- Pinduoduo experienced remarkable financial performance in Q1 2024, with total revenue surging, primarily driven by online marketing and transaction services.

- PDD Holdings exhibited robust stock performance in Q1 2024, underperforming major indices with a -21% price return.

- Looking ahead, PDD's e-commerce, agriculture, consumer electronics, and international expansion segments hold significant growth potential.

- Technical analysis indicates upward momentum for PDD stock in 2024, with a price target of $185.

- Despite its positive outlook, PDD faces challenges including competition from established and emerging players, supply chain risks, regulatory compliance, and challenges associated with global expansion.

I. Pinduoduo Q1 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

Pinduoduo (PDD Holdings) reported remarkable financial performance in Q1 2024. Total revenue soared to RMB 86.8 billion (US$12.0 billion), marking a 131% increase from the previous year. This substantial growth was driven primarily by online marketing services and transaction services, with the latter witnessing an impressive 327% increase.

Operating profit for the quarter was RMB 26.0 billion (US$3.6 billion), reflecting a significant 275% increase from the same period in 2023. The company's net income attributable to ordinary shareholders also saw a substantial rise, reaching RMB 28.0 billion (US$3.9 billion), up 246% from Q1 2023. Basic and diluted earnings per ADS were RMB 20.33 (US$2.82) and RMB 18.96 (US$2.63), respectively, both showing significant improvements compared to the previous year.

The company's balance sheet remained robust with cash, cash equivalents, and short-term investments totaling RMB 242.1 billion (US$33.5 billion) as of March 31, 2024, up from RMB 217.2 billion at the end of 2023. Net cash generated from operating activities was a notable RMB 21.1 billion (US$2.9 billion), reflecting the company's strong operational efficiency.

Operational Performance:

The company actively engaged in promotional activities during significant shopping events such as the Spring Festival and May Day, which helped boost consumer engagement and sales. Pinduoduo's strategic collaborations with top brands facilitated new product launches on its platform, further diversifying its product offerings and attracting a broader customer base.

Technological Advancements and Innovations:

Significant technological achievements in Q1 2024 included the rollout of tailored fulfillment solutions to improve supply chain efficiency and reduce costs, and the enhancement of its compliance infrastructure to build a trustworthy platform. Pinduoduo also leveraged its technological capabilities to support agricultural initiatives, such as smart agriculture competitions and the Agriculture Cloud initiative, which aimed to provide e-commerce training and consultation to local farmers.

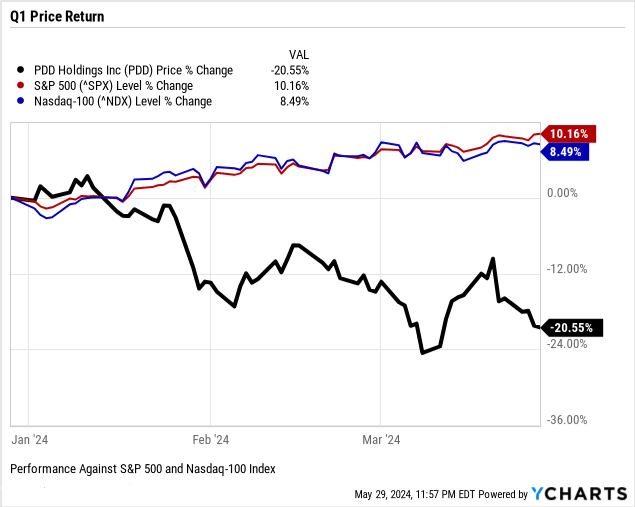

B. PDD Stock Price Performance

PDD Holdings (NASDAQ: PDD) marked a weaker stock performance in Q1 2024. Opening the quarter at $143.88, the stock peaked at $152.99 and reached a low of $108.87, closing at $116.25. With the volatility, PDD delivered a -21% price return (close-to-close) over Q1, significantly underperforming major indices such as the S&P 500 and NASDAQ-100, which posted returns of 10% and 9%, respectively. PDD's market capitalization stood at $208 billion. The Q1 price range indicates substantial adversities and bearish sentiment in the market.

Source: Ycharts.com

II. PDD Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

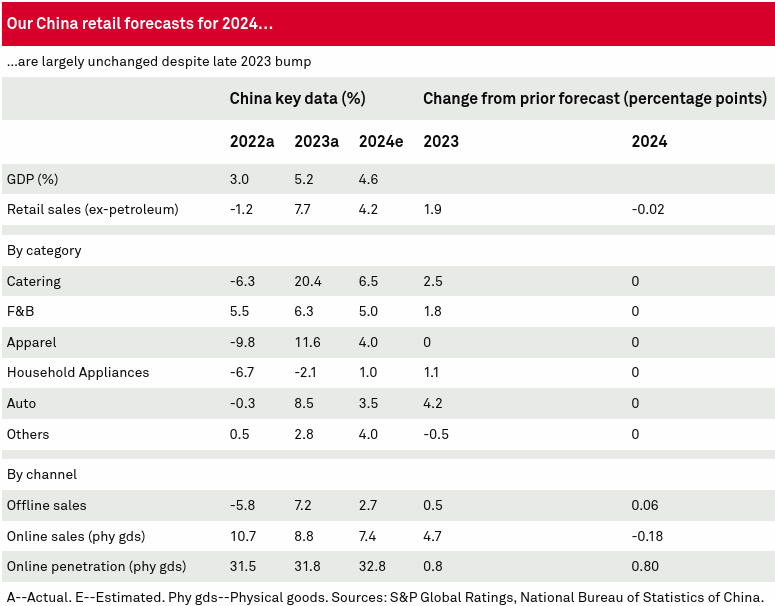

E-commerce: PDD's core business of e-commerce remains strong. Despite a predicted slowdown in overall retail growth in China, online retail continues to show robust performance. Online sales are expected to outperform offline sales, with online purchases projected to constitute 32.8% of physical goods purchases in 2024. PDD's focus on high-quality consumption, extensive product selection, and efficient supply chain management will drive this segment's growth. The retail sales market is expected to boost by 4.2% in 2024.

Source: S&P Global

Agriculture: PDD is making substantial investments in agricultural technology and e-commerce training for farmers, which is expected to boost this segment significantly. The company's initiatives such as the smart agriculture competition and agriculture cloud initiative support local farmers, enhancing productivity and expanding its market reach.

Consumer Electronics: This sector is critical for PDD's growth strategy. The company's trading services, which include mobile phones, electronics, and household appliances, are designed to meet consumer demand for upgrades and better services. These market segments are expected to hit positive growth in 2024.

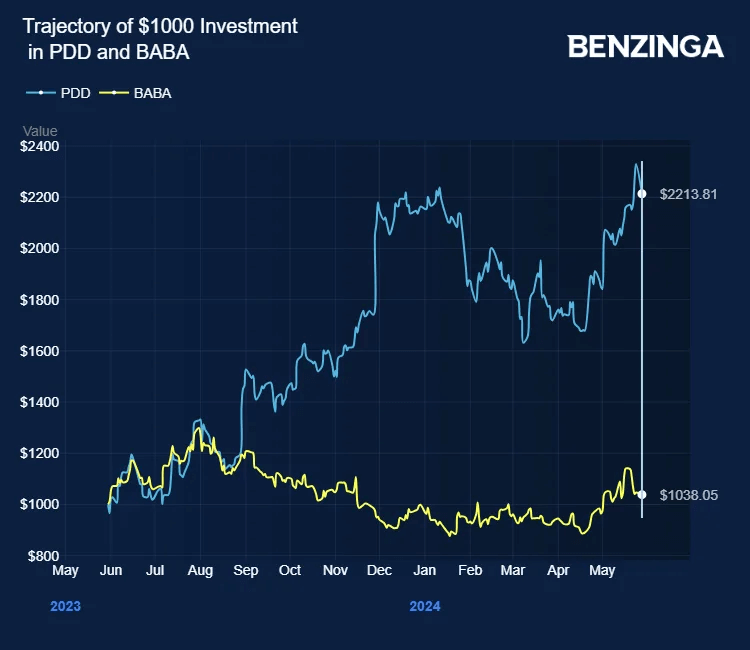

International Expansion: Temu's growth boost is supporting Parent PDD beat Alibaba as China's most valuable E-Commerce giant, reflecting in the mid-term trajectory of the stocks of these companies. PDD, with Temu, is making considerable international leads, extensifying into vital markets like the US, Australia, and Europe. Considering that, Goldman Sachs upgraded PDD's stock rating to Buy. This validated PDD's solid momentum in advertising revenue and Temu's potency.

Source: Benzinga.com

B. Expansions and Strategic Initiatives

Research and Development Investments: PDD's commitment to R&D is evident in its substantial increase in R&D spending, which reached RMB 2.3 billion on a non-GAAP basis in the first quarter of 2024. This investment focuses on improving the user shopping experience, supply chain efficiency, and building a robust compliance program.

Partnerships and Collaborations: PDD is deepening its cooperation with top global brands to expand its product offerings. For example, during the spring festival shopping season, PDD partnered with quality merchants to launch exclusive products, significantly boosting sales in various categories like dairy products and agricultural specialties.

Promotional Activities and Consumer Incentives: PDD is proactive in launching promotional activities to stimulate consumer spending. Initiatives like the RMB10 billion program and various seasonal promotions provide significant savings and incentives to consumers, driving increased engagement and sales.

Supply Chain and Fulfillment Enhancements: PDD's focus on supply chain innovation, such as tailored fulfillment solutions and digital tools for merchants, enhances efficiency and reduces costs. This is critical in maintaining a competitive advantage and supporting high-quality consumption.

III. PDD Stock Price Prediction 2024

A. PDD Stock Forecast: Technical Analysis

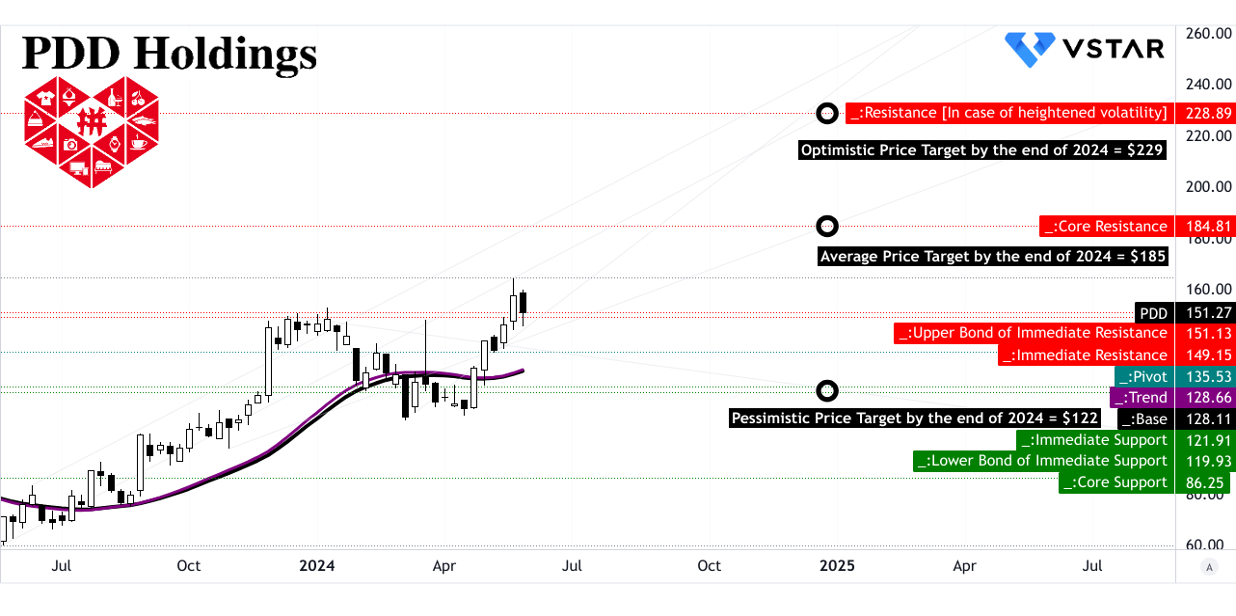

Analysts have set an average PDD stock price target of $185 by the end of 2024. This target is derived from analyzing the momentum of the stock's change in polarity over the mid-to-short term, using Fibonacci retracement and extension levels. The optimistic PDD price target stands at $229, suggesting strong upward momentum if the current trend continues, while the pessimistic PDD target price is $122, accounting for potential downward movements based on the same analytical methods.

PDD's current stock price is $151.27, with both the trendline and baseline set around $128, calculated using a modified exponential moving average (EMA). The direction is upward, indicating a positive market sentiment. Key support levels include $151.13 and $119.93, with a core support at $86.25. These levels indicate where the stock is expected to find buying interest if it declines. Resistance levels are critical for identifying potential selling points, with core resistance at $184.81 and a resistance level at $228.89, reflecting the upper boundary in case of heightened volatility.

Source: tradingview.com

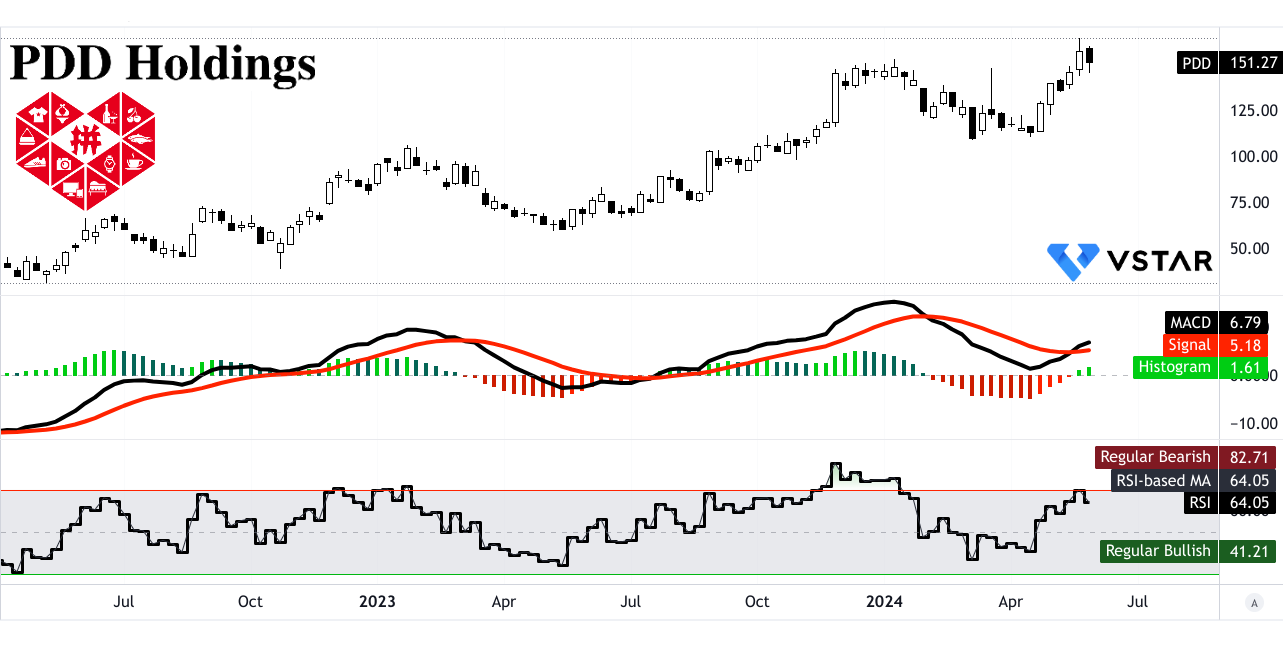

The Relative Strength Index (RSI) is at 64.05, indicating a neutral-to-bullish stance. The RSI shows no significant bullish or bearish divergence and is trending sideways, suggesting a balanced momentum without extreme overbought or oversold conditions. The Moving Average Convergence/Divergence (MACD) indicator is bullish, with a MACD line of 6.79 and a signal line of 5.18. The MACD histogram value of 1.610 and an increasing trend strength reinforce the bullish outlook.

Source: tradingview.com

B. Pinduoduo Stock Forecast: Fundamental Analysis

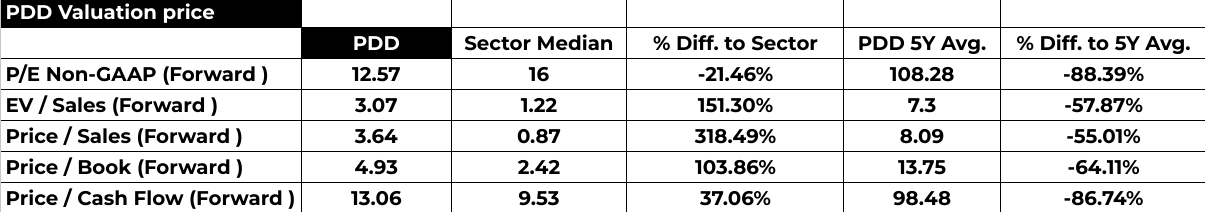

Pinduoduo stock (PDD) is assessed through financial ratios and market sentiment indicators.

- P/E Non-GAAP (Forward): PDD's ratio of 12.57 is 21.46% below the sector median (16) and significantly lower than its five-year average of 108.28, indicating potential undervaluation.

- EV/Sales (Forward): At 3.07, PDD's ratio is 151.30% above the sector median (1.22) but substantially lower than its five-year average of 7.3, implying a mixed valuation picture.

- Price/Sales (Forward): PDD's ratio of 3.64 is 318.49% higher than the sector median (0.87) but notably lower than its five-year average of 8.09, suggesting a divergence from historical norms.

- Price/Book (Forward): PDD's ratio of 4.93 is 103.86% above the sector median (2.42) and significantly below its five-year average of 13.75, indicating a potential value opportunity.

Source: Analyst's compilation

PDD Price Target

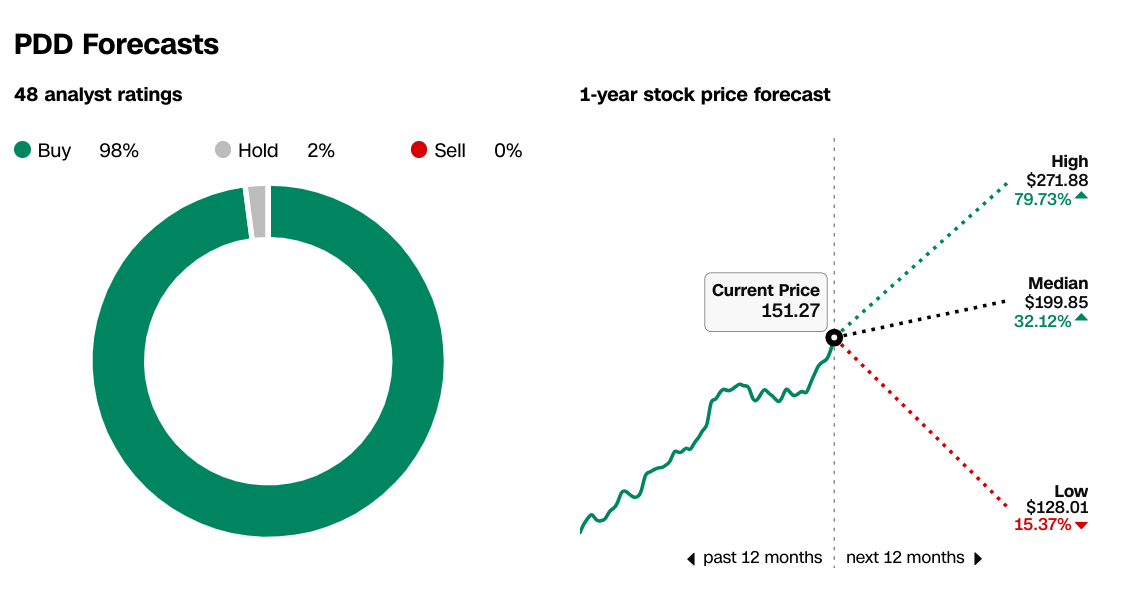

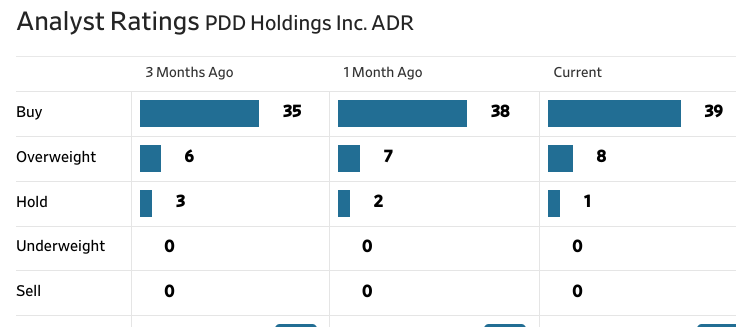

For PDD stock prediction 2024, out of 48 analyst ratings, 98% rate PDD as a buy, indicating strong bullish sentiment. Median price target for PDD is $199.85, which represents a 32.12% increase from the current price of $151.27. The same trend is observed among WSJ analysts with increasing bullish sentiment.

source: CNN.com

Source: WSJ.com

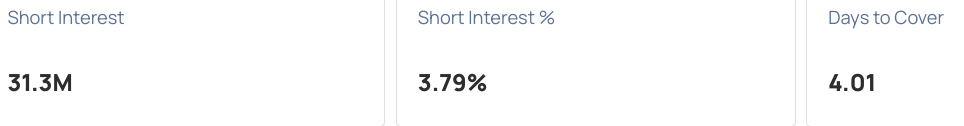

Institutional ownership stands at 6.90%, with a total value of holdings at $58.004 million, suggesting moderate institutional confidence. PDD has a short interest of 31.3 million shares, accounting for 3.79% of total shares outstanding, indicating minor bearish sentiment in the market.

source: Nasdaq.com

source: Benzinga.com

IV. PDD Holdings Stock Forecast: Challenges & Risk Factors

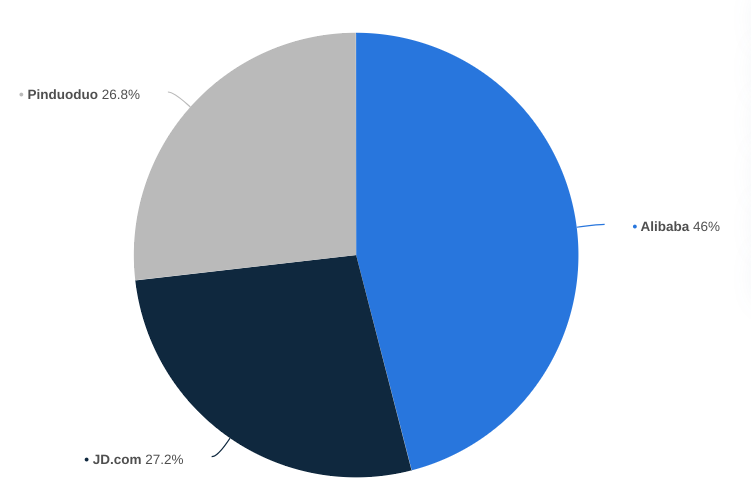

One notable challenge for PDD Holdings is the competitive landscape. As an e-commerce platform, PDD faces fierce competition from established players like Alibaba's Taobao and JD.com, as well as emerging competitors such as Douyin and Kuaishou. These competitors pose a threat to PDD's market share by offering similar services and products, potentially leading to price wars and decreased profitability.

[Gross merchandise volume share of comprehensive e-commerce retailers in China in 2023]

Source: Statista.com

Moreover, PDD's reliance on high-quality consumption and supply chain capabilities introduces inherent risks. Disruptions in the supply chain, such as logistical challenges or fluctuations in raw material prices, could impact operations and profitability.

In conclusion, Pinduoduo (PDD Holdings) witnessed exceptional financial performance in Q1 2024, based on online marketing and transaction services. PDD maintained a strong operational presence, focusing on supply chain enhancement, key partnerships, and high-quality consumption. E-commerce, agriculture, consumer electronics, and international expansion segments hold significant growth potential for PDD. Technical indicators suggest upward momentum in PDD's stock price, with an average price target of $185.

One can consider CFD trading on PDD stock for short-term gains, leveraging its price volatility. For that, utilization of VSTAR trading app provides benefits of low trading costs and institutional-level trading experience.