- GE Aerospace's total orders surged by 34% to $11.0 billion in Q1 2024, indicating strong demand.

- Profitability metrics improved, with adjusted profit margin up 300 bps organically to 10.2%.

- Strategic investments include $650 million in manufacturing facilities and partnerships with major customers.

- Core dependency on orders growth poses a fundamental weakness.

- Technicals are providing a $210 average price target for 2024.

As the aerospace industry propels forward, GE Aerospace (NYSE:GE) emerges as a key lead, soaring through robust financial performance and strategic collaborations. Amidst its upward trajectory, this analysis delves into GE Aerospace's fundamental strengths, weaknesses, and technical forecasts.

GE Aerospace Fundamental Strengths

Strong Financial Performance:

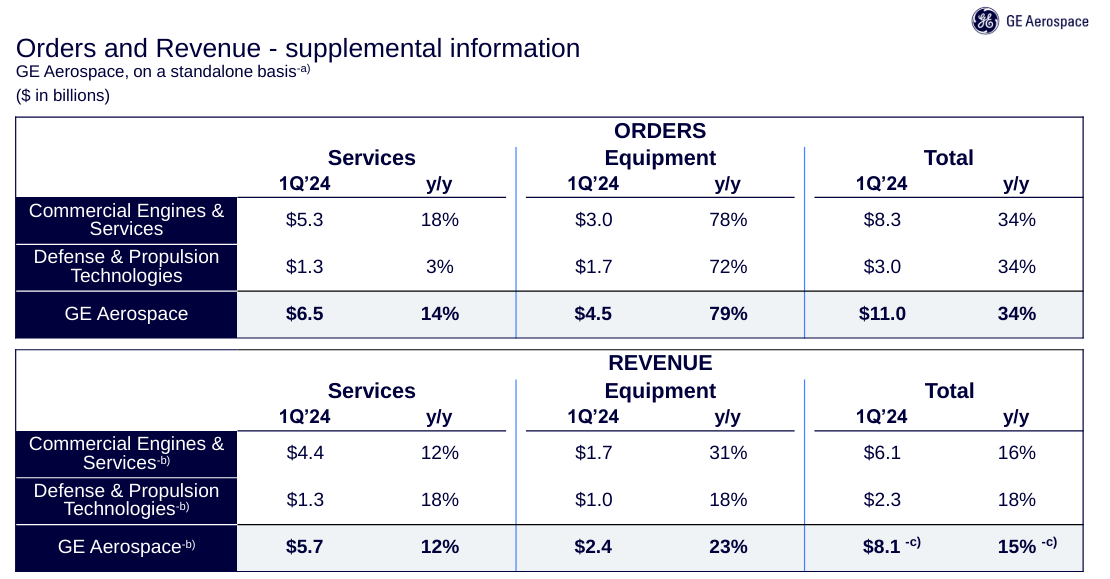

GE Aerospace's financial performance is robust, evident from its first-quarter 2024 results. Total orders surged by 34% to reach $11.0 billion, showcasing a significant increase in demand for the company's products and services. This growth is especially notable in both the Commercial Engines & Services (CES) and Defense & Propulsion Technologies (DPT) segments. Moreover, adjusted revenue climbed by 15% to $8.1 billion, indicating substantial organic growth. Operating profit soared by 24% to $1.5 billion, with an operating profit margin expansion of 140 basis points to 19.1%. These figures reflect the company's operational efficiency and effective cost management strategies, contributing to enhanced profitability.

Source: GE 1Q 2024 Earnings Slides

GE Aerospace experienced significant growth in total orders, which reached $11.0 billion in the first quarter of 2024, representing a remarkable increase of 34% compared to the previous year. This surge in orders suggests strong demand for the company's offerings and indicates a potentially robust backlog. Additionally, orders in both the Commercial Engines & Services (CES) and Defense & Propulsion Technologies (DPT) segments increased substantially, reflecting broad-based demand across GE Aerospace's product portfolio.

Profitability and Margin Expansion:

GE Aerospace's profitability metrics demonstrate notable improvement, with adjusted profit margin increasing by 300 basis points organically to 10.2%. Operating profit margin expanded by 140 basis points to 19.1%, highlighting the company's ability to enhance operational efficiency and extract greater value from its revenue streams. This margin expansion is primarily driven by pricing strategies, volume growth, and favorable product mix, underscoring GE Aerospace's strong market positioning and effective execution of its business strategies.

Strategic Investments and Partnerships:

GE Aerospace's strategic initiatives, such as investing over $650 million in manufacturing facilities and the supply chain, underscore its commitment to enhancing operational capabilities and supporting future growth. Furthermore, securing agreements with prominent customers like Thai Airways, American Airlines, and easyJet for engine purchases and services agreements reflects the company's strong market presence and the attractiveness of its offerings to key industry players.

Source: GE 1Q 2024 Earnings Slides

GE Aerospace Fundamental Weakness

Overreliance on Orders Growth:

GE Aerospace heavily depends on increasing orders to drive revenue growth, as evidenced by the substantial 34% increase in total orders. However, this overreliance on orders growth as the primary revenue driver exposes the company to vulnerabilities in market demand fluctuations. Any inflection in orders’ growth may lead to a solid drop in stock price. Without diversifying revenue streams or improving operational efficiency, GE Aerospace risks significant revenue loss if orders growth stagnates or declines. This dependency on orders growth represents a fundamental weakness in the company's growth strategy and market valuation.

Source: GE 1Q 2024 Earnings Slides

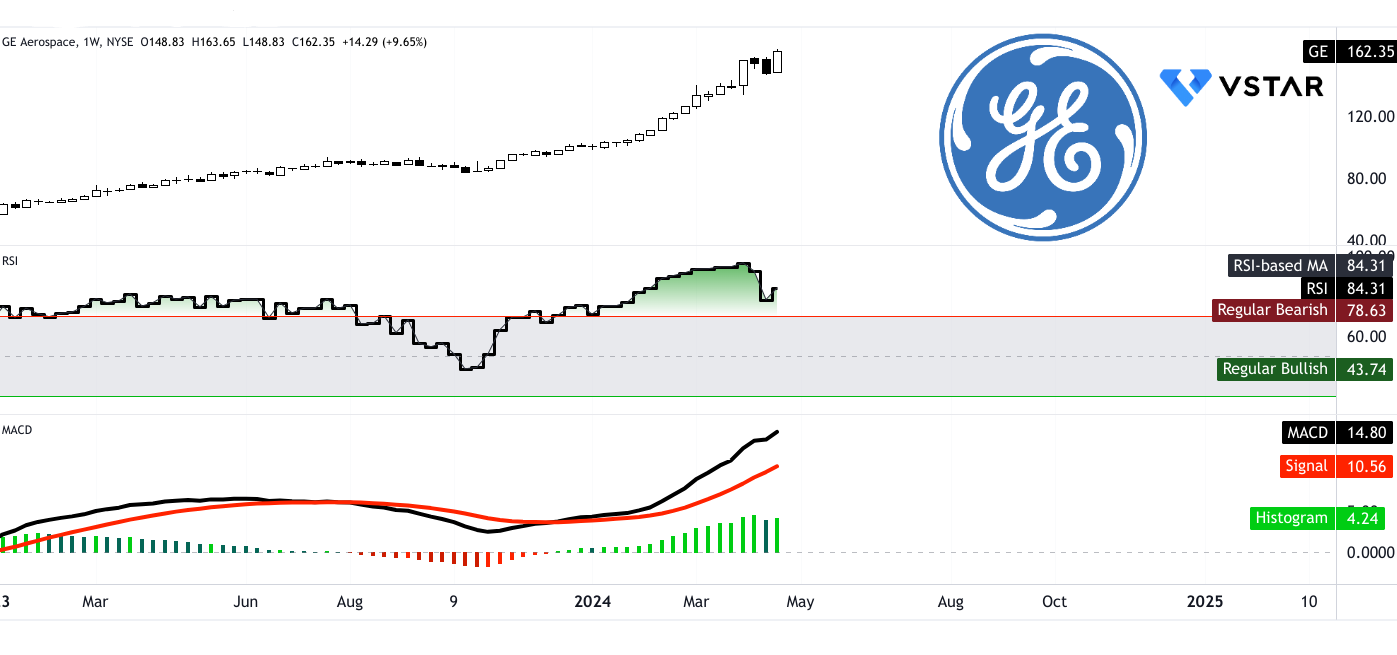

GE Stock Price Forecast 2024

The current price of GE (GE) stands at $162.35, exhibiting an upward trend according to the modified exponential moving average, which is calculated at $120.97. This indicates a positive momentum in GE's stock price movement. The baseline, set at $118.79, reinforces this upward trajectory, suggesting a strong bullish sentiment in the market for GE. The average price target by the end of 2024 for GE is $210.00, with an optimistic projection reaching $249.00. These targets are derived from the momentum of change-in-polarity over mid- to short-term periods, projected over Fibonacci retracement/extension levels. This implies that the stock is expected to continue its upward trajectory, fueled by positive momentum and potentially strong buying pressure.

GE Stock Price Forecast - Support and Resistance Levels

GE's primary support is observed at $151, indicating a level where buying interest could potentially increase, supporting the GE stock price. The pivot of the current horizontal price channel is at $123.48, suggesting a crucial level that could act as a turning point for GE stock's direction. Core resistance is identified at $210.40, representing a significant barrier that the stock may encounter on its upward journey. Additionally, a lower support level is noted at $95.95, suggesting a potential floor for GE stock price during downturns.

Source: tradingview.com

Ge Stock Forecast - RSI & MACD

The RSI value for GE is currently at 84.31, indicating an overbought condition. While this suggests strong bullish momentum, it also raises concerns about a potential reversal in the near term. The absence of bullish divergence and the presence of bearish divergence further support the notion of a downward RSI trend, indicating a possible correction or consolidation phase. Moreover, GE's MACD indicators demonstrate a bullish trend, with the MACD line at 14.8, above the signal line at 10.56. The MACD histogram, standing at 4.240, indicates increasing strength in the bullish trend. This suggests that the positive momentum in GE stock price is robust and likely to continue in the near term.

Source: tradingview.com

Conclusion

GE stock exhibits positive momentum, supported by upward trending moving averages and bullish price targets. However, overbought RSI and potential resistance at $210 indicate caution. Despite strong fundamentals, one should monitor for signs of reversal or consolidation in price direction.