- Alphabet's Q2 2024 saw a 14% revenue increase and a 26% rise in operating income.

- Google Cloud surpassed $10 billion in quarterly revenues, reflecting strong growth.

- Alphabet stock price surged 20.81% this quarter, significantly outperforming major indices and holding a positive technical outlook.

- Future growth is driven by advancements in AI, cloud computing, and YouTube.

- Key risks include competition from Microsoft and Amazon, regulatory pressures, and economic downturns.

I. Alphabet Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

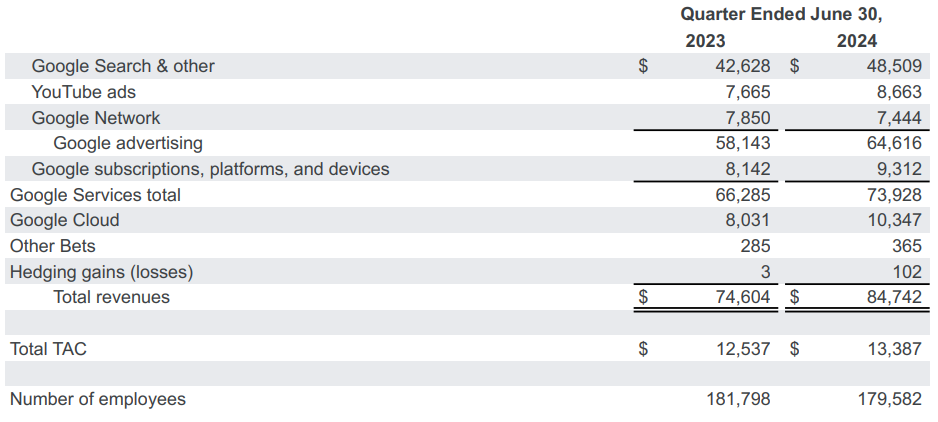

Alphabet reported consolidated revenues of $84.7 billion for Q2 2024, a 14% increase from the previous year, reflecting robust performance across key segments. Google Cloud's revenues surpassed $10 billion for the first time. Net income reached $23.6 billion, with earnings per share (EPS) at $1.89. This reflects a strong 26% increase in operating income to $27.4 billion and a solid operating margin of 32%.

The operating margin for the quarter was 32%, and the Google Services segment reported an operating margin of 40%. Google Cloud achieved an operating margin of 11%. Operating income grew by 26% to $27.4 billion. Total cost of revenues was $35.5 billion, up 11%, driven by content acquisition costs and depreciation. Operating expenses increased by 5% to $21.8 billion.

Alphabet ended Q2 with $101 billion in cash and marketable securities. Free cash flow was $13.5 billion for the quarter and $60.8 billion for the trailing 12 months.

Source: GOOG Exhibit 99.1 Q2 2024

Operational Performance

Google Services revenues, including Search, YouTube ads, and Network revenues, totaled $73.9 billion, with Search contributing $48.5 billion, up 14%. YouTube ads grew 13% to $8.7 billion, while Network revenues declined by 5% to $7.4 billion. Subscription platforms and devices revenues increased by 14% to $9.3 billion.

Alphabet's Search and YouTube continued to dominate their respective markets, with YouTube maintaining its position as the leading streaming platform in the US. Network revenues faced a decline due to increased competition and shifting advertising budgets. Alphabet expanded its partnerships, including significant collaborations with Oracle and notable customers like Uber, WPP, and Deutsche Bank. These collaborations focus on integrating AI and cloud solutions.

Source: GOOG Exhibit 99.1 Q2 2024

Technological Advancements and Innovations

Alphabet's advancements include the introduction of the Pixel 8a with the Tensor G3 chip and AI features like Circle to Search. Major AI model updates were unveiled, including Gemini models, which enhance various Google products. Q2 saw substantial R&D investments in AI infrastructure, including the launch of data centers in Malaysia and expansion projects in the US. The latest Trillium TPU and Nvidia Blackwell platforms were highlighted as part of Alphabet's ongoing commitment to AI and cloud computing.

The Gemini AI model family was expanded, improving efficiency and versatility in AI applications. Alphabet also made strides in AI overviews, visual search via Lens, and multimodal understanding with Project Astra.

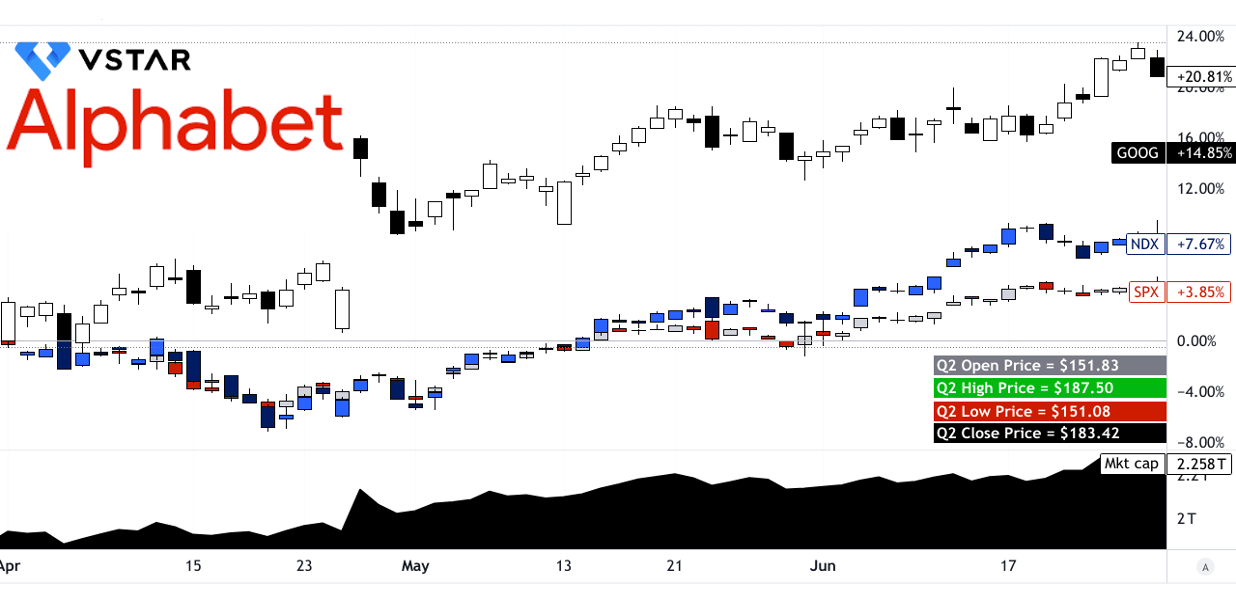

B. GOOG Stock Price Performance

Alphabet Inc. (NASDAQ: GOOG) experienced a notable 20.81% increase in its stock price over the recent quarter, with the stock opening at $151.83 and closing at $183.42. During this period, the stock hit a high of $187.50 and a low of $151.08, reflecting a substantial price fluctuation within the quarter. In comparison to major stock market indices, Alphabet's performance significantly outpaced both the S&P 500 (SPX) and the NASDAQ (NDX).

Moreover, the S&P 500, a broad benchmark of U.S. equities, recorded a relatively modest 3.85% price return over the same period. The NASDAQ, which includes a higher concentration of technology stocks, saw a 7.67% return. Alphabet's return demonstrates a considerable outperformance relative to these indices with a market cap of $2.258 Trillion.

Source: tradingview.com

II. Google Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

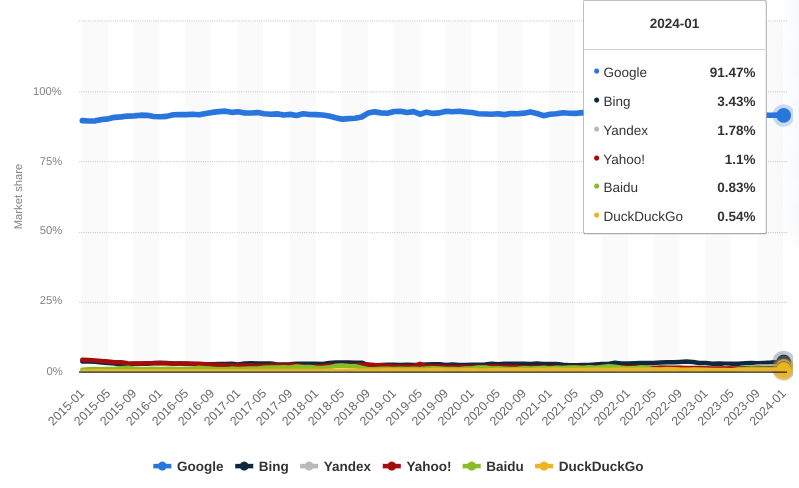

Search and AI Integration: Google's core Search segment continues to exhibit robust growth, driven by the integration of advanced AI technologies. AI advancements, particularly through the Gemini models, are enhancing the capabilities of Google Search by offering improved responses and new ways to search. The introduction of AI overviews and the expansion of visual search functionalities, such as Lens, are driving higher engagement and user satisfaction. This ongoing innovation positions Search as a critical growth area, leveraging AI to maintain and enhance its dominance in the booming digital advertising landscape.

[Market share of leading search engines worldwide from January 2015 to January 2024]

Source: statista.com

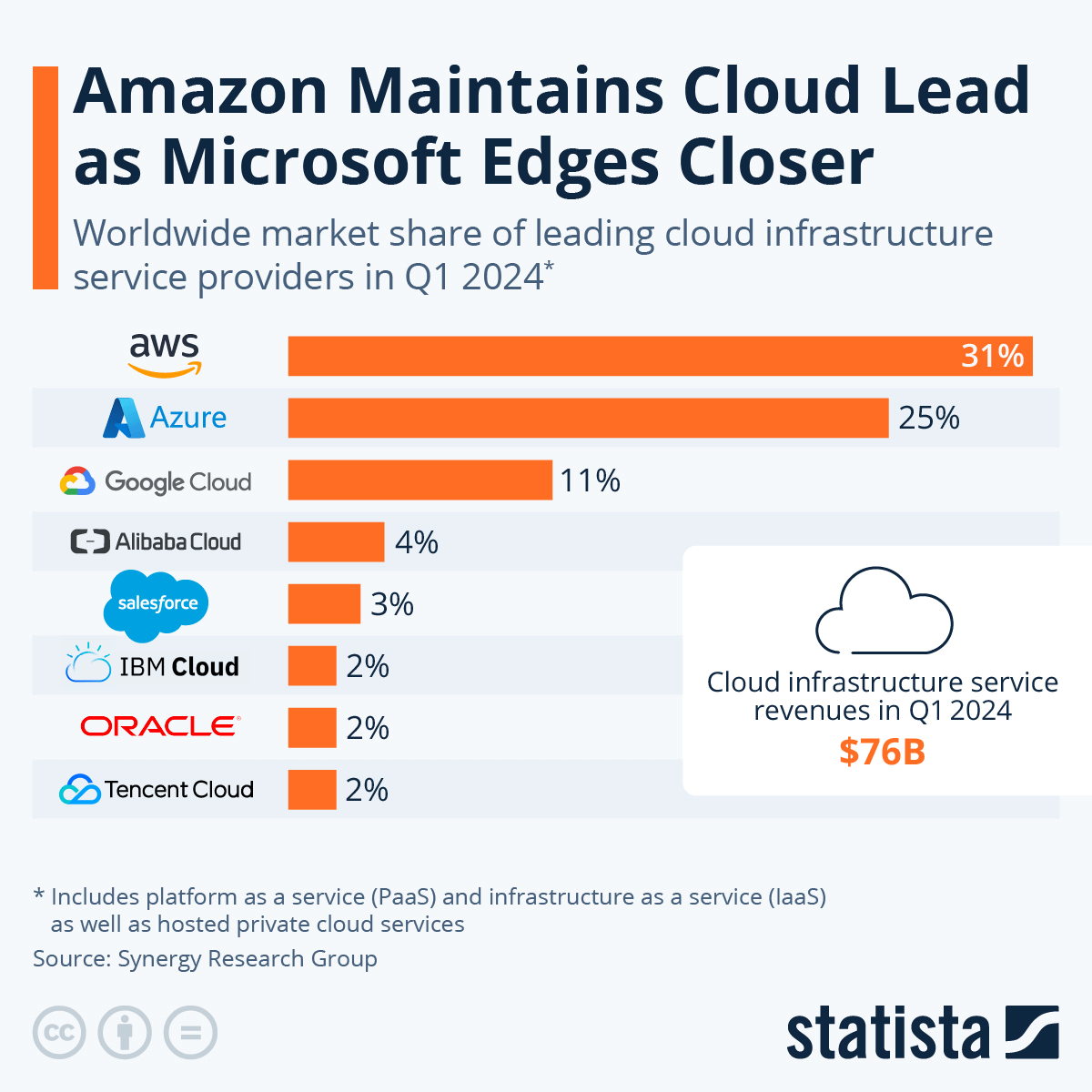

Cloud Computing: Google Cloud is a major growth segment, having crossed $10 billion in quarterly revenues for the first time. This success is partly due to the rapid adoption of generative AI solutions and infrastructure. The segment's growth is driven by strong demand from large enterprises and AI startups, underpinned by innovations like the Trillium AI accelerators and the Gemini AI models. The increasing adoption of AI infrastructure by more than 2 million developers further fuels growth, positioning Google Cloud as a competitive player in the rapidly expanding cloud computing market.

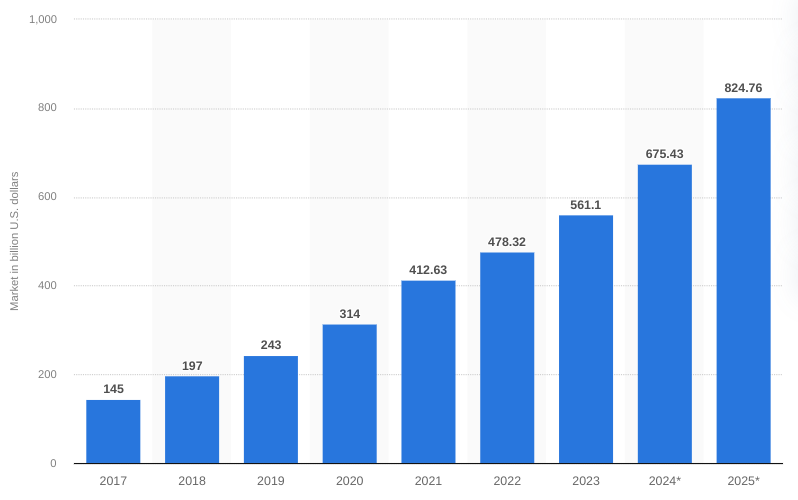

[Public cloud services end-user spending worldwide from 2017 to 2024(in billion U.S. dollars)]

Source: statista.com

YouTube: YouTube remains a significant growth driver, bolstered by its dominant position in streaming and advertising. The platform's expansion into new formats, such as YouTube Shorts and Connected TV, is attracting both viewers and advertisers. The rise in watch time on CTV and the successful integration of AI in ad targeting are contributing to increased revenue. YouTube's ability to monetize effectively through a combination of subscriptions, brand partnerships, and innovative ad formats positions it as a key growth area.

B. Expansions and Strategic Initiatives

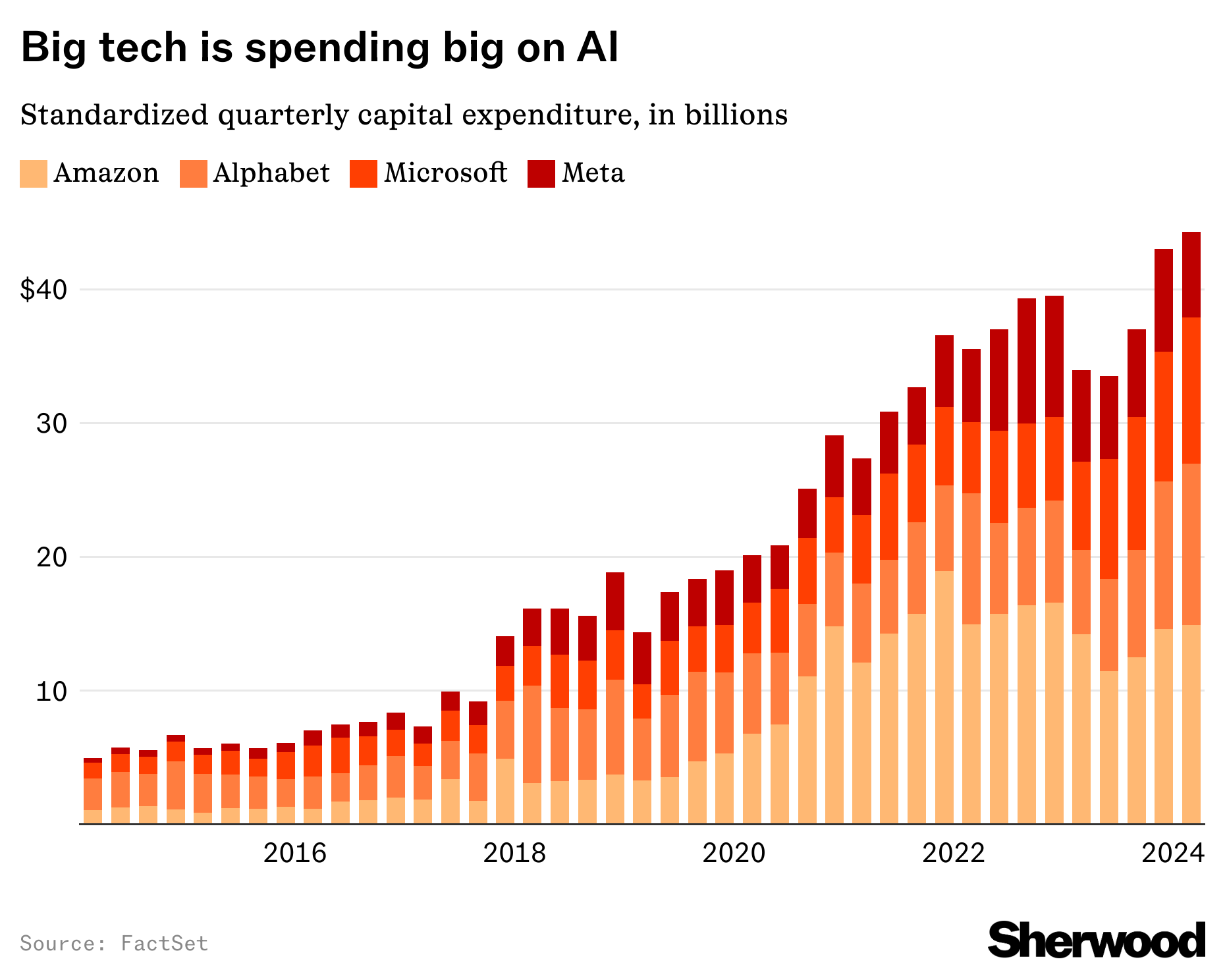

Research and Development Investments: Google is heavily investing in R&D, particularly in AI and cloud technologies. The development of the Trillium AI accelerators and advancements in Gemini AI models reflect its commitment to maintaining technological leadership. Investments in new data centers, such as those in Malaysia, and expansions in existing locations further support this strategy. Its enterprise AI platform, Vertex, is attached with major clients like Deutsche Bank and the U.S. Air Force to build AI agents.

Source: sherwood.news

Partnerships and Collaborations: Strategic partnerships play a crucial role in Google's growth strategy. Collaborations with companies like Oracle and the expansion of joint offerings highlight the importance of strategic alliances in enhancing Google Cloud's capabilities. Additionally, partnerships with hardware manufacturers like Samsung and content creators on YouTube contribute to the growth and adoption of Google's products and services.

III. GOOG Stock Forecast 2024

A. Google Stock Prediction: Technical Analysis

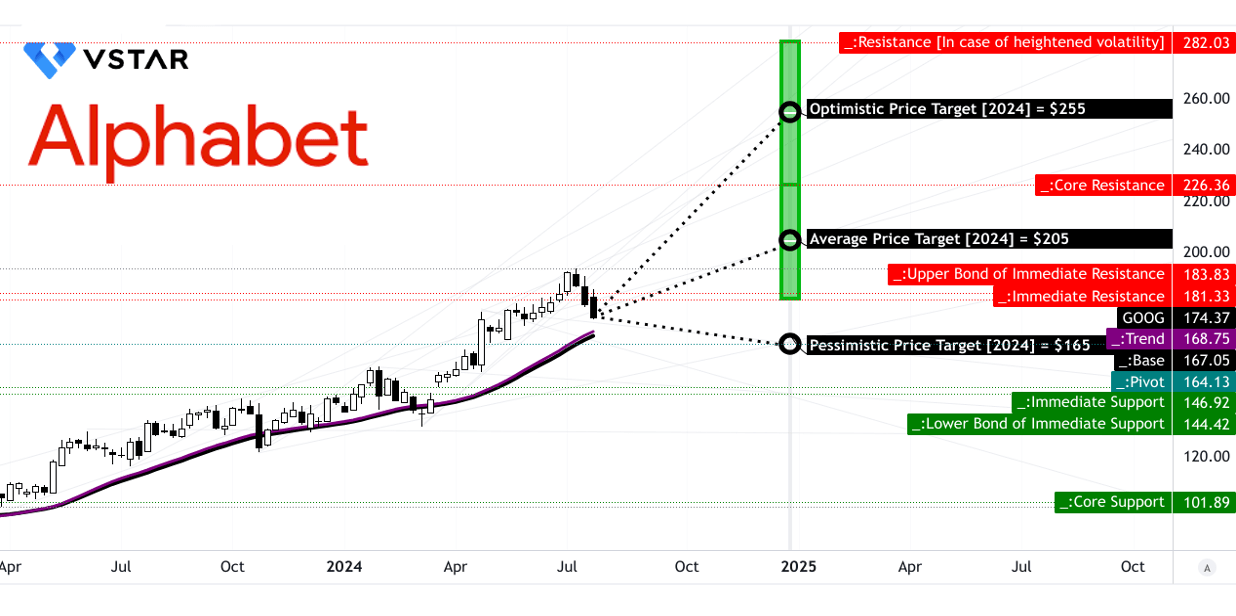

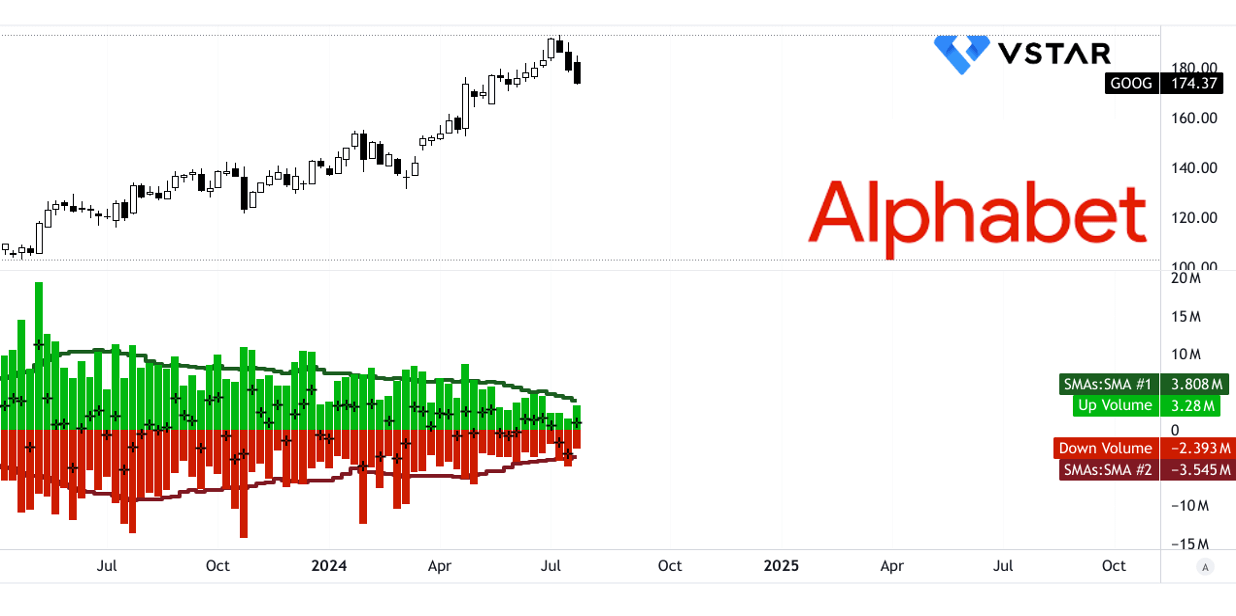

Alphabet's stock (NASDAQ:GOOG) is currently priced at $174.37. The trend analysis shows a downward direction with the current price above both the modified exponential moving average (EMA) values: the trendline at $168.75 and the baseline at $167.05. This suggests a prevailing drop in bullish sentiment in the stock's short-term performance.

Google Price Target

The average GOOG price target by the end of 2024 is $205.00. This Google target price is derived from the momentum of change-in-polarity over the mid- to short-term, with adjustments made based on Fibonacci retracement and extension levels. The optimistic target is set at $255.00, reflecting strong upward momentum if the stock maintains its current swing and market conditions improve. Conversely, the pessimistic target stands at $165.00, indicating potential declines if the current downward trend persists. These projections highlight significant variability in the stock's future performance, contingent upon short-term market dynamics and broader economic conditions.

GOOG Stock Prediction - Resistance and Support Levels

GOOG's technical levels are crucial for understanding potential price movements. The primary resistance is identified at $183.83, a threshold that the stock must surpass to signal a bullish trend. The pivot of the current horizontal price channel is at $164.13, suggesting that this level might act as a psychological or technical barrier. In extreme scenarios, heightened volatility could push resistance levels up to $282.03 and core resistance to $226.36. On the downside, support is at $146.92, with core support at $101.89. These levels are essential for identifying potential floors in the stock's price, with lower levels indicating greater risks.

Source: tradingview.com

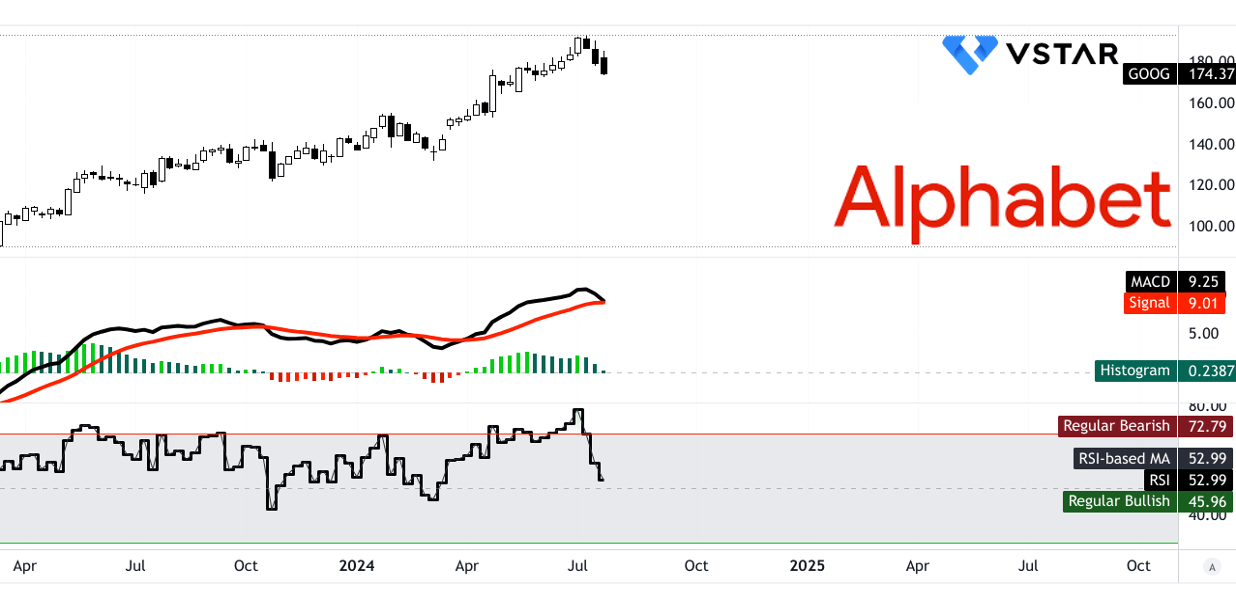

Google Stock Forecast - Relative Strength Index (RSI)

The RSI value for GOOG is currently at 52.99, which is near the neutral level. The RSI has a regular bullish threshold of 45.96 and a bearish threshold of 72.79. The RSI line trend is downward, but there is no current bullish or bearish divergence, suggesting a neutral to mildly bearish sentiment. This neutral RSI indicates that the stock is neither in an overbought nor oversold condition but may be on a downward trajectory.

GOOG Stock Forecast - Moving Average Convergence/Divergence (MACD)

The MACD line stands at $9.25, while the signal line is at $9.01, resulting in a MACD histogram of $0.24. This indicates a bullish trend, but the strength of this trend is decreasing. The decreasing strength suggests that while the stock may have been bullish, the momentum is weakening, which could impact future price stability.

Source: tradingview.com

Alphabet Stock Forecast - Price Volume Trend (PVT)

The PVT line at $227.86 million is above the moving average of $211.41 million, indicating a bullish price volume trend. This suggests that there is a positive correlation between volume and price, supporting the notion of upward price movement.

Google Stock Forecast - Moving Average of Volume

The moving average of up volume is $3.81 million, while the moving average of down volume is -$3.55 million, resulting in a volume delta of $0.26 million. This positive volume delta supports a bullish outlook, indicating that buying pressure is currently exceeding selling pressure.

Source: tradingview.com

Source: tradingview.com

B. Google Stock Price Prediction: Fundamental Analysis

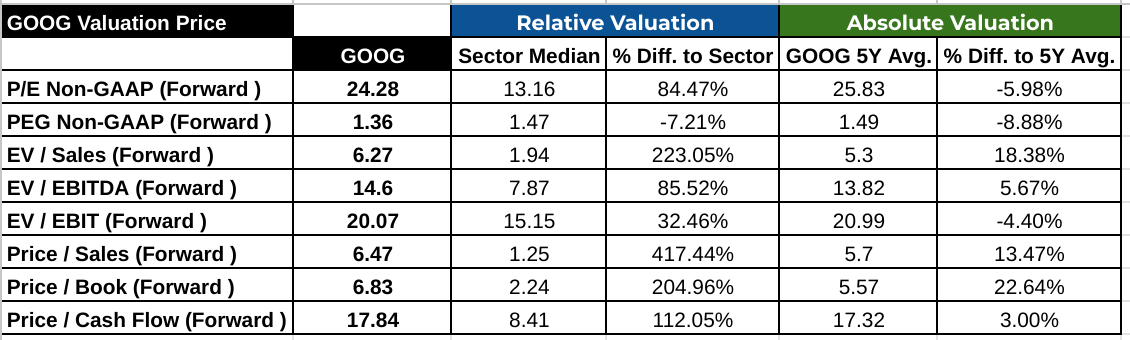

P/E Ratio (Price-to-Earnings): Alphabet's forward P/E ratio stands at 24.28, significantly higher than the sector median of 13.16, reflecting a premium valuation. Historically, GOOG's P/E has averaged 25.83, indicating a slight discount of 5.98% to its 5-year average. This suggests investors are willing to pay more for Alphabet's future earnings relative to historical levels, possibly due to expected growth or market confidence.

PEG Ratio (Price/Earnings-to-Growth): The PEG ratio, a measure of the P/E ratio relative to growth expectations, is 1.36, which is lower than the sector median of 1.47 and also below its 5-year average of 1.49. This suggests Alphabet's stock may be relatively undervalued based on expected earnings growth, as a lower PEG ratio implies a more favorable valuation when growth prospects are considered.

Source: Analyst's compilation

C. GOOG Forecast: Market Sentiment

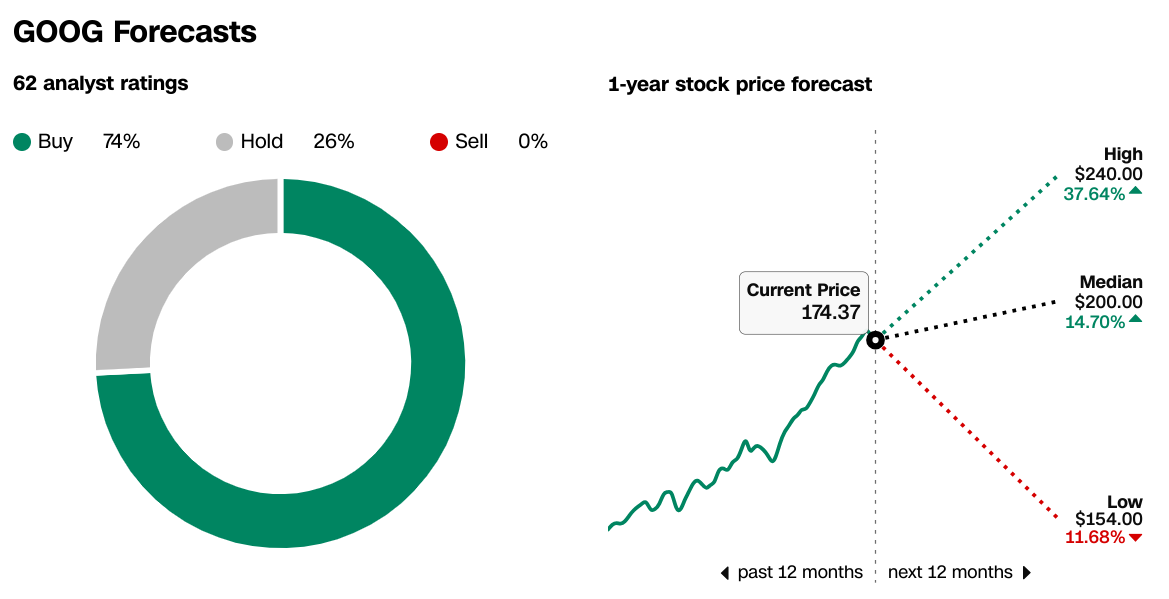

Google Stock Price Target: Analysts have a range of price targets for GOOG, with a high estimate of $240.00, a median of $200.00, and a low of $154.00. The current price is $174.37, implying potential upside based on median and high targets (14.70% and 37.64%, respectively).

According to CNN, 74% of analysts recommend a "Buy," while 26% suggest a "Hold." No analysts recommend selling the stock. This positive sentiment indicates strong confidence in Alphabet's growth prospects.

Source:CNN.com

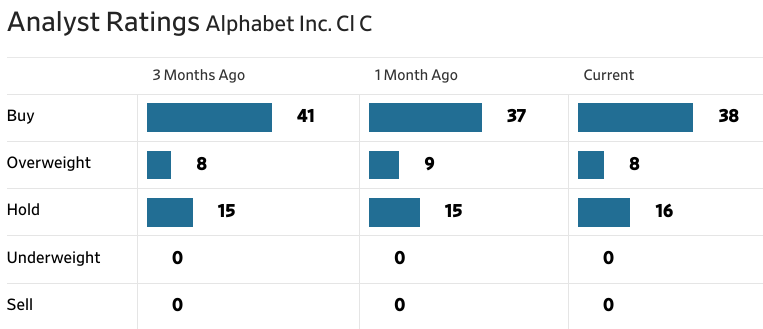

Over the past three months, the number of “Buy” ratings has remained stable with 38 current recommendations, while “Overweight” and “Hold” ratings are also consistent. This stability in recommendations supports a positive outlook from analysts.

Source:WSJ.com

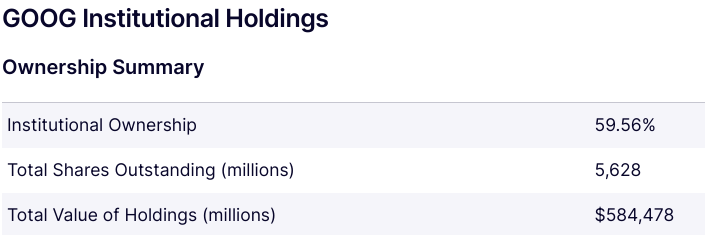

- Institutional Holdings: Institutions hold 59.56% of Alphabet's shares, reflecting substantial institutional confidence.

Source:Nasdaq.com

- Short Interest: With 70.08 million shares shorted, representing 1.19% of total shares, and a low "Days to Cover" ratio of 2.77, short interest is relatively modest. This indicates limited bearish sentiment.

Source:Benzinga.com

IV. Alphabet Stock Forecast: Challenges & Risk Factors

Google Competitors

Alphabet (NASDAQ: GOOG), the parent company of Google, faces notable competitive challenges in the tech and advertising space. Microsoft's aggressive push into AI, particularly with its integration of OpenAI's GPT models into products like Azure and Office, directly challenges Google's dominance in AI and cloud computing. Amazon Web Services (AWS) remains a formidable competitor to Google Cloud, boasting a larger market share and more extensive infrastructure. Apple's focus on privacy and security in its ecosystem competes with Google's data-centric approach. In the social media and digital advertising sphere, Meta's platforms, such as Facebook and Instagram, offer robust competition.

Source: statista.com

Other Risks

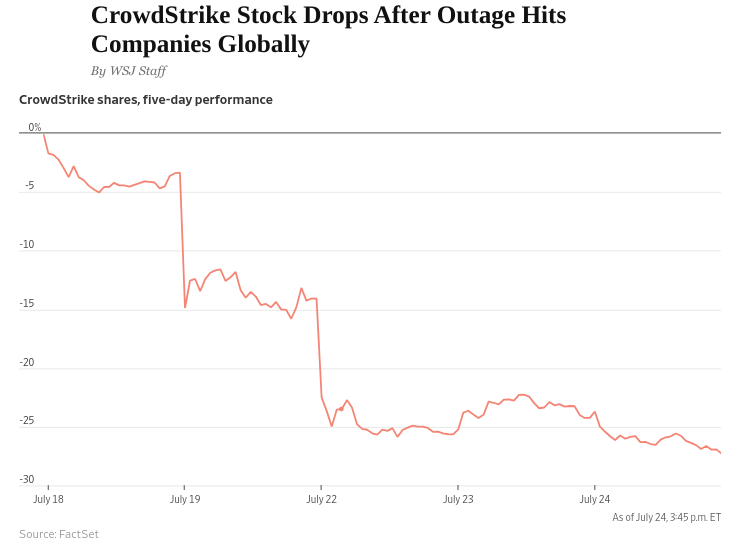

Cybersecurity Threats: As a major tech company, Alphabet is a target for cyberattacks. Breaches could lead to loss of user trust, massive loss in market cap (like recent CrowdStrike+Microsoft Error), financial penalties.

Source: wsj.com

In conclusion, Alphabet Inc. (GOOG) has shown strong Q2 2024 performance. The stock rose over the quarter, outperforming major indices, and may continue to do so, to hit technical price targets upwards. Looking ahead, Google's growth drivers include advancements in AI, cloud computing, and YouTube. However, challenges include competition from Microsoft and Amazon, regulatory risks, and economic fluctuations. For trading GOOG/GOOGL stock CFDs, consider VSTAR, a regulated trading platform by ASIC. VSTAR offers low trading fees, access to a wide range of markets, and a user-friendly app for both beginners and pro traders.