- Microsoft reported strong Q2 2024 financial results with significant revenue and net income growth.

- Azure, Office 365, and gaming were key contributors to this growth.

- Microsoft stock price outperformed the S&P 500, though it lagged behind the NASDAQ.

- Strategic investments in AI, cloud computing, and gaming fuel optimistic future outlooks.

I. Microsoft Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights [Q4 Fiscal 2024]

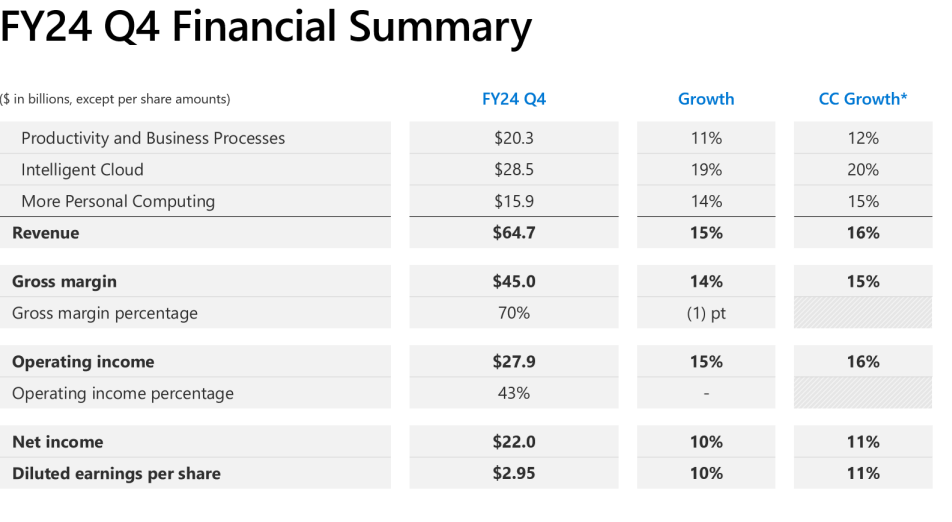

Microsoft reported total revenue of $64.7 billion, marking a 15% increase year-over-year, and a 16% rise in constant currency. For the fiscal year 2024, the company achieved $245.1 billion in revenue, a 16% growth from the previous year. Net income reached $22.0 billion, a 10% increase from the previous year, and diluted EPS was $2.95, reflecting a 10% growth, or 11% in constant currency. The fiscal year net income stood at $88.1 billion, up 22%, with EPS at $11.80, increasing by 22% or 20% in constant currency.

Further, the operating income for Q2 was $27.9 billion, up 15% year-over-year (16% in constant currency). The operating margin was stable at 43%, while the gross margin percentage slightly decreased by 2 points to 70%, influenced by Azure's sales mix shift. Operating expenses grew by 13%, partly due to the Activision acquisition. Microsoft's strategic investments in R&D and security were evident, with expenses escalating but well managed, maintaining robust cash flow and balance sheet strength.

Source: Q4 Fiscal 2024 Presentation

Operational Performance

Revenue hit $20.3 billion, up 11% (12% in constant currency). Key growth drivers included a 12% rise in Office Commercial products and a 13% increase in Office 365 Commercial revenue. Revenue rose to $28.5 billion, a 19% increase (20% in constant currency), with Azure's cloud services growing by 29%, underscoring Microsoft's dominance in cloud computing. This segment generated $15.9 billion, a 14% increase (15% in constant currency). Windows revenue grew by 7%, while Xbox content and services surged by 61%, driven significantly by the Activision acquisition.

Moreover, Azure continued to expand its market share, supported by strategic partnerships with AMD, NVIDIA, and VMware, enhancing its AI and cloud service offerings. Microsoft's collaboration with SAP and Oracle further solidified its position as the preferred cloud for mission-critical enterprise workloads.

Technological Advancements and Innovations

Over 60,000 Azure AI customers, and the launch of Azure Maia, enhancing AI capabilities with AMD and NVIDIA accelerators. Microsoft Fabric, with 14,000 customers, introduced real-time intelligence features, reflecting advancements in data analytics. GitHub Copilot adoption surged, with over 77,000 organizations using it, boosting GitHub's revenue run rate to $2 billion. Microsoft 365 Copilot's daily user base doubled, showcasing AI's integration into everyday workflows. Microsoft's Secure Future Initiative advanced, with over 1.2 million security customers. Azure Defender for Cloud reached $1 billion in revenue, reinforcing Microsoft's commitment to cybersecurity.

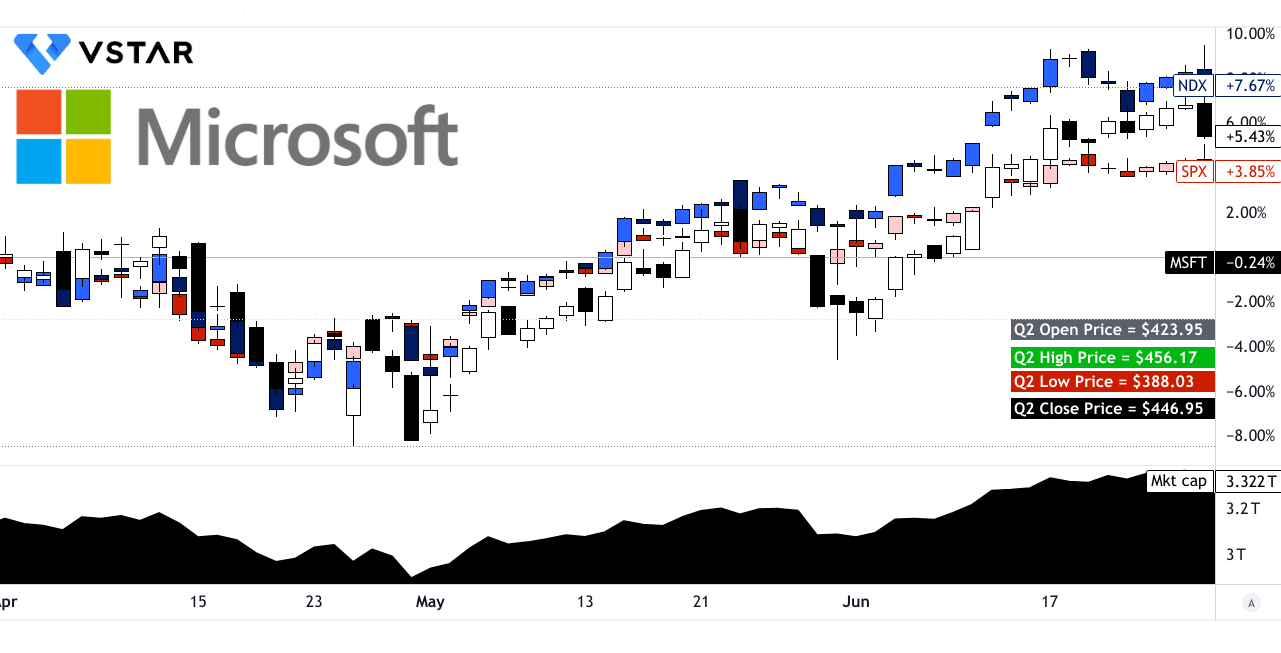

B. MSFT Stock Price Performance

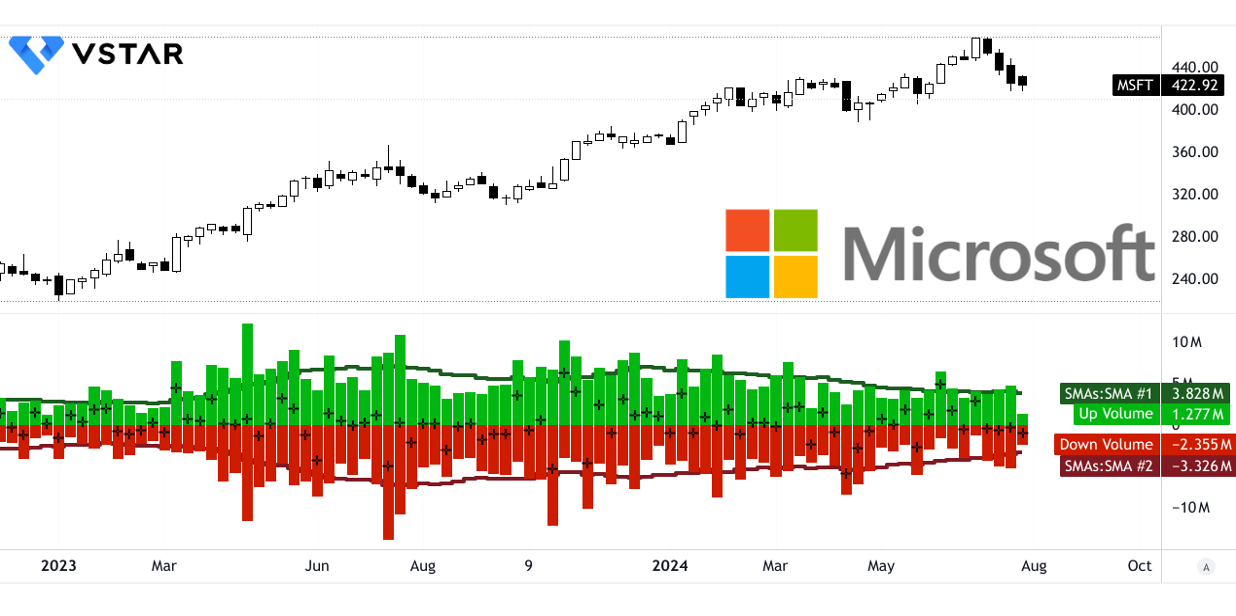

Microsoft (NASDAQ: MSFT) has a market cap of $3.322 trillion. During the quarter, its stock opened at $423.95 and closed at $446.95, with highs and lows of $456.17 and $388.03, respectively. The MSFT stock price saw a 5.43% increase, outperforming the S&P 500's 3.85% return but lagging behind the NASDAQ's 7.67% return.

Source: tradingview.com

II. Microsoft Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Microsoft (NASDAQ: MSFT) is strategically positioned for significant growth across various segments, each contributing to its robust financial outlook and promising revenue trajectory.

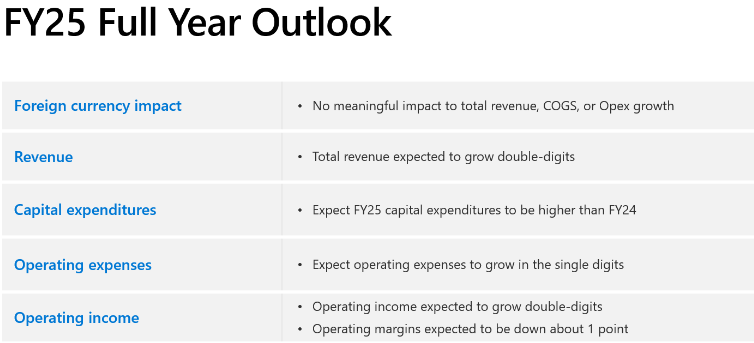

Source: Q4 Fiscal 2024 Presentation

Cloud Computing (Azure)

Azure is a key driver of Microsoft's growth, with its revenue growing 29% year-over-year. The increasing adoption of cloud services, driven by AI integration and expanding data center footprint, positions Azure to capture more market share. With 36,000 Arc customers and over 60,000 Azure AI customers, Azure is becoming a critical component for enterprises migrating to the cloud.

Artificial Intelligence (AI)

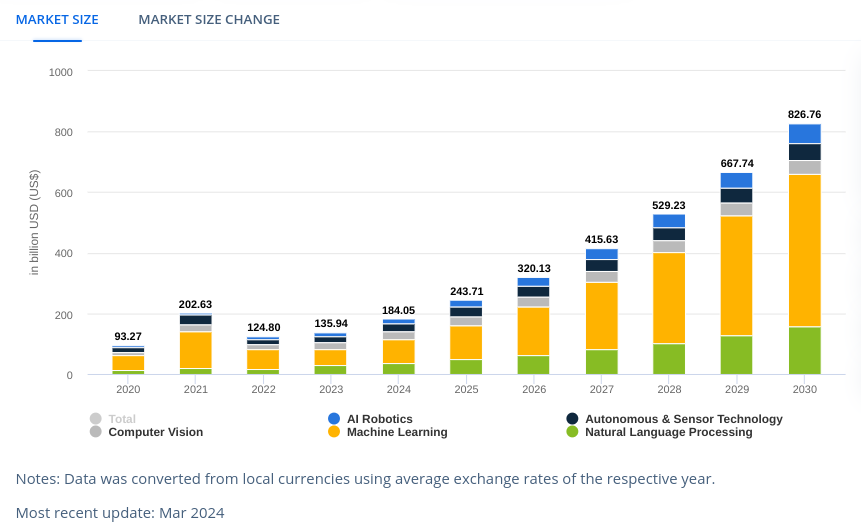

Microsoft's AI initiatives are accelerating growth across multiple platforms. The Azure OpenAI Service and Models as a Service are gaining traction, with companies like H&R Block and Suzuki leveraging these services. The AI-powered Microsoft Intelligent Data Platform and Microsoft Fabric are seeing rapid adoption, indicating a robust demand for AI-driven data solutions. The revenue size in the AI market may hit $184 in 2024 and continue to grow at a growth rate (2024-2030) of 28.46% annually.

[Artificial Intelligence market]

Source: statista.com

Productivity and Business Processes

Office 365 and Dynamics 365 continue to exhibit strong growth. Office 365 commercial revenue increased by 13%, driven by the Copilot for Microsoft 365. Dynamics 365, which grew by 19%, is becoming integral for organizations' ERP and CRM solutions. The integration of AI into these tools is enhancing productivity and driving user adoption.

Gaming

Microsoft's gaming division, bolstered by Game Pass and cloud gaming services, is another growth catalyst. With over 500 million monthly active users and a strong content pipeline, Microsoft is well-positioned to capitalize on the expanding gaming market.

B. Expansions and Strategic Initiatives

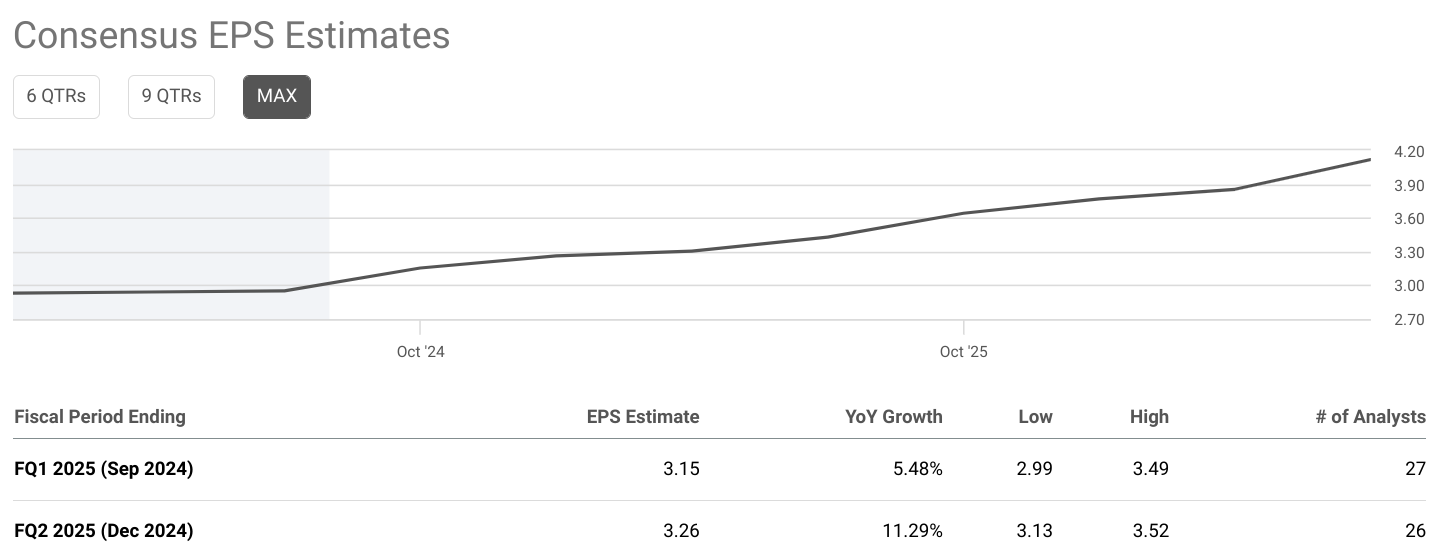

Analysts predict consistent growth in MSFT earnings and revenue. For Q1 FY2025, the consensus EPS estimate is $3.15, a 5.48% year-over-year increase, with revenue projected at $65.45 billion, up 15.80%. For Q2 FY2025, the EPS estimate is $3.26, reflecting an 11.29% growth, while revenue is expected to be $70.01 billion, a 12.88% increase.

Source:seekingalpha.com

Mergers and Acquisitions (M&A)

Microsoft's acquisition strategy enhances its capabilities and market presence. The acquisition of Activision Blizzard, although initially a drag on operating income, is expected to strengthen Microsoft's position in the gaming industry. This acquisition adds a vast portfolio of popular gaming titles and significantly increases Microsoft's reach.

Research and Development (R&D) Investments

Microsoft's heavy investment in R&D, particularly in AI and cloud technologies, is critical for sustaining its competitive edge. Innovations such as the Azure AI accelerators from AMD and NVIDIA, along with first-party silicon like Azure Maia, exemplify Microsoft's commitment to cutting-edge technology. These investments ensure continuous enhancement of product offerings and infrastructure.

Partnerships and Collaborations

Strategic partnerships are pivotal for Microsoft's growth. Collaborations with industry leaders like SAP, Oracle, and VMware are expanding Azure's footprint. Furthermore, the Azure OpenAI Service's partnerships with companies like Cohere, Meta, and Mistral are diversifying Microsoft's AI offerings and attracting more customers.

Geographic Expansion

Microsoft's global expansion of its data center footprint, with investments across four continents, is aimed at driving long-term growth. These investments not only enhance service delivery but also position Microsoft to meet the increasing demand for cloud services globally.

III. MSFT Stock Forecast 2024

A. Microsoft Stock Price Prediction: Technical Analysis

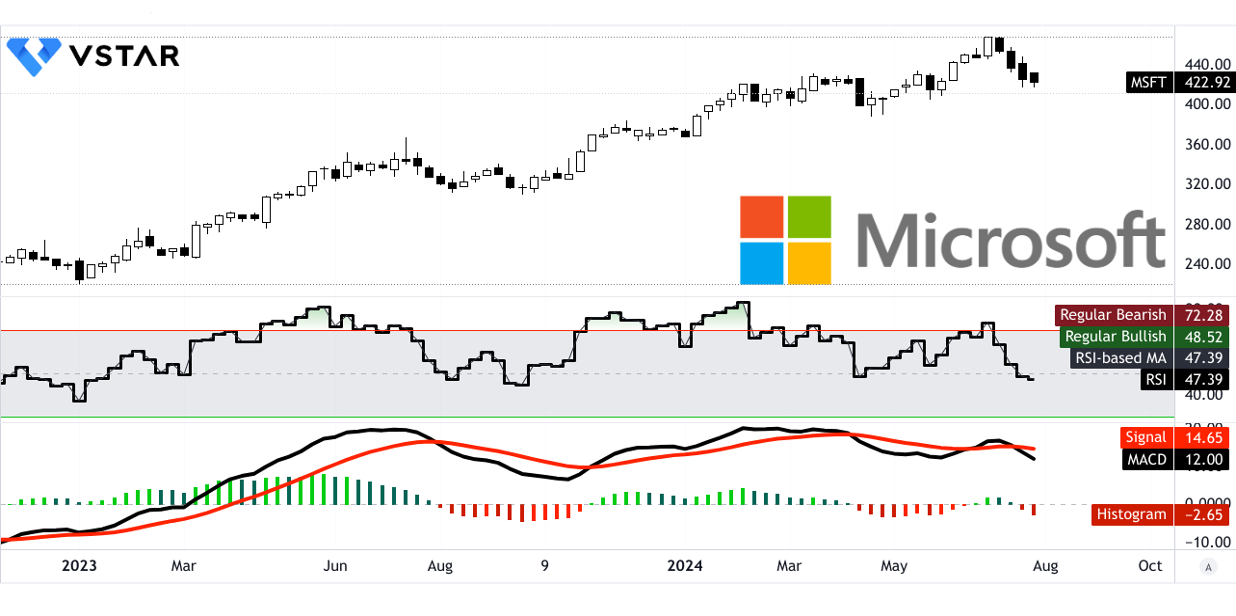

As of now, Microsoft's current stock price stands at $422.92, with several technical indicators providing a comprehensive forecast. The modified exponential moving averages (EMAs) indicate a trendline at $425.63 and a baseline at $423.45, which are both very close to the current price, suggesting a stable short-term trend. Analysts have set an average MSFT price target of $535.00 by the end of 2024. This target is derived from the momentum of change-in-polarity over mid- to short-term periods, projected using Fibonacci retracement/extension levels. The optimistic Microsoft price target reaches $605.00, based on the strong upward price momentum seen in current swings, again projected over Fibonacci levels. Conversely, the pessimistic MSFT stock price target is $450.00, reflecting potential downward price momentum within the same technical framework.

Source: tradingview.com

Resistance and Support Levels

Microsoft's primary resistance is at $433.35, slightly above the current price, which could act as a hurdle for immediate upward movement. The pivot point of the current horizontal price channel is $446.42, serving as a crucial level for trend confirmation. In case of heightened volatility, the resistance could escalate to $536.00, aligning with the average MSFT target price. Core resistance is identified at $493.70, with another significant resistance level at $406.41. The support levels, especially the core support at $399.13 and the heightened volatility support at $356.84, provide a safety net for downward movements, indicating areas where buying interest might emerge.

Relative Strength Index (RSI)

The RSI for Microsoft is at 47.39, which is below the regular bullish level of 48.52 but well above the bearish level of 72.28. This neutral RSI indicates that the stock is not currently overbought or oversold, with the RSI line trending downwards. This downtrend suggests weakening momentum, but no bullish or bearish divergence is observed, meaning no strong reversal signals are present at this time.

Moving Average Convergence/Divergence (MACD)

The MACD indicator shows the MACD line at $12.00 and the signal line at $14.65, with a MACD histogram of -$2.65, indicating a bearish trend. The strength of this bearish trend is increasing, suggesting that short-term selling pressure might persist. This bearish momentum is crucial for traders to monitor as it may impact short-term trading strategies.

Source: tradingview.com

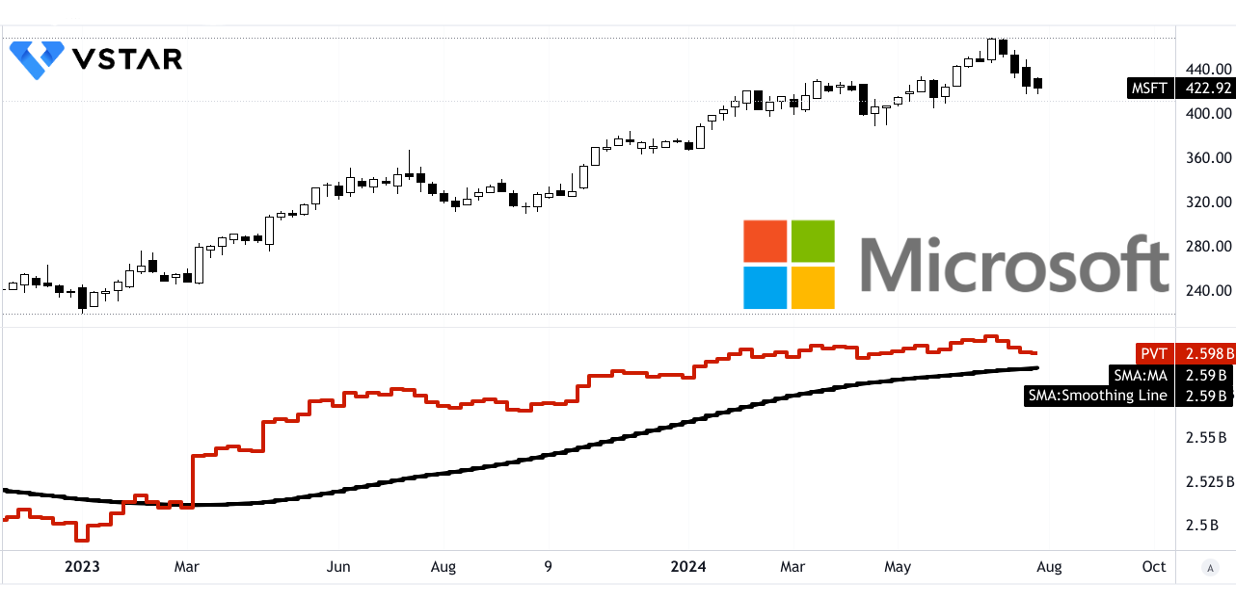

Price Volume Trend (PVT)

The PVT line is at $2.60 billion, slightly above its moving average of $2.59 billion, indicating bullish stock price volume momentum. This positive momentum is supported by a moving average of up volume at $3.83 million, outweighing the down volume moving average of -$3.33 million. The volume delta, at $0.50 million, further supports the prevailing bullish volume trend, suggesting strong investor interest and buying activity.

Source: tradingview.com

Source: tradingview.com

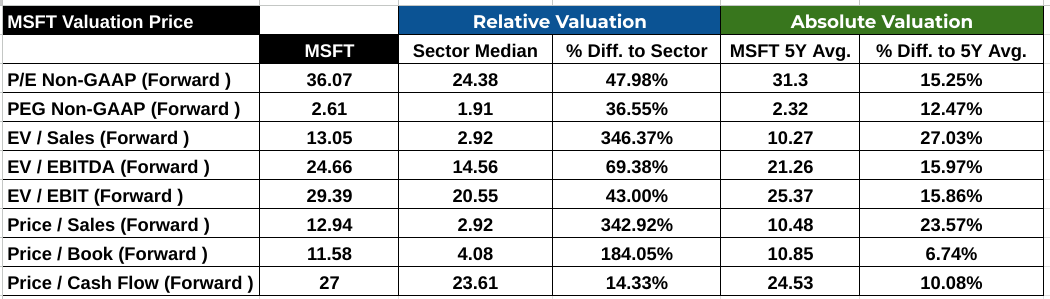

B. MSFT Stock Prediction: Fundamental Analysis

Microsoft's financial ratios suggest a robust but premium valuation. The P/E ratio (36.07) is significantly higher than the sector median (24.38) by 47.98%, indicating that investors are willing to pay more for each dollar of earnings, likely due to Microsoft's strong market position and growth potential. Compared to its 5-year average P/E of 31.3, the current ratio is 15.25% higher, showing an increased valuation over time.

The PEG ratio of 2.61, compared to the sector median of 1.91, is 36.55% higher, suggesting that Microsoft's stock is expensive relative to its growth rate. However, the increase from its 5-year average PEG of 2.32 by 12.47% indicates consistent premium growth expectations.

Source: Analyst's compilation

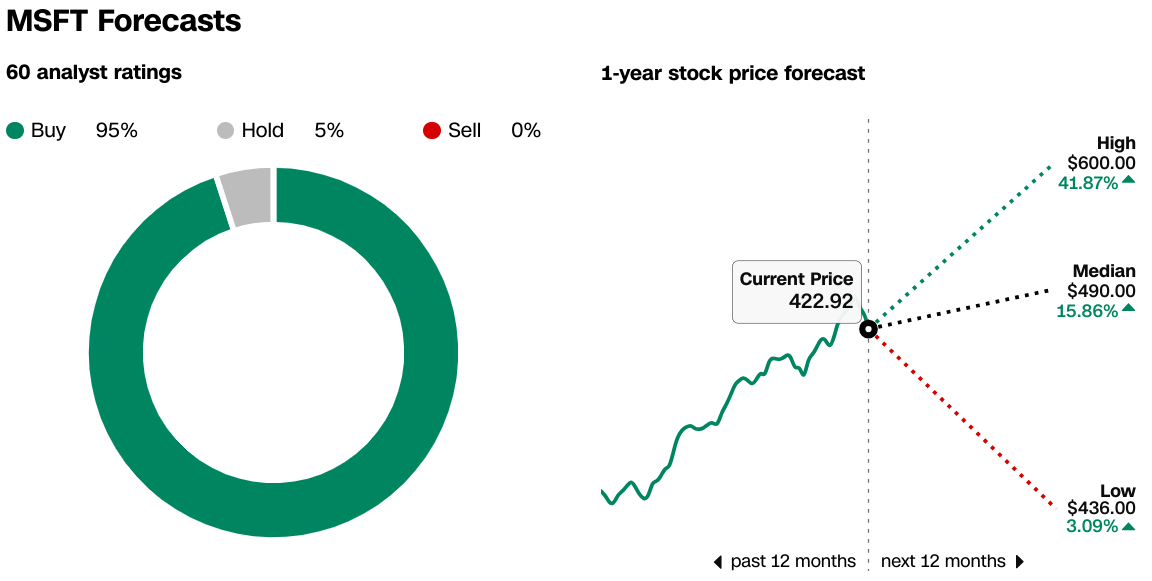

C. MSFT Forecast: Market Sentiment

Analysts have a bullish outlook on Microsoft, with 60 ratings showing 95% Buy, 5% Hold, and 0% Sell. The 1-year stock price forecast indicates a high target of $600 (41.87% upside), a median of $490 (15.86% upside), and a low of $436 (3.09% upside), with a current price of $422.92. This consensus reflects strong confidence in Microsoft's future performance, supported by its market leadership and innovation capabilities.

Source:CNN.com

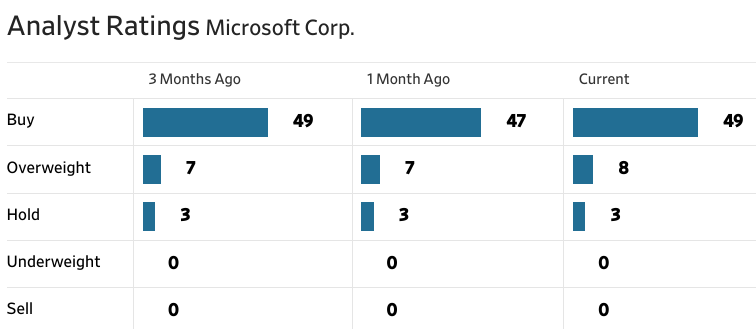

According to the WSJ, the current analyst recommendations for Microsoft include 49 Buy, 8 Overweight, 3 Hold, 0 Underweight, and 0 Sell ratings. This reinforces the positive sentiment and expectation of continued growth, with a high Microsoft target price of $600, a median of $490, and a low of $436, aligning closely with the consensus.

Source:WSJ.com

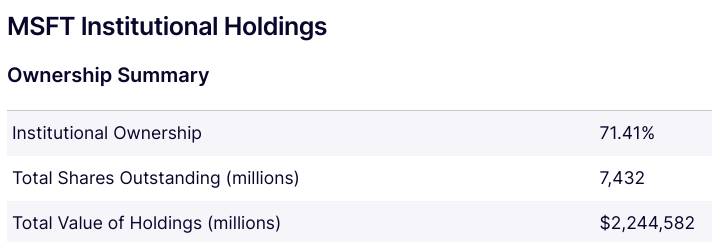

Institutional holdings in Microsoft are significant, with 71.41% ownership, amounting to $2,244,582 million in total value. This high level of institutional investment demonstrates strong confidence from large investors in Microsoft's stability and growth potential.

Source:Nasdaq.com

Microsoft's short interest stands at 61.93 million shares, representing 0.83% of total shares outstanding, with a days-to-cover ratio of 3.91. This relatively low short interest indicates a lack of bearish sentiment among investors, further highlighting positive market sentiment and confidence in Microsoft's stock performance.

Source:Benzinga.com

IV. Microsoft Stock Predictions: Challenges & Risk Factors

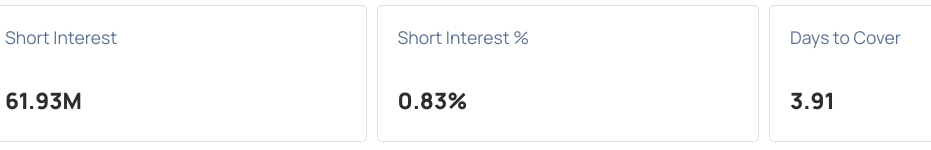

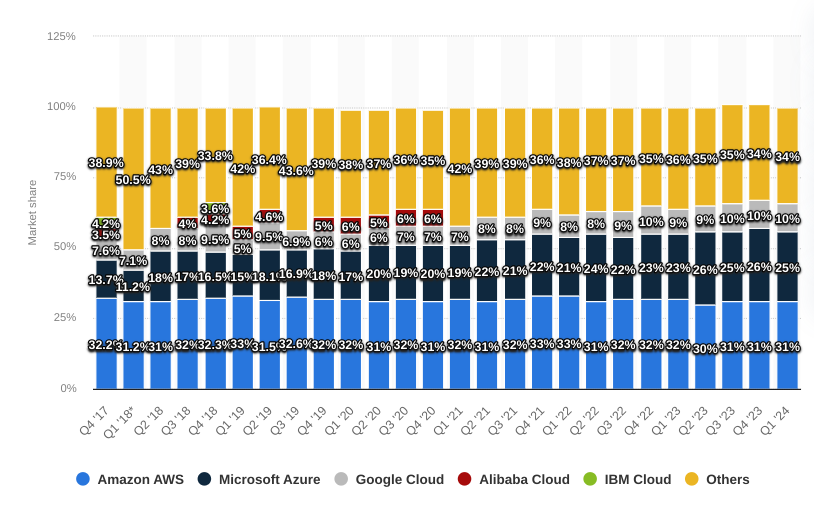

Microsoft (MSFT) operates in a highly competitive landscape, facing substantial challenges from several key players across its core business segments. In the cloud computing arena, Amazon Web Services (AWS) is a formidable rival, holding the largest market share and continually pushing innovation boundaries. Google Cloud Platform (GCP) also presents significant competition with its robust AI and machine learning capabilities, appealing to a wide range of enterprise customers. Similarly, the gaming sector is another battleground, with Microsoft's Xbox division contending with Sony's PlayStation and Nintendo.

[Cloud infrastructure services vendor market share worldwide]

Source: statista.com

Other Risks

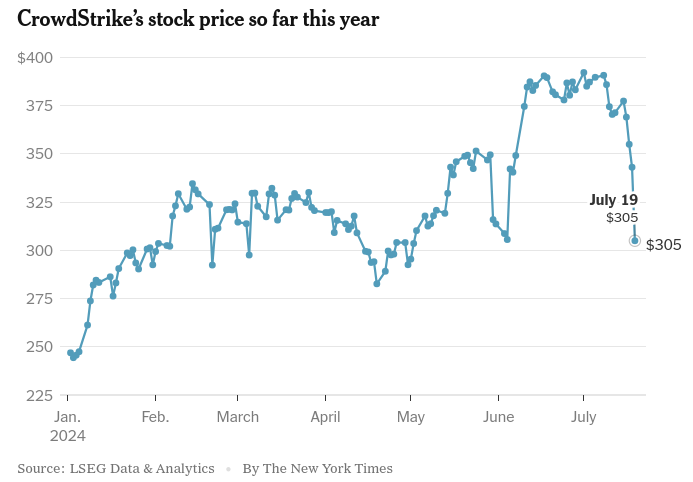

Cybersecurity threats also pose a considerable risk, given the extensive use of Microsoft's products across the globe. Any major security breach (Microsoft-CrowdStrike Error) could damage its reputation and customer trust. Lastly, geopolitical tensions and global economic fluctuations can affect Microsoft's international business operations and overall financial performance.

Source: NYtimes.com

In conclusion, Microsoft (MSFT) demonstrates strong financial health with Q2 2024 solid revenue and net income. The growth, driven by growth in Azure, Office 365, and gaming segments. Microsoft's outlook is optimistic, supported by strategic investments in AI, cloud computing, and gaming, with analysts predicting continued revenue and earnings growth. For investors interested in trading MSFT stock CFDs, the VSTAR trading app, regulated by ASIC, offers a secure platform for CFD trading on a wide range of assets, including Microsoft stock.