- Applied Materials' Semiconductor Systems segment remained robust, driven by record ion implant sales, while Applied Global Services (AGS) experienced sustained growth momentum.

- Market forecasts project significant growth opportunities within the semiconductor equipment market, aligning with Applied Materials' strategic focus areas.

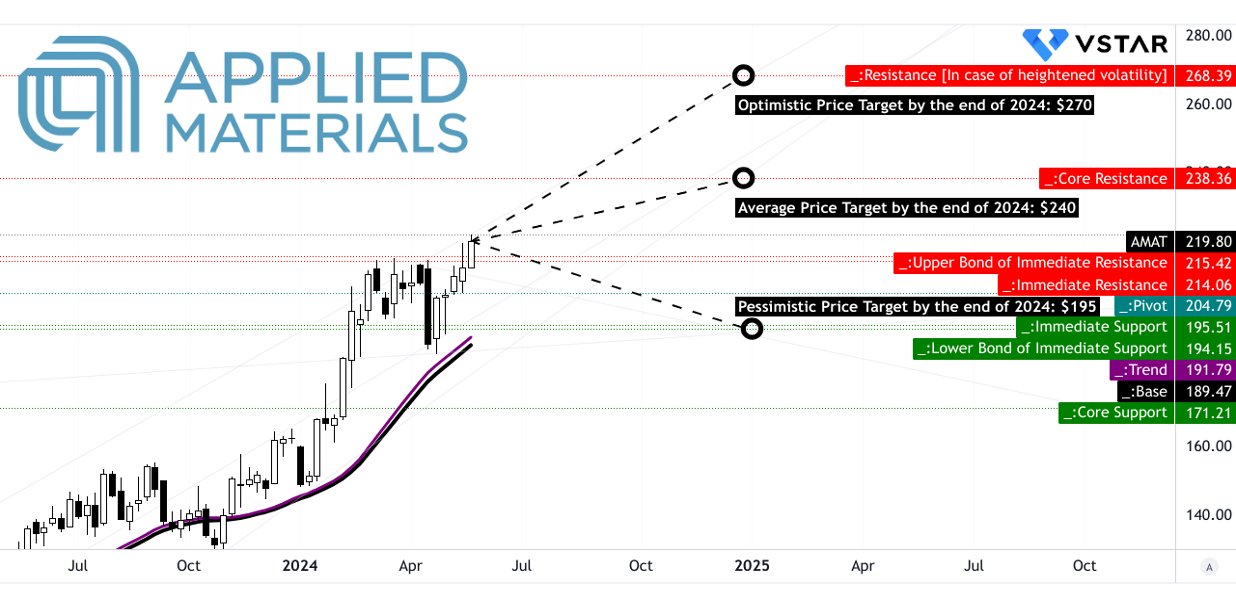

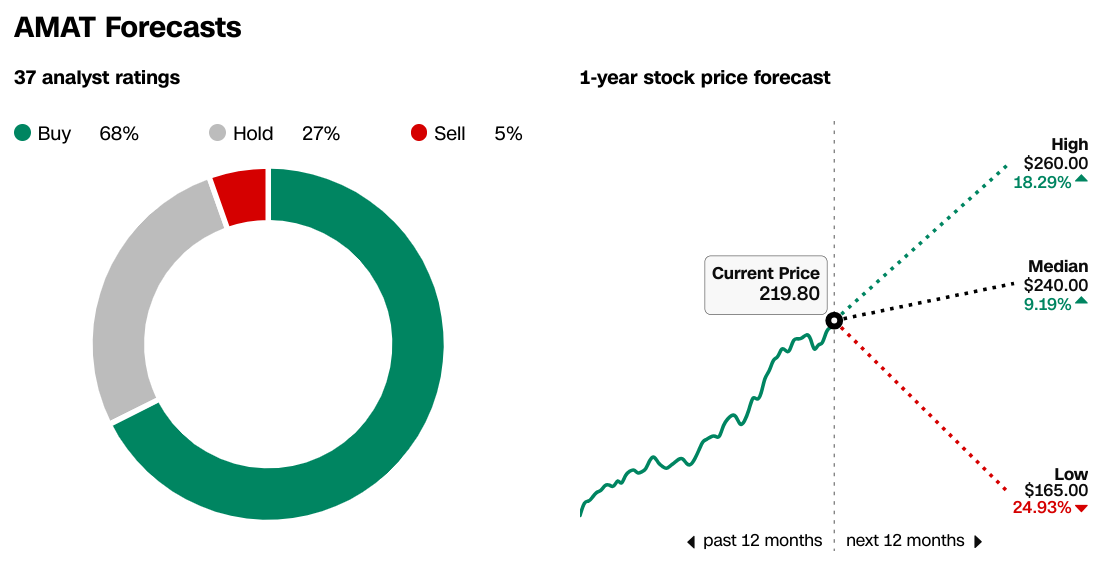

- For 2024, AMAT stock price target is projected to be $240 by the end of the year.

- Despite a positive outlook, Applied Materials faces challenges including competition from rivals like Lam Research and ASML, market dependency, regulatory risks, and technology obsolescence.

I. Applied Materials Q1 2024 Performance Analysis

A. Applied Materials Key Segments Performance

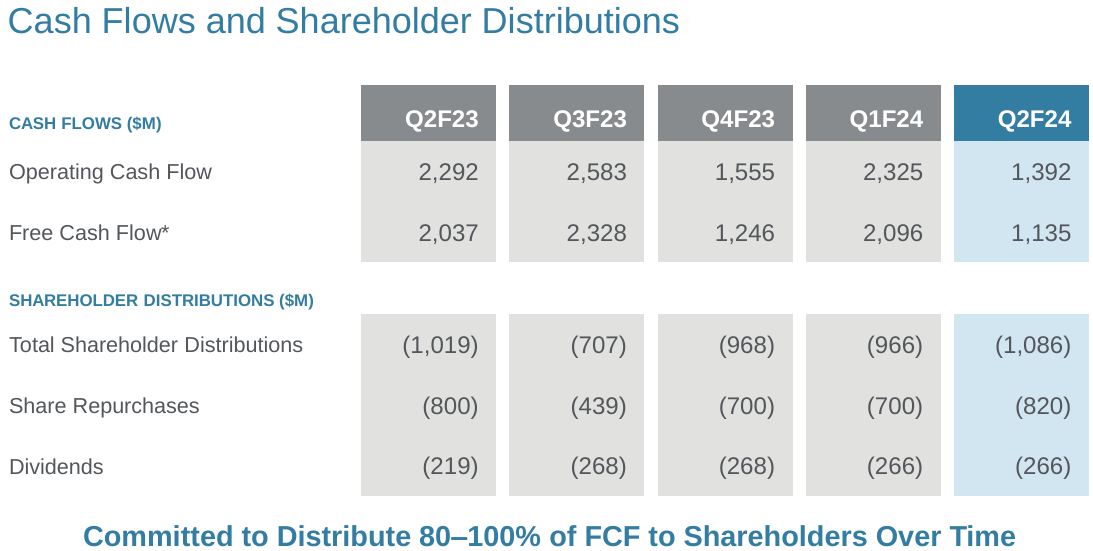

Applied Materials (NASDAQ:AMAT) reported its Q2 fiscal 2024, showcasing steady revenue at $6.65 billion, flat year-over-year. Key financial metrics demonstrated resilience with GAAP operating margin at 28.8% and non-GAAP at 29.0%, showcasing stability with a slight decrease. GAAP EPS increased by 11% to $2.06, while non-GAAP EPS rose by 5% to $2.09 compared to the previous year. The company generated $1.39 billion in cash from operations, a solid indicator of financial health and operational efficiency.

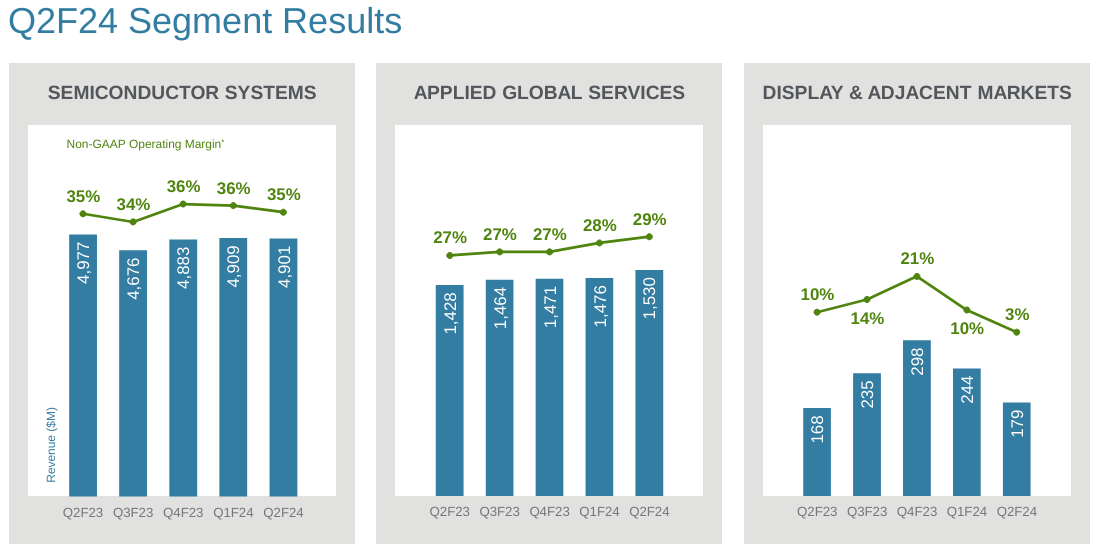

Source: Q2 2024 Earnings Presentation

The Semiconductor Systems segment, representing the core revenue driver, remained robust with revenue at $4.9 billion, featuring record ion implant sales. Applied Global Services (AGS) experienced a 7% revenue increase year-over-year to $1.53 billion, demonstrating sustained growth momentum, while the Display segment revenue stood at $179 million.

Source: Q2 2024 Earnings Presentation

The company's performance narrative is closely tied to its strategic focus on technological advancements and market trends. The company's positioning within transformative technology sectors like AI, IoT, electric vehicles, and clean energy. It has a pivotal role in enabling these sectors through materials engineering technologies for semiconductor chips, projecting long-term growth aligned with these secular trends.

B. AMAT Stock Price Performance

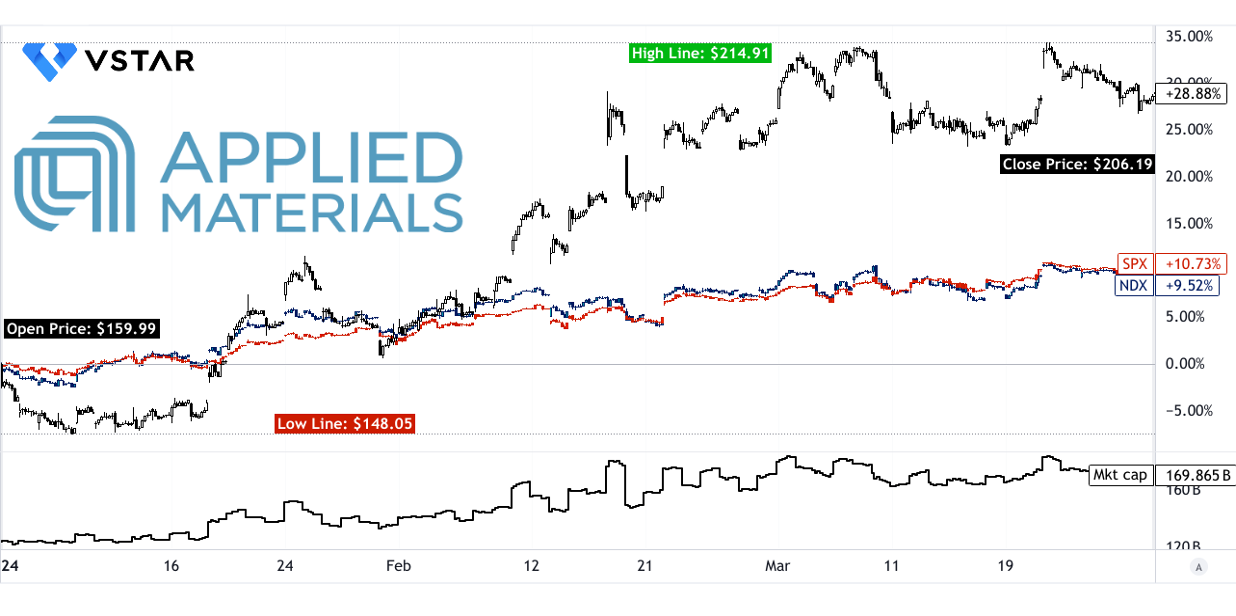

In Q1 2024, Applied Materials (NASDAQ: AMAT) demonstrated robust performance, reflecting a compelling investment proposition. The company's market capitalization surged to $169.865 billion, reflecting its strong fundamentals and market position. AMAT's stock exhibited significant price movement, with an opening price of $159.99 and a closing price of $206.19, reflecting an impressive 29% price return. Notably, the stock experienced highs of $214.91 and lows of $148.05 during the quarter, indicating resilience amid market fluctuations.

Comparative analysis against key stock market indices further accentuates AMAT's outperformance. While the S&P 500 and NASDAQ posted price returns of 11% and 10%, respectively, Applied Materials surpassed these benchmarks with its 29% price return. This stellar performance underscores AMAT's ability to generate superior returns for investors compared to broader market indices.

Source: tradingview.com

II. AMAT Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with Growth Potential:

Semiconductor Systems: With a projected revenue of approximately $4.8 billion in the third quarter of fiscal 2024, this segment remains a stronghold for Applied Materials. The transition to advanced chip technologies, such as gate-all-around transistors and high-bandwidth memory (HBM), presents substantial growth opportunities. Applied Materials holds process technology leadership in areas crucial for AI datacenters, including leading-edge logic, high-performance DRAM, and advanced packaging.

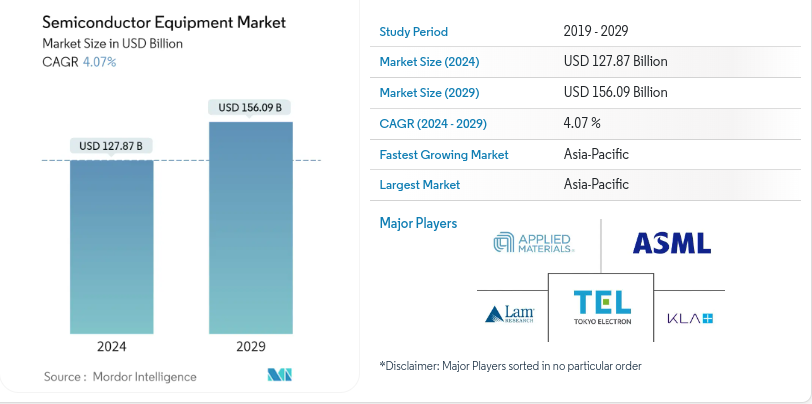

As per mordorintelligence.com, the global semiconductor equipment market is expected to grow from $127.87 billion in 2024 to $156.09 billion by 2029, at a CAGR of 4.07% . After a slight dip in 2023, wafer fab equipment sales are expected to see modest growth of 3% in 2024. The segment is anticipated to rebound strongly with an 18% growth in 2025 due to new fab projects and technology migrations. Key drivers include the expansion of advanced technologies and high demand for sophisticated semiconductor solutions, particularly in AI, IoT, and high-performance computing.

Source: mordorintelligence.com

Back-End Equipment, covering test, assembly, and packaging equipment, is set for significant recovery and growth in 2024. Test equipment sales are expected to grow by 13.9%, and assembly and packaging equipment by 24.3%. Renewed investments in semiconductor manufacturing infrastructure and increased demand for advanced packaging solutions, such as high-bandwidth memory (HBM), are key growth drivers.

These are expected to see a slight contraction in 2024 but will grow substantially by 15% in 2025, driven by increased capacity expansions and new device architectures. NAND and DRAM equipment segments will experience significant growth. NAND equipment sales are forecasted to rise by 21% in 2024 and by 51% in 2025. DRAM equipment sales are projected to grow steadily due to continuous technology migration and demand for high-bandwidth memory .

Applied Global Services (AGS): Expected to generate around $1.57 billion in revenue in Q3 2024, AGS represents a critical aspect of Applied Materials' business model. AGS not only provides recurring revenue through long-term service agreements but also facilitates the optimization of customers' manufacturing operations. As semiconductor manufacturing becomes more complex, the demand for services to enhance performance, yield, and cost efficiency is expected to increase, further driving growth in this segment.

Display and Adjacent Markets: Despite a smaller revenue contribution compared to other segments, with projected revenue around $245 million in Q3 2024, the display segment holds promise, particularly with the anticipated adoption of OLED technology in various devices beyond smartphones. As larger screen sizes become more prevalent in notebooks, PCs, and tablets, there is potential for increased capital investments in display-related equipment, presenting growth opportunities for Applied Materials.

B. Expansions and Strategic Initiatives:

Investments in R&D: With over $3 billion invested annually in research and development, Applied Materials collaborates closely with customers to develop cutting-edge semiconductor technologies. This focus on innovation ensures that the company remains at the forefront of enabling advancements in AI, IoT, electric vehicles, and renewable energy.

Integrated Solutions: Applied Materials emphasizes the delivery of complete and connected solutions to accelerate major device inflections. By offering integrated solutions that address the increasing complexity of the industry roadmap, the company aims to drive demand for its advanced technologies and gain market share.

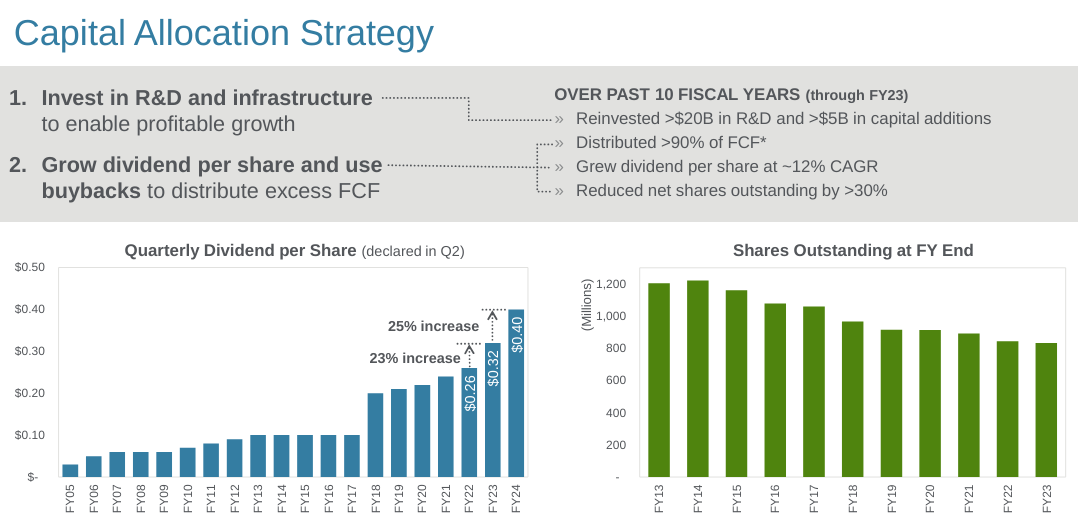

Capital Allocation Strategy: Applied Materials prioritizes capital allocation towards investments in R&D and capital infrastructure to enable profitable growth. Additionally, the company focuses on returning value to shareholders through dividends and share buybacks, leveraging its efficient business model and strong free cash flow generation.

Source: Q2 2024 Earnings Presentation

Collaboration with Customers and Partners: Recognizing the importance of collaboration in driving innovation and accelerating technology adoption, Applied Materials fosters deeper partnerships with customers and partners. Through initiatives like the global EPIC platform, the company aims to support high-velocity innovation and commercialization of next-generation technologies, thereby enhancing its competitive position.

III. AMAT Stock Price Forecast 2024

A. AMAT Stock Forecast: Technical Analysis

Applied Materials (NASDAQ:AMAT) stock's average price target by the end of 2024 is $240, supported by the momentum of change-in-polarity over the mid- to short-term, projected over Fibonacci retracement/extension levels. An optimistic AMAT stock price target of $270 and a pessimistic target of $195 provide a range of potential outcomes, considering upward and downward price momentum, respectively.

AMAT's current stock price stands at $219.80, with a modified exponential moving average trendline of $191.79 and a baseline of $189.47. The direction of the stock price is upward, indicating positive momentum. Primary support is observed at $215.42, with a pivot of the current horizontal price channel at $204.79. In case of heightened volatility, resistance levels are projected at $268.39 and core resistance at $238.36. Correspondingly, support levels are at $194.15 and core support at $171.21.

Source: tradingview.com

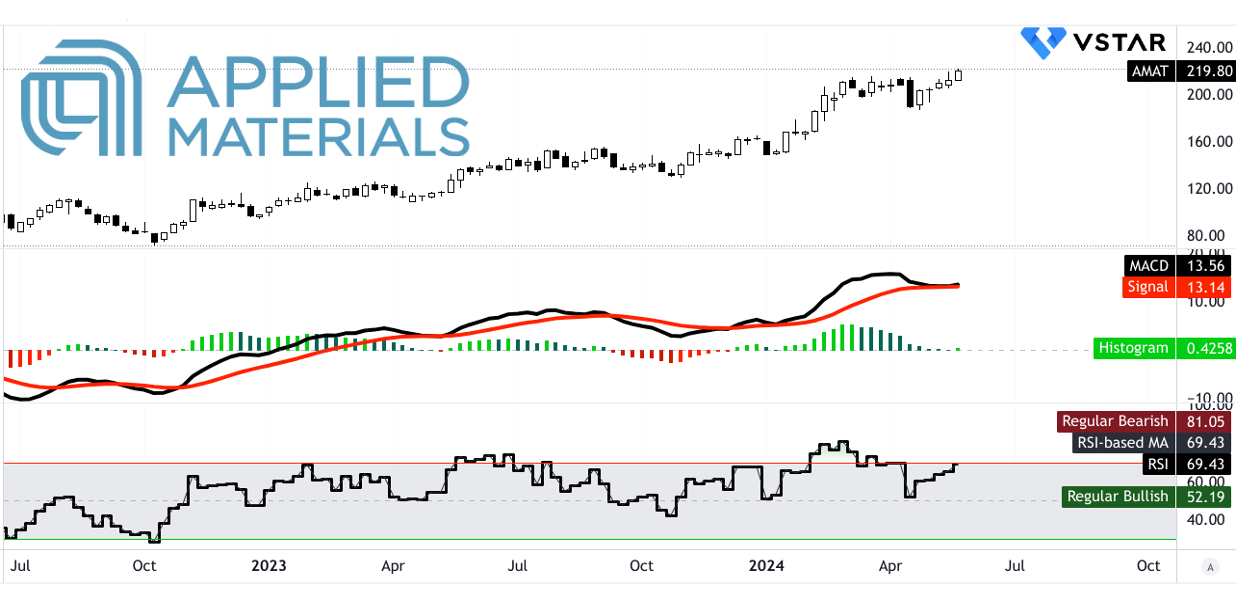

The Relative Strength Index (RSI) value is 69.43, indicating a bullish trend. Although it's approaching the regular bearish level, there are no signs of bearish or bullish divergence. The RSI line trend is upward, suggesting continued positive momentum. The Moving Average Convergence/Divergence (MACD) line at 13.56 exceeds the signal line at 13.14, with a positive MACD histogram of 0.426. The trend is bullish and stabilized, supporting the upward movement of the stock price.

Source: tradingview.com

B. AMAT Stock Prediction: Fundamental Analysis

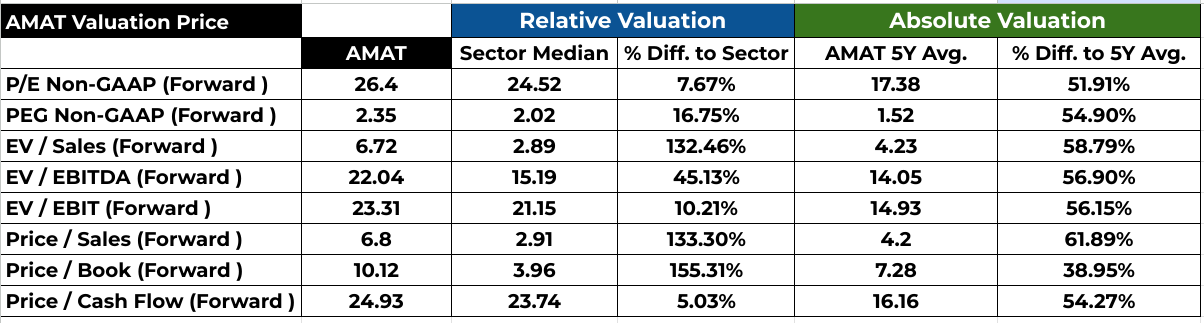

The forward P/E ratio for AMAT is 26.4, slightly above the sector median of 24.52 by 7.67%, and significantly higher than its 5-year average of 17.38, indicating a premium valuation currently. The forward PEG ratio stands at 2.35, higher than the sector median of 2.02 by 16.75%, and well above its 5-year average of 1.52, suggesting that growth expectations are priced at a premium. Other metrics like EV/Sales and EV/EBITDA ratios also exceed sector medians by 132.46% and 45.13% respectively, and their 5-year averages, reflecting robust market expectations for AMAT's future revenue and earnings performance. These elevated valuations might indicate potential overvaluation risk if the company fails to meet growth expectations.

Source: Analyst's compilation

C. Applied Materials Stock Forecast: Market Sentiment

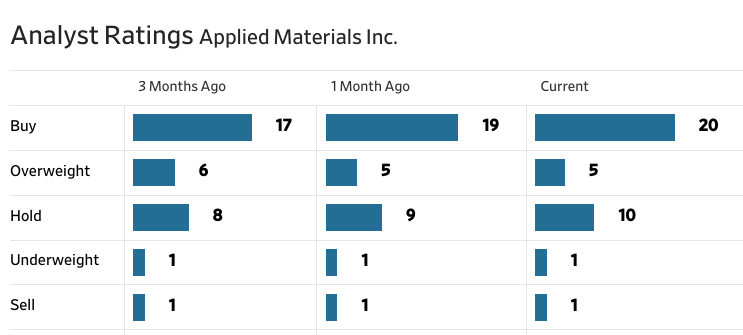

Market sentiment for AMAT, as derived from analyst recommendations and price targets, shows a strong bullish trend. Over the past three months, the number of analysts recommending a "Buy" has increased from 17 to 20, while the "Hold" recommendations have also slightly increased. The stock price targets from analysts present a high AMAT price target of $260, a median of $240, and a low AMAT target price of $165, with the current price at $219.80. This range indicates substantial potential upside, with the high target implying an 18.29% increase from the current level.

Source: WSJ.com

Source: CNN.com

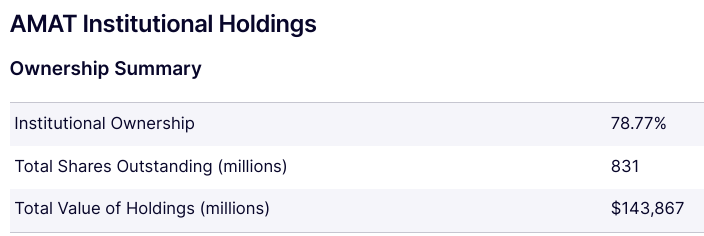

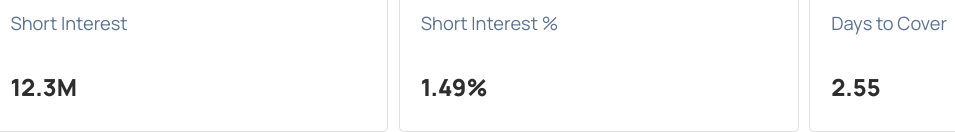

Institutional confidence is significant, with institutional holdings at 78.77%, reflecting strong investor confidence. Short interest is relatively low at 1.49%, suggesting that there is limited bearish sentiment against the stock.

Source: nasdaq.com

Source: Benzinga.com

IV. Applied Materials Stock Forecast 2024: Challenges & Risk Factors

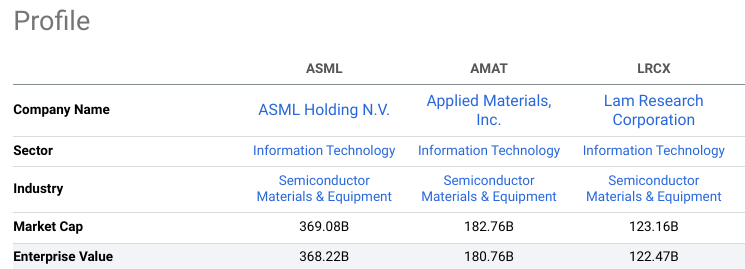

Competitive Landscape: Applied Materials has a lead in semiconductor equipment, but it's imperative to acknowledge the competitive landscape. Specific examples of competitors such as Lam Research and ASML could pose challenges in market share retention and pricing dynamics, especially as semiconductor manufacturing complexities increase.

Source: seekingalpha.com

Market Dependency: Applied Materials' revenue projections are heavily contingent on sustained semiconductor demand, particularly in leading-edge logic, DRAM, and advanced packaging. Any adverse shifts in market demand, geopolitical tensions impacting supply chains, or macroeconomic downturns could disrupt revenue forecasts.

Regulatory Risks: Trade rules affecting market access highlight regulatory risks that could impede growth trajectories, especially in key markets like China. Evolving regulations related to technology exports, intellectual property protection, or environmental standards could introduce uncertainties.

In conclusion, Applied Materials demonstrated resilience in Q1 2024 with steady revenue, strong profit margins, and strategic focus on transformative technology sectors. The company operates in segments with substantial growth potential, including Semiconductor Systems, AGS, and Display.

For investors seeking leverage and flexibility, trading AMAT stock through Contracts for Difference (CFDs) could offer opportunities to capitalize on short-term price movements. VSTAR offers a user-friendly platform for trading various markets, including currencies, stocks, crypto, indices, and commodities. With low trading costs, deep liquidity, and regulatory compliance, it provides a reliable option for trading AMAT stock CFDs.