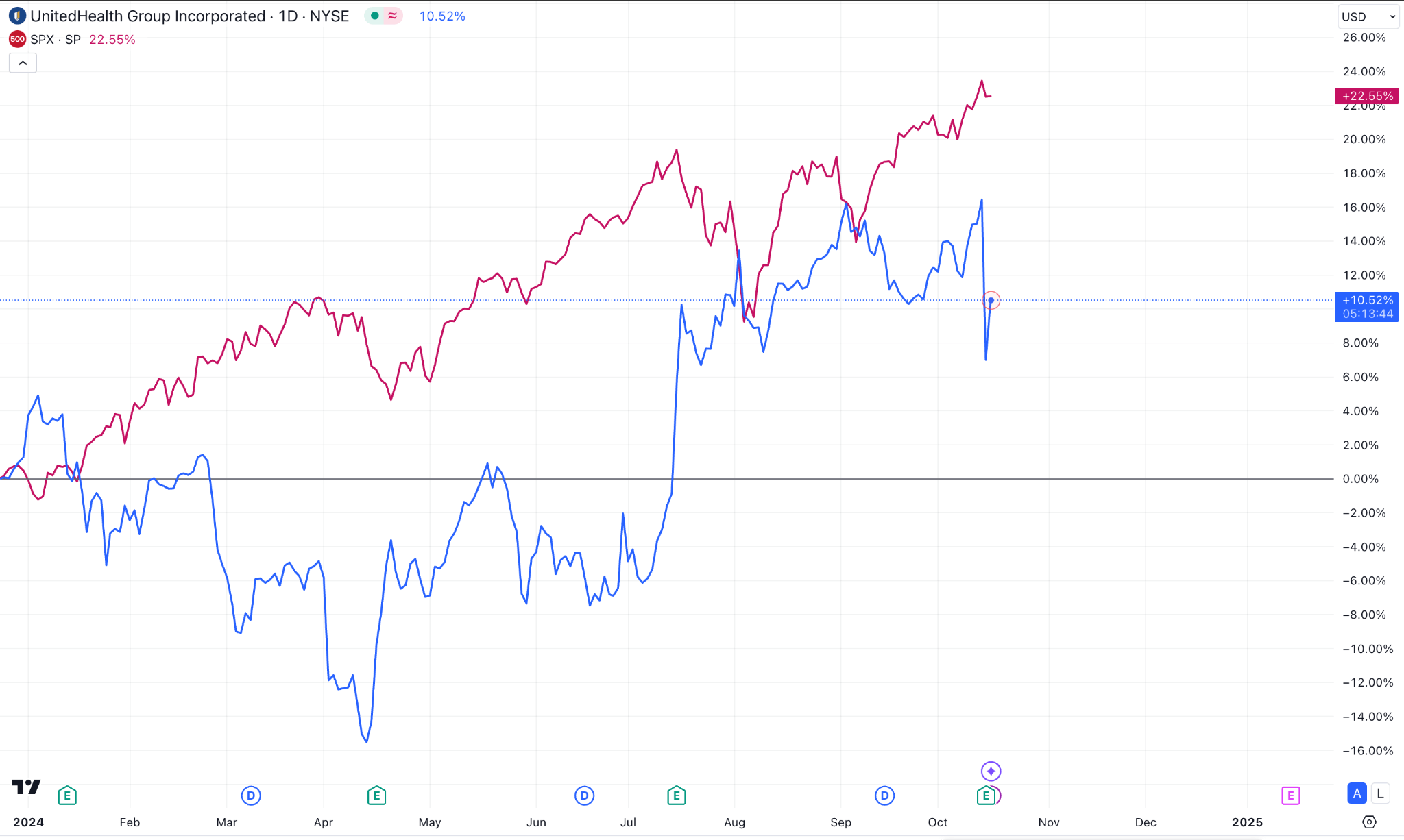

I. Recent UnitedHealth Stock Performance

Robust Performance of UNH

UnitedHealth Group Inc. (NYSE: UNH) has achieved a significant milestone, with its stock reaching a record high of $607.98, reflecting a 12.67% increase over the past year. This notable ascent is driven by increasing demand for healthcare services, consistent positive performance, well-timed acquisitions, and UnitedHealth's agility in an ever-changing market, reinforcing its position as a dominant force in the healthcare sector.

TD Cowen maintains a Buy rating on the UNH stock, projecting a 12.6% year-over-year growth in the forthcoming earnings report. The report is anticipated to address the impact of disruptions related to Change Healthcare (NASDAQ: CHNG), providing further clarity on the company's performance outlook. KeyBanc has also issued an Overweight rating, underscoring UnitedHealth's resilience and ability to navigate strategic challenges effectively.

UNH Management Forecast

Due to more significant delays than expected from a cybersecurity issue earlier this year, UnitedHealth Group (UNH) updated its full-year earnings outlook. The company's shares dropped 8.1%, the biggest decrease on the Dow and among the worst on the S&P 500.

In a conference call with investors, CEO Andrew Witty stated that the business is adopting a "more conservative than usual" estimate for the upcoming year, in part because of low state reimbursement rates for Medicaid plans that serve low-income customers and government payment reductions for Medicare plans. In December, UnitedHealth intends to release a more thorough prediction.

As many seniors planned treatments they had put off during the COVID-19 outbreak, the demand for healthcare services under Medicare, which covers individuals 65 and older or those with disabilities, has increased dramatically since late last year. A change in Medicaid membership has also resulted in greater medical costs for the corporation and other insurers, leaving them with a larger proportion of sicker patients.

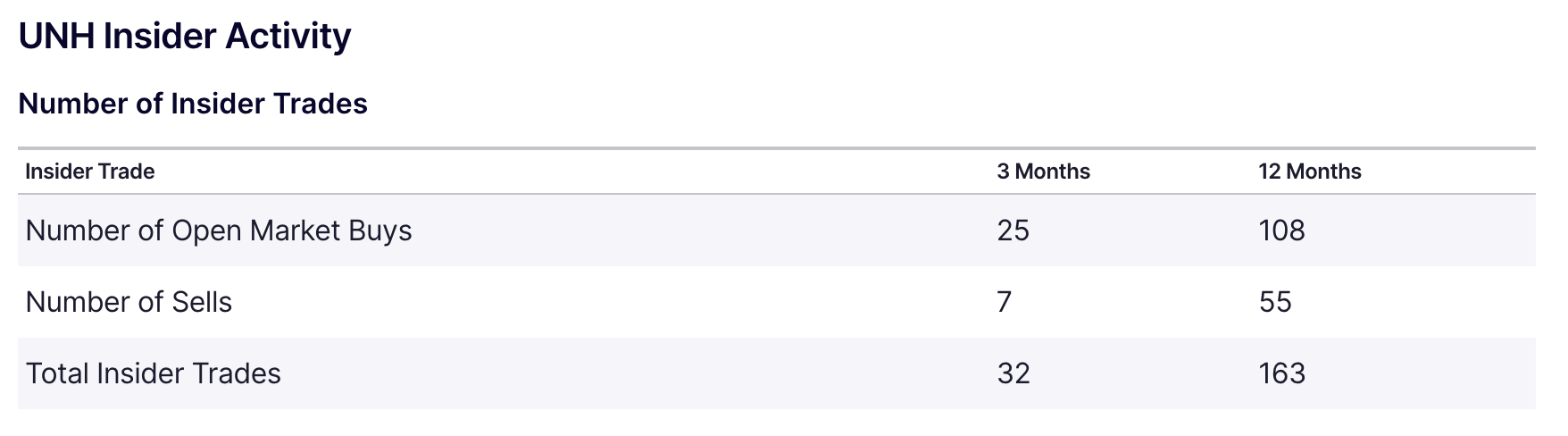

UnitedHealth Insider Transactions

On July 18th, UnitedHealth Group's Executive Vice President, Erin McSweeney, sold 1,500 shares at an average price of $579.03, totaling $868,545.00. After the sale, she holds 7,785 shares, valued at roughly $4.51 million, with no significant change to her overall ownership. Additionally, on July 17th, Chief Accounting Officer Thomas E. Roos sold 2,851 shares at an average price of $569.88, generating $1,624,727.88. Roos now holds 29,501 shares, with a total estimated value of $16.81 million. Like McSweeney's transaction, this sale did not result in any material reduction in his ownership of UnitedHealth Group stock. Both sales were recorded following SEC regulations.

Expert Insights on UNH Stock Forecast for 2024, 2025, 2030 and Beyond

UNH stock price, floating near the ATH, recovered from the loss of Q1 this year and remained on a straight uptrend since then. The chart reveals an attractive performance for the asset from previous years till now through posting consecutive gaining years. However, before proceeding further, let's check experts' price predictions for UNH stock prices for 2024, 2025, 2030, and beyond with a quick view.

|

Providers |

2024 |

2025 |

2030 & beyond |

|

StockScan |

$550.39 |

$619.49 |

$800.18 |

|

WalletInvestors |

$622.45 |

$662.35 |

$796.76 |

|

Coincodex |

$640.32 |

$731.23 |

$1,858.10 |

|

Coinpriceforecast |

$637 |

$768 |

$1,194 |

II. UNH Stock Forecast 2024

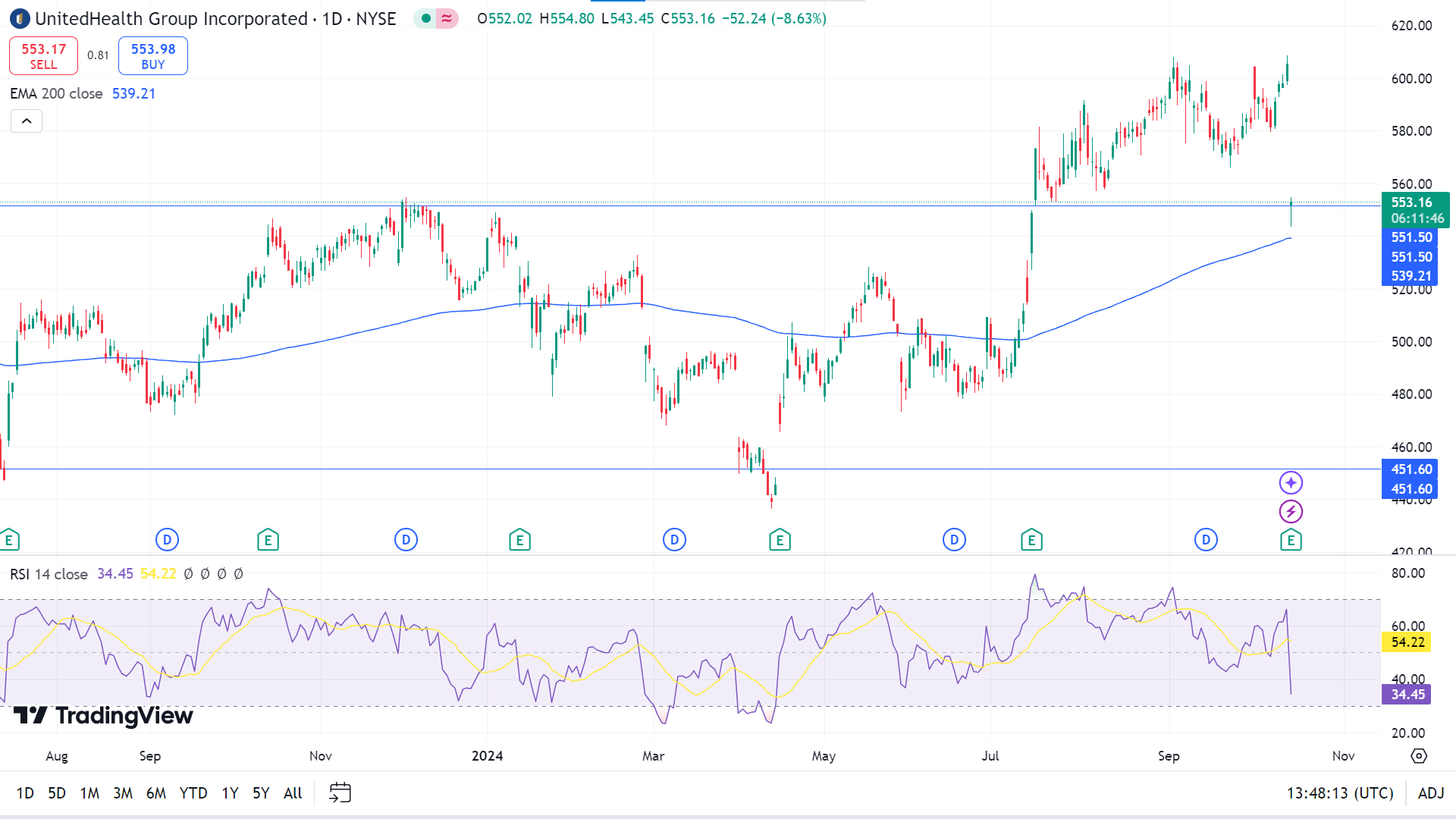

The UNH stock price posted an impressive gain in recent months after retracing in Q1; since then, it has been moving on a solid uptrend and may end the year 2024 by reaching a new ATH near the 650.00 level.

The daily chart confirms that the price of UNH stock successfully broke the range of 451.00 -551.00 and was retraced to validate the breakout. This enables investors to find investment opportunities, as the long-term trend has been bullish for decades. However, the primary outlook for the UNH stock could be bearish as a corrective pressure.

The price suddenly drops at the EMA 200 level to validate the range breakout that it has remained in since November 2021. The EMA 200 line still suggests bullish pressure is intact on the asset, which may drive the price toward the primary resistance near 605.54. A breakout of that resistance might trigger the price to hit a new possible resistance near 605.00 level.

Based on the UNH Stock Forecast 2024, the corrective price action at the all-time high area, with a divergence with the RSI could signal a downside correction towards the 200 day EMA line. Moreover, the price may decline toward the nearest support near 501.24 or further downside toward the previous range low of 451.60.

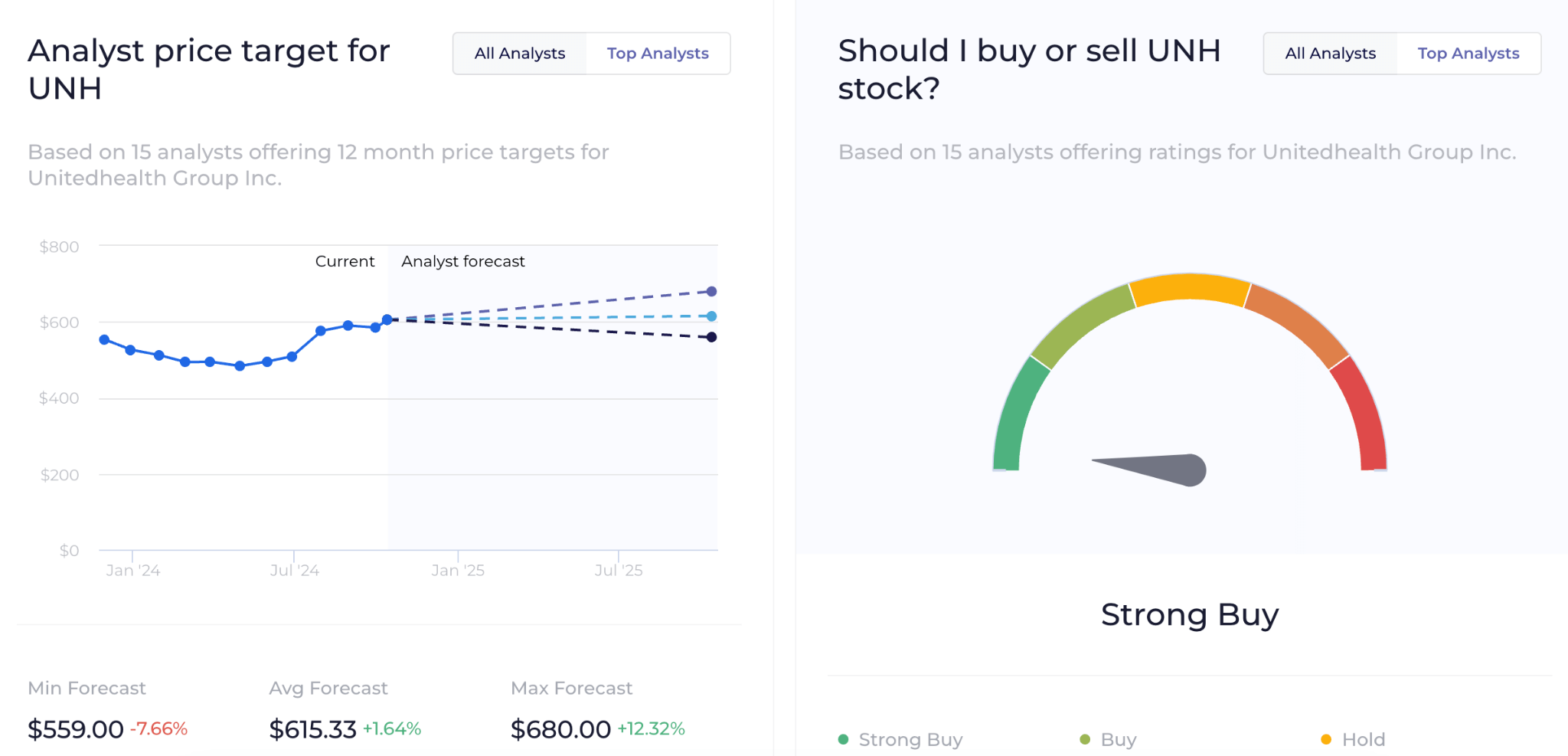

A. Other UNH Stock Forecast 2024 Insights

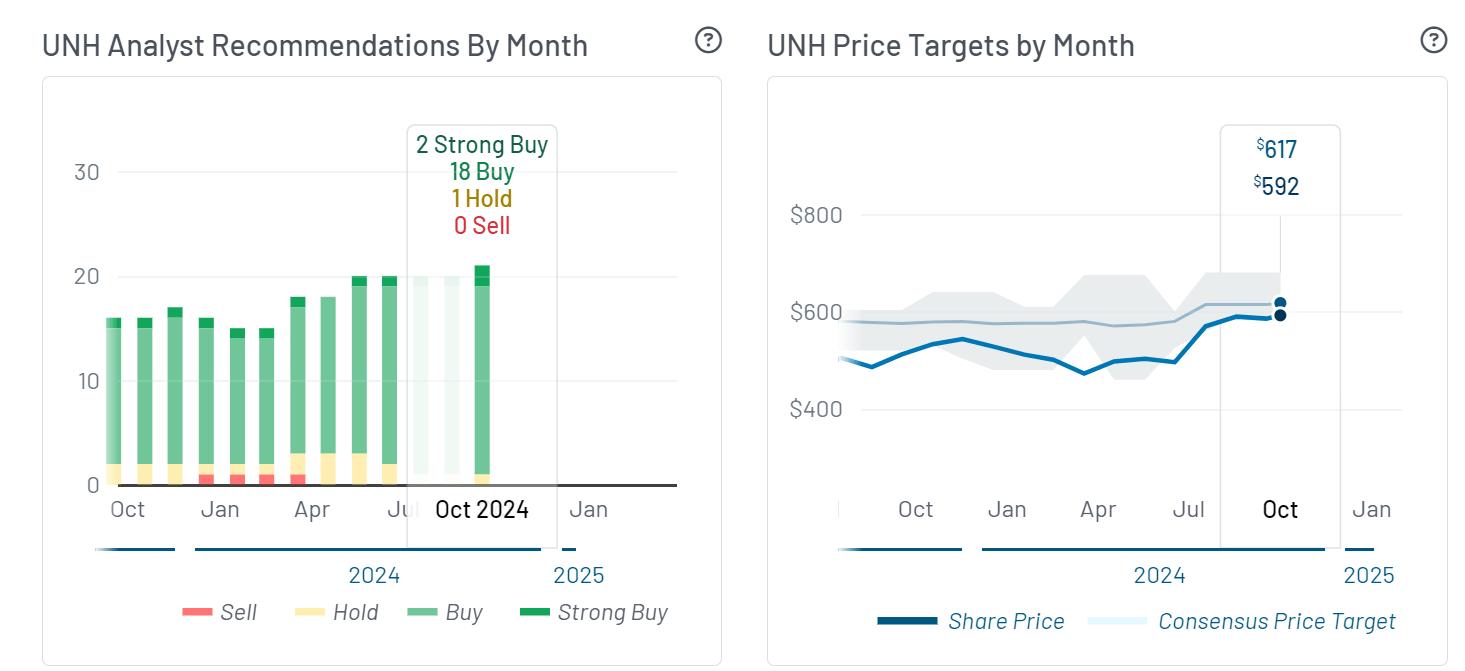

Fifteen analysts on wallstreetzen provided price predictions about UNH stock price for the next twelve months, besides suggesting ratings on the asset. Thirteen gave the stock a “strong-buy” rating, and two suggested only “buy.” Meanwhile, no analysts suggested selling, declaring UNH stock an attractive investment asset for twelve months.

In the meantime, they anticipated the average price could be $615.33, while the minimum would be $559.00, and the maximum would be $680.00 for the asset.

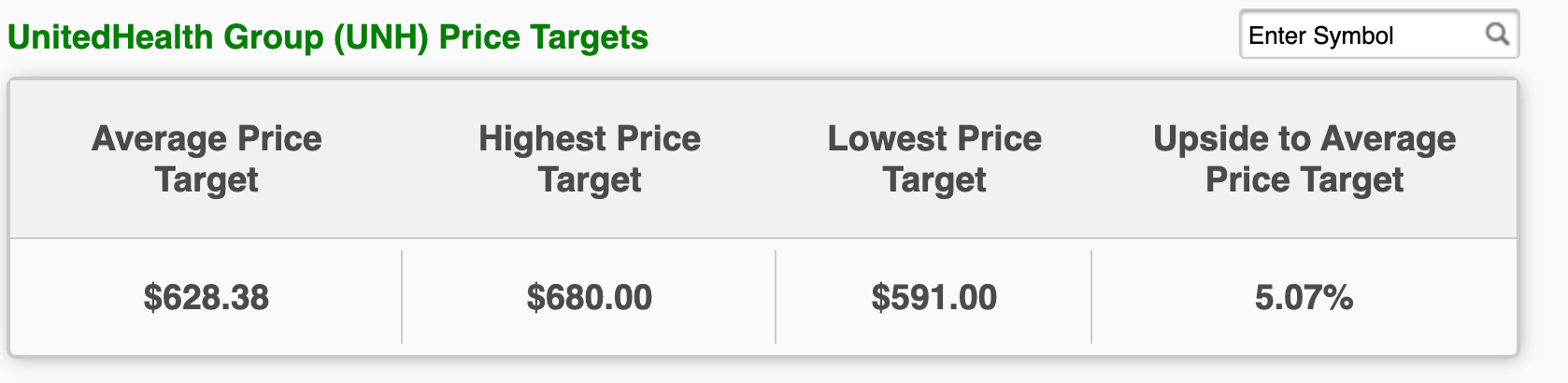

Another famous firm, Zacks, reported price predictions for the UNH stock. Twenty-four analysts projected the price for the asset, with the highest UNH price target at $680, the average price target at $628.38, and the lowest price of $591.00 for the short term.

Additionally, they published broker ratings from 25 firms, of which 23 anticipated UNH stock as a “strong-buy” asset, and only two suggested it as a “buy” asset. Meanwhile, there are no “sell” suggestions.

B. Key Factors to Watch for UNH Stock Forecast 2024

UNH Q3 Earnings Analysis

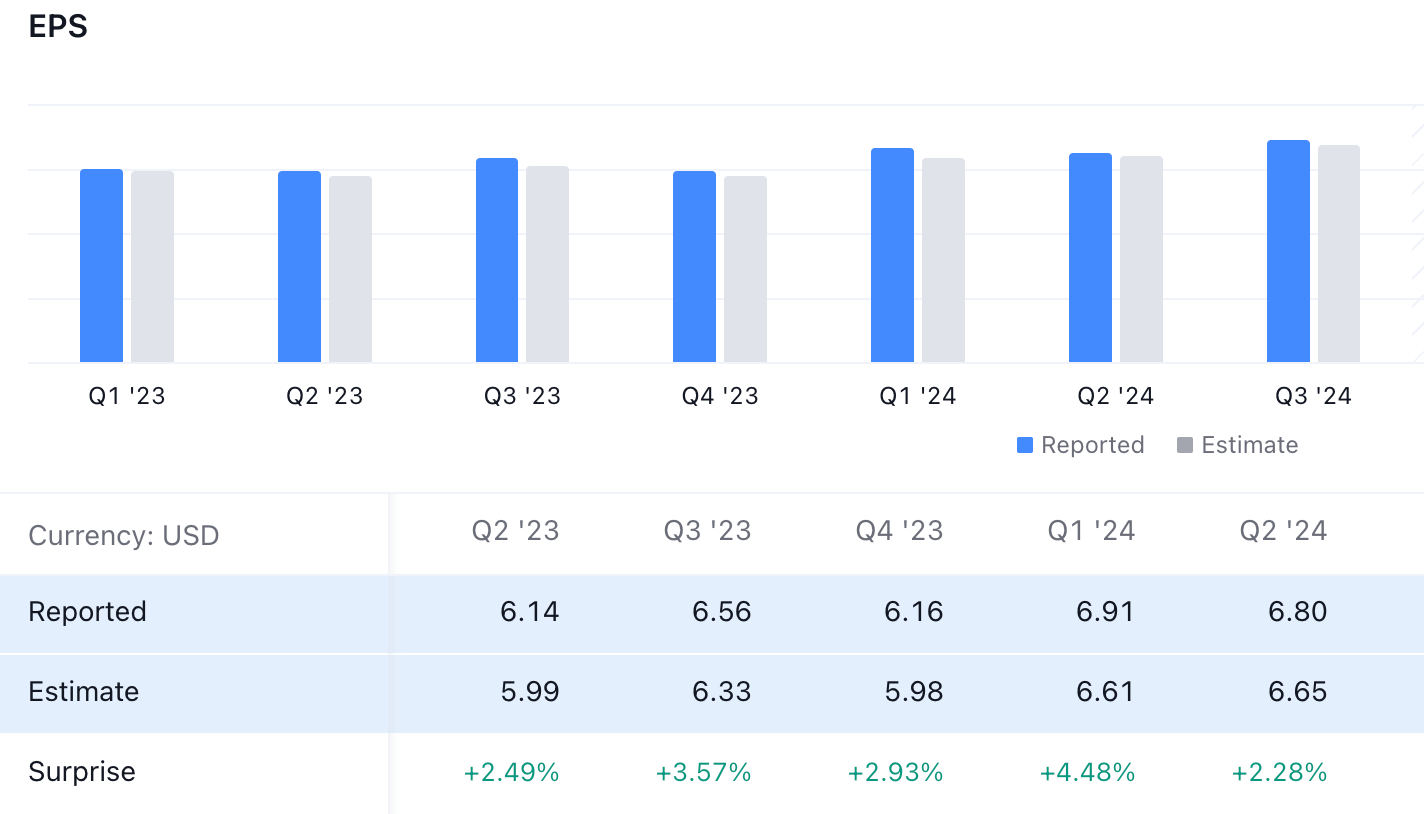

UnitedHealth Group (UNH) published a report for Q3 2024 revenue of $100.82 billion, a 9.2% YoY increase. The company's earnings per share (EPS) came in at $7.15, up from $6.56 in the same period last year, showcasing solid earnings growth.

This revenue surpassed analysts' estimate of $99.51 billion, resulting in a positive surprise of 1.31%. UnitedHealth also delivered an EPS beat, with the consensus estimate of $7.02, leading to a 1.85% increase in earnings.

While investors closely monitor YoY changes in earnings and revenue to assess performance, key financial metrics often provide deeper insights into a company's overall health. Analyzing these metrics enables investors to observe UnitedHealth's financial strength and potential impact on stock price performance compared to past performance and analyst projections.

This consistent growth in both revenue and earnings signals the company's strong execution and resilience in the competitive healthcare market.

UnitedHealth (UNH) Management Outlook 2024

The continued high demand for healthcare services and decreased reimbursements from government-backed plans were the main causes of UnitedHealth's third-quarter medical expenses exceeding Wall Street projections.

Due in part to a 10-cent-per-share impact from a February hack on its technology division, Change Healthcare, the company reduced the upper range of its 2024 adjusted profit expectation by 25 cents to $27.75 per share.

Due to significant payment delays and other operational issues, UnitedHealth now projects that the hack will disrupt corporate operations by $705 million, or roughly 75 cents per share, this year.

The business had to pay for informing customers about the breach and gave billions of dollars in loans to healthcare providers impacted by it. As it recovers from the attack, Change Healthcare is also trying to draw in new customers after losing business to smaller rivals.

United Healthcare Stock Forecast 2024 - Bullish Factors

- UNH currently holds a dominant position in the healthcare sector, supported by factors like adaptability to market shifts, diversified services, etc. These factors solidify the company's future potential.

- UNH posted attractive revenue growth of 9.2% YoY increase in the third quarter of 2024, driven by strategic development and robust healthcare services.

- The company consistently beat earnings expectations and reported an EPS of $7.15 for Q3 2024, which reflects operational efficiency and makes it a potential investment.

UNH Stock Forecast 2024 - Bearish Factors

- The company faces a surge in operational costs, especially in technology investments and healthcare services. These factors can weigh the 2024 margin and negatively impact the stock price.

- Potential healthcare reforms and regulatory scrutiny pose risks for UnitedHealth and may negatively impact future growth and profitability.

III. UNH Stock Forecast 2025

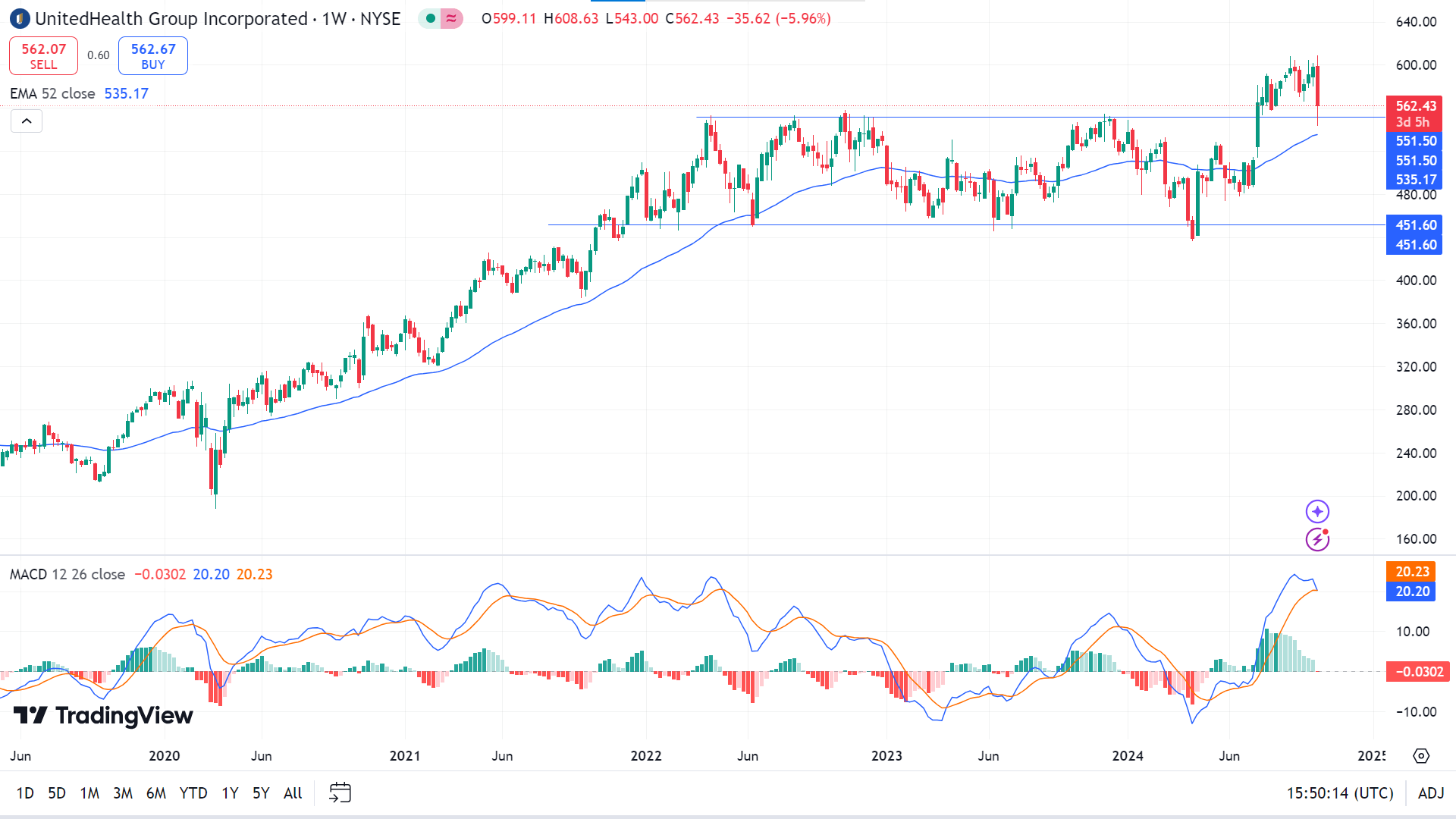

The weekly chart confirms a valid breakout occurred on the asset price from the range of 451.60-551.50, that the price remained since Q4 2021 and can end up near $680 by the end of 2025.

In a broader context, UNH stock price has remained sideways after several years of bullish moves, ranging between 451.60 and 551.50 from Q4 2021 to Q2 2024. The price successfully broke out of the range in Q3, and now, it has been validating the range by retouching the upper level of the range. The following method will determine the price's further direction.

As we know, the 52-week moving average is a widely used trading tool for generating trading ideas for many investment assets. The price is still above the EMA 52 line on the weekly chart, which means the bullish pressure remains intact on the asset, which can drive the price toward the primary resistance of 608.63. A breakout might trigger the price toward the following resistance near the 680.00 level.

Meanwhile, the MACD indicator reading remains bullish, but the green histogram bars are fading, suggesting a possible retracement.

Based on the UNH Stock Forecast 2025, the bullish continuation is present, where any valid rebound from the 52-week SMA could resume the existing trend.

However, a deeper correction is possible towards the 460.00 ti 450.00 zone but a valid rebound below the 450.00 level could signal a selling pressure toward the primary support of 496.44, followed by the next support near 439.06.

A. Other UNH Stock Forecast 2025 Insights

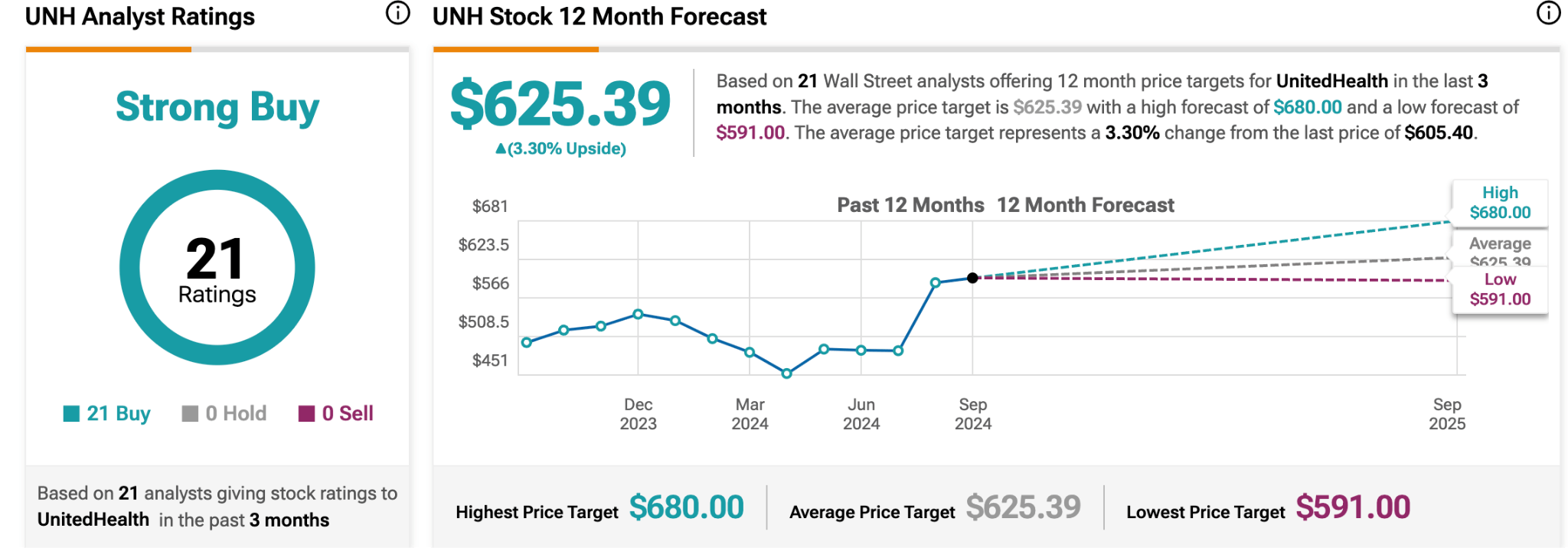

According to Tipranks, twenty-one analysts predicted the UNH stock price based on various factors, giving the asset a “buy” rating in the past three months. In the meantime, they projected the asset price for the next twelve months; the average price for the asset would be $625, the highest target would be $680, and the lowest would be $591.

Another platform, Marketbeat, provides reports on UNH stock. Twenty-one analysts provided their recommendations; among them, two suggested a “strong buy,” eighteen suggested a “buy,” one rated a “hold,” and no “sell” recommendations were made. They projected the price by the end of Oct might hit $617.

B. Key Factors to Watch for UNH Stock Forecast 2025

UNH Growth Forecast 2025

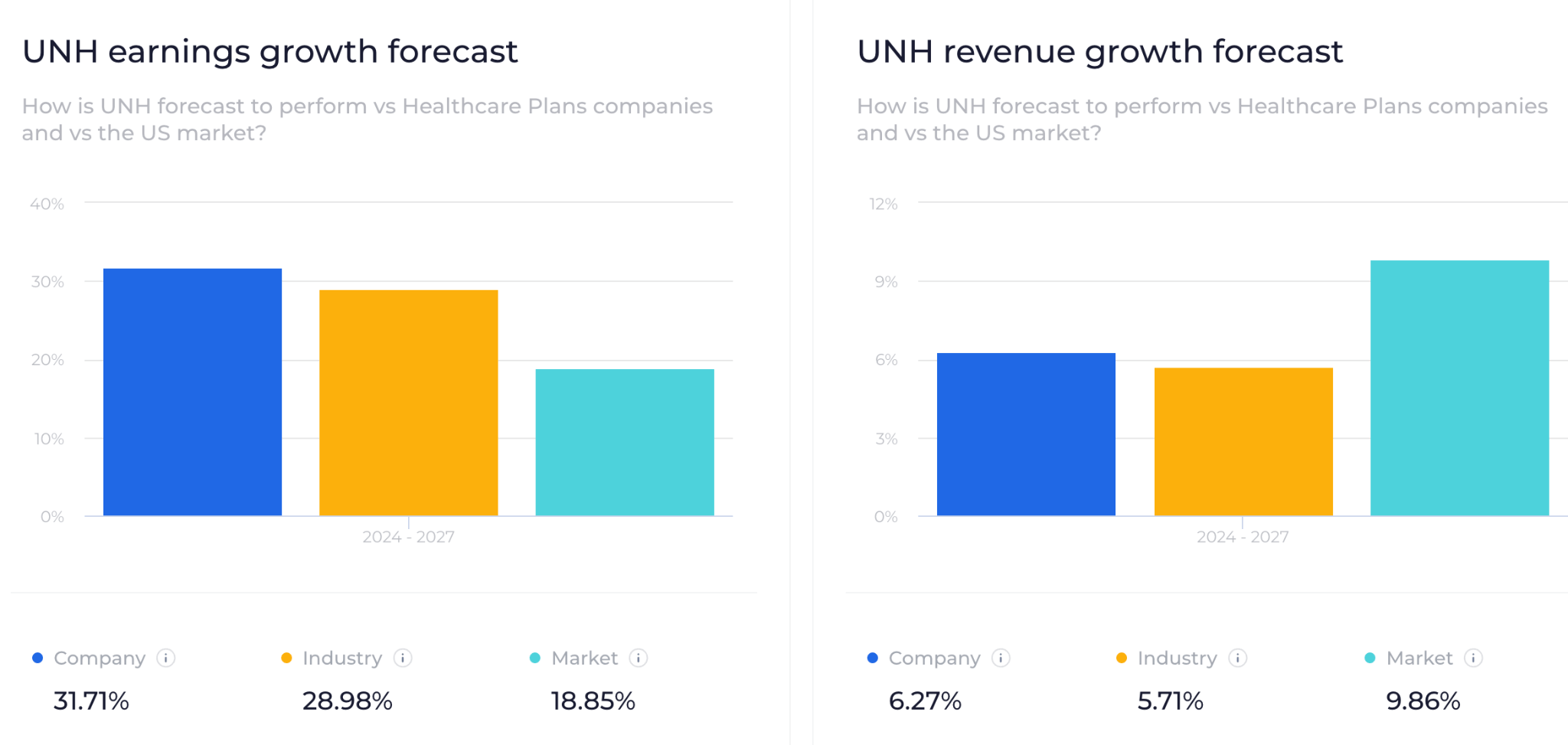

UNH's revenue growth is stable at 6.26%, above the industry average of 5.71%. In the earnings section, the company has a strong position with 31.71% growth, which is also higher than the industry growth of 28.98%.

As the company maintains higher-than-industry growth, investors might expect buying pressure in this stock.

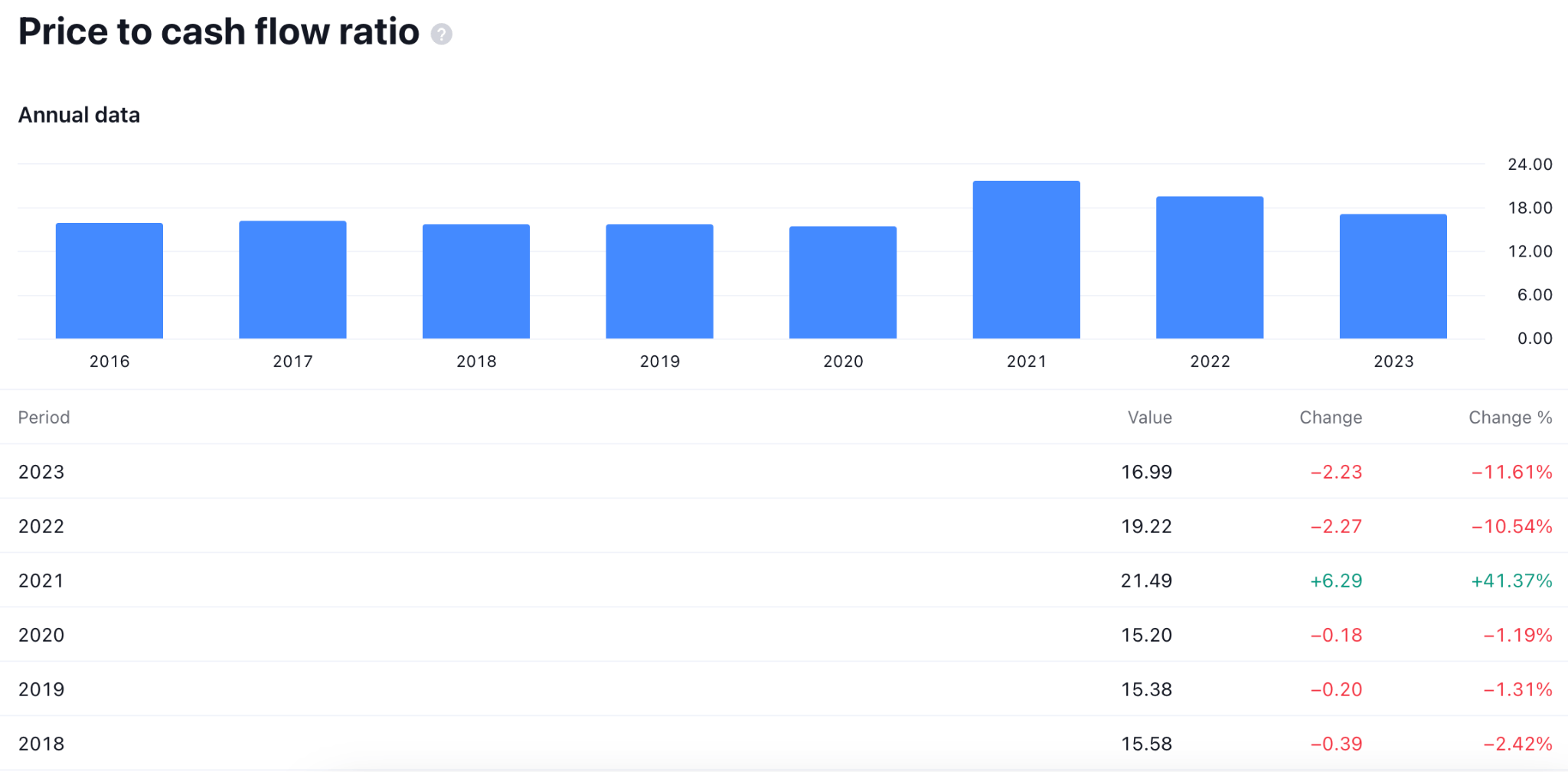

UNH Cash Flow Position

The above chart shows the cash flow for the United Health Company, which reveals a positive outlook in 2021, which was during the Covid-19 pandemic. However, a cash outflow is seen in 2021, which is insignificant compared to the previous result.

UNH Stock Forecast 2025 - Bullish Factors

- The upbeat earnings report, with revenue growth of over $400 billion in 2024, could signal a stable business that could continue supporting the company in 2025.

- The ongoing business stability in the Medicare segment could generate strong revenue for UNH. According to current analyst projections, the company is likely to cover 96% of Medicare customers by the end of 2025.

- The Optum unit is another growth factor for UNH, as the company can benefit from data-driven healthcare support.

United Health Stock Forecast 2025 - Bearish Factors

- There is an ongoing lawsuit from UNH shareholders, who might work as a negative price director for UNH in 2025. Investors should monitor how corporate governance deals with lawsuits and if any goodwill loss appears.

- Rising medical costs are another factor to consider, which could eat into the wider portion of the profit margin. The UNH management already considered these costs and provided a lower than expected profit forecast for 2025.

IV. UNH Stock Forecast 2030 and Beyond

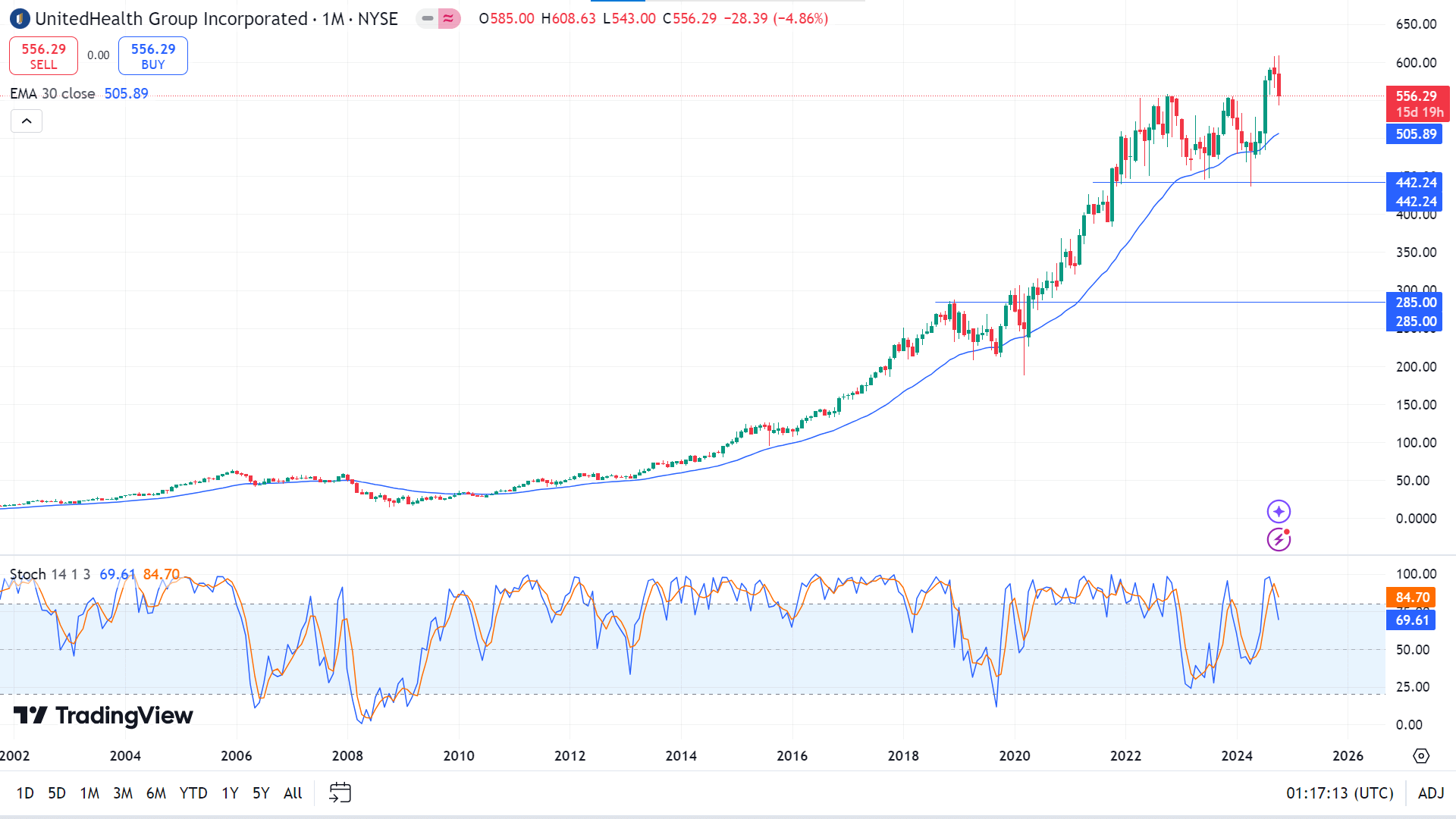

The monthly chart shows that the price of UNH stock has remained on a straight uptrend over the decades and may reach nearly 800.00 by the end of 2030, as many analysts predict.

The UNH stock price created a possible double-top pattern on the monthly chart between Q4 2022 and Q2 2024. The price reached above the top of the pattern in Q3, declaring solid bullish pressure and validating the previous top as a support level before increasing further. If the positive move is sustained, it can create a new ATH by continuing to gain in the upcoming years.

The price has remained above the EMA 30 line due to the bullish pressure on the asset price, while the Stochastic indicator reading turned bearish. If the price continues above the EMA 30 line, it may hit the ATH of 608.00 soon, and a breakout will enable the room to reach a new ATH in the upcoming years, which will be toward 800.00, as price projections from many experts.

Based on the UNH Stock Forecast 2030 and Beyond, the Stochastic indicator is sloping below the upper line of the indicator window suggesting fresh bearish pressure; if the price reaches below the EMA 30 line, it can decline toward the primary support of 442.24, followed by the next support near 285.00.

A. Other UNH Stock Forecast 2030 and Beyond Insights

A famous platform, Markettalks, published an analysis and prediction report on United Health's share price, as the company's position is already dominant. Analysts projected an average of 14% growth from 2029. The focus of OptumRx on pharmacy service can boost overall profitability and revenue.

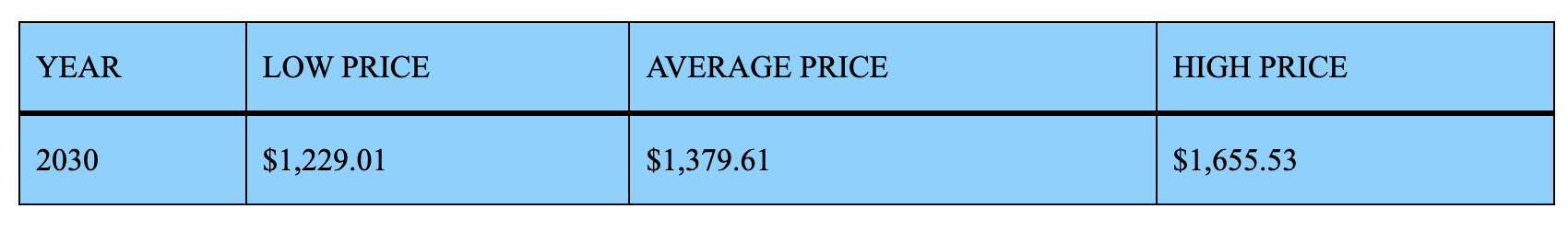

Developing AI-driven drug discovery platforms may also create new revenue streams, and partnerships with other companies may improve market position and share price. The price projection for 2030 is a low of $1229.01, an average of $1379.61, and a high of $1655.53. UNH will continue to expand and innovate in healthcare, like other companies, such as Johnson & Johnson, in the coming decades.

Another report from Nasdaq.com reveals that the current 10% annual growth for UNH could take 7 years to reach the $1 trillion market cap. However, investors can double their value in 6 years, if a slightly higher performance of 12% per year appears.

B. Key Factors to Watch for UNH Stock Forecast 2030

UNH Earnings Forecast 2030

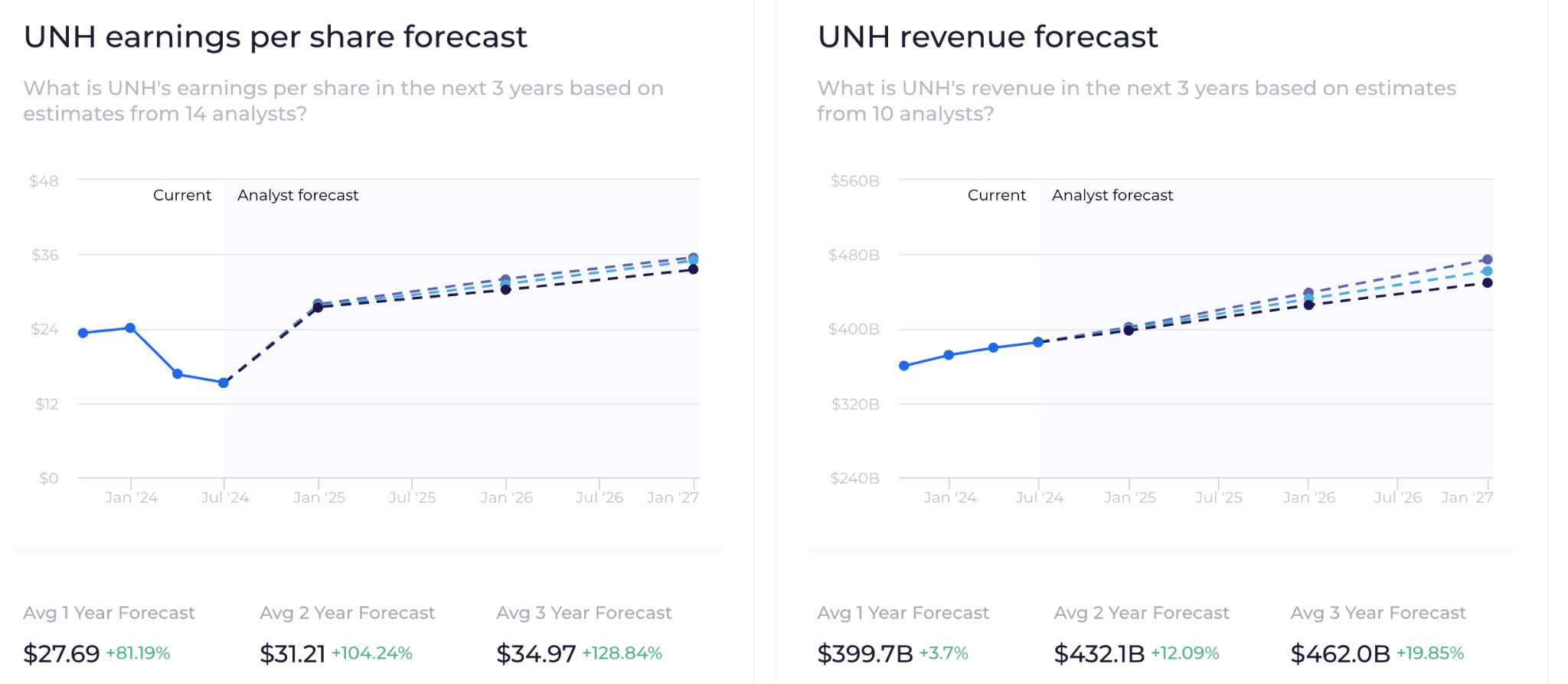

According to analysts' projections, earnings per share for UNH are projected to be $27.69 on average for one year, surging 81.19%; in two years, an average of $31.21, increasing 104.24%, and in three years.

Meanwhile, the revenue growth forecast is also attractive, which could gradually increase to $399.7B on average for one year; in two years, the average estimation is $432.1B, and in three years, average revenue is $462.0B.

HBI Market Size in 2030

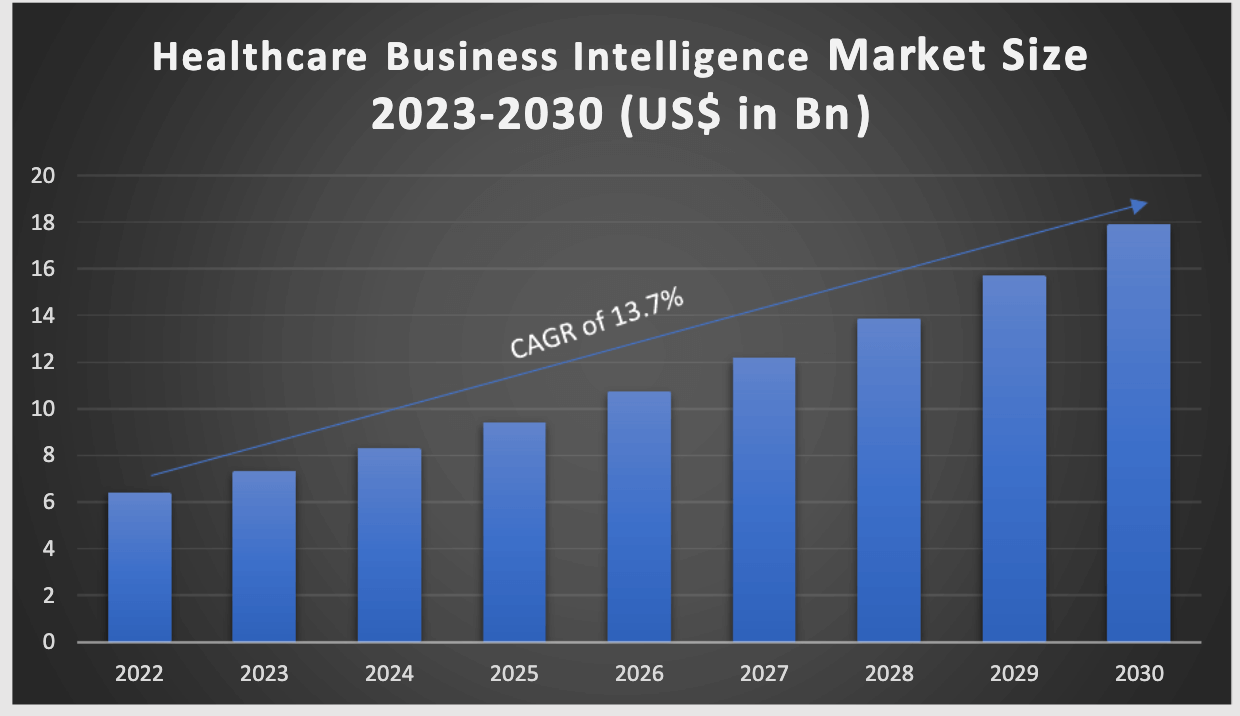

The Healthcare Business Intelligence Market is expanding as organizations seek to improve patient outcomes while reducing costs. BI solutions help analyze large datasets, such as electronic health records (EHRs) and claims data, allowing healthcare providers to identify trends and make informed decisions to enhance care and operational efficiency.

A growing focus on patient-centered care drives this market, as BI tools provide insights into patient behavior and preferences, improving care quality and satisfaction. Additionally, BI helps streamline clinical operations and optimize resource use, leading to better outcomes and reduced costs.

UNH Stock Forecast 2030 and Beyond - Bullish Factors

- The ongoing revenue growth with forecasted stability could influence the UNH market cap to reach the $500.00 milestone by the decade's end.

- The focus on technology and artificial intelligence could help the medical industry to grow and run more efficiently.

- UnitedHealth's efforts to globalize the business which may drive future growth opportunities.

UNH Stock Prediction 2030 and Beyond - Bearish Factors

- The competitive threat is a challenging factor for this stock as a failure to focus on innovation and new technology could change the environment at any time.

- As a heavily regulated company, certain risks could come from pharmacy benefits, medical advances, and other policies. Any adverse change could directly affect the UNH stock

V. Conclusion

A. UNH Stock Outlook

UNH stock is trading within a stable buying pressure, which already provided a decent return in 2024. Although the outcome is insignificant compared to the S&P 500 index, the stock price reached the all-time high level, despite labor cost concerns.

Following the downbeat forecast from the management and a technical divergence, the stock is likely to show a bearish recovery in 2025. However, the industry demand remains solid, creating more room to move upward in 2030 and beyond.

B. Trade UNH Stock CFD with VSTAR

Trading in stock CFDs could provide more benefits as investors can make money from going long and short. Moreover, a good trading environment like VSTAR is a crucial factor as funds safety, and deeper liquidity could limit the loss at any time.

In VSTAR, the mobile portability, multi-regulated environment, regular market updates, top-notch customer support, and wider available assets could be strong factors to mention.

Investors can easily benefit from the downside reversal of UNH while keeping the growth from any trend continuation signal.