- Dell Technologies reported Q1 2024 revenue with solid uplift in diluted EPS.

- The Infrastructure Solutions Group saw a rapid revenue increase, driven by a massive rise in servers and networking.

- Dell stock surged 45% in the quarter, significantly outperforming the S&P 500 and NASDAQ.

- Technical outlook is positive for 2024 with an average DELL price target of $250.

- Growth opportunities lie in AI-optimized servers, with strong demand and strategic initiatives like the Dell AI Factory and partnerships with NVIDIA and Microsoft.

I. DELL Q1 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

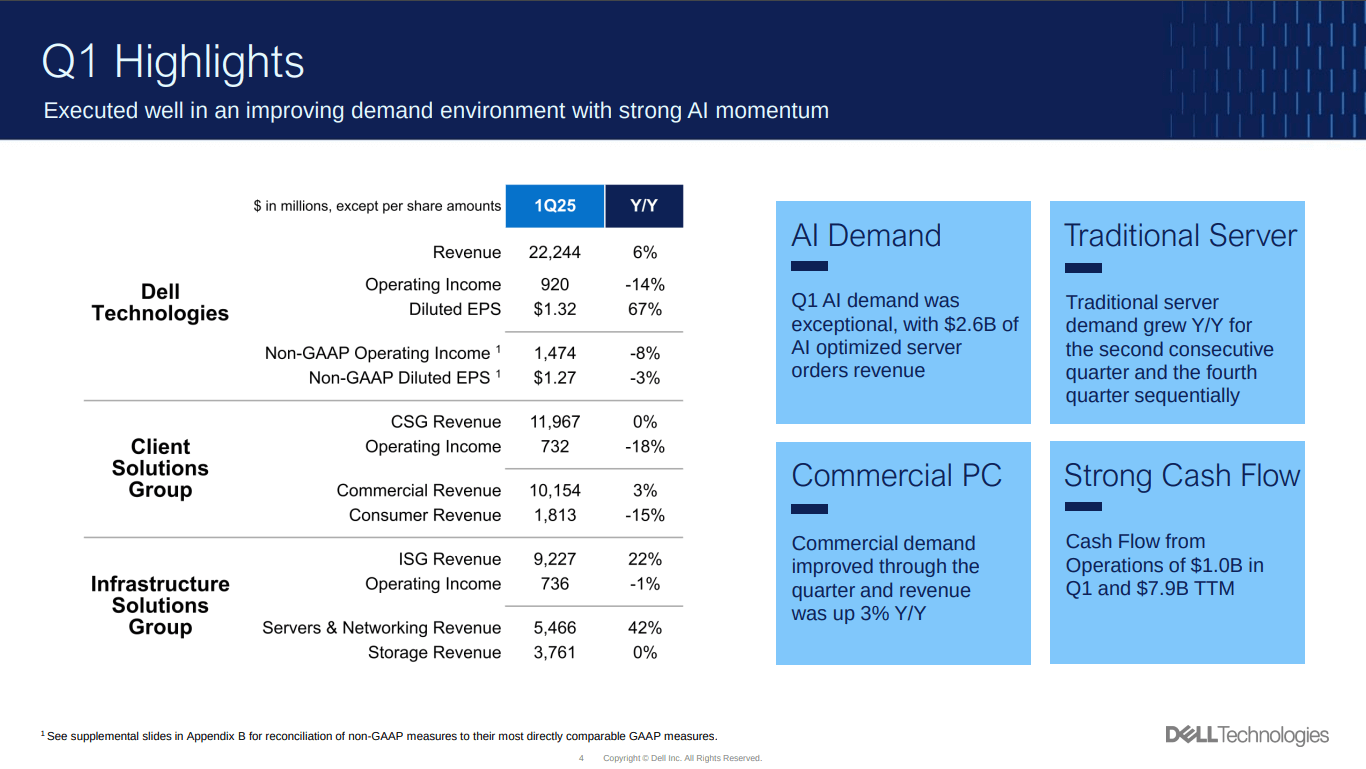

Dell Technologies reported a robust financial performance for Q1 2024, showcasing a revenue increase of 6% year over year, reaching $22.2 billion. The company reported an operating income of $920 million, with a non-GAAP operating income of $1.5 billion, marking a decrease of 14% and 8% respectively from the previous year. Despite the mixed results in operating income, Dell demonstrated strong profitability with diluted earnings per share (EPS) rising by 67% to $1.32, although non-GAAP diluted EPS slightly declined by 3% to $1.27. Net income for the quarter stood at $923 million. Dell's balance sheet remained solid with $7.3 billion in cash and investments, and the company generated $1 billion in cash flow from operations. Dell returned $1.1 billion to shareholders through share repurchases and dividends.

Source: Q1 FY 2025 Earnings

Operational Performance

Dell's performance across its major business segments was notable. The Infrastructure Solutions Group (ISG) achieved a revenue of $9.2 billion, a significant 22% increase year over year. This was driven by a record performance in servers and networking, which saw a 42% increase to $5.5 billion. Conversely, storage revenue remained flat at $3.8 billion. The ISG's operating income was $736 million.

The Client Solutions Group (CSG) maintained stable performance with a revenue of $12.0 billion, unchanged from the previous year. Within this segment, commercial client revenue grew by 3% to $10.2 billion, while consumer revenue declined by 15% to $1.8 billion. The CSG's operating income was $732 million.

Technological Advancements and Innovations

Key product launches included the new PowerEdge XE9680L server, designed for high GPU density and efficiency, and updates to the PowerStore software, which now offers up to a 66% performance boost and improved data mobility capabilities. Dell also introduced new AI PCs, powered by Qualcomm Snapdragon X Elite and Snapdragon X Plus processors, aimed at enhancing battery life and AI performance.

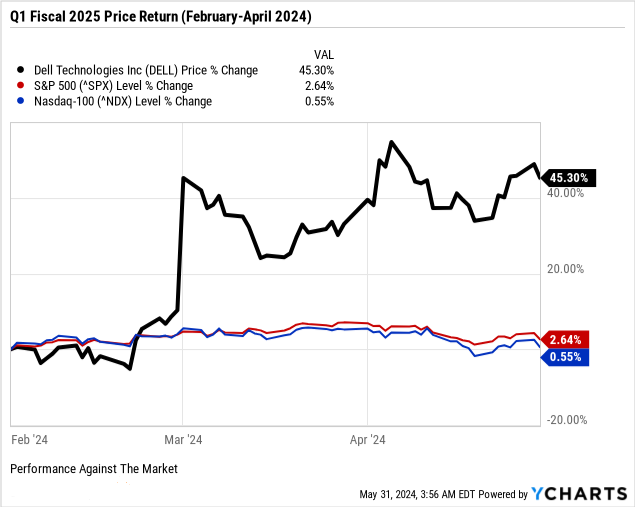

B. DELL Stock Price Performance

Dell (NYSE:DELL) has demonstrated robust stock performance with a market cap of $89 billion. Over the recent quarter, Dell's stock price surged from an opening price of $83.60 to a closing price of $124.64, marking a significant 45% price return. This impressive gain is underscored by the stock's volatility, reaching a high of $136.16 and a low of $80.49 during the quarter. When compared to broader market indices, Dell's performance is particularly notable. The S&P 500 and NASDAQ posted modest returns of 3% and 1%, respectively, during the same period.

Source: Ycharts.com

II. DELL Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

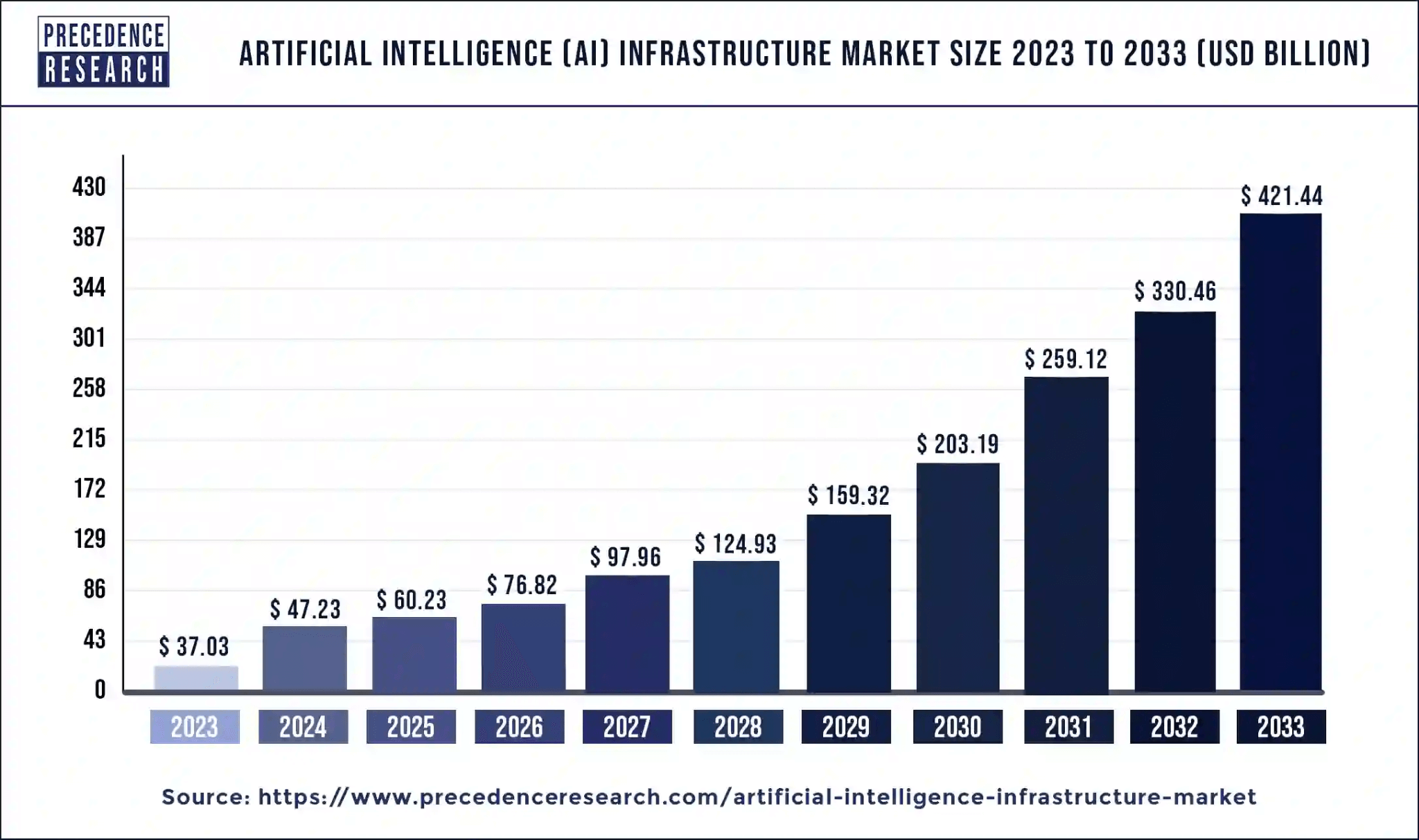

Dell Technologies (NYSE: DELL) may hit significant growth, particularly in the Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG). ISG, which includes servers, networking, and storage, is expected to grow over 20% in FY25, driven by robust demand for AI-optimized servers. As per Precedence Research, the AI infrastructure market may expand with a CAGR of 27.53% (over 2024-2033). Similarly, ResearchAndMarkets.com projects the AI server market growth at a CAGR of 26.54% (over 2024-2029).

With that, the backlog for AI servers has grown by $900 million to $3.8 billion, indicating strong future demand. Traditional server demand also remains strong, showing year-over-year and sequential growth. The storage segment, part of ISG, has stabilized with flat year-over-year revenue, driven by high demand for solutions like HCI, PowerMax, PowerStore, and PowerScale.

Source: precedenceresearch.com

In the CSG segment, the upcoming PC refresh cycle, driven by the aging PC install base and the end of Windows 10 support, is expected to boost demand. Dell's focus on high-end consumer PCs and gaming, coupled with advancements in AI-enabled architectures, positions the company to capitalize on this refresh cycle.

B. Expansions and Strategic Initiatives

Research and Development Investments:

Dell has launched the Dell AI Factory, combining its solutions and services optimized for AI workloads with an open ecosystem of partners like NVIDIA, Meta, Microsoft, and Hugging Face. This initiative aims to accelerate AI innovation by providing an extensive AI-optimized portfolio. Significant updates across Dell's portfolio include the new PowerEdge XE9680L, an 8-way GPU server with advanced cooling technology, and enhancements to the PowerStore and PowerScale storage solutions. These innovations aim to boost performance and cater to demanding AI workloads.

Partnerships and Collaborations:

Dell's AI strategy involves collaborations with major technology firms to build an open, modular architecture for AI. Partnerships with NVIDIA and Microsoft are central to this strategy, allowing Dell to integrate cutting-edge AI capabilities into its offerings. The company has expanded its networking portfolio with the PowerSwitch Z9864, providing high throughput for AI workloads, demonstrating its commitment to providing comprehensive solutions that support AI applications.

III. DELL Stock Forecast 2024

A. DELL Share Price Prediction: Technical Analysis

The average Dell stock price target by the end of 2024 is projected to be $250. This prediction leverages the momentum from a change-in-polarity analysis, applied over Fibonacci retracement and extension levels. An optimistic scenario places the DEll target price as high as $385, predicated on the continued upward momentum of the current swing, again based on Fibonacci analysis. Conversely, a pessimistic outlook could see the stock fall to $103, suggesting significant downward pressure in adverse conditions.

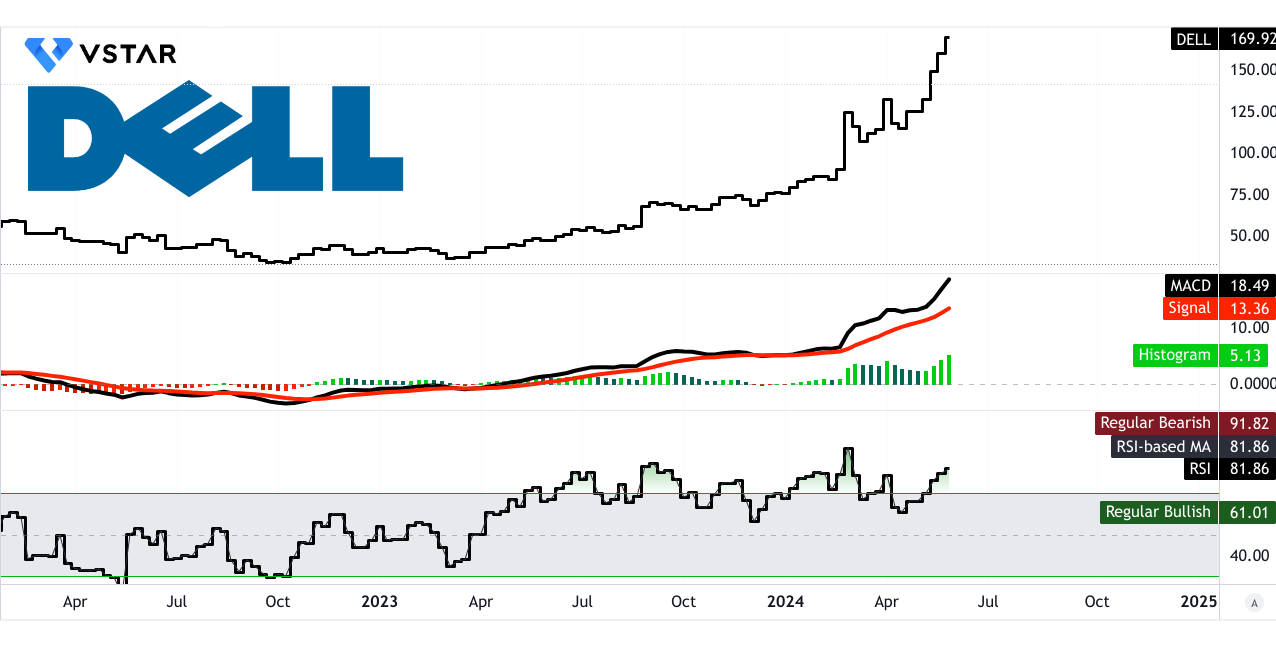

The current price of Dell shares is $169.92, showing an upward trend supported by a modified exponential moving average (EMA) with trendline and baseline values at $111.25 and $108.64, respectively. Primary support for Dell stock is identified at $150.47, with the pivot point of the current horizontal price channel at $103.32. This pivot point aligns closely with the pessimistic price target, indicating a critical level to watch. Core resistance is identified at $252.24, just above the average price target, signaling a significant barrier to further upward movement if volatility increases.

Source: tradingview.com

The RSI for Dell is 81.86, indicating overbought conditions, as typical bullish and bearish levels are 61.01 and 91.82, respectively. Despite the high RSI, there are no bullish or bearish divergences, and the RSI trend remains upward. The MACD indicator, with a MACD line at 18.49 and a signal line at 13.36, produces a histogram value of 5.130, confirming a bullish trend with increasing strength.

Source: tradingview.com

B. DELL Stock Price Prediction: Fundamental Analysis

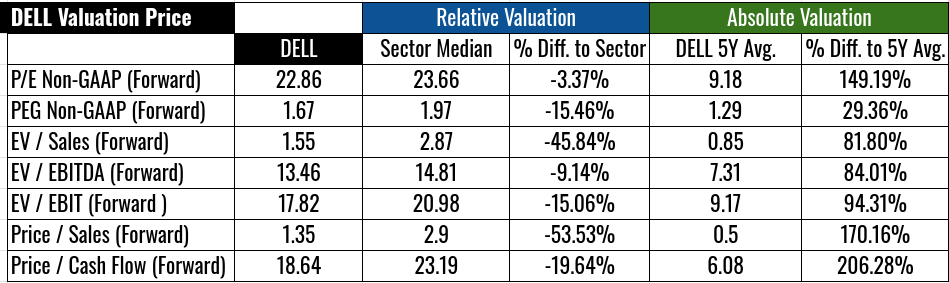

Financial ratios are critical in evaluating Dell Technologies (NYSE: DELL). The Forward P/E ratio of 22.86 is slightly below the sector median of 23.66, indicating Dell is priced comparably to its peers. However, it's substantially higher than its five-year average of 9.18, suggesting that investors have high future growth expectations. The Forward PEG ratio of 1.67 is lower than the sector median of 1.97, which shows Dell is moderately valued relative to its growth potential. This ratio is, however, 29.36% higher than its five-year average, indicating higher growth expectations are priced in.

Source: Analyst's compilation

C. DELL Stock Prediction: Market Sentiment

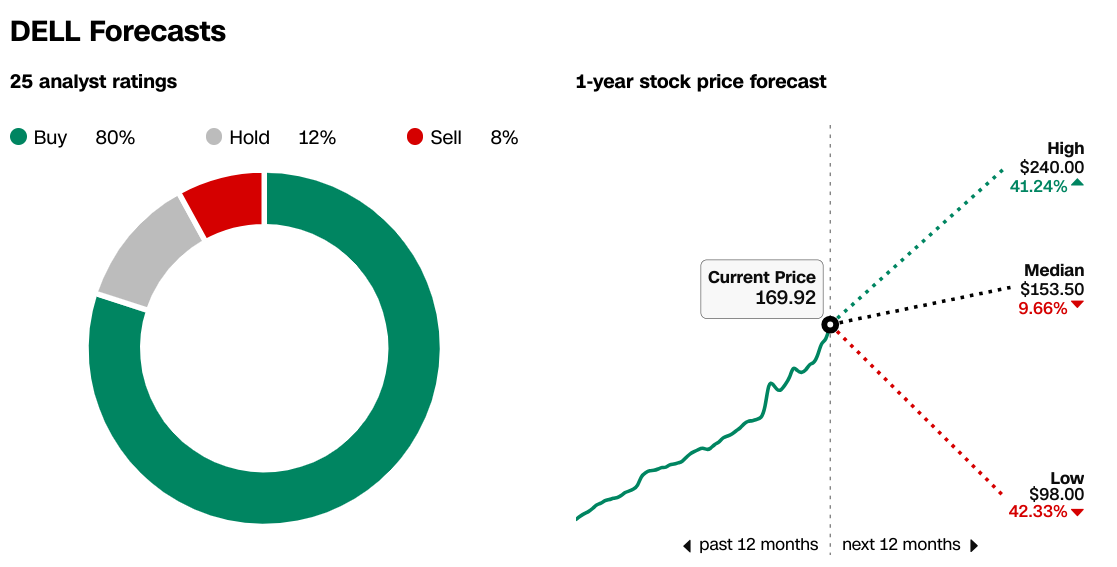

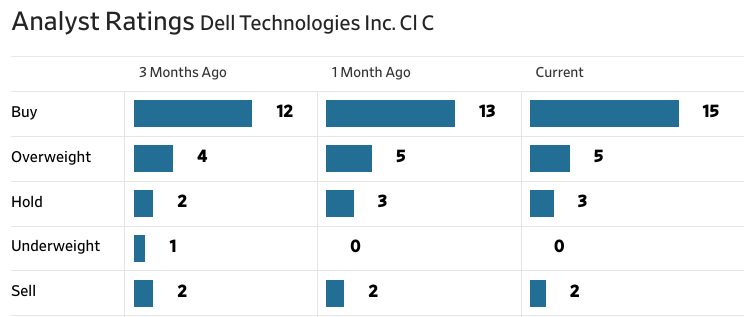

Market sentiment around Dell is generally positive. Analyst recommendations (on WSJ) are predominantly favorable. On CNN, 80% of 25 analysts rated it as a "Buy." The price targets vary, with a high of $240 and a low of $98. The median target is $153.50, reflecting moderate optimism given the current price of $169.92.

Source: CNN.com

Source: WSJ.com

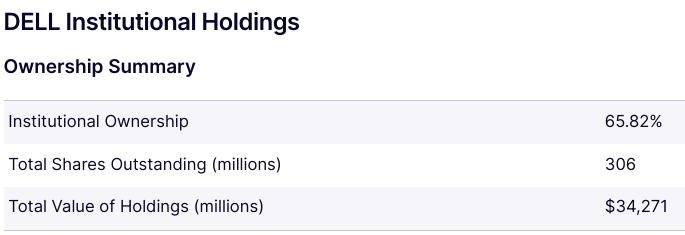

Investor confidence is also evident from the institutional ownership of 65.82%, signifying strong institutional interest and a significant stake in the company's future. Short interest is relatively low at 3.02%, indicating that few investors are betting against Dell.

Source: Nasdaq.com

Source: Benzinga.com

IV. DELL Stock Predictions: Challenges & Risk Factors

With a 26% server market share, Dell Technologies faces significant competition across its various business segments. In the server and storage markets, key competitors include Hewlett Packard Enterprise (HPE), which offers similar AI-optimized server solutions, and IBM, known for its robust enterprise server and storage systems. Additionally, Dell competes with Cisco in networking equipment and cloud services. In the PC market, Dell's primary rivals are HP Inc. and Lenovo, both of which have strong presences in the commercial and consumer segments. Apple's innovative product design and strong brand loyalty also pose challenges, especially in the high-end consumer and creative professional markets.

Source: Q1 FY 2025 Earnings

Dell's reliance on hardware sales makes it vulnerable to fluctuations in demand. Economic downturns can reduce clients' CapEx and IT spending, affecting revenue from both commercial and consumer segments. Furthermore, the increasing shift towards cloud computing presents a risk, as customers might prefer cloud-based solutions over traditional on-premises hardware, potentially diminishing Dell's hardware sales.

In conclusion, Dell Technologies (DELL) has shown strong performance, with a Q1 Fiscal 2025 revenue with year-over-year increase, and a massive rise in bottomline. The stock surged in the quarter, driven by high demand for AI-optimized servers and strategic initiatives, such as partnerships with NVIDIA and Microsoft. As an investment recommendation, Dell stock is a buy at the technical support levels. To take advantage of the stock's volatility CFD trading can be considered. Platforms like VSTAR offer DELL stock CFDs, allowing traders to speculate on Dell's price movements without owning the underlying asset. VSTAR provides a user-friendly app with low trading costs and deep liquidity, making it accessible for both beginners and professional traders.