SpaceX first proposed an IPO plan in March 2020, when COO Gwynne Shotwell suggested Starlink could be a spinoff candidate. However, Elon Musk hesitated due to SpaceX's long-term goals, like Mars missions, which may conflict with public market pressures. Interest in a SpaceX IPO has surged due to its dominance in reusable rockets and satellite internet (Starlink), securing a recent valuation of $210 billion. Its significant government contracts and leadership in the $1 trillion projected space economy highlight SpaceX's potential to reshape sectors like space tourism, manufacturing, and communications, making the IPO highly attractive to investors.

Source: CNBC

I. What is SpaceX

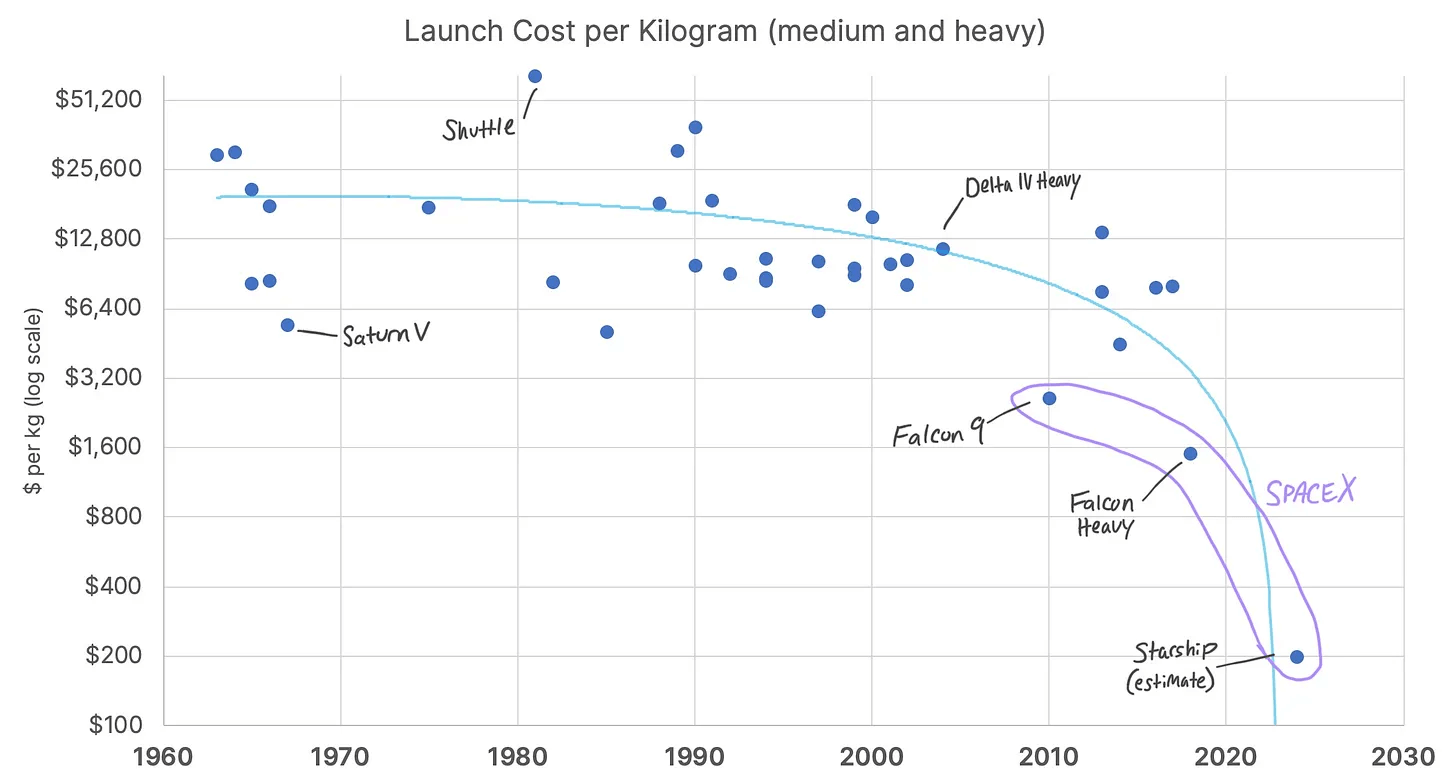

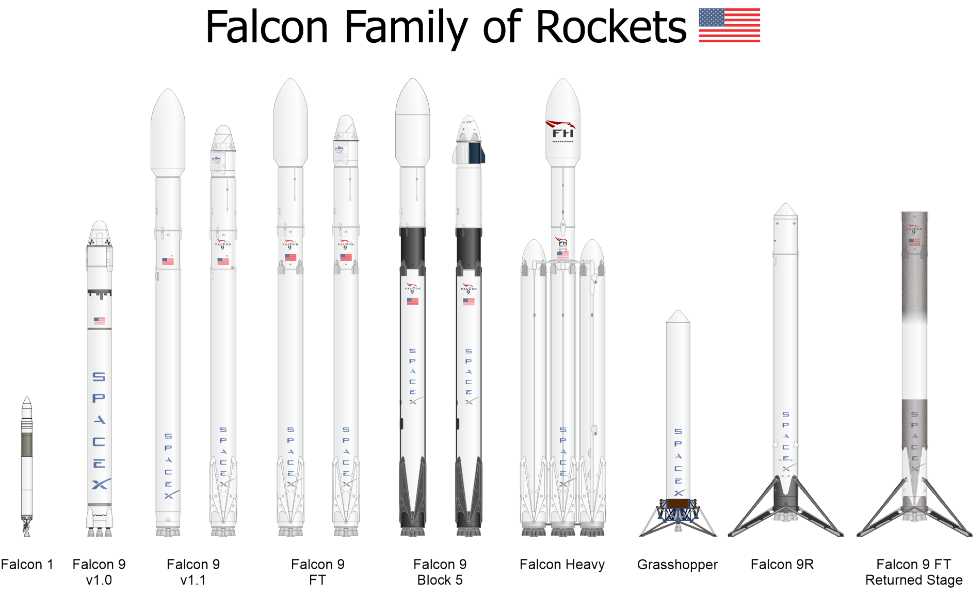

SpaceX, founded in 2002 by Elon Musk, is a private American aerospace manufacturer and space transport services company based in Hawthorne, California. It revolutionized space exploration by offering a low-cost, reliable alternative to traditional rocket launches. Unlike United Launch Alliance (ULA), SpaceX targeted government and commercial markets, focusing on affordable payload deployment services for satellites and national security applications. Its first rocket, Falcon 1, cost one-third of the 1980s-era Space Shuttle ($/kg of payload), and through reusable technology, its launch costs have decreased further, enhancing accessibility to space for more clients.

Source: futureblind.com

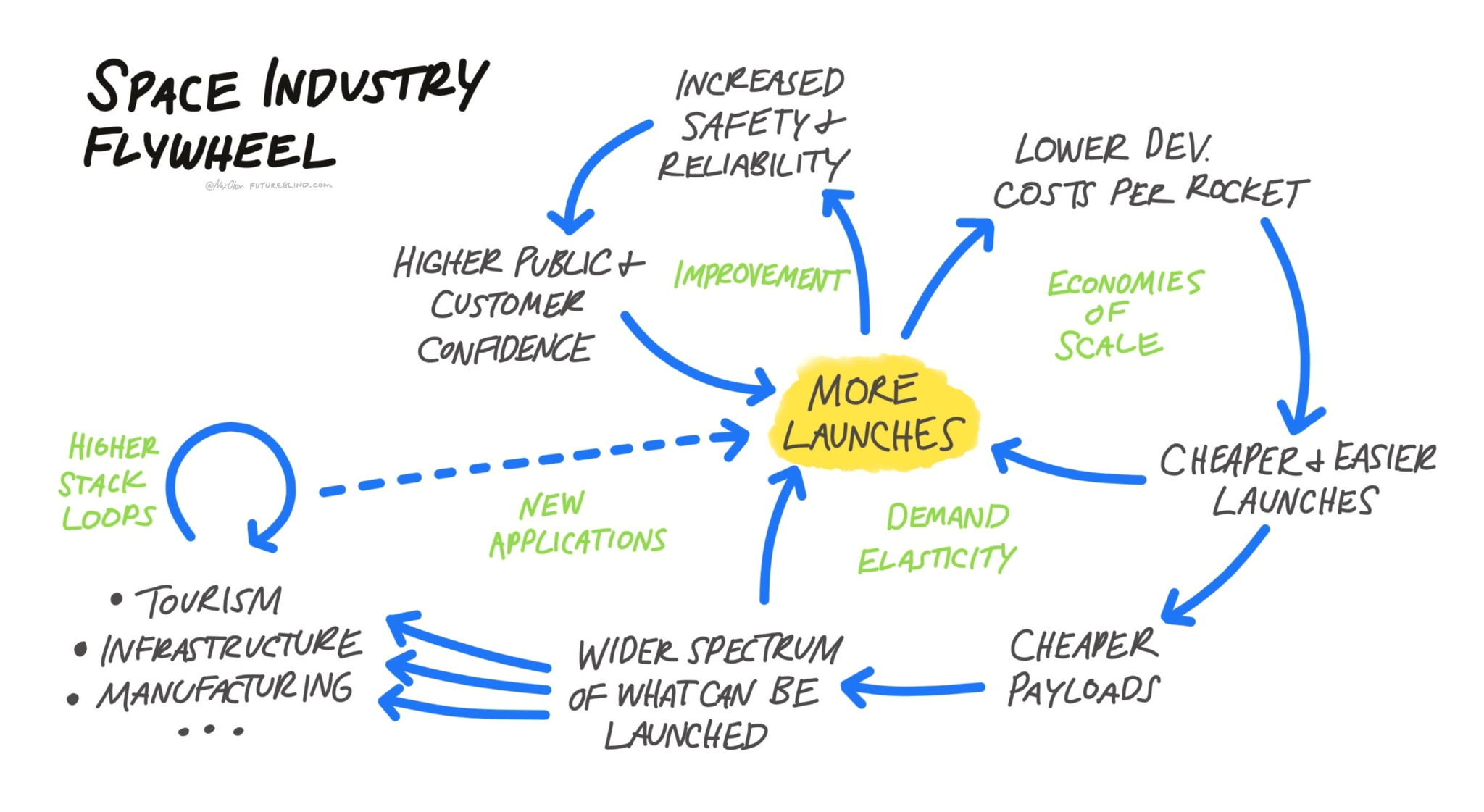

SpaceX's business model is anchored on a flywheel effect, where revenue from launch services is reinvested into R&D to create advanced reusable rockets, making each launch increasingly cost-efficient. This setup allows SpaceX to gain more contracts, creating a steady revenue stream that supports its larger mission to enable human life on Mars. Its notable launches include the Demo-2 mission on May 30, 2020, which transported NASA astronauts to the ISS, underscoring its growing capability and ambition in space transport.

SpaceX has 225 investors, including 222 institutional and three angel investors, with significant backers like Fidelity Investments, Google, Sequoia Capital, and NASA. Recent investments highlight SpaceX's global appeal, with contributions from Intesa Sanpaolo (Italy), Mirae Asset (South Korea), and ADH (UAE), among others. Through Series J and F rounds, SpaceX has secured substantial funding to support its ambitious projects, positioning it as a major player in commercial space travel.

II. SpaceX Financials

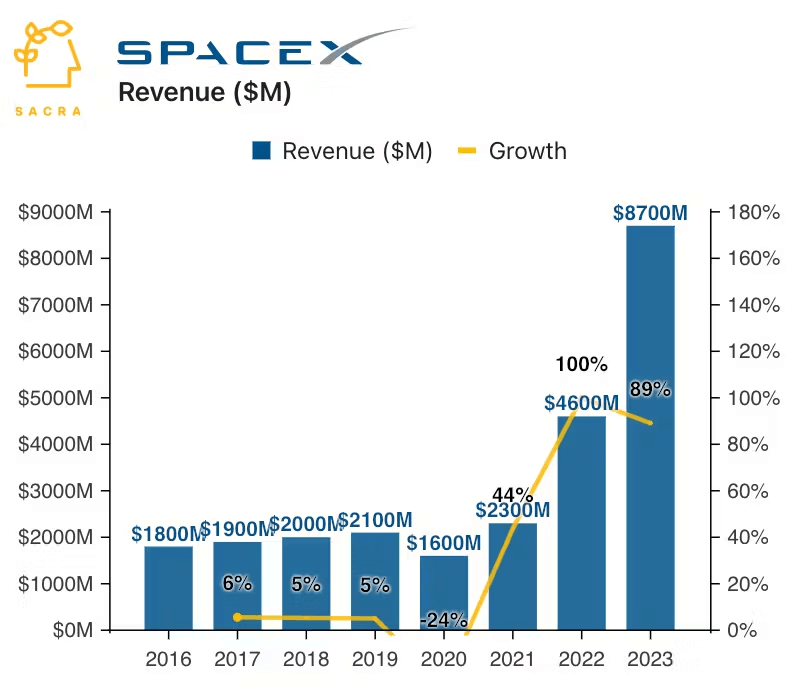

In 2023, SpaceX achieved remarkable financial growth, generating $8.7 billion in revenue—an 89% increase from $4.6 billion in 2022, following a prior doubling from $2.3 billion in 2021. This rapid revenue acceleration was supported by two main pillars: launch services and the expanding Starlink satellite internet business. SpaceX's core launch revenue reached approximately $3.5 billion in 2023, increasing 46% year-over-year. This growth was driven by 28 Falcon 9 and five Falcon Heavy launches, with 12 commercial Falcon 9 launches generating an estimated $800 million and three crewed missions adding another $780 million.

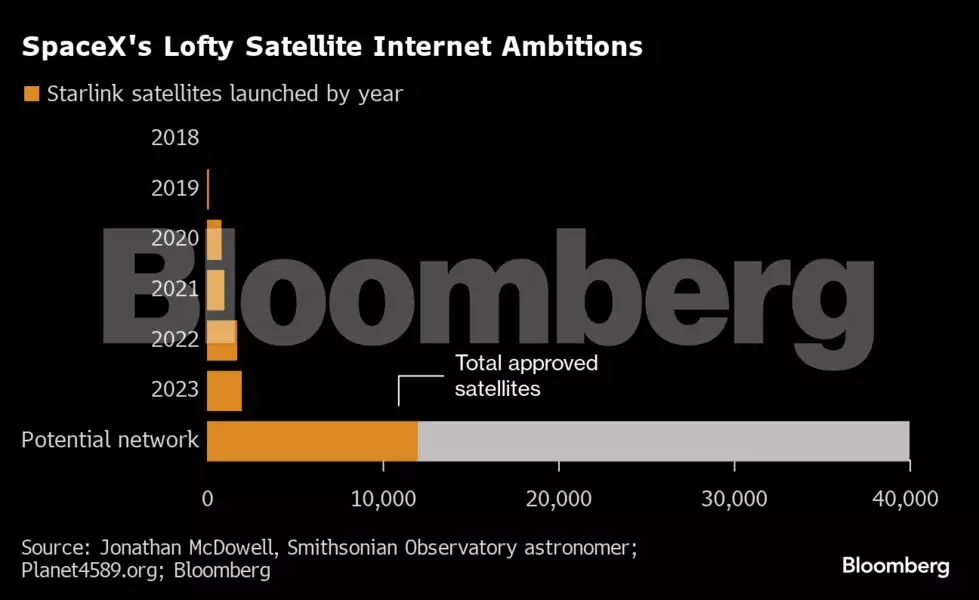

The Starlink division saw particularly strong growth in 2023, with revenue climbing 121% to $4.1 billion as its subscriber base more than doubled, from 1 million in 2022 to 2.3 million. Starlink's revenue model incorporates both residential and enterprise customers, with residential subscribers averaging $105 per month and business clients paying $400–$2,500 per month, providing a stable, recurring revenue stream. This rapid subscriber growth in Starlink bolstered SpaceX's financial base, contributing significantly to its cash flow and supporting further technology development and infrastructure.

Source: sacra.com

SpaceX's use of reusable rockets, primarily the Falcon 9, has transformed the cost structure of launch services. The cost to launch a new Falcon 9 is roughly $50 million, while reusing the rocket reduces this to around $15 million, allowing SpaceX to offer competitive launch prices while maintaining healthy margins. The standard commercial Falcon 9 launch is priced at $60 million, and a Falcon Heavy mission costs around $125 million. This competitive pricing has allowed SpaceX to secure around 66% of NASA's launches, costing approximately 10% of what NASA would have spent using United Launch Alliance (ULA).

SpaceX's high vertical integration further distinguishes it from competitors. With around 70% of Falcon 9's components produced in-house, SpaceX avoids the higher costs of specialized components, enabling greater control over manufacturing quality and cost. By choosing standard commercial components where feasible, SpaceX has reduced component costs significantly, like lowering the price of an onboard radio from $100,000 to $5,000.

SpaceX's current position and future growth potential are supported by strong financials and an innovative model, with anticipated revenue projections reaching $15 billion by 2024, largely driven by Starlink's expansion. With a substantial market share in both aerospace and satellite internet services, SpaceX continues to redefine the economics of space exploration and satellite services.

III. SpaceX IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

An IPO for SpaceX presents substantial growth potential, grounded in the company's technological advancements, market share, and cost-effective space services. SpaceX's primary competitors in the space launch industry, such as Blue Origin, Arianespace, and United Launch Alliance (ULA), face significant challenges replicating SpaceX's competitive advantages in reusable rocket technology and vertical integration. For example, ULA relies on over 1,200 subcontractors, while SpaceX produces about 70% of its Falcon 9 rocket components in-house. This approach enables SpaceX to manage production costs efficiently and to pass these savings on to customers, capturing 66% of NASA's launches in 2023 at costs far below traditional providers.

Source: historicspacecraft.com

Beyond its established launch services, SpaceX's Starlink constellation positions it uniquely within the satellite internet market. Starlink reached 2.3 million subscribers by the end of 2023, with projected growth as it expands offerings in maritime, aviation, and mobile markets. Given the limited availability of high-speed internet in rural and remote regions, Starlink holds an estimated market potential of tens of millions of users, with a Total Addressable Market (TAM) in broadband alone expected to increase to nearly $1 trillion by the early 2030s. Moreover, SpaceX's forthcoming Starship spacecraft is designed to enable high-cadence satellite launches, which could further expand Starlink's user base, potentially reaching 100 million subscribers by 2026.

Source: Bloomberg.com

Future growth prospects for SpaceX extend beyond satellite internet. The company is actively exploring interplanetary travel, space tourism, and space manufacturing, particularly in microgravity-dependent production of high-value goods such as ZBLAN fiber optic cables and pharmaceuticals. For instance, ZBLAN fiber, projected to reach a market size of $12 billion by 2025, can only be optimally manufactured in microgravity, where impurities are minimized. SpaceX's ability to transport materials at lower costs could accelerate commercialization in these emerging industries, providing long-term revenue diversification beyond launch services.

B. Weaknesses & Risks

Despite these opportunities, several risks remain. SpaceX faces high capital requirements, as demonstrated by CEO Elon Musk's 2021 admission of a “Raptor production crisis” that threatened liquidity. The aerospace sector's capital intensity exposes SpaceX to financial risks, particularly if projected revenues from Starlink and other ventures fall short. Additionally, the unproven nature of the space economy beyond traditional applications, like communications, means that SpaceX's broader ambitions, such as LEO manufacturing, are speculative.

IV. SpaceX IPO Details

A. SpaceX IPO Date

The SpaceX IPO's timing remains uncertain, partly due to CEO Elon Musk's historical reluctance to subject SpaceX to public market pressures. Public ownership could complicate SpaceX's long-term goals, particularly its Mars-focused missions, which may not align with the shorter-term profitability objectives of public investors. Musk has indicated that an IPO might only be viable once SpaceX achieves regular flights to Mars, aligning financial goals with its exploratory objectives.

B. SpaceX Valuation

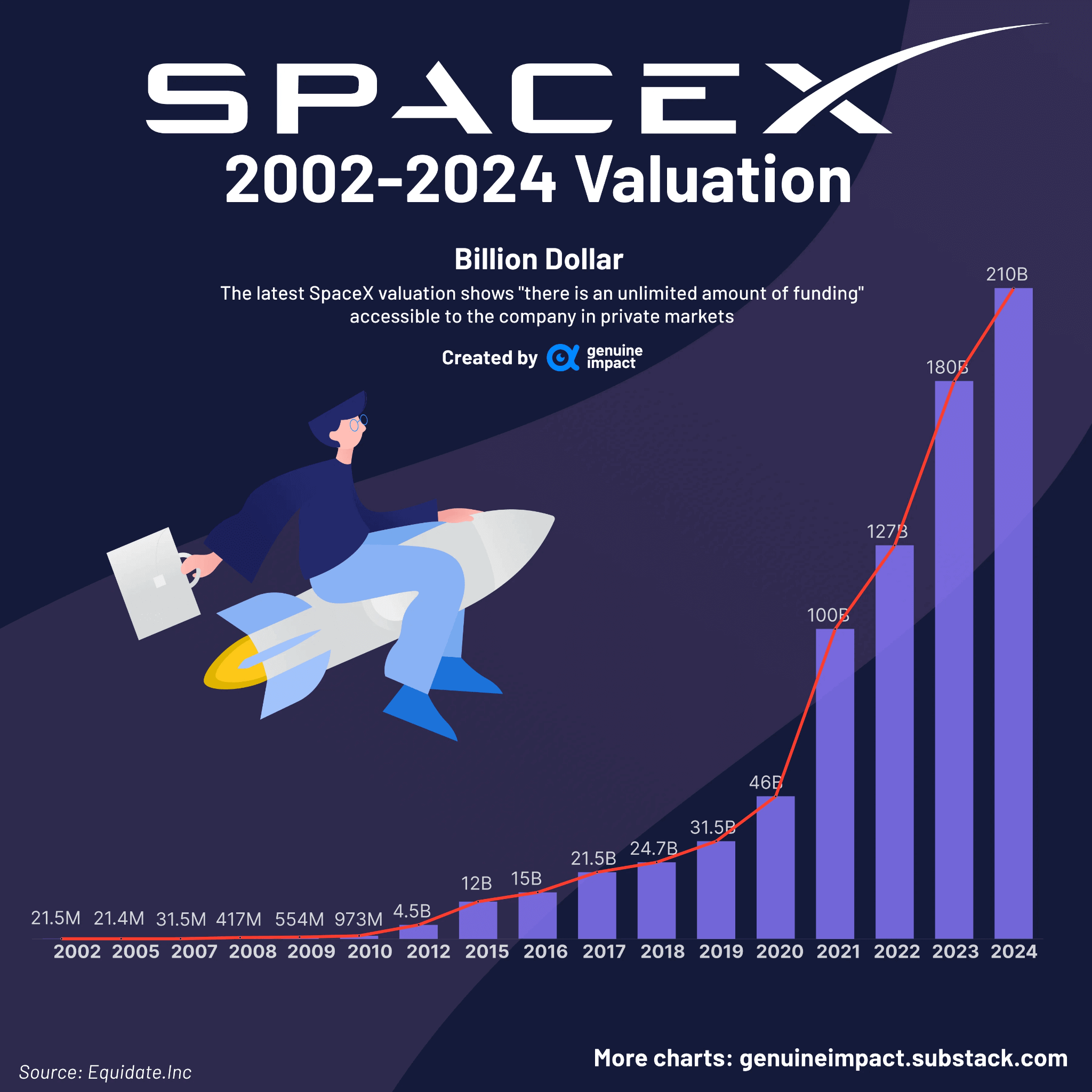

SpaceX's IPO valuation is projected between $200 billion and $210 billion, following substantial funding from major investors like Andreessen Horowitz, Founders Fund, Sequoia, and Fidelity. As of August 2024, an internal tender offer valued the company at $208 billion, exceeding the valuations of aerospace giants Boeing ($94 billion) and Lockheed Martin ($144 billion). In recent private sales, SpaceX's shares have been valued at $112 each, further affirming investor confidence and strong demand for a potential IPO.

SpaceX has raised approximately $11.9 billion across 30 funding rounds since its inception in 2002. This includes pivotal rounds, such as a $750 million Series J in January 2023, which resulted in a post-money valuation of $137 billion. In 2021, SpaceX reached a $100 billion valuation, spurred by Starlink's rapid expansion and increasing launch cadence, a major leap from the $36 billion valuation seen in early 2020. These capital injections have enabled SpaceX to maintain momentum in research, development, and production, particularly in reusable launch vehicles and Starlink infrastructure.

Source: reddit.com

Investor appetite remains high, driven by SpaceX's leadership in commercial spaceflight, with a 2023 revenue of $8.7 billion and a private market valuation multiplier of about 20.7x last twelve months (LTM) revenue. Starlink's expansion has also played a critical role in bolstering SpaceX's valuation, as it opens up lucrative opportunities in satellite internet and telecommunications. Moreover, SpaceX's vertical integration strategy, wherein 70% of rocket components are manufactured in-house, has enhanced its cost competitiveness, making its Falcon 9 rockets cheaper than those of many competitors.

C. Analyst Opinions

Analysts have noted that SpaceX's strong market position, high barriers to entry in space travel and satellite internet, and robust government contracts make it a promising IPO candidate. However, the high capital demands of its projects, combined with the company's ambitious objectives, present risks. An IPO would give public investors a rare opportunity to participate in a dominant player in the growing space economy, though the valuation reflects both SpaceX's achievements and the high expectations for its future trajectory.

V. How to Invest in SpaceX IPO & SpaceX Stock

Where to Buy SpaceX IPO Shares

To invest in SpaceX's IPO, investors will need to open a brokerage account that provides access to IPO shares, likely through full-service brokers or platforms with IPO allocation capabilities. IPO shares are typically in high demand, so early interest or large accounts may improve access.

SpaceX IPO Trading Strategies

For trading strategies, investors can consider day trading for short-term price movements, though IPOs can be volatile. Long-term investing may appeal to those banking on SpaceX's growth in the $1 trillion-plus space economy and its leadership in sectors like reusable rocket technology and satellite internet (Starlink). For longer-term strategies, it's vital to note SpaceX's recent valuation and revenue-generating assets in a competitive space tech landscape.

Ways to Buy SpaceX Stock: ETFs, Options, CFDs

Alternatives for investing in SpaceX stock include indirectly purchasing exchange-traded funds (ETFs) with holdings in companies invested in SpaceX, such as Fidelity or Sequoia Capital. Brokers like VSTAR might offer contracts for difference (CFDs) on SpaceX once it's public, providing leveraged exposure. However, ETFs offer lower volatility than direct stock or options, making them suitable for cautious investors. Access to these options depends on regulatory approvals and broker capabilities, particularly for U.S.-based investors.

Source: investopedia.com