- AMD reported a Q1 2024 with significant gross margin improvements.

- The Data Center segment saw record revenues driven by AMD Instinct GPUs and EPYC CPUs, while the Gaming and Embedded segments faced notable declines.

- AMD's stock performed strongly in Q1 2024, closing with a 22% return, outpacing major market indices.

- Future growth opportunities for AMD lie in data centers, client devices, AI, and embedded systems, supported by strategic acquisitions and R&D investments.

- Technical analysis predicts a potential AMD stock price target of $222 by the end of 2024, with optimistic scenarios reaching up to $269.

- AMD faces competitive challenges from Intel and NVIDIA, as well as risks related to supply chain disruptions and market volatility.

I. AMD Q1 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

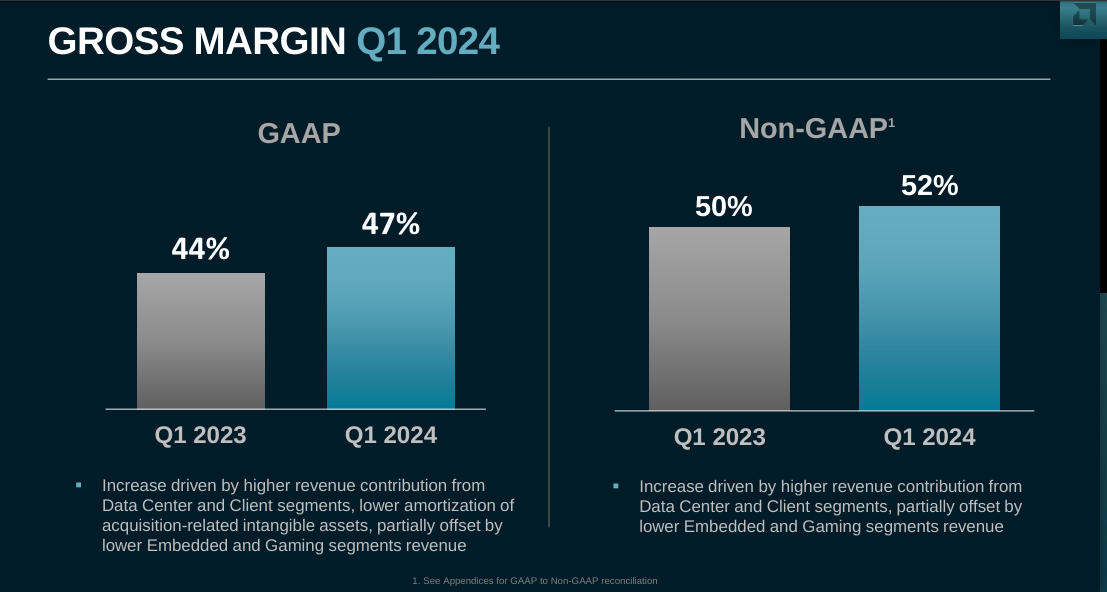

AMD reported a revenue of $5.5 billion for Q1 2024, with a gross margin of 47%. While the non-GAAP gross margin improved to 52%, operating income stood at $36 million, and net income was $123 million. Diluted earnings per share were reported at $0.07, with non-GAAP diluted earnings per share at $0.62. The company expects revenue for Q2 2024 to be around $5.7 billion, with a non-GAAP gross margin of approximately 53%.

Source: Q1 2024 Earnings

Operational Performance:

The Data Center segment recorded a remarkable performance, achieving a record revenue of $2.3 billion, driven by the growth in AMD Instinct GPUs and 4th Gen EPYC CPUs. However, the Client segment witnessed a decline in revenue by 6%, despite a year-over-year growth of 85%, attributed to Ryzen 8000 Series processor sales. The Gaming segment faced significant challenges, with revenue declining by 48% year-over-year to $922 million, mainly due to a decrease in semi-custom revenue and lower GPU sales. Similarly, the Embedded segment experienced a decline in revenue by 46% year-over-year to $846 million, as customers focused on managing their inventory levels.

Technological Advancements and Innovations:

AMD made significant strides in technological advancements and innovations during Q1 2024. The company expanded its AI solutions for various markets, including cloud, enterprise, embedded, and PC. It launched new products such as the ThinkSystem SR685a V3 8GPU server, powered by AMD Instinct MI300X, and introduced Ryzen PRO notebook and desktop processors targeting enterprise PCs. Additionally, AMD enhanced its software offerings for gamers with AMD FidelityFX™ Super Resolution 3.1 and AMD Fluid Motion Frames, aiming to improve image quality and frame generation in gaming.

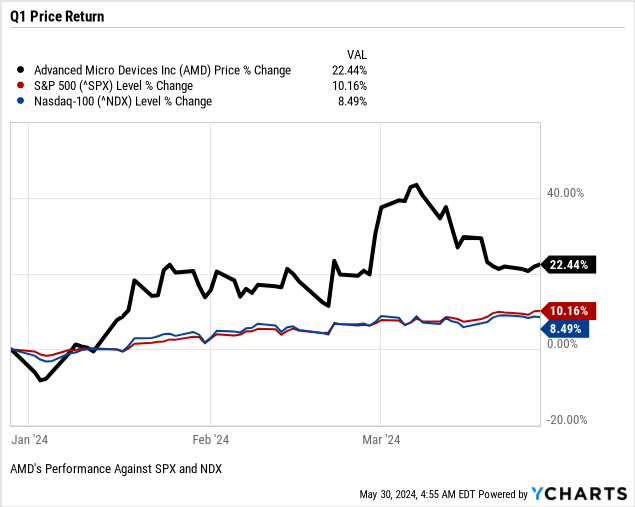

B. AMD Stock Price Performance

In Q1 2024, Advanced Micro Devices (AMD) exhibited a robust stock price performance, reflecting its strong market position. AMD's stock opened at $144.28 and reached a high of $227.30, a low of $133.74, and closed at $180.49, resulting in a substantial close-to-close price return of 22%. This significant return far outpaced broader market indices, with the S&P 500 gaining 10% and the Nasdaq-100 9% over the same period.

Source: Ycharts.com

II. AMD Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Data Center: The data center market is a significant growth driver for AMD. Data center revenue increased by 80% year-over-year in Q1 2024, driven by strong adoption of AMD's Instinct MI300 GPUs and EPYC processors. As per ResearchAndMarkets.com, the data center accelerator market, which includes GPUs and other AI hardware, is expected to grow at a compound annual growth rate (CAGR) of 24% from 2023 to 2031. This rapid growth is fueled by the demand for high-performance computing, AI, and cloud services.

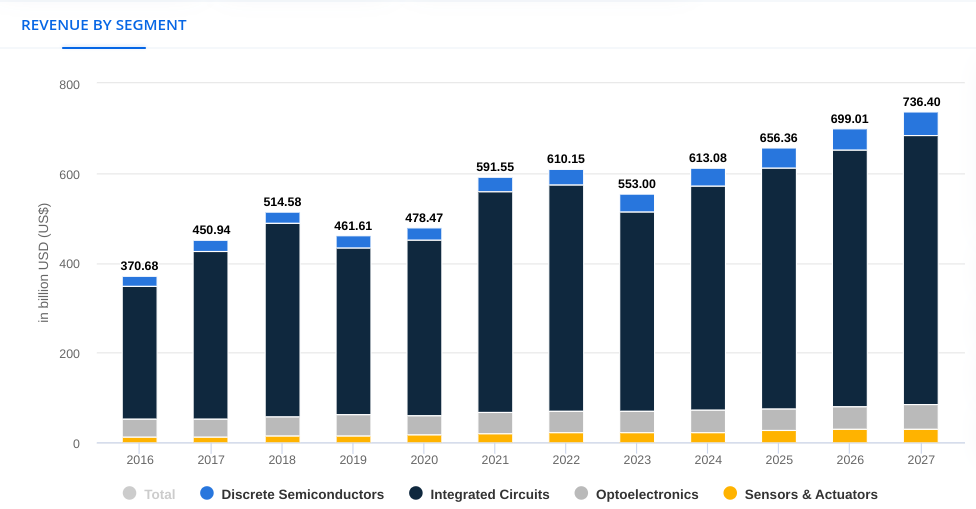

Client Segment: The semiconductor market for client devices, including PCs and mobile devices, is projected to grow at a CAGR of 6.3% from 2024 to 2027 (as per Statista). AMD's Ryzen processors, particularly with their AI capabilities, are expected to benefit from this growth. The client segment saw a revenue increase of 85% year-over-year, driven by strong demand for Ryzen mobile and desktop processors. This trend is expected to continue with the upcoming launch of the Strix mobile processors.

Source: statista.com

AI and Accelerators: The AI chips market is experiencing robust growth, with an anticipated annual growth rate exceeding 20% in 2024, according to IDC. AMD's Instinct MI300 series GPUs are well-positioned to capture this market, with data center GPU revenue expected to exceed $4 billion in 2024, up from the previously guided $3.5 billion. This highlights the increasing demand for AI training and inference capabilities, positioning AMD for substantial growth in this segment.

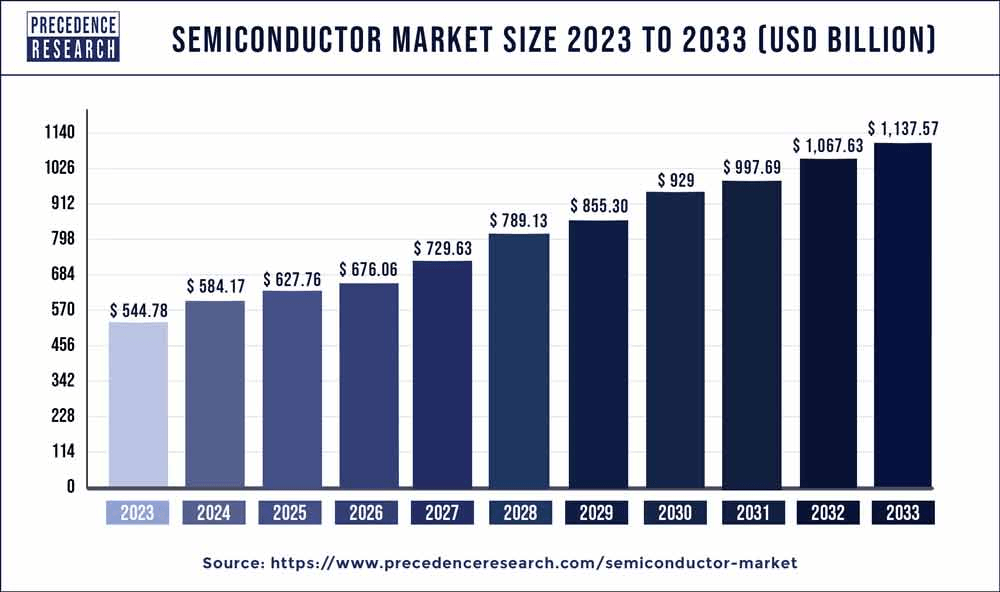

Embedded Systems: The embedded systems market, while currently experiencing a downturn, holds long-term growth potential. AMD's new Versal Gen 2 adaptive SoCs, which deliver significant improvements in AI performance and efficiency, are set to drive future demand. As per precedenceresearch.com, the global semiconductor market size, including embedded systems, is forecasted to grow at a CAGR of 7.64% from 2024 to 2033, reaching approximately $1,137.57 billion by 2033.

Source: precedenceresearch.com

B. Expansions and Strategic Initiatives

Mergers and Acquisitions: AMD has strategically expanded its capabilities through acquisitions, such as the purchase of Xilinx, which enhances its adaptive computing portfolio. This acquisition positions AMD to address diverse computing needs across various industries.

Research and Development Investments: AMD is significantly investing in R&D to maintain its competitive edge in AI and high-performance computing. The development of the next-generation Turin family of EPYC processors and continued improvements in the AI software stack exemplify AMD's commitment to innovation.

Partnerships and Collaborations: AMD's collaborations with major cloud providers (Amazon, Microsoft, Google) and AI leaders (Meta, Microsoft) strengthen its market position. These partnerships not only drive immediate revenue through product adoption but also foster long-term growth through co-optimized solutions and ecosystem development.

III. AMD Stock Forecast 2024

A. AMD Price Prediction 2024: Technical Analysis

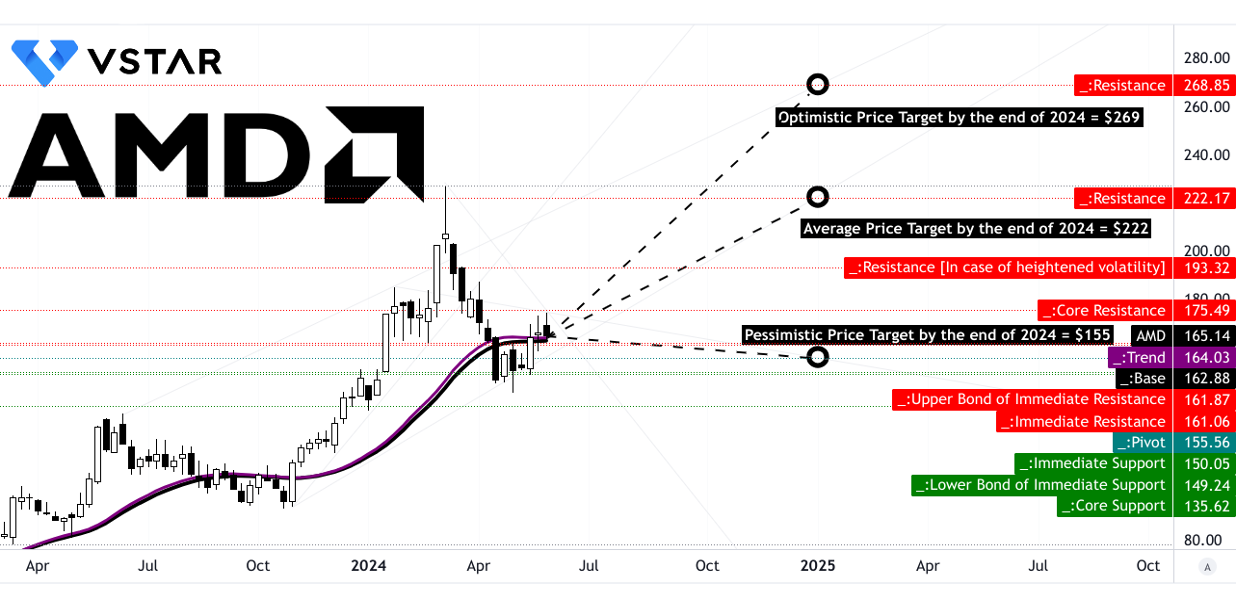

Advanced Micro Devices (NASDAQ:AMD) has experienced significant upward momentum in its stock price, currently trading at $165.14. The trendline, based on a modified exponential moving average, sits slightly lower at $164.03, while the baseline is at $162.88, suggesting a solid upward trajectory.

Technicals predict an average AMD price target of $222.00 by the end of 2024. This projection is derived from the momentum of change-in-polarity over mid- to short-term periods and projected over Fibonacci retracement/extension levels, indicating confidence in AMD's continued upward trend. Optimistic forecasts see the stock potentially reaching $269.00, based on the current swing's upward momentum and similar technical analysis tools. Conversely, a pessimistic outlook places the stock at $155.00, accounting for potential downward swings.

The primary support level for AMD is established at $161.87, which acts as a critical price floor. The stock's pivot within its current horizontal price channel is $155.56, with core resistance identified at $175.49. Should volatility increase, a significant resistance level is marked at $193.32. The ultimate resistance level aligns with the average AMD target price at $222.17. On the support side, critical levels include $150.05 and $135.62, although heightened volatility scenarios lack a defined support level.

Source: tradingview.com

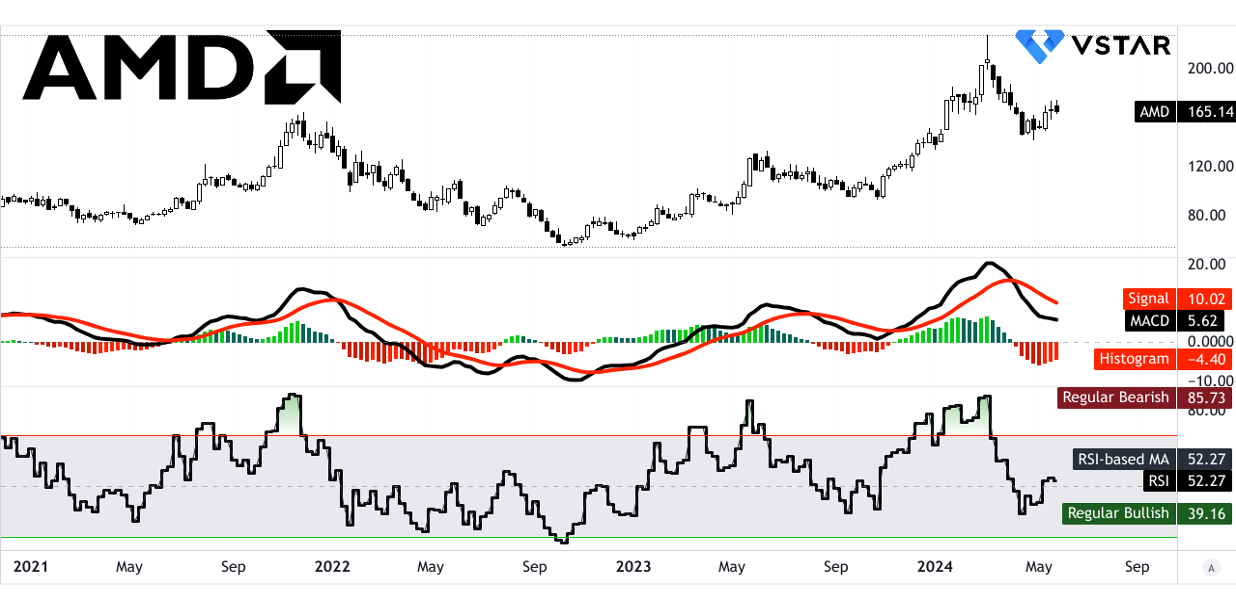

Relative Strength Index (RSI) value for AMD is 52.27, indicating neither overbought nor oversold conditions but rather a neutral position with an upward trend. Regular bullish and bearish levels are pegged at 39.16 and 85.73, respectively. The absence of bullish or bearish divergence corroborates the neutral to slightly bullish stance suggested by the RSI line trend.

Moving Average Convergence/Divergence (MACD) presents a mixed outlook. The MACD line is at 5.62, while the signal line is higher at 10.02, resulting in a negative histogram of -4.400. This configuration indicates a bearish trend, albeit with decreasing strength. The divergence between the MACD and the signal line suggests a potential shift, but the trend's decreasing strength might point to an imminent reversal or stabilization.

Source: tradingview.com

B. AMD Stock Prediction 2024: Fundamental Analysis

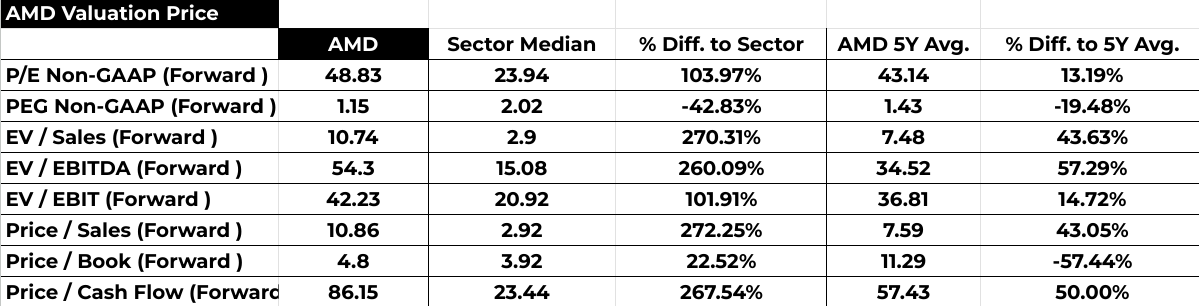

AMD's forward P/E of 48.83 outstrips the sector median by 103.97%, suggesting a premium valuation. Conversely, the PEG ratio (P/E to growth ratio), at 1.15, is below the sector median, indicating a potentially undervalued growth stock. However, caution should be exercised, given the premium valuation compared to sector peers, especially concerning forward P/E and EV/EBITDA ratios.

Source: Analyst's compilation

C. AMD Price Target 2024: Market Sentiment

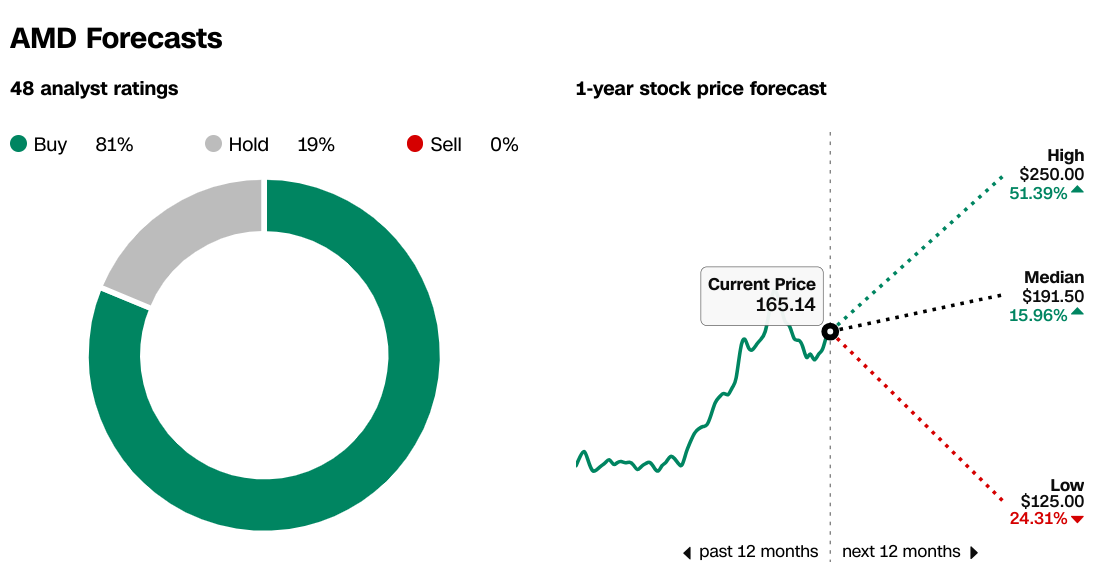

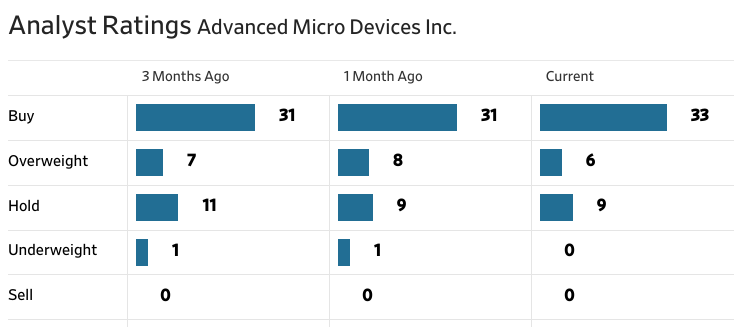

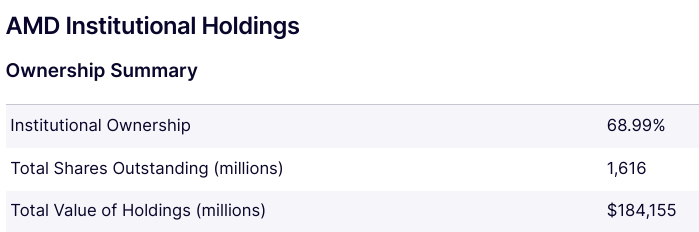

Analyst recommendations (on CNN) portray a bullish outlook, with 81% of analysts rating AMD as a buy, aligning with a high median price target of $191.50. Institutional holdings at 68.99% of outstanding shares signal confidence from large investors, adding weight to positive market sentiment. The same trend can be observed in WSJ based data.

source: CNN.com

source: WSJ.com

Short interest, at 2.16% of total shares, reflects investor sentiment through bets against the stock. A lower short interest suggests lesser bearish pressure on the stock price. Additionally, a short interest covering only one day indicates limited speculative interest against AMD.

source: Nasdaq.com

Source: Benzinga.com

IV. AMD Forecast: Challenges & Risk Factors

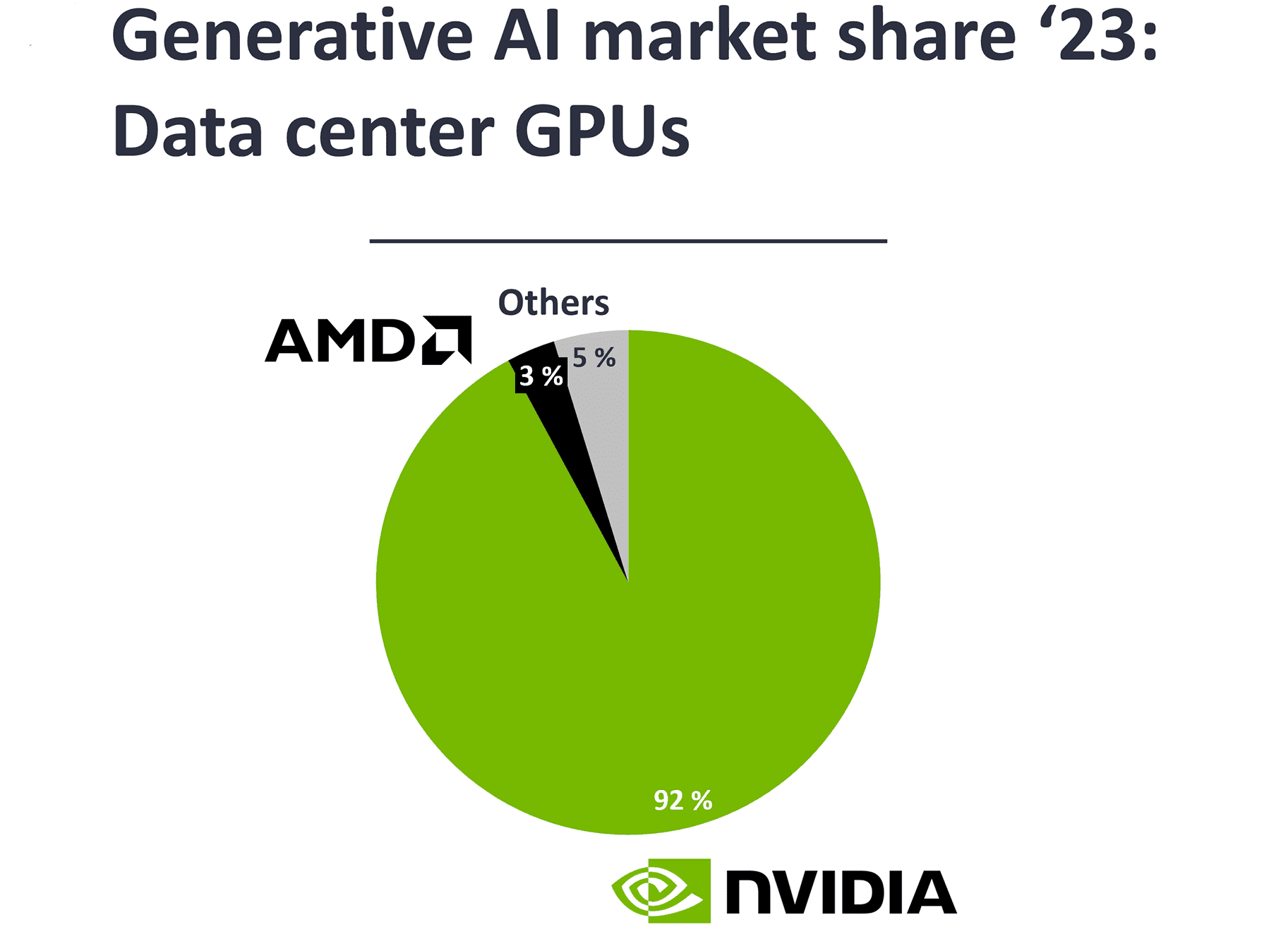

Competitively, AMD faces stiff competition from industry giants like Intel and NVIDIA. Intel's new product releases and aggressive marketing strategies pose a threat to AMD's market share, especially in the server CPU and data center GPU segments.

Source: IOT Analytics

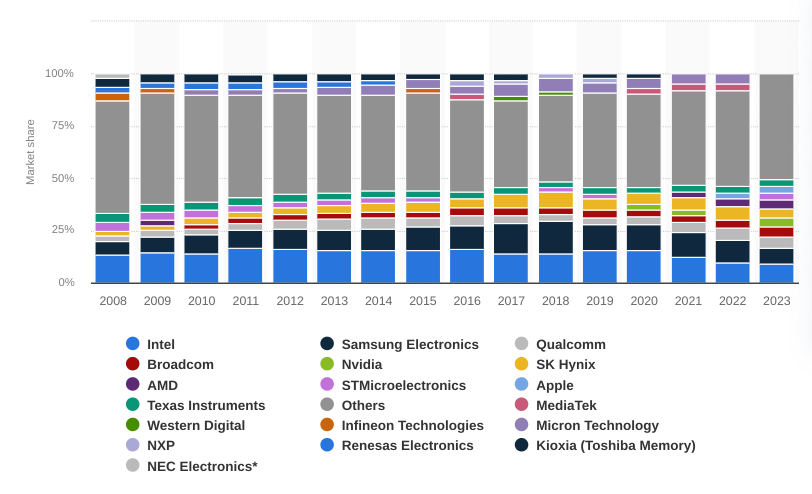

Similarly, NVIDIA's dominance in the gaming graphics market remains a significant challenge, impacting AMD's revenue and market position. Overall, AMD's market share has increased in recent years (2021-2023) to have a hold of 4.2% (2023) on semiconductors play.

[Semiconductor companies market revenue share worldwide from 2008 to 2023]

Source: statista.com

Aside from competition, other risks loom on the horizon. AMD's dependency on the semiconductor supply chain exposes it to supply chain disruptions, such as shortages of critical components or geopolitical tensions affecting manufacturing facilities. Fluctuations in demand, particularly in the gaming segment due to the cyclical nature of console sales, also pose revenue volatility risks. Additionally, AMD's ambitious expansion plans and investments in R&D require careful management to ensure efficient resource allocation and timely product launches, amidst increasing industry complexities and technological advancements.

In summary, AMD's Q1 2024 performance showcased robust revenue growth, particularly in the Data Center segment, while facing challenges in Gaming and Embedded segments. Despite competitive pressures, AMD's innovative product launches and expansions in AI solutions indicate promising future growth opportunities. Technical analysis suggests a potential price target of $222 by 2024, with bullish sentiment from analysts and institutional investors. However, risks include competition from Intel and NVIDIA, supply chain disruptions, and market volatility. Considering these factors, cautious investment strategies such as long-term holding or diversified portfolios may be prudent. Platforms like VSTAR offer accessible trading options for those interested in AMD stock CFDs.