- Marvell's Q1 2024 (Q1 fiscal 2025) performance revealed a decline in net revenue, driven by robust demand in data centers but offset by declines in other segments.

- MRVL stock demonstrated modest performance, slightly outperforming NASDAQ-100 but lagging behind S&P 500.

- Growth opportunities lie in data center, AI, and strategic initiatives like acquisitions and R&D investments.

- MRVL stock price prediction (technical) varies from $53 to $124, with market sentiment generally positive.

- Marvell faces competition from major players like Broadcom, Intel, and Nvidia, while its performance is sensitive to market saturation and cyclicality.

I. Marvell Q1 2024 Performance Analysis

A. Key Segments Performance

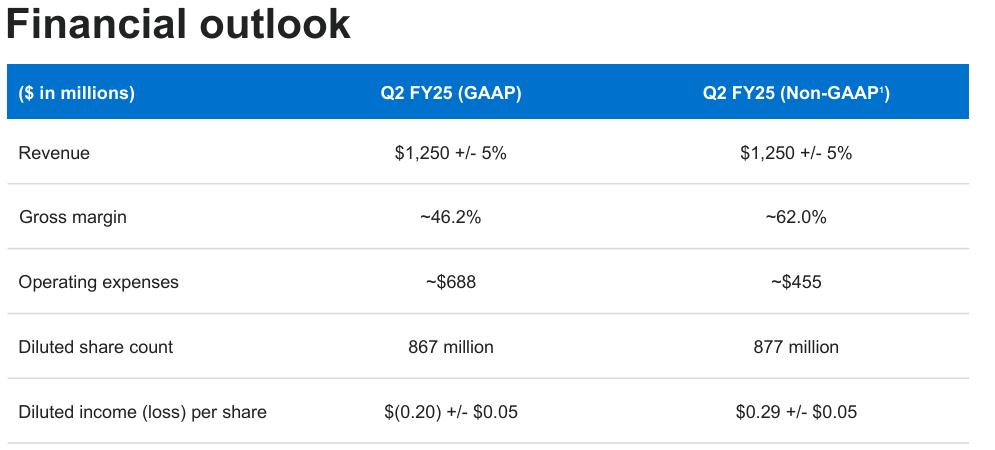

Financial Highlights:

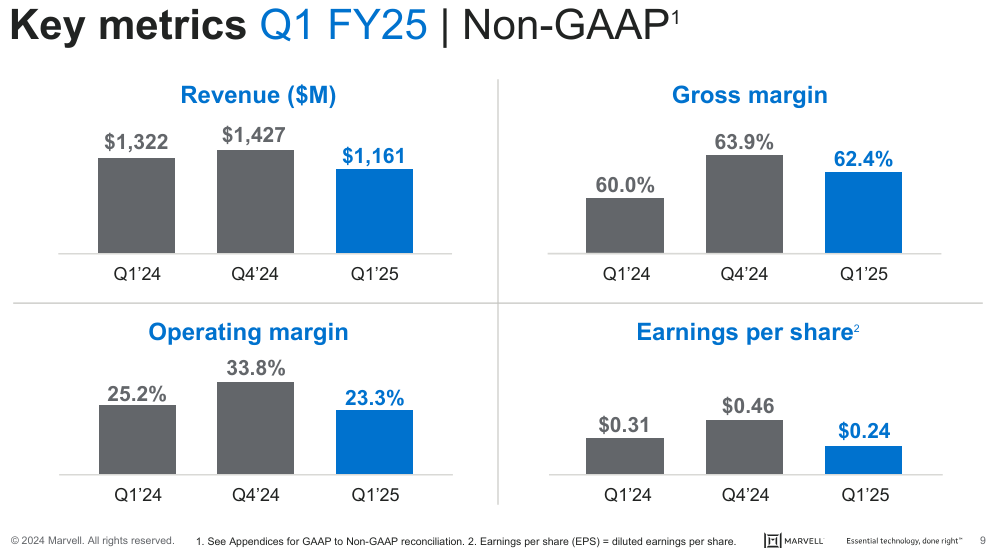

Marvell Technology, Inc. reported a mixed performance in Q1 2024, with a notable 12% year-over-year decline in net revenue, reaching $1.161 billion. Despite this drop, revenue surpassed the midpoint of the company's guidance by $11 million, driven primarily by robust demand in the data center sector. GAAP gross margin stood at 45.5%, while the non-GAAP gross margin was significantly higher at 62.4%. The company posted a GAAP net loss of $215.6 million, or $(0.25) per diluted share, contrasted by a non-GAAP net income of $206.7 million, or $0.24 per diluted share. Operational cash flow was robust at $324.5 million, indicating strong internal cash generation capabilities despite the losses.

Source: Q1_FY2025_Financial_Business_Results

Operational Performance:

Marvell's data center segment was a standout, generating $816 million in revenue and accounting for 70% of the total revenue. This represented an 87% year-over-year increase, largely due to heightened demand from cloud AI applications. The enterprise networking and carrier infrastructure segments, however, faced declines, reflecting a broader industry inventory correction and subdued demand, with revenues of $153 million and $72 million respectively. The consumer segment experienced a dramatic 70% year-over-year drop, primarily due to the end of a significant program in the prior quarter and adjustments in the gaming console market. The automotive and industrial sector also saw a 13% year-over-year decline, with revenue hitting $78 million.

Technological Advancements and Innovations:

Marvell's technological prowess is underscored by its continued innovation in data center solutions. The company's introduction of 100 gig per lane, 800 gig PAM products, and the development of 200 gig per lane, 1.6T solutions for AI deployments demonstrate its leadership in high-speed connectivity. Furthermore, Marvell's launch of PCIe Gen 6 retimers, designed to enhance data flow within AI server systems, highlights its commitment to staying at the forefront of technology.

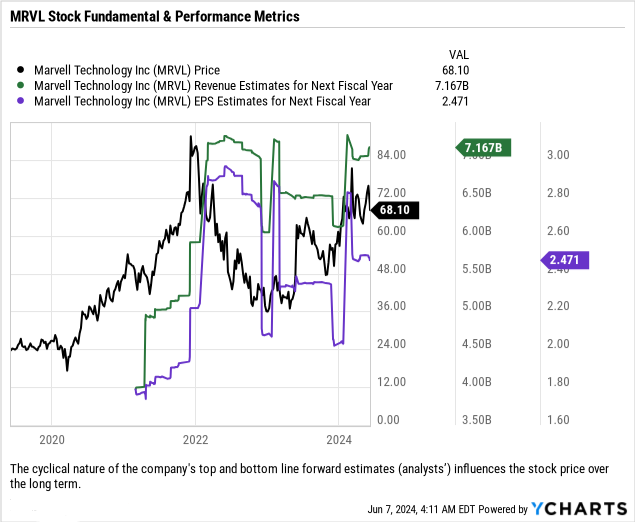

Source: Ycharts.com

Overall, the cyclical nature of the company's top and bottom line forward estimates (analysts') influences the stock price over the long term.

B. MRVL Stock Price Performance

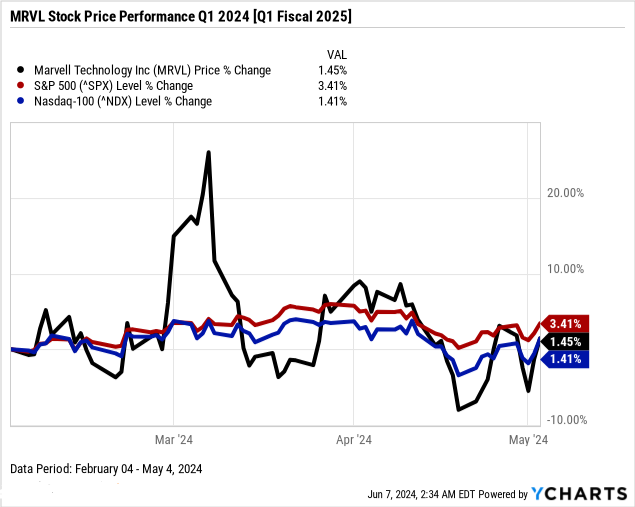

Marvell Technology (NASDAQ: MRVL), with a market cap of $59 billion, showed a modest stock price performance in the latest quarter. The stock opened at $67.68 and closed at $68.51, marking a 1.45% price return. Throughout the quarter, MRVL experienced significant volatility, with highs of $85.76 and lows of $61.72. Despite this fluctuation, the overall quarterly performance was relatively stable. When compared to major stock indices, Marvell's performance was slightly above the NASDAQ's 1.41% price return but notably below the S&P 500's 3.41% return. This indicates that while Marvell managed to outperform the tech-heavy NASDAQ index marginally, it lagged behind the broader market represented by the S&P 500 during its Q1 fiscal 2025.

Source: Ycharts.com

II. Marvell Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

Marvell Technology (NASDAQ: MRVL) is poised for significant growth across several key segments, particularly within the data center and AI sectors.

Data Center and AI: Marvell's electro-optics portfolio, including products like PAM, DSPs, TIAs, drivers, and ZR data center interconnects, is central to growth in 2024. The outlook for Q2 and beyond suggests continued mid-single-digit sequential growth, fueled by the ramping of custom AI silicon and advancements in interconnect solutions such as 100G/200G PAM products and 400G/800G ZR solutions. The data center total addressable market (TAM) is expected to grow from $21 billion in 2023 to $75 billion by 2028, highlighting a substantial growth opportunity for Marvell.

Enterprise Networking and Carrier Infrastructure: Enterprise networking and carrier revenue are projected to be flat sequentially in Q2 but are expected to recover in the second half of FY25 as inventory levels normalize and new product transitions, such as the 5nm OCTEON 10 DPUs, take effect. The long-term growth in the 5G market further enhances Marvell's prospects in these segments.

Automotive and Industrial: Marvell's strategic relationships with major automotive OEMs, such as the partnership with General Motors, position the company well for future growth. The introduction of new model year 2025 vehicles towards the end of the calendar year is expected to drive revenue growth in the latter half of FY25.

Source: Q1_FY2025_Financial_Business_Results

B. Expansions and strategic initiatives

Marvell has undertaken several strategic initiatives to bolster its market position and drive growth across its core segments.

Mergers and Acquisitions: Marvell's acquisition of Cavium and Avera has been instrumental in enhancing its custom compute capabilities. These acquisitions have provided Marvell with decades of expertise in compute and custom silicon, enabling the company to develop and ramp multiple custom AI compute programs. This strategic move is expected to significantly contribute to Marvell's revenue, with the custom AI compute market projected to grow from $7 billion in 2023 to over $40 billion by 2028.

Research and Development Investments: Marvell continues to invest heavily in R&D to stay ahead in the competitive semiconductor market. The development of next-generation products such as 200G PAM, 1.6T solutions, PCIe Gen 6 retimers, and 51.2T switches underscores Marvell's commitment to innovation. These advanced products are designed to meet the growing demands of AI, cloud, and data center applications, ensuring that Marvell remains at the forefront of technological advancements.

Partnerships and Collaborations: Collaborations with leading cloud providers and industry partners are central to Marvell's strategy. The company has secured design wins with multiple Tier 1 cloud customers for its PAM DSPs and PCIe Gen 6 retimers. Additionally, Marvell's strong relationships with automotive OEMs and its recognition by General Motors as a key supplier highlight the importance of strategic partnerships in driving growth and market penetration.

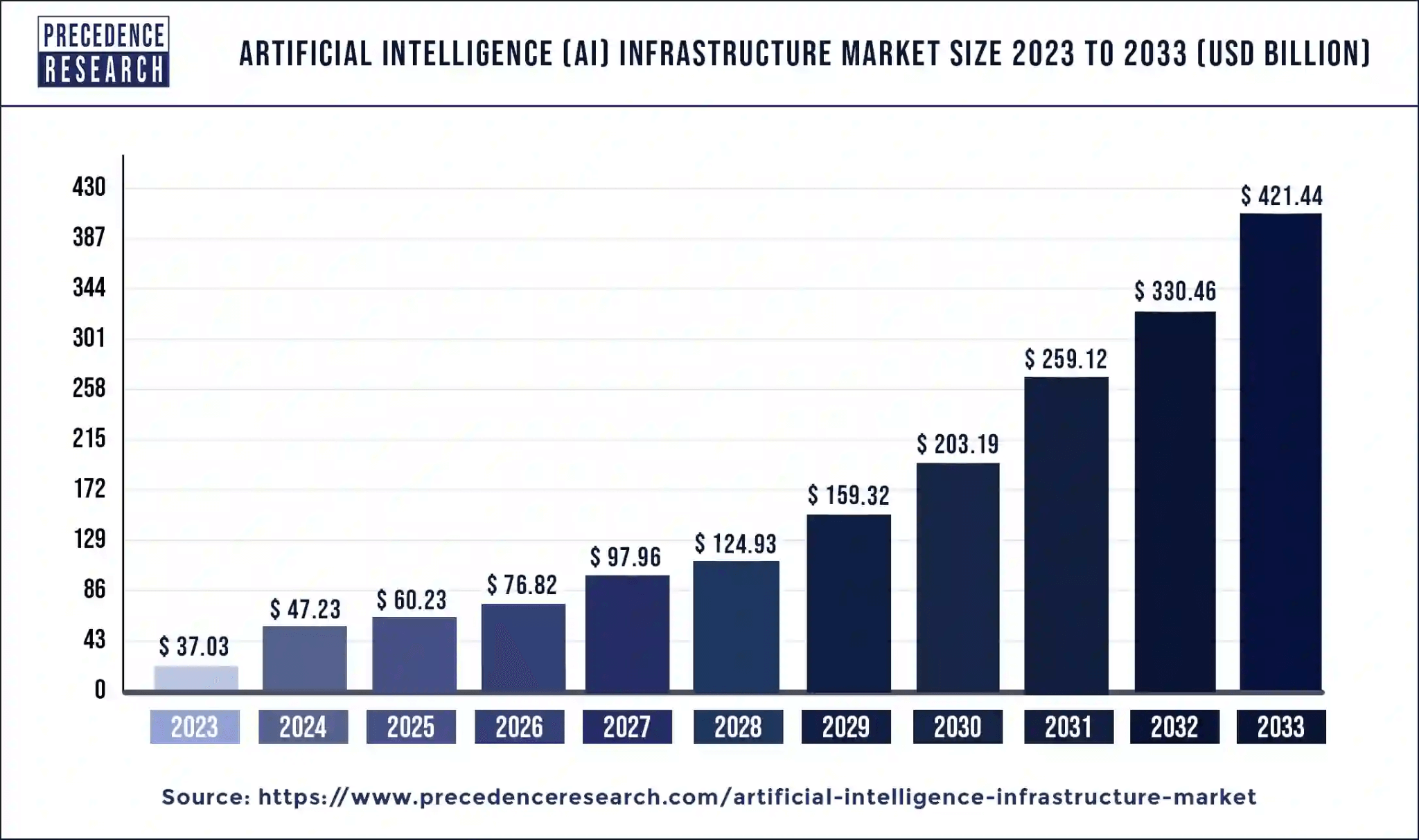

As per precedenceresearch.com, the global AI infrastructure market may grow at a 27.53% CAGR (2024 to 2033) that will benefit Marvell's long-term top-line growth.

Source: precedenceresearch.com

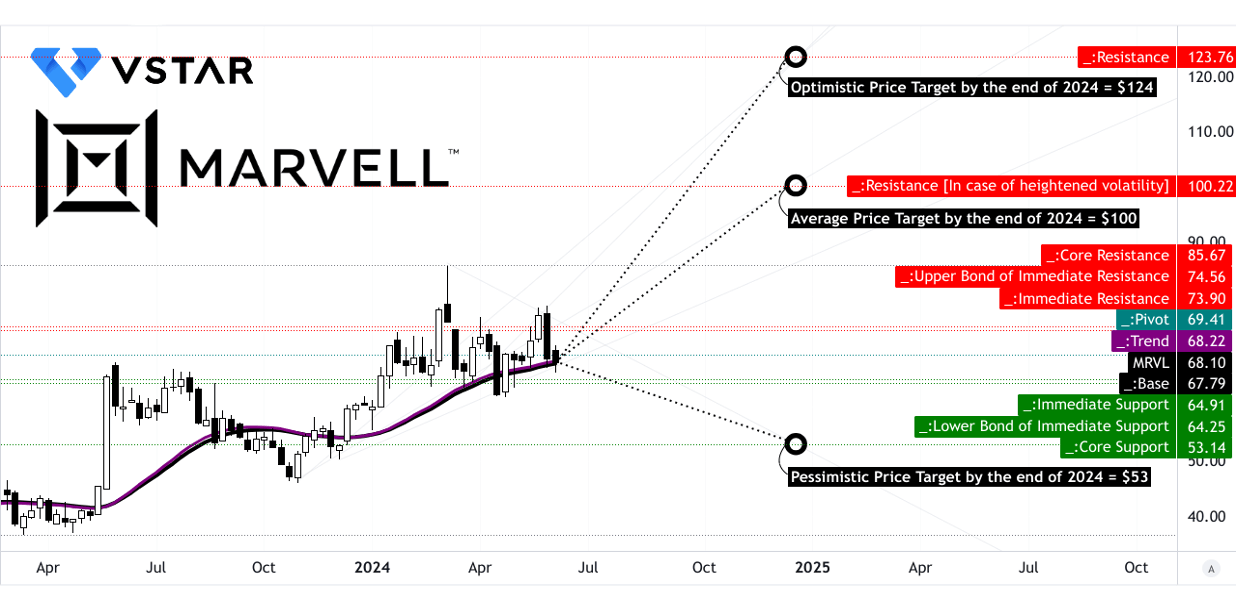

III. MRVL Stock Forecast 2024

A. MRVL Stock Price Prediction: Technical Analysis

Marvell's current stock price stands at $68.10, with a slight deviation from the trendline and baseline figures of $68.22 and $67.79, respectively, indicating a sideways movement.

Looking ahead, the average MRVL price target by the end of 2024 is projected at $100. This estimation is based on momentum changes and is derived from Fibonacci retracement/extension levels, signifying a potential upward trajectory. However, a more optimistic outlook places the price at $124, reflecting the current upward momentum extended over the mid-to-short term. Conversely, a pessimistic scenario anticipates a price of $53, driven by downward momentum over 2024.

Source: tradingview.com

The primary resistance is noted at $74.56, with a pivotal point of $69.41 and core resistance at $85.67. Should volatility increase, resistance could climb to $100.22. Conversely, support levels stand at $64.25 and $53.14, with heightened volatility potentially impacting support.

Source: tradingview.com

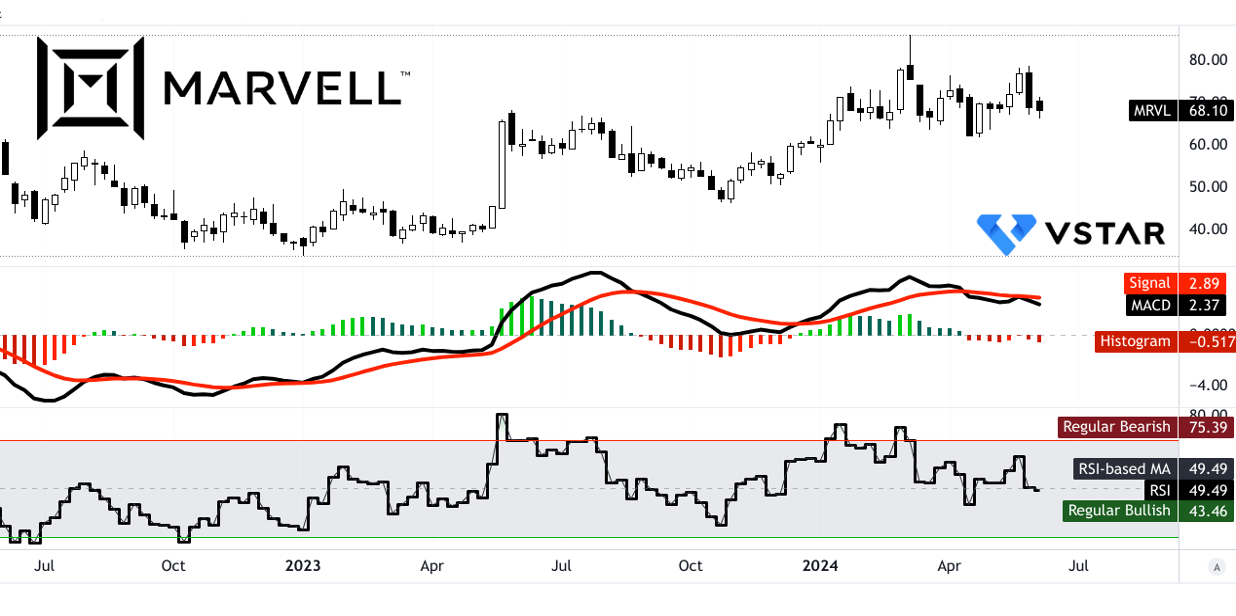

The Relative Strength Index (RSI) currently sits at 49.49, indicating a neutral stance for MRVL stock, with the trend pointing downwards. Similarly, the Moving Average Convergence/Divergence (MACD) signifies that trend is bearish for Marvell's Stock, albeit with increasing strength.

B. Marvell Technology Stock Forecast: Fundamental Analysis

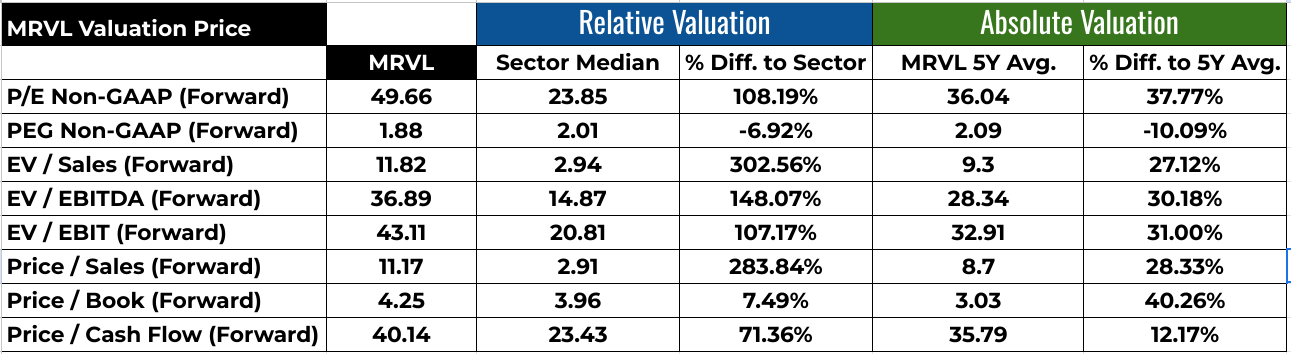

Marvell Technology (NASDAQ) shows mixed signals based on its financial ratios. The P/E ratio (Non-GAAP, Forward) is 49.66, significantly higher than the sector median of 23.85 and its 5-year average of 36.04, indicating a high valuation and potentially inflated expectations for future earnings. The PEG ratio (Non-GAAP, Forward) of 1.88, however, is below the sector median of 2.01 and its 5-year average of 2.09, suggesting that the high P/E ratio might be justified by future growth prospects. Other metrics like EV/Sales, EV/EBITDA, and EV/EBIT are substantially above the sector medians, indicating premium pricing, but these values also exceed MRVL's historical averages, hinting at possible overvaluation.

Source: Analyst's compilation

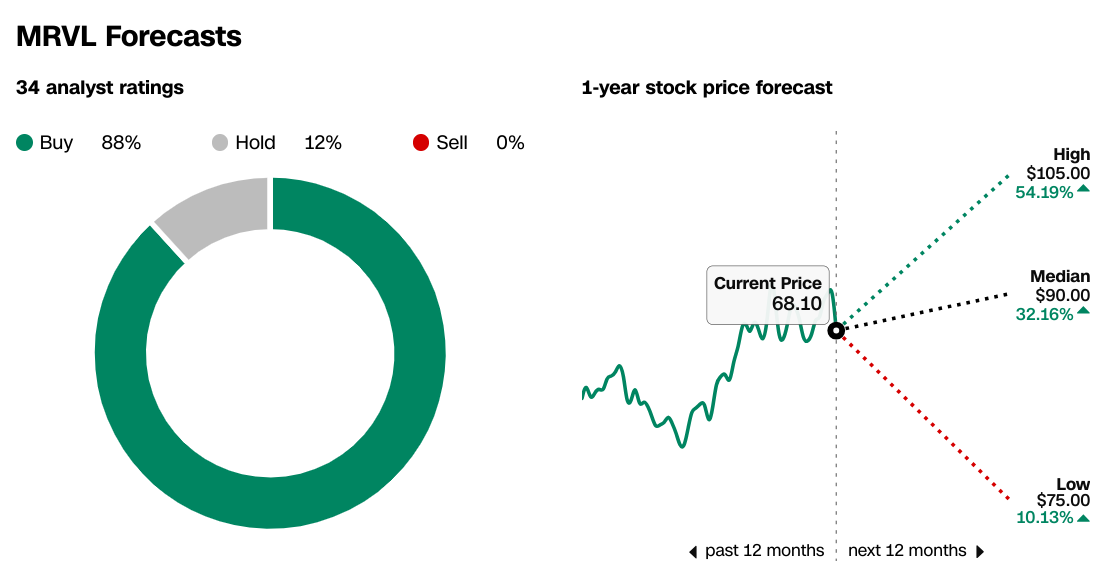

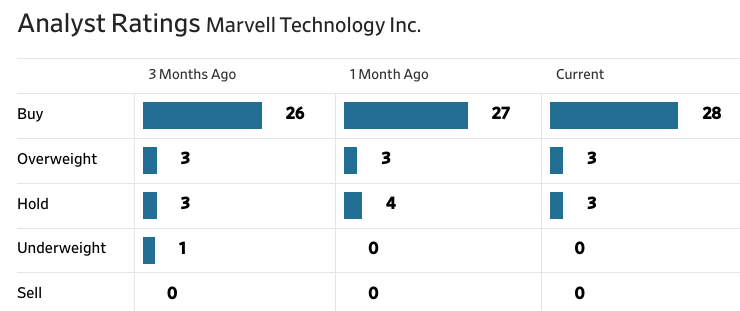

C. MRVL Forecast: Market Sentiment

The market sentiment for MRVL is generally positive. Analyst recommendations from both CNN.com and WSJ.com show a strong consensus towards "Buy" with 88% and a steady increase in "Buy" ratings over the past three months. The 1-year stock price forecast suggests a high Marvell price target of $105.00 (54.19% increase), a median of $90.00 (32.16% increase), and a low MRVL stock price target of $75.00 (10.13% increase) from the current price of $68.10.

Source: CNN.com

Source: WSJ.com

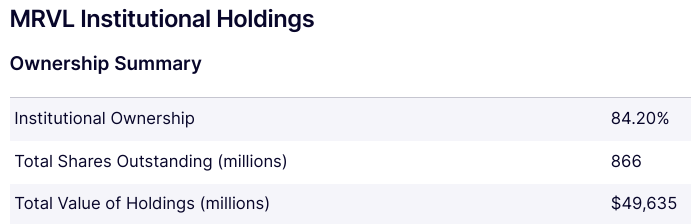

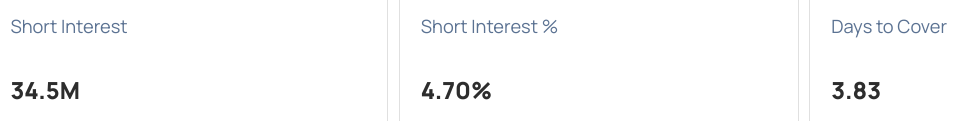

This optimism is supported by significant institutional ownership at 84.20%, indicating strong confidence from large investors. However, the short interest of 4.70% and 34.5 million shares suggests some skepticism about MRVL's near-term performance, although the days to cover ratio of 3.83 indicates manageable short pressure.

Source: nasdaq.com

Source: Benzinga.com

IV. Marvell Stock Forecast: Challenges & Risk Factors

Marvell Technology faces significant competition in the semiconductor industry, particularly from major players such as Broadcom, Intel, and Nvidia. Broadcom is a formidable competitor in the networking and broadband sectors, offering a broad portfolio of similar data infrastructure products. Intel, with its robust data center and networking solutions, competes fiercely in areas overlapping Marvell's offerings. Nvidia, a leader in AI and GPU technology, poses a significant threat with its advanced AI computing solutions, directly competing with Marvell's AI silicon initiatives.

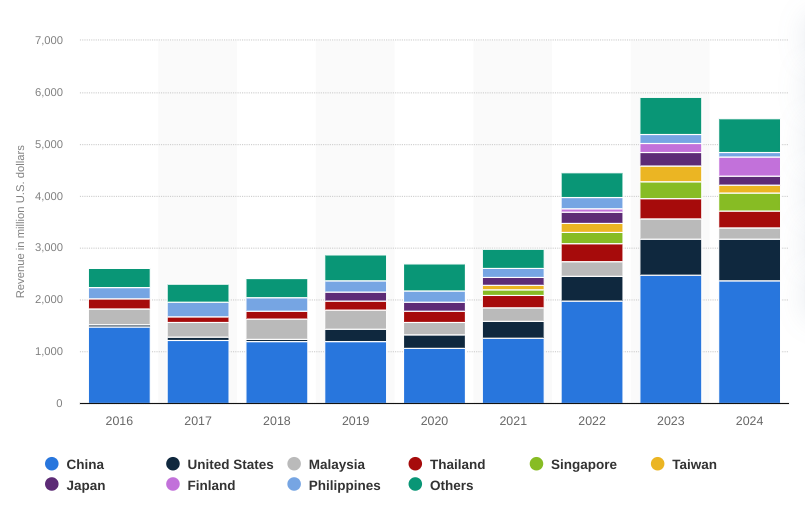

Moreover, the cyclical nature of markets like storage, enterprise networking, and wireless carriers adds complexity, requiring Marvell to identify and capitalize on product-specific drivers beyond mere cyclical recoveries. Also, the increasing topline from China extends the company sensitivity against US-China-Taiwan geopolitical shifts.

[Marvell Technology revenue worldwide from FY 2016 to FY 2024, by country(in million U.S. dollars)]

Source: statista.com

In conclusion, Marvell's Q1 2024 performance showcased a decline in net revenue amidst mixed segment results. While data centers flourished, other sectors faced challenges. MRVL stock exhibited modest performance, slightly surpassing NASDAQ but trailing S&P 500. Growth prospects in data centers and AI are promising, backed by strategic acquisitions and R&D investments. Stock forecasts range from $53 to $124, with positive sentiment tempered by short-term skepticism. CFD trading on MRVL stock via VSTAR trading app offers opportunities to have institutional level trading experience with 0 commission, solid tight spreads, and liquidity.