- Marathon Digital's Q1 2024 saw impressive revenue growth driven by Bitcoin price increases. Its net income soared reflecting bullish Bitcoin trends.

- Marathon aims to reach a hash rate of 50 EH/s by 2025, focusing on mining efficiency, diversification into AI, and strategic expansions.

- Technical outlook of MARA stock is bullish, while short interest is high.

- Marathon faces fierce competition, Bitcoin price volatility, and increased production costs post-halving.

I. Marathon Digital Q1 2024 Performance Analysis

A. Marathon Digital Key Segments Performance

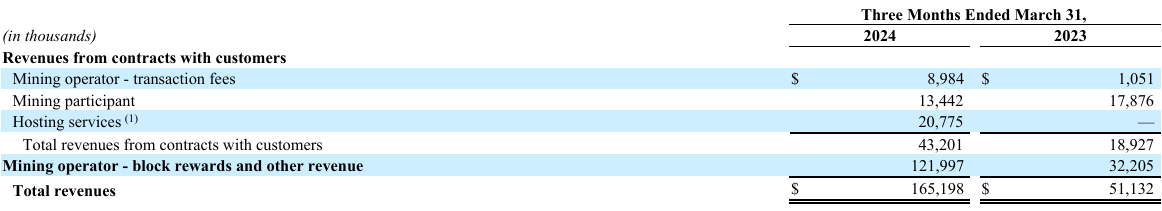

Financial Highlights:

Marathon's financial performance in Q1 2024 showcased remarkable growth across key metrics. Revenue surged by an impressive 223% year-over-year, reaching $165.2 million, driven primarily by the substantial increase in the average price of Bitcoin mined and enhanced production capabilities. The company's net income soared by 184% to $337.2 million, reflecting the favorable mark-to-market adjustment of digital assets and the overall bullish trend in the Bitcoin market. Adjusted EBITDA witnessed a staggering 266% increase, reaching $528.8 million, underlining Marathon's ability to capitalize on the positive momentum in Bitcoin prices.

Source: SEC 10-Q Q1 2024

Despite these record-breaking financial results, there are notable challenges and considerations. Operational issues, such as unexpected equipment failures and weather-related curtailments, negatively impacted Bitcoin production and revenues during the quarter. Additionally, hosting and energy costs escalated due to the expansion of the mining fleet, which could affect profitability in the long run. However, Marathon's strategic approach of systematically deploying capital for accretive growth and its dollar-cost averaging strategy for Bitcoin acquisitions have proven effective in generating substantial gains and bolstering the company's financial position.

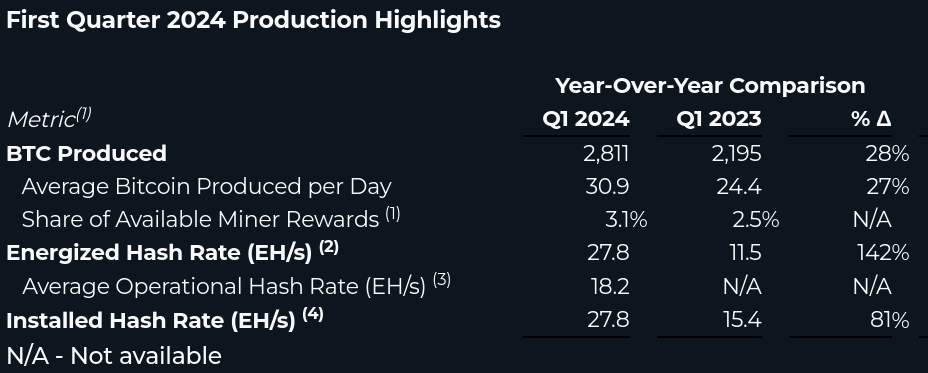

Operational Performance:

Marathon's operational performance in Q1 2024 demonstrated significant advancements and strategic initiatives aimed at enhancing its competitive edge and market positioning. The company achieved notable milestones, including doubling the size of its portfolio of digital asset compute through strategic acquisitions and increasing its energized hash rate to 27.8 EH/s, representing a remarkable 142% year-over-year growth. Moreover, Marathon introduced innovative products and services, such as Anduro, Slipstream, MARA Firmware, and 2PIC immersion technology, to support the Bitcoin ecosystem and diversify revenue streams.

Source: ir.mara.com

Technological Advancements and Innovations:

Marathon's focus on technological advancements and innovations is evident in its efforts to develop proprietary hardware, software, and services aimed at maximizing energy efficiency and performance. The introduction of Slipstream, MARA Firmware, and 2PIC immersion technology underscores the company's commitment to driving innovation and enhancing operational capabilities.

B. MARA Stock Price Performance

Marathon Digital (NASDAQ:MARA) experienced a challenging Q1 2024, with its stock price declining by 15% to hit a market capitalization of $6.5 billion, closing at $22.56 per share from an opening of $26.63. This performance stands in stark contrast to the broader market indices, with the S&P 500 and NASDAQ achieving price returns of 11% and 10%, respectively. The stock's volatility was evident, reaching a high of $34.09 and a low of $14.62 during the quarter.

Source: tradingview.com

II. Marathon Digital Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with growth potential

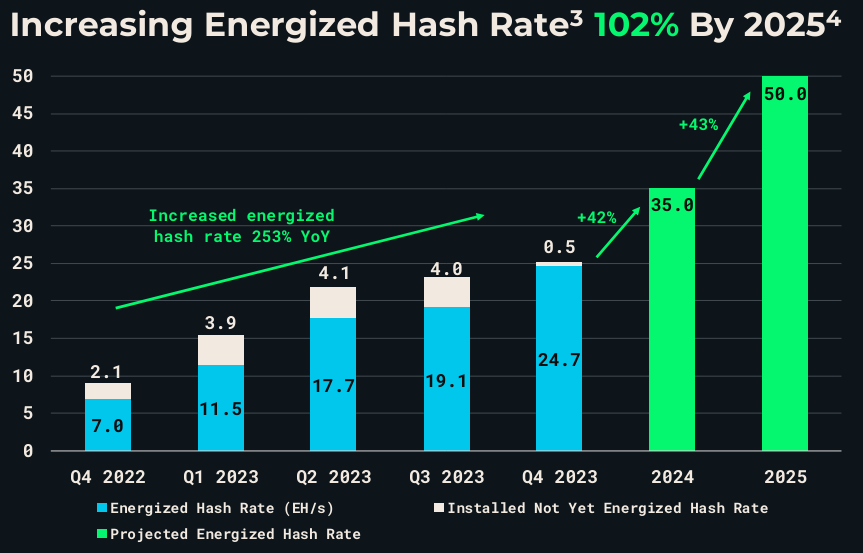

Utility-Scale Mining Operations: Marathon's primary business of Bitcoin mining continues to be a core growth segment. The company aims to reach a hash rate of 50 EH/s by the end of 2025, up from 28.7 EH/s as of February 2024. This significant increase in computing power will enhance their ability to mine more Bitcoin, especially valuable post-halving when rewards per block are reduced.

Source: Investor Presentation

Bitcoin Mining Efficiency and Scale: Marathon Digital's strategy revolves around achieving lower operational costs through the acquisition and deployment of more efficient mining rigs. The halving of Bitcoin rewards necessitates such efficiency improvements. By focusing on owning a larger share of their hosting sites, Marathon aims to reduce costs by up to 20% and improve mining efficiency by 10-15% by deploying next-generation rigs. This emphasis on cost-effective scaling positions Marathon to maintain profitability even when block rewards decrease.

Diversification into AI and High-Performance Computing: Like other forward-thinking miners, Marathon may explore opportunities beyond Bitcoin mining. The integration of AI and high-performance computing (HPC) offers a lucrative diversification avenue. As demand for AI infrastructure grows, mining companies with adaptable data centers can capitalize on this trend.

B. Expansions and strategic initiatives

Mergers and Acquisitions: Marathon has been actively acquiring new sites to boost its power capacity and expand its operational footprint. For instance, the acquisition of two data centers from Generate Capital added 390 MW of power capacity, with Marathon controlling 64 MW immediately and the potential to add another 310 MW. This acquisition lowered Marathon's direct cost per Bitcoin by over 30% and significantly increased their operational scale.

Similarly, the planned acquisition of a 200 MW, wind-powered site from Applied Digital will further enhance Marathon's capacity. This site, primarily powered by renewable energy, is expected to reduce Marathon's cost per Bitcoin by approximately 20%.

Research and Development Investments: Marathon's investment in proprietary technologies, such as the MARA Firmware and 2-Phase Immersion Cooling (2PIC), demonstrates their commitment to R&D. These technologies enhance miner efficiency and performance, reduce downtime, and lower maintenance costs. The successful integration and commercialization of these technologies are expected to generate significant revenues and improve operational metrics.

Partnerships and Collaborations: Strategic collaborations play a crucial role in Marathon's growth strategy. The launch of Slipstream, a direct Bitcoin transaction submission service, exemplifies this approach. This service leverages Marathon's mining pool to streamline complex Bitcoin transactions, increasing transaction fee revenues. The MARA Pool's ability to capture higher transaction fees further underscores the benefits of operating a proprietary mining pool.

International Expansion: Marathon is also focusing on international growth, appointing a new Managing Director for expansion in regions like Europe, the Middle East, Africa, and parts of Asia. This strategic move aims to capitalize on global opportunities and diversify Marathon's revenue streams. The goal is for 50% of revenues to come from overseas operations by 2028, leveraging regional opportunities and reducing dependence on the North American market.

III. MARA Stock Price Prediction 2024

A. MARA Stock Forecast: Technical Analysis

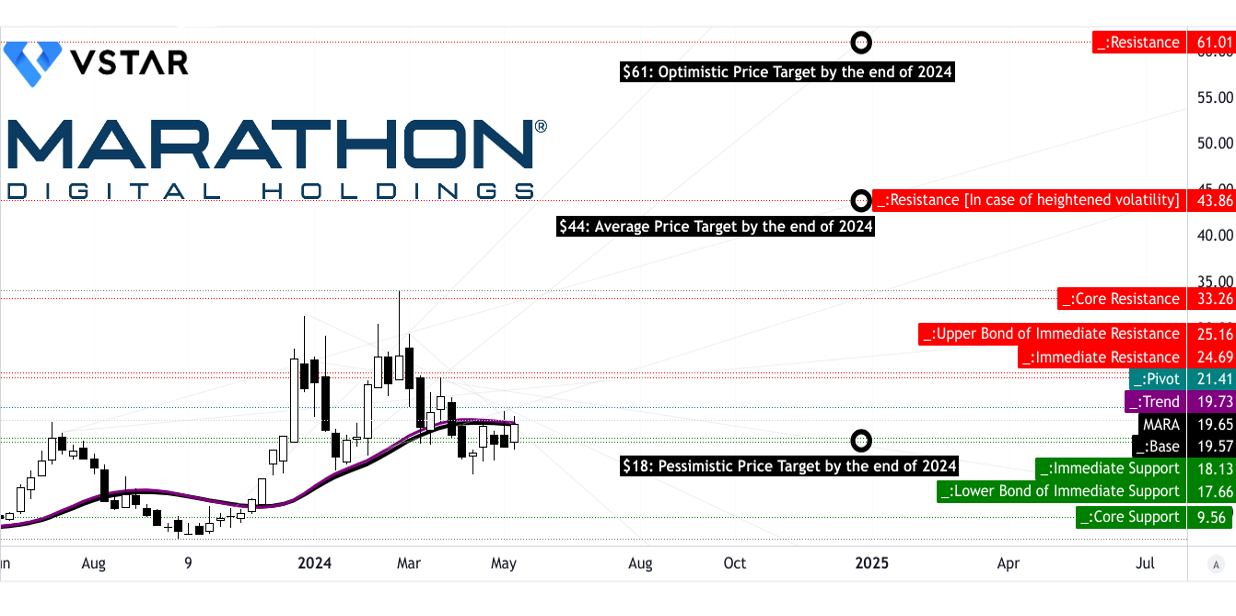

The average MARA price target by the end of 2024 is estimated at $44.00, with an optimistic projection of $61.00 and a pessimistic projection of $18.00. These projections are based on the momentum of change-in-polarity over mid- to short-term, projected over Fibonacci retracement/extension levels. The optimistic target reflects an upward price momentum, while the pessimistic target considers downward momentum, indicating potential volatility and uncertainty in the stock's future trajectory.

MARA's current stock price stands at $19.65, with a sideways trend indicated by the modified exponential moving average trendline and baseline, both hovering around this figure. This suggests a lack of significant directional bias in the short term. The primary support level is identified at $18.13, with the pivot of the current horizontal price channel at $21.41. Core resistance is noted at $33.26, with a higher resistance level of $43.86 in case of heightened volatility. These levels offer crucial reference points for investors to gauge potential entry and exit positions.

Source: tradingview.com

Moreover, the Relative Strength Index (RSI) at 51.6 suggests a neutral stance, neither overbought nor oversold. However, the upward trend in the RSI line indicates strengthening buying pressure. However there is a lack of divergence. Conversely, the Moving Average Convergence/Divergence (MACD) indicator portrays a bearish trend, with the MACD line below the signal line and a negative histogram, albeit stabilized. This suggests a prevailing bearish sentiment in the market.

Source: tradingview.com

B. MARA Price Prediction: Fundamental Analysis

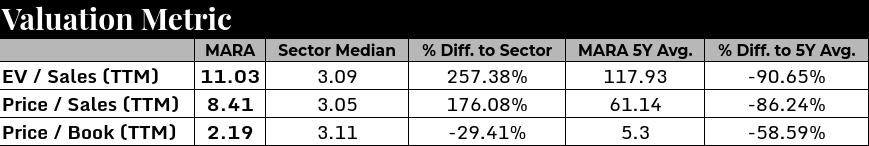

Firstly, the EV/Sales ratio stands at 11.03, marking a significant 257.38% difference from the sector median and a staggering -90.65% deviation from its own five-year average. This suggests a potential overvaluation compared to industry peers and massive undervaluation against its historical performance.

Similarly, the Price/Sales ratio of 8.41 indicates a 176.08% deviation from the sector median and an -86.24% variance from the company's five-year average. This emphasizes a considerable premium in the market price relative to sales in relative terms. But in absolute terms the stock is dramatically undervalued. However, the Price/Book ratio of 2.19 shows a -29.41% difference from the sector median and a -58.59% variance from the five-year average, possibly indicating a high undervaluation against the assets.

Source: Analyst's compilation

C. MARA Stock Predictions: Market Sentiment

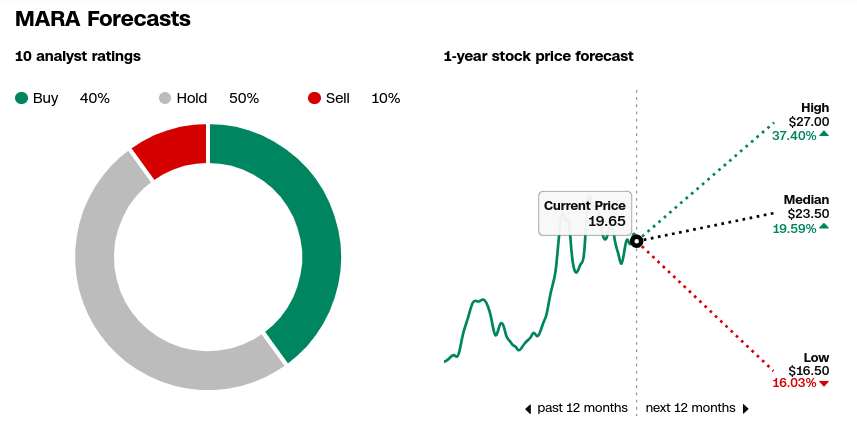

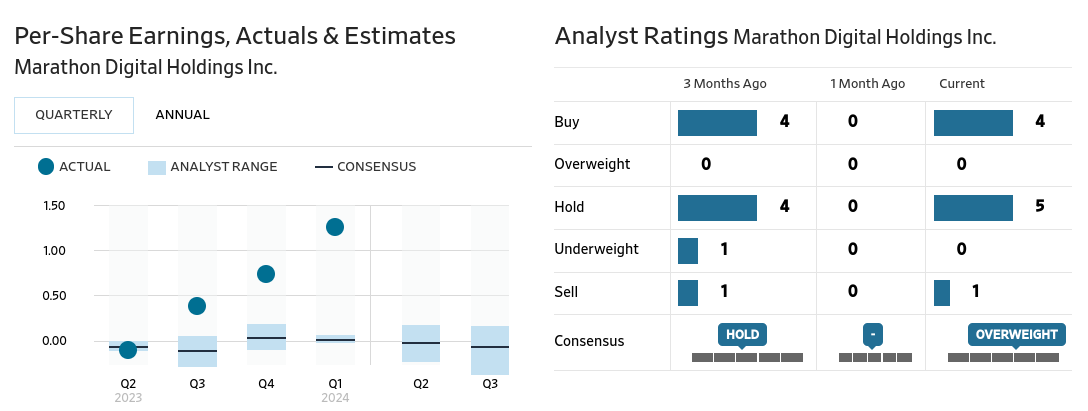

According to CNN.com, 40% of analysts rate MARA as a Buy, 50% as Hold, and 10% as Sell. Median price forecasts for the next 12 months range from $16.50 to $27.00, indicating varied opinions on its future performance. Analyst ratings from WSJ.com show similar sentiments, with a mix of high Buy, high Hold, and low Sell recommendations.

Source: cnn.com

Source: wsj.com

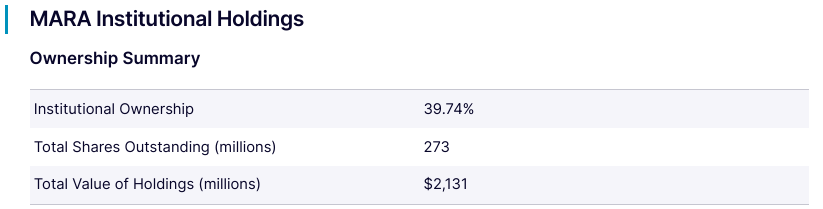

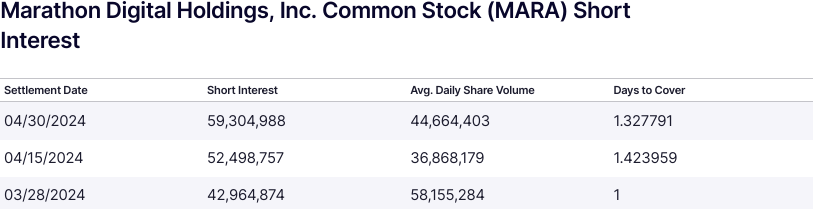

Institutional holdings, currently at 39.74%, demonstrate relatively low lead of large investors on the stock. However, the significant short interest of 24% (and increasing) suggests a high bearish sentiment, indicating a considerable fraction of the market is betting against the stock.

Source: nasdaq.com

Source: nasdaq.com

IV. MARA Stock Forecast 2024: Challenges & Risk Factors

Marathon Digital faces intense competition in the Bitcoin mining industry, notably from CleanSpark (CLSK) and Riot Platforms (RIOT). CleanSpark, with a current hashrate of 17.3 EH/s and a total fleet efficiency of 24.22 J/TH, mined 721 bitcoins in April 2024. Riot Platforms, despite a downturn, holds a significant 8.8 EH/s average operating hash rate and substantial Bitcoin reserves (8,872 BTCs). This competitive landscape forces Marathon to continually enhance its operational efficiency and scale to maintain its market position.

Marathon's profitability is closely tied to Bitcoin prices, which are highly volatile. In fiscal 2023, Bitcoin prices fluctuated between approximately $16,600 and $42,300. This volatility affects Marathon's ability to forecast growth and revenue, potentially leading to financial instability during price downturns.

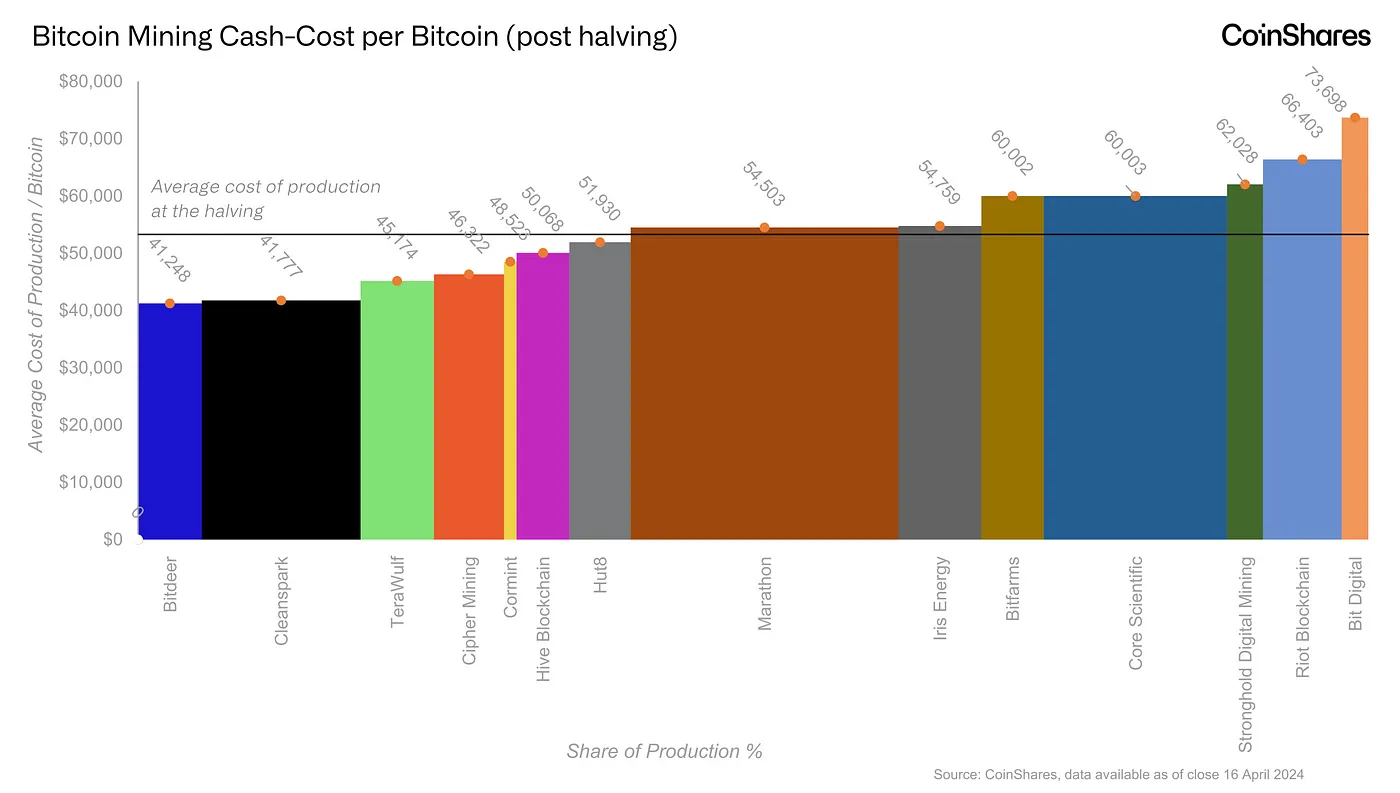

The Bitcoin halving event, which occurred in 2024, significantly reduces mining rewards by 50%, thereby increasing the cost of Bitcoin production. Marathon must optimize its energy costs and mining efficiency to remain competitive. The post-halving production cost is projected to rise to approximately $53,000 per Bitcoin.

Source: blog.coinshares.com

In conclusion, Marathon Digital's Q1 2024 performance showcased remarkable growth in revenue, net income, and adjusted EBITDA driven by the surge in Bitcoin prices, despite operational challenges. MARA stock experienced volatility. Growth opportunities lie in scaling mining operations, improving efficiency, and diversification into AI and high-performance computing. However, challenges include intense competition, Bitcoin price volatility, and post-halving production costs. Marathon Digital stock is a buy. Explore trading opportunities with VSTAR for diversified investment options, with institutional level, super fast order execution and low-cost trading experiences.