- Delta Air Lines reported record Q2 2024 revenue of $16.7 billion, driven by strong demand.

- The company achieved a pre-tax income of $2 billion, translating to EPS of $2.36.

- Operating margin stood at 15%, with significant cash flow generation and debt reduction.

- Delta's premium product revenue grew by 10%, with substantial gains in cargo and loyalty programs.

- Despite a 2% stock price decline, Delta's stock's technical outlook remains positive.

I. Delta Air Lines Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

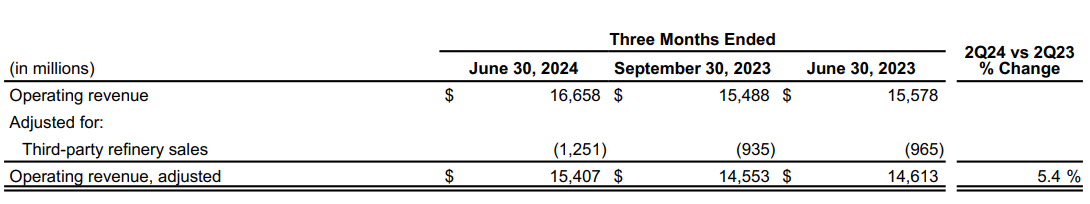

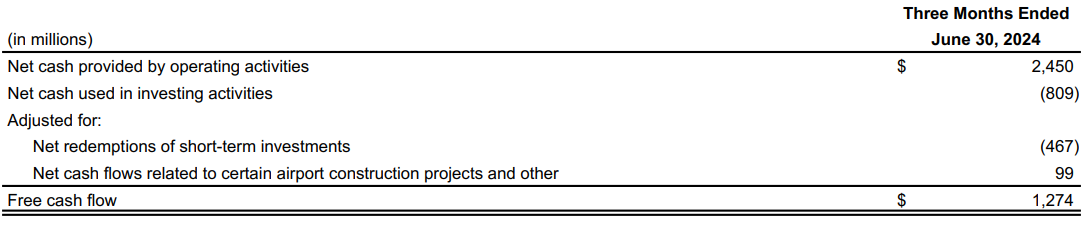

Delta Air Lines reported a record revenue of $16.7 billion in Q2 2024, representing a 5.4% increase compared to the same quarter in 2023. This growth was driven by strong demand across both domestic and international markets. The company achieved a pre-tax income of $2 billion, translating to earnings per share (EPS) of $2.36. This figure is indicative of Delta's robust profitability and efficient operational management. EPS for the quarter stood at $2.36, showcasing a significant improvement from previous periods and aligning with Delta's guidance.

Source: ir.delta.com

Delta achieved a 15% operating margin, underscoring the company's ability to manage costs effectively while maximizing revenue. The pre-tax margin was recorded at 13%. Operating income for Q2 2024 was $2.3 billion, reflecting the company's ability to maintain high operational efficiency. Non-fuel costs were reported at $9.8 billion, with non-fuel cost per available seat mile (CASM) increasing by 0.6% year-over-year. Fuel expenses were $2.8 billion, impacted by a 5% year-over-year increase in fuel prices.

Delta generated $2.5 billion in operating cash flow and $1.3 billion in free cash flow during the quarter. The company also repaid $1.4 billion in debt, further strengthening its balance sheet. Total debt and finance lease obligations stood at $18 billion at the end of the quarter.

Source: ir.delta.com

Operational Performance

Revenue from premium products and services grew by 10%, while loyalty program revenue increased by 8%. Cargo revenue also saw a significant boost of 16% year-over-year. Financially, revenue passenger miles grew 7% year-over-year, bolstering total revenue per available seat mile at 22.31 cents. Despite a 2.6% decline in adjusted TRASM, adjusted non-fuel costs stood at $9.8 billion, with a non-fuel CASM of 13.14 cents, up 0.6%. Operationally, Delta excelled with high reliability metrics and expanded its fleet with 11 new aircraft, including A321neo and A350-900. Strategic advancements included partnerships with Riyadh Air for expanded connectivity and new routes to Europe and Asia, reinforcing Delta's competitive edge and market position.

Technological Advancements and Innovations

Delta introduced several new product offerings, including the expansion of Delta Premium Select cabins and the launch of Delta One Lounges at major airports like JFK, Boston, and Los Angeles. These initiatives are aimed at enhancing the customer experience and differentiating Delta's premium services. Delta's operational performance remained strong, with a high completion factor of 99.5% and 39 brand-perfect days in the first half of 2024. The company's maintenance program improvements led to a 77% reduction in maintenance cancellations, highlighting its commitment to reliability and customer satisfaction.

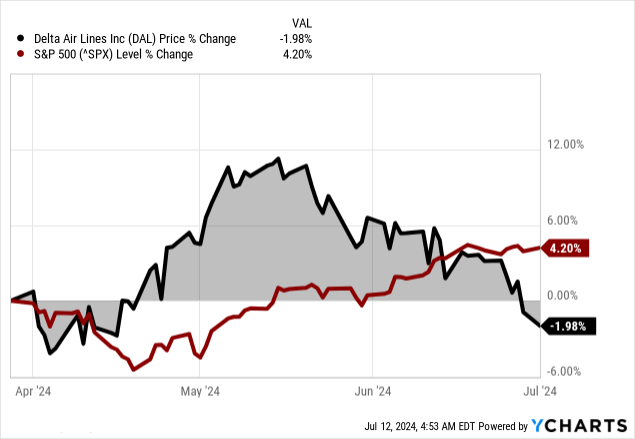

B. DAL Stock Price Performance

Delta Air Lines (NYSE: DAL) exhibited a price decline of 2% over the analyzed period, contrasting with the S&P 500's 4% gain. This underperformance against broader market indices can be attributed to several factors specific to Delta and the airline industry. Airlines face ongoing challenges such as fluctuating fuel costs, regulatory changes, and operational complexities. Delta's market capitalization of $31 billion reflects its substantial scale but also exposes it to industry-wide risks, including economic downturns and competitive pressures. The stock's quarterly performance, marked by a high of $53.86 and a low of $45.45, underscores volatility in the sector, influenced by factors like travel demand fluctuations and global economic conditions.

Source: Ycharts.com

II. DAL Stock Forecast: Outlook & Growth Opportunities

Delta Air Lines (NYSE: DAL) stands poised for significant growth, with a robust outlook backed by diverse revenue streams and strategic initiatives.

A. Segments with Growth Potential

- Premium and Loyalty Programs: Delta's premium services and loyalty programs constitute a substantial portion of its revenue. In the June quarter, premium revenue grew by 10% year-over-year, indicating strong demand for upgraded travel experiences. Loyalty revenue, bolstered by co-brand spend and an increasing premium card mix, grew by 8%. The remuneration from American Express, up by 9% from the previous year, further underscores the potential of this segment.

- Corporate Travel: Corporate travel demand has shown consistent growth, with managed corporate travel volumes increasing in double digits for six consecutive months. Recent surveys indicate that 90% of companies plan to maintain or increase their travel volumes, promising steady growth in this segment.

- International Markets: Delta's international passenger revenue increased by 4% compared to the previous year. The Pacific and Latin American regions have seen substantial capacity growth, driven by network restoration and enhanced connectivity with JV partners. The strong performance in these regions, coupled with robust demand across the Transatlantic routes, highlights significant growth potential.

B. Expansions and Strategic Initiatives

- Research and Development Investments: The recent comprehensive refresh of the Fly Delta app, aimed at enhancing customer self-service capabilities, is one example.

- Partnerships and Collaborations: The recent exclusive partnership with Riyadh Air, aimed at expanding connectivity and premium travel options between North America and Saudi Arabia, highlights Delta's proactive approach to tapping into new markets and enhancing its global network. Furthermore, Delta's JV partnerships in the Pacific and Latin America have significantly contributed to its international capacity growth and improved connectivity.

- Infrastructure and Service Enhancements: Recent developments include the opening of new Delta One Lounges and upgrades to existing Delta Sky clubs. These investments, along with expanded premium offerings and fast, free Wi-Fi on board, are designed to attract high-value customers and differentiate Delta's service offerings from competitors.

III. DAL Stock Forecast 2024

A. Delta Stock Forecast: Technical Analysis

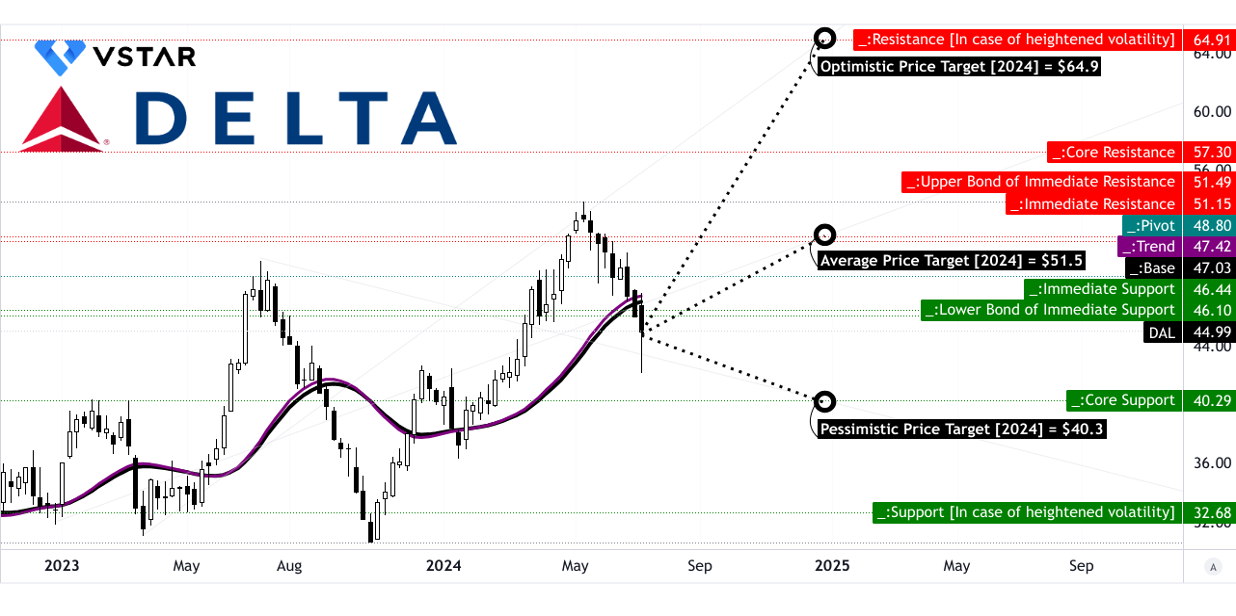

The Stock of Delta Air Lines (NYSE: DAL) is currently priced at $44.99. The trendline and baseline, modified exponential moving averages, are at $47.42 and $47.03, respectively. The direction of the stock price is downward, suggesting a bearish trend in the short term.

DAL Target Price

The average DAL price target by the end of 2024 is projected at $51.50. This projection is based on the momentum of change-in-polarity over the mid- to short-term, using Fibonacci retracement and extension levels. The optimistic DAL stock price target is $64.90, reflecting a strong upward price momentum within the current swing, again projected using Fibonacci levels. Conversely, the pessimistic Delta price target is $40.30, based on downward price momentum over similar time frames and methodologies.

Source: tradingview.com

Key resistance levels include $46.44 (primary resistance), $51.15 (resistance), and $57.30 (core resistance). The pivot of the current horizontal price channel is at $48.80. Core support is identified at $40.30, with support in heightened volatility situations dropping to $32.68. Notably, support and resistance levels are crucial for traders to identify potential reversal or continuation points in the stock's price movements.

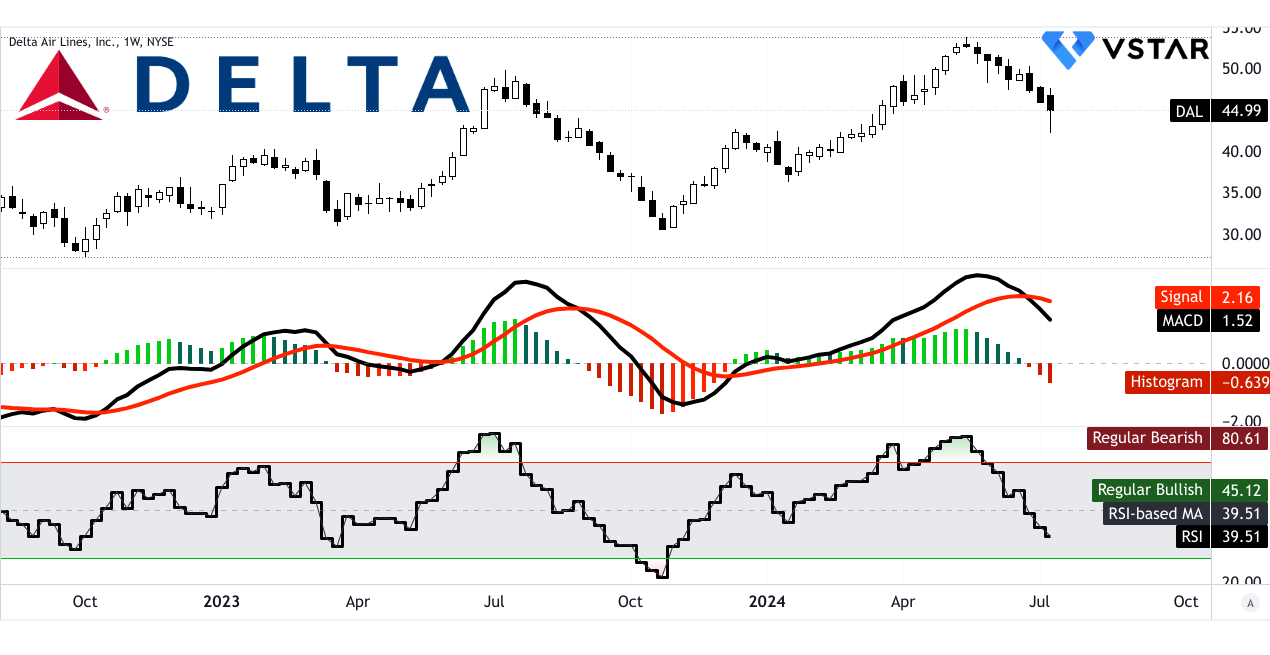

Relative Strength Index (RSI): The RSI value is 39.51, indicating that the stock is approaching oversold territory. The regular bullish level is set at 45.12, while the regular bearish level is at 80.61. There is no bullish or bearish divergence observed, and the RSI line trend is downward, reinforcing the current bearish sentiment.

Moving Average Convergence/Divergence (MACD): The MACD line is at 1.52, below the signal line at 2.16, with a MACD histogram value of -0.639. This configuration indicates a bearish trend, with the strength of the bearish trend increasing. The MACD is a crucial indicator for identifying potential reversals and the overall momentum of the stock.

Source: tradingview.com

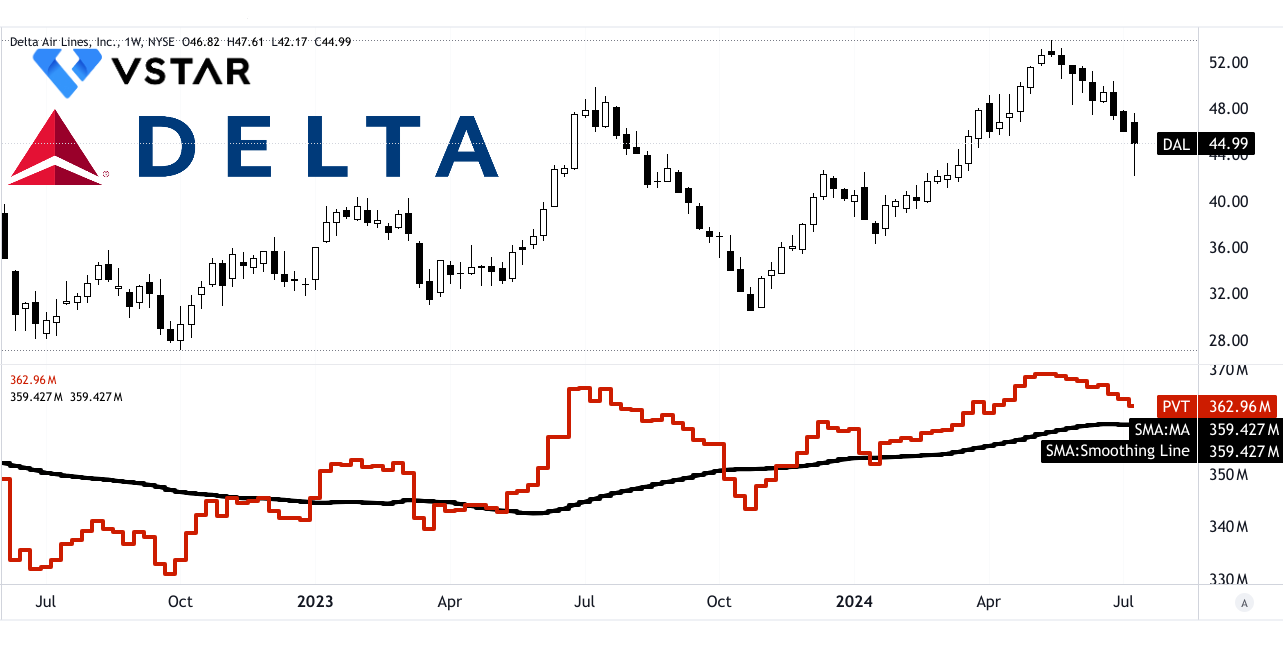

Price Volume Trend (PVT): The PVT line stands at 362.96 million, with the moving average at 359.427 million, indicating a prevailing bullish stock price momentum. PVT combines price and volume to provide insights into the strength of price movements, and the current data suggests underlying buying pressure.

Source: tradingview.com

B. Delta Airlines Stock Forecast: Fundamental Analysis

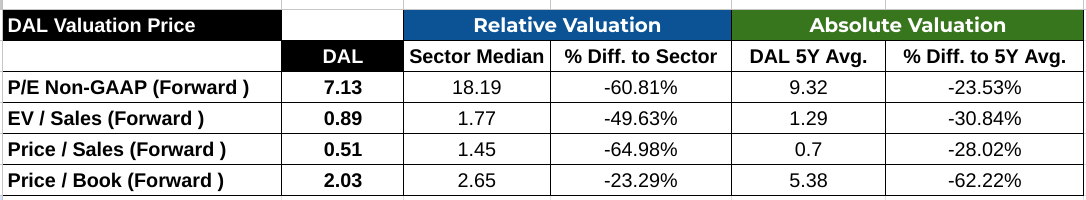

Delta Airlines' stock (DAL) Price-to-Earnings (P/E) ratio, which is a measure of the stock price relative to its earnings per share, stands at 7.13 for DAL, significantly lower than the sector median of 18.19. This indicates that DAL is undervalued by approximately 60.81% compared to its peers, suggesting potential for upward price adjustment. Historically, DAL's 5-year average P/E ratio is 9.32, and the current P/E ratio is 23.53% below this average, reinforcing the undervaluation sentiment. The Price/Sales (P/S) ratio is another critical metric, which for DAL is 0.51, significantly below the sector median of 1.45 and its 5-year average of 0.7. This indicates a 64.98% and 28.02% undervaluation, respectively.

Source: Analyst's compilation

C. DAL Stock Forecast: Market Sentiment

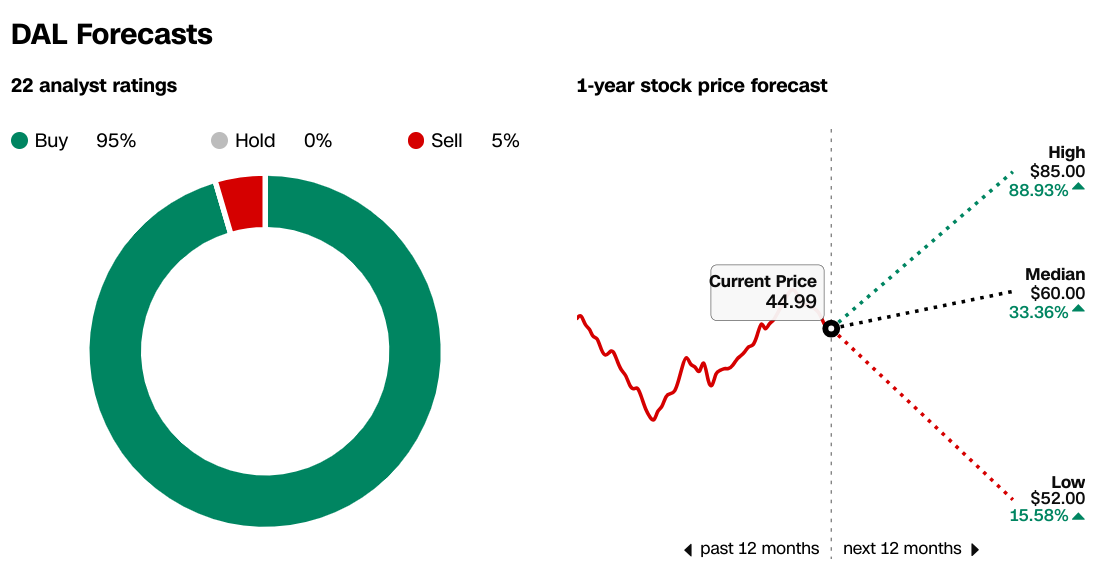

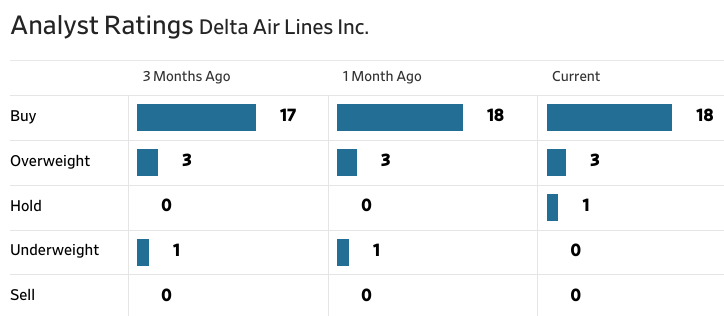

Market sentiment for Delta Airlines is notably positive, with strong endorsements from analysts. According to CNN, 22 analysts provide ratings with 95% recommending a buy, 0% a hold, and 5% a sell. The 1-year stock price forecasts show a high target of $85.00, representing an 88.93% upside from the current price of $44.99, a median target of $60.00 (a 33.36% upside), and a low target of $52.00 (a 15.58% upside). This bullish sentiment is echoed by WSJ, which also reports 18 buy recommendations, 3 overweight, 1 hold, and 0 sell ratings.

Source:CNN.com

Source:WSJ.com

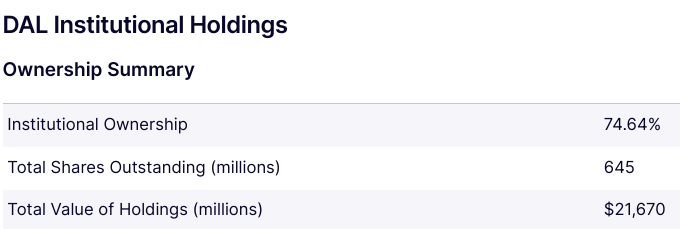

Investor confidence in DAL is reflected in its substantial institutional ownership, which stands at 74.64%. This high level of institutional ownership, with total holdings valued at approximately $21,670 million, indicates strong confidence from institutional investors in DAL's future performance.

Source:Nasdaq.com

Short interest in DAL is another critical sentiment indicator. As per Benzinga, DAL's short interest is 26.26 million shares, which constitutes 4.60% of the total shares outstanding, with a days-to-cover ratio of 3.42. This relatively moderate level of short interest suggests a balanced view among investors regarding the stock's near-term movements, though not overwhelmingly negative.

Source:Benzinga.com

IV. DAL Stock Forecast: Challenges & Risk Factors

Delta Competitors

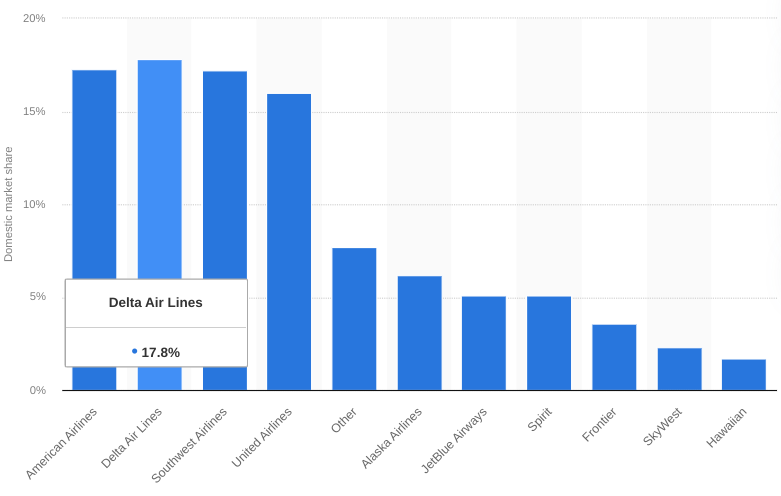

Delta Air Lines (DAL) faces significant competition from various airlines, both domestic and international. Key competitors include American Airlines (AAL), United Airlines (UAL), Southwest Airlines (LUV), JetBlue Airways (JBLU). These airlines also compete with Delta on transatlantic and transpacific routes, often offering strong alternatives for international travelers. However, Delta maintained its position as a leading carrier in the US, with strong market share across both domestic and international routes.

[Domestic market share of leading U.S. airlines from March 2023 to February 2024]

Source: statista.com

Other Risks

- Fuel Price Volatility: Delta's operations are significantly impacted by fuel price fluctuations. While Delta employs hedging strategies to mitigate this risk, unexpected spikes in fuel prices can drastically increase operational costs, squeezing profit margins.

- Aircraft Delivery Delays: Delta relies on timely deliveries of new aircraft from manufacturers like Airbus and Boeing. Delays in aircraft deliveries can disrupt fleet planning and expansion strategies. Although Delta has managed Boeing's delivery challenges relatively well, ongoing delays could impact future capacity and growth plans.

In conclusion, Delta Air Lines (NYSE: DAL) is positioned for robust growth driven by strong demand across domestic and international markets, premium services, and loyalty programs. Despite recording solid revenue and significant operational achievements, the stock faced a price decline due to industry-specific challenges like fuel cost volatility and economic uncertainties. Technical analysis shows a bearish short-term trend, with price targets ranging from $40.30 to $64.90. CFD trading platforms like VSTAR provide opportunities to trade DAL stock CFDs, allowing traders and investors to leverage potential price movements with lower upfront capital.