- CrowdStrike reported strong Q1 2024 financial performance, highlighted by significant revenue growth and record profitability metrics.

- Future growth opportunities are driven by cloud security, identity protection, next-gen SIEM, and data protection segments.

- Technical and fundamental analyses suggest potential for significant upside, although market sentiment indicates cautious optimism.

- Key risks include competition and equity dilution from stock-based compensation, impacting future performance.

I. CrowdStrike Q1 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

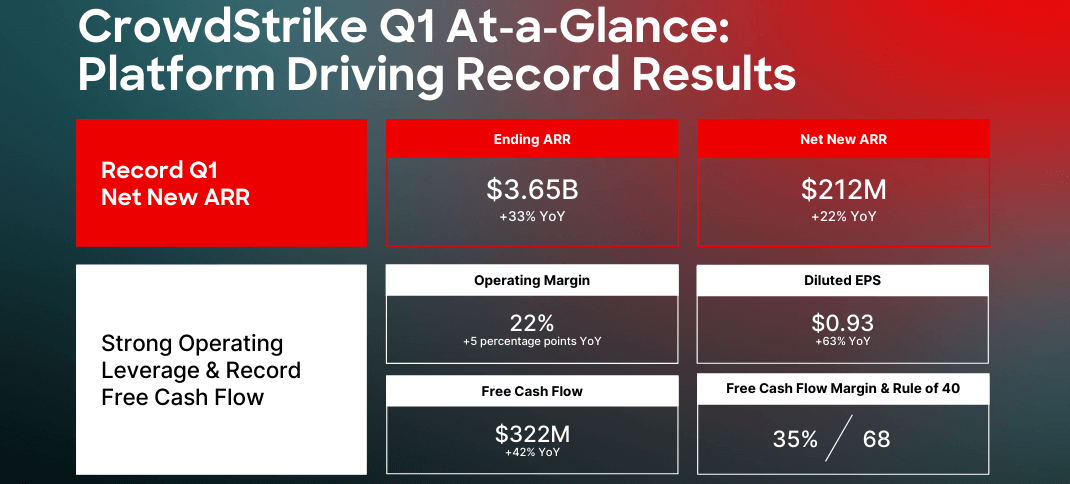

CrowdStrike reported an impressive Q1 2024 performance, demonstrating significant growth across various financial metrics. Revenue grew by 33% year-over-year to reach $921 million, driven by a 34% increase in subscription revenue to $872.2 million. The company also reported record net new Annual Recurring Revenue (ARR) of $212 million, marking a 22% year-over-year increase, and an ending ARR of $3.65 billion, which grew 33% year-over-year.

Profitability metrics also showed strong performance. The company's gross margin reached a record 78%, with a subscription gross margin of 80%, reflecting improved data center and workload optimization. Operating income rose by 72% year-over-year to $198.7 million, with an operating margin of 22%. Additionally, CrowdStrike achieved its fifth consecutive quarter of GAAP profitability, posting a GAAP net income of $42.8 million. Free cash flow was robust at $322 million, representing 35% of revenue.

Source: 1Q25 Earnings Presentation

Operational Performance

Operationally, CrowdStrike's Falcon platform continued to demonstrate its strength and market penetration. The company's strategy of consolidating cybersecurity solutions onto a single AI-powered platform has paid off, with significant increases in module adoption. Deals involving eight or more modules surged by 95% year-over-year. The adoption of modules related to cloud, identity, and next-gen SIEM doubled compared to the previous year.

Technological Advancements and Innovations

CrowdStrike's commitment to technological innovation is evident in its continuous development and integration of new products and features. The launch of Falcon for Defender, which provides a protective layer for Microsoft Defender users, showcases the company's proactive approach to addressing market needs. The integration of LogScale next-gen SIEM and the acquisition of Flow, adding runtime Data Security Posture Management (DSPM) capabilities, further strengthen the Falcon platform. The company has heavily invested in AI, with its Charlotte AI enhancing platform utility and reducing the time required for threat detection and response.

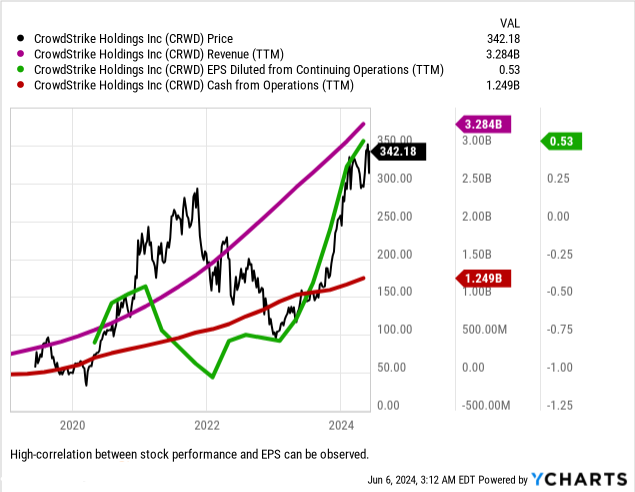

Source: Ycharts.com

B. CRWD Stock Price Performance

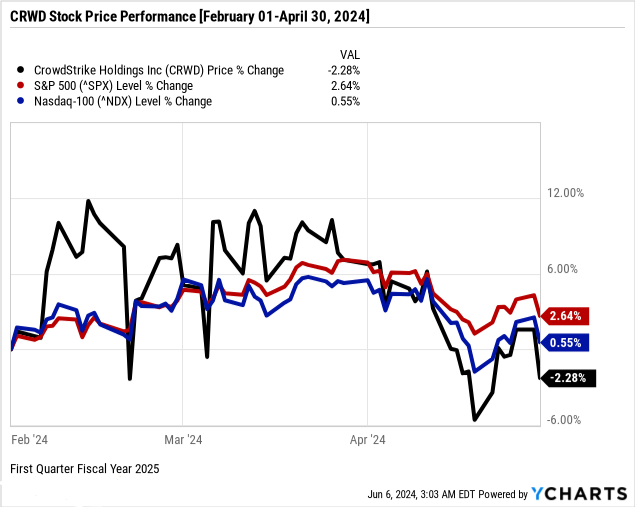

CrowdStrike (NASDAQ:CRWD) experienced a challenging quarter with its stock price declining by over 2%, closing at $292.54, down from an opening of $296.14. Despite reaching a quarterly high of $365, the stock also hit a low of $273.16, reflecting significant volatility. This performance contrasts sharply with broader market indices; the S&P 500 (SPX) gained nearly 3%, and the Nasdaq-100 (NDX) rose by approximately 1% during the same period. CrowdStrike's market capitalization remains robust at $71 billion, but the negative return underscores the street’s concerns.

Source: Ycharts.com

II. CrowdStrike Stock Forecast: Outlook & Growth Opportunities

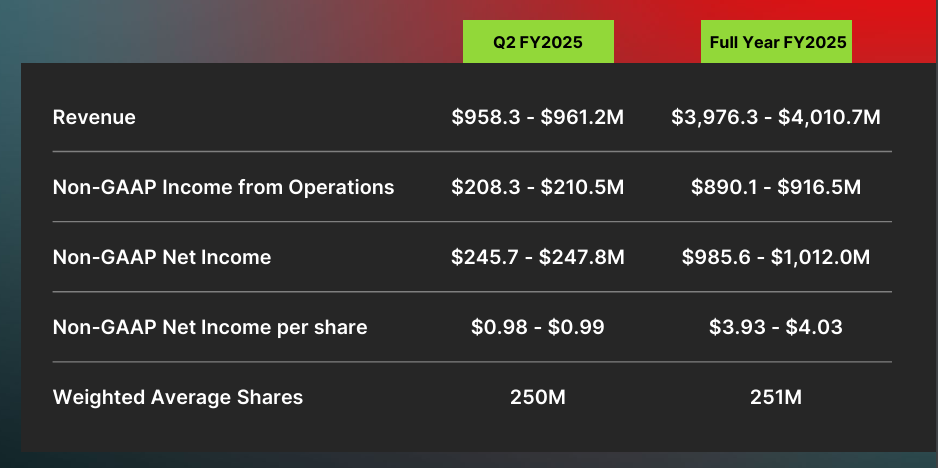

Revenue for Q2 is expected between $958.3M and $961.2M, with full-year projections between $3,976.3M and $4,010.7M. Non-GAAP net income is forecasted at $245.7M-$247.8M for Q2 and $985.6M-$1,012.0M for the full year, translating to $0.98-$0.99 and $3.93-$4.03 per share, respectively. Anticipated double-digit growth in ARR and a free cash flow margin of 31-33% underscore Crowdstrike's robust financial health and market position.

Source: 1Q25 Earnings Presentation

A. Segments with growth potential

Cloud Security:

The Falcon platform's cloud security offerings, including the recent integration of ASPM (Application Security Posture Management) and runtime DSPM (Data Security Posture Management), provide comprehensive real-time visibility and protection. This has positioned CrowdStrike as a leader in securing AI workloads and heterogeneous cloud environments. A notable example is the adoption of Falcon Cloud Security by 62 of the Fortune 100 companies.

Identity Protection:

CrowdStrike's identity detection and response (IDR) capabilities are unique, leveraging a single agent solution to support both traditional Active Directory and modern cloud identity systems like Microsoft Entra ID. This segment continues to see significant traction, exemplified by a seven-figure deal with a large healthcare provider that replaced two vendors and improved mean time to respond by 85%.

Next-Gen SIEM (Security Information and Event Management):

The LogScale next-gen SIEM platform addresses the growing demand for efficient and cost-effective SIEM solutions. With over 500 integrations, it facilitates seamless data ingestion and actionable insights, driving significant customer interest. A notable win includes an eight-figure deal with a Global 2000 manufacturing conglomerate that transitioned from Splunk to LogScale.

Data Protection:

CrowdStrike's data protection module, launched recently, has already attracted several hundred customers, including many Fortune 1000 accounts. Its seamless integration with existing Falcon platform capabilities offers compliance and protection without additional deployment complexities.

IT Management:

The Falcon for IT module extends endpoint management capabilities, including enterprise search, patching, deployment, and device health monitoring. This segment has shown rapid growth, with an eight-figure pipeline emerging shortly after its launch.

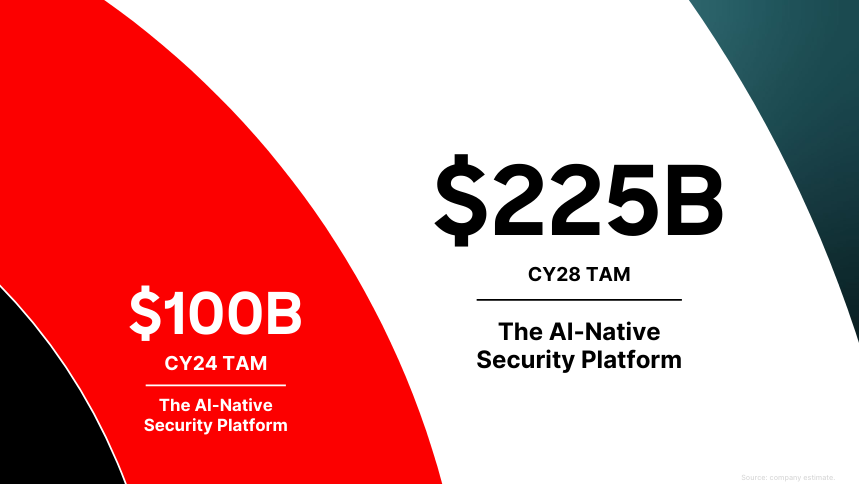

Overall, Crowdstrike's outlook for Q2 FY2025 and beyond remains strong, driven by significant growth in the AI-native security platform market, projected to reach $100B in 2024 and $225B by 2028.

Source: 1Q25 Earnings Presentation

B. Expansions and strategic initiatives

Mergers and Acquisitions:

CrowdStrike's acquisition of Bionic has bolstered its cloud security suite by integrating ASPM, enhancing its real-time visibility and protection features. The acquisition of Flow further strengthens its competitive position by adding runtime DSPM capabilities, securing data at rest and in motion.

Research and Development Investments:

Continuous innovation is a cornerstone of CrowdStrike’s strategy. The development of Falcon Flex, a subscription model allowing customers to adopt Falcon modules more flexibly, is an example of how CrowdStrike is adapting to market demands. The rapid integration of new acquisitions like Bionic and Flow into the Falcon platform showcases the company's robust R&D capabilities.

Partnerships and Collaborations:

CrowdStrike has formed strategic partnerships to enhance its market reach and technological capabilities. The partnership with NVIDIA exemplifies this, where CrowdStrike’s AI-driven cybersecurity solutions are paired with NVIDIA’s accelerated computing and generative AI, providing enterprises with enhanced threat visibility and protection. Additionally, collaborations with leading MSSPs (Managed Security Service Providers) like eSentire and Mandiant (a Google Cloud company) are driving broader adoption of the Falcon platform.

Market Consolidation Efforts:

CrowdStrike's focus on consolidation is evident through its Falcon Flex subscription model and significant customer wins involving the displacement of multiple vendors. For instance, a Fortune-100 healthcare company consolidated its cybersecurity solutions on the Falcon platform, reducing its agent footprint by 75% and improving mean time to detect and respond by 700%.

III. CrowdStrike Stock Forecast 2024

A. CRWD Stock Forecast: Technical Analysis

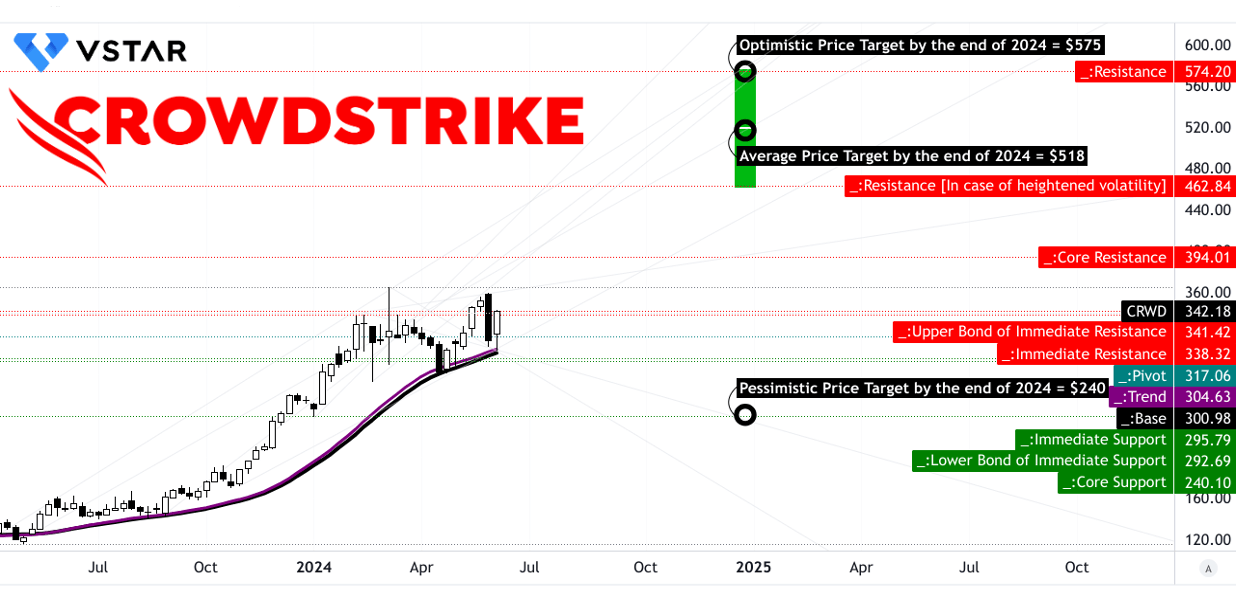

The average CRWD price target by the end of 2024 is projected to be $518. This forecast is rooted in the momentum of change-in-polarity over the mid- to short-term, extending this trend over Fibonacci retracement/extension levels. The optimistic CRWD price target stands at $575, reflecting strong upward momentum in current market swings, again using Fibonacci levels for projection. Conversely, the pessimistic CrowdStrike price target is set at $240, indicating potential downward momentum based on the same technical framework. Currently priced at $342.18, CRWD is demonstrating an upward trend considering the trendline (purple) and baseline (black).

Key support and resistance levels further elucidate the stock's potential movements. The primary support is identified at $338.32, with the pivot of the current horizontal price channel at $317.06. For heightened volatility scenarios, resistance levels include $462.84, with core resistance at $394.01 and an ultimate resistance point at $574.20. Support levels include $295.79, with core support at $240.10.

Source: tradingview.com

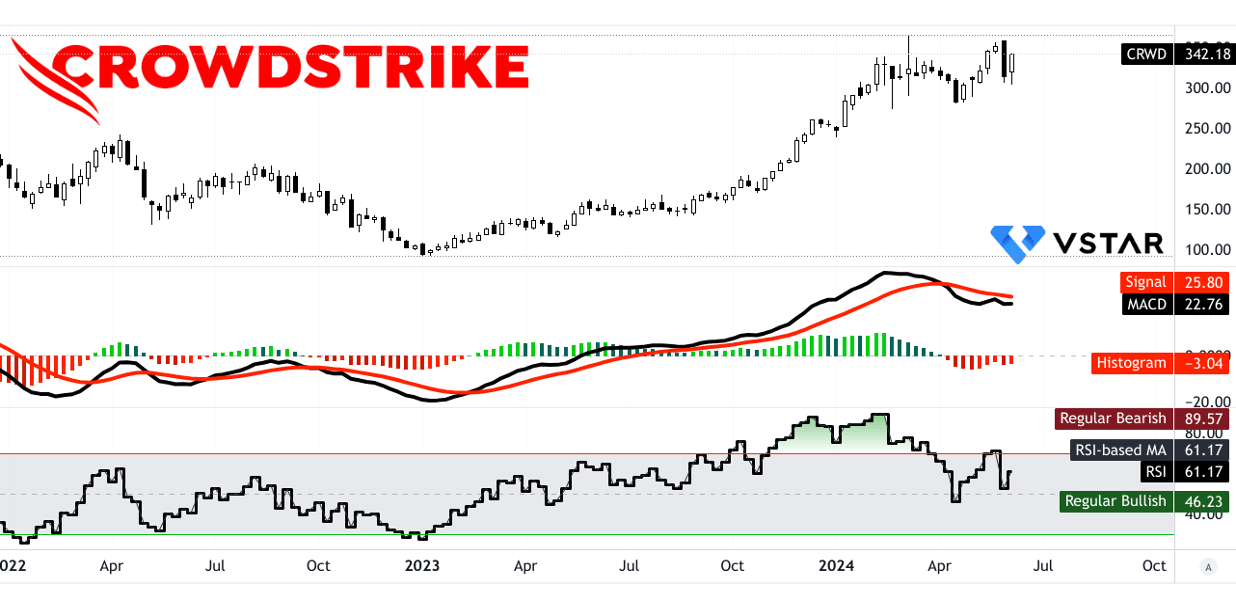

Analyzing momentum indicators, the Relative Strength Index (RSI) is currently at 61.17, signaling a generally bullish sentiment as it trends upwards. The RSI values suggest regular bullish and bearish levels at 46.23 and 89.57, respectively, though neither bullish nor bearish divergence is present at this time. The Moving Average Convergence/Divergence (MACD) indicator shows the MACD line at 22.76 against a signal line of 25.8, resulting in a negative histogram value of -3.040. This indicates a bearish trend, though the strength of this trend has stabilized.

Source: tradingview.com

B. CRWD Forecast: Fundamental Analysis

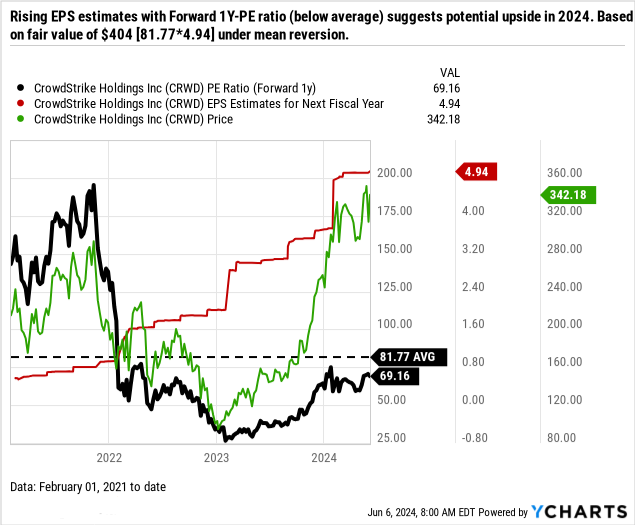

Crowdstrike (CRWD) has a forward P/E ratio of 69.16, below its average of 81.77, indicating potential undervaluation relative to its historical valuation. The forward EPS estimate is 4.94, suggesting strong earnings growth. Based on mean reversion, the forward price estimate is $404, significantly higher than the current price of $342, implying upside potential. However, the forward PEG ratio of 2.13, above the sector median of 2.01, indicates that CRWD's high valuation may not be fully justified by its growth rate, suggesting possible overvaluation compared to peers.

Source: Ycharts.com

C. CrowdStrike Stock Prediction: Market Sentiment

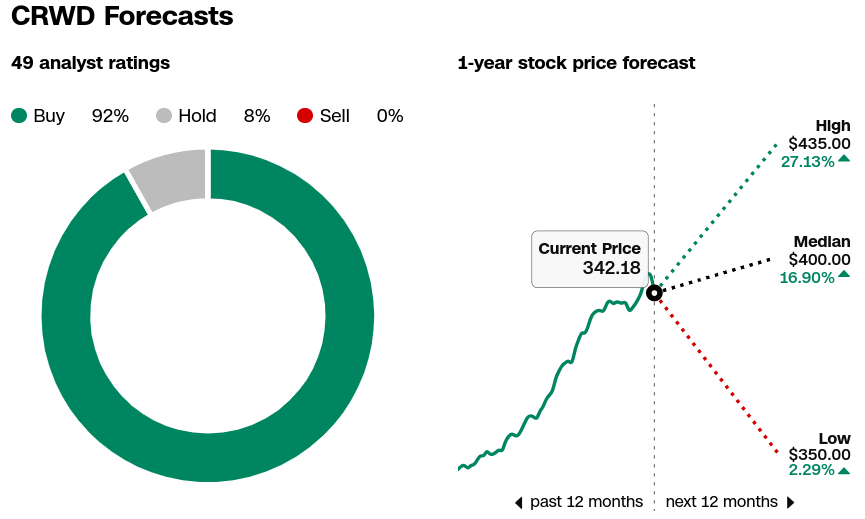

According to CNN, CrowdStrike (NASDAQ: CRWD) has a strong bullish outlook with 92% of analysts recommending a "Buy," 8% a "Hold," and 0% a "Sell." The one-year price targets suggest significant upside potential, with a high estimate of $435 (27.13% increase), a median of $400 (16.90% increase), and a low of $350 (2.29% increase).

Source: CNN.com

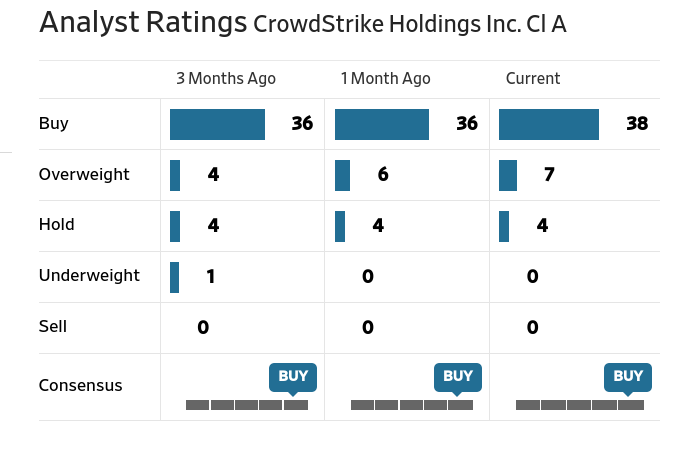

Similarly, the Wall Street Journal shows a trend of increasing "Buy" ratings over the past three months, indicating rising confidence among analysts. The consistency in "Hold" and "Sell" ratings, with no "Sell" recommendations, further underscores positive sentiment.

Source: WSJ.com

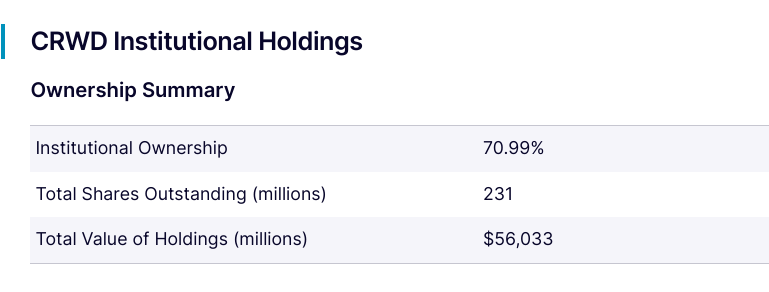

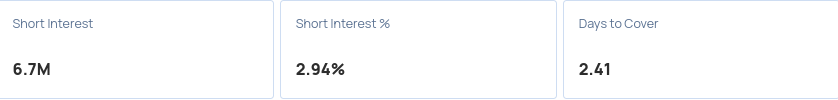

Smart money is putting confidence in CrowdStrike that reflects substantial institutional holdings, with 70.99% of its shares owned by institutions, translating to a total value of $56.033 billion. This high level of institutional investment often signals strong confidence in the company's long-term prospects. Additionally, short interest stands at 6.7 million shares, which is 2.94% of the float, with a relatively short "days to cover" ratio of 2.41. This low short interest suggests that few investors are betting against the stock, reflecting broader market optimism.

Source: nasdaq.com

Source: benzinga.com

IV. CRWD Stock Prediction: Challenges & Risk Factors

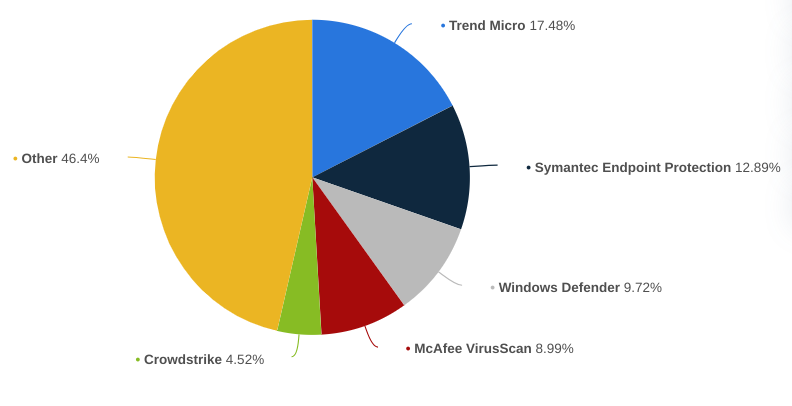

Crowdstrike stock forecast faces competition from vendors like Microsoft, Palo Alto Networks, SentinelOne, Wiz, Splunk, and Trellix in the endpoint protection and response software market. However, Crowdstrike's AI-native security platform offers distinct advantages, leveraging data gravity from endpoints and next-gen SIEM capabilities. The company holds nearly 5% share in the endpoint protection software market worldwide against Trend Micro (18%), Symantec Endpoint Protection (13%), and Microsoft (10%).

[Vendor share in the endpoint protection software market worldwide in 2024]

Source: statista.com

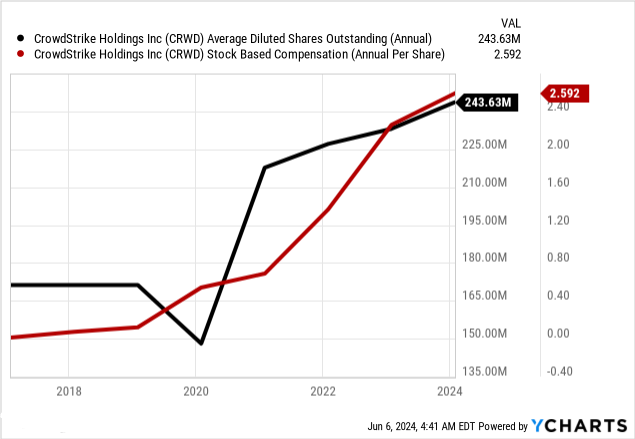

Core risks include dilution effect on the equity due to back-to-back stock-based compensation (SBC) increases and navigating pricing dynamics amidst platformization. In the ongoing challenging IT spending environment, competitive pricing strategies or customer resistance to price increases for bundled services may impact revenue and margins.

Source: Ycharts.com

In conclusion, CrowdStrike stock presents a promising outlook for 2024, driven by strong Q1 performance and strategic initiatives in cloud security and AI. Despite recent stock price volatility, the company's financial health, technological innovations, and market position signal potential for growth. For traders, CRWD stock CFDs offer opportunities to leverage this potential, available through platforms like the VSTAR trading app offering institutional level trading experience. CFD trading on CRWD can provide flexibility to capitalize on both upward and downward price movements. To sum up, CrowdStrike stock (CRWD) is a buy.