- Nvidia's Q3 2024 revenue reached $30 billion, up 122% YoY, with data centers contributing 87.7% of the total.

- Data Center segment growth was driven by Nvidia's Hopper GPUs and generated $26.3 billion, up 154% YoY.

- Nvidia's automotive and healthcare segments are emerging growth areas, with YoY increases of 37% and strong potential in AI applications.

- Nvidia's strategic expansions in AI through partnerships and R&D investments highlight confidence, supported by a $50 billion share repurchase.

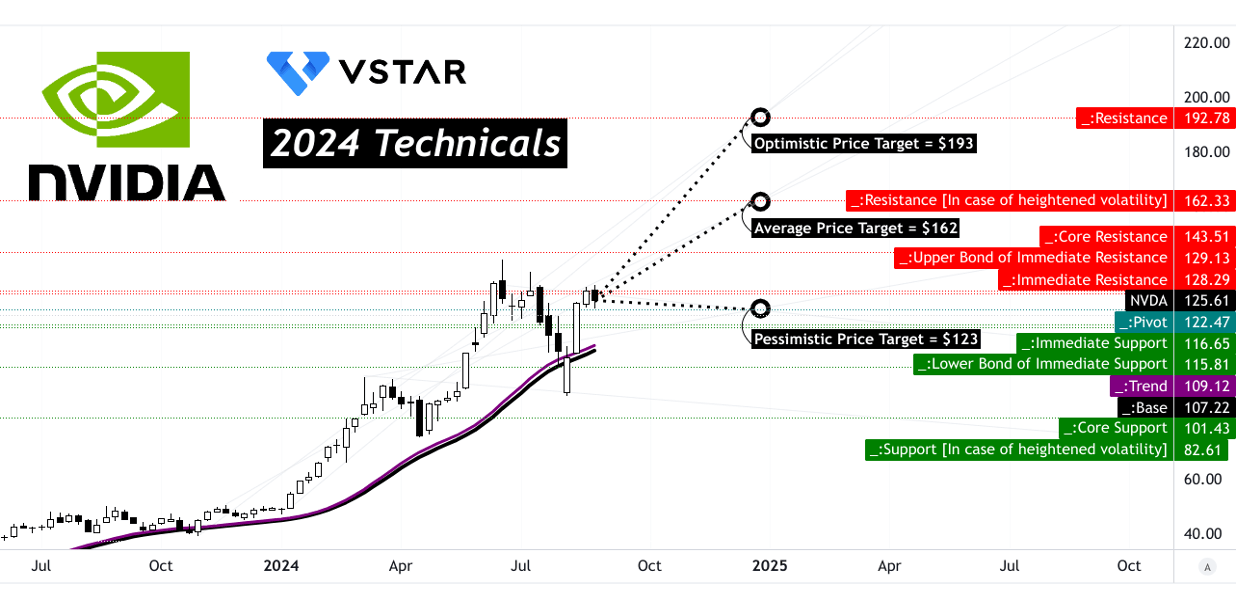

- Nvidia stock shows mixed technical signals, with a current price of $125 and an optimistic year-end target of $193.

I. Nvidia Q3 2024 Performance Analysis

A. Key Segments Performance

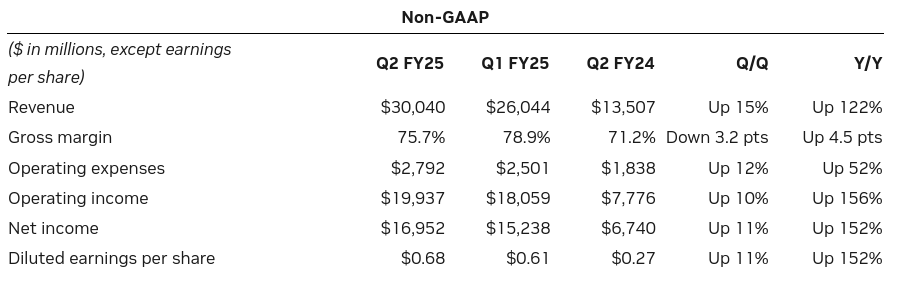

Financial Highlights:

Nvidia reported a record Q3 2024 revenue of $30 billion, marking a 15% increase from Q2 and a staggering 122% YoY growth. The Data Center segment was the primary driver, contributing $26.3 billion, up 154% YoY. Net income surged by 160% YoY to $8.25 billion, translating to GAAP EPS of $0.67 (up 168% YoY). Non-GAAP EPS reached $0.68, up 152% YoY. Operating income rose by 120% YoY to $12 billion, with GAAP gross margins at 75.1%. Nvidia's operating expenses increased by 12% sequentially to $4.3 billion, driven by higher compensation-related costs. The balance sheet remains robust, with $25.7 billion in cash and equivalents, while cash flow from operations hit $14.5 billion.

Source: nvidianews.nvidia.com

Operational Performance:

Data Center performance was exceptional, driven by strong demand for Nvidia's Hopper and Blackwell architectures, with Data Center revenue accounting for 87.7% of total revenue. Gaming revenue grew 16% YoY to $2.9 billion, fueled by RTX GPU sales and increased demand for AI-powered gaming experiences. Nvidia introduced several new products, including the Blackwell GPU, Spectrum-X Ethernet platform, and advancements in AI and generative AI technologies, solidifying its market leadership. Nvidia's market share in the Data Center segment increased to over 80%, driven by accelerated adoption of AI solutions across industries.

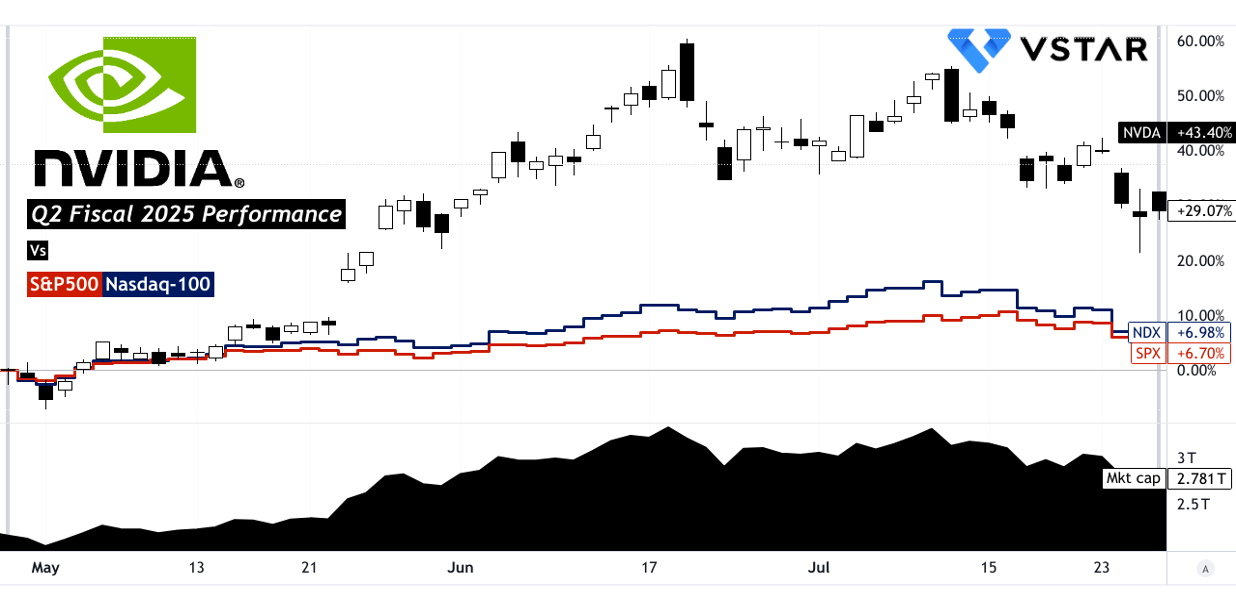

B. NVDA Stock Price Performance

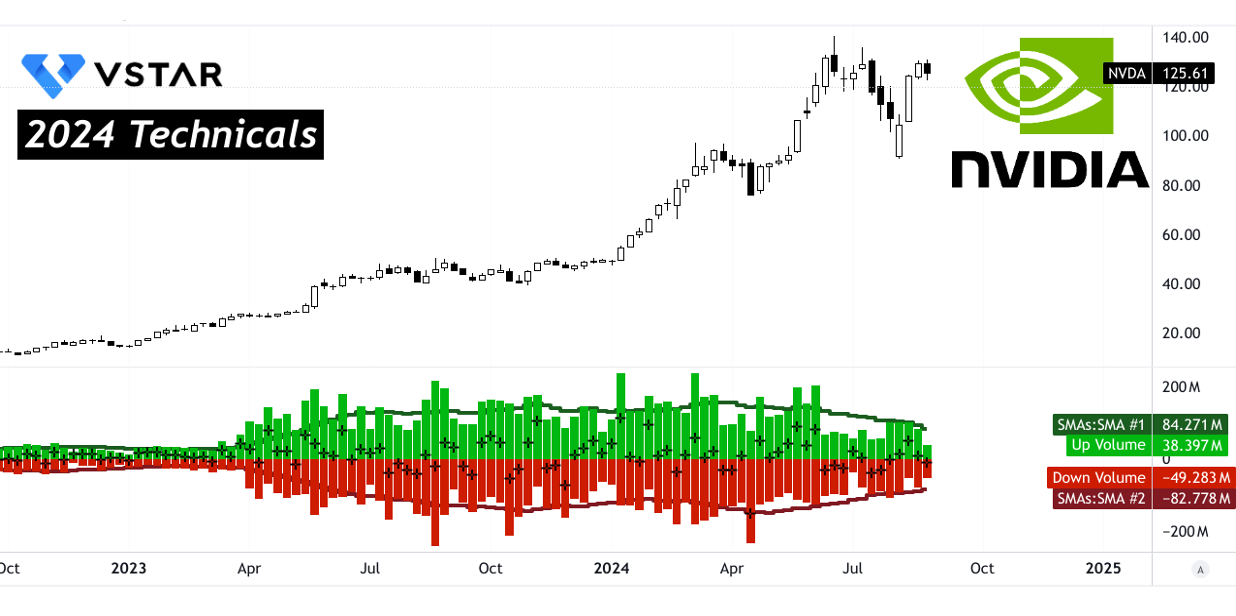

NVIDIA's (NVDA) stock price surged 29% during the quarter, with the price rising from $87.60 to $113.06. The stock hit a high of $140.76 and a low of $81.25. In comparison, the S&P 500 and NASDAQ returned 6.7% and 7%, respectively. This stark outperformance underscores NVIDIA's market strength, contributing to its market capitalization reaching $2.78 trillion. The 29% price return significantly exceeded broader market indices, highlighting investor confidence in NVIDIA's growth potential amid favorable conditions in the semiconductor sector.

Source: tradingview.com

II. NVDA Stock Prediction: Outlook & Growth Opportunities

A. Segments with Growth Potential

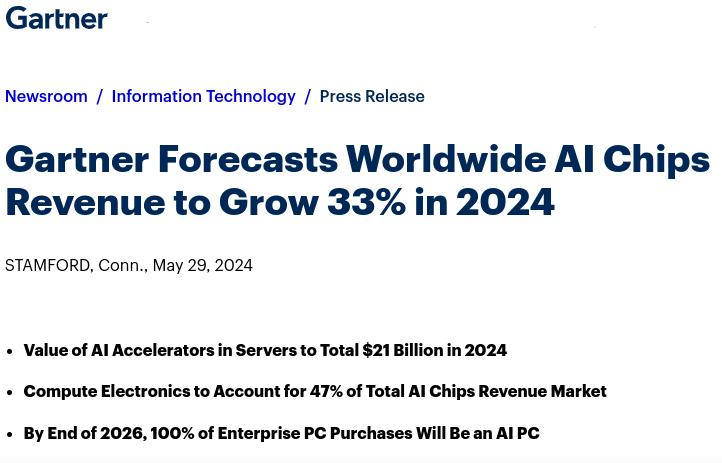

NVIDIA's data center segment is a primary driver of growth, achieving $26.3 billion in revenue in Q2 FY 2025, representing a 16% sequential increase and a staggering 154% year-on-year growth. This surge is largely due to the strong demand for NVIDIA Hopper GPUs and networking platforms. The compute and networking revenues within this segment grew by over 2.5 times and 2 times, respectively, compared to last year. Generative AI workloads, model training, and inference are key contributors, with inference alone driving more than 40% of data center revenue over the past four quarters. Additionally, NVIDIA's automotive segment shows promise, with a 37% year-on-year increase in Q2 FY 2025, driven by the adoption of self-driving platforms and AI cockpit solutions. Healthcare is also emerging as a growth area, particularly in AI-driven medical imaging and drug discovery, with expectations to evolve into a multi-billion dollar business.

Source: gartner.com

B. Expansions and Strategic Initiatives

Source: NVIDIA_Annual_Stockholder_Meeting_2024

NVIDIA is strategically positioned to capitalize on AI's expansion through targeted mergers and acquisitions, R&D investments, and partnerships. The recent launch of the NVIDIA AI Foundry service, in collaboration with Meta's Llama 3.1, exemplifies NVIDIA's focus on generative AI for enterprises. NVIDIA's partnerships with companies like Accenture and SAP to integrate AI into business applications underscore its commitment to expanding AI capabilities across industries. In R&D, NVIDIA's continuous investments are evident in the development of the Blackwell platform, expected to generate billions in revenue starting Q4 FY 2025. The $50 billion share repurchase authorization indicates strong confidence in future growth, bolstered by significant expansions in AI, automotive, and data center technologies.

III. Nvidia Stock Forecast 2024

A. Nvidia Price Prediction: Technical Analysis

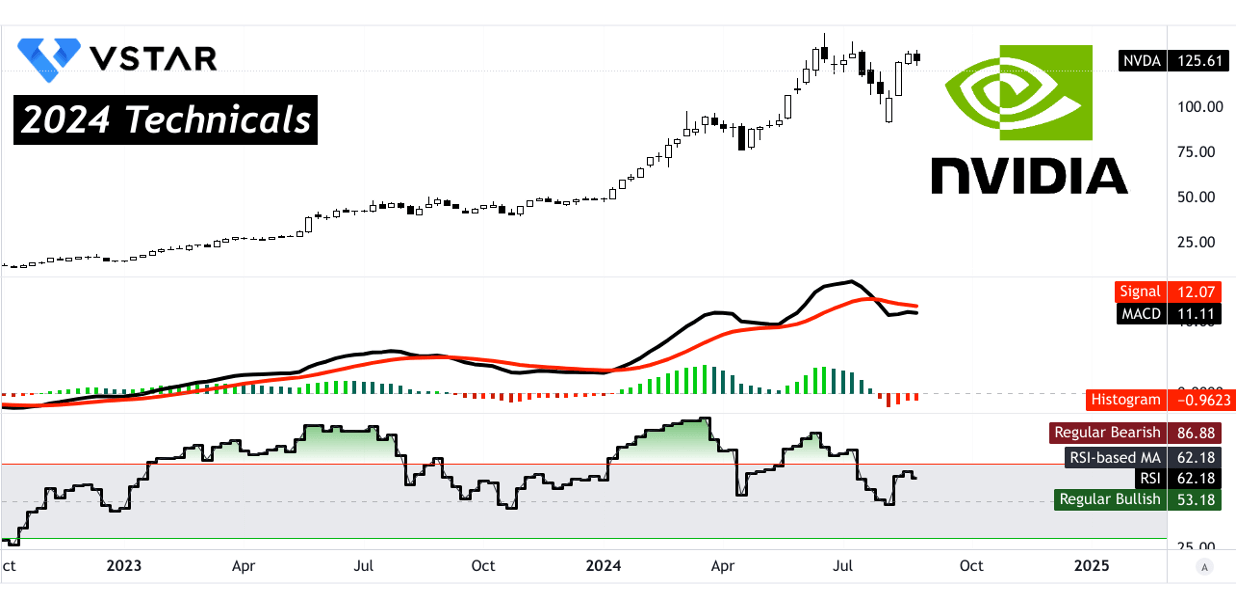

Nvidia's (NVDA) stock price is $125, hovering close to its primary resistance level at $129.00. The price is above both the trendline and baseline, set at $109 and $107 respectively, indicating a slight bullish momentum. However, the Moving Average Convergence/Divergence (MACD) presents a bearish trend with a MACD line of 11.11 against the signal line at 12.07, and a histogram of -0.96, though the trend's strength is decreasing.

Source: tradingview.com

The average NVDA price target by the end of 2024 is forecasted at $162.00, derived from Fibonacci retracement/extension levels, considering the stock's momentum and mid- to short-term polarity changes. Optimistically, the price could rise to $193.00, driven by upward momentum, with key resistance levels at $143.50 and $192.80. Conversely, a pessimistic outlook predicts a decline to $123.00, with core support at $101.40 and a lower bound at $82.60 in case of heightened volatility.

Source: tradingview.com

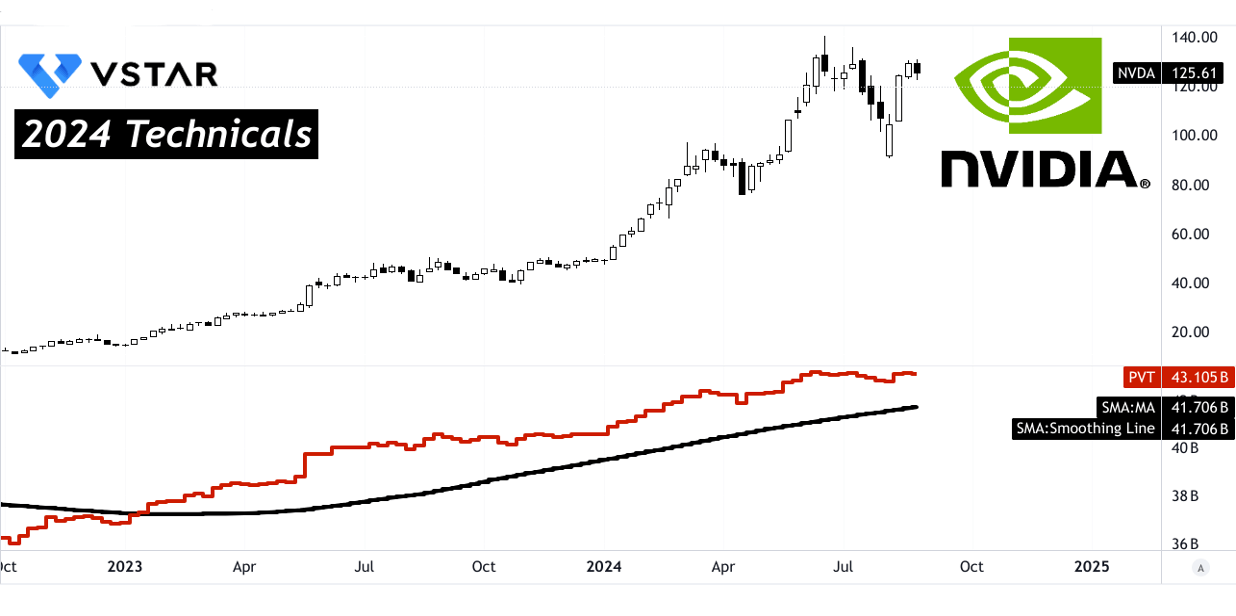

The Relative Strength Index (RSI) at 62.18, indicates bullish divergence, but the RSI line trend remains sideways, suggesting indecision. Price Volume Trend (PVT) shows a bullish momentum with a PVT line of 43.11 billion against a moving average of 41.71 billion. Additionally, the moving average of up volume surpasses the down volume (84.27 million vs. 82.78 million), further supporting a bullish outlook.

Source: tradingview.com

Source: tradingview.com

B. Nvidia Stock Price Prediction: Fundamental Analysis

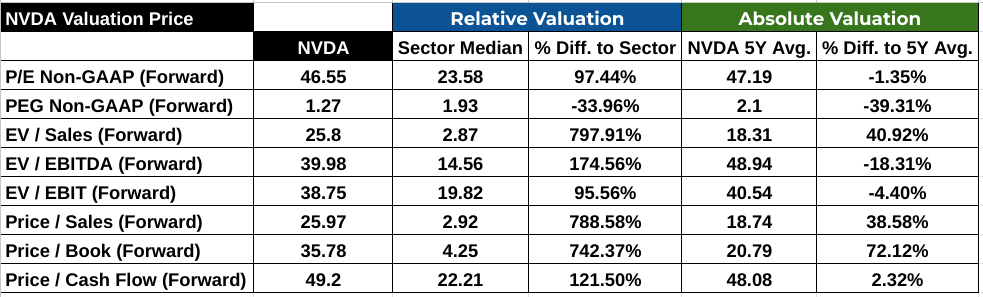

Nvidia's fundamental analysis shows a mixed valuation picture. The company's forward P/E ratio stands at 46.55, nearly double the sector median of 23.58, indicating that Nvidia is significantly more expensive than its peers. However, it's close to its 5-year average of 47.19, suggesting that this high valuation is consistent with historical norms.

The PEG ratio, a more comprehensive measure considering growth, is 1.27, which is 33.96% lower than the sector median of 1.93 and 39.31% lower than its 5-year average of 2.1. This implies that Nvidia's stock may be undervalued relative to its expected growth, offering potential upside.

However, the EV/Sales and Price/Sales ratios, at 25.8 and 25.97 respectively, are exorbitantly higher than the sector medians of 2.87 and 2.92, by 797.91% and 788.58%. These high multiples could suggest that Nvidia is overpriced based on revenue generation.

The EV/EBITDA ratio is 39.98, much higher than the sector median of 14.56 but lower than its 5-year average of 48.94, reflecting a premium valuation relative to the sector but a slight discount to its historical performance.

Source: Analyst's compilation

C. Nvidia Stock Prediction: Market Sentiment

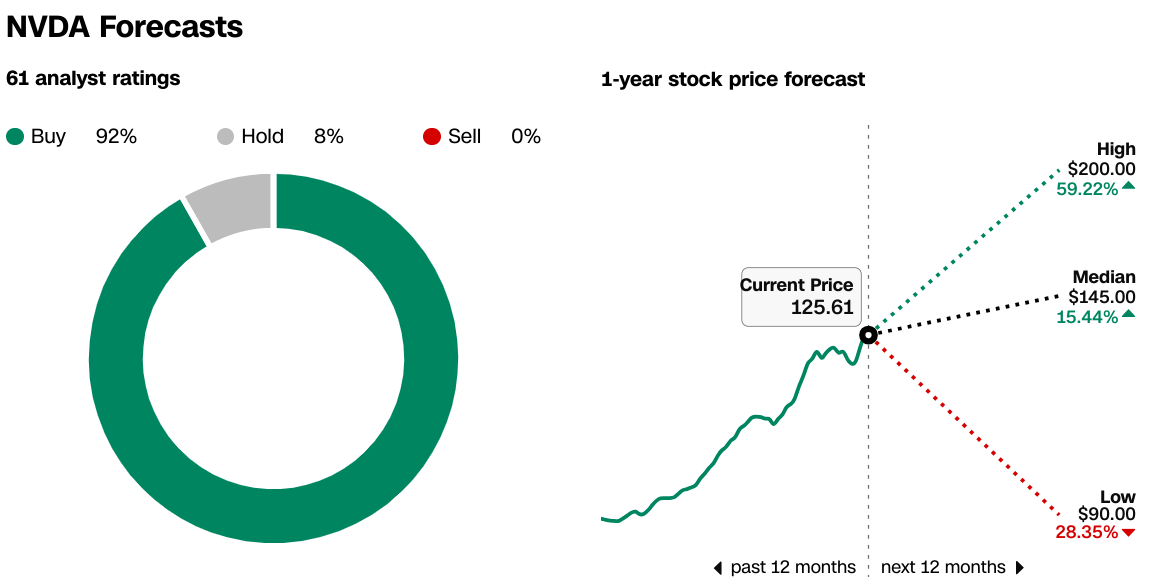

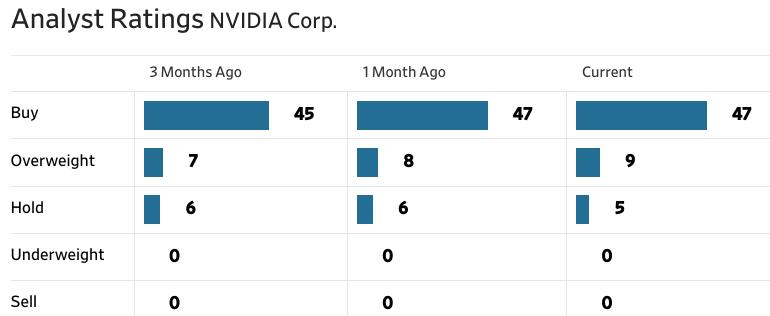

Market sentiment for Nvidia is overwhelmingly positive. Analyst ratings show 92% of analysts recommending a "Buy," with no "Sell" ratings. The consensus Nvidia price target is $145.00, offering a 15.44% potential upside from the current price of $125.61. The high NVDA price target 2024 is $200.00, indicating a possible 59.22% upside.

Source:CNN.com

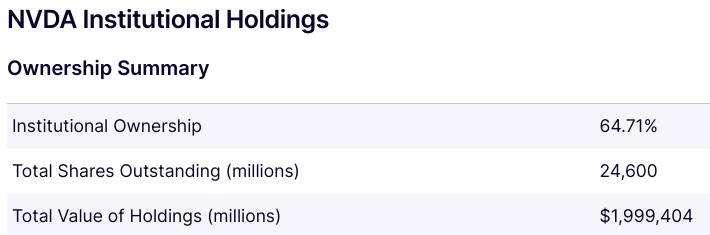

Institutional investors own 64.71% of Nvidia's shares, signaling strong confidence in the company. Meanwhile, short interest is low, at just 1.17%, implying limited bearish sentiment in the market. This combination of strong institutional support and low short interest reinforces the bullish outlook for Nvidia stock.

Source: Nasdaq.com

Source: Benziga.com

Source: WSJ.com

IV. NVDA Stock Forecast: Challenges & Risk Factors

Nvidia faces significant competition, especially from companies like AMD, Intel, and newcomers like Cerebras and Graphcore. AMD's Radeon series GPUs, though currently trailing Nvidia in market share, offer competitive performance at a lower price point. Intel's recent entry into the GPU market with its Arc series aims to leverage its deep integration in data centers, directly challenging Nvidia's dominance in AI workloads. Additionally, specialized AI chipmakers like Cerebras, with their wafer-scale engine, and Graphcore's IPU technology present serious competition in niche markets. As Nvidia expands into more specialized AI and data center applications, these competitors are aggressively innovating, which could limit Nvidia's pricing power and market share.

Source: IOT Analytics

Other Risks:

Beyond competition, Nvidia faces risks such as potential supply chain disruptions and geopolitical tensions, particularly with its reliance on Taiwan Semiconductor Manufacturing Company (TSMC) for chip production. Any escalation in Taiwan's geopolitical situation could severely impact Nvidia's production capabilities and financial performance.

In conclusion, Nvidia stock outlook is bullish, underpinned by its dominance in AI and data center segments, which drove Q3 2024 revenue to a record $30 billion, up 122% YoY. Despite this, Nvidia's high forward P/E ratio of 46.55 indicates overvaluation concerns, especially compared to the sector median. The stock's premium valuation reflects strong growth expectations, yet it remains vulnerable to competitive pressures from AMD and Intel, and geopolitical risks linked to TSMC. For CFD traders on platforms like VSTAR, the stock's volatility and tight spreads present significant trading opportunities, with potential gains from both bullish and bearish market movements.