I. Recent Marathon Digital Stock Performance

MARA's Move On Mining Industry

MARA Holdings, Inc. (NASDAQ: MARA), formerly Marathon Digital Holdings, Inc., is rapidly becoming a credible entity in the U.S. Bitcoin space, specifically in the digital asset technology sector. The company has made prominent progress in prioritizing sustainability and energy efficiency, making it an attractive choice for day traders.

The company focuses on transforming stranded and unused energy into economic values, bolstering mining capabilities, demand surges, and allocating the increasing demand for eco-friendly practices in the crypto space. It utilizes its operational efficiency by locating its significant data centers close to affordable energy sources. The additional cooling systems enable its transformation capabilities of waste energy to productive resources, benefiting both environmental demand and financial performance.

In Q2, MARA Holdings' revenue growth surged by 78%, reaching $145 million compared to Q2 last year, indicating robust mining activity and declaring a significant company position in the Bitcoin mining industry.

Is The HODLing Approach Good For MARA Investors?

Mara Holdings recently updated its treasury policy to embrace its full HODL policy, which means it will retain all BTCs it produces. The decision reflects the firm's strong belief in the long-term value potential of BTC as a premier treasury reserve investment element.

The company is rapidly expanding its mining operations to achieve a hash rate of 50 EH/s by 2024. As part of development at the Granbury, Texas site, the company recently activated 18 immersion containers and initiated the transformation of part of the data center to an enhanced immersion cooling system, compared to traditional ones. This transition is anticipated to finish this year, positively boosting MARA's mining capacity and efficiency.

Expert Insights on MARA Stock Forecast for 2024, 2025, 2030 and Beyond

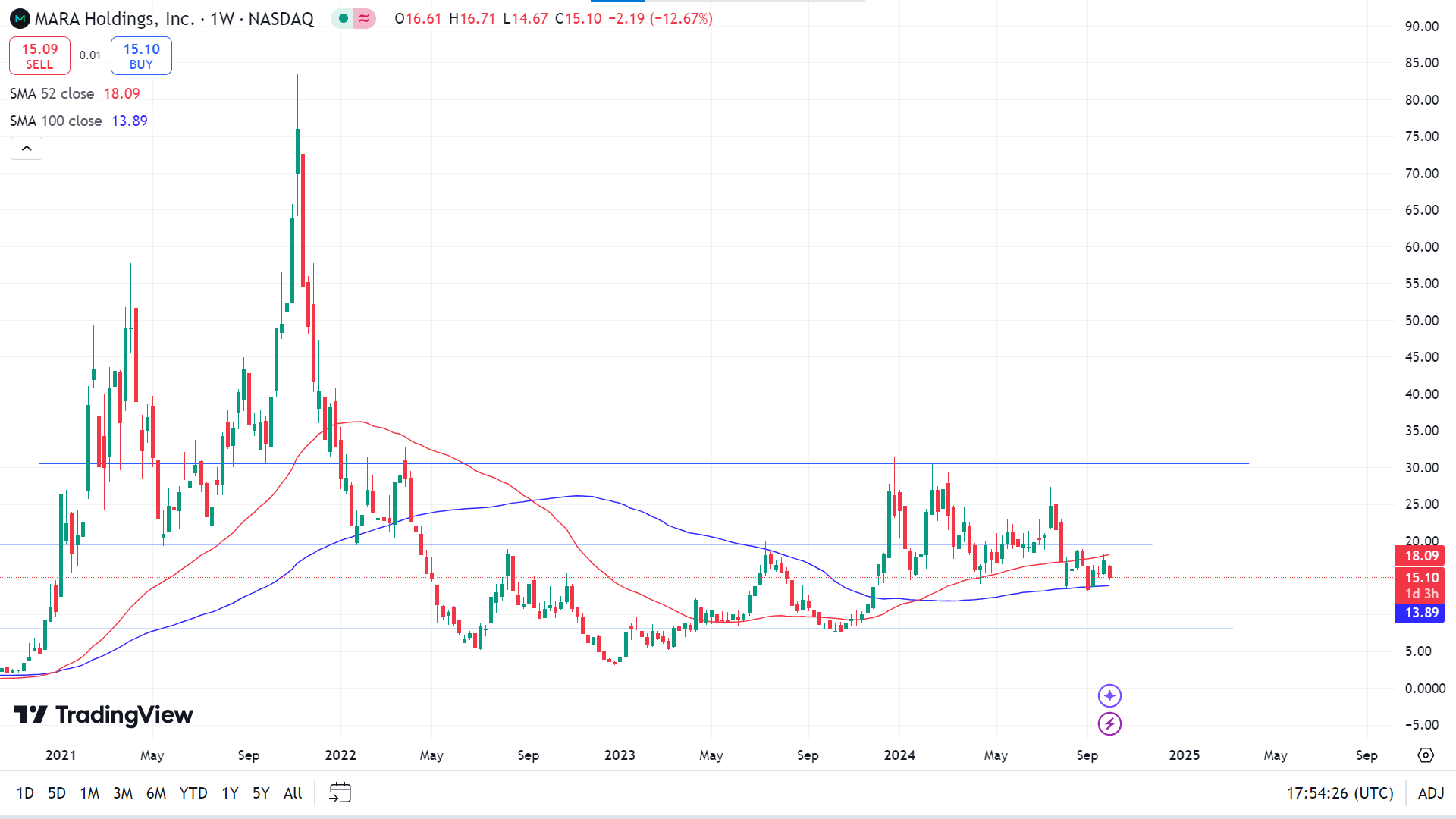

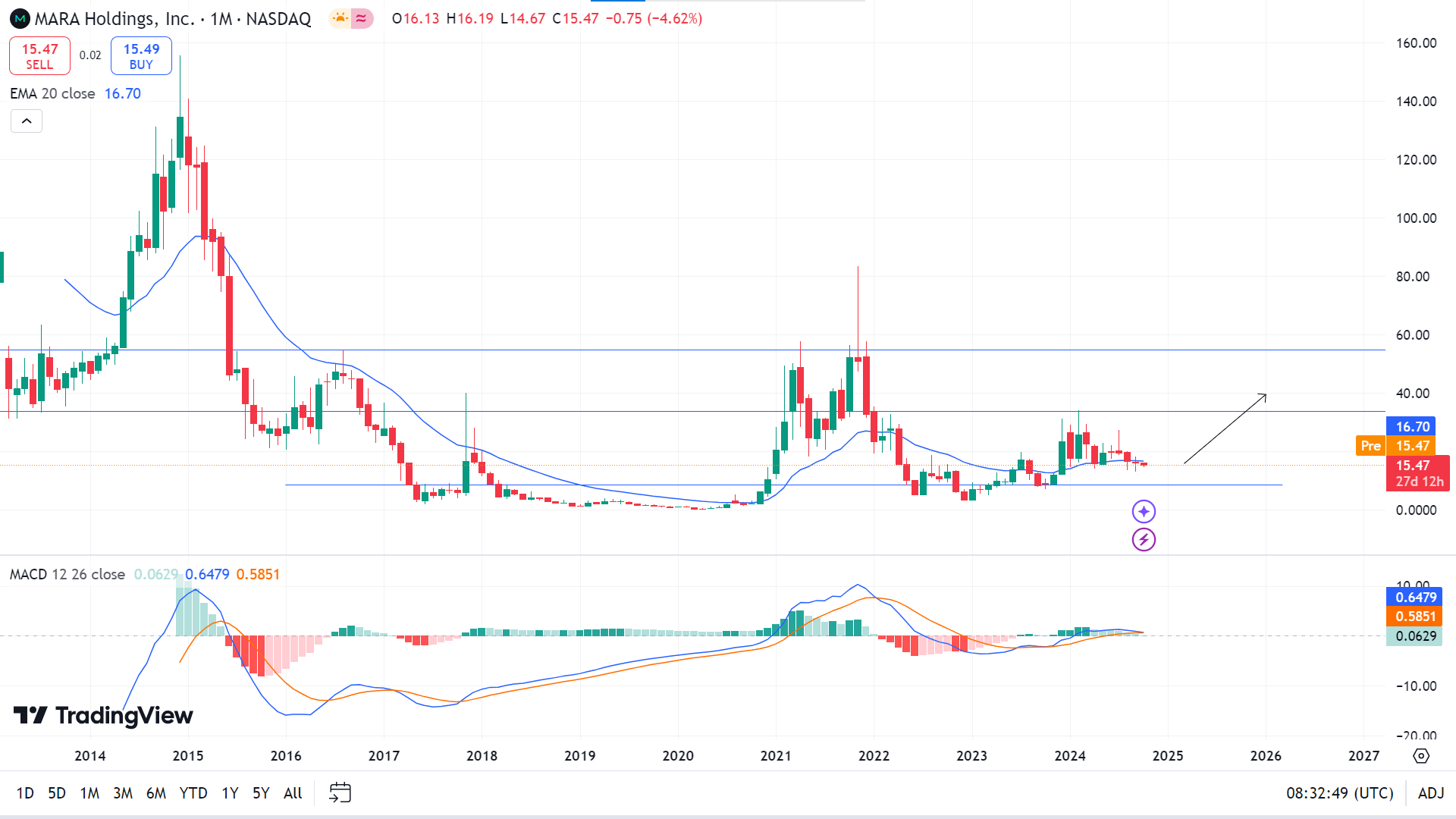

In Q4 2021, the MARA stock price hit a high near 83.45; since then, it has remained in a downtrend, making a low near 5.32 and bouncing back toward a high near 34.09. The price is floating at a potential support level and is ready to reach its peak. Before proceeding further, let's check at a glance what experts anticipate seeing MARA stock price in 2024, 2025, 2030 and beyond.

|

Providers |

2024 |

2025 |

2030 & beyond |

|

StockScan |

$21.26 |

$33.32 |

$48.57 |

|

WalletInvestors |

$19.32 |

$18.09 |

$11.08 |

|

Coincodex |

$17.00 |

$38.63 |

$4,016.85 |

|

Coinpriceforecast |

$16.29 |

$18.32 |

$47.00 |

II. MARA Stock Forecast 2024

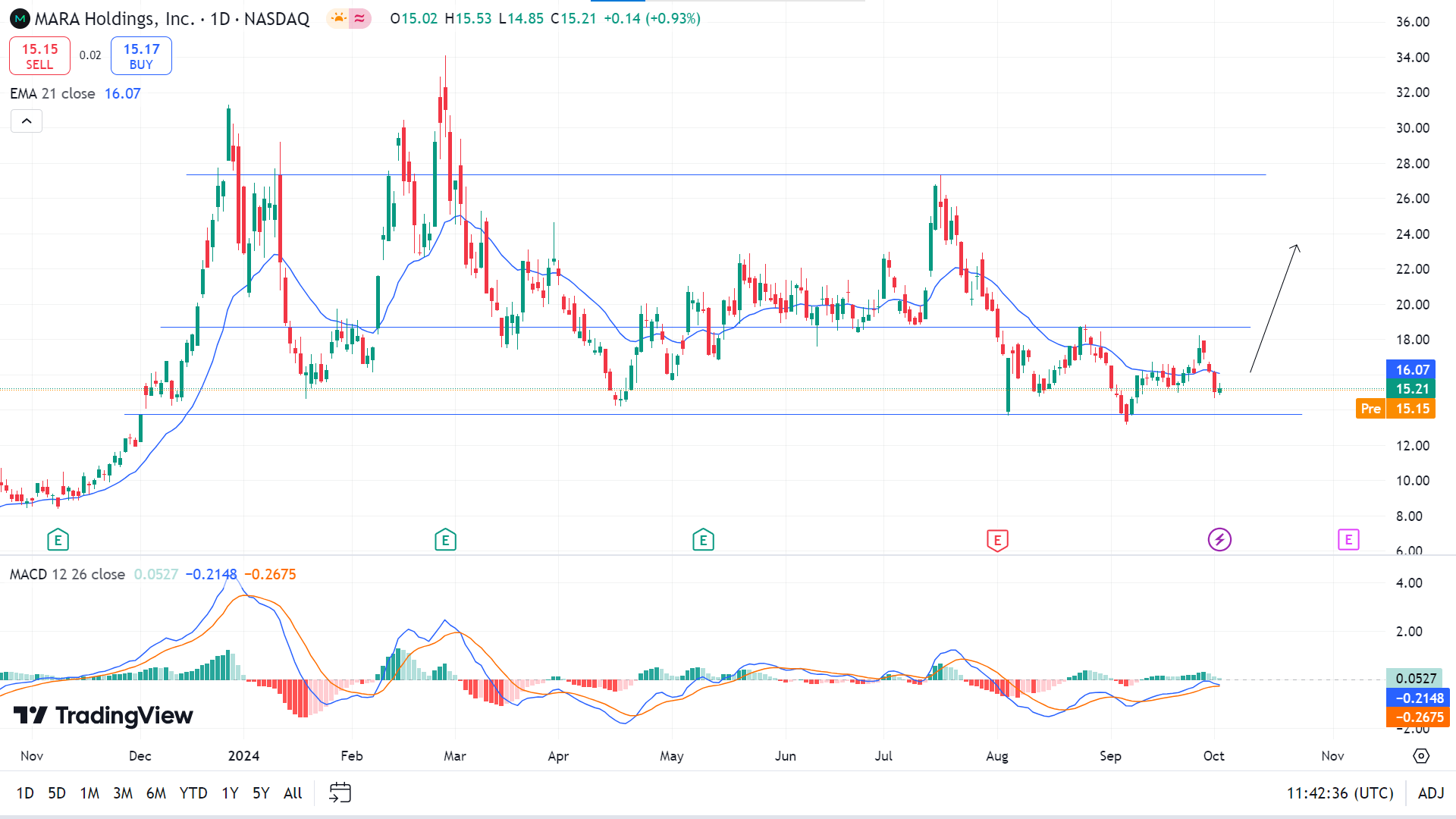

In the recent chart, the price is bouncing within a range of 13.74-18.70, whereas a breakout above the range may trigger MARA stock price to drive the resistance of 27.34 by the end of 2024.

MARA has been trading within a tight range for a considerable time, where a valid range breakout momentum could offer a trend trading opportunity. Moreover, the broader market remains within the bullish wave seen in 2023, suggesting an ongoing bullish momentum. Therefore, the primary outlook for this stock would be to find the following strategy.

The price is moving below the EMA 21 line on the daily chart, while the EMA remains flat. It is a sign of an extreme sideways market, where the major market trend remains bullish. As the MACD Histogram maintains a positive presence for a considerable time, we may expect bulls to win in this stock.

Based on the MARA Stock Forecast 2024, a valid bullish range breakout with an hourly candle above the 19.20 level could open a long opportunity aiming for the 28.00 level.

On the other hand, if the price continues to float below the EMA 21 line and the red histogram bars appear below the midline of the MACD indicator window, it may drop to the primary support of 13.74, followed by the next possible support near 10.50.

A. Other MARA Stock Price Prediction 2024 Insights

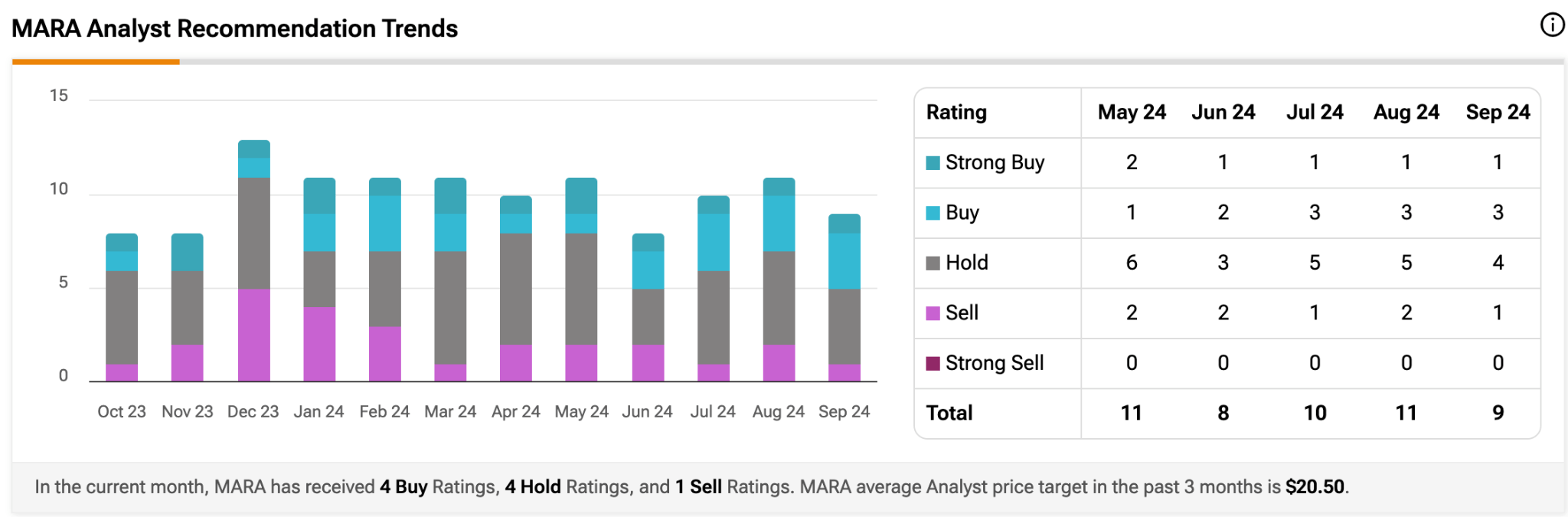

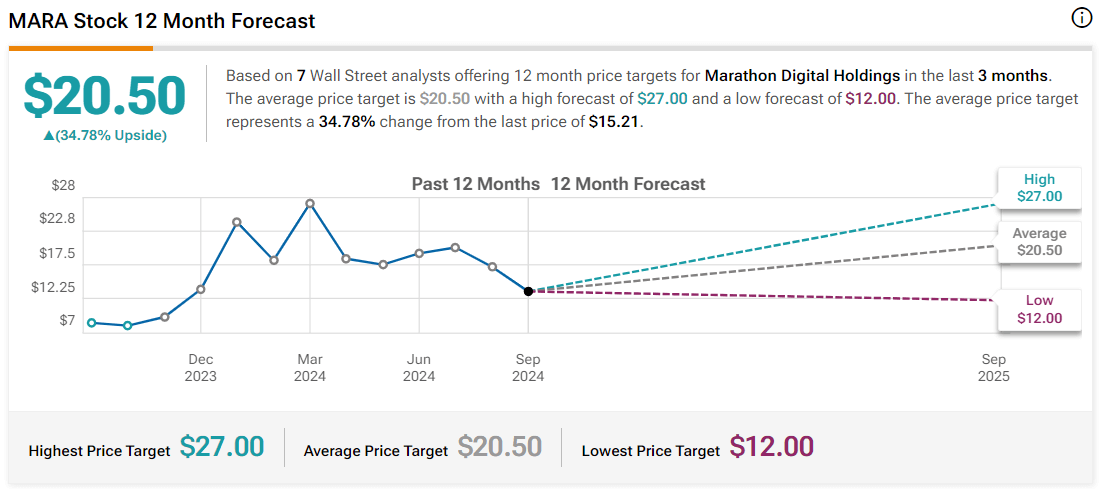

Nine analysts in Tipranks provided their ratings on the MARA stock for the current month. One suggests a strong buy, three suggested buy ratings, and four maintain holding the asset, while only one recommends selling.

The platform provides price prediction for the next twelve months of an average price reaching 20.50, while the high they anticipate is 27.00 and the low is 12.00.

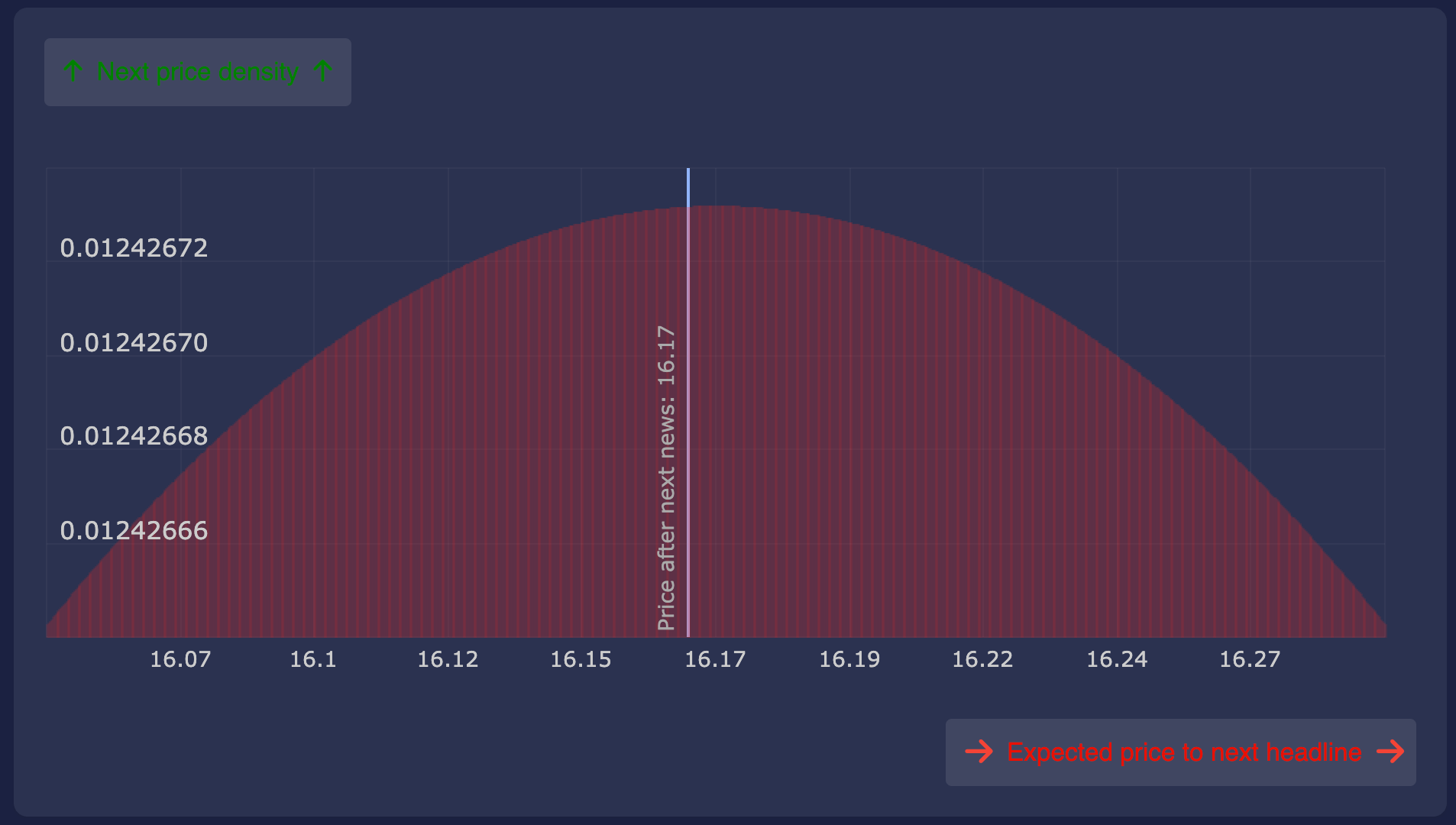

Another popular platform, Macroaxis, provides price margin prediction for the MARA stock price between 9.54 and 20.76 in the upcoming days. Meanwhile, the stock price can reach at least 16.17 after the news declaration.

B. Key Factors to Watch for MARA Stock Forecast 2024

MARA's Struggle with Revenue Generation

Marathon has established itself as a critical player in the Bitcoin mining industry through consecutive expansion and optimization of its operations. Between Q4 2022 and Q4 2023, the company achieved notable progress in hash rate, operational efficiency, Bitcoin mining, and market share, positively influencing financial growth.

Marathon reported a decline in Bitcoin mining in Q2 2024 due to a surge in global hash rate, a halving event in April, and unforeseen events like transmission line maintenance and third-party equipment failures. Despite these setbacks, the company's activated hash rate reached 31.5 exhausted per second, higher from the previous 17.7, increasing 78% from Q2 2023 yearly.

With its diversified mining operations and ability to navigate obstacles, Marathon continues to lead the Bitcoin mining sector, further cementing its reputation as a critical industry pioneer.

Crypto Seasonal Performance

Thorn believes many see Donald Trump's potential election victory as a positive for the cryptocurrency market. Now campaigning for the presidency, Trump has promised to make the U.S. the “crypto capital of the planet,” boosting optimism within the crypto community. Simultaneously, Kamala Harris has supported policies to expand the crypto industry, further elevating the topic's relevance. Thorn predicts a Trump win could push the market higher, fueled by expectations of regulatory easing. In contrast, given her advisors' ties to the Biden administration's crypto policies, he expects a Harris victory to be more neutral for the industry.

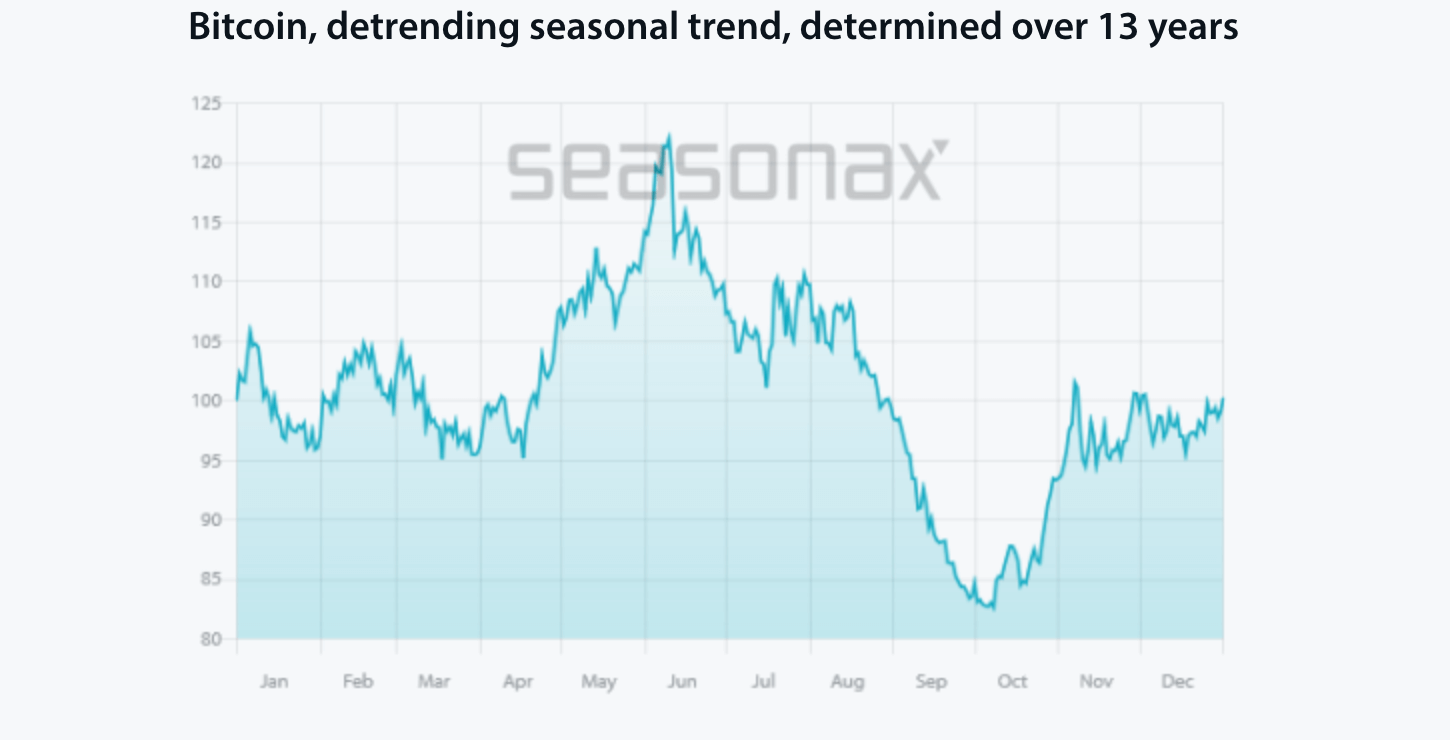

Looking forward, Thorn notes that while September is seasonally weak for crypto, the following months—October, November, and December—tend to be more bullish. Despite the highly anticipated Federal Reserve interest rate cuts, investors remain cautious. JPMorgan's Head of Global and European Equity Strategy has downplayed the likelihood of a significant crypto bull market. Although September has historically been the worst month for U.S. stocks, Thorn hints that rate cuts could break this pattern.

MARA Stock Forecast 2024 - Bullish Factors

- Marathon (MARA) has reported a hash rate surge of 78% in Q2 2024, achieving 31.5 exahashes per second, indicating solid operational scaling growth potential.

- In Q2, MARA reported YoY revenue growth of 78%, driven by operational efficiency and a surge in hash rate capacity, highlighting future growth potential.

- More favorable regulations, especially if Donald Trump's pro-crypto stance becomes a reality, could positively impact regulatory easing, possibly boosting profitability and the company's position in the marketplace.

MARA Stock Price Prediction 2024 - Bearish Factors

- In the second quarter of 2024, MARA witnessed a decline in BTC mining due to increasing global hash rate competition, which may weigh on profitability and margin in the future.

- Unexpected equipment failures and transmission line maintenance impacted MARA's production capacity, signaling potential risks of future operational challenges that may limit growth.

III. MARA Stock Forecast 2025

The price finds adequate support and is ready to return toward an acceptable resistance near 30.48 by the end of 2025.

In the broader context, the MARA is trading sideways after the bull run from 2021 to 2022. However, the price keeps moving higher from the bottom formed in 2023, suggesting a bullish continuation. Also, the most recent price showed a symmetrical triangle formation from where a valid bullish reversal could resume the existing trend continuation.

Looking at the weekly chart, the price remains between SMA 100 and SMA 52 lines. The SMA 52 line acts as a dynamic resistance, and the SMA 100 line acts as a dynamic support level, leaving mixed signals for investors.

As the SMA 52 crosses above the SMA 100 line, signaling bullish dominance, if the price continues to exceed the SMA 52 line, it will indicate sufficient bullish pressure on the asset price, and the price may head toward the primary resistance near 19.50. In contrast, a breakout might trigger the price toward the next possible resistance near 30.48.

However, if the price declines below the SMA 100 line, it will enable bearish dominance and signal the MARA stock price may head to reach the primary support near 10.29, followed by the next support near 5.22.

A. Other MARA Stock Price Prediction 2025 Insights

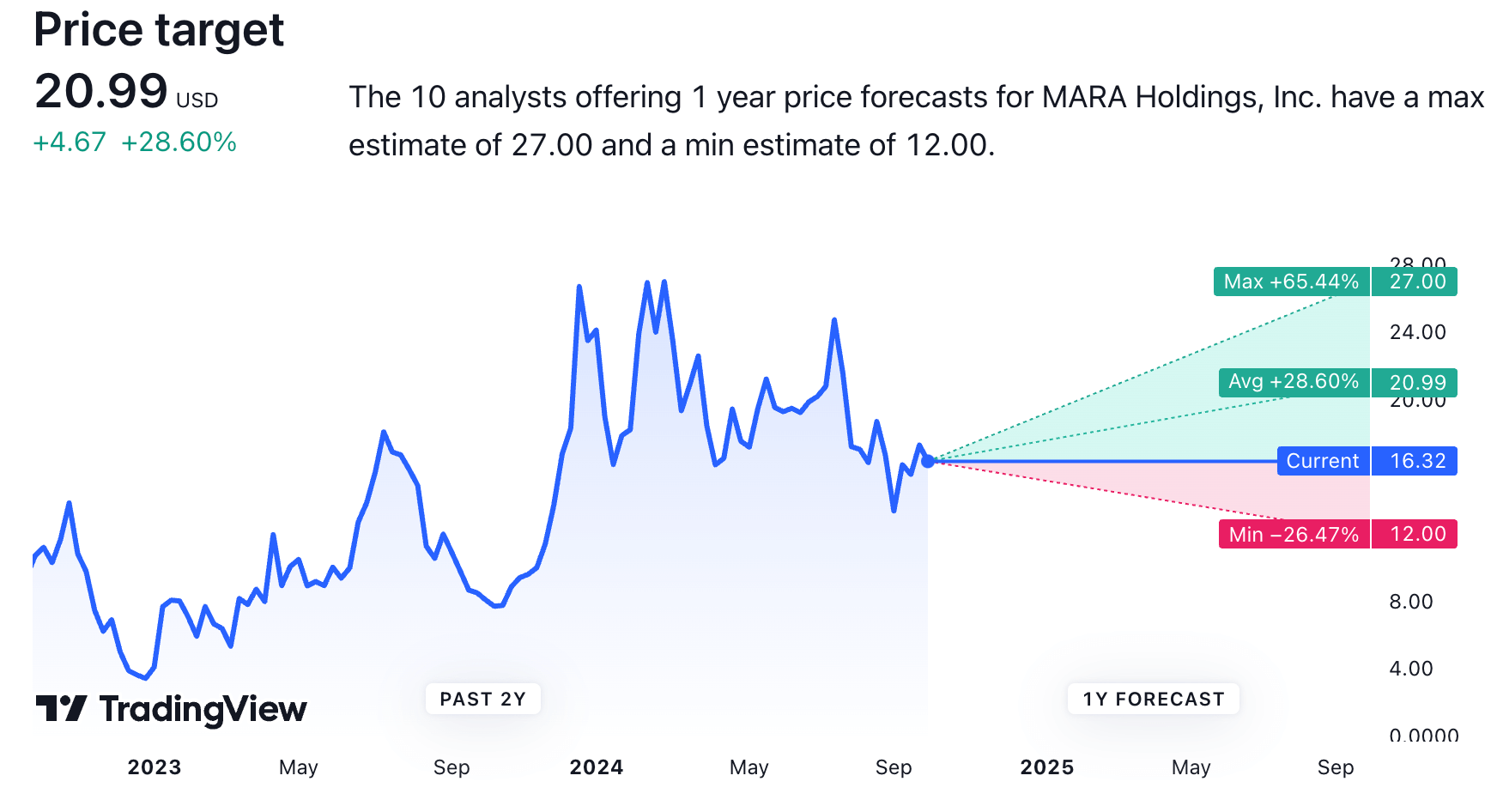

According to Tradingview, ten analysts offer price predictions for the MARA stock, which may reach an average of 20.99. They estimated the low to be 12.00 and the possible high to be near 27 in the next twelve months. In the past three months, twelve analysts gave their ratings on the MARA stock price. Six suggested holding, one maintained a buy rating, and four rated it as a “strong-buy” asset. Only one suggested sell ratings, making it an attractive investment for the upcoming months.

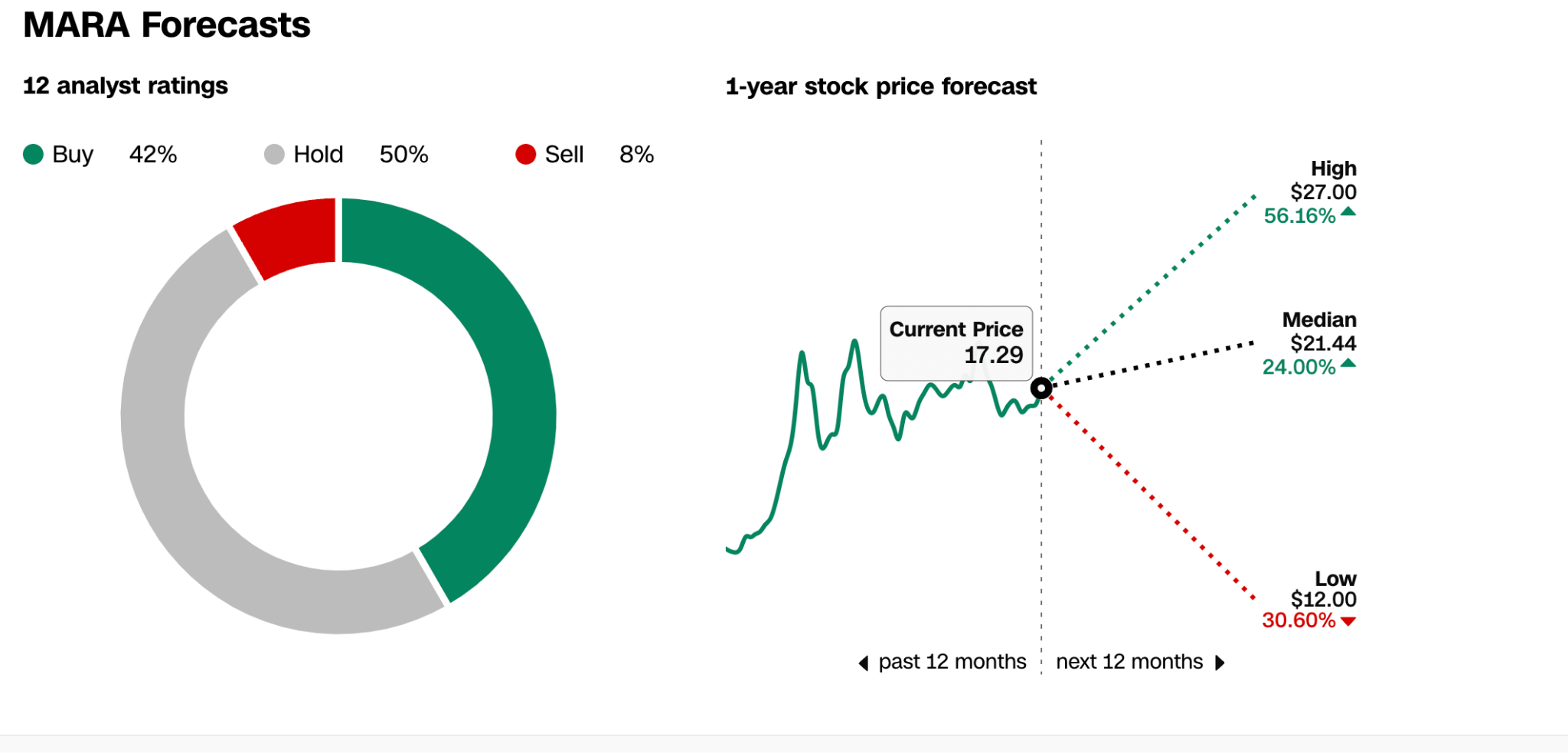

Another popular platform, CNN, reveals the price anticipation for the MARA stock, where twelve analysts gave ratings. The price estimation in the next twelve months was high at 27.00, the median price was 21.44, and the low price they estimated was 12. Among them, 42% suggested buying, 50% suggested holding, and only 8% gave sell ratings for the asset.

B. Key Factors to Watch for MARA Stock Forecast 2025

MARA Revenue Forecast 2025

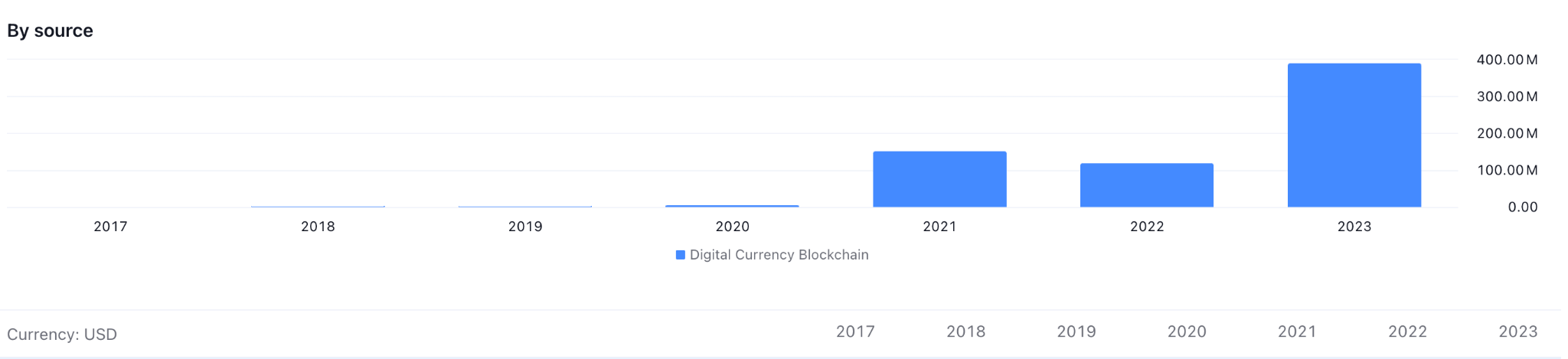

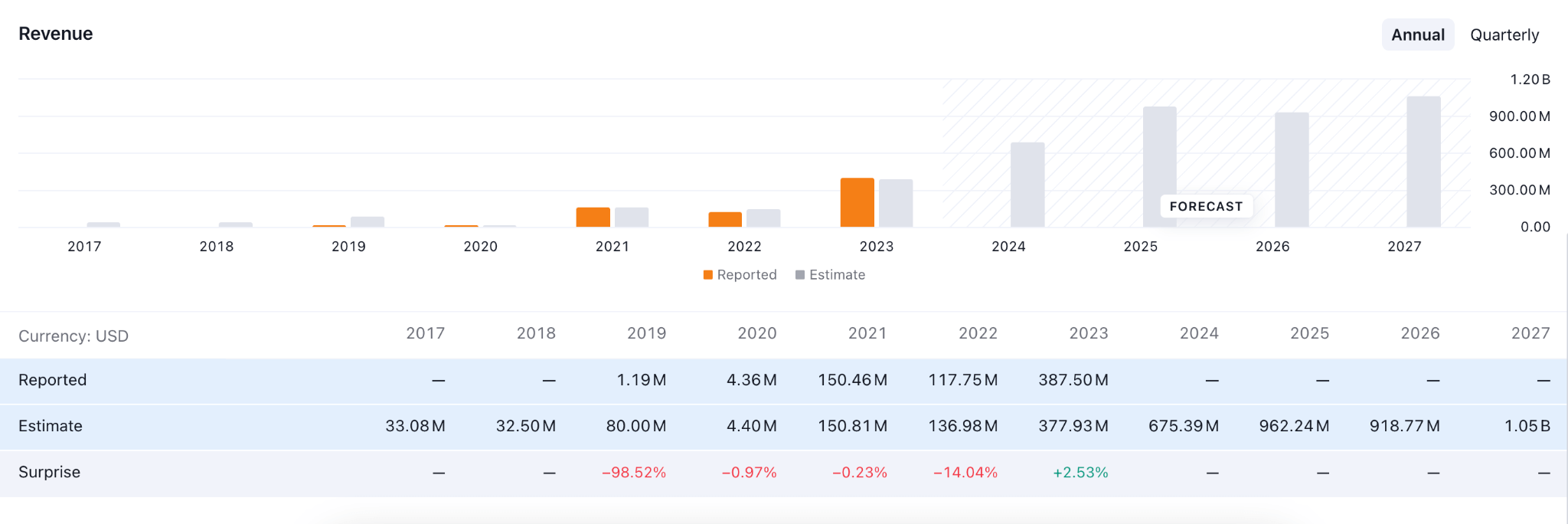

The revenue estimation chart above confirms that revenue growth beat expectations in 2023 and that the figure will gradually rise for the upcoming years, possibly reaching a billion in 2027, making MARA a progressive company and attractive investment asset.

MARA Competitor Analysis

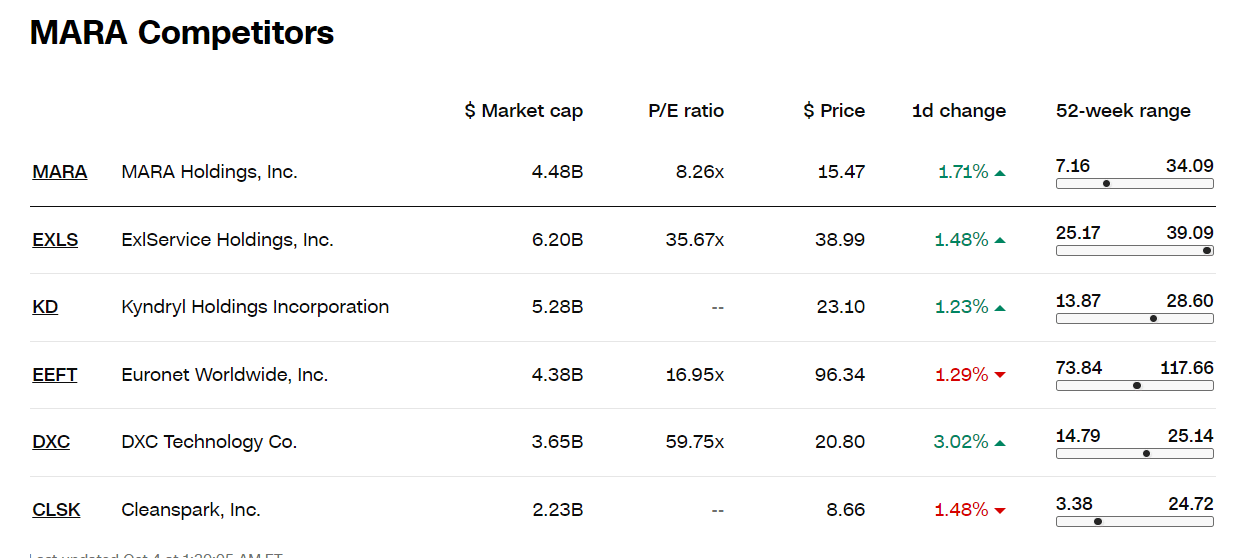

The current market cap of MARA remains at 4.48 billion, and the 52-week range data shows the stock price is closer to the lower level, making it a potential investment as it may hit the range high in the upcoming weeks.

MARA Stock Forecast 2025 - Bullish Factors

- MARA offers a broader range of service offerings, including Auradine, MARAPOOL, 2PIC, MARAFW, and other sustainability initiatives, which are highlighted as crucial strengths for the company's growth.

- Marathon Digital has established itself as an integrated and scaled platform for BTC miners, and its full HODL updated policy makes it a legitimate company in the cryptocurrency space.

- Reducing costs and using energy efficiently is positive, countering eco-friendly energy use, which is now challenging. This makes MARA a potentially progressive company in the future.

MARA Stock Price Prediction 2025 - Bearish Factors

- The company can face regulatory challenges when expanding, which can negatively impact its future growth.

- Cryptocurrencies can fail to grow as anticipated. If the BTC price declines as it did a few years ago, it will negatively impact MARA's income and growth.

IV. MARA Stock Forecast 2030 and Beyond

The MARA stock price has been in a downtrend for several years. With fundamental support, it may hit 55.04 or beyond to recover previous peaks by the end of 2030.

In the monthly time frame, the most recent chart shows sideways momentum, with bullish trend line support. Moreover, a pump-and-dump was over during the pandemic, as the price failed to break the existing low of 1.97. As the static trend line support is working as a bullish factor, investors should monitor how the price reacts at this support to gauge the future price.

The MACD indicator window on the monthly chart reveals that the price is continuing to move with bullish pressure, as the dynamic signal line reaches above the midline. Despite the corrective buying pressure the main price chart failed to provide a clear direction. If the price reaches above the EMA 20 line with a valid monthly close, it can reach the primary resistance near 33.85. Moreover, a breakout may trigger the price toward the next resistance near 55.04.

On the other hand, if the price continues to float below the EMA 20 line and the MACD indicator reading turns bearish, MARA stock price can reach the nearest support near 8.59, followed by the next support near 3.41.

A. Other MARA Stock Price Prediction 2030 and Beyond Insights

Bitcoin is expected to stabilize and gradually rise over the next decade as it becomes a mainstream investment asset alongside gold and other precious metals. While its value may not soar into the millions, it could triple or quadruple, pushing Marathon Digital's stock price to new peaks. Patient investors might enjoy significant returns as the ride will be volatile.

MARA stock price has surged 19% since 2024 started, reaching 16.24 from 13.70. Analysts see the price at 19.48 by December 2024, representing a 42% increase YoY and a 20% increase from current levels. Moving into 2025, the MARA stock price is anticipated to get $20.43 in the first half and hit $23.76 by Q4, representing a 46% increase.

Significant growth is anticipated five years from now. By 2026, the stock price could reach $34.35, up 112% from current levels, and continue to surge to $61.51 by 2030, a 159% gain.

B. Key Factors to Watch for MARA Stock Forecast 2030 and Beyond

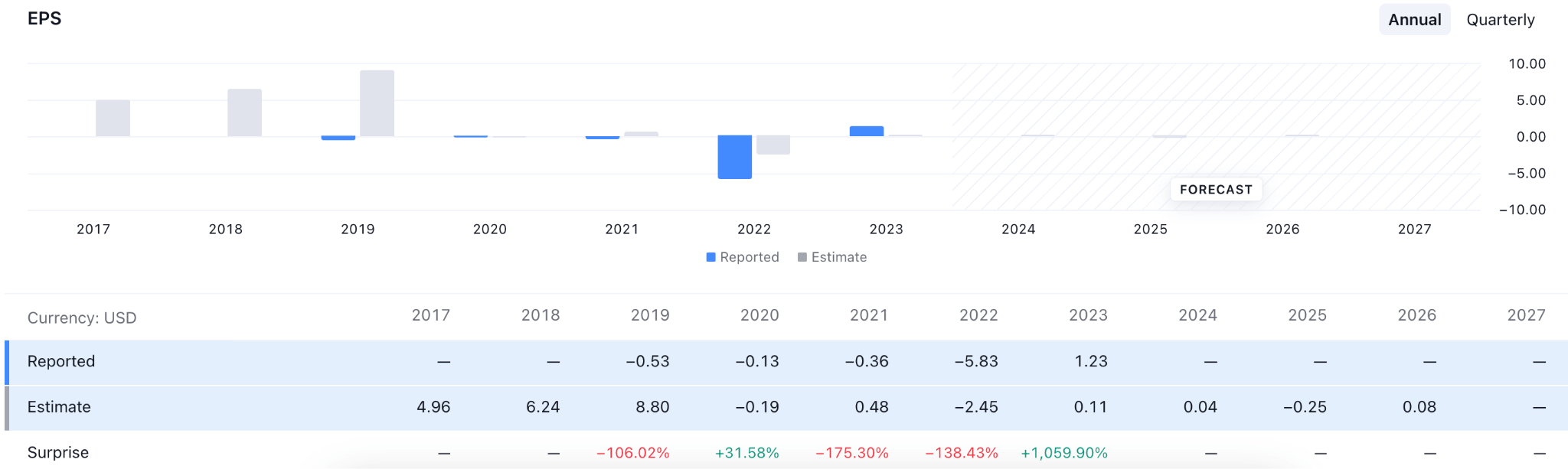

MARA EPS Forecast

The EPS data is an important metric for anticipating the MARA stock price, which has fluctuated recently due to several factors, such as operational costs and hash rate competition worldwide. However, in 2024, the company's EPS will be under pressure due to several challenges, including regulatory uncertainties and increasing energy costs.

However, the company improved its operational efficiency and mining capacity, achieving significant hash rate growth. It could positively impact the EPS growth in the future alongside BTC price stability and confirm that the uptrend will positively impact MARA's future EPS growth, which will be positive for the company.

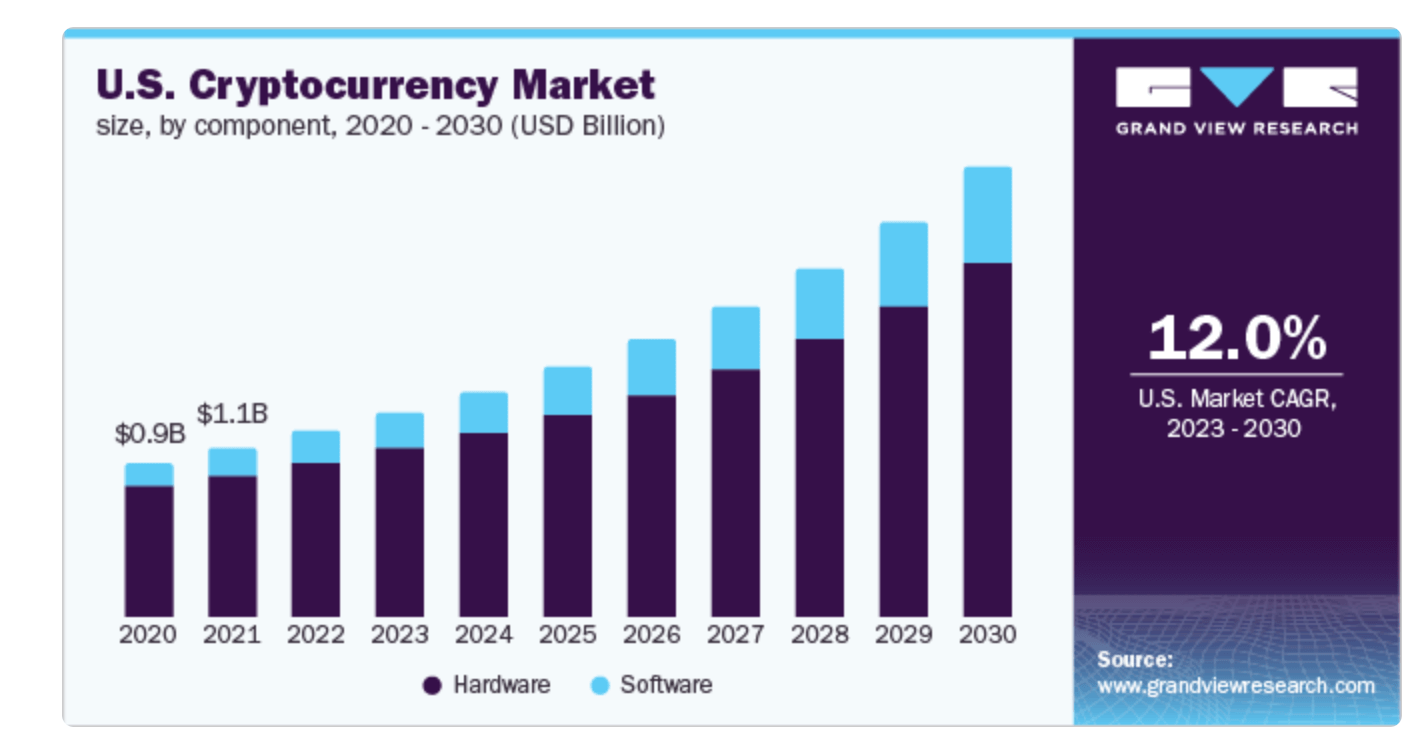

Crypto Market Cap Forecast 2030

The global cryptocurrency market grew 12.5% between 2023 and 2030, and the overall cryptocurrency market cap surpassed USD 800 billion in the same year.

Additionally, the growing use of cryptocurrencies for cross-border remittances, which reduces consumer fees and exchange costs, is anticipated to further fuel market expansion.

Following the growth, MARA stock could find buying pressure from the increased activity in the network.

MARA Stock Forecast 2030 and Beyond - Bullish Factors

- Marathon expanded its power capacity through acquisitions, including an upcoming 200 MW wind-powered site from Applied Digital and 390 MW from Generate Capital. These will reduce the BTC production cost by 20% and 30%, respectively, while significantly improving scaling operations.

- The company is expanding rapidly, with the goal of making 50% of its revenue from outside North America by 2028. To achieve this goal, the company appoints new managing directors to lead in Asia, the Middle East, Europe, and Africa, diversifying its revenue base and capitalizing on global opportunities.

- Investments in proprietary technologies such as 2-Phase Immersion Cooling (2PIC) and MARA Firmware will enhance mining capacity, reduce costs, and lower downtimes. These approaches will improve operational efficiency and drive revenue growth positively in the future.

MARA Stock Forecast 2030 and Beyond - Bearish Factors

- Bitcoin is a volatile asset, and massive price fluctuations are common. In that case, buying momentum in this industry might come with an excessive correction, creating panic among mass investors. Following the industry sentiment, MARA investors might fluctuate, creating a panic among investors.

- MARA's profitability heavily depends on energy. In that case, the rising energy cost could be a challenging factor for this stock in the coming year.

V. Conclusion

A. MARA Stock Outlook

MARA stock price could face decent buying pressure after having a valid trend line breakout. After having a valid swing high formation some minor downward pressure might come in 2025 and 2026. However, the market sentiment would be volatile creating a massive swing in this stock before reaching the ultimate target of the 30.00 level by the end of 2030.

Despite the volatility in the crypto following market, investors might find it as a way to boost the benefit through MARA stock CFDs. The opportunity for having long and short positions could create an opportunity to benefit from bullish and bearish movements.

B. Trade MARA Stock CFD with VSTAR

Finding a regulated and user-friendly trading platform is the primary condition for trading a CFD instrument. For that reason, VSTAR would be a great choice as it is a multi-regulated platform with the availability of enormous trading instruments, including forex, stocks, indices, cryptocurrencies, etc.

In VSTAR, investors can easily buy and sell MARA stock as the super-fast execution, premium customer support, mobile portability, and deep liquidity could provide a safe and secure environment.