- Costco's Q2 2024 performance showcased significant financial growth, with net sales up and net income rising.

- The company saw impressive e-commerce growth, indicating successful adaptation to digital trends.

- COST stock price appreciated in Q2 2024, outperforming broader market indices.

- Costco stock price technical forecast predicts a continued bullish trend, with year-end price targets around $1,040.

- Despite competitive risks, Costco's expansion and strategic initiatives present strong growth potential.

I. Costco Q2 2024 Performance Analysis

A. Key Segments Performance

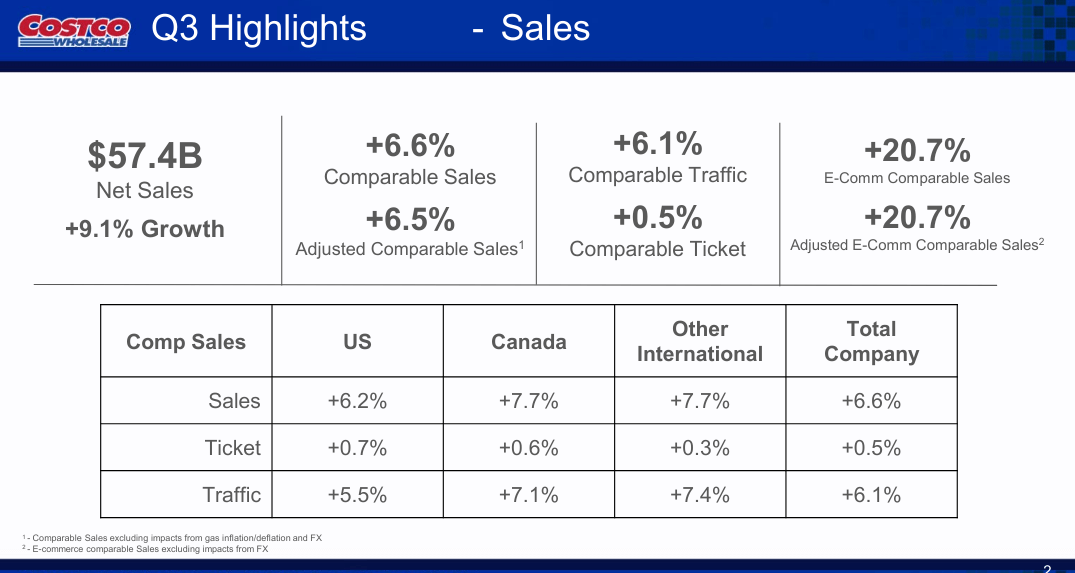

Financially, Costco demonstrated solid growth in net sales, with a 9.1% increase to $57.39 billion in the quarter and a 7.0% increase to $171.44 billion for the first 36 weeks of fiscal 2024. This growth was partly influenced by the shift in the fiscal calendar, contributing approximately 0.5 to 1.0 percent to net sales for the quarter. Net income also saw a significant uptick, reaching $1.68 billion for the quarter, up from $1.30 billion in the same period last year. EPS rose to $3.78 compared to $2.93 in the prior year's quarter.

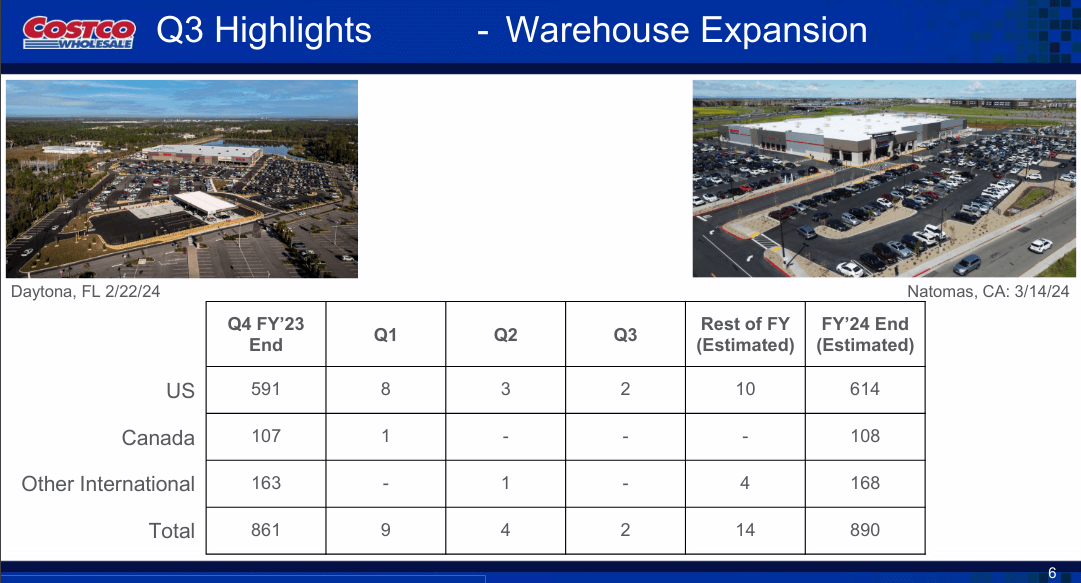

Source: Q3 Fiscal 2024 Highlights

Operational performance metrics further highlight Costco's success. Comparable sales data showed positive trends across various regions, with U.S. comp sales at 6.2%, Canada at 7.7%, and other international markets also posting robust figures. E-commerce comp sales surged by an impressive 20.7%, indicating the company's effective adaptation to digital retail trends. Additionally, Costco's membership fee income grew by 7.6%, reflecting strong customer loyalty and increasing membership numbers. The company ended the quarter with 74.5 million paid household members, a 7.8% increase from the previous year.

Technological advancements played a crucial role in driving Costco's growth and enhancing customer experience. The company continued to invest in its e-commerce platform, witnessing significant growth in online sales. Innovations such as the Costco Next curated marketplace and partnerships with Uber Eats expanded the company's reach and provided customers with convenient shopping options.

Costco's strategic initiatives and operational efficiencies were evident in its margin performance. The reported gross margin rate increased by 52 basis points year-over-year, reaching 10.84%. Core margins remained stable, reflecting Costco's ability to manage costs effectively. Despite challenges such as inflationary pressures, the company maintained competitive pricing strategies, ensuring value for customers while sustaining profitability.

B. COST Stock Price Performance

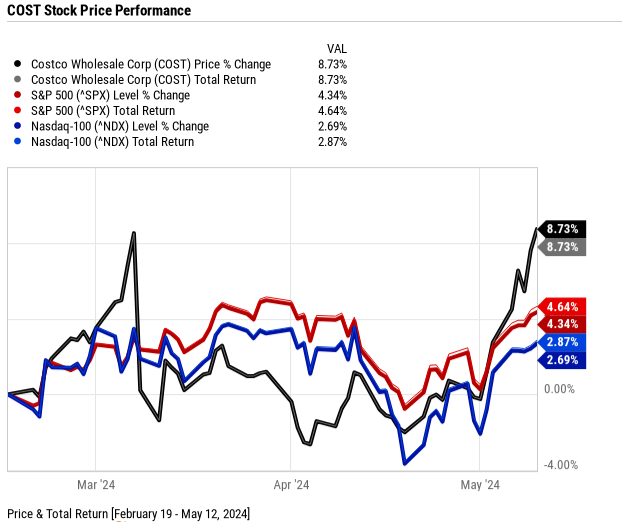

During Q3 fiscal 2024, Costco (NASDAQ: COST) demonstrated robust stock price performance, underscoring its strong market position with a market cap of $349 billion. Opening at $728.03 and closing at $787.19, Costco's stock price appreciated by 8.7% over the quarter. This performance significantly outpaced the broader market indices, with the S&P 500 and NASDAQ posting price returns of 4.3% and 2.9%, respectively.

The quarterly high of $787.45 and a low of $697.27 indicate that Costco's stock experienced notable volatility, yet it managed to end near its peak, reflecting positive investor sentiment and possibly strong financial results or optimistic forward guidance. The closing price near the high end suggests sustained buying interest and confidence in the company's future prospects.

Source: Ycharts.com

II. Costco Stock Price Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Non-Food Categories: Non-food segments exhibit strong comparative sales, indicating potential growth avenues. The emphasis on high-quality items resonating with members underscores merchandising effectiveness. Categories like toys, tires, lawn and garden, and health and beauty aids are experiencing notable momentum, suggesting continued demand and revenue growth.

Ancillary Businesses: The food court stands out with exceptional sales performance, driven by product innovation such as the introduction of the chocolate chip cookie. This underscores Costco's ability to capitalize on consumer preferences and enhance offerings to drive traffic and revenue.

Digital Expansion: E-commerce sales growth signifies evolving consumer behavior towards online shopping. Investments in app and website enhancements, coupled with initiatives like Costco Next marketplace, reflect Costco's commitment to digital transformation. The partnership with Uber Eats expands access to customers and offers additional revenue streams through gift card sales and membership discounts.

Membership Fee Income: The steady growth in membership fee income, coupled with high renewal rates, underscores Costco's ability to maintain customer loyalty and drive recurring revenue. Expansion of executive memberships further enhances sales penetration and revenue generation potential.

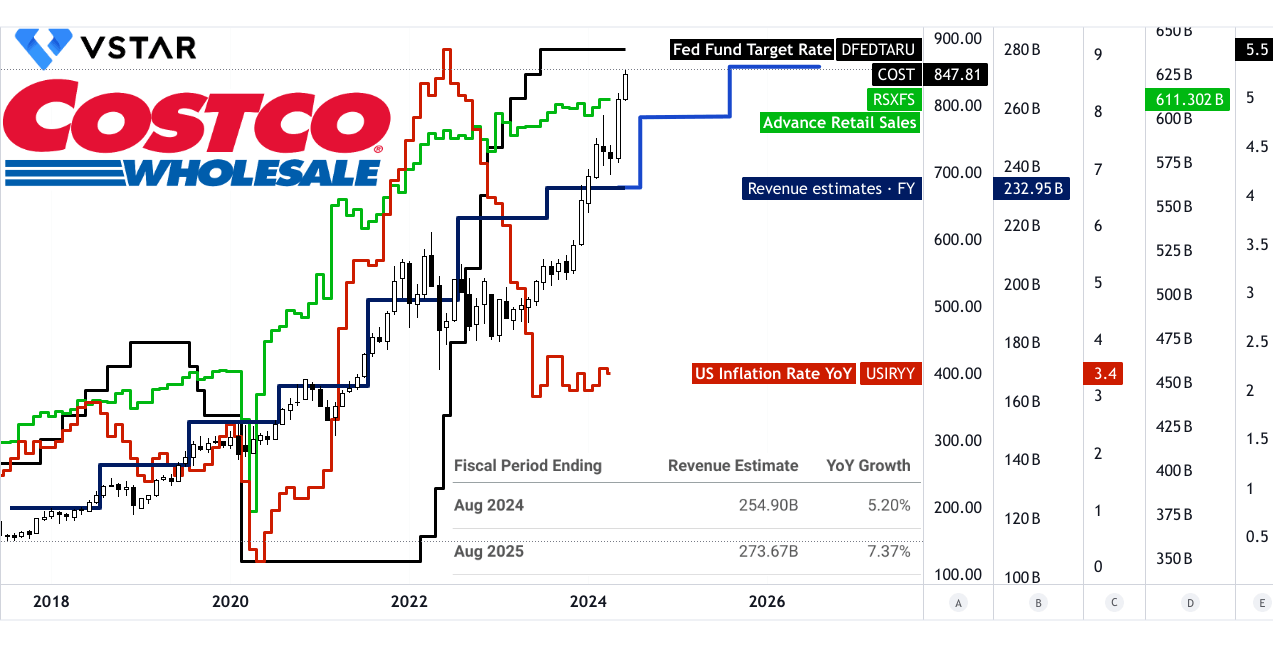

At the macro level, inflation may continue to be on a downward trajectory in 2024. With a decline in interest rates, consumer spending may boom, which is beneficial for Costco's top-line growth. Any rate cut in 2024 by the Fed may serve as a bullish catalyst for Costco's volatility.

Source: tradingview.com

B. Expansions and Strategic Initiatives

Warehouse Expansion: Costco's aggressive expansion plans, including new warehouse openings in the U.S., Japan, and Korea, signify a commitment to geographic diversification and market penetration. The expansion strategy aims to capture untapped markets and sustain revenue growth through increased footprints.

Source: Q3 Fiscal 2024 Highlights

Capital Expenditure: Significant capital expenditure allocation underscores Costco's commitment to infrastructure development and capacity expansion. The planned investments in new warehouses and technology enhancements are crucial for supporting growth initiatives and enhancing operational efficiency.

Product Innovation and Pricing Strategy: Costco's focus on product innovation, exemplified by the introduction of new Kirkland Signature items and price reductions on existing products. The emphasis on providing quality products at competitive prices aligns with consumer preferences and strengthens Costco's competitive positioning.

Digital Transformation: Investments in digital platforms, evidenced by app and website enhancements, signify Costco's strategic focus on omnichannel retailing. The partnership with Uber Eats and expansion of delivery services reflect efforts to enhance convenience and accessibility for customers, driving sales growth in the digital space.

III. Costco Stock Forecast 2024

A. Costco Stock Predictions: Technical Analysis

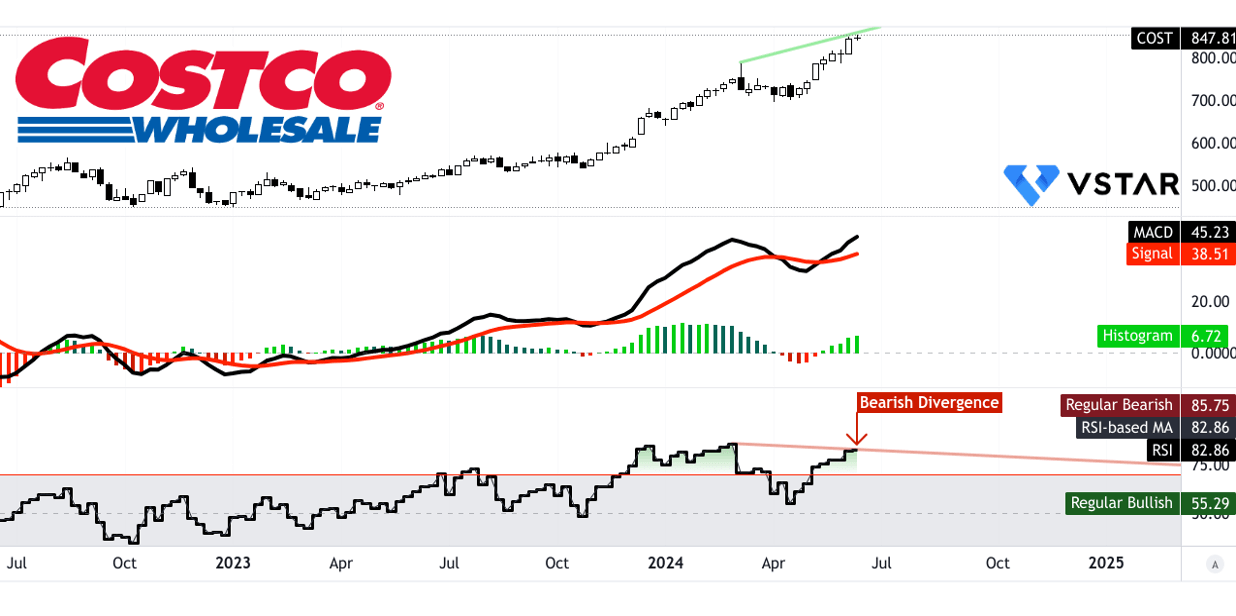

As of now, Costco (NASDAQ: COST) is trading at $847.81. The average Costco price target by the end of 2024 is projected at $1,040. This forecast is based on the momentum of change-in-polarity over the mid- to short-term, extrapolated using Fibonacci retracement and extension levels. This implies a continued bullish trend driven by sustained positive market sentiment and strong fundamental performance.

The optimistic COST price target stands at $1,350, predicated on the current swing's upward momentum. Conversely, the pessimistic target is $690, factoring in potential downward swings. These projections underscore the stock's volatility, influenced by broader market conditions and company-specific developments.

Key support levels include $800 (primary) and $580 (in case of heightened volatility), with resistance levels at $1,038.13 (core) and a potential high of $1,349.70 under volatile conditions. The pivot point of the current horizontal price channel is $690, indicating a critical threshold for maintaining the upward trend.

Source: tradingview.com

The RSI value of 82.86 indicates an overbought condition, typically a precursor to a potential bearish correction. The regular bullish level is 55.29, while the regular bearish level is 85.75, highlighting a current bearish divergence. Despite the upward RSI line trend, the overbought condition warrants caution as it may signal an impending price correction. The Moving Average Convergence/Divergence (MACD) line is at 45.23, with a signal line at 38.51 and a histogram of 6.720, reflecting a bullish trend with increasing strength. The MACD suggests robust upward momentum, reinforcing the optimistic Costco stock price target predictions.

Source: tradingview.com

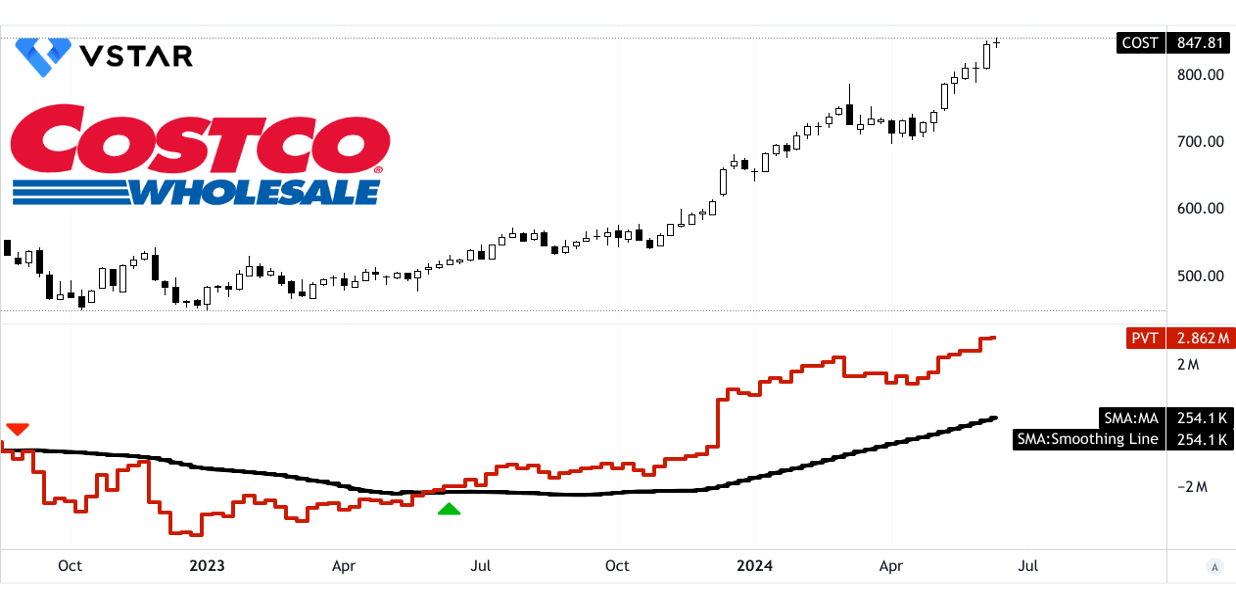

The Price Volume Trend (PVT) line is at 2.862 million, with a moving average of 254.1 thousand, indicating strong bullish momentum. High PVT values generally correspond with significant price increases, supporting the projection of a higher stock price.

Source: tradingview.com

B. COST Stock Forecast: Fundamental Analysis

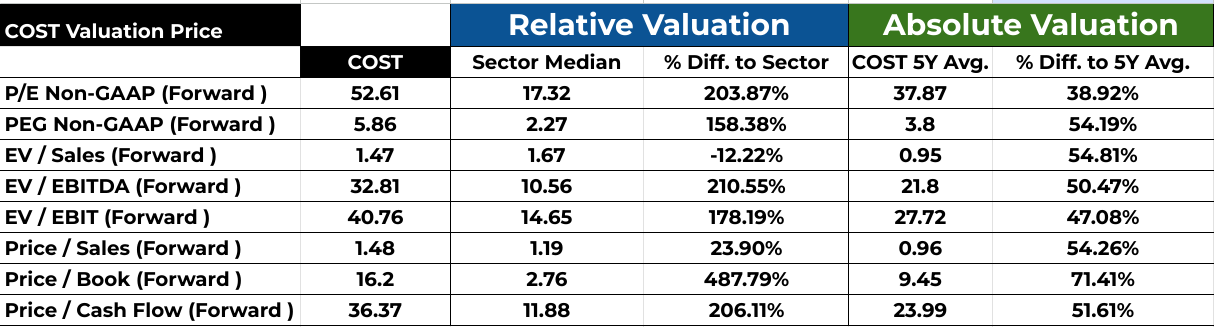

Costco's financial ratios reveal a robust valuation compared to both sector medians and its own historical averages. The Price/Earnings (P/E) ratio stands at 52.61, indicating a considerable premium of 203.87% over the sector median. Similarly, the Price/Earnings Growth (PEG) ratio at 5.86 suggests a 158.38% deviation from the sector median, signifying a relatively high growth expectation. These metrics highlight investors' confidence in Costco's future earnings potential, likely fueled by its consistent revenue growth and stable profitability.

Source: Analyst's compilation

C. Costco Stock Prediction: Market Sentiment

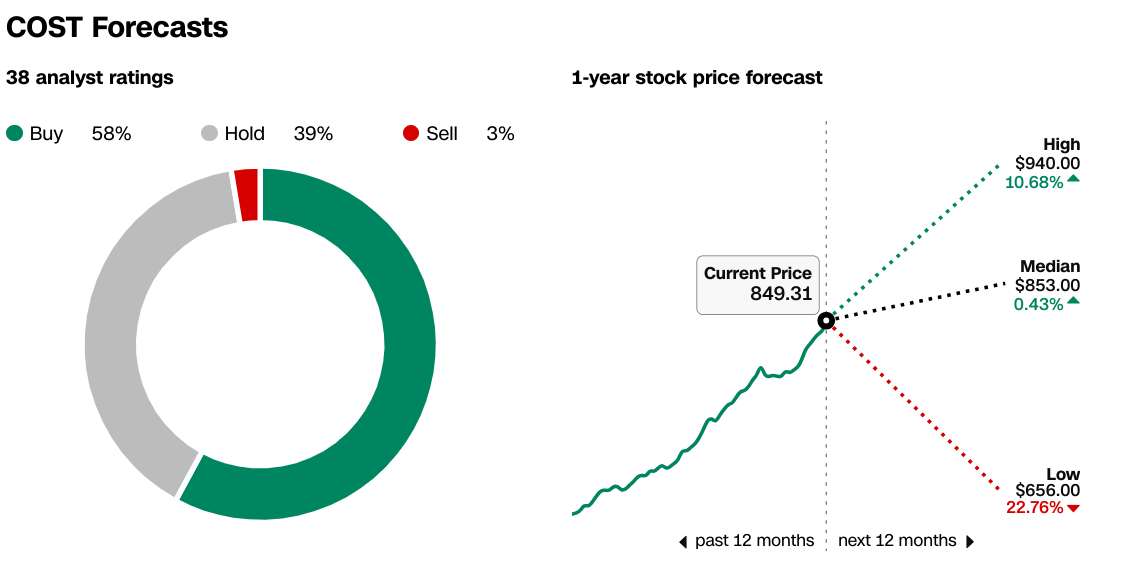

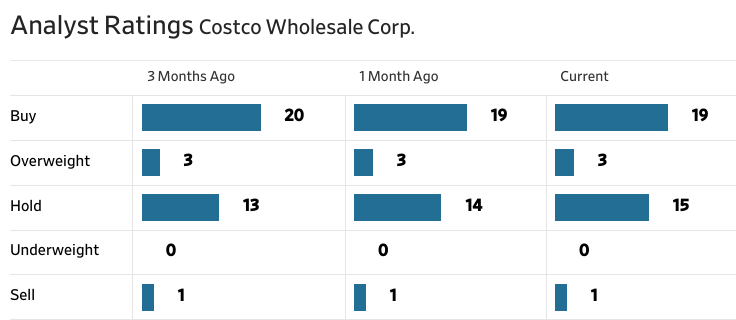

CNN.com reports that out of 38 analyst ratings, 58% advocate buying, 39% suggest holding, and only 3% recommend selling Costco stocks. The 1-year stock price forecast indicates a bullish sentiment, with a high estimate of $940, a median of $853, and a low of $656. This consensus reflects a positive outlook for Costco's performance in the coming year, supported by factors such as strong consumer demand, effective cost management, and expansion initiatives. WSJ.com's analyst ratings corroborate this sentiment, showing a steady trend of buy and overweight ratings over the past three months.

Source:CNN.com

Source:WSJ.com

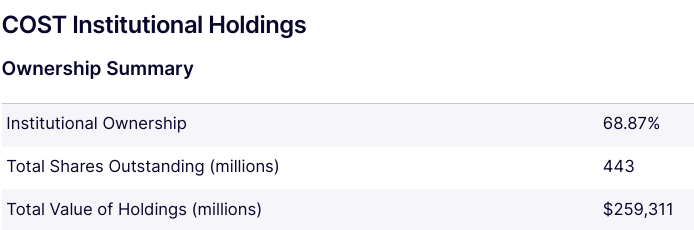

Moreover, Costco's institutional ownership, standing at 68.87%, underscores strong investor confidence in the company's long-term prospects. Institutions hold a substantial stake in Costco, with a total value of holdings reaching $259.311 million. This high level of institutional ownership signifies institutional investors' trust in Costco's business model, growth trajectory, and potential for generating returns.

Additionally, Costco's short interest at 6.6 million shares, representing 1.49% of the total shares outstanding. With a relatively low short interest and a moderate days-to-cover ratio of 3.89, it suggests that investors are not heavily betting against Costco stock, further supporting the prevailing positive sentiment.

Source:Nasdaq.com

Source:Benzinga.com

IV. Costco Stock Price Forecast: Challenges & Risk Factors

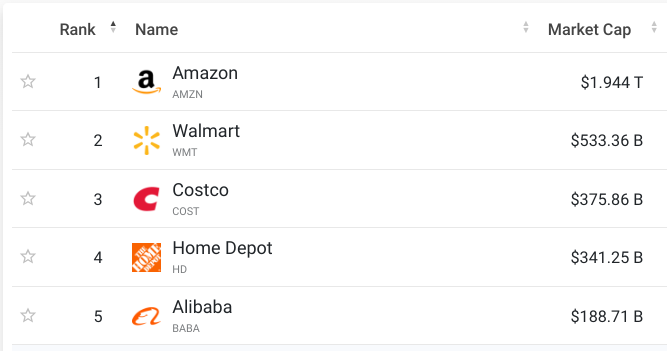

Costco stock price forecast faces challenges and risks stemming from various factors. Competitors pose a significant threat, with other retailers making price investments and enhancing their digital capabilities. For instance, besides Amazon, Walmart, and Target, the emergence of alternative shopping platforms like Instacart and Uber for grocery delivery services could impact Costco's market share. While Costco strategically partners with these platforms to enhance member value, it also exposes them to potential competition.

[World's Largest Retailers]

Source: companiesmarketcap.com

Another risk factor is Costco's gross margin cap policy, which aims to maintain margins between 14% and 15%. While this strategy has historically proven effective, it limits the company's ability to maximize profitability, especially amidst inflationary pressures and increasing costs. Similarly, any failure to hit the limit may deteriorate the market value of the Costco stock.

In conclusion, Costco stock outlook remains positive, driven by robust Q3 fiscal 2024 performance with topline and bottomline boost. Analysts project a bullish trend, targeting $1,040 by the end of 2024. For traders, the VSTAR app offers CFDs on COST stock, providing exposure to price movements with low trading fees and deep liquidity. CFDs allow for leveraged trading on Costco shares, enhancing potential returns but also carrying higher risk. The app's user-friendly interface and secure, regulated, institutional level platform make it accessible for both beginners and experienced traders.