Weekly Market Overview and Forecast 0210 - 0216

Weekly Market Overview and Forecast for the week of 10 February - 16 February, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Wheat Bullish Recovery Awaits One More Push to Confirm the Trend Change

In order to offer some assistance, wheat price rose in each of the three marketplaces while the US dollar index dipped. As a result, the price showed a potential price pattern, which could attract technical traders to open long positions at lower prices.

Weekly Market Overview and Forecast 0120 - 0126

Weekly Market Overview and Forecast for the week of 20 January - 26 January, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0113 - 0119

Weekly Market Overview and Forecast for the week of 13 January - 19 January, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0106 - 0112

Weekly Market Overview and Forecast for the week of 06 January - 12 January, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 1230 - 0105

Weekly Market Overview and Forecast for the week of 30 December - 05 January, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 1223 - 1229

Weekly Market Overview and Forecast for the week of 23 December - 29 December, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Platinum (XPTUSD) Awaits a Valid Buy Signal From the Symmetrical Triangle Breakout

Platinum provided a decent return over the years, following a larger industrial demand. However, the price still lags behind precious yellow metal, which could make investors cautious.

Can Silver Price Reach the All-Time High Following the Double Bottom Breakout?

According to analysts, most of Silver's recent gains are anticipated to continue into the new year. Experts predict that the price of silver will surpass gold in 2025.

Weekly Market Overview and Forecast 1216 - 1222

Weekly Market Overview and Forecast for the week of 16 December - 22 December, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Cocoa Price Could Rise as the Price Reached a Crucial Breakout Point

In recent days, cocoa price has significantly increased as it has continued their upward trend for six weeks.

Weekly Market Overview and Forecast 1209 - 1215

Weekly Market Overview and Forecast for the week of 09 December - 15 December, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Natural Gas (NG) Rise as the Price Struggles at the Yearly High Level?

Natural gas (NG) aimed higher after rising from a one-week low due to forecasts that Arctic air would flow into the lower 48 US states, increasing demand for nat-gas for heating.

Weekly Market Overview and Forecast 1202 - 1208

Weekly Market Overview and Forecast for the week of 02 December - 08 December, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Soybean Prices Could Rise From a Solid Trendline Breakout

The soybean market maintained its gains to begin the week. Also, the market structure and price pattern could signal an early investment opportunity in this commodity from the discounted price.

Weekly Market Overview and Forecast 1125 - 1201

Weekly Market Overview and Forecast for the week of 25 November - 01 December, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Coffee Prices Move Higher After Reaching the Crucial Fibonacci Extension Level?

With Arabica plunging to a 13-year nearest-future peak, the cost of coffee settled significantly higher. Moreover, Coffee prices reached the crucial overextension level, from where a decent downside recovery is pending.

Weekly Market Overview and Forecast 1118 - 1124

Weekly Market Overview and Forecast for the week of 18 November - 24 November, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 1111 - 1117

Weekly Market Overview and Forecast for the week of 11 November - 17 November, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Brent Crude Oil (UKOUSD) Soar From the FOMC Rate Decision?

For December, OPEC+ said it would continue to reduce oil production by 2.2 million barrels daily. Lower oil prices, along with decreased demand, caused them to postpone production growth from October, and this trend appears to be continuing.

Weekly Market Overview and Forecast 1104 - 1110

Weekly Market Overview and Forecast for the week of 04 November - 10 November, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Platinum (XPTUSD) Rise Following the Lower Than Anticipated Nonfarm Payroll?

Platinum futures benefited from the gold price rally and its positive effect on bullion prices, rising to more than $1,030 per troy ounce by the end of October, its highest level since May.

Weekly Market Overview and Forecast 1028 - 1103

Weekly Market Overview and Forecast for the week of 28 October - 03 November, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Platinum Rise From the Bullish Pre-Breakout Structure?

As per the technical chart, platinum prices have stayed trapped within a rather small range despite persistent market shortfalls.

Weekly Market Overview and Forecast 1014 - 1020

Weekly Market Overview and Forecast for the week of 14 October - 20 October, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Wheat Rebound as the Price Remained Sideways From 3-Month High?

After plunging precipitously, the Wheat price rebounded from the three-and-a-half-month highs. Reports that bad weather could harm Russia’s wheat crop and increased anxiety over supply interruptions after a drone attack at a Ukrainian stream port caused wheat to spike.

Weekly Market Overview and Forecast 1007 - 1013

Weekly Market Overview and Forecast for the week of 07 October - 13 October, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Can Natural Gas Price Move Higher From the Breakout Point?

The Natural Gas (NG) price has jumped to a high of three and a half months, signaling a potential upward continuation. Moreover, weekly EIA natural gas stocks increased less than anticipated on Thursday, which provided carryover support for rising natural gas prices.

Weekly Market Overview and Forecast 0930 - 1006

Weekly Market Overview and Forecast for the week of 30 September - 06 October, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0923 - 0929

Weekly Market Overview and Forecast for the week of 23 September - 29 September, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0916 - 0922

Weekly Market Overview and Forecast for the week of 16 September - 22 September, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Silver Price (XAGUSD) Awaits a Direction From the US CPI Release

Silver price (XAGUSD) increased marginally to almost $28.00 per one troy ounce. Non-yielding resources like silver gain traction as the probability of a 25 basis-point rate reduction from the Federal Reserve (Fed) at the September meeting rises due to weak employment data.

Weekly Market Overview and Forecast 0909 - 0915

Weekly Market Overview and Forecast for the week of 09 September - 15 September, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0902 - 0908

Weekly Market Overview and Forecast for the week of 02 September - 08 September, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Gold (XAUUSD) Holds the Buying Pressure at the All-Time High

This week, gold price fell below $2,520 an ounce as traders awaited new indications regarding the extent of the Federal Reserve's impending interest rate reduction.

Weekly Market Overview and Forecast 0826 - 0901

Weekly Market Overview and Forecast for the week of 26 August - 01 September, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Wheat Prices Remained Bearish At the Record Low

Although there were indications that wheat was at least forming a bottom, the three U.S. wheat futures exchanges were trading close to some of their lowest points in recent memory.

Weekly Market Overview and Forecast 0819 - 0825

Weekly Market Overview and Forecast for the week of 19 August - 25 August, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0812 - 0818

Weekly Market Overview and Forecast for the week of 12 August - 18 August, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0805 - 0811

Weekly Market Overview and Forecast for the week of 05 August - 11 August, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Is Brent Crude Oil (UKOUSD) A Buy As it Hovers At A Crucial Demand Zone?

After the death of a Hamas leader in Iran brought up concerns about the potential for a broader Middle East conflict and its potential effects on oil prices, oil prices increased on Wednesday, creating a bullish, engulfing candlestick formation.

Weekly Market Overview and Forecast 0729 - 0804

Weekly Market Overview and Forecast for the week of 29 July - 04 August, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0722 - 0728

Weekly Market Overview and Forecast for the week of 22 July - 28 July, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0715 - 0721

Weekly Market Overview and Forecast for the week of 15 July - 21 July, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0708 - 0714

Weekly Market Overview and Forecast for the week of 08 July - 14 July, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Platinum (XPTUSD) Awaits A Breakout From The Crucial $1000.00 Level

Despite reaching new highs in gold and silver, platinum has lagged. The divergence in performance highlights the distinctive obstacles that PGMs encounter as they pursue a stable bottom.

Weekly Market Overview and Forecast 0701 - 0707

Weekly Market Overview and Forecast for the week of 01 July - 07 July, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0624 - 0630

Weekly Market Overview and Forecast for the week of 24 June - 30 June, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Brent Crude Oil (UKOUSD) Formed A Bullish V-shape Recovery

Brent Crude Oil experienced a price surge on Thursday, influenced by multiple factors. Brent crude futures extended the gain, reaching their highest price since early May.

Weekly Market Overview and Forecast 0617 - 0623

Weekly Market Overview and Forecast for the week of 17 June - 23 June, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Gold Price (XAUUSD) Could Dip From A Valid Head & Shoulders Breakout

Gold price (XAUUSD) experienced a minor upward correction since the post-NFP selling pressure. The upcoming high-impact release, with a potential bearish reversal price pattern, could make XAUUSD an attractive investment opportunity.

Weekly Market Overview and Forecast 0610 - 0616

Weekly Market Overview and Forecast for the week of 10 June - 16 June, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0603 - 0609

Weekly Market Overview and Forecast for the week of 03 June - 09 June, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Silver (XAGUSD) Maintained The Growth Amid Thin Trading

This week, silver prices surged significantly as investors capitalized on a sparse market caused by bank holidays in the United States and the United Kingdom.

Weekly Market Overview and Forecast 0527 - 0602

Weekly Market Overview and Forecast for the week of 27 May - 02 June, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0520 - 0526

Weekly Market Overview and Forecast for the week of 20 May - 26 May, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

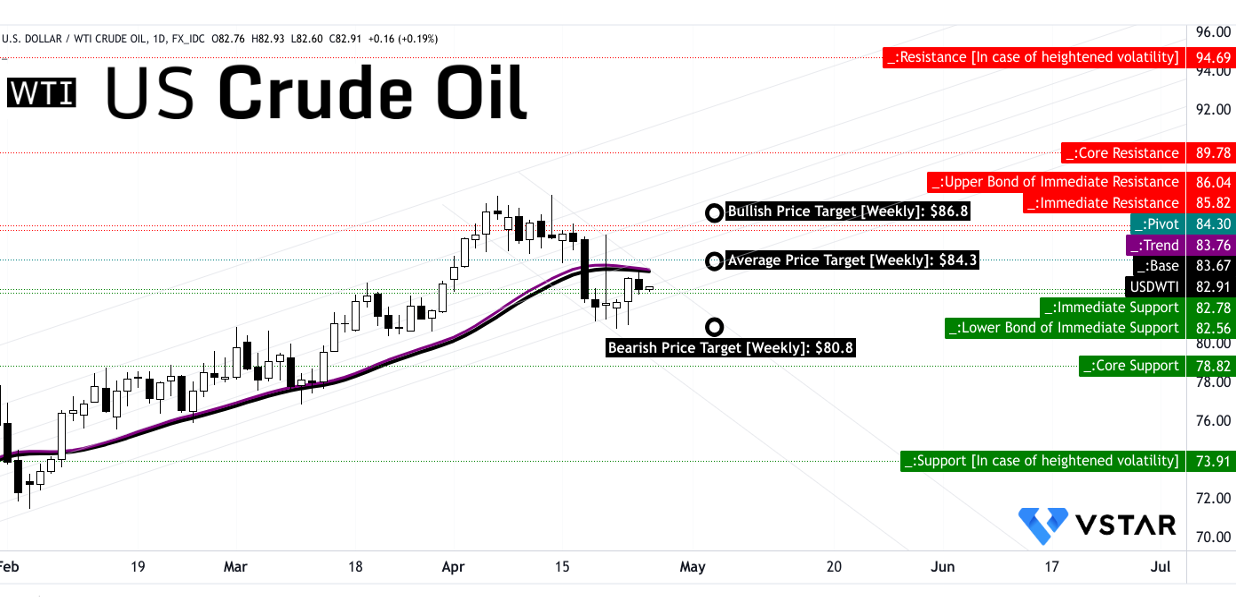

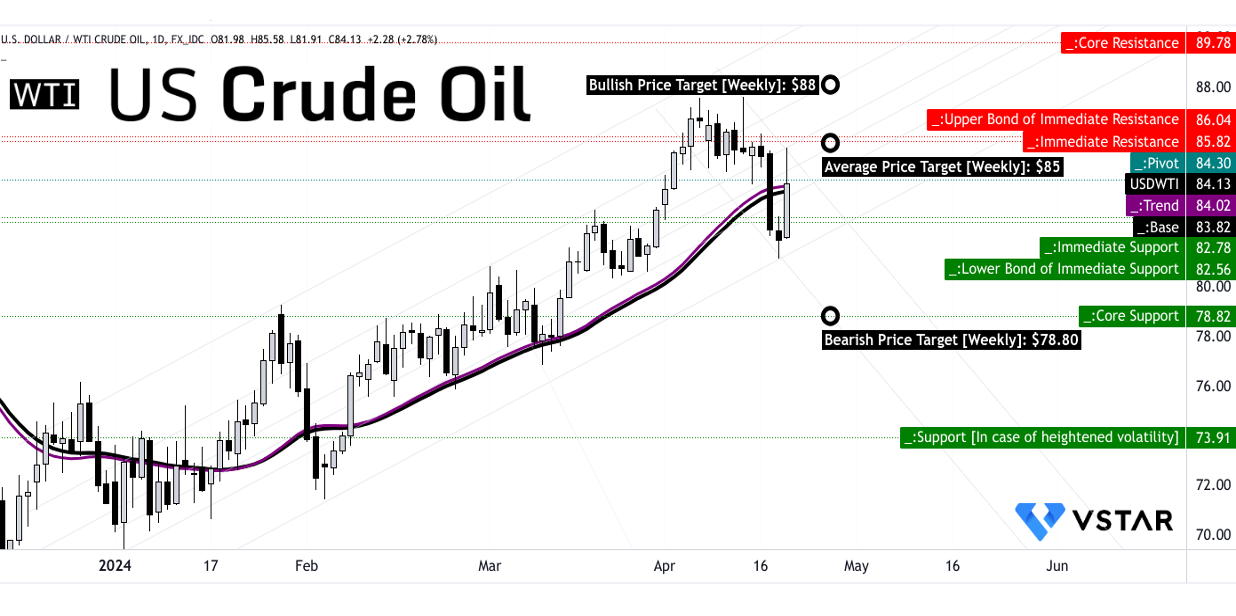

US Crude Oil (USOUSD) Awaits A Breakout From The Current Congestion

The buying pressure in Crude Oil became corrective as soon as the weekly EIA report revealed a decreased inventory.

Weekly Market Overview and Forecast 0513 - 0519

Weekly Market Overview and Forecast for the week of 13 May - 19 May, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0506 - 0512

Weekly Market Overview and Forecast for the week of 06 May - 12 May, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Weekly Market Overview and Forecast 0429 - 0505

Weekly Market Overview and Forecast for the week of 29 April - 05 May, analyzing Forex, Indices, Crypto, Commodities, and Stocks markets.

Oil Prices Forecast: WTI Crude Oil Weekly Dynamics

Exploring the latest EIA Data on refinery inputs, imports, inventories, and price trends to project the prices of WTI crude oil CFDs.

WTI Crude Oil: Weekly Price Projections And EIA Data Analysis

Learn the current dynamics of refinery inputs, production, imports, and WTI Crude Oil critical prices levels.

WTI Crude Oil Bulls Are Active From Geopolitical Uncertainty & Golden Cross Formation

The weaker US Dollar Index (DXY) and apprehensions regarding possible disruptions in crude supply resulting from geopolitical tensions in the Middle East have brought WTI prices nearly to their greatest level in six months.

Gold Showed A Haven Demand From The Middle East Tension

Despite the increase in US Treasury yields, gold prices reached an all-time high of $2288.59 during the Asian session, propelled by escalating geopolitical tensions.

Gold Price Prediction & Forecast: 2023 and Beyond

Gold price prediction and forecast for 2023 and beyond, analyzing gold price performance, factors affecting gold price, and gold fundamental forecast 2023.

Oil Price Forecast for 2023, 2030 and beyond: Continue to Go Long for the Long Term

Comprehensive oil price forecast for 2023, 2025, 2030 and beyond, analyzing market trends, geopolitical factors, and supply-demand dynamics. Get insights and predictions for the future of oil prices.

Oil Trading Platforms for CFDs

Learn about oil trading platforms for CFDs, major oil CFD platforms, key features of oil CFD platforms.

Strategies for Trading Gold During Inflationary Times and Rate Hikes: A Comprehensive Gold Trading Guide

Discover effective trading strategies for navigating gold trading during times of inflation and interest rate hikes with this comprehensive gold trading guide.

Key Drivers of Crude Oil Prices: What Investors Should Know

Oil prices are subject to a complex interplay between supply and demand, driven by several fundamental factors. Understanding these key drivers is critical to gaining insight into oil price movements.

How To Trade Gas CFDs Using Technical Analysis: A Complete Trading Guide

In gas Contract for Difference (CFD) trading, technical analysis plays a crucial role in making informed trading decisions.

Insider Gold Trading Strategies: How to Use Price Charts Like a Pro to Maximize Profits

When it comes to trading gold, understanding price charts is crucial for making informed decisions and maximizing profits. Gold price charts provide a wealth of information, showing live gold prices as well as historical data. By utilizing these charts, you can track gold prices in real-time and analyze long-term price trends.

Unlock the Secrets of Gold Price Charts: A Comprehensive Guide to Analyzing Price Movements

Gold has long been regarded as a safe-haven asset and a store of value. Investors and traders closely monitor its price movements to make informed decisions. Gold price charts serve as a powerful tool for understanding market dynamics and predicting future trends.

Gas CFD Trading Costs

By understanding the factors that affect trading costs and implementing strategies to minimize them, traders can improve their profitability in Gas CFD trading.

Gas CFD Trading and Fundamental Analysis

Gas CFD trading, which stands for Contracts for Difference, is a popular method for speculating on the price movements of natural gas without owning the underlying asset. Fundamental analysis plays a crucial role in Gas CFD trading as it helps traders make informed decisions based on the intrinsic value of the gas market.

The Risks Involved In Trading Gas CFDs And How To Mitigate Them

Gas CFD trading exposes traders to market risks, including volatility and price fluctuations, as well as supply and demand factors. Mitigating risks is crucial to protecting investments and enhancing the chances of success in gas CFD trading.

How To Manage Your Gas CFD Trading Risks With Stop-Loss Orders

Gas CFD trading involves speculating on the price movements of gas contracts without owning the physical asset. While it offers potential opportunities for profit, it also carries inherent risks that traders should be aware of.

How to Analyze Gas CFD Charts and Make Informed Trading Decisions

Gas Contract for Difference (CFD) trading is a popular method for investors to speculate on the price movements of natural gas without owning the physical commodity. To make informed trading decisions, analyzing gas CFD charts is crucial.

Advanced Strategies for Trading Gold CFDs

Advanced trading strategies for gold CFDs can give you a deeper understanding of the market and enhance your trading skills. Whether you choose trend following, scalping, position trading, or hedging, it's crucial to adapt your approach based on the most recent information in 2023.

A Guide to the Most Common Oil CFDs: WTI and Brent

Oil trading plays a vital role in global financial markets, facilitating the exchange of this precious commodity on various platforms. Contracts for Difference (CFDs) have emerged as a popular financial instrument for oil trading, allowing investors to speculate on oil price movements without owning the physical asset.

Gas CFD Trading and Geopolitical Events

Gas CFD (Contract for Difference) trading refers to the buying and selling of contracts that derive their value from the price movements of gas commodities without actually owning the physical gas itself.

From Beginner to Pro: How to Trade Oil CFDs with Confidence Oil CFD Trading 101: Strategies, Risks, and Best Practices

Oil CFD trading has emerged as a popular investment avenue for traders seeking exposure to the oil market. Contracts for Difference (CFDs) offer a flexible and efficient way to speculate on the price movements of crude oil without owning the physical commodity.

Profiting from WTI: A Beginner's Guide to Trading the World's Most Important Oil

If you're looking to enter the exciting world of oil trading, understanding the dynamics of West Texas Intermediate (WTI) is crucial. As one of the most important benchmarks for oil prices, WTI holds immense significance in the global oil market. This beginner's guide will provide you with valuable insights on profiting from WTI in 2023.

Expert Traders Share Tips For Successful Gold Trading

Gold trading requires careful research and monitoring of the market in order to make informed decisions and maximize profits. Expert traders emphasize the importance of staying up-to-date with current events that could potentially impact the price of gold.

Developing a Risk Management Strategy for Trading Gold CFDs

In the world of financial trading, success often hinges on the ability to effectively manage risk. This is particularly true when it comes to trading Gold CFDs (Contracts for Difference), where market volatility and price fluctuations can pose significant challenges.

Why Gold Is So Popular With Traders and Investors

Gold trading and investing is a popular financial activity that involves the buying and selling of Gold as a commodity or investment vehicle.

Factors that a trader may focus on when trading gas CFDs

Gas CFDs (contracts for difference) allow traders to speculate on the price movements of natural gas without owning the underlying asset. In a CFD, traders initiate an agreement with a broker to exchange the difference in natural gas prices between the opening and closing of the contract.

Unlocking the Secret to Gold Trading: 5 Key Charting Techniques to Try

Charting is crucial in gold trading as it enables traders to analyze historical price data and identify patterns, trends, and support/resistance levels. This analysis helps traders make informed decisions about when to enter or exit trades, anticipate future price movements, and manage risk effectively.

Which Precious Metal Should You Trade? Gold, Silver, Platinum, Or Palladium?

Gold CFDs provide investors with a flexible and accessible way to trade the price movements of gold without physically owning the metal. Other precious metals, like silver, palladium, and platinum, offer intriguing investment opportunities beyond the allure of gold.

Gas CFD Trading Strategies for Different Market Conditions

Gas CFD trading refers to trading contracts for difference (CFDs) that derive their value from the price movements of natural gas. Natural gas is a fossil fuel used primarily for heating and electricity generation. It is also used as a raw material in producing chemicals and other products.

The Most Comprehensive Factors That Affect The Gold Price

A gold CFD, or contract for difference, is a financial derivative instrument that allows traders to speculate on the price movements of gold without owning the physical asset. In a gold CFD, the buyer and the seller agree to exchange the difference in the price of gold between the opening and closing of the contract. If the price of gold goes up, the buyer makes a profit, and if the price goes down, the seller makes a profit.

Trading Gold CFDs in the US Dollar Market: What Investors Need to Know

Gold CFDs (contracts for difference) are derivative instruments to speculate on the price of gold movements without owning the physical commodity. Instead, a CFD is a contract between the trader and the CFD provider that enables the trader to profit from changes in the gold price without taking physical delivery of the asset. The trader earns a profit or loss based on the range between the open and close prices of the CFD.

Investing in Gold: Buy Physical Gold or Trade Gold CFD?

Which is better for investing in gold: buy physical gold or trade gold CFD?

Gold CFD: A Safe-Haven Asset to Protect Your Investment Portfolio Against Volatility

Gold CFDs, or contracts for differences in gold, are financial derivatives that enable traders to speculate on gold's price movements without owning the underlying asset. These instruments have gained popularity among investors due to the volatility of gold prices and its status as a safe-haven asset during economic uncertainty.

Mastering Technical Analysis: A Guide to Successful Gold CFD Trading

In gold CFD trading, technical analysis can be a valuable tool for predicting market movements and optimizing trading strategies.

Understanding Historical Price Trends And Patterns Of Gold CFD: A Comprehensive Guide

Gold CFD (Contract for Difference) is a financial derivative product used to speculate on the price movements of gold without owning the physical commodity. When trading a gold CFD, the trader agrees to exchange the difference in the price of gold from when the contract is opened to when it is closed.

Crude Awakening: Understanding the Multifaceted Factors Affecting Oil CFD Prices

Oil CFDs (Contracts for Difference) are financial derivatives that used to speculate on crude oil price movements without owning the underlying asset. With an oil CFD, traders can make profits by predicting the direction of oil prices, whether they will rise or fall.

Mastering Gas CFD Trading: Strategies for Harnessing Profits in the Volatile Market

Gas CFD trading can be a volatile and unpredictable market, but with the right strategies, traders can harness its potential for significant profits. The key to success lies in understanding the different trading strategies and identifying the ones that work best for current market conditions. Whether it's trend-following, breakout trading, news trading, hedging, or scalping, each strategy has its unique strengths and weaknesses.

Optimizing Profitability: Tips and Strategies for Successful Oil CFD Trading

We'll explore tips and strategies for successful oil CFD trading, including understanding the advantages and risks, factors affecting the price of oil CFDs, and how to navigate the highs and lows of the market.