Turo first proposed an IPO plan in January 2022 when it confidentially filed its S-1 with the SEC. The timing of this move reflects Turo's ambition to capitalize on the growing demand for car-sharing services and the broader trend toward the sharing economy. With over $523 million raised in funding across 16 rounds, including a recent $35 million Series F round in April 2022, Turo's growth trajectory has been strong, driven by increasing consumer adoption.

The IPO has generated significant interest due to Turo's unique business model, which offers a peer-to-peer platform for car rentals, appealing to both consumers and investors who see potential in the expanding car-sharing market. Additionally, Turo's estimated valuation of approximately $2.7 billion, combined with its solid revenue growth positions it as a promising investment in the tech-driven mobility sector.

Source: sec.gov

I. What is Turo

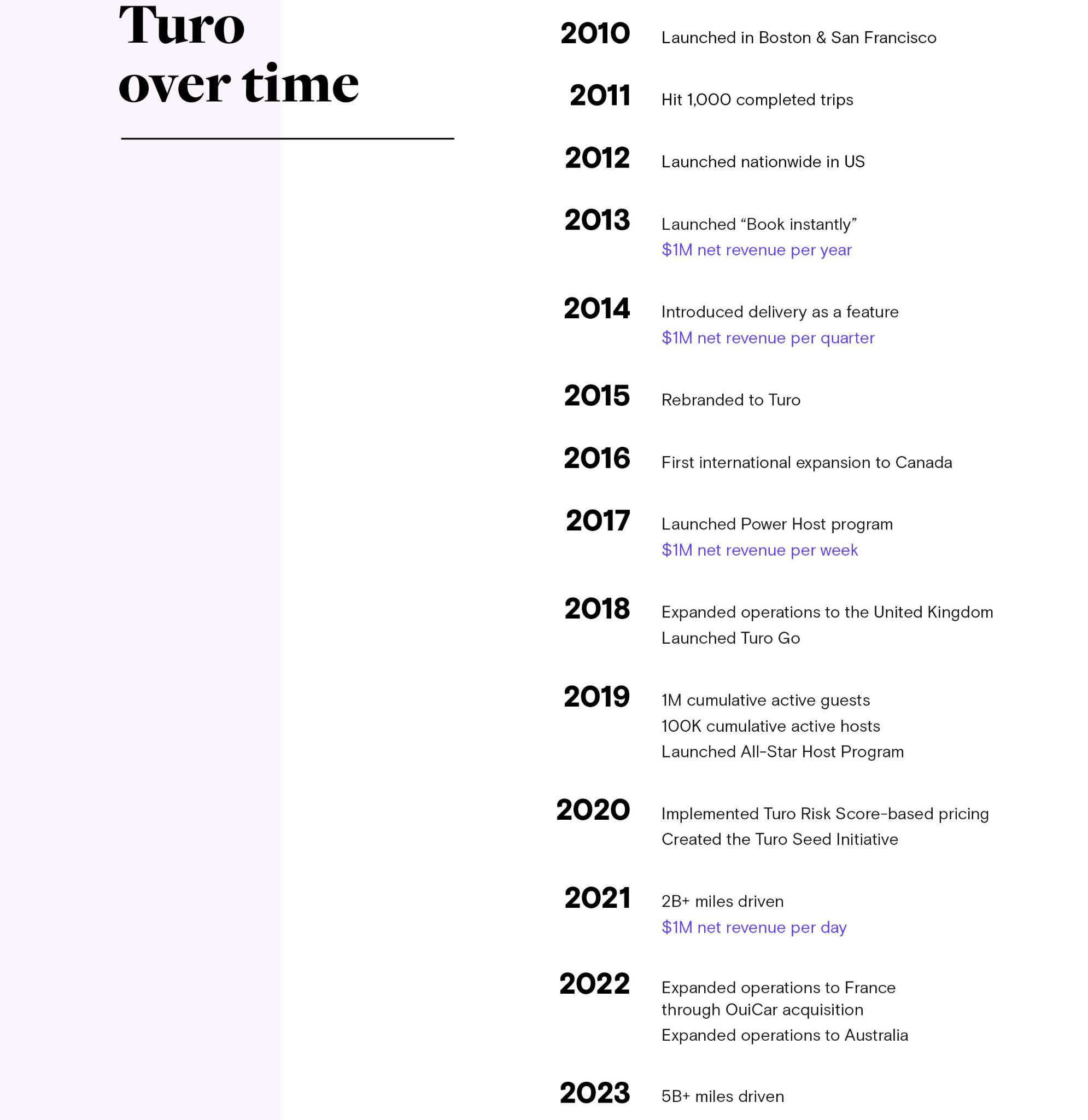

Turo, initially founded as RelayRides in August 2009 by Shelby Clark, is a pioneering peer-to-peer car-sharing marketplace. The company, headquartered at 111 Sutter Street, San Francisco, California, rebranded to Turo in March 2016. It was established to offer an innovative alternative to traditional car rental services, allowing car owners (hosts) to rent their vehicles to users (guests) for various durations, ranging from short-term to extended periods. This model leverages underutilized personal vehicles, transforming them into income-generating assets.

Source: sec.gov

Business Model and Core Services

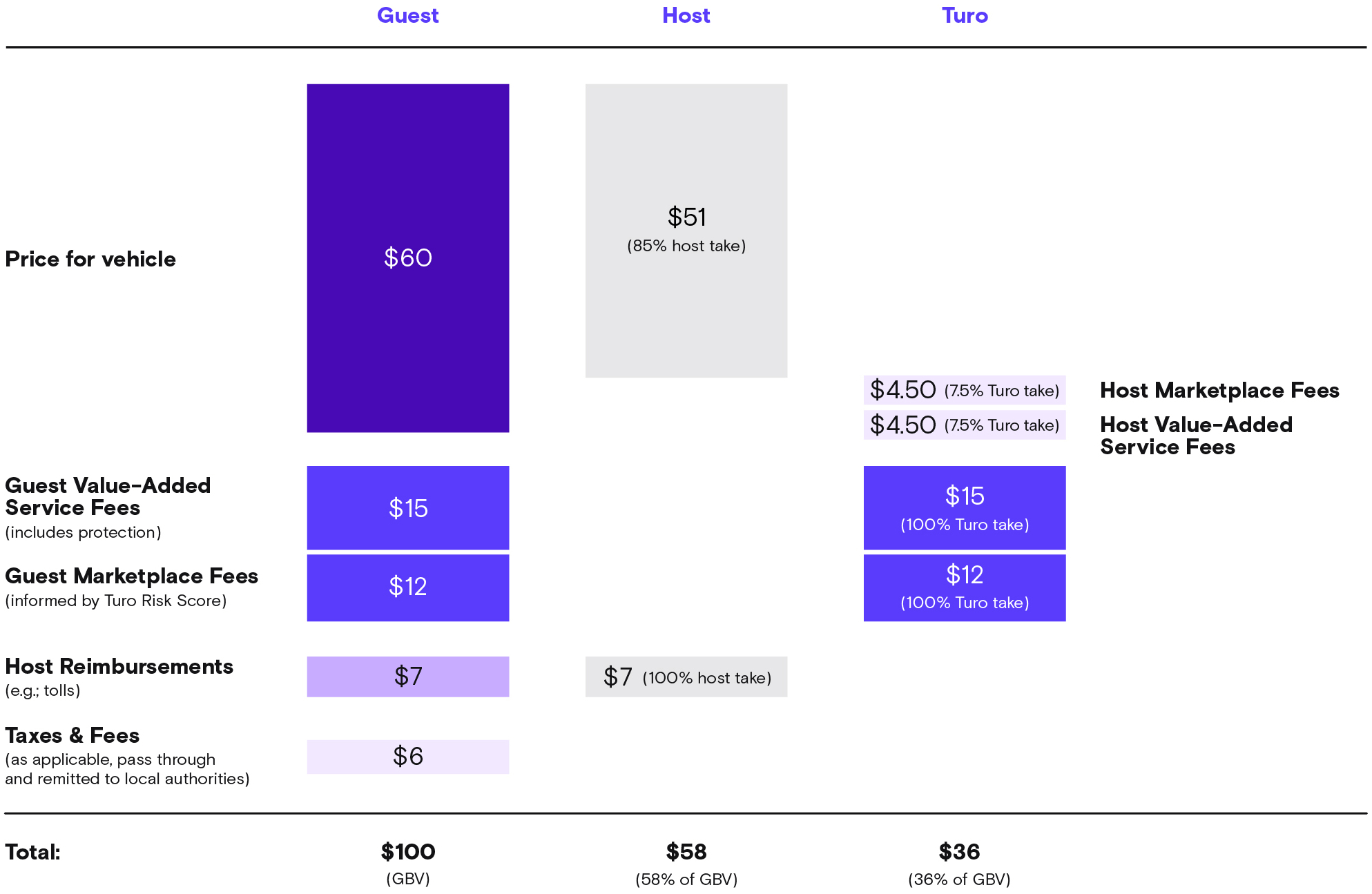

Turo operates an asset-light business model, meaning it does not own the vehicles listed on its platform. Instead, it provides a marketplace where car owners can list their vehicles and set terms such as availability and pricing, while users can browse and book vehicles that meet their specific needs. The platform is designed to cater to a wide range of use cases, including daily commutes, family vacations, and even long-term rentals. As of December 31, 2023, Turo had approximately 170,000 active hosts, 360,000 active vehicle listings, and 3.5 million active guests. The platform's unique offerings and geographic reach—spanning the United States, the United Kingdom, Canada, Australia, and France—have made it a leader in the peer-to-peer car-sharing industry.

Source: sec.gov

Turo's revenue streams primarily come from marketplace fees and value-added service fees, which include customer support, roadside assistance, and protection plans. Hosts on Turo range from individuals with a single car to small business owners and professional hosts with fleets of 10 or more vehicles. The company's focus on organic growth, bolstered by strong brand affinity and repeat usage, has resulted in 89% of site traffic being organic in 2023.

Ownership

Turo is a privately held company. Specific investors include August Capital, IAC, SK Holdings, Kleiner Perkins, Manhattan Venture Partners, and Allen & Company.

II. Turo Financials

Turo Revenue Growth

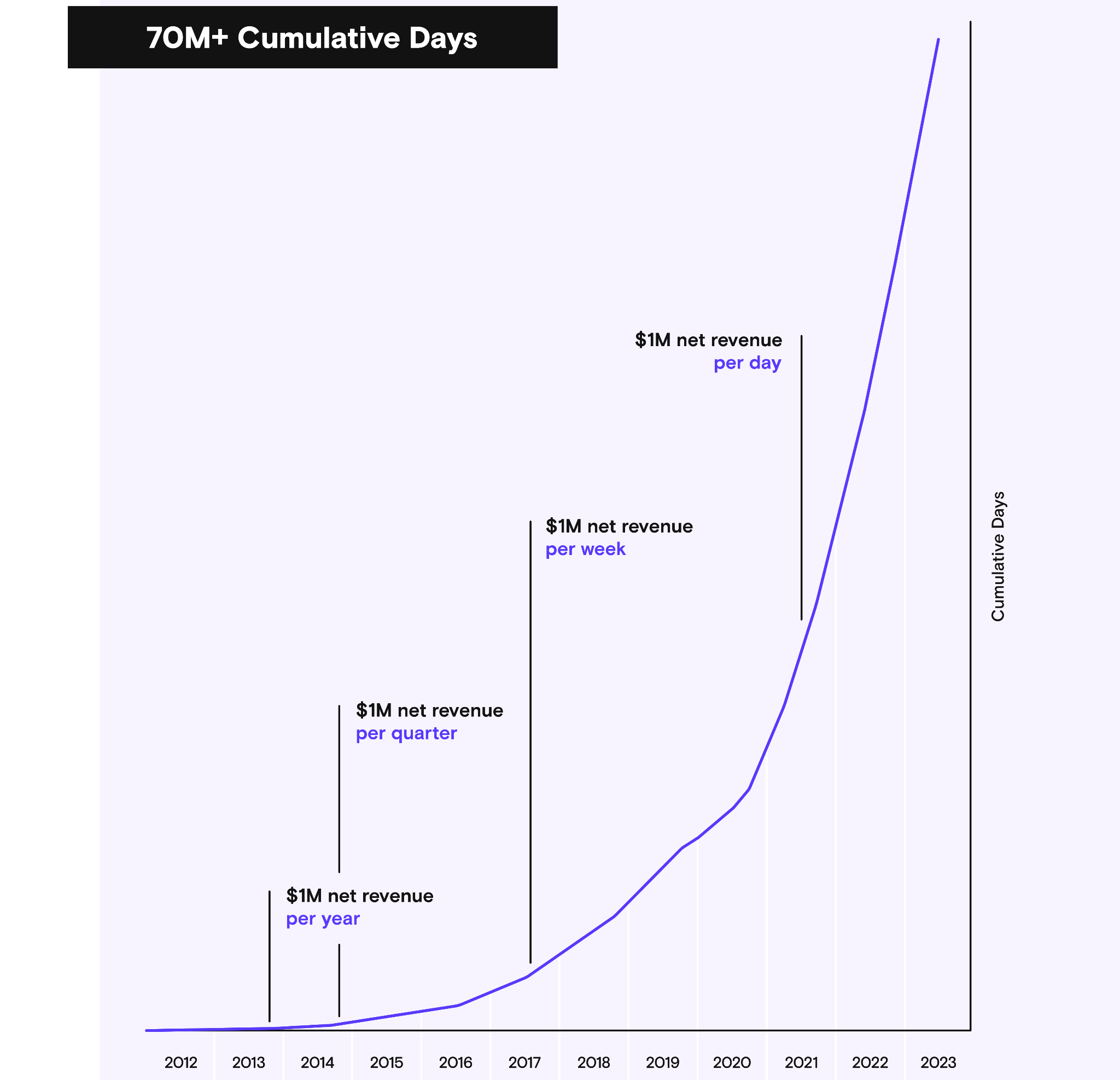

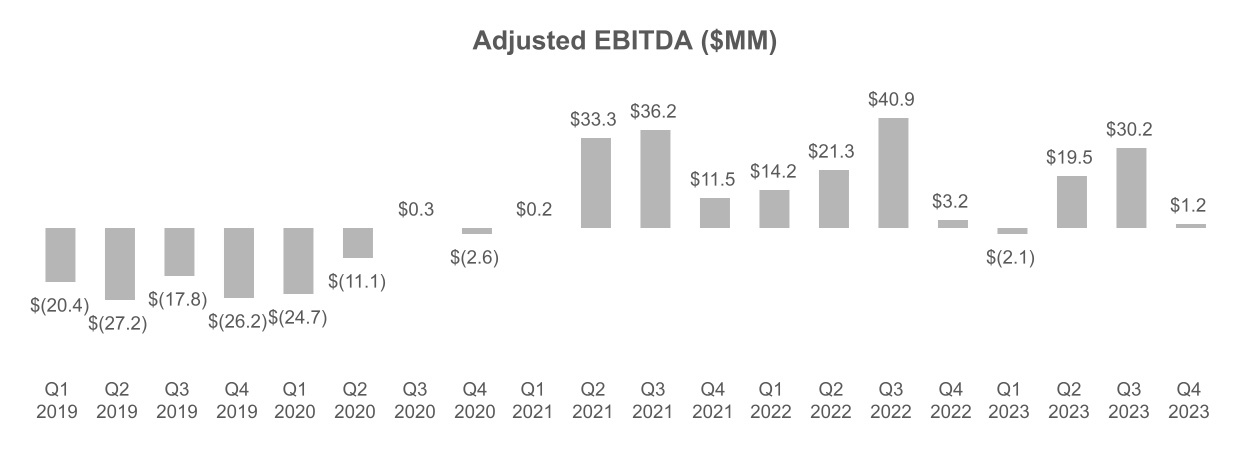

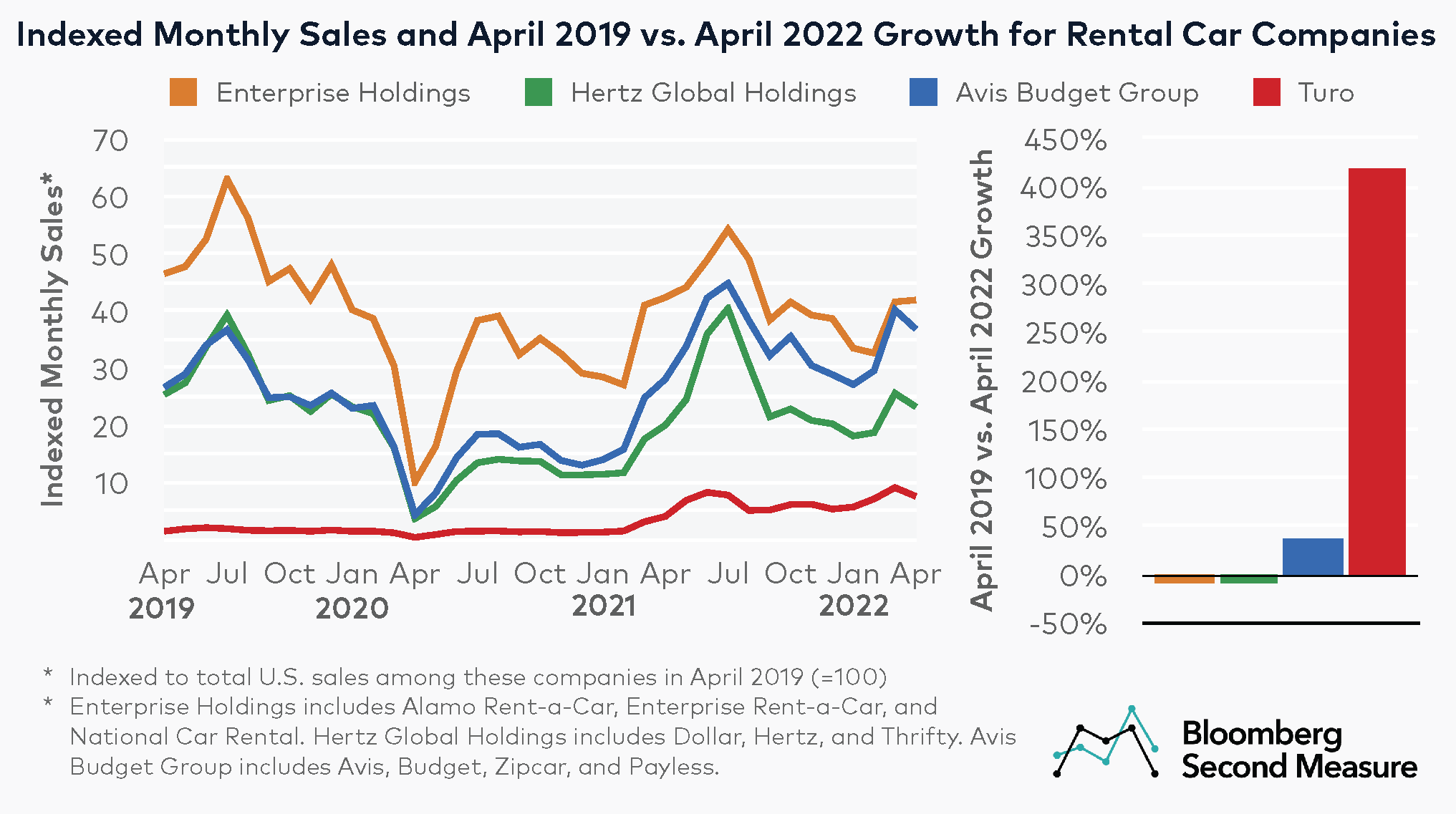

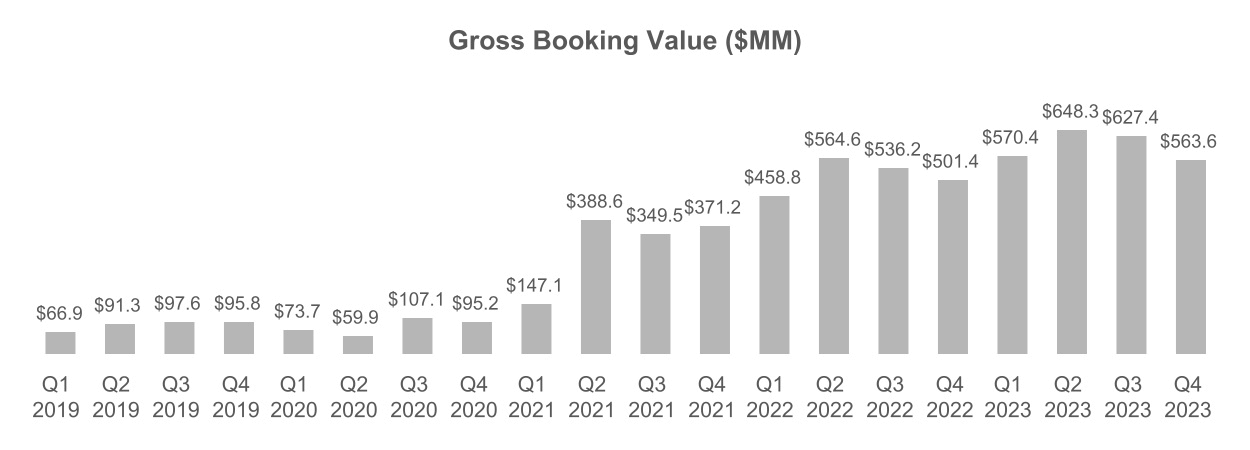

Turo's financial performance demonstrates rapid growth, albeit with some fluctuations in profitability and margins. In 2021, Turo generated $469 million in revenue, marking a substantial 213% year-over-year increase. This growth was driven by the pandemic's positive impact on demand for Turo's services, as well as higher rental prices due to a vehicle shortage. However, the growth rate decelerated in subsequent years, with revenue increasing by 59% in 2022 to $746.6 million and by just 18% in 2023 to $879.7 million. The decline in the rate of growth from 213% in 2021 to 18% in 2023 reflects the stabilization of the market as the effects of the pandemic waned.

Is Turo Profitable?

Despite the strong revenue growth, Turo has struggled with profitability. In 2021, the company posted a net loss of $40.4 million, but it turned profitable in 2022 with a net income of $154.7 million. However, profitability slipped again in 2023, with net income dropping sharply to $14.7 million, indicating challenges in maintaining profit margins. This decline in profitability is underscored by the adjusted EBITDA figures, which dropped from $81.1 million in 2021 to $48.8 million in 2023.

Source: sec.gov

Source: secondmeasure.com

Key Financial Metrics

Key business metrics also reflect Turo's expansion. The platform recorded 24.4 million booked days in 2023, up from 19.1 million in 2022 and 10.9 million in 2021. This growth aligns with an increase in Gross Booking Value (GBV), which rose to $2.41 billion in 2023 from $2.06 billion in 2022. However, the GBV growth rate has also slowed, highlighting the company's challenge in sustaining its earlier rapid expansion.

Source: sec.gov

Turo's platform saw significant user engagement, with approximately 3.7 million active guests and 170,000 active hosts by the end of 2023. Despite these strong engagement numbers, the slowing growth and declining profitability raise concerns about the long-term sustainability of Turo's business model in a competitive car-sharing market.

Source: appfigures.com

III. Turo IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

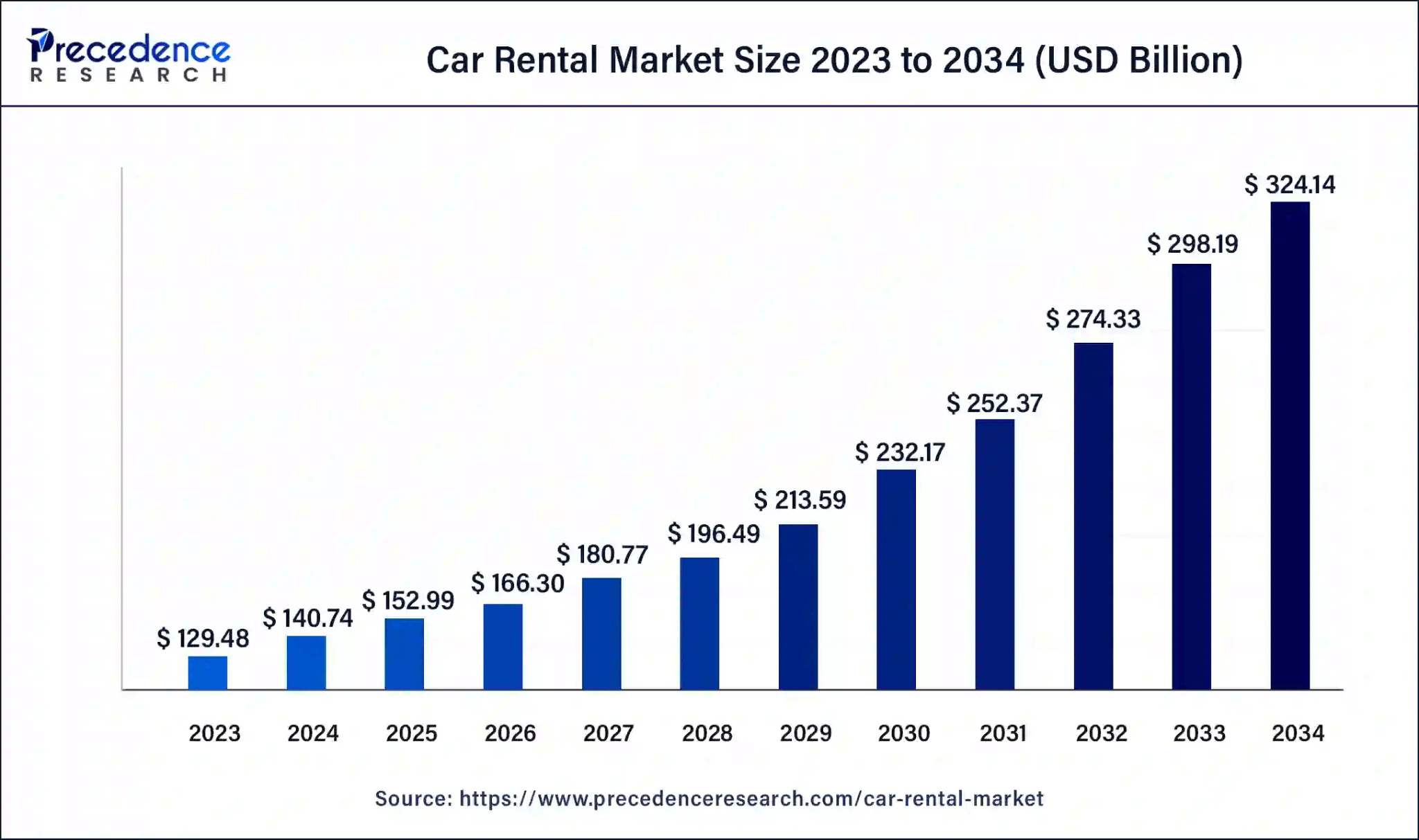

Turo operates within a massive $172 billion total addressable market (TAM), offering significant profitability potential and growth prospects. TAM includes North America ($85 billion), Europe ($60 billion), and the rest of the world ($27 billion). Serviceable Addressable Market (SAM) is $113 billion. With a conservative measure of long-term opportunity.

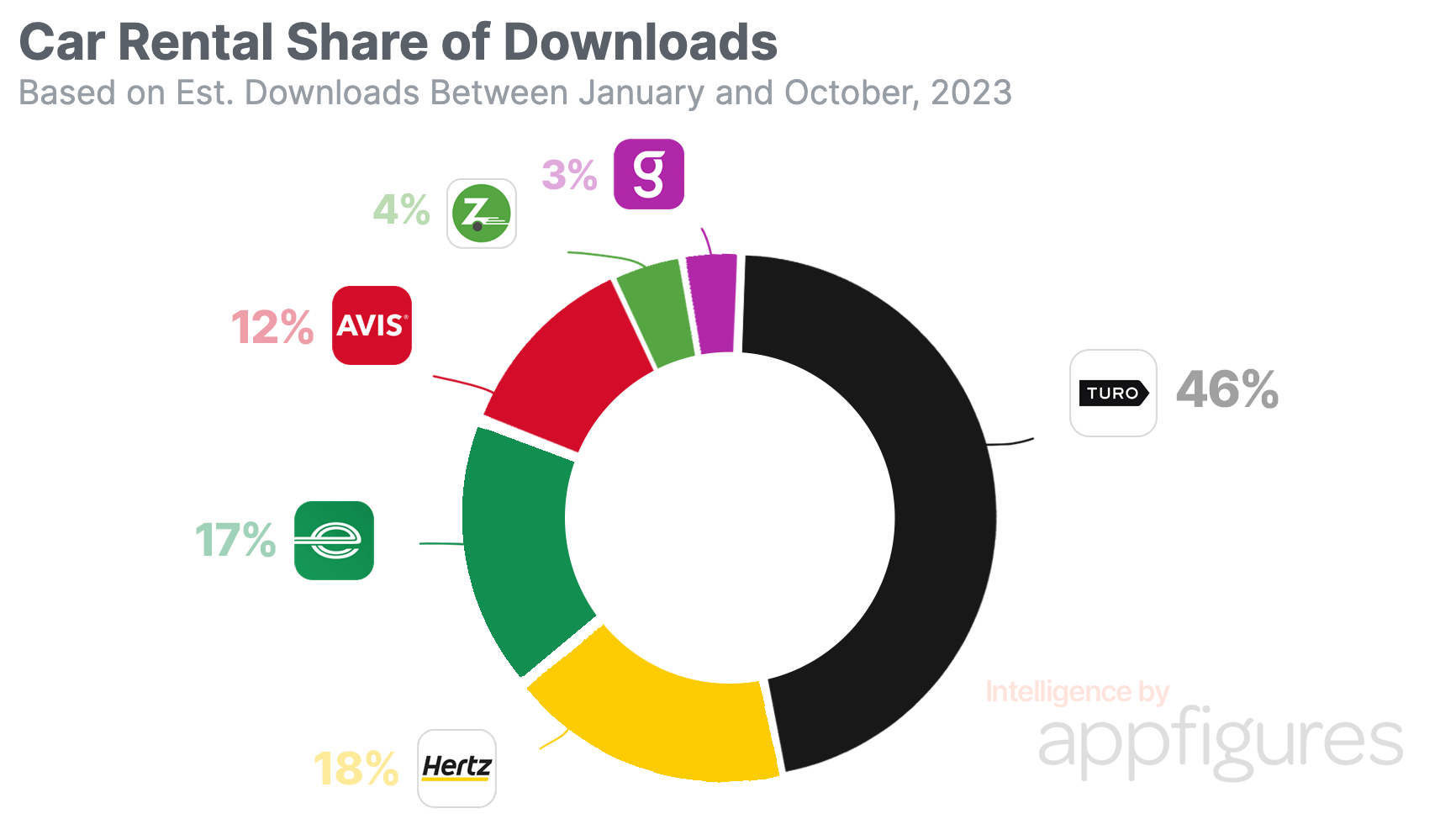

The peer-to-peer car-sharing platform has a unique competitive edge, particularly against traditional rental companies like Hertz and Avis, and direct competitors such as Getaround. Turo's platform hosts over 360,000 active vehicle listings, a figure that grew by 12% year over year, underscoring its expanding market presence.

One of Turo's primary competitive advantages is its diverse and exclusive inventory, featuring 1,600 unique makes and models. This positions Turo to capitalize on consumer demand for varied and personalized travel experiences, which traditional rental companies struggle to offer. The launch of limitless search and personalized content leveraging machine learning further enhances Turo's user experience, allowing customers to browse and select from this diverse inventory without restrictions on location or date.

Growth prospects for Turo are bolstered by several strategic initiatives. The company is actively expanding into new markets and enhancing its service offerings, such as introducing electric vehicle (EV) rentals and developing partnerships with automakers and travel platforms. This positions Turo to tap into the growing demand for sustainable travel options and aligns with broader industry trends towards electrification. As of December 31, 2023, electric vehicles represented approximately 9% of Turo vehicle listings.

Additionally, Turo's partnership with insurance companies through Turo Host Services helps mitigate one of the significant operational challenges for hosts—vehicle financing and insurance. This not only aids in retaining current hosts but also in attracting new ones, as Turo's hosts have already earned over $4 billion on the platform. The introduction of features like Book Instantly and Pay Later, along with the new passive income hosting program, further facilitates seamless user experiences, potentially driving higher repeat usage and host retention.

As per precedenceresearch.com, the global car rental market size is $141 billion in 2024 and may hit $324 billion by 2034 based on a CAGR of 8.7%.

Source: precedenceresearch.com

B. Weaknesses & Risks

However, Turo faces risks related to market saturation and the cyclical nature of the travel industry. Economic downturns, rising interest rates, and inflation could impact consumer spending and host profitability, particularly as the cost of vehicle financing increases. Additionally, Turo's profitability is closely tied to its ability to maintain and grow its host and guest base that could be challenging in a competitive market with fluctuating demand.

Turo Competitors

Turo faces competition from both peer-to-peer and traditional car rental services. Direct competitors include SnappCar and HyreCar, which offer similar car-sharing platforms. HyreCar specializes in renting vehicles for rideshare and delivery drivers, while SnappCar functions similarly to Turo. Traditional car rental companies like Hertz and Enterprise also pose a threat, offering extensive fleets across many countries. Additionally, Uber and Lyft Rentals provide similar services via their apps, and Zipcar, which owns its fleet, is another alternative. BlaBlaCar focuses on long-distance carpooling, and GIG Car Share serves specific regions in California.

Source: tickernerd.com

IV. Turo IPO Details

A. Turo IPO Date

Turo, the peer-to-peer car-sharing company, is expected to go public in mid to late 2024. While the exact date hasn't been finalized, the company's S-1 filing indicates that the IPO could occur within this timeframe.

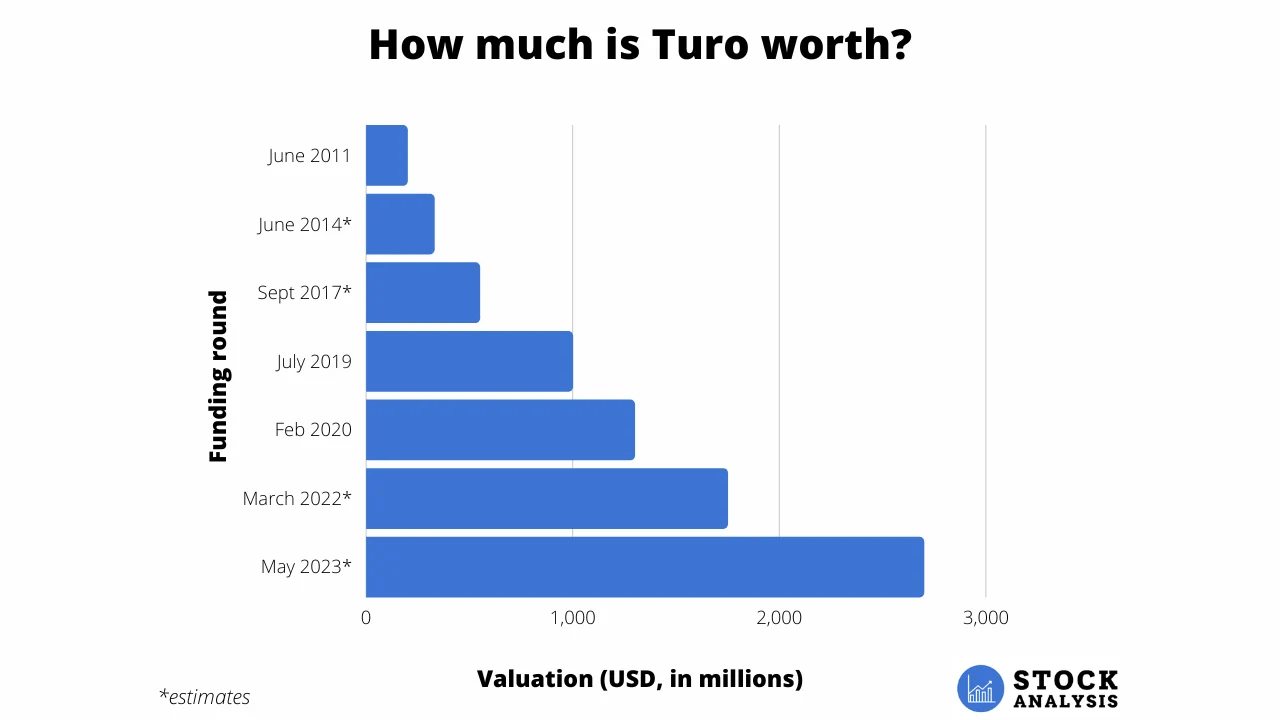

B. Turo Valuation

Turo's estimated valuation for its upcoming IPO is approximately $2.7 billion. This valuation reflects the company's growth in a burgeoning market for car-sharing platforms. Turo has raised a total of $523 million across 16 funding rounds, with key contributions including a $250 million Series E round in July 2019. Significant investors in these rounds include IAC, SK Holdings, Kleiner Perkins, and August Capital. Notably, the company's most recent funding round in April 2022 raised $35 million, further supporting its expansion efforts.

Source: stockanalysis.com

C. Share Structure & Analyst Opinions

The IPO is expected to offer a substantial number of shares, though the exact number remains undisclosed. Analysts anticipate a significant market capitalization given the $2.7 billion valuation. The share pricing is yet to be confirmed, but early speculation suggests it will be aligned with the company's strong revenue growth, which stands at an estimated $880 million annually. However, its net tangible book value (deficit) as of December 31, 2023 was $(321.8) million or $(19.97) per share.

Turo's share structure is complex, with a mix of common stock and redeemable convertible preferred stock. As of December 31, 2023, there were approximately 91.9 million shares of redeemable convertible preferred stock, which will automatically convert into common stock prior to the IPO. Additionally, there are a significant number of options and Restricted Stock Units (RSUs) that could dilute the share value post-IPO, depending on their exercise and vesting conditions. Specifically, there are about 13.2 million options with a weighted-average exercise price of $8.25 per share, along with 8.3 million RSUs.

Analyst opinions on Turo IPO are cautiously optimistic, given its leadership in a growing market. However, concerns remain about profitability and the competitive landscape. Some investment research reports suggest that Turo's path to profitability is still uncertain, and market conditions at the time of the IPO could significantly impact the stock's performance.

V. How to Trade Turo IPO & Turo Stock

Getting Turo IPO Shares

To acquire shares in Turo IPO, potential investors should begin by opening a brokerage account with a firm that has access to IPO shares. Examples include traditional brokers like Fidelity, Charles Schwab, or newer platforms like Robinhood, which often provide access to IPOs. Once your account is set up, monitor communications from your broker regarding Turo's IPO, as they will provide details on how to request shares. However, IPO shares are typically allocated based on factors such as account size and trading history, so availability may be limited for smaller investors.

Turo IPO & Turo Stock Trading Strategies

When trading Turo IPO, strategies should focus on either short-term gains or long-term investment potential. For short-term strategies, investors might consider the “IPO pop,” where stocks often surge on the first day of trading due to high demand. This approach involves buying shares early and selling them quickly for a profit. For long-term strategies, investors should evaluate Turo's fundamentals, market position, and growth prospects, potentially holding the stock to capitalize on the company's future expansion. However, given the volatility of IPOs, a balanced approach with careful risk management is advisable.

Ways to Trade Turo Stock

Once Turo stock is publicly traded, there are multiple ways to trade it beyond direct stock purchases:

- Exchange-Traded Funds (ETFs): Investors may also access Turo indirectly through ETFs that focus on tech or mobility companies. This method provides diversification, reducing the risk associated with investing in a single IPO stock.

- Contracts for Difference (CFDs): CFDs allow traders to speculate on Turo stock price movements without owning the actual shares. This approach enables leverage, increasing potential gains, but also risks. VSTAR, a trading platform known for its diverse financial instruments, offers the ability to trade Turo stock via CFDs. This flexibility can appeal to both short-term traders and those seeking long-term investment opportunities.

By leveraging these methods, investors can tailor their approach to Turo stock based on their risk tolerance and investment objectives.