Can Natural Gas (NG) Rise as the Price Struggles at the Yearly High Level?

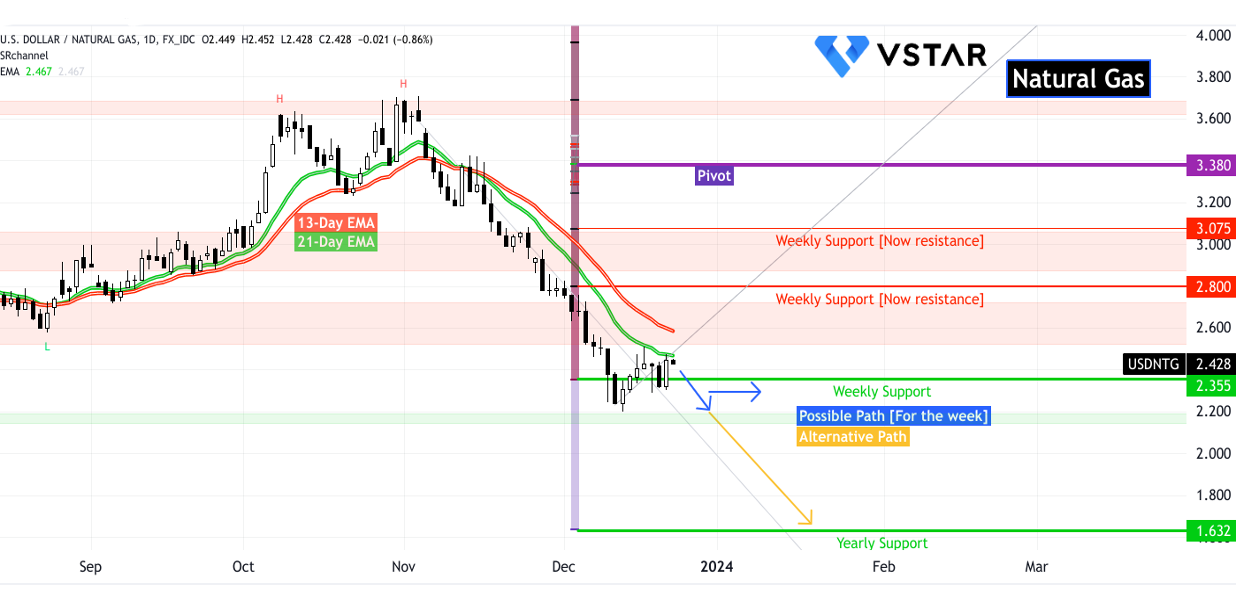

Natural gas (NG) aimed higher after rising from a one-week low due to forecasts that Arctic air would flow into the lower 48 US states, increasing demand for nat-gas for heating.

Can Natural Gas Price Move Higher From the Breakout Point?

The Natural Gas (NG) price has jumped to a high of three and a half months, signaling a potential upward continuation. Moreover, weekly EIA natural gas stocks increased less than anticipated on Thursday, which provided carryover support for rising natural gas prices.

Natural Gas CFDs: Weekly Projections

Discover the prevailing short-term bullish fundamentals and possible weekly price moves in Natural Gas.

The Natural Gas CFD Conundrum

Analyzing storage dynamics, market trends, supply-demand equilibrium, and global influences on pricing for Natural Gas CFDs.

How To Trade Gas CFDs Using Technical Analysis: A Complete Trading Guide

In gas Contract for Difference (CFD) trading, technical analysis plays a crucial role in making informed trading decisions.

Gas CFD Trading Costs

By understanding the factors that affect trading costs and implementing strategies to minimize them, traders can improve their profitability in Gas CFD trading.

Gas CFD Trading and Fundamental Analysis

Gas CFD trading, which stands for Contracts for Difference, is a popular method for speculating on the price movements of natural gas without owning the underlying asset. Fundamental analysis plays a crucial role in Gas CFD trading as it helps traders make informed decisions based on the intrinsic value of the gas market.

Gas CFD Trading and Geopolitical Events

Gas CFD (Contract for Difference) trading refers to the buying and selling of contracts that derive their value from the price movements of gas commodities without actually owning the physical gas itself.

Factors that a trader may focus on when trading gas CFDs

Gas CFDs (contracts for difference) allow traders to speculate on the price movements of natural gas without owning the underlying asset. In a CFD, traders initiate an agreement with a broker to exchange the difference in natural gas prices between the opening and closing of the contract.