- Salesforce reported strong Q1 FY2025 results with significant revenue growth and operational efficiency.

- Future growth opportunities lie in Data Cloud integration, industry-specific solutions, and AI adoption.

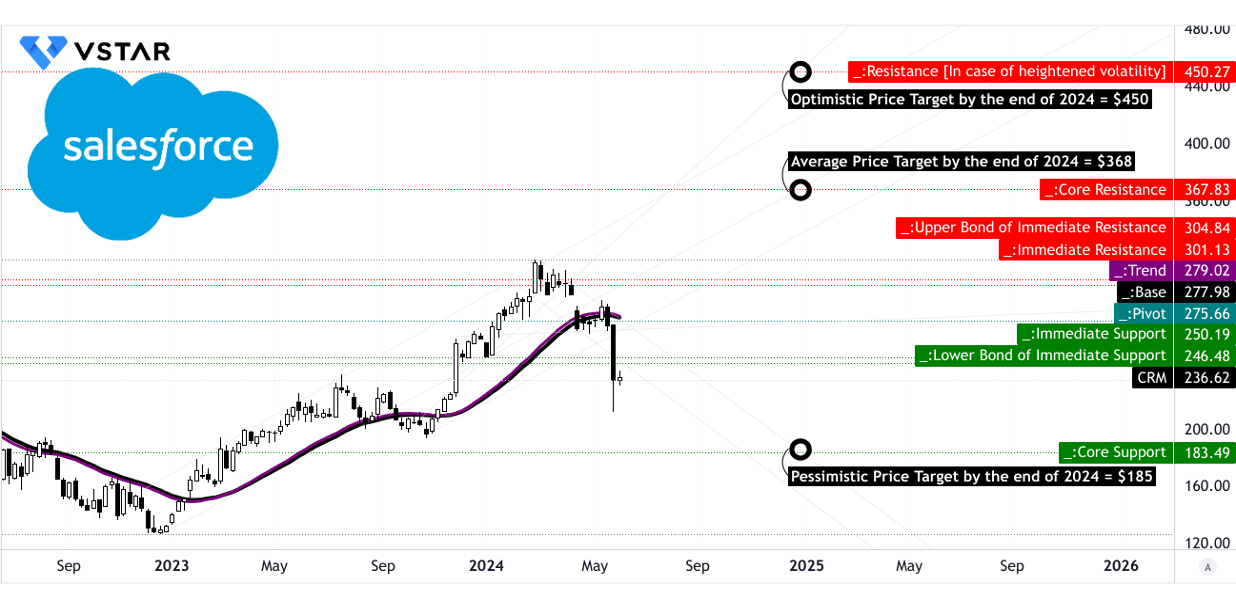

- CRM stock price prediction technical analysis provides a 2024 price target of $368 for CRM, projecting a recovery from current stock price dip.

- Fundamental analysis indicates Salesforce's valuation is more attractive compared to historical trends.

- Competitive pressure based on technological edge is a key risk to Salesforce's performance growth.

I. Salesforce Q1 2024 Performance Analysis

A. Key Segments Performance

A. Financial Highlights

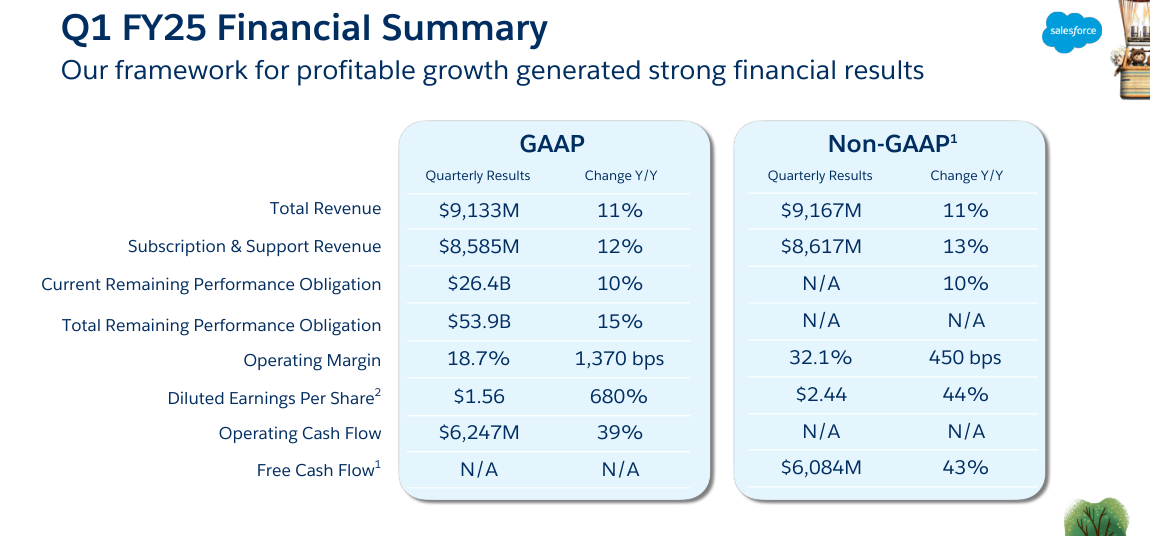

Salesforce reported robust financial results for Q1 FY2025, ended April 30, 2024. The company achieved a revenue of $9.13 billion, marking an 11% year-over-year (Y/Y) increase both nominally and in constant currency. Subscription and support revenue was a significant contributor, growing 12% Y/Y to $8.59 billion. The company's GAAP operating margin was 18.7%, while the non-GAAP operating margin stood at 32.1%, reflecting a disciplined approach to cost management and operational efficiency.

The firm demonstrated impressive cash flow performance, with operating cash flow surging 39% Y/Y to $6.25 billion and free cash flow increasing by 43% Y/Y to $6.08 billion. Salesforce returned $2.2 billion through share repurchases and distributed $0.4 billion in dividends to shareholders, highlighting its commitment to returning value to investors. The balance sheet remained strong, with a current remaining performance obligation (CRPO) of $26.4 billion, up 10% Y/Y, indicating robust future revenue streams.

Source: Q1 FY25 Quarterly Investor Deck

B. Operational Performance

Salesforce's operational metrics underscore its market leadership and strategic focus. As the #1 AI CRM, Salesforce manages over 250 petabytes of customer data, critical for AI-driven customer relationship management. The company's product portfolio saw significant traction, with Data Cloud emerging as a standout performer. Data Cloud contributed to 25% of deals over $1 million and added over 1,000 customers for the second consecutive quarter.

Market share analysis from IDC confirms Salesforce's position as the leading CRM provider for the 11th consecutive year. The company's diversified product suite, including Sales Cloud, Service Cloud, Marketing Cloud, and Commerce Cloud, continues to drive multi-cloud adoption. Nearly half of Salesforce's top 50 wins in the quarter involved six or more cloud products, underscoring the comprehensive nature of its solutions.

C. Technological Advancements and Innovations

Salesforce's technological advancements have been pivotal in maintaining its competitive edge. The company is at the forefront of AI integration, with its Einstein AI platform generating billions of predictions daily. The recent launch of Einstein Copilot, Prompt Builder, and Einstein Studio has empowered customers with advanced generative AI capabilities. These innovations have seen rapid adoption, with hundreds of Copilot deals closed since their general availability.

The introduction of Slack AI further exemplifies Salesforce's innovation, enhancing collaboration and productivity. Slack AI, launched in February, provides features like recap summaries and personalized search, with customers summarizing over 28 million Slack messages since launch. Additionally, Salesforce's internal AI adoption has saved its engineering teams over 20,000 coding hours per month, showcasing operational efficiencies.

In Q1, Salesforce launched several new products and initiatives. The Data Cloud is poised to be the company's next billion-dollar cloud, integrating customer data across systems to provide a single source of truth. This facilitates AI-driven insights and actions across the Customer 360 platform.

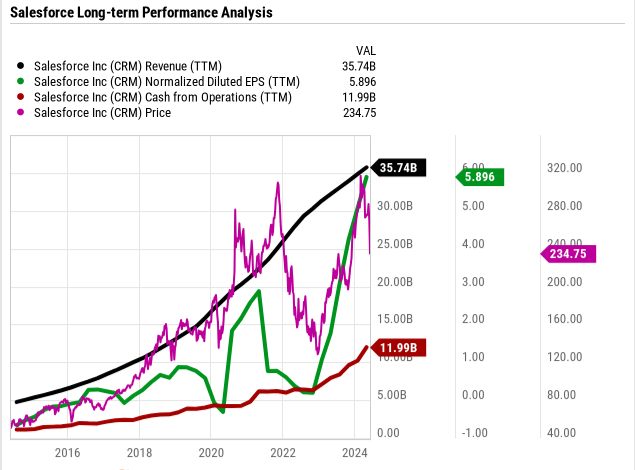

Source: Ycharts.com

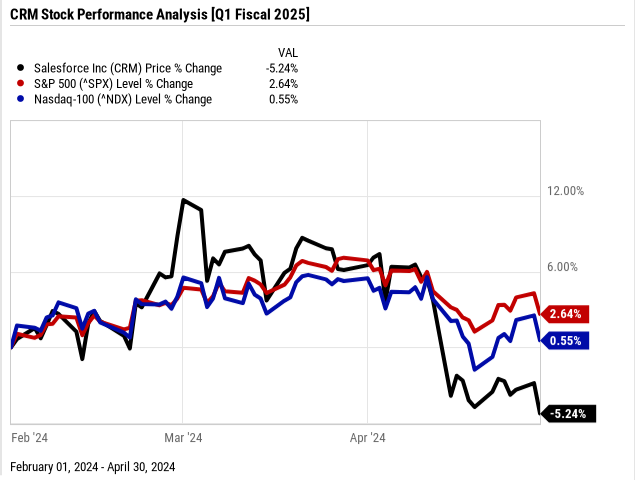

B. CRM Stock Price Performance

In Q1 Fiscal 2025, Salesforce (CRM) experienced a -5% decline in stock price, opening at $282.01 and closing at $268.94. The stock's high during the quarter was $318.71, while the low was $268.36. This performance contrasts sharply with broader market indices; the S&P 500 posted a 3% return and the Nasdaq-100 saw a 1% return. The underperformance of CRM relative to these indices suggests company-specific challenges and the street concerns, despite a significant market cap of $261 billion.

Source: Ycharts.com

II. CRM Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Data Cloud Integration:

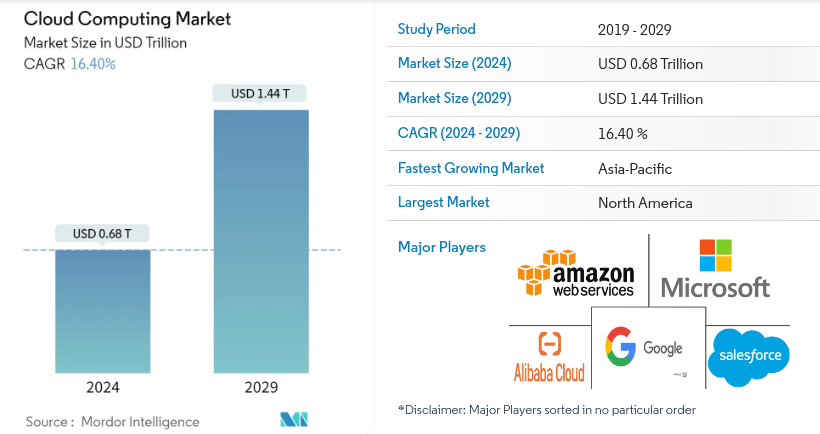

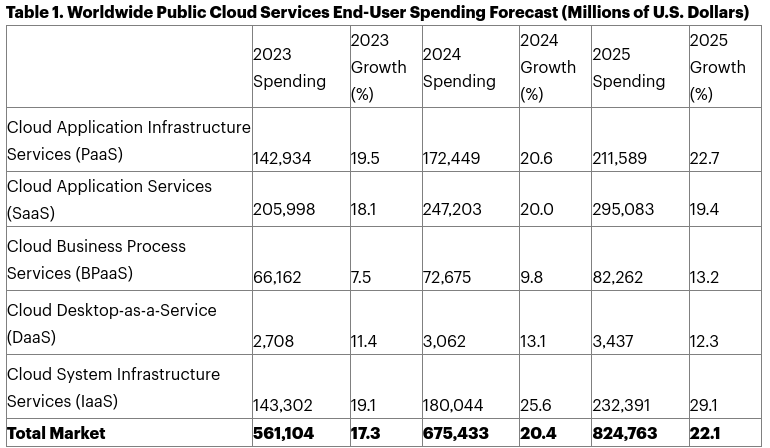

With 250 petabytes of customer data managed, Salesforce's Data Cloud segment stands out for significant expansion. This vast repository facilitates informed decision-making and enhances customer experiences, as evidenced by its integration into various Salesforce offerings like CrowdStrike. As per mordorintelligence.com, the Cloud Computing Market may hit $0.68 trillion in 2024 expanding at a CAGR of 16.4%. As per Gartner, Cloud Application Services (SaaS) spending may expand by 20% to hit $247.2 billion in 2024.

Source: mordorintelligence.com

Expansion in Industry Clouds:

Salesforce's industry-specific cloud solutions offer tailored functionalities, driving growth in vertical markets. The adoption of industry clouds, exemplified by success stories like Paychex and the City of Los Angeles, signifies significant market potential. This segment's revenue growth is forecasted at approximately 22.7% in 2025, indicating sustained momentum. As per gminsights.com, Industrial Cloud Platform market may hit a growth rate of 17.5% (CAGR) in 2024. As per Technavio, the private cloud services market may grow at 26.71% (CAGR) in 2024.

Source: gartner.com

AI Adoption:

Salesforce's Einstein platform presents substantial growth opportunities. AI integration across multiple clouds enhances predictive analytics, personalization, and automation, fostering deeper customer engagement and operational efficiencies. Notably, AI-driven capabilities like Einstein Copilot have closed hundreds of deals, indicating strong market adoption and growth potential. As per mordorintelligence.com, the Cloud AI Market size is estimated at USD 67.56 billion in 2024 and expected to grow at a CAGR of 32.37% till 2029.

B. Expansions and Strategic Initiatives

Mergers and Acquisitions (M&A):

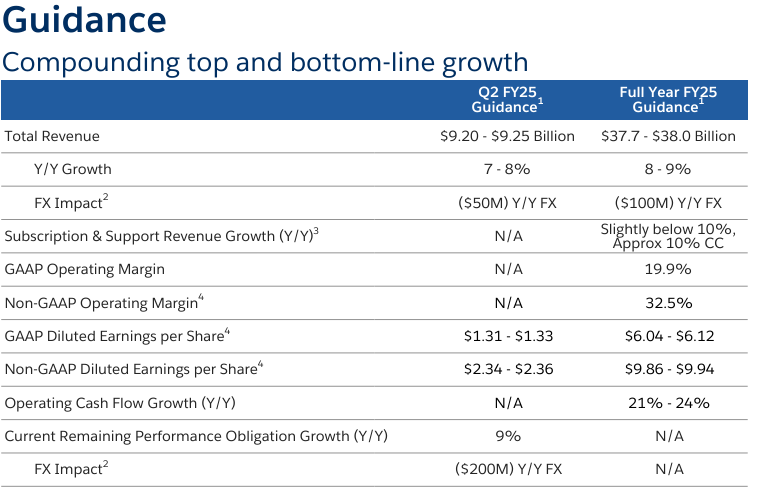

Strategic acquisitions like Slack Technologies, MuleSoft, and Tableau bolster Salesforce's market reach and product portfolio. These acquisitions contribute to revenue growth, with FY25 guidance projecting a revenue range of $37.7 billion to $38.0 billion, up 8% to 9% year-over-year. The acquisition of Slack Technologies, in particular, enhances collaboration capabilities and expands Salesforce's ecosystem.

Source: Q1 FY25 Quarterly Investor Deck

Research Investments:

Salesforce's commitment to R&D drives innovation and product enhancement. Continued investments in AI, data analytics, and cloud infrastructure enable Salesforce to deliver cutting-edge solutions. These investments support revenue growth projections, with subscription and support revenue expected to grow approximately 10% year-over-year in constant currency.

Partnerships and Collaborations:

Collaborations with industry leaders like Amazon Web Services (AWS), Google, IBM, and Microsoft amplify Salesforce's market presence. Partnerships with AWS streamline deployment processes, enhancing customer accessibility and scalability. These collaborations contribute to revenue growth, with Salesforce products now available on the AWS marketplace, facilitating expedited deployments and flexible budgeting options.

III. CRM Stock Forecast 2024

A. Salesforce Stock Forecast: Technical Analysis

Technical Price Targets:

- Average CRM Price Target: $368, grounded in momentum analysis over Fibonacci retracement and extension levels, suggesting a significant recovery.

- Optimistic CRM Stock Price Target: $450, based on positive momentum in short to mid-term swings, indicating a strong bullish reversal.

- Pessimistic Salesforce Price Target: $185, considering possible negative momentum, reflecting bearish conditions continuing.

As of the current observation, Salesforce stock (CRM) is priced at $236.62. The stock's current trendline and baseline, calculated using a modified exponential moving average, stand at $279.02 and $277.98 respectively. Here these values being higher than the current price, the overall direction indicates a downward trend.

Salesforce stock's pivot is at $275.66. CRM faces several critical resistance and support levels:

- Primary Resistance: $246.48, a level where the stock has recently struggled to surpass.

- Core Resistance: $367.83, the driver of the average CRM target price.

- Core Support: $183.49, near the pessimistic CRM price target, indicating a crucial support zone.

Source: tradingview.com

Relative Strength Index (RSI)

The RSI value of 31.92 indicates that the stock is nearing oversold territory, as regular bullish and bearish levels are 43.99 and 82 respectively. However, there is no bullish or bearish divergence observed, and the RSI line trend is downward, implying continued selling pressure.

Moving Average Convergence/Divergence (MACD)

The MACD indicator presents a bearish scenario with the MACD line at 1.36, well below the signal line at 10.9, and a negative histogram value of -9.540. The increasing strength of this bearish trend suggests growing momentum in the stock's decline.

Source: tradingview.com

B. Salesforce Stock Prediction: Fundamental Analysis

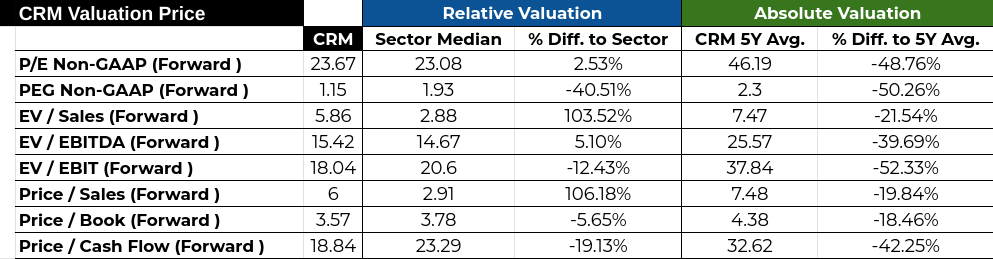

Salesforce's (CRM) valuation metrics indicate a mixed picture. The forward P/E ratio is 23.67, slightly above the sector median of 23.08, indicating a modest 2.53% premium, yet significantly below its five-year average of 46.19, representing a 48.76% discount. This suggests that while CRM is valued higher than its peers, it is trading at a notable discount compared to its historical valuations.

The forward PEG ratio stands at 1.15, substantially lower than both the sector median (1.93) and its five-year average (2.3), indicating a 40.51% and 50.26% discount, respectively. This suggests that Salesforce offers growth at a more reasonable price compared to historical trends and industry peers.

C. CRM Stock Prediction: Market Sentiment

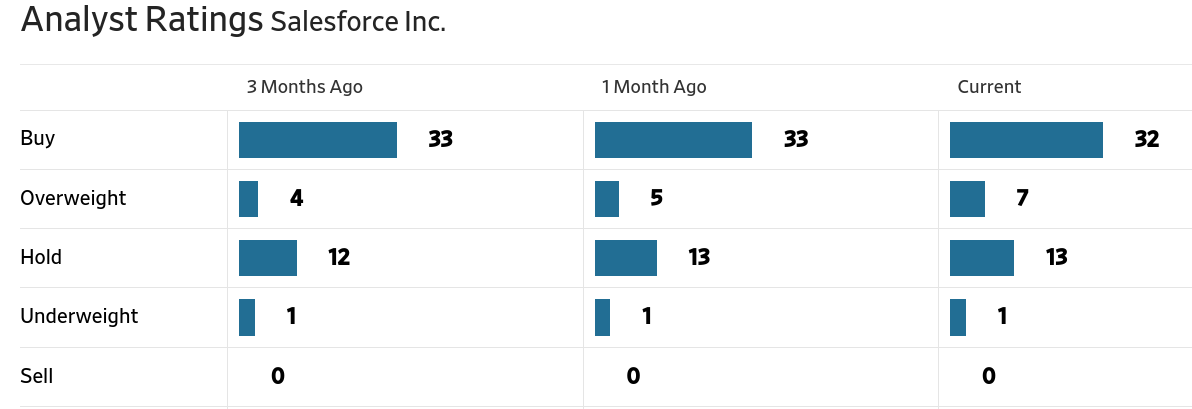

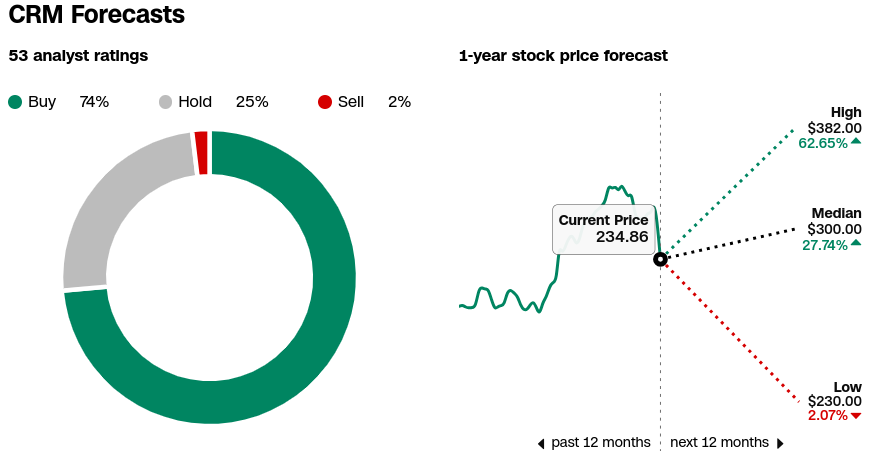

Analyst sentiment towards CRM remains predominantly positive. As per WSJ, out of the current ratings, 32 analysts recommend a "Buy," 7 suggest "Overweight," 13 rate it as "Hold," and only 1 suggests "Underweight," with no "Sell" ratings. CNN.com's forecasts corroborate this positive sentiment, with 74% of analysts recommending "Buy," 25% "Hold," and only 2% "Sell." The 1-year price targets range from a high of $382 to a low of $230, with a median of $300, reflecting significant potential upside from the current price of $234.86.

Source: WSJ.com

Source: benzinga.com

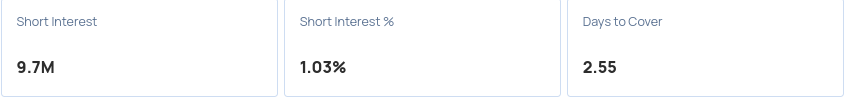

Institutional ownership of Salesforce is robust, with institutions holding 81.12% of outstanding shares, amounting to $184.619 million in value. This high level of institutional ownership typically signals strong confidence among large, professional investors. Furthermore, the short interest in CRM is low at 1.03%, with 9.7 million shares sold short, indicating limited bearish sentiment and a generally optimistic outlook.

Source: Nasdaq.com

Source: Benzinga.com

IV. CRM Stock Forecast: Challenges & Risk Factors

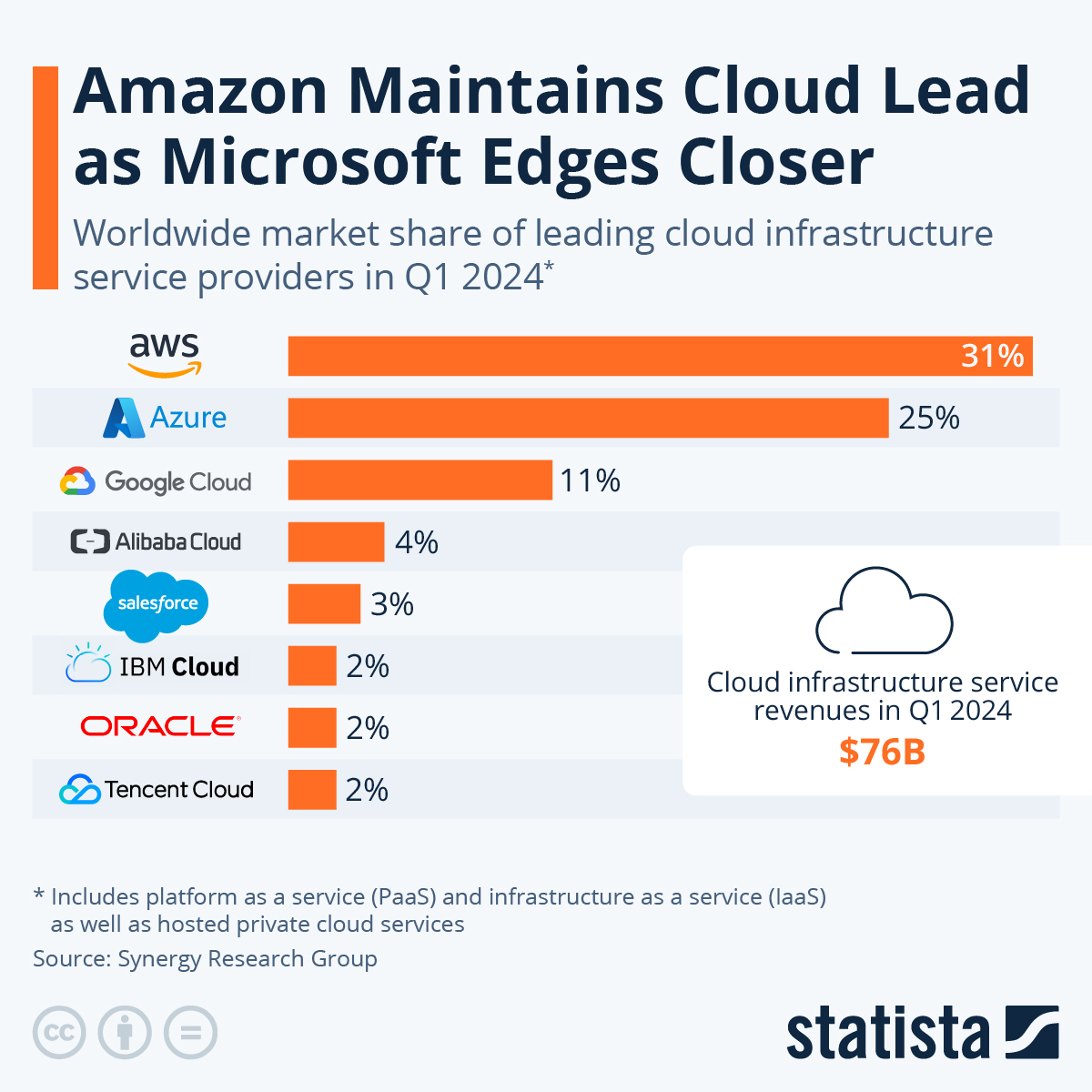

One critical challenge is Salesforce's competition with industry rivals, such as Oracle, SAP, and Microsoft. Despite Salesforce's leading market position (with 3% market share), competitors' offerings (Microsoft Dynamics 365 and Oracle CX Cloud Suite) may attract potential customers. For instance, CrowdStrike, a cybersecurity leader, expanded its usage to multiple Salesforce clouds but might explore alternatives if offered better solutions elsewhere.

Source: statista.com

Additionally, Salesforce's global performance indicates varied regional impacts. Weaker performance in EMEA and challenges in the Americas, particularly in the technology sector, signify geographical vulnerabilities. Economic uncertainties and measured buying behavior further compound these risks, affecting Subscription & Support Revenue.

Salesforce stock outlook for 2024 is optimistic, driven by strong financial performance, innovative product offerings, and strategic initiatives. The company's focus on AI and cloud integration positions it well for future growth. Despite a recent dip in stock price, the overall sentiment is positive, with analysts predicting significant upside potential. Salesforce stock is a buy. CFD trading allows investors to speculate on CRM stock without owning the shares directly, offering flexibility in both rising and falling markets. Platforms like VSTAR trading app provide access to CRM stock CFDs, enabling traders to leverage these opportunities with institutional level experience.