Stripe is IPOing to capitalize on its vital growth, profitability, and dominant market position in the fintech industry. The company's IPO has generated considerable interest due to its solid financial performance, including processing over $1 trillion in payments annually, and its solid customer base featuring major tech companies.

Additionally, Stripe's suite of services and global reach position it well for continued expansion, making it an attractive investment opportunity for both institutional and retail investors. The IPO offers a chance to invest in one of the most valuable and influential private fintech firms transitioning to the public market.

I. What is Stripe

Stripe is a leading technology company in the financial services and software as a service (SaaS) industries. It was founded in 2010 by brothers Patrick and John Collison. The company is headquartered in San Francisco, California.

Business Model and Core Services

Stripe's business model revolves around providing a suite of payment processing software and APIs for e-commerce and other types of businesses. Their core services include:

- Payment Processing: Enabling online payments for businesses, handling everything from card payments to local payment methods.

- Stripe Connect: Facilitating payments for multi-sided platforms like marketplaces.

- Stripe Atlas: Assisting startups with company formation, including incorporation and opening bank accounts.

- Stripe Radar: Offering fraud prevention tools to secure transactions.

- Stripe Issuing: Allowing businesses to create, manage, and distribute virtual and physical cards.

- Stripe Terminal: Providing solutions for in-person payments.

- Billing: Supporting recurring billing and subscription management.

- Treasury: Offering banking-as-a-service capabilities.

Key Customers

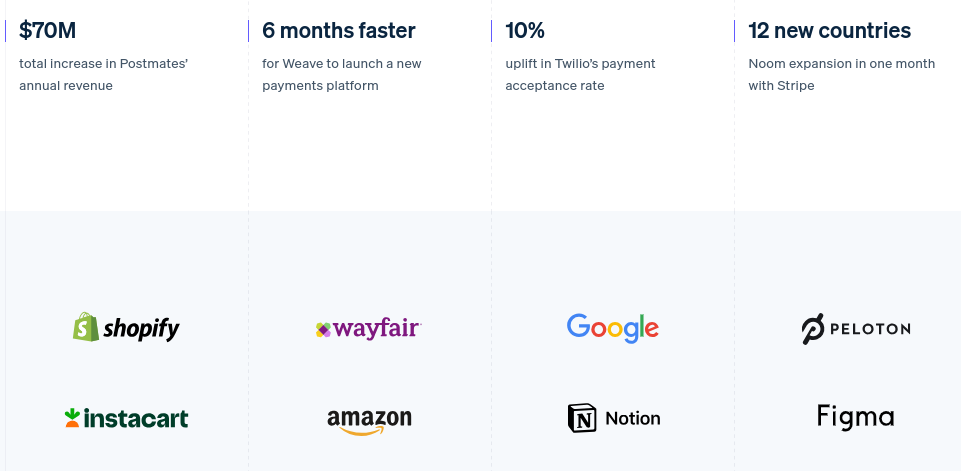

Stripe serves a diverse range of customers from small startups to large enterprises. Key customers include tech giants like Amazon, Google, and Shopify, as well as other businesses such as Zoom, Lyft, and Slack. This broad customer base highlights Stripe's versatility and scalability across different sectors and business sizes.

Source: stripe.com

Who Owns Stripe

Stripe remains a privately held company. The ownership is primarily divided among the founders, Patrick and John Collison, early investors, employees, and institutional investors. Major investors include venture capital firms such as Sequoia Capital, Andreessen Horowitz, Goldman Sachs Asset and Wealth Management, and Tiger Global Management. Despite remaining private, Stripe has undergone multiple funding rounds, raising vital capital and achieving a high valuation, positioning it as one of the most valuable private fintech companies globally.

II. Stripe Financials

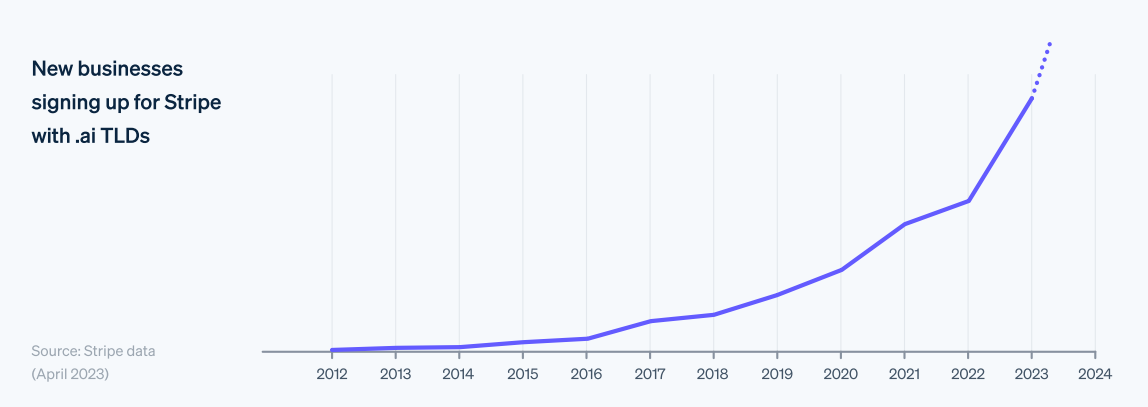

Stripe's 2023 annual report reflects a solid financial performance, emphasizing considerable revenue growth, profitability, and operational edge. Stripe processed over $1 trillion in total payment volume in 2023, marking a 25% increase from the previous year. This growth significantly outpaces the 7.6% growth in U.S. e-commerce, underscoring Stripe's rapid expansion and market penetration (like AI adoptions/sign-ups). This volume milestone translates to approximately 1% of global GDP, highlighting Stripe's vital impact on the global economy.

Source: Stripe-2022-update

In terms of profitability, Stripe achieved positive cash flow in 2023 and expects to maintain this trend in 2024. This profitability is crucial as it allows Stripe to reinvest in long-term projects without being overly concerned about market volatility. Such a stable financial foundation reassures customers of Stripe's ability to provide consistent, reliable infrastructure.

Key Financial Metrics

Total Transaction Volume Processed: The company surpassed the $1 trillion mark in payment volume processed in 2023. This milestone, representing a 25% year-over-year increase, showcases Stripe's capability to handle large-scale transactions sharply and its growing footprint in the payment processing industry.

Customer Base Growth: Stripe's customer base has also expanded significantly. The number of new businesses joining Stripe increased by 19% in 2022, with over 1,000 new ventures launching daily. Notably, 55% of these new businesses were based outside the U.S., reflecting Stripe's successful international expansion. Additionally, more than 100 companies now process over $1 billion annually with Stripe, with this segment growing by more than 50% each year since 2018.

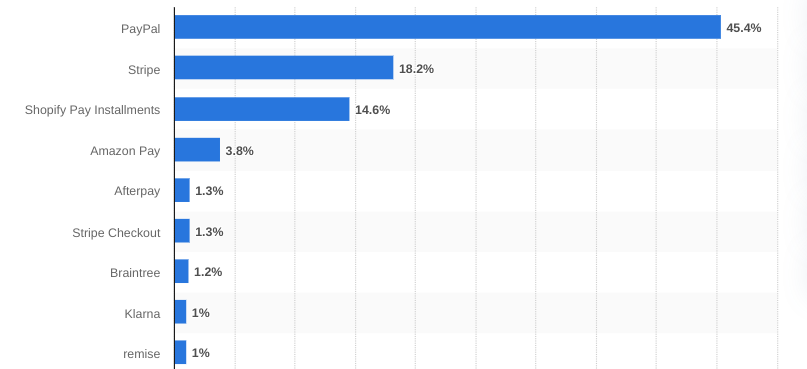

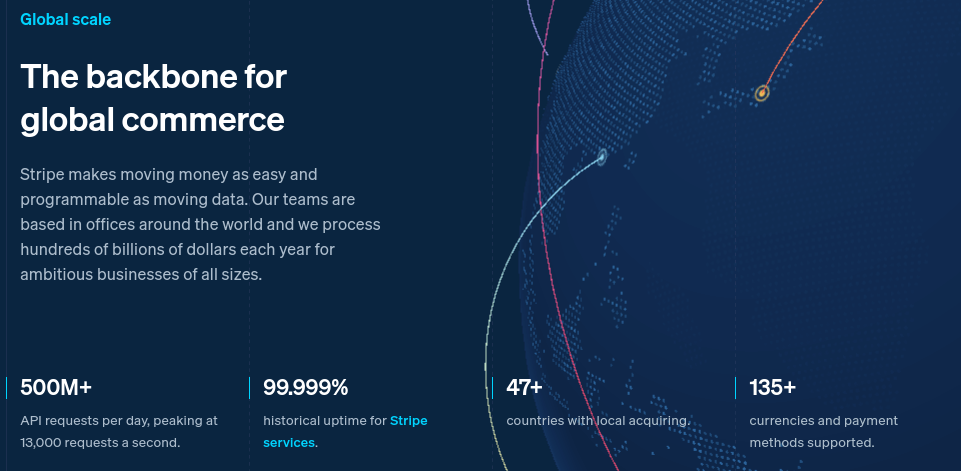

Market Share in the Payment Processing Industry: Stripe's share in the payment processing market is vital. With businesses on Stripe processing about 1% of global GDP, Stripe has established itself as a critical player in the global payments ecosystem. Its ability to support over 100 payment methods and its extensive international reach further solidify its competitive position.

Analysis and Implications

The reported metrics and financial performance indicate that Stripe is on a strong growth trajectory. The 25% increase in total transaction volume year-over-year demonstrates not only Stripe's operational capabilities but also its growing adoption among businesses of all sizes. The solid cash flow and profitability underscore a sustainable business model capable of supporting long-term investments and innovation.

The considerable growth in Stripe's customer base, especially its international expansion, highlights the company's ability to attract and retain diverse businesses globally. This growth is facilitated by Stripe's continuous improvement in its product offerings, such as the addition of 50 new payment methods in the past year, which cater to the varied needs of global markets.

Stripe's market share, supported by its solid transaction volumes and customer base growth, positions it well to continue capitalizing on the increasing shift towards online and digital payments. The company's strategic focus on reducing barriers to online purchases through optimized checkout processes and expanded payment method support aligns well with market trends towards more seamless and diverse payment options.

[Most used payment processing technology - including payment gateways and BNPL (buy now, pay later) - on websites worldwide as of February 2024]

Source: statista.com

III. Stripe IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

The payment processing industry is experiencing rapid growth, driven by the increasing adoption of e-commerce, digital transactions, and global digitalization trends. The market is highly competitive, with major players like PayPal, Square, and dLocal vying for dominance.

Stripe's Competitive Advantages:

Stripe has established itself as a lead through its developer-centric platform, vast suite of APIs, and global reach. Unlike PayPal, which is consumer-facing, Stripe focuses on providing solid infrastructure for businesses, facilitating seamless integration of payment processing into their services. Stripe's scalability and ease of use have made it a favorite among startups and tech companies.

Stripe also distinguishes itself with its extensive international reach, supporting payments in over 135 currencies and offering localized payment methods. This global focus is a considerable advantage over Square, which primarily serves the US market. Additionally, partnerships with major companies like Accor enhance Stripe's credibility and market penetration, offering vital future growth opportunities in the hospitality sector and beyond.

Source: stripe.com

B. Weaknesses & Risks

Dependence on Shopify:

One considerable risk is Stripe's heavy reliance on Shopify, a major client that contributes vitally to its revenue. Any negative changes in this partnership, such as Shopify developing its own payment processing capabilities, could materially impact Stripe's financial performance.

High Valuation:

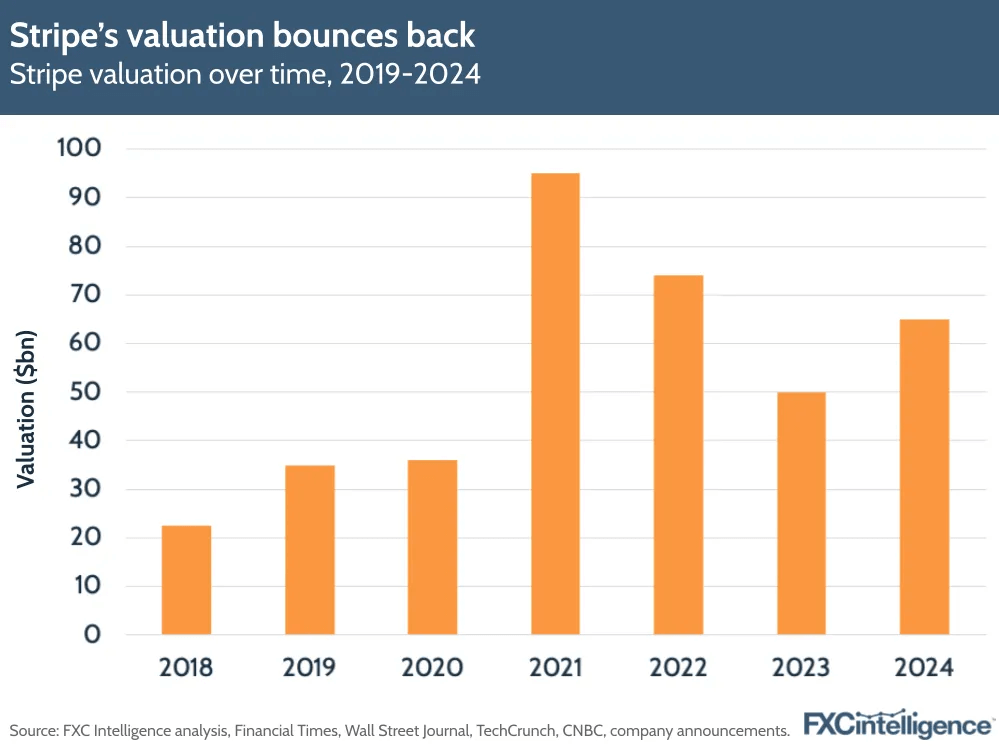

Stripe's high valuation poses another risk. As of its latest funding round, Stripe was valued at around $65 billion. This lofty valuation sets high expectations for growth and profitability, and any failure to meet these expectations could result in considerable market corrections. The IPO market has shown volatility, especially for tech companies with high valuations, as seen with previous IPOs in the fintech space.

Regulatory and Competitive Pressures:

Stripe operates in a highly regulated industry, and compliance with varying international regulations can be challenging and costly. Additionally, the competitive landscape, with giants like PayPal and innovative newcomers like dLocal, means Stripe must continuously innovate to maintain its competitive edge.

IV. Stripe IPO Details

A. Stripe IPO Date

The Stripe IPO is anticipated within 2024, with specific dates yet to be confirmed. Key milestones to watch include the filing of the S-1 registration with the SEC, the subsequent roadshow period, and the pricing of the shares. These events typically occur over a few months, with the roadshow happening 2-3 weeks before the IPO date.

B. Stripe Valuation

Stripe's valuation for the IPO is expected to be between $50 billion and $70 billion. This range reflects investor expectations based on the company's growth trajectory and market position in the fintech sector.

C. How Much Has Stripe Raised to Date?

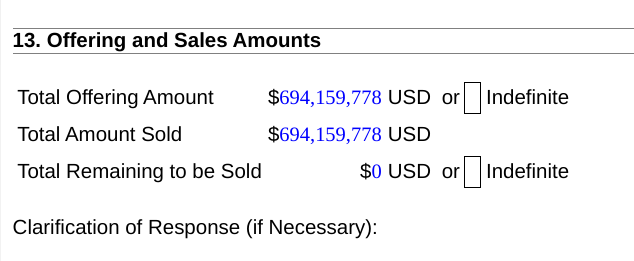

As of the last funding round, Stripe has raised approximately $9.81B over 24 rounds. Major funding rounds include a $600 million round in March 2021, which valued the company at $95 billion ($65 billion in 2024), and earlier rounds that saw investments from major venture capital firms like Sequoia Capital and Andreessen Horowitz. With the latest funding round [2024-04-08], as per latest SEC filing, the company may have derived $694 million.

Source: bloomberg.com

Source: SEC filings

D. Stripe IPO Share Structure

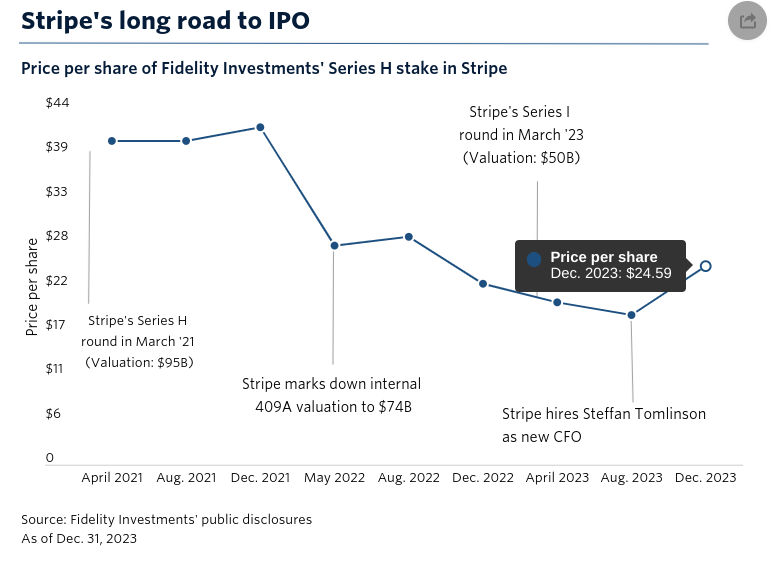

The exact number of shares to be offered and their pricing will be detailed in the S-1 filing. The street predicted that Stripe may offer 5-10% of its total shares, aiming to raise between $5 billion and $7 billion, with an expected market capitalization reflecting the company's valuation range of $50-$70 billion. As per Fidelity Investments' Series H stake in Stripe, the price per share is marked up at $24.59.

Source: pitchbook.com

E. Analyst Opinions on Stripe IPO

Analyst perspectives on Stripe IPO are generally positive, highlighting its strong market presence, solid revenue growth, and innovative product offerings. Investment research reports suggest a high demand for Stripe shares, given its dominant position in online payments and potential for continued expansion into broader financial services. However, some caution is noted regarding market volatility and competition in the fintech space, which could affect post-IPO performance.

V. How to Trade Stripe IPO

A. Getting Prepared for Stripe IPO

Before trading the Stripe IPO, thorough research and analysis are crucial. Understand Stripe's business model, financial health, market position, and growth potential. Assess industry trends and competitor performance. Open a trading account with a broker like VSTAR, which offers low fees, tight spreads, and fast execution, to ensure sharp trading.

B. Stripe IPO Trading Strategies

Day Trading vs. Long-Term Investing: Decide between day trading, which capitalizes on short-term price movements, and long-term investing, focusing on Stripe's growth potential over years. Day trading requires constant market monitoring and quick decision-making, while long-term investing demands patience and a solid understanding of Stripe's business fundamentals.

Risk Management Techniques: Implement risk management strategies such as setting stop-loss orders to limit potential losses and diversifying portfolio to mitigate risk. Use position sizing to avoid overexposure to a single stock, and stay updated with market news and trends.

C. Post-IPO Trading

Monitoring Stock Performance: After Stripe's IPO, closely monitor the stock's performance, especially in the initial days, as prices can be volatile. Watch for considerable news, quarterly earnings reports, and analyst ratings that could impact stock prices.

Strategies for Dealing with Volatility: In periods of high volatility, consider using limit orders to control the price at which you buy or sell stocks. Avoid emotional trading and stick to a pre-defined trading plan. Be prepared to adapt the strategies based on market conditions.

D. Why Trade Stripe Stock with VSTAR

Trading Stripe stock with VSTAR offers several advantages:

- Regulated Platform: VSTAR is regulated by the Cyprus Securities and Exchange Commission (CySEC), ASIC, and FSC, ensuring a secure trading environment.

- Tight Spreads and Fast Execution: Benefit from ultra-low trading costs and rapid order execution, enhancing profit potential.

- Institutional-Level Trading Experience: Enjoy 0 commission fees, deep liquidity, and reliable execution, catering to both professional traders and beginners.

- VSTAR's solid features and regulatory compliance make it an ideal choice for trading Stripe's IPO, offering tools and support to optimize trading strategies effectively.