- Apple achieved a record $85.8 billion revenue in Q2 2024, up 5% YoY, with an 11% increase in EPS.

- AAPL stock surged 23% this quarter, closing at $210.62, amid a market cap of $3.23 trillion.

- Analysts predict a bullish outlook with a AAPL price target of $270 by year-end, reflecting growth potential.

- Risks include strong competition from Samsung and Microsoft, regulatory challenges, and economic fluctuations.

I. Apple Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights [Q3 Fiscal 2024]

Apple reported a record quarterly revenue of $85.8 billion for Q2 2024, a 5% year-over-year increase. This growth was driven by robust performance in services and higher sales in key regions, despite a 230 basis point negative impact from foreign exchange. The company achieved a net income of $21.4 billion, translating to earnings per share (EPS) of $1.40, marking an 11% year-over-year increase and setting a new June quarter record. Apple's gross margin stood at 46.3%, near the high end of its guidance range. Product gross margin was 35.3%, while services gross margin was significantly higher at 74%.

Source: apple.com

Operating expenses totaled $14.3 billion, a 7% increase year-over-year, reflecting ongoing investments in innovation and market expansion. Apple ended the quarter with $153 billion in cash and marketable securities. Operating cash flow was a robust $28.9 billion. The company returned over $32 billion to shareholders through dividends and stock repurchases.

Operational Performance

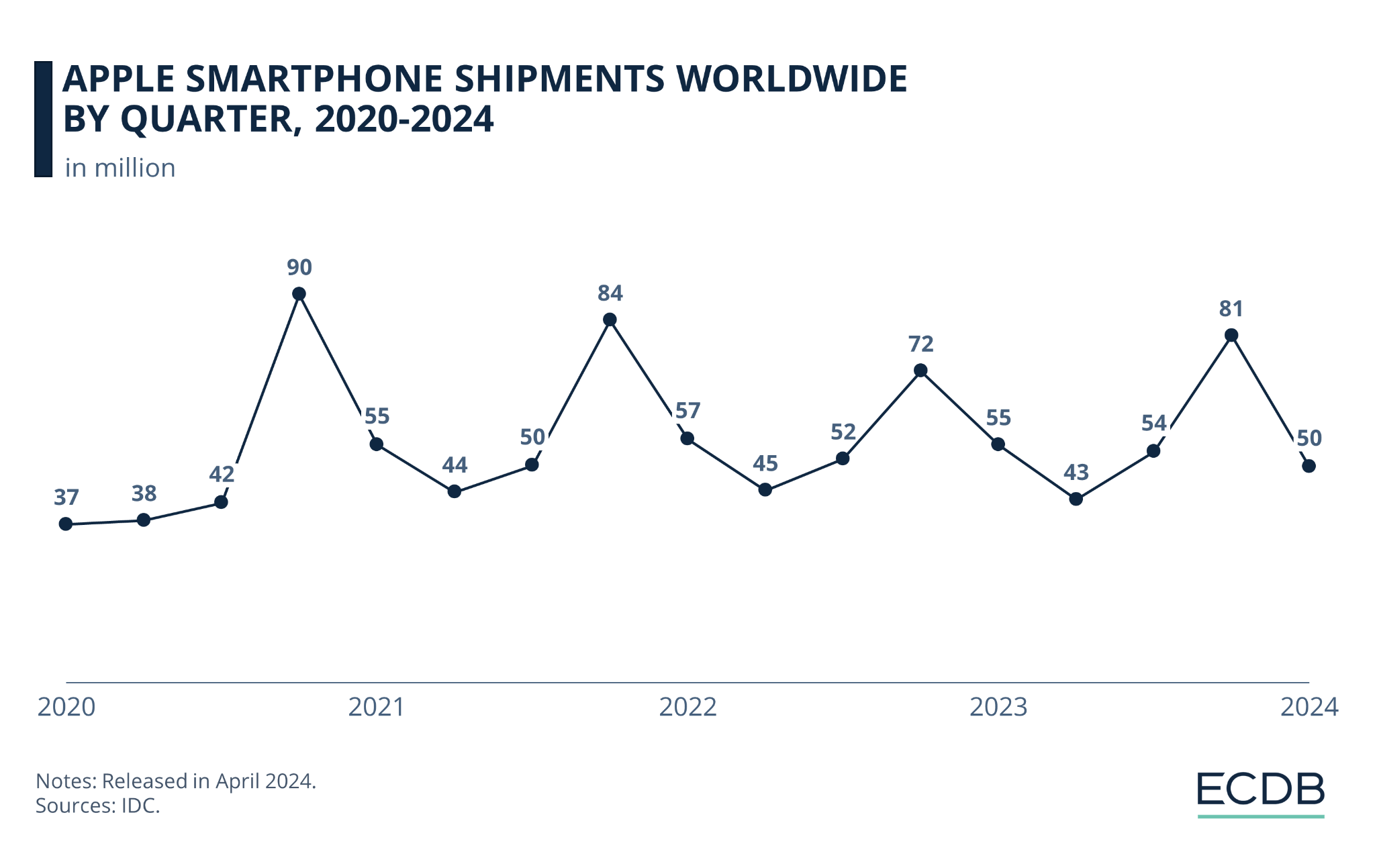

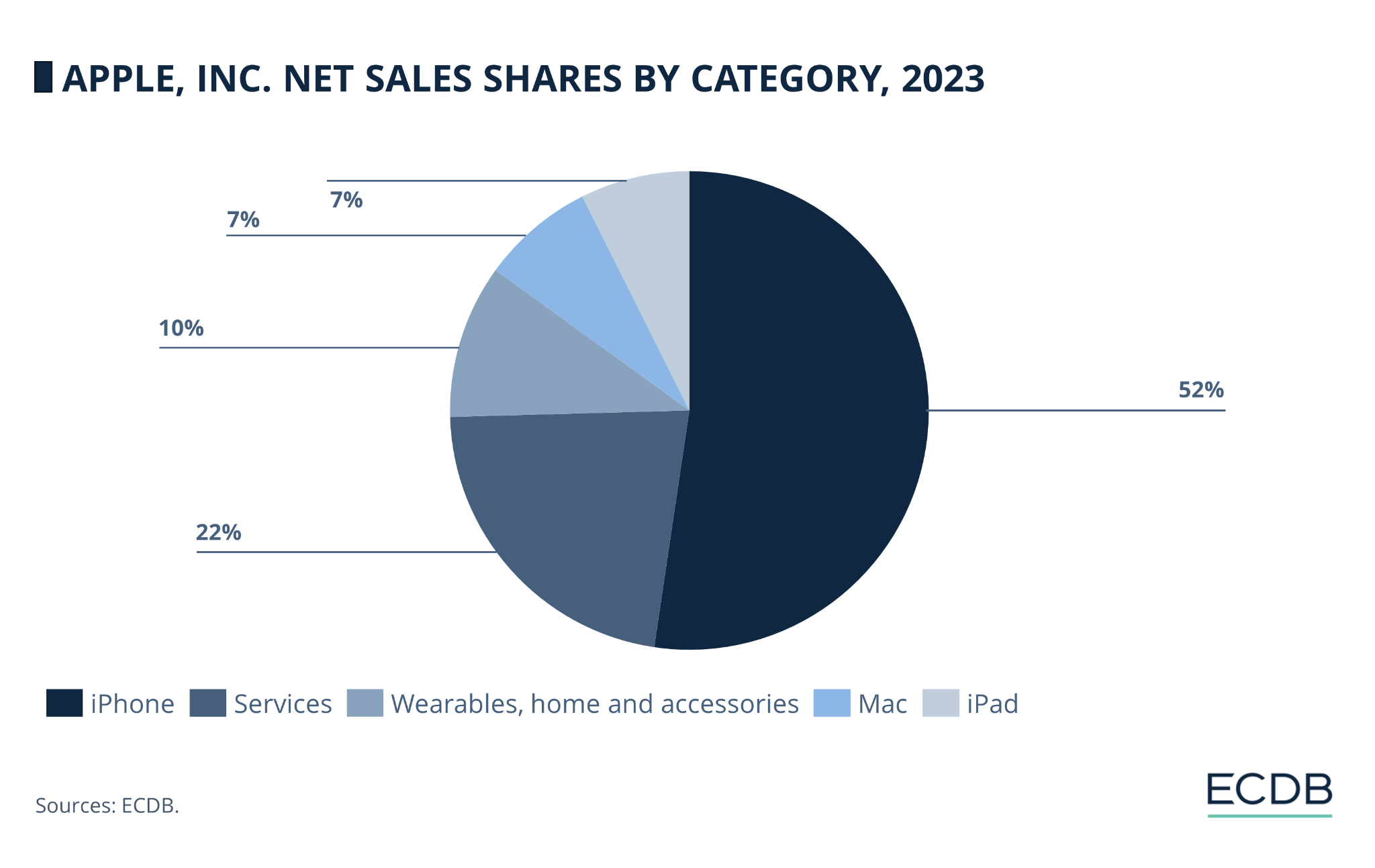

- iPhone: Revenue was $39.3 billion, a 1% year-over-year decline but stable on a constant currency basis. The iPhone 15 lineup received high praise for its battery life, camera quality, and performance.

Source: static.ecommercedb.com

- Mac: Generated $7 billion in revenue, up 2% year-over-year. The M3-powered MacBook Air contributed significantly, especially in emerging markets.

- iPad: Revenue reached $7.2 billion, a substantial 24% increase year-over-year, driven by the new iPad Pro and iPad Air models.

- Wearables, Home, and Accessories: Revenue was $8.1 billion, down 2% year-over-year. Apple Watch continued to attract new customers, pushing the installed base to a new high.

- Services: Achieved an all-time revenue record of $24.2 billion, up 14% year-over-year. This was driven by strong growth in advertising, cloud, and payment services.

Market Share Analysis:

- Geographical Performance: Apple set quarterly revenue records in over two dozen countries, including Canada, Mexico, France, Germany, the UK, India, Indonesia, the Philippines, and Thailand.

- Product Popularity: iPhone remained the top-selling smartphone in key markets like the US, urban China, the UK, Germany, Australia, and Japan.

New Product or Technological Advancements and Innovations:

- Apple Intelligence: Introduced at the Worldwide Developers Conference, this AI-driven platform enhances user interaction with generative AI models integrated into iPhone, iPad, and Mac. It includes tools for writing, image creation, and notification management, all with a focus on privacy.

- Apple Vision Pro: Expanded to more countries, offering users advanced spatial computing experiences. Vision Pro is gaining traction in both consumer and enterprise markets, with over 2,500 native spatial apps available.

- iOS 18 and New Features: The iOS 18 update brought significant enhancements, including a redesign of the Photos app, satellite messaging, and new AI capabilities through Apple Intelligence.

- MacBook Air and M3 Chip: The new M3-powered MacBook Air has been well-received, especially among students and professionals.

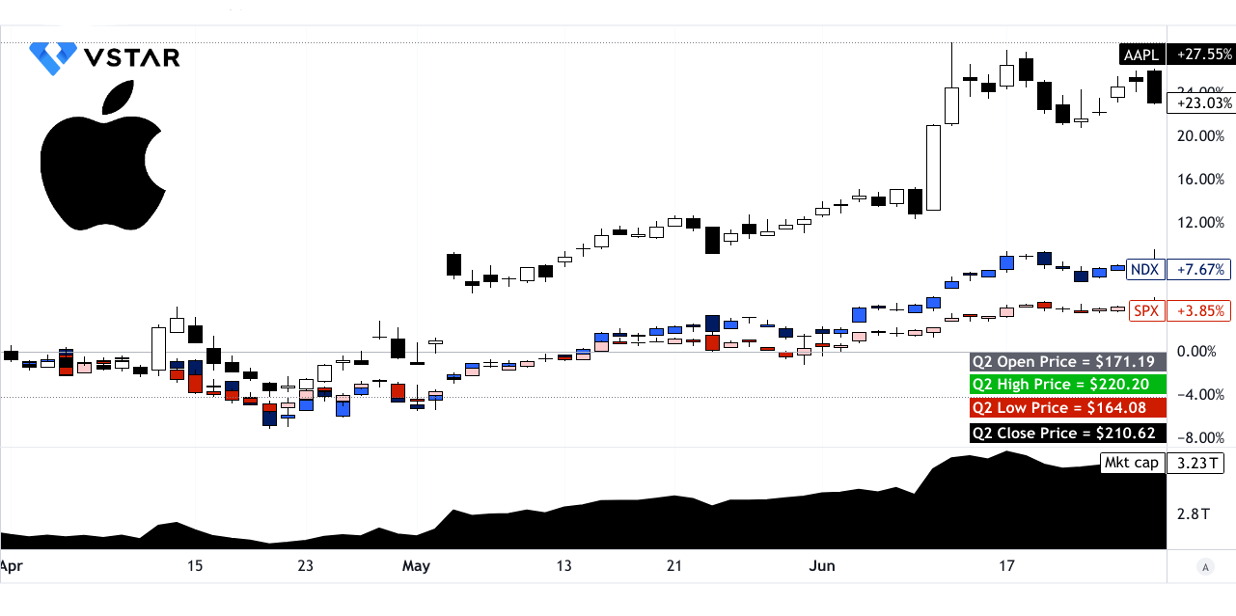

B. AAPL Stock Price Performance

Apple stock (NASDAQ: AAPL) exhibited robust performance with a 23.03% price increase, opening at $171.19 and closing at $210.62. Throughout the quarter, it traded between highs of $220.20 and lows of $164.08. This growth propelled Apple's market capitalization to $3.23 trillion, underscoring its dominance in the tech sector. In contrast, broader market indices like the S&P 500 (SPX) and NASDAQ (NDX) reported more modest price returns of 3.85% and 7.67%, respectively.

Source: tradingview.com

II. Apple Stock Predictions: Outlook & Growth Opportunities

A. Segments with growth potential

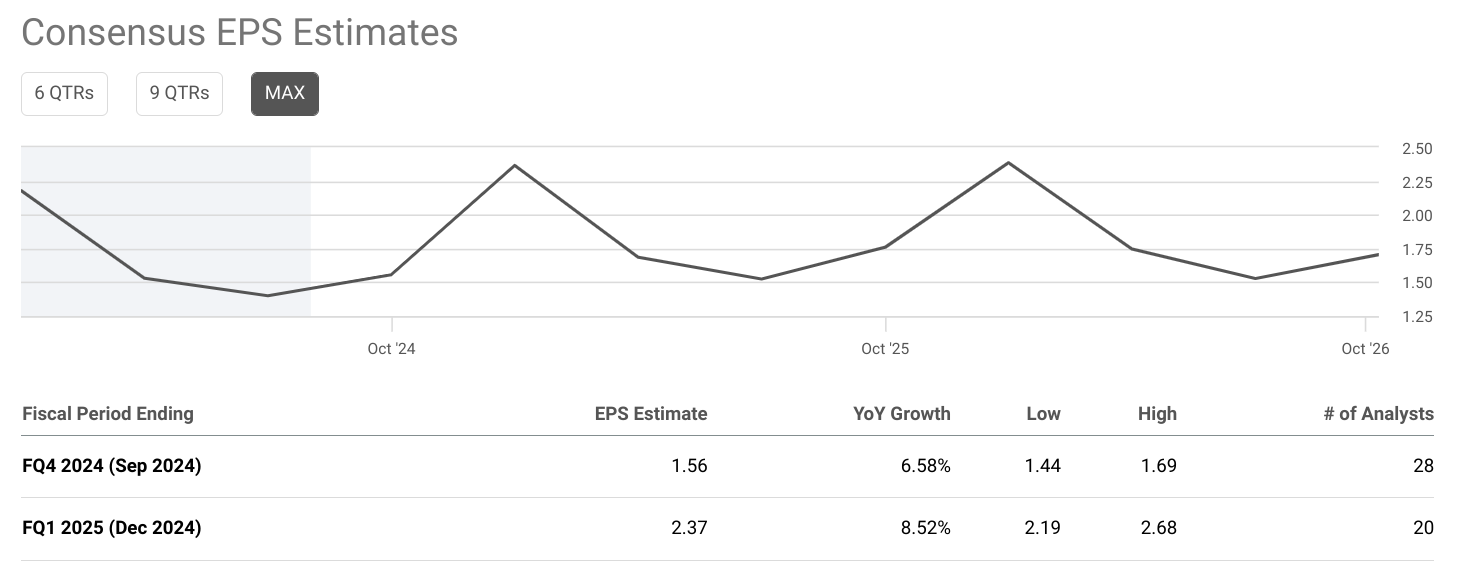

Apple's financial outlook remains strong, driven by its diversified product portfolio and expanding services segment. For fiscal Q4 2024, the consensus EPS estimate is $1.56, reflecting a year-over-year growth of 6.58%. Revenue is expected to reach $93.30 billion, a 4.25% increase. Looking ahead to fiscal Q1 2025, EPS is estimated at $2.37 with an 8.52% growth, and revenue is projected to be $126.88 billion, up 6.11%.

Source: seekingalpha.com

Apple (NASDAQ: AAPL) continues to demonstrate robust growth potential across several key segments:

- iPhone: Despite a slight year-over-year decline, iPhone revenue remains strong, with an all-time high active installed base. New models and feature enhancements in the iPhone 15 lineup, combined with high customer satisfaction rates, underpin sustained demand.

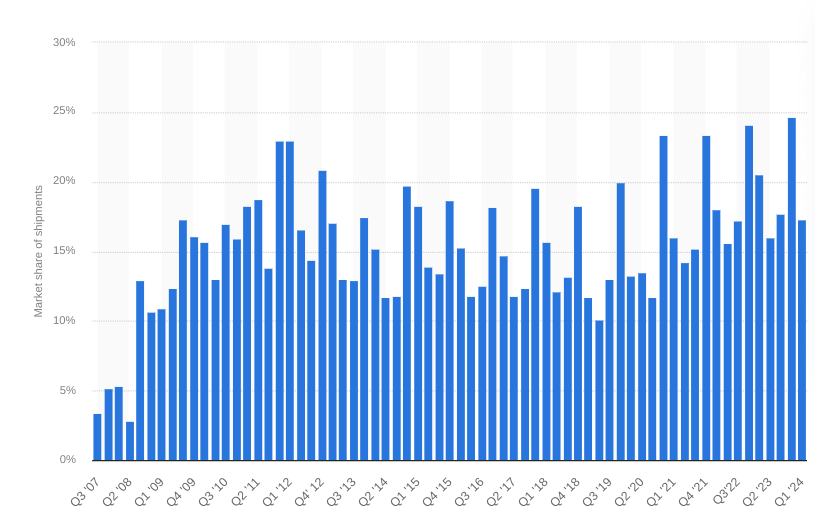

[iPhone unit shipments as share of global smartphone shipments]

Source: statista.com

- Mac: Mac revenue grew by 2% year-over-year, driven by the popularity of the M3-powered MacBook Air. The introduction of more powerful models and back-to-school demand are expected to sustain this growth. The Mac installed base also hit a new high, suggesting continued market penetration.

- iPad: iPad revenue surged by 24% year-over-year, reflecting strong demand for the new iPad Pro and iPad Air. These devices, powered by Apple's advanced silicon chips, offer enhanced performance and AI capabilities, appealing to both educational and professional markets.

- Wearables, Home, and Accessories: Although revenue in this segment saw a slight dip, it remains a significant contributor. The Apple Watch continues to attract new users, with advanced health features like irregular heart rhythm notifications and crash detection driving adoption.

- Services: This segment achieved an all-time revenue record of $24.2 billion, up 14% year-over-year. Growth in services is propelled by the increasing installed base of active devices, new content on Apple TV+, and enhanced features across Apple's ecosystem. The introduction of Apple Intelligence and expanded service offerings like Tap to Pay on iPhone are expected to further drive growth.

Source: static.ecommercedb.com

B. Expansions and strategic initiatives

Research and Development Investments: Apple's significant investments in R&D are driving innovation across its product lineup. The development of the M-series chips, advancements in AI and machine learning, and the introduction of Apple Intelligence exemplify how R&D investments are translating into competitive advantages and new growth opportunities.

Partnerships and Collaborations: Collaborations with enterprise customers, such as American Express and Boston Children's Hospital, are expanding the use of Apple products in professional settings. Partnerships in content creation, like those for Apple TV+, are enriching the services ecosystem, attracting more subscribers, and increasing revenue.

III. Apple Stock Forecast 2024

A. AAPL Stock Forecast: Technical Analysis

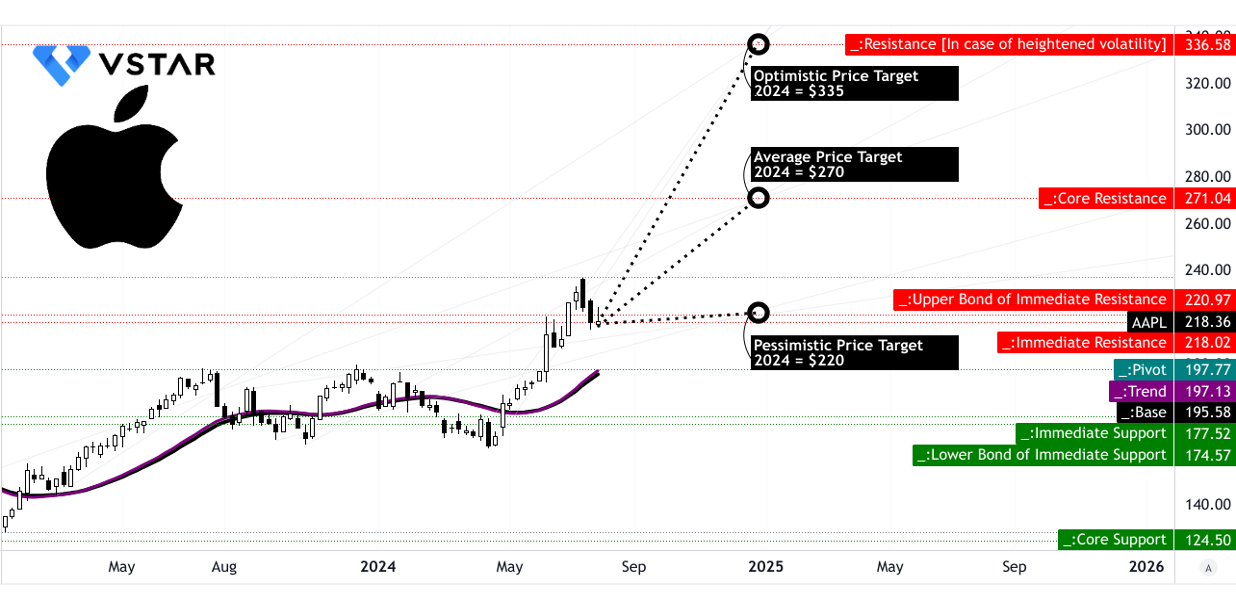

Apple Inc. (NASDAQ: AAPL) is trading at $218.36. The technical indicators suggest a complex yet promising outlook for the stock by the end of 2024. The trendline and baseline, which are modified exponential moving averages (EMAs), stand at $197.13 and $195.58, respectively. These values indicate that the stock is currently trading above its trendline and baseline, reflecting a bullish trend in the short term.

Apple Stock Projections - Price Targets and Their Basis

The average Apple price target by the end of 2024 is set at $270.00. This target is derived from analyzing the momentum of change-in-polarity over the mid- to short-term and projecting it over Fibonacci retracement and extension levels.

An optimistic Apple target price of $335.00 is projected, based on the upward price momentum observed in the current swing, also analyzed through Fibonacci levels. This suggests that if the stock maintains its bullish trajectory and momentum continues to strengthen, reaching this target is plausible. Conversely, a pessimistic target of $220.00 reflects a scenario where downward momentum could prevail, projecting a modest gain in line with Fibonacci retracement levels.

Source: tradingview.com

Apple Price Prediction - Resistance and Support Levels

Apple's primary resistance is identified at $221.00, which is crucial for short-term trading strategies. The core resistance is slightly higher at $271.04, indicating a potential hurdle if the stock surpasses the primary resistance level. In a scenario of heightened volatility, the resistance could escalate to $336.58, aligning with the optimistic Apple stock price target.

On the downside, support levels are at $177.52 and $124.50, with $177.52 serving as immediate support. The core support at $124.50 represents a significant fallback level should the stock experience substantial declines.

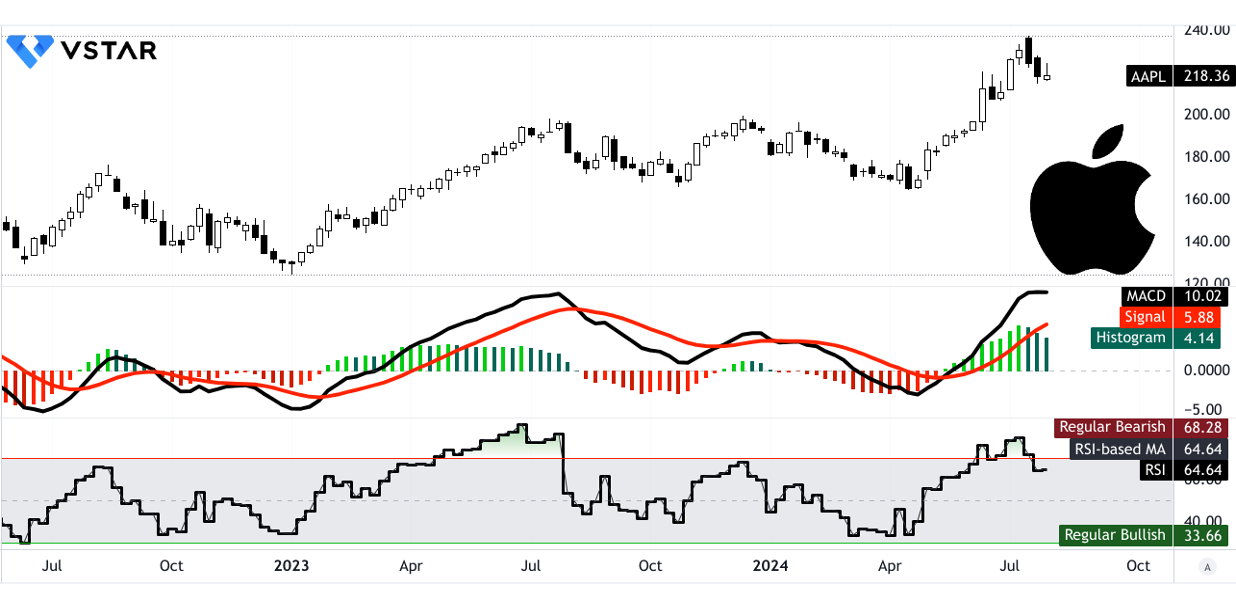

Relative Strength Index (RSI) Analysis

The RSI value for Apple stands at 64.64. This is above the regular bullish level of 33.66 but below the regular bearish level of 68.28. The RSI's current level indicates that the stock is in a bullish phase but approaching overbought conditions. The absence of bullish or bearish divergences suggests that the current trend is consistent with the RSI's indication. However, the RSI line trend is currently down, which may signal a potential easing in the bullish momentum.

Source: tradingview.com

Apple Forecast - MACD Analysis

The Moving Average Convergence/Divergence (MACD) indicator shows a MACD line of $10.02, a signal line of $5.88, and a MACD histogram of $4.14. This configuration reflects a bullish trend, though the strength of the trend is decreasing. The decreasing strength indicates that while the bullish trend is present, its momentum might be waning.

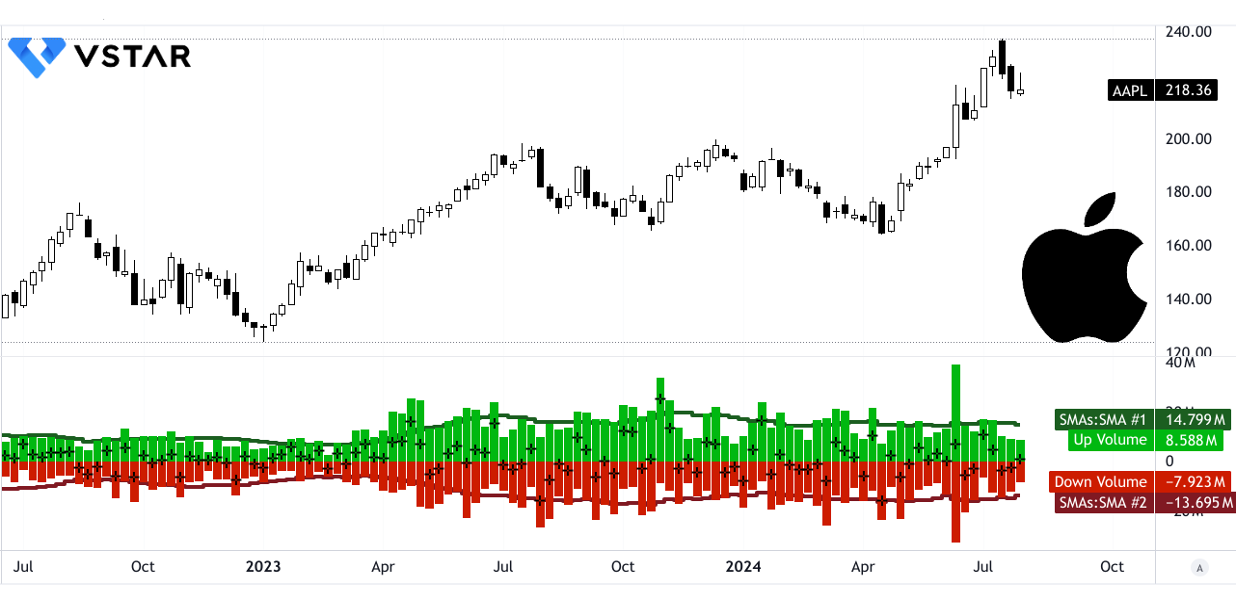

Price Volume Trend (PVT) and Volume Analysis

The Price Volume Trend (PVT) line is at $21.71 billion, slightly above its moving average of $21.64 billion, signaling a bullish volume momentum.

Source: tradingview.com

The Moving Average of Up Volume is $14.80 million, compared to the Down Volume at $13.70 million, showing a positive volume delta of $1.10 million. This data further supports the prevailing bullish sentiment in Apple stock.

Source: tradingview.com

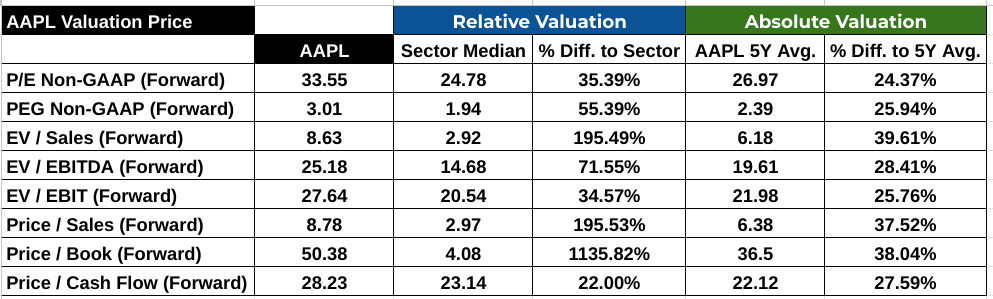

B. Apple Stock Prediction: Fundamental Analysis

Apple (NASDAQ: AAPL) showcases robust financial metrics, albeit with premium valuations. Its P/E ratio (Non-GAAP forward) stands at 33.55, significantly higher than the sector median of 24.78, representing a 35.39% premium. Historically, Apple's five-year average P/E ratio is 26.97, indicating a 24.37% increase compared to its past valuations. The PEG ratio (Non-GAAP forward) at 3.01 also exceeds the sector median of 1.94 by 55.39%, underscoring higher growth expectations priced into the stock. This is also a 25.94% premium over its five-year average PEG ratio of 2.39.

Source: Analyst's compilation

These ratios indicate that AAPL stock is trading at a substantial premium both to its sector and its historical averages, reflecting strong investor confidence in its future growth prospects.

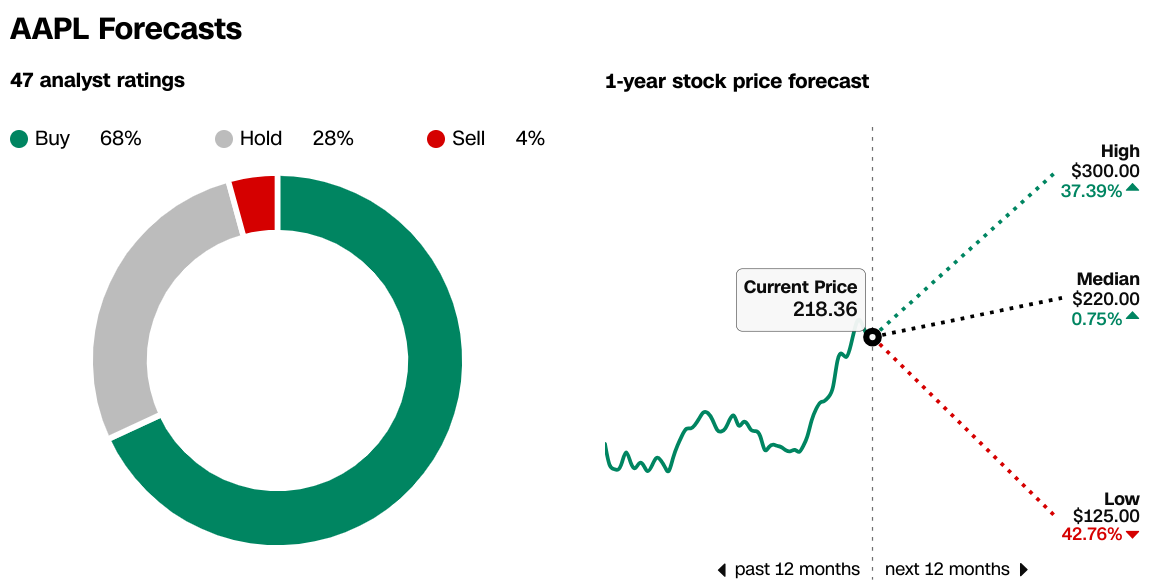

C. Apple Stock Price Prediction: Market Sentiment

Analyst Ratings and Price Targets

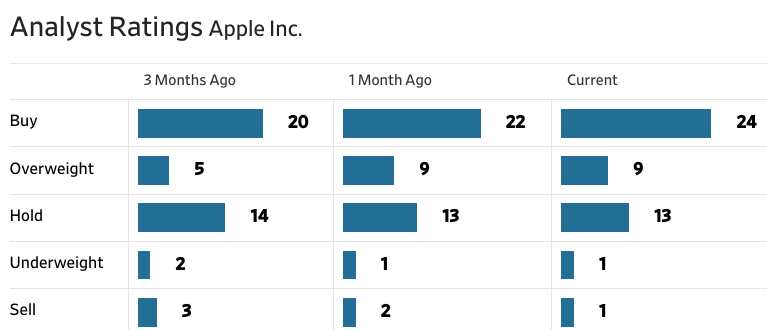

Analyst sentiment for Apple remains predominantly positive. According to CNN.com, out of 47 analyst ratings, 68% recommend buying, 28% suggest holding, and 4% advise selling. Price targets range from a high of $300, representing a 37.39% upside, to a median of $220, and a low of $125, indicating a potential downside of 42.76%. Currently, Apple stock trades at $218.36, close to the median AAPL target price.

Source:CNN.com

The Wall Street Journal data echoes this sentiment, showing an increase in 'Buy' ratings from 20 to 24 in the past three months, with 'Hold' ratings steady at 13. 'Sell' ratings have decreased from three to one, further indicating growing optimism. The price targets similarly range from $125 to $300, with an average of $228.27, suggesting moderate potential upside from the current price.

Source:WSJ.com

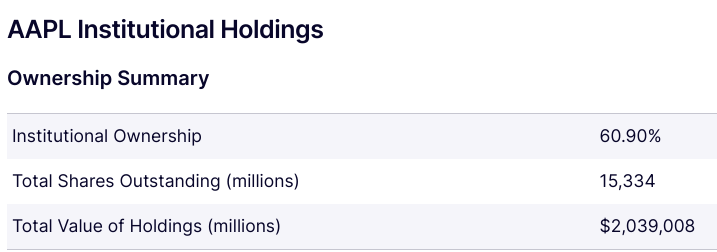

Institutional Holdings

Institutional investors hold a substantial 60.90% of Apple's outstanding shares, amounting to 15,334 million shares with a total value of approximately $2.04 trillion. This high level of institutional ownership often signals confidence in the company's long-term performance and stability.

Source:Nasdaq.com

Short Interest

Short interest in Apple stands at 135.38 million shares, representing 0.88% of the float, with days to cover at 2.42. This relatively low short interest suggests that bearish sentiment is limited, indicating that investors largely expect the stock to maintain or increase its value.

Source:Benzinga.com

IV. AAPL Forecast: Challenges & Risk Factors

Apple Competitors

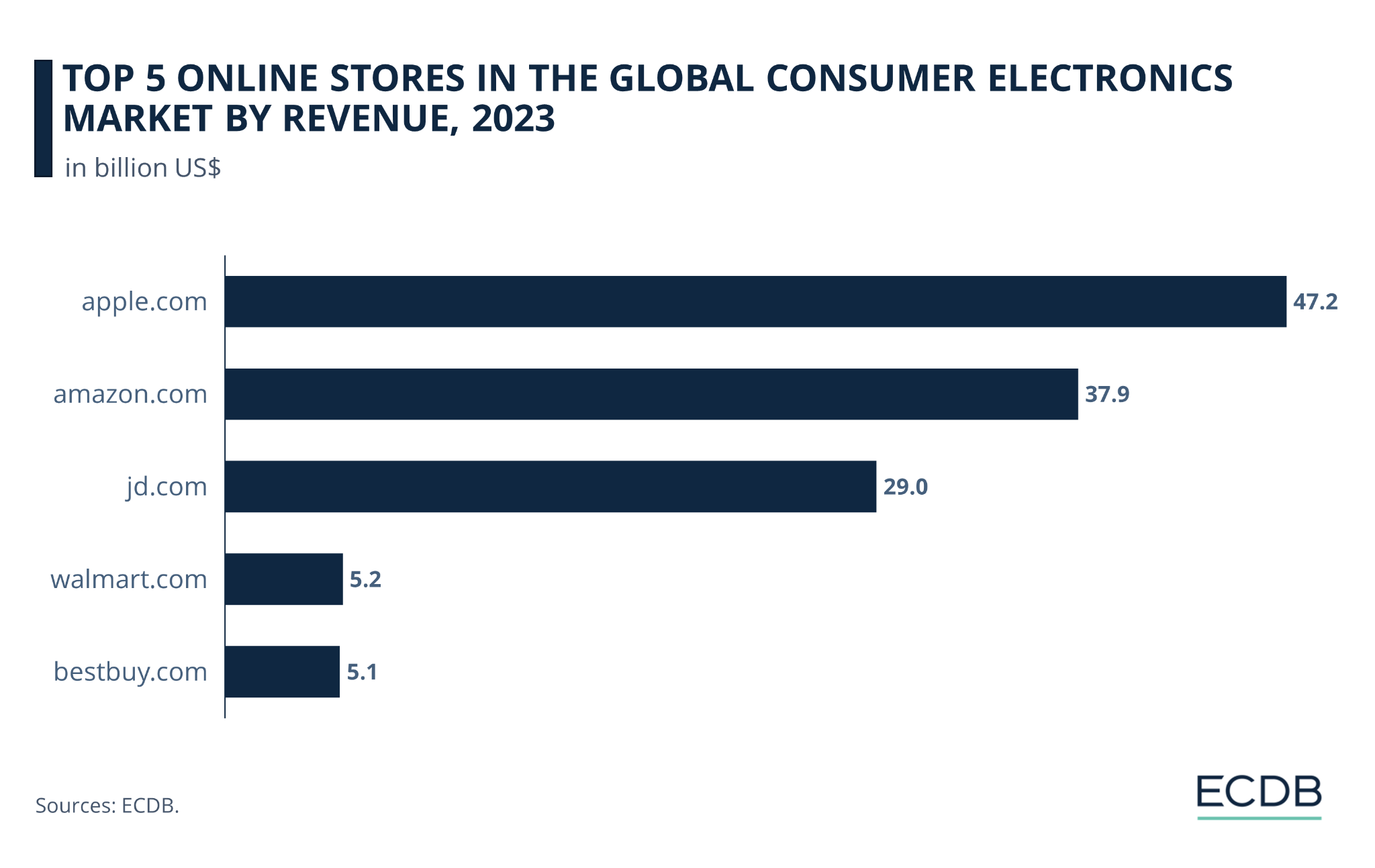

Apple Inc. (NASDAQ: AAPL) faces significant competition across its diverse product lines. In the smartphone market, Samsung Electronics (KRX: 005930) remains a formidable rival, offering a broad range of devices that compete directly with Apple's iPhone series. In the personal computing space, Microsoft Corporation (NASDAQ: MSFT) is a key competitor. The Surface series, particularly the Surface Pro and Surface Laptop, provides strong alternatives to Apple's MacBook and iPad lines. Google (NASDAQ: GOOG) is another significant competitor, particularly in software and services. Android, the leading mobile operating system globally, competes directly with Apple's iOS. Above all, Apple.com is the world's largest online consumer electronics market platform.

Source: static.ecommercedb.com

Other Risks

As Apple continues to expand, market saturation in developed regions poses a challenge. The potential for growth in mature markets is limited, which could impact future sales growth.

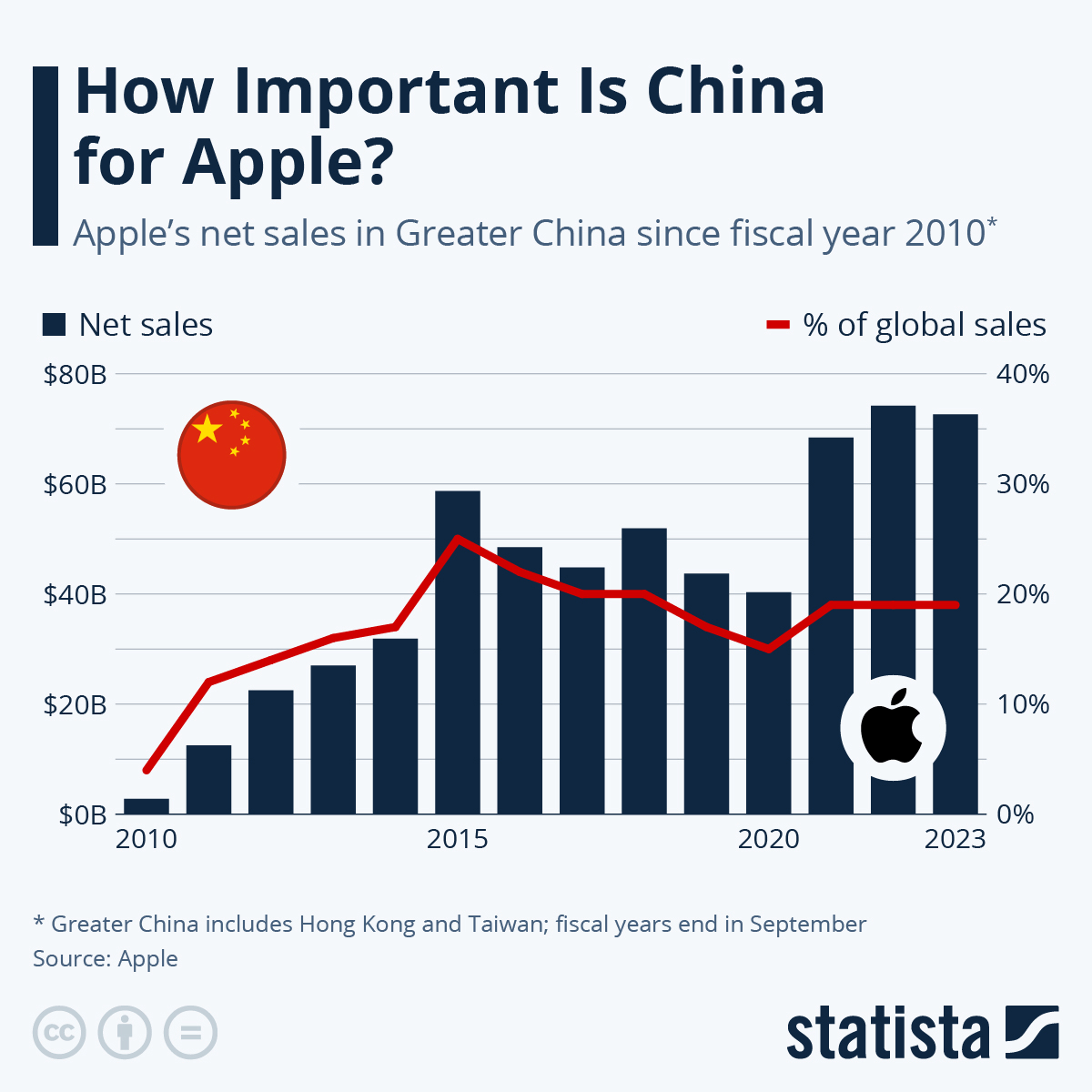

iPhone Cycles and China Market Dynamics

Tim Cook has indicated that the iPhone 15 is outperforming the iPhone 14 in terms of early sales figures. The replacement cycles are crucial as a larger base of aged iPhones suggests pent-up demand, potentially driving strong upgrade rates. Apple's focus on value through its advanced features like Apple Intelligence is aimed at compelling users to upgrade.

Source: statista.com

In conclusion, Apple Inc. (NASDAQ: AAPL) reported a strong Q2 2024, with record revenues and net income driven by robust service growth and a new high in iPad sales. Apple stock price has surged 23% this quarter, reaching $210.62. Analysts project a bullish outlook with a potential target of $270 by year-end. Risks include intense competition from Samsung and Microsoft, regulatory scrutiny, and economic fluctuations. For traders, Apple CFDs can be accessed via platforms like VSTAR, a regulated trading app under ASIC, offering a way to speculate on AAPL stock price movements.