An initial public offering (IPO) enables investors to make significant money. Many investors choose this option due to the attractive return opportunities.

However, making constant profits through IPO investing requires sufficient understanding, for example, of what IPO investing is, its benefits, risks, types of IPOs, research guidelines for choosing the best potential IPOs, investment guidelines, etc. In the following section, we will briefly discuss IPO, providing sufficient elements to make considerable profit periodically through this investment type.

What is IPO

The Initial Public Offering (IPO) is a process through which a private company becomes public for the first time. In other words, through the IPO process, which is sometimes also called "going public," the ownership of a private company changes to public ownership.

The term "IPO" has been widely known among investors and Wall Street for decades. Historically, the Dutch have been credited with conducting the first modern IPO by offering shares to the Dutch East India Company.

Startup companies or companies that have been in business for decades can decide to go public through this IPO process. They usually do this to raise funds to settle debts, increase funds, grow public profile, enable company holders to diversify their portfolio, or provide liquidity by selling partially or all of their shares through the IPO process.

When a company chooses to “go public,” it usually hires a lead underwriter to help with the securities registration process and assembles a group of investors (brokers or investment banks) to distribute or sell the IPO shares to investors.

IPO Process

The IPO goes through a complex process to become public for the first time. Let's see the key phases a company should face from the beginning:

- Pre-Announcement Phase: It's the very beginning phase, when the company assesses capital, hires advisors, conducts due diligence, assesses financial performance, etc.

- IPO Announcement Phase:The company applies for an IPO to the SEC (for the US), providing details like financial information, risks, etc.

- Pricing Phase: In this phase, the company considers the investors' interest and share demand to collect bids from potential investors.

- Allocation Phase: Shares are allocated to institutions, retailers, and stakeholders. Institutional investors typically receive most of the shares due to their substantial buying power and potential to hold shares long-term.

- Regulatory Approval: The regulatory body like SEC, reviews the document and disclosures before approving any IPO.

- Trading Debut: This is a crucial stage as at that point the share is listed in a stock exchange like NYSE, Nasdaq, etc.

- Post-IPO Phase: There is a lock-up period of 90-180 days, during which time IPO holders are unable to sell their shares.

Benefits And Risks Of IPO

This part consists of the benefits or opportunities of investing in an IPO alongside listing the risks or disadvantages of this type of investing.

Benefits Of IPO

High Volatility on First Trading Day

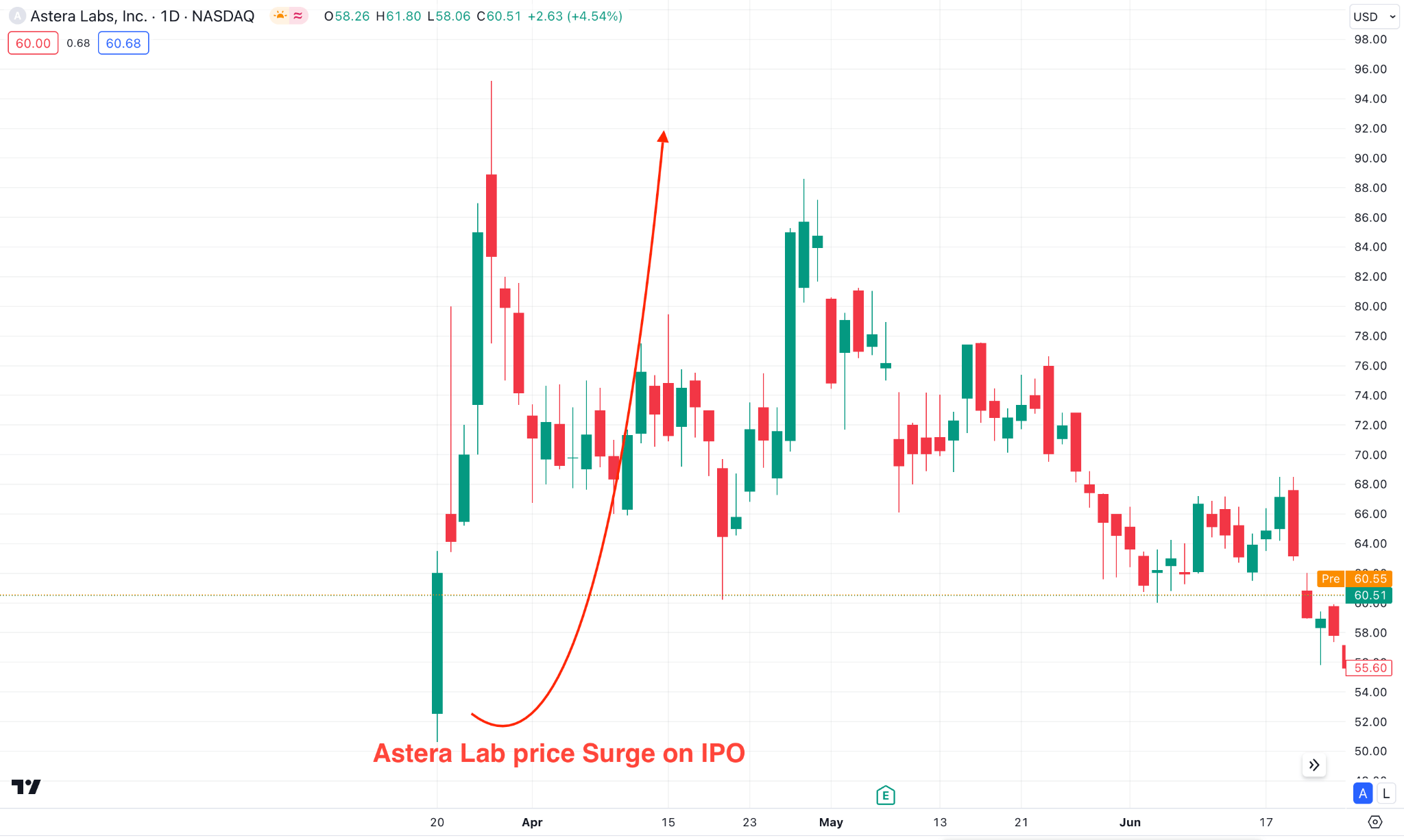

Investing in an IPO enables a considerable profit on the first trading day, as the price surges often to find support and resistance levels when the asset goes public. Most IPOs make considerable surges on the first day, for example, Astera Labs (72%), Reddit (48%) this year, Arm (25%) and Nexttracker (more than 25%) last year.

The above image shows how the price surged from $50.00 to $95.00 level since the launch, representing a huge volatility.

Other benefits of investing in IPO include:

- Early Investment Opportunity: An IPO enables investors to invest in an asset at an early stage when the company is going public for the first time, which can lead to potential long-term gains.

- Access to promising companies: An IPO enables investors to access many promising and innovative companies that may have been previously private.

- High Return Potentiality: Investing in an IPO enables making a significant profit when it becomes successful as the value increases after listing.

- Market Visibility: Going public can increase a company's credibility and visibility, positively impacting growth prospects and business relationships.

- Liquidity For Early Investors And Founders: An IPO enables the monetization of shares by selling them to existing stakeholders, including early investors and founders.

- Transparency: An IPO allows a company to go public, which increases transparency. Quarterly reporting is also required, which can usually help the company get more credit borrowing terms.

Risks Of IPO

Price Volatility

When investing in an IPO, the share price can be highly volatile in the early trading period, making it challenging to predict short-term price direction. Investing in IPOs entails considerable volatility risk.

After the IPO, the stock price might fall below the offering price, influencing early investors to cash out with a significant loss. However, investors might wait and hold their positions, hoping the price will move above the IPO price. However, the decision should be based on predetermined criteria in financial trading.

Overvaluation Risk

Some IPOs may be overvalued at the initial stage due to various circumstances, so when the hype fades, the price correction occurs.

Capital Lockup

IPO shares are often subject to a specific lock-up period, lasting up to six months. This means investors cannot offload their shares instantly after listing, only after the lock-up period ends. If you notice, after the lock-up period, there is usually no significant sell pressure, which indicates the shareholders predict the asset may have growth potential, so they are holding. Meanwhile, investors may lose confidence if the share price declines after the lock-up period.

As you know, the lockup period is useful in controlling the oversupply of shares and maintaining decent distribution. However, investors can expect a price decline when the period ends due to oversupply. Major investors may want to offload their shares, and some may hedge their long positions with options. However, it is only sometimes necessary that the share price declines when the lockup period expires.

Failure to List

After announcing the IPO, the company might fail to list the stock. This might happen due to not passing the compliance requirements, regulatory issues, or company-specific problems.

Market Circumstances

Broader market circumstances can affect IPO success, and unfavorable market circumstances can be reasons to cancel or postpone the IPO.

How To Take An IPO Position

The most important part for an IPO investor is to select the best potential IPOs to make considerable profits and follow specific guidelines for successful investment. When an investor's profile matches those criteria, they have them sign up for IPO alert services. When it comes to choosing the most potential IPOs, better check on some unavoidable factors such as,

Research Potential IPOs

An investor's primary aim should be researching upcoming IPOs through various sources. One popular way to keep track is to follow an IPO calendar. While researching, one must check on company financials, growth potential, industry position, competitors, etc.

The next step is to find a way to anticipate the future price of the company. The popular way is to find key metrics and indicators to gauge the upcoming price direction. Under financial metrics- profitability, liquidity, and gearing are key points to look at.

Remember to check the company prospectus, which the company provides to the broker. It includes useful information like the company's capital, managing body, goal, customer base, and services.

Company Fundamental Analysis

First, investors should look at the macrostructure from the industry outlook. For example, if the use of artificial intelligence surges, the relevant startups and potential companies related to this field will perform better since the launch.

An IPO investor must check all available information about his target company, including its overall health, liquidity position, earnings, growth potential, competitors, etc. When the company's financial performance has potential and is supported by the industry, we might find a great return on the investment.

The amount of funds raised is another key fundamental indicator related to the project. If the company can meet the targeted fund, it can likely perform better by eliminating capital rationing.

Choose a Reliable Broker & Open an Account

When choosing the best potential IPO, make sure to follow these points while choosing the right broker:

First, the broker should have the option to access IPOs. Kindly note that all brokers do not have the facility to access IPOs to investors. A good broker with the availability of this function under reliable regulation should be considered as a safe place.

Brokers with robust underwriting capabilities are more likely to offer high-quality IPOs. Usually, brokers with strong underwriting relationships may receive better allocations of shares in popular IPOs, increasing the chances that their clients can secure shares at the offering price rather than in the secondary market, where prices may be higher.

Choosing the right account type is another key factor, as a Share Dealing Account allows investors to be the owners of actual shares. Losses are also limited to the investment, where the charge is applicable on a commission basis. This account type is suitable for long-term investors and dividend hunters.

On the other hand, investors can eliminate owning the asset and profit from buying and selling through the Leverage Trading account. Unlike the share dealing account, this account is suitable for short-term investors as it can maximize profit from leverage.

Subscribe IPO

Subscribing to an IPO on your trading account means you are participating in the share-buying process that is going to be public.

It is a simple process to show that you are interested in buying shares from the IPO on a particular date. This involves committing to buy a certain number of shares at the IPO price, which is set by the underwriters and the company going public.

Before subscribing to IPO, investors should ensure eligibility as not all brokers have the option to access this feature. Also, deeper research is needed to determine whether the stock is likely to provide a good return or not.

In the action phase, the subscription means filling out an application form, where you should mention the number of shares you have agreed to buy.

Wait for Allocation

Now, it is clear how to select the best potential IPO and be picky about the brokerage firm. Never skip checking the company's prospectus before selecting, as the company provides it to the brokerage firm that will bring it public. The prospectus contains valuable information, such as opportunities and risks, alongside the company's future vision of how it may use the money.

For example, if the funds they raise will be spent to repay loans, it may not be a worthy investment on that IPO, as it is not a positive sign that having faith in a company that can't repay its debt and has to issue IPOs to cover it. On the other hand, a company may have plans to raise funds for marketing, research purposes, and expansion of the market or production, indicating that a progressive company and an IPO may be a worthy investment.

However, check the prospectus carefully, as over-promising and under-delivering stocks are avoidable. Only choosing shares projected with the mentioned figures makes them a more attractive investment. So, stay tuned and check for updates before making an investment decision on an IPO.

IPO Trading Strategies & Tips

At this point, learning some pro terms and tips is important to create a successful IPO investing strategy.

Pre-IPO Trading

Gray Market

The term "gray market" is widely used in the stock market, which is an unofficial marketplace in which to buy/sell shares. A term you may seek, white, is quite correct and pure.

Meanwhile, black may stand for all negative or wrong. So, in that case, the gray market is the middle way to participate as it enables buy/sell applications or IPO shares before even launching officially or being listed on the stock exchange. In other words, the gray market is over-the-counter before the IPO is listed on the stock exchange.

Investing In Pre-IPO shares

Pre-IPO shares enable investors to invest in innovative and progressive companies before they hit the broader marketplace. This pre-investing can lead to significant profits, as when the company is listed on the stock exchange, its value will increase, and investors can make significant returns.

However, when investing in pre-IPO shares, investors must consider some factors, including regulatory, market-driven, legal, etc. These factors are essential to understand when exploring any pre-IPO investment asset.

Participating In Private Placements Or Secondary Markets

An IPO always remains under regulation by the SEC (Securities and Exchange Commission) and is bound to report periodically to remain accessible to investors. Meanwhile, private placement offerings are assets or securities available for accredited investors to purchase, such as mutual funds or pensions, investment banks, etc. Some high-profile investors may also participate through these investment options.

Companies using private placements usually seek smaller amounts of investments from specific investors. Accredited investors can purchase more shares from a private placement issuer company with an understanding of risk-reward, allowing companies to remain privately owned and avoiding filing annual disclosures to the SEC.

Post-IPO Trading

Shares of any company that may be eligible for trading after a successful initial public offering are listed or post-IPO shares. These shares are accessible to individuals and institutes in the secondary market. The notable positive side of post-IPO shares is liquidity, which enables buy/sell by the current market price.

First Trading Day

On the first day of the IPO, debut occurs in the public market, and the stock price usually surges due to high volatility. This method enables purchasing IPO shares at the opening bell and selling within a very short period, within a few minutes or a few hours. When capturing initial momentum, investors can make quick profits. However, this type of trading requires precise timing and is highly speculative.

Following IPO

Opening a position on an IPO at the initial stage could be challenging as there are no established support-resistance levels. So it is better to wait and keep track until the price establishes these essential levels and is done with price discovery.

This will help you manage risks and use effective stop-loss, which is important to keep your capital safe while investing in an IPO.

Follow-On Offering

A follow-on offering (FPO) refers to shares of a company already listed on the exchange. Companies usually offer these types of shares after an IPO, also called a secondary offering. There are two types of secondary offerings: dilutive and non-dilutive.

Managing Post-IPO Volatility

Once the company goes public, the stock might fluctuate significantly. In that case, investors should remain cautious in making decisions to avoid losing due to excessive price fluctuations.

Understanding market volatility through fundamental analysis is important for long-term traders. If the company has high potential and stable earnings growth, we may expect the stock price to rise shortly. Also, dividend reinvestment would be another way to get the best outcome from the investment over time.

On the other hand, short-term investors might get the best benefit from technical analysis, where the main aim is to anticipate the future price based on past actions. Investors should use to stop loss and proper money management to limit risks from short-term trading.

Another crucial event is the lock-up expiration. As we know, insiders and early investors are restricted from selling their stocks for a certain period, known as a lock-up period. Once the period is over, significant activity might occur, potentially causing price volatility.

Reviewing Financial Reports & Market Performance

Understanding the quarterly earnings report and anticipating the price based on the report is a crucial part. Easily, a consistent growth in quarterly earnings of around 20% is a positive sign for a company. Also, there are other factors to consider like revenue, gross profit margin, net profit margin, and liquidity position.

Anticipating the future price from multiple fundamental indicators could help investors remain safe from inadequate business operations.

Common Mistakes to Avoid

This part consists of common mistakes to avoid in IPO investing, such as

- Do sufficient research before investing, and avoid any overhyped IPOs.

- Remember to check the company profile, financial health, products, services, industry growth, competitors, management background, promoters, customers, risk factors, etc.

- Avoid fear or missing out (FOMO) due to the hype, it can lead you to purchase overpriced assets.

- Be careful if you purchase shares from the gray market, as this market is not regulated, so it is open to manipulation and usually has no rules.

- Observe the lock-up period movement, as insiders will open opportunities.

- Don't lose patience, and use proper fund management before opening positions.

Upcoming IPOs to Watch in 2024

Many companies are waiting to go public or release IPOs in 2024 for listing. Stripe, Bytedance, Shein, and Skims are the most attractive among them.

Stripe

Stripe is a technology company that provides online business payment processing software and services. Founded in 2010 by Patrick and John Collison, Stripe's platform enables businesses to accept online payments, manage subscriptions, and handle financial transactions securely and efficiently.

Let's see why investors should keep a close eye on Stripe IPO:

- Stripe has shown stable revenue growth coming from its payment processing section, where the future revenue looks potent.

- The recent profitability looks potent, and the jump into the stock market would expand the business, creating new profit-generating activities.

- Stripe's competitive edge in the fintech space, its market share, and its ability to innovate and maintain its leadership position are important considerations.

Bytedance

ByteDance is a Chinese technology company known for its flagship product, TikTok, a popular short-video platform. Founded in 2012 by Zhang Yiming, ByteDance has expanded its influence globally, focusing on AI-driven content recommendations and mobile entertainment.

Let's see why investors should keep a close eye on Bytedance IPO:

- The company is behind popular platforms like TikTok, which has a strong user base.

- ByteDance has a strong position in social media, allowing investors to diversify their portfolios.

- The risk is that the company does not offer any traditional ways for retail investors to buy this from the IPO.

Shein

Shein is a Chinese e-commerce company specializing in fast-fashion apparel and accessories. Founded in 2008, it offers trendy and affordable clothing options worldwide through its online platform. Shein has gained popularity for its extensive product range and competitive pricing in the fashion industry.

Let's see what investors could see from the Shein IPO:

- As the company has shown massive growth in recent years, it could be a potential opportunity for high-growth investment in the e-commerce industry.

- The company is backed by a strong tech-based infrastructure, creating an opportunity to leverage the profit from the customer data.

- Shein has a significant global presence, particularly in Asia and the US, which allows global investors to invest, especially in developing economies.

Skims

Skims is a shapewear and loungewear brand founded by Kim Kardashian in 2019. Known for its inclusive sizing and diverse range of skin-toned hues, Skims offers comfortable and supportive undergarments designed to enhance natural body shapes and promote body positivity.

Let's see what investors could see from the Skims IPO:

- Skim has strong support from influences like Kim Kardashian, which might work as a strong revenue generator.

- Skim has a strong track record of profits, making it a high-growth company.

The opportunity to expand the investment portfolio is not limited here. Some other potential upcoming IPOs in 2024 are Discord, Databricks, Turo, Navan, etc.

Why Take a position on IPOs with VSTAR?

Taking a position on IPOs with VSTAR offers several compelling advantages for investors looking to capitalize on new market opportunities. Here are key reasons to consider:

- Access to Early Opportunities: VSTAR provides access to initial public offerings (IPOs), allowing investors to potentially enter the ground floor of companies poised for significant growth. This early entry can yield substantial returns by going long (or short) as the company grows and its stock price increases (or decreases).

- Comprehensive Research and Analysis: VSTAR provides investors with thorough research and analysis on upcoming IPOs. Detailed reports, financial assessments, and market trends help investors make informed decisions. This comprehensive approach reduces the risks associated with investing in newly listed companies.

- User-Friendly Platform: VSTAR's platform is designed with user experience in mind, making it easy for investors to browse, analyze, and invest in IPOs. The intuitive interface ensures that even those new to IPO investing can navigate the process with confidence and ease.

- Expert Support and Guidance: VSTAR offers access to a team of experienced professionals who provide personalized support and guidance. Whether you're a seasoned investor or new to IPOs, VSTAR's experts can answer questions, offer insights, and help strategize your investments.

- Competitive Fees and Pricing: Investing in IPOs through VSTAR is cost-effective, with competitive fees and transparent pricing. This ensures that more of your investment works for you rather than being eaten up by hidden costs and charges. With less capital, you get the same market volatility.

- Robust Security Measures: Security is a top priority at VSTAR. The platform employs advanced security protocols to protect your investments and personal information, giving you peace of mind when investing in IPOs.

- Diversification Opportunities: Investing in various IPOs can diversify your portfolio, spreading risk across different sectors and industries. VSTAR offers a wide range of IPOs, allowing you to build a balanced and varied investment portfolio.

- Real-Time Updates and Notifications: Stay informed with real-time updates and notifications about IPOs. VSTAR ensures you take advantage of every opportunity by updating you on the latest market movements, subscription periods, and listing dates.

In summary, taking a position on IPOs with VSTAR offers early access to high-potential investments, comprehensive research, user-friendly tools, expert support, competitive pricing, robust security, diversification opportunities, and real-time updates. These features make VSTAR an ideal platform for investors exploring the lucrative world of IPOs.

Finally, investing in IPOs has great potential and may enable attractive returns. However, there are also some barriers and challenges, as no guaranteed profits exist. So, you must follow a specific guideline when investing in any IPO. This article contains all the basic info you need to know when investing in any IPO. Do some more research before starting investing.