I. Recent Bank of America Stock Performance

Recent BAC Stock Price Performance and Changes

Bank of America (NYSE) has shown mixed stock performance in recent times, reflecting both challenges and resilience in the market. The stock has a market cap of $306.87 billion and has fluctuated significantly within a 52-week range of $24.96 to $40.19. BAC stock price surged by 15.62% over the past six months and 16.54% year-to-date, slightly outpacing the S&P 500's gains of 15.09% and 13.87%, respectively. This suggests a strong recovery and investor confidence in the bank's performance and future prospects.

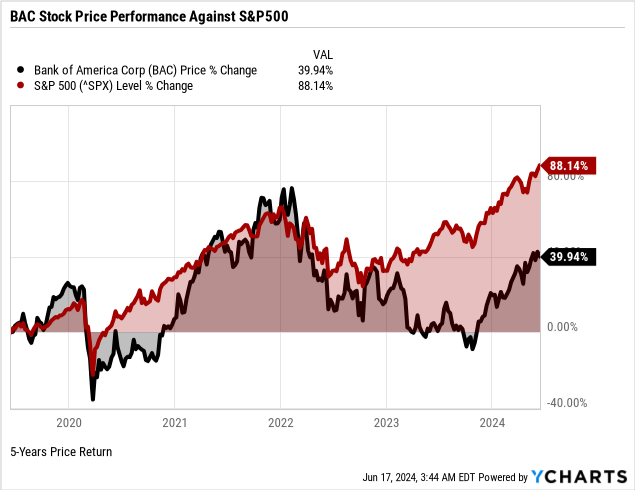

Over the past year, BAC stock returned 34.75%, surpassing the S&P 500's 24.22%. However, over three and five years, BAC underperformed with returns of -5.13% and 39.94%, respectively, compared to the S&P 500's 27.65% and 88.14%. Over ten years, BAC returned 154.15%, still trailing the S&P 500's 180.53%. This indicates long-term growth but at a slower pace compared to the broader market.

Source: Ycharts.com

Main Influencing Factors

Revenue Diversification: Bank of America revenue streams are diversified across consumer banking, global wealth management, global banking, and global markets. Each segment contributes differently based on market conditions and client activity. For instance, investment banking fees surged by 35%, indicating robust market demand and the bank's strong market share in this sector.

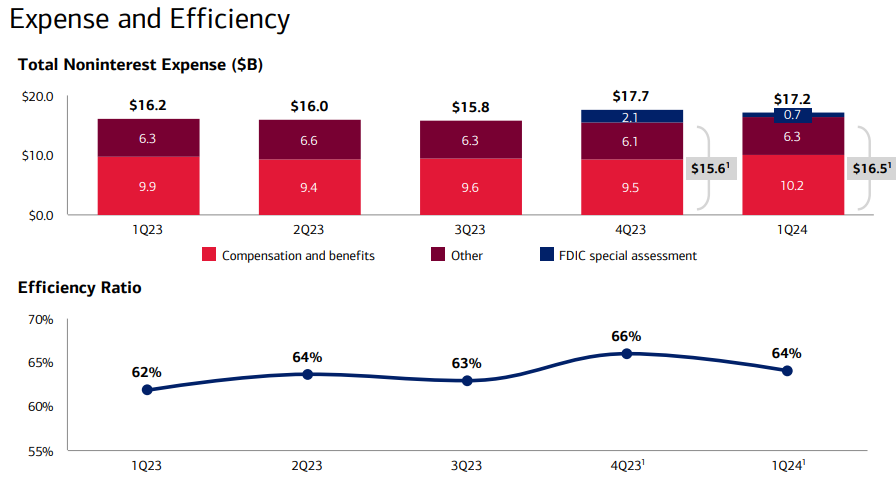

Expense Management: Despite facing inflationary pressures (with expenses up 2% against inflation rates of 4%+), Bank of America has managed to keep its noninterest expenses under control. This disciplined expense management is crucial for maintaining profitability amid economic uncertainties.

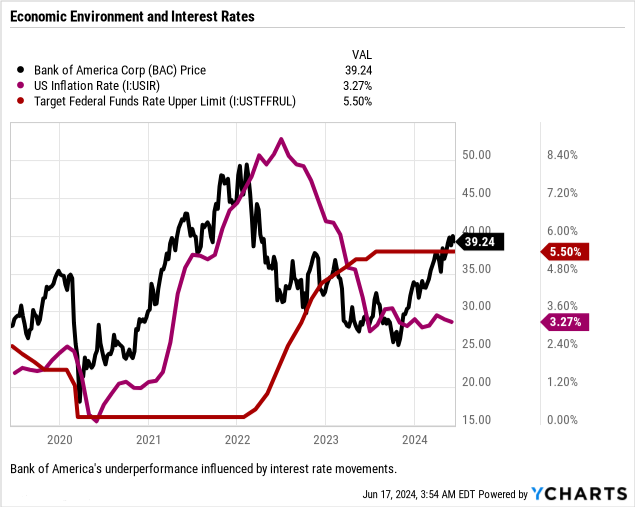

Economic Environment and Interest Rates: Bank of America's performance is heavily influenced by macroeconomic conditions and interest rate movements. In Q1 2024, despite facing higher deposit costs, the bank managed to benefit from higher asset yields and modest loan growth. The Federal Reserve's monetary policy decisions, including potential interest rate changes, significantly impact Bank of America's net interest income (NII), which accounts for a substantial part of its revenue.

Source: Ycharts.com

Credit Quality and Provisions: Provision for credit losses increased to $1.3 billion, reflecting cautious optimism about the economic outlook but also higher net charge-offs. The bank's credit quality metrics show a balanced approach to risk management, with provisions influenced by macroeconomic forecasts such as unemployment rates.

Digital Transformation and Customer Engagement: Bank of America continues to invest in digital platforms, enhancing customer experience and operational efficiency. This strategic focus has resulted in record digital logins and increased digital sales, indicating strong customer adoption and cost savings through automation.

Capital and Returns to Shareholders: The bank maintains a robust capital position with Common Equity Tier 1 (CET1) capital of $197 billion, well above regulatory requirements. This capital strength supports both business growth and significant returns to shareholders through dividends and share repurchases ($4.4 billion in Q1-24).

Expert Insights on BAC Stock Forecast for 2024, 2025, 2030 and Beyond

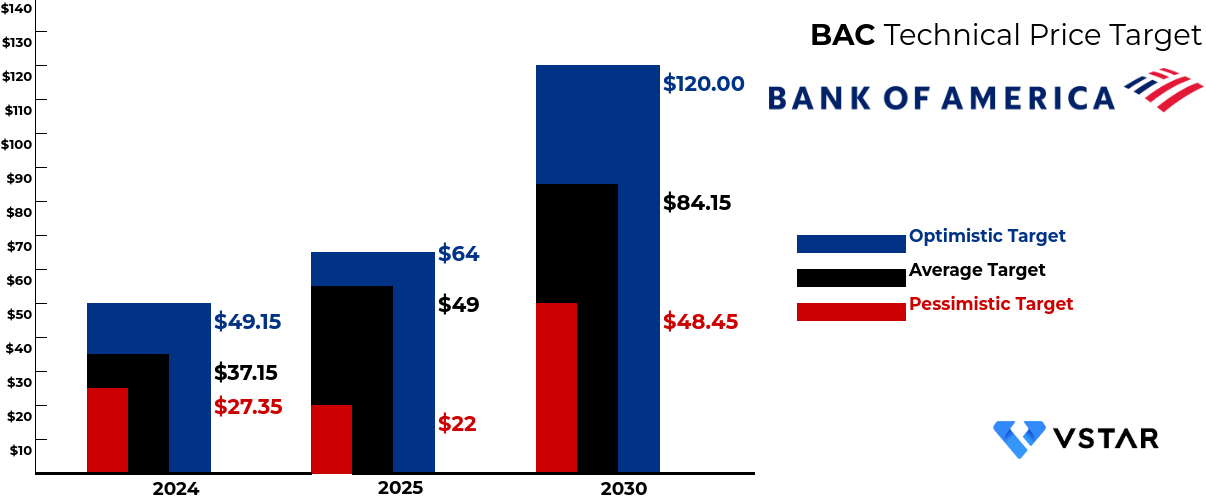

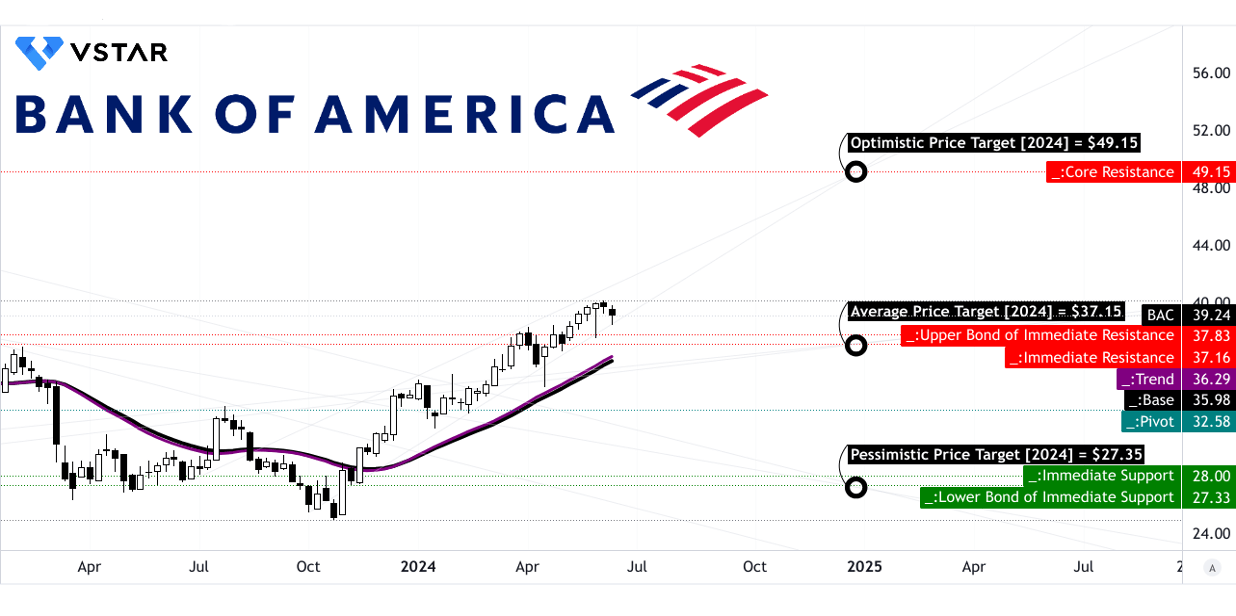

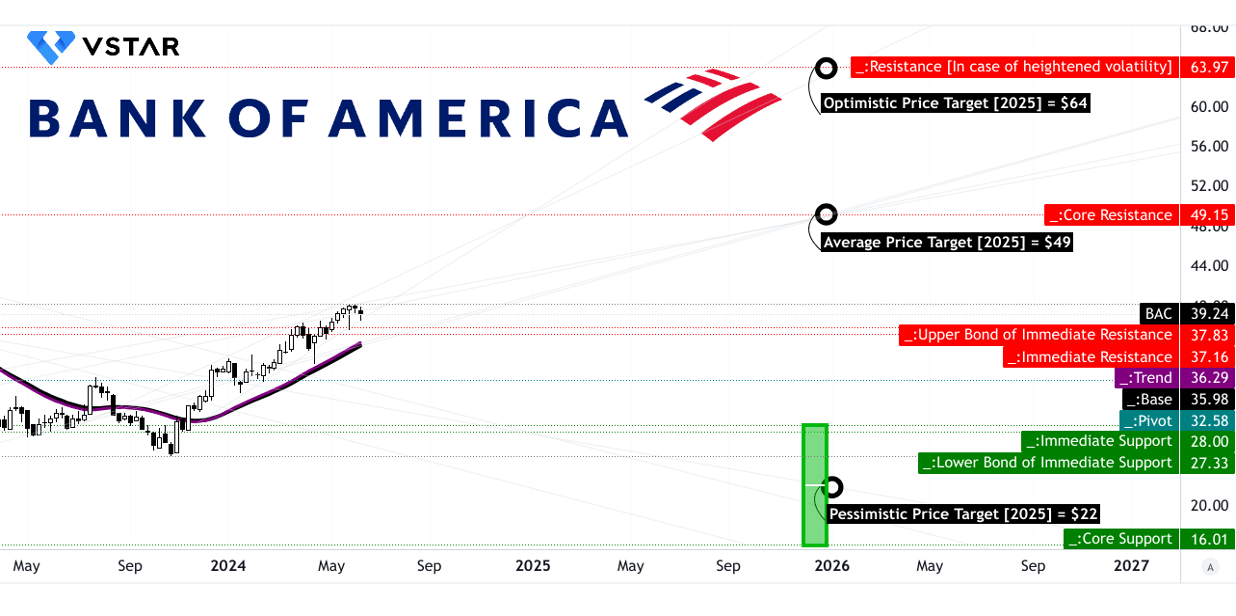

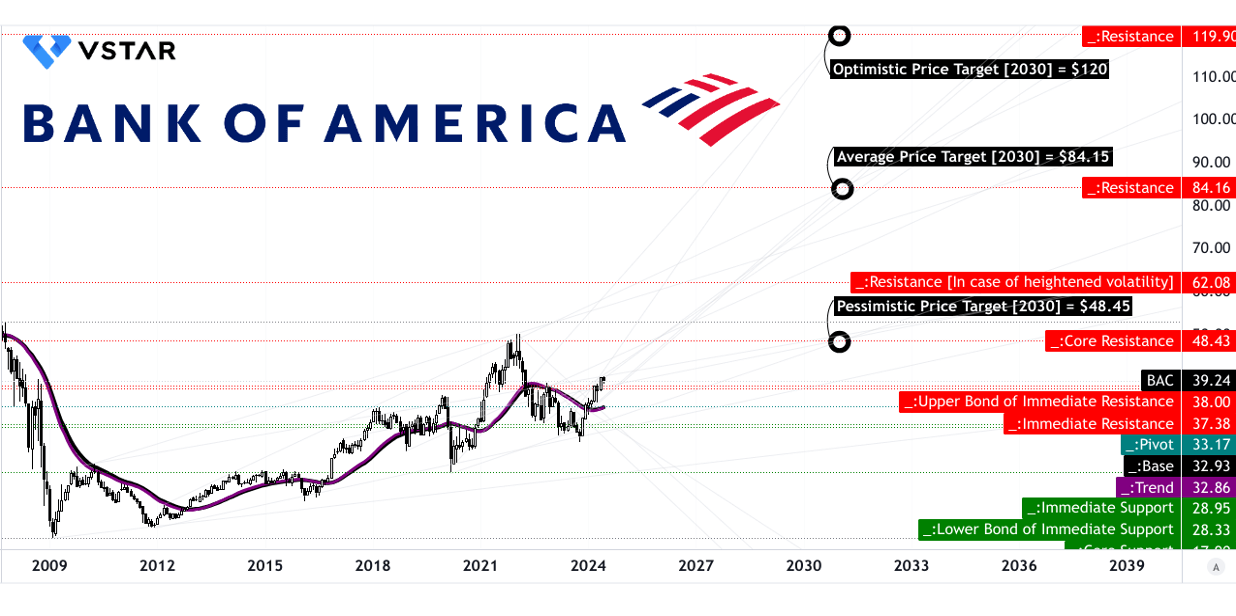

The technicals outline varying expert forecasts for Bank of America stock across 2024, 2025, and 2030. These projections indicate a range of potential outcomes based on differing analyses: optimistic targets suggest substantial growth, with potential highs of $49.15 in 2024, $64 in 2025, and $120 by 2030. Conversely, pessimistic targets propose more conservative estimates, predicting lows of $27.35 in 2024, $22 in 2025, and $48.45 in 2030. Overall, the average price targets are $37.15 in 2024, $49 in 2025 and $120 in 2030.

Source: Analyst's compilation

II. BAC Stock Forecast 2024

The average Bank of America price target by the end of 2024 is projected at $37.15, driven by the momentum of recent shifts in market sentiment, analyzed through Fibonacci extension levels. This conservative estimate reflects a cautious optimism in the stock's ability to maintain its upward trajectory amidst potential market fluctuations. Conversely, an optimistic scenario predicts Bank of America's stock could reach $49.15 by the end of 2024, buoyed by sustained upward momentum and validated by Fibonacci extension projections. This outlook indicates potential for significant gains if current market trends continue favorably.

On the other hand, a pessimistic forecast suggests a potential decline to $27.35, influenced by short-term downward momentum and supported by Fibonacci retracement levels. This scenario underscores the importance of considering potential market corrections or adverse economic conditions that could impact BAC's performance.

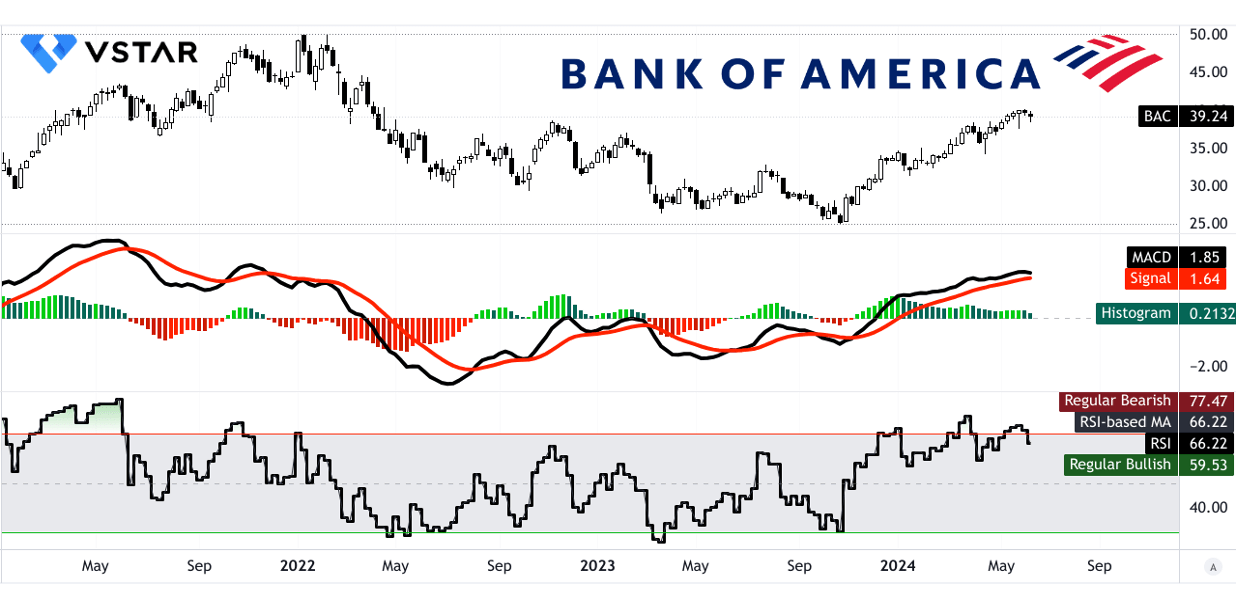

Currently trading at $39.24, the stock exhibits a robust upward trend supported by modified exponential moving averages indicating a trendline at $36.29 and a baseline at $35.98. These figures suggest continued positive momentum in the stock's price trajectory throughout the 2024.

Source: tradingview.com

BAC's primary support level is identified at $37.83, indicating a level where buying interest may stabilize declines, while resistance is projected at $43.15, representing a potential barrier to further price appreciation. The Relative Strength Index (RSI) currently at 66.22 suggests bullish sentiment, albeit with recent indications of bearish divergence, while the Moving Average Convergence/Divergence (MACD) remains bullish with some weakening in trend strength, as reflected in decreasing histogram values.

Source: tradingview.com

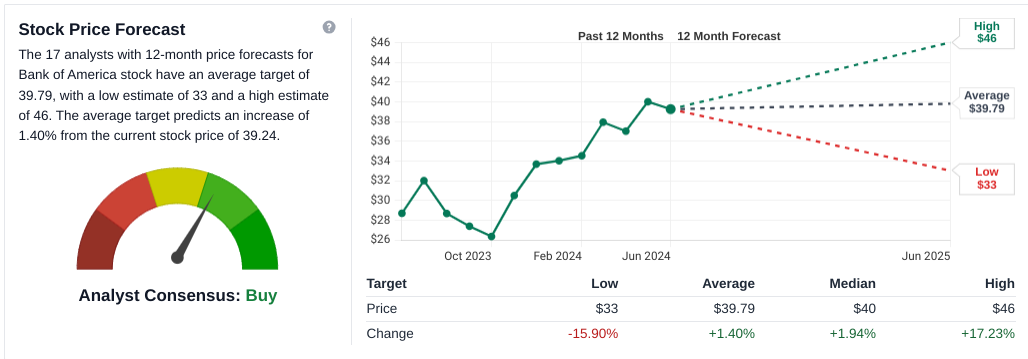

The 2024 stock forecasts for Bank of America (BAC) from tipranks.com and coinpriceforecast.com present varying perspectives on its potential performance. Tipranks.com analysts suggest an average BAC price target of $40.36 for BAC, indicating a modest 2.85% increase from its current price of $39.24. Their high forecast of $46.00 and low forecast of $35.20 show a range of bullish to bearish sentiments among analysts.

On the other hand, coinpriceforecast.com predicts a more optimistic outlook, forecasting BAC to reach $42.45 by the end of 2024 from a mid-year estimate of $39.46. This suggests an 8% potential increase over the year, reflecting a bullish sentiment in their long-term analysis.

As per stockanalysis.com, the BAC stock may hit the price target of $33, $39.79, $40, and $46 on low, average, median, and high level of optimism.

Source: stockanalysis.com

A. Other Bank of America Stock Forecast 2024 Insights: Is Bank of America a good stock to buy?

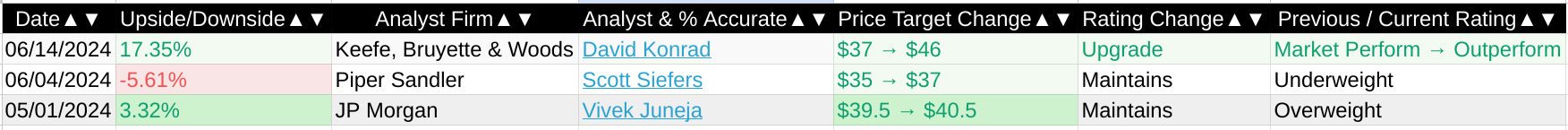

In 2024, Bank of America (BAC) has garnered varied forecasts and ratings from prominent financial institutions and analysts.

Keefe, Bruyette & Woods (June 14, 2024): Analyst David Konrad upgraded BAC from Market Perform to Outperform, citing a significant upside potential of 17.35%. The BAC price target was adjusted from $37 to $46, reflecting a bullish outlook on the stock.

Piper Sandler (June 4, 2024): Analyst Scott Siefers maintained an Underweight rating on BAC with a modest downside forecast of -5.61%. The BAC stock price target was raised slightly from $35 to $37, indicating cautious optimism tempered by concerns.

JP Morgan (May 1, 2024): Analyst Vivek Juneja reiterated an Overweight rating on BAC, adjusting the price target from $39.5 to $40.5, implying a 3.32% upside potential. This suggests a positive sentiment but with a more conservative BAC price target adjustment compared to others.

Source: Benzinga.com

B. Key Factors to Watch for BAC Stock Forecast 2024

In 2024, Bank of America (BAC) faces a complex outlook influenced by various bullish and bearish factors.

BAC Forecast 2024 - Bullish Factors

Revenue Growth: Consensus revenue estimates for FY 2024 show promising growth:

- Q2 2024: $25.32 billion (0.50% YoY)

- Q3 2024: $25.43 billion (1.04% YoY)

- Q4 2024: $25.13 billion (14.44% YoY)

The expected revenue growth, especially the significant YoY increase projected for Q4 2024, reflects positive market conditions and effective business strategies.

Diversification and Market Share: Bank of America's investment banking segment saw a 35% increase in fees YoY in Q1 2024, reaching nearly $1.6 billion. This growth underscores their market leadership and effective client engagement strategies.

BAC Stock Predictions 2024 - Bearish Factors

Interest Rate Sensitivity: Bank of America's net interest income (NII) faces challenges from potential interest rate cuts expected in 2024. Although Q1 2024 NII of $14.2 billion exceeded expectations, future quarters might see moderation due to lower deposit balances and market rate adjustments.

Credit Risks: Despite proactive risk management, the commercial real estate sector poses challenges. Office exposure led to higher net charge-offs in Q1 2024, impacting profitability. Although provisions and reserves are managed prudently, uncertainties in real estate markets could continue to affect performance.

III. BAC Stock Forecast 2025

Based on the technical analysis for Bank of America (NYSE:BAC), the forecasted prices for 2025 present a spectrum of potential outcomes. The average BAC price target of $49.00 reflects a moderate bullish sentiment, underpinned by the momentum observed in the change-in-polarity over the mid-term, projected using Fibonacci extension levels. This target suggests a steady upward trajectory for BAC, supported by the current trendline and baseline modified exponential moving averages at $36.29 and $35.98, respectively.

The optimistic price target of $64.00 underscores a more aggressive bullish scenario, driven by the robust upward price momentum seen in the current swing. This optimistic outlook aligns with Fibonacci extension levels, indicating a potential for accelerated gains if the momentum continues to strengthen over the next few years. Conversely, the pessimistic BAC target price of $22 highlights downside risks, primarily driven by potential retracement levels and market volatility, although such scenarios are less likely given the current bullish momentum.

Source: tradingview.com

The primary support level at $37.00 and core resistance at $49.15 provide critical thresholds for monitoring price movements. The presence of a horizontal price channel pivot at $32.58 suggests strong support, with additional levels at $27.30 in case of heightened volatility, reinforcing the technical support zones crucial for sustaining upward momentum.

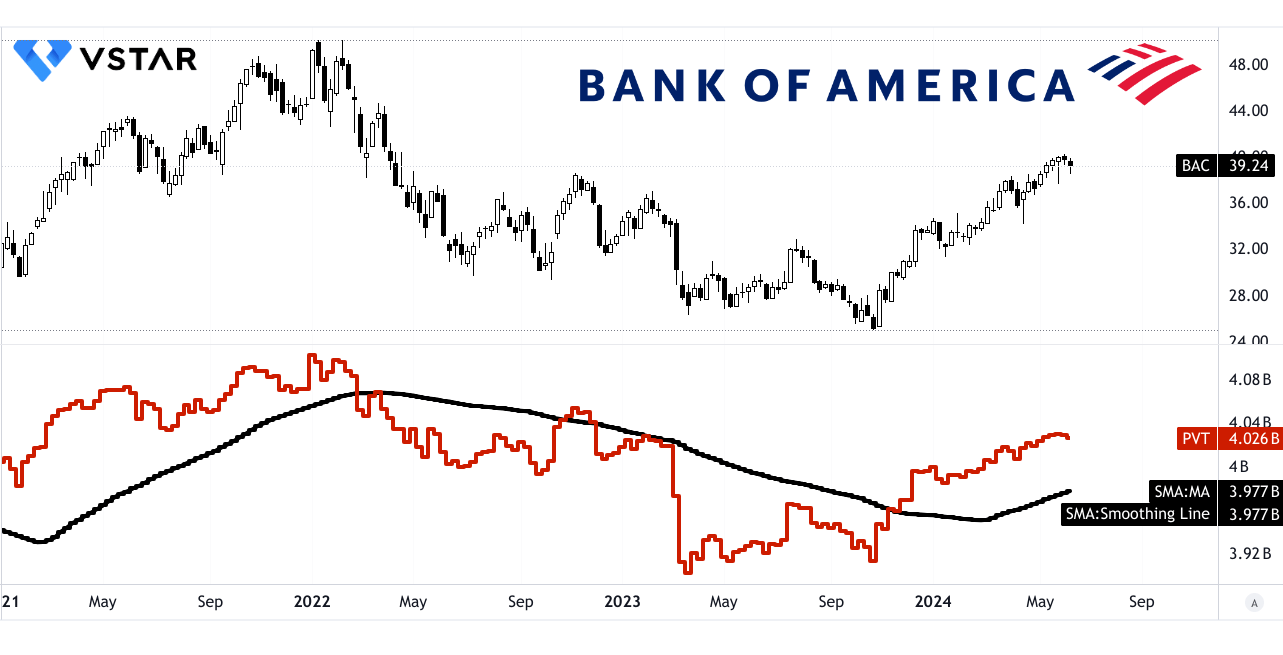

The Price Volume Trend (PVT) indicator, showing a bullish trend with the PVT line at 4.026 billion, supports the notion of robust buying interest and volume backing the current upward price trend in BAC. This bullish momentum, coupled with the technical indicators and support levels identified, lends credibility to the forecasted price targets for 2025.

Source: tradingview.com

The 2025 BAC stock forecasts vary: coincodex.com predicts a $43.11 price, anticipating a 9.86% rise based on historical growth. In contrast, coinpriceforecast.com suggests a more optimistic outlook, forecasting up to $53.05 by year-end 2025, projecting a 35% increase.

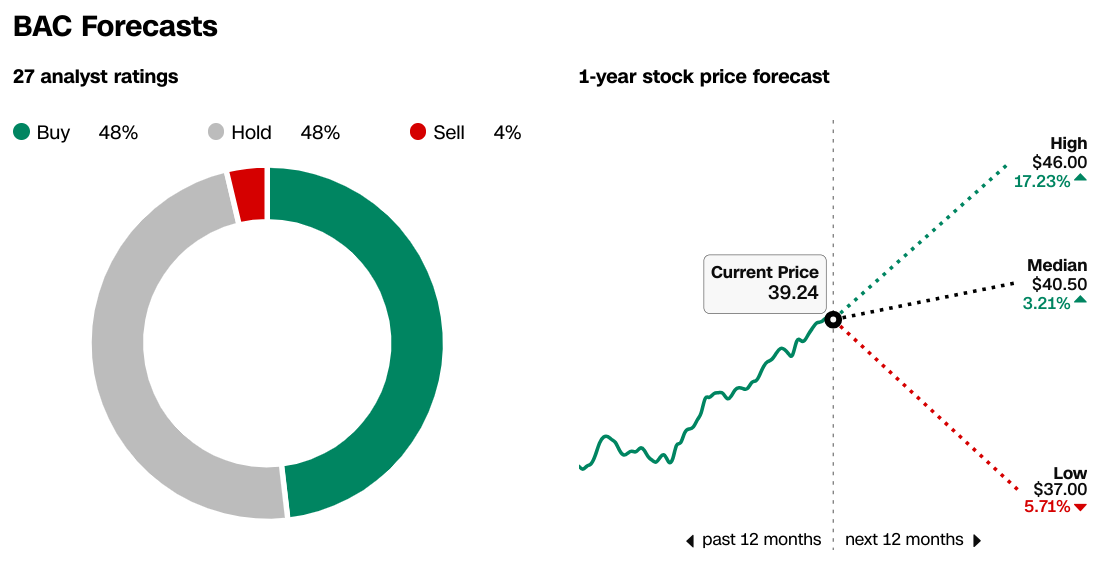

A. Other Bank of America Stock Forecast 2025 Insights: BAC buy or sell?

The stock forecast for Bank of America in 2025, as analyzed by CNN.com and WSJ.com, shows cautious optimism among analysts. According to CNN.com, out of 27 analysts, opinions are split with 48% recommending "Buy," 48% suggesting "Hold," and 4% advising "Sell." Predictions for the stock price by 2025 vary, with estimates ranging from a high of $46.00 (up 17.23% from the current price) to a low of $37.00 (down 5.71%).

Source:CNN.com

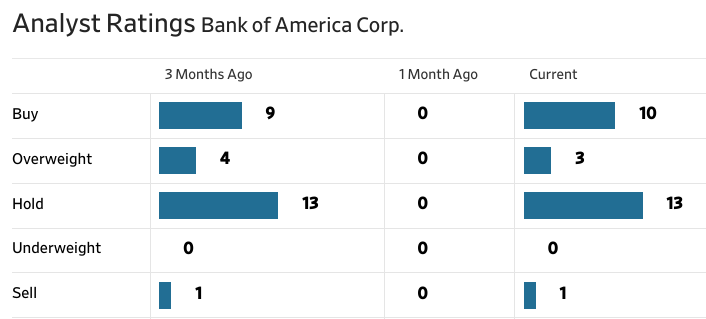

Meanwhile, WSJ.com reports a recent shift in analyst sentiment towards more positive outlooks, with the number of "Buy" ratings increasing to 10 from 9 three months ago. Analysts on WSJ.com also set price targets for Bank of America, ranging from $37.00 to $46.00, with an average target of $40.77, compared to the current price of $39.24.

Source:WSJ.com

B. Key Factors to Watch for Bank of America Stock Prediction 2025

BAC Stock Forecast 2025 - Bullish Factors

Strong Revenue Growth Momentum: Bank of America is projected to see a moderate revenue growth trajectory. Consensus estimates indicate a 2.66% increase in revenue to $104.50 billion by December 2025, supported by robust performance across various segments, including investment banking, wealth management, and global banking.

Capital Strength and Shareholder Returns: With a robust common equity Tier 1 capital of $197 billion, Bank of America remains well-positioned to support its operations and return value to shareholders. The bank's commitment to returning capital through dividends and share repurchases, totaling $4.4 billion in a recent quarter, underscores its financial strength and shareholder-friendly approach.

Strategic Expansion in Wealth Management: The addition of 7,300 net new wealth relationships and $60 billion in total flows in the past year underscores the bank's success in expanding its wealth management segment. This growth is crucial for diversifying revenue streams and capitalizing on high-net-worth client bases.

Bank of America Stock Forecast 2025 - Bearish Factors

Economic Sensitivity and Interest Rate Outlook: Bank of America's net interest income (NII) faces challenges from anticipated interest rate cuts in 2025, potentially impacting profitability. The bank expects a decline in NII in the second quarter, although it aims for recovery in the latter half of the year.

Expense Management Challenges: Despite effective cost controls, inflationary pressures and ongoing investments in digital infrastructure and talent could lead to higher operational costs. Balancing expense growth with revenue generation remains crucial for maintaining profitability margins.

Source: Presentation Materials_1Q24

IV. BAC Stock Forecast 2030 and Beyond

Looking ahead to 2030, technical analysis indicates a promising outlook. The average price target for Bank of America (NYSE:BAC) stock by the end of the decade is projected at $84.15, reflecting sustained momentum and growth potential over Fibonacci extension levels. This optimistic scenario is bolstered by an upward swing trajectory, potentially pushing the stock price to $120.00 by 2030. However, there are considerations for potential volatility, as indicated by a pessimistic target of $48.45, reflecting possible retracements over Fibonacci retracement levels.

The stock is currently trading at $39.24, showing a clear upward trend according to modified exponential moving averages. The trendline sits comfortably above the baseline, suggesting strong bullish momentum. Key support levels are identified at $37.35 and $28.95, reinforcing the resilience of the bullish trend. Resistance levels are notable at $62.08, $48.43, and prominently at $84.16, indicating significant barriers that the stock may face during its ascent. These levels are crucial for assessing entry and exit points based on market conditions and volatility.

Source: tradingview.com

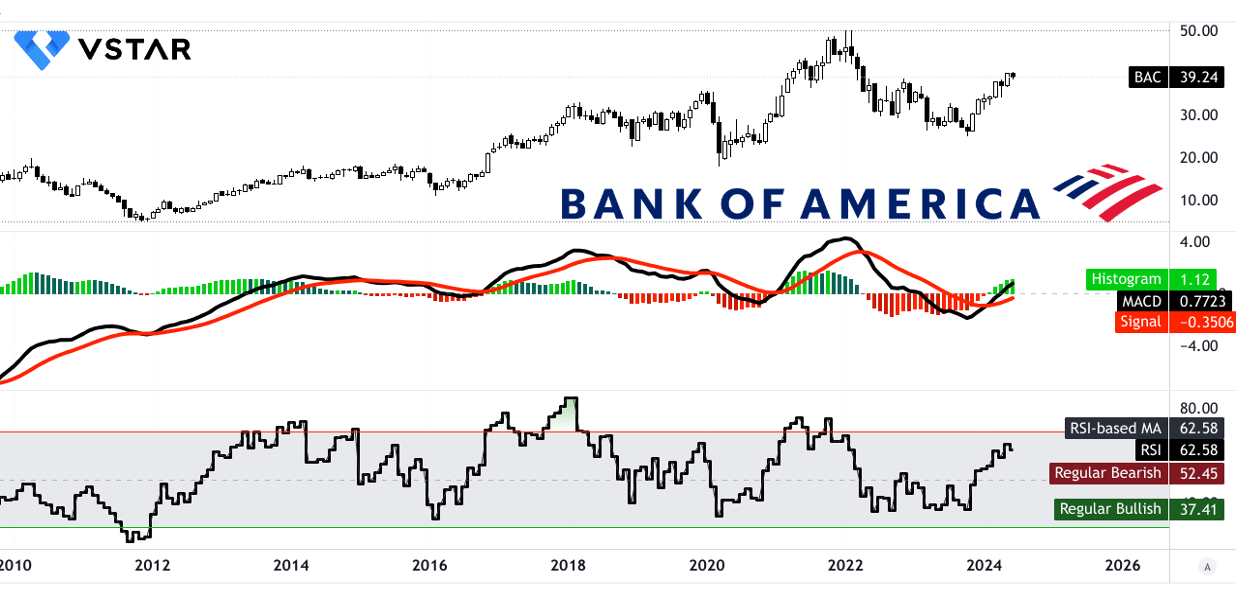

Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) support the bullish forecast. The RSI, currently at 62.58, signals a bullish trend with upward momentum and bullish divergence, suggesting ongoing buying pressure. The MACD histogram, with a strong bullish trend and increasing strength, reinforces the positive sentiment surrounding BAC stock.

Source: tradingview.com

The forecasts for BAC stock by 2030 vary significantly between sources. Coincodex predicts a steady increase, with a 75.77% rise to $68.97 by 2030, implying consistent growth. In contrast, coinpriceforecast.com projects more aggressive gains, with prices potentially reaching $82.81 (+111%) by year-end 2030.

Source:coinpriceforecast.com

A. Other Bank of America Stock Forecast 2030 and Beyond Insights: Is BAC a good stock to buy?

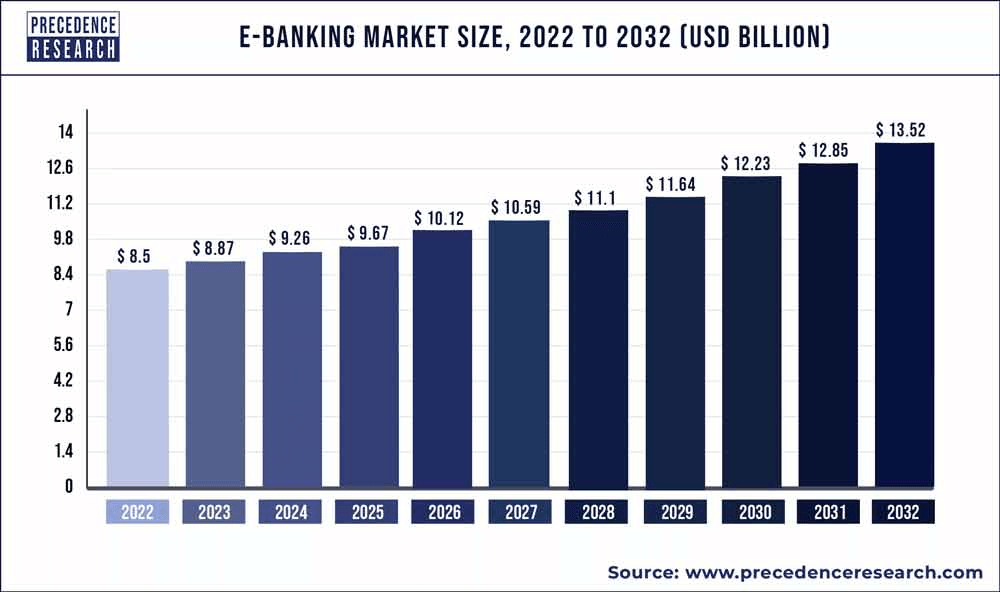

As per precedenceresearch.com, the e-banking market value may hit $13.52 trillion by 2032 through a CAGR of 4.80% during 2023 to 2032. Where North America may serve as a Fastest Growing Region. With that, Bank of America's digital transformation effort may lead to benefit the bank's top-line by targeting this market growth.

Source: precedenceresearch.com

B. Key Factors to Watch for BAC Stock Forecast 2030 and Beyond

BAC Stock Forecast 2030 and Beyond - Bullish Factors

Bank of America (BAC) projects steady growth in both earnings per share (EPS) and revenue through 2033, with moderate fluctuations in growth rates. For instance, EPS estimates show a gradual increase from $3.24 in 2024 to $4.70 in 2033, indicating resilience in profit generation despite varying market conditions and regulatory impacts. Similarly, revenue estimates demonstrate a consistent upward trajectory, albeit with modest year-over-year growth rates ranging from 2.28% to 4.02% up to 2033.

Digital Transformation: Continued investment in digital platforms like Erica and Zelle has enhanced customer engagement and operational efficiency. Erica, the virtual assistant, recorded over 2 billion interactions, indicating strong adoption and potential for cost savings and customer retention.

Diversified Revenue Streams: The bank's diversified revenue sources across consumer banking, wealth management, and global banking mitigate risks associated with economic cycles. Strong performance in investment banking and wealth management segments underscores their ability to capture market opportunities and expand client relationships.

BAC Stock Forecast 2030 and Beyond - Bearish Factors

Sectoral Challenges: Specific challenges within sectors like commercial real estate, as evidenced by increased charge-offs in office exposures, highlight vulnerabilities in loan portfolios that could affect asset quality and necessitate higher provisions for credit losses.

V. Conclusion

A. BAC Stock Outlook: Bank of America stock buy or sell?

Bank of America (NYSE: BAC) has demonstrated resilience and growth potential amidst fluctuating market conditions.

- BAC stock price prediction 2024: Forecasts range from a conservative estimate of $27.35 to an optimistic high of $49.15, with an average target around $37.15.

- BAC stock price forecast 2025: Average forecasts indicate a price target of $49, with optimistic scenarios reaching up to $64.

- Bank of America stock price prediction 2030: Long-term projections vary significantly, with targets ranging from $48.45 to as high as $120.

Bank of America's stock is poised for growth supported by robust revenue diversification, digital transformation initiatives, and strategic expense management. Based on the current assessment, BAC stock is a cautious Buy.

B. Trade BAC Stock CFD with VSTAR

When considering trading Bank of America stock CFDs, VSTAR offers several advantages:

- Tight Spreads: Ensures competitive pricing for traders, optimizing profit potential.

- Regulated by ASIC: Provides a secure trading environment under rigorous regulatory oversight.

- Global Reach and Accessibility: Access to a wide range of global markets and assets, including stocks, indices, crypto, forex, and commodities.

VSTAR's platform is designed to cater to both seasoned traders and beginners, offering user-friendly interfaces, low entry barriers, and robust customer support. Whether trading for short-term gains or long-term strategies, VSTAR provides the tools and resources necessary to navigate the complexities of financial markets effectively.

FAQs

1. Is BAC a good buy right now?

Bank of America (BAC) is considered a good buy by many analysts due to its low price-to-earnings ratio of about 10 and a solid dividend yield of around 2.53%.

2. What is the outlook for BAC in 2024?

The outlook for BAC in 2024 is moderately positive. The consensus analyst price target is around $40.41, with a high estimate of $46.00 and a low estimate of $33.00. The bank is expected to benefit from potential economic stabilization and favorable market conditions.

3. Where will Bank of America stock be in 5 years?

Over the next five years, Bank of America stock is expected to experience significant growth. By 2030, Bank of America stock is expected to reach around $84.15.