StubHub is a dominant player in the online ticket industry, which has been on investors' monetization for a potentially profitable IPO, driven by its induction in the ticketing industry and advantageous live events. The platform was initially acquired in 2007 by eBay, and later in 2020, it was sold to Viagogo. The company is currently competing with giants in this sector like Vivid Seats, Eventbrite, and Ticketmaster, while the platform is gaining advantages following several unavoidable facts such as enormous inventory, trusted platform, and trustworthy customer base.

StubHub has been a privately operated company since its inception. The recent resurrection was driven by recent live events after the Pandemic, while the company bought attractions due to a demand surge in online tickets with significant industry growth. The governing body of the company recently hinted at an IPO possibility, especially when the tech-related stocks are soaring, making it an attractive investment asset.

The timing seems ideal and the company recently improved services to capitalize on the market growth as the platform is expanding besides taking strategic initiatives. It seems Stubhub might have promising growth soon as the company is now focused on improving its website and mobile app to achieve more user engagement and provide smoother services which will make ticket purchasing easier and elegant.

Taking all these into consideration, StubHub IPO is going to be an attractive investment opportunity for investors seeking to make money from the live event sector growth as traditional ticketing may be doomed shortly, and digitalization in this secto, according to demand, has significant space to further surge.

I. What is Stubhub

StubHub is a leading online marketplace for live event tickets, covering several types of events, including concerts, sports, theater, and other entertainment. The platform was founded by Eric Baker and Jeff Fluhr in 2000 and is headquartered in San Francisco, California. Since its inception, the company has become a remarkable one in the live events and ticketing industry.

The center of the StubHub business model is to offer a secondary ticketing marketplace where users can safely buy/sell tickets. The company ensures verified transactions and earns revenue through commissions from each sale. Although initially acquired by eBay in 2007, it was sold for $4 billion to Viagogo in 2020, and the platform maintains its brand besides taking advantage of Viagogo's international reach.

The platform's key customers are usually concert-goers, sports fans, and theater enthusiasts who rely on this company for access to tickets, which are often subject to high-demand events and sold-out. The company also partners with event promoters and venues, which delivers tools to reach broader customers and optimize ticket selling.

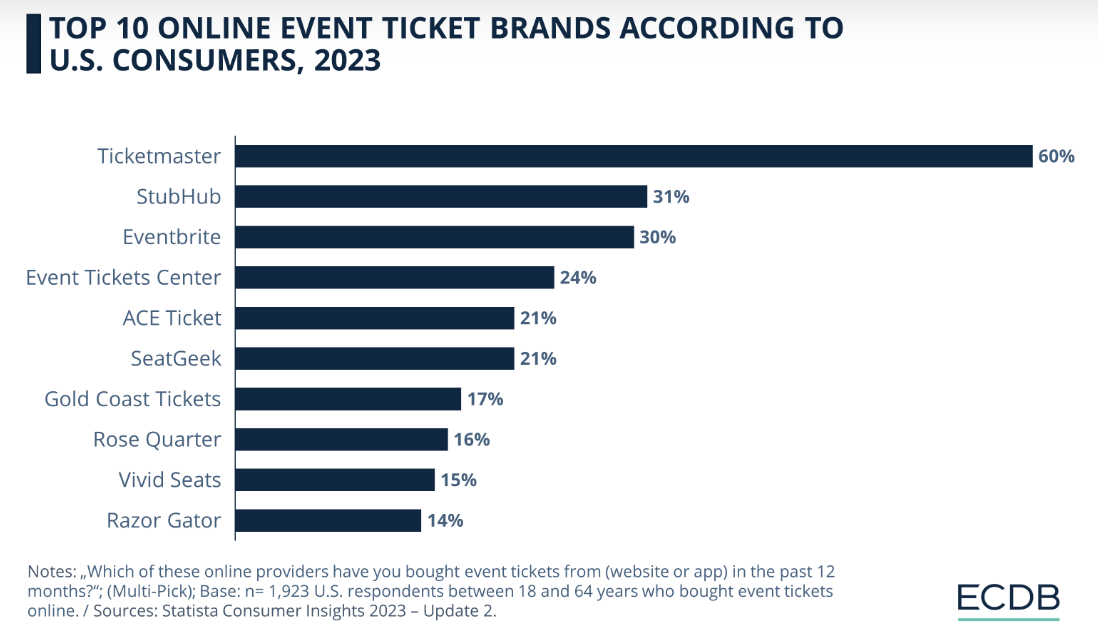

StubHub remains in second place among the top ten in the United States and now competes with similar giants in the sector like Eventbrite, Ticketmaster, and Vivid Seats. However, it holds a positive edge due to its emphasis on user experience, credibility, and broader range of inventory. Additionally, StubHub's recent movement in experiential offerings is another plus, as it will deliver fans and users incomparable and exclusive event experiences.

The company is projected to have further growth in the future under the ownership of Viagogo, especially as global demand surges in live events, which has recently declared IPO or going public, can be an attractive investment opportunity.

II. Stubhub Financials

StubHub has seen an enormous post-pandemic recovery driven by demand surge in live events and lift-up restrictions. The company is under the ownership of Viagogo and as per reports it generates annual revenue between $1 billion to $5 billion which is driven by several factors such as lift-up pandemic restrictions, demand surge in live events, expansions in a new era of experiential events and partnership with significant concert and sports promoters.

It allows customers from 170 countries, local language support, and transactions in multiple currencies. Despite the growth, the company reports having debt in billions and a cash reserve of approx. $500 million. It focuses on enhancing technology and cost efficiencies, allowing high margins and offering low fixed costs.

Key Financial Metrics

The company currently has millions of users, and the increasing number of fans and brokers contributes millions of ticket sales annually. StubHub currently focuses on improving its mobile platform and website which are enhancing the online ticket purchase experience.

The geographical reach is also remarkable as it currently operates in approx. 90 countries, and is getting popular among users due to prioritizing digital service enhancements.

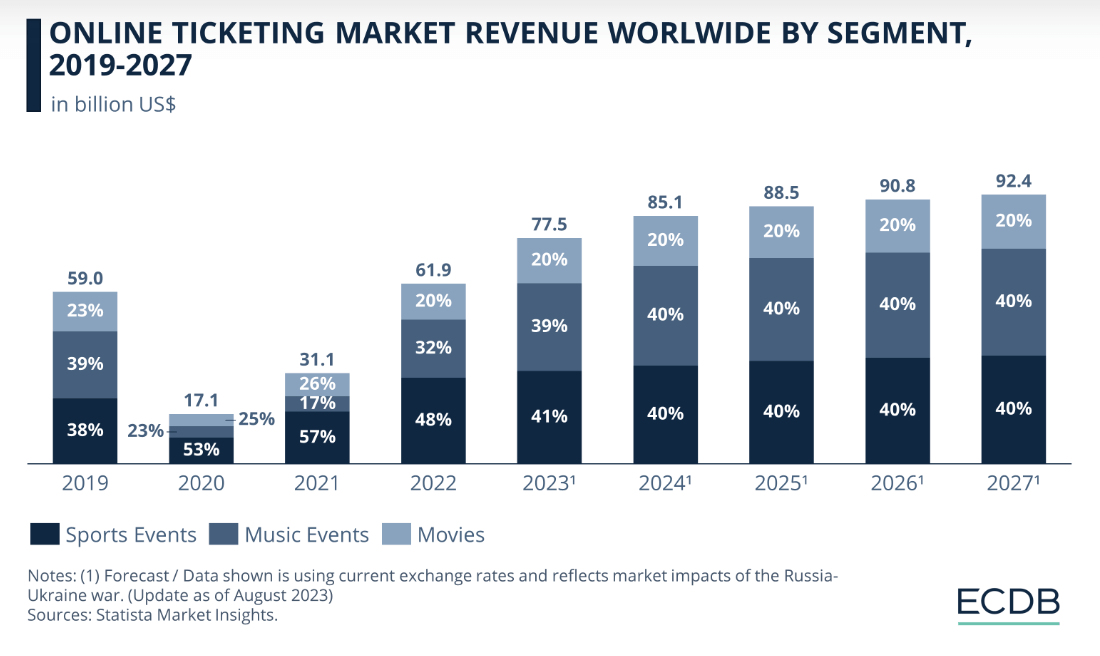

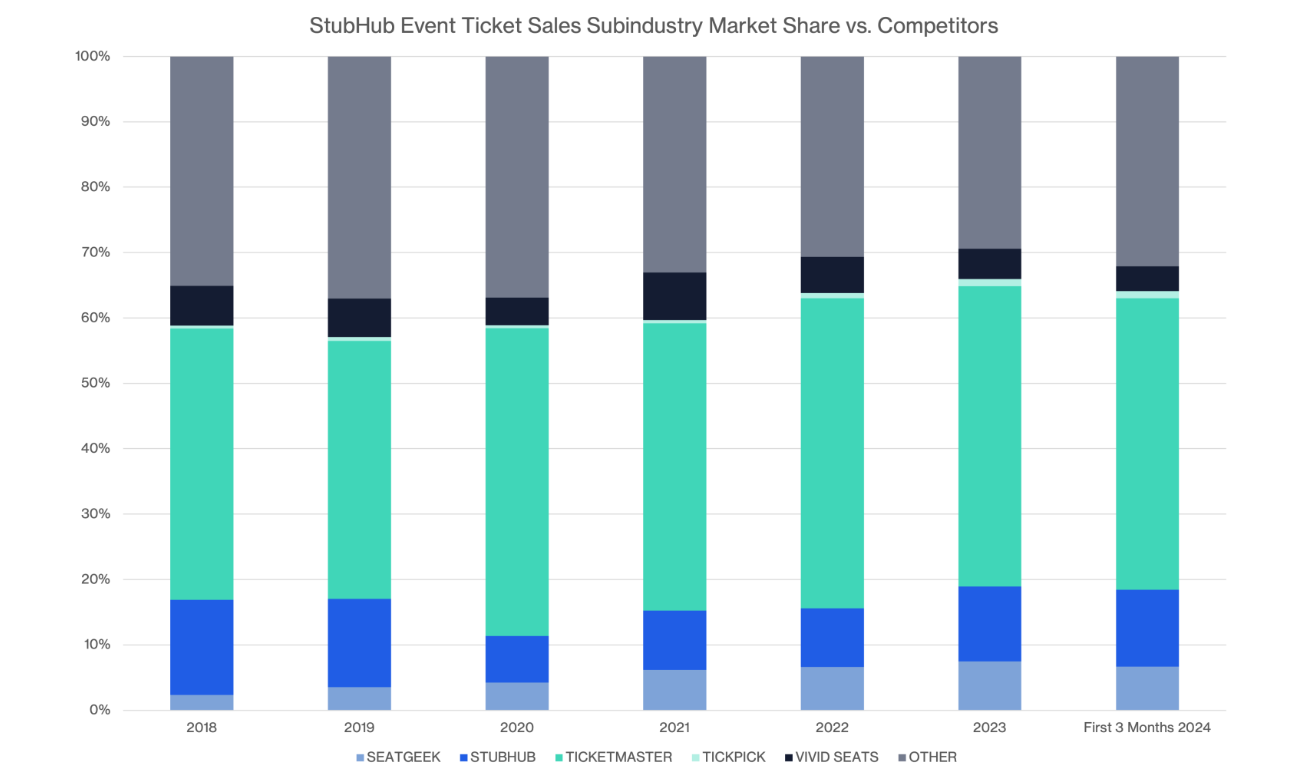

The market volume of online ticket purchasing is projected to grow by 2.54% in the next four years and may reach $94.06bn by 2028. The figure above contains StubHub's current market possessions and those of other competitors. StubHub is a remarkable marketplace for ticket resale as a reliable source for people who have extra tickets to sell or no longer plan to attend any events. Sometimes they resell it ten times more than the standard price.

The leading body confirms that in the United States, the average ticket price for 40% of concerts is under $50, while for 80%, it is below $100. StubHub is seeking a market valuation of $16.5 billion while going public.

III. Stubhub IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

StubHub has been providing ticket buy/sell services for over twenty years and is making progress gradually. The company's market share compared to other competitors is increasing rapidly, declaring rapid progress.

Focusing on fan-centric services, trusted platforms, and broader event inventory has profitability potential. Major industry players such as SeatGeek, Ticketmaster, Tick Pick, Vivid Seats, and others are competing with StubHub as the market expands.

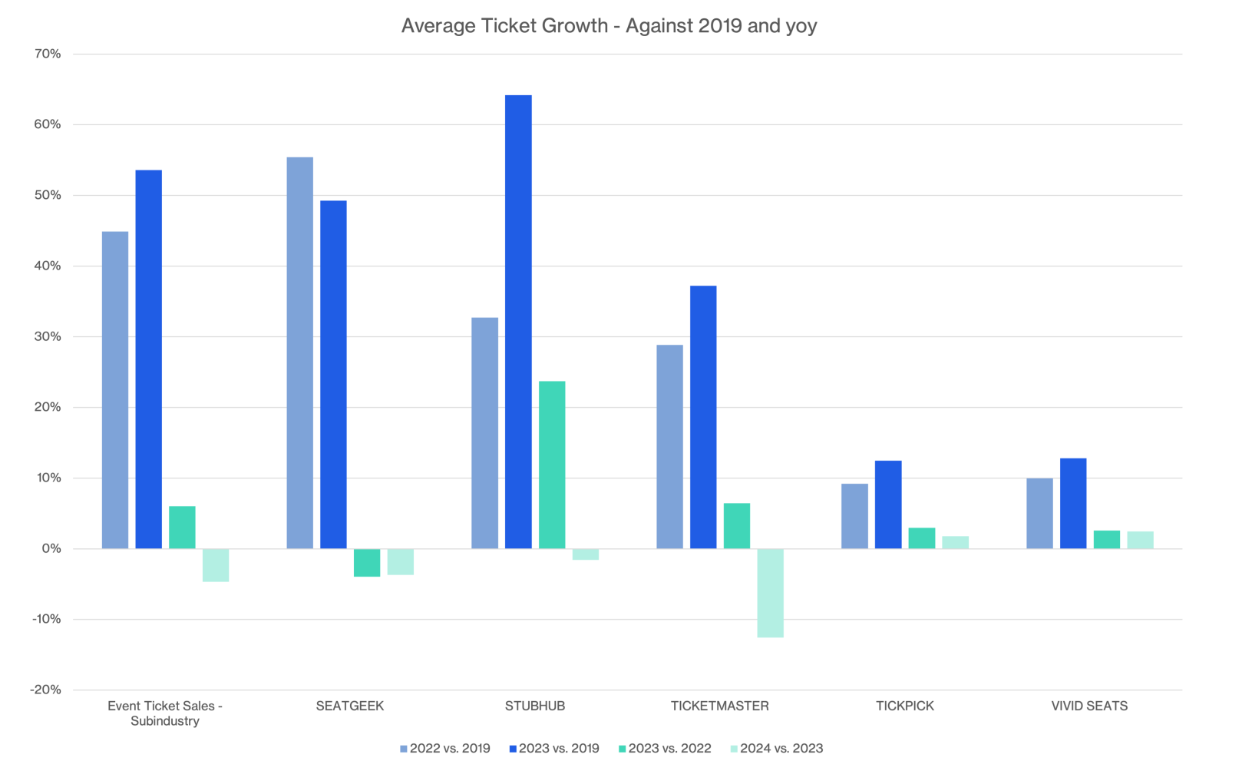

The figure above shows the demand surge in online ticket purchasing for StubHub and others in recent years before and after the pandemic. In comparison to 2019, ticket selling was boosted by 40% in 2022 and 2023.

The ticket selling surged by 60% in 2023 alone partially driven by a renewed partnership with MLB as an authorized marketplace for ticket selling, especially in basketball season.

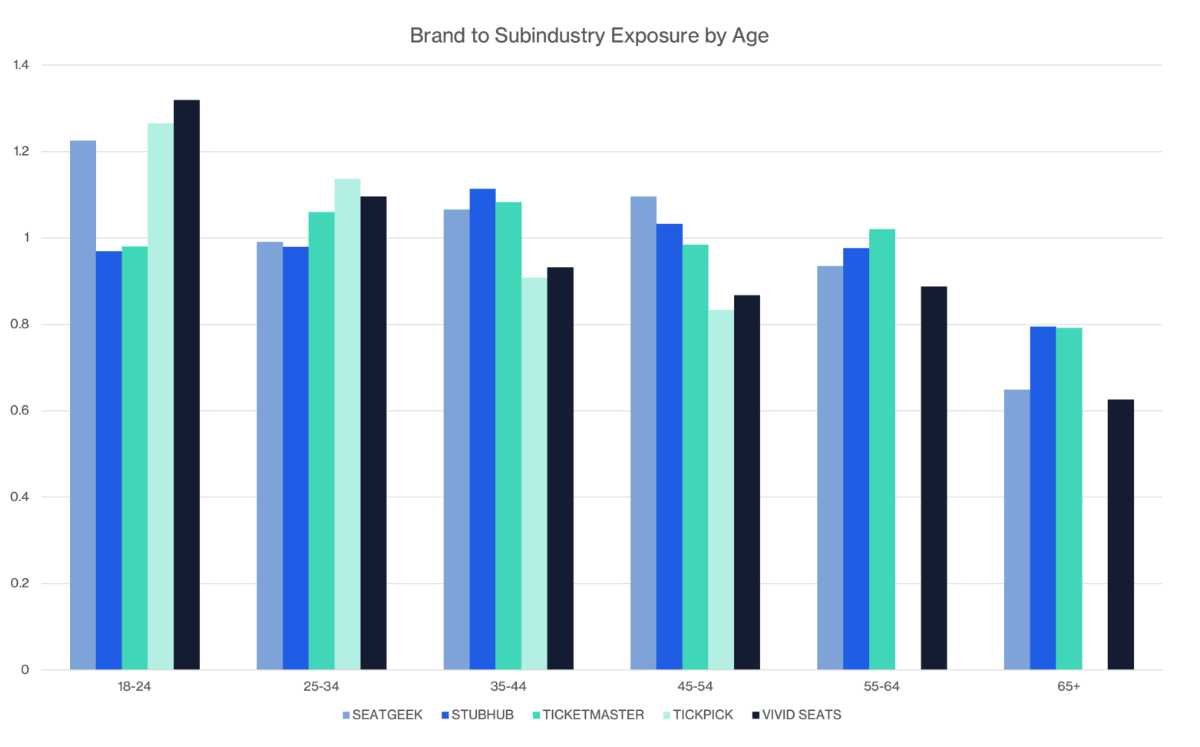

The figure above shows consumers of various ages use online ticket-purchasing platforms to participate in or join various live events. It reveals that StubHub has the majority of consumers aged between 35 and 44, while many other competitors might have 18-24-year-old consumers, which is positive. For example, Vivid Seats’ loyalty and sports betting options and TickPick’s no-fee model attract younger fans.

In contrast, StubHub keeps faith in an older demographic drawn to its trusted reputation. StubHub has nineteen partners, among them, fourteen are institutional.

B. Weaknesses & Risks

- Economic uncertainty and volatility are primary challenges for StubHub to go public. The company also faces competition from similar companies, which offer loyalty programs and no-fee models that attract younger and cost-efficient customers.

- Other remarkable risk factors are legal scrutiny and regulatory challenges. The company faced criticism for allowing scalpers and bots to manipulate prices and dominate ticket availability, subjected to the BOTS Act and compliance. A lawsuit related to fraudulent ticket selling may be subject to an artist's reputation, the abnormal ticket price surge, and raise ethical concerns that may harm the reputation of the company.

- Additionally, depending on older customers significantly is not a good move just before IPO, so StubHub may consider younger customers' demand for rewards, experiences, and transparency. However, balancing these risks and addressing regulatory concerns are essential for StubHub, especially in this pre-IPO period as it will lead to future growth of the company.

IV. Stubhub IPO Details

A. Stubhub IPO Date

As of writing, StubHub First reported filing for IPO in January 2022 secretly according to Bloomberg, and now delaying due to market uncertainty. It will resubmit the papers in the United States Security and Exchange Commission (SEC) as the IPO time changes. The American ticket exchange and resale company may be looking at a summer IPO after Labour Day as many sources confirm, with no exact date published.

B. Stubhub Valuation

The potential IPO estimation valuation for StubHub is currently $16.5 Billion as of 2021, the last private funding round. The final valuation might vary depending on several factors such as the timing of the IPO and market conditions. The company already worked with major players like Goldman Sachs and JP Morgan for preparation purposes of going public.

The last StubHub acquisition, which was made for $4.05 billion in 2019 by Viagogo, declared a growth trajectory and made it a significant player in the industry. There is a significant challenge in that the company has a debt of over $2 billion, subject to the question of how they are going to use the IPO fund and balance financial stability and growth. IPO timing is an essential factor as it can impact success.

Major Funding Rounds & Total Funding

|

Funding Date |

Round Name |

Funding Amount |

Investors |

|

Jan 16, 2001 |

- |

- |

- |

|

Mar 12, 2002 |

Series B |

Undisclosed |

Allen & Company, Mike Slade, and 1 more |

|

Mar 02, 2004 |

Series C |

$4M |

- |

|

Jan 04, 2006 |

Series D |

$12.3M |

- |

|

Jun 01, 2020 |

Series D |

Undisclosed |

The Stephens Group |

|

Dec 23, 2021 |

Series E |

$35M |

Digital Fuel Capital |

StubHub raised $53.4M in six rounds, four large-stage rounds, and two early-stage rounds. In the latest round, in 2021, it raised $35M.

C. Share Structure & Analyst Opinions

As of writing the details on share numbers, pricing, etc are currently not available as till now StubHub operating as a private company. When companies go public, they usually issue a substantial number of shares to match the expectation of raised funds, in this case, the figure is $16.5 Billion. The capitalization amount will depend on the share price and the number of issued shares.

There is no official investment report on StubHub's IPO, but many analysts anticipate it as a potential investment asset due to its dominant position in the ticket-selling marketplace and rapid progress in recent years.

V. How to Invest in Stubhub IPO & Stubhub Stock

Getting StubHub IPO Shares

If you want to invest in StubHub IPO shares, you must first check on supported platforms like brokerages, banks, or other intermediary institutes. Often, investors are required to open an account and pass verification tests to be eligible to perform trades.

When all these occur successfully, you may deposit capital and easily invest in StubHub pre-IPO shares even before the market launches. So it would be better to keep an eye on the official report release about the StubHub IPO and related info like authorized brokers or mediums to access the asset.

StubHub IPO Trading Strategies

Once the shares of StubHub become available on the marketplace, you can participate in trading using various methods. Experts often use momentum-based investment methods, check on past performance, moving averages, candlestick patterns, etc. for opening adequate trading positions.

You can invest using short-term trading methods, such as day trading, swing trading, etc., or hold on to the asset for a longer period to generate sufficient profits.

Ways to Trade StubHub Stock

There are various ways to invest in StubHub stock, but the safest and most reliable method is to invest in ETFs. ETFs, or Exchange Traded Funds, usually track the performance of the actual asset and reflect the price movements of the particular trading instrument. Investors can benefit from investing in ETFs for many assets as it doesn’t require purchasing the actual asset and reduces the hassles involved in buying or selling a particular asset.

Investors can also consider the option trading method when investing in StubHub shares, as it allows them to open positions at a particular price.

CFD trading, or contract-for-difference trading, would be another elegant approach when trading StubHub stocks. It allows investors to use huge margins and have low costs on trades. Investors can participate in a single click and enable going long or short.