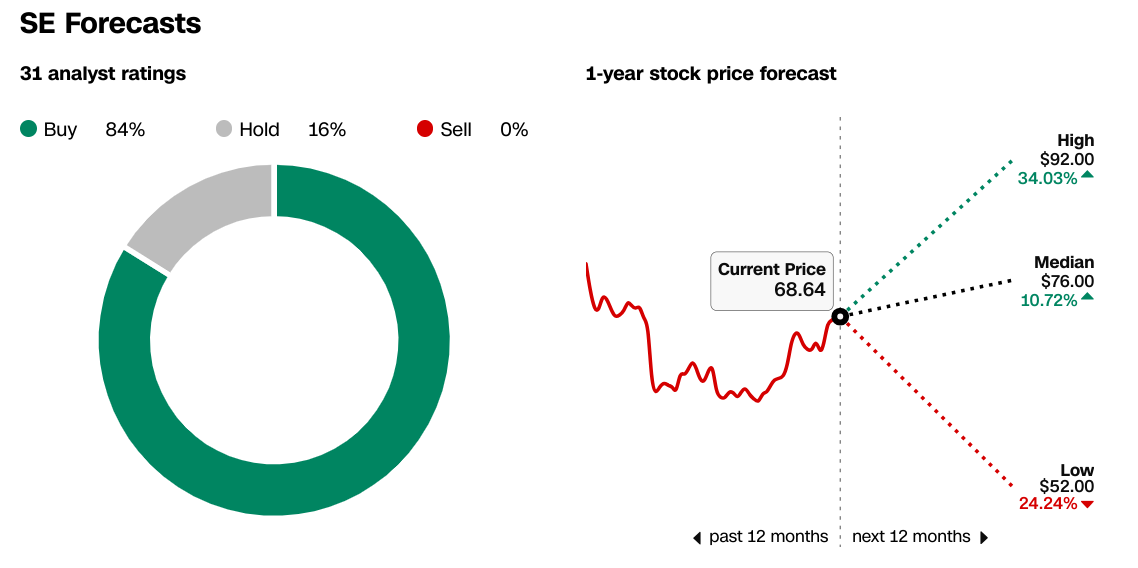

On CNN.com, forecasts reinforce this positive sentiment, with a majority of analysts recommending a Buy (84%) and projecting a median SE price target of $76.00, slightly lower than WSJ's but still indicating substantial growth potential.

Source: CNN.com

Institutional holdings indicate significant confidence in Sea Limited, with institutional ownership standing at 58.84% of total shares outstanding. This substantial backing from institutional investors underscores positive market sentiment and long-term confidence in the company's growth prospects. While short interest is relatively low at 7.65% of total shares outstanding. This covers 4.37 days based on average daily trading volume. This represents a modest bearish sentiment in the market.

Source: Nasdaq.com

Source: Benzinga.com

IV. Sea Ltd Stock Forecast 2024: Challenges & Risk Factors

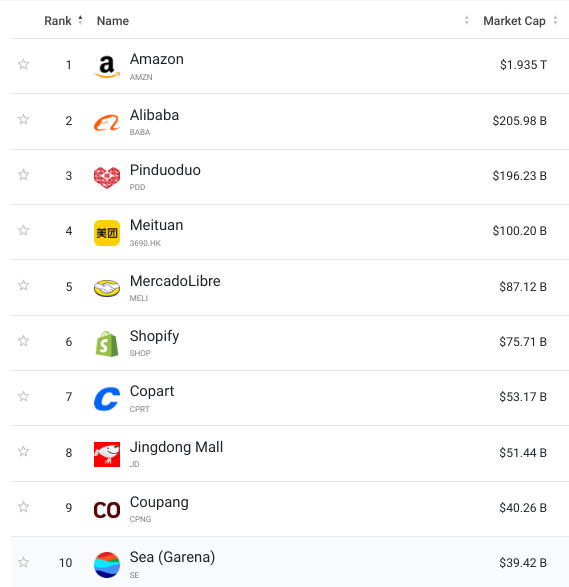

Comparing the market cap, it can be observed that the company has solid competition both in terms of reach and resources. Major competitors are Amazon, Alibaba, and PDD. On the positive side, the company has a lot of room to grow and seize market share exponentially.

Source: companiesmarketcap.com

One significant challenge is competition from other e-commerce platforms, posing a threat to Sea's market share and profitability. For instance, the inclusion of Shopee in the U.S. Trade Representative's list of "notorious markets" for counterfeiting and piracy highlights regulatory risks and potential damage to the company's reputation. Additionally, regulatory changes, such as lending restrictions in various markets, may constrain Sea's credit offerings and affect its financial services revenue.

Furthermore, Sea's reliance on a few key revenue-generating games in its digital entertainment segment, notably Free Fire, exposes it to risks associated with declining popularity, content quality issues, or regulatory actions affecting monetization. The company's digital entertainment revenue decreased significantly in 2023 due to factors like moderation in user engagement.

Additionally, Sea's financial performance is susceptible to fluctuations in foreign currency exchange rates, as indicated by its operational and financial results being reported in U.S. dollars. Moreover, the company's history of net losses and uncertainty about sustaining profitability amid global market volatility raise concerns about its long-term financial stability.

In conclusion, considering Sea Limited's strong growth prospects and technicals despite operational challenges, SE stock is a buy for long-term growth potential. However, it's essential to monitor regulatory developments (China-US risk) and level of competitiveness closely. To buy-sell SE stock CFDs is a sharp instrument. Here, VSTAR offers a comprehensive trading platform with low costs and a wide range of trading options. This seeking exposure to global markets may find VSTAR beneficial for their trading needs, especially with its institutional-level trading experience and regulatory compliance. However, investors should conduct thorough research and consider their risk tolerance before engaging in trading activities.