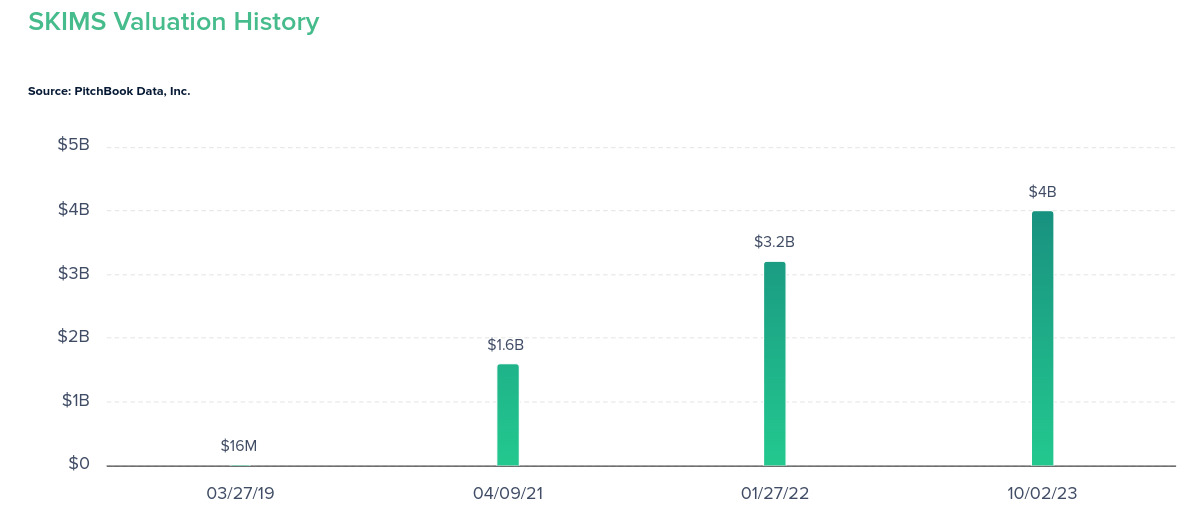

Skims first proposed its IPO plan in 2023 but postponed it to the first half of 2025 due to uncertain macroeconomic conditions. The company's rapid growth, reaching a $4 billion valuation in 2023 from $3.2 billion in 2022, has garnered significant investor interest. Skims' appeal lies in its unique market positioning, blending celebrity influence from co-founder Kim Kardashian and innovative product launches in the shapewear and loungewear sectors. The company raised $270 million in funding to fuel expansion, aiming to establish itself as a dominant apparel brand, which has driven speculation around its public offering.

Source: instyle.com

I. What is Skims

Founded in 2019 by Kim Kardashian, Jens Grede, and Emma Grede, Skims is a direct-to-consumer apparel company specializing in shapewear, loungewear, and underwear. Headquartered in Los Angeles, Skims operates primarily through its e-commerce platform. Its core products focus on enhancing body shape, offering inclusive sizing (XXS-5X) and diverse skin-tone shades (9+ per item), appealing to underserved demographics. Skims targets millennial and Gen Z women, with 70% of its customers under 40. As of 2023, Skims has diversified its offerings into menswear and swimwear, expanding its market presence through strategic partnerships with Nordstrom and Selfridges.

Business Model and Core Services

Skims' business model revolves around online sales, creating buzz through limited-edition drops and collaborations. The company's pricing strategy positions products as premium but accessible, with most items priced between $30 and $100. This approach, alongside frequent product launches and partnerships, drives significant consumer interest. Skims also maintains a strong offline presence with pop-up shops, such as its 2023 Selfridges collaboration, and its first brick-and-mortar store in Georgetown in 2024. The company's ability to offer size inclusivity and skin-tone diversity allows it to tap into a broad customer base and foster brand loyalty.

Source: skims.com

Who Owns Skims: Ownership and Investors

Kim Kardashian, alongside Jens and Emma Grede, co-owns Skims, leveraging her celebrity status and vast social media following to drive brand visibility. Key investors include Lone Pine Capital, Thrive Capital, Wellington Management, and Imaginary Ventures. This funding round, its largest to date, fuels expansion into new markets and product categories. Overall, Skims' rapid rise in the apparel industry stems from its innovative product lines, inclusive approach, and strong celebrity backing.

II. Skims Financials

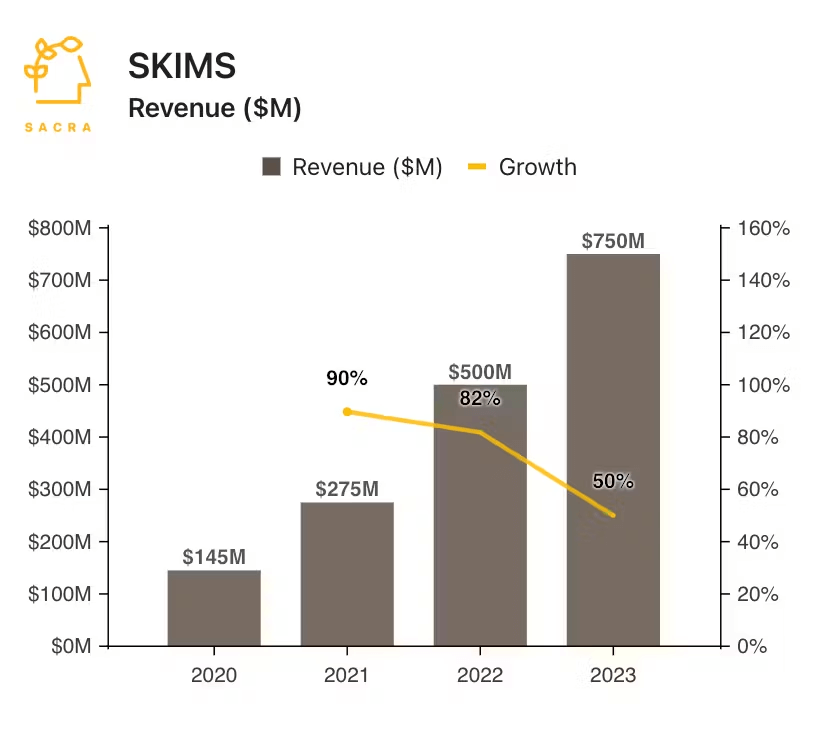

In 2023, Skims achieved remarkable revenue growth, generating $750 million, up 50% year-over-year from $500 million in 2022. This growth marks a fivefold increase from its 2020 revenue of $145 million. The company's rapid expansion is driven by product diversification, transitioning from shapewear to categories like loungewear and swimwear. In fall 2023, Skims further expanded into menswear, while flagship stores in Los Angeles and New York are slated for 2024.

Though specific profitability details are private, Skims is estimated to have posted a net profit of $190 million in 2023, benefitting from gross margins likely between 50-60%. The direct-to-consumer model and Kim Kardashian's celebrity influence enable lower customer acquisition costs, boosting profitability. Additionally, around 15% of Skims' online customers come from outside the U.S., while 70% of its customers belong to the millennial and Gen Z demographics, underscoring its appeal to younger consumers.

In terms of market share, Skims is emerging as a key player in the shapewear and broader apparel industry. The company has cultivated a strong brand, with over 11 million people joining waitlists for product restocks, showcasing high demand. Retail partnerships with Nordstrom and Selfridges, alongside its brick-and-mortar store expansions, are helping Skims scale its sales channels beyond e-commerce.

Skims raised $270 million in a Series C round in July 2023, bringing its valuation to $4 billion, up from $3.2 billion in 2022. Key investors, including Wellington Management and Greenoaks Capital Partners, have shown confidence in its growth trajectory. Despite challenges like managing inventory and inflation-driven consumer pullbacks, Skims' strategic initiatives and solid financial position position it well for continued expansion.

Source:sacra.com

III. Skims IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

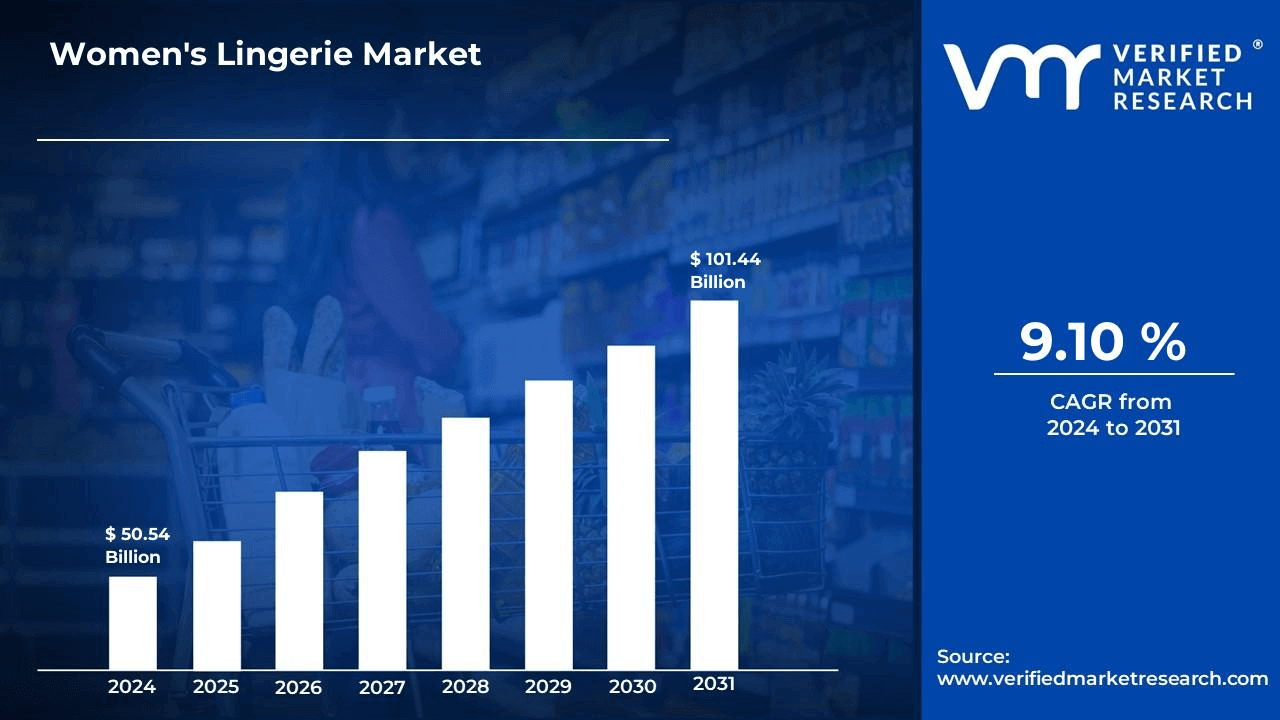

The women's lingerie market is projected to grow from $50.54 billion in 2024 to $101.44 billion by 2031, driven by factors like increasing demand for inclusive, comfortable apparel. Skims' core competitive advantage lies in its product differentiation. With a focus on inclusivity, offering sizes from XXS to 5X and over 10 skin-tone options, Skims appeals to diverse body types. This is in contrast to competitors like Spanx ($1.2 billion valuation) and Aerie, which focus on more traditional market segments. Skims also sets itself apart through pricing, with its Sculpting Bodysuit priced at $62 versus Spanx's $78.

Expansion opportunities include Skims' planned entry into activewear and menswear in 2024, along with its pivot to physical retail. Flagship stores are scheduled to open in Los Angeles and New York City, expanding Skims' omnichannel presence. Additionally, collaborations with major retailers like Nordstrom and Selfridges have bolstered distribution. Skims' marketing, heavily influenced by Kim Kardashian's social media power, will likely evolve through influencer partnerships and campaigns targeting younger audiences. The brand's ability to create scarcity through product drops and waiting lists of 11 million people adds to its competitive edge.

Source: verifiedmarketresearch.com

B. Weaknesses & Risks

- Overreliance on Kim Kardashian: Skims' brand is closely tied to Kardashian's image. A decline in her influence or any scandal could harm brand perception.

- Supply Chain Challenges: Skims has faced stock shortages due to high demand. As it expands into new categories and global markets, managing inventory effectively will be critical to avoid customer frustration.

- Intense Competition: Fast fashion players like Zara and H&M, alongside brands like Aerie, offer lower-cost alternatives, pressuring Skims to maintain its premium positioning without eroding margins.

Source: elle.com

IV. Skims IPO Details

A. Skims IPO Date

As of now, Skims has not announced a confirmed IPO date. Speculation continues about the timing to be in H1 2025.

B. Skims Valuation

Skims reached a valuation of $4 billion following its Series C funding round on July 19, 2023. This round raised $270 million, led by Wellington Management with participation from Greenoaks, D1 Capital Partners, and Imaginary Ventures. The valuation increased from $3.2 billion during its Series B round in January 2022. Overall, Skims has raised $670 million in total funding over three rounds since its inception in 2019.

Funding Rounds Summary

- Series A (April 2021): Raised $154 million, post-money valuation of $1 billion.

- Series B (January 2022): Raised $240 million, post-money valuation of $3.2 billion.

- Series C (July 2023): Raised $270 million, valuation of $4 billion.

Skims remains a unicorn, with significant investor interest and plans to expand into new categories and retail markets.

Source: upmarket.co

C. Share Structure & Analyst Opinions

No specific information regarding the number of shares to be offered or the pricing of shares has been disclosed for Skims' anticipated IPO. Analysts expect the company to pursue further growth in product categories and geographic expansion, likely increasing its valuation closer to the IPO. Speculative estimates suggest a potential share price of around $15.54, based on a hypothetical 250 million shares outstanding and the recent valuation of $3.89 billion. However, this is subject to change pending official IPO filings.

V. How to Invest in Skims IPO & Skims Stock

Where to Buy Skims IPO Shares

To buy Skims IPO shares, you'll need to open a brokerage account with a firm that provides access to IPOs, such as Charles Schwab, Fidelity, or TD Ameritrade. These platforms typically allow individual investors to participate in IPOs if they meet certain requirements. Once the IPO is live, one can place orders through your broker, just as one would with any other stock.

Skims IPO Trading Strategies

Investors can use different trading strategies for Skims stock, such as day trading or swing trading. Day trading involves buying and selling Skims stock within a single day, aiming to profit from short-term price fluctuations. This method is highly speculative and requires significant market attention. Swing trading, on the other hand, holds the stock for several days or weeks, capitalizing on price trends and momentum.

Source: centerpointsecurities.com

Ways to Trade Skims Stock

Once Skims goes public, there will be various ways to trade its stock, including ETFs, options, and CFDs (Contracts for Difference). Skims stock may be included in ETFs that focus on consumer brands or celebrity-backed companies, allowing indirect exposure to its shares. Options trading can provide leverage, allowing investors to buy or sell Skims shares at a predetermined price on a future date. CFDs, available through brokers like VSTAR, enable traders to speculate on Skims stock price movements without owning the shares, benefiting from both rising and falling markets. CFDs offer flexibility but come with higher risks due to leverage.