Shein first proposed an IPO plan in 2022 but paused due to market volatility from Russia's invasion of Ukraine. Recently, Shein confidentially filed for a London IPO to potentially sidestep U.S. regulatory challenges related to forced labor allegations in its supply chain. This move has generated significant interest due to Shein's rapid growth, innovative e-commerce model, and ability to offer trendy fashion at low prices. Investors are drawn to its massive customer base and disruptive market potential, making it one of the most anticipated IPOs of 2024.

I. What is Shein

Shein, pronounced as "she-in," has swiftly ascended from a modest online retailer to a dominant force in the global fast fashion industry. Founded in 2008 by Chris Xu in Nanjing, China, Shein initially operated under the name SheInside before rebranding to Shein. The company's headquarters are located in Nanjing, reflecting its Chinese origins. The fashion industry, particularly the fast fashion segment, drives Shein's operations. Fast fashion emphasizes quickly changing trends, affordability, and widespread availability, catering to a broad consumer base eager for up-to-date styles at competitive prices. The company platform is the largest e-commerce fashion site by revenue. After its first IPO plans in 2022, Shein may go public in 2024 as market conditions become favorable.

Source: sheingroup.com

Business Model and Core Services

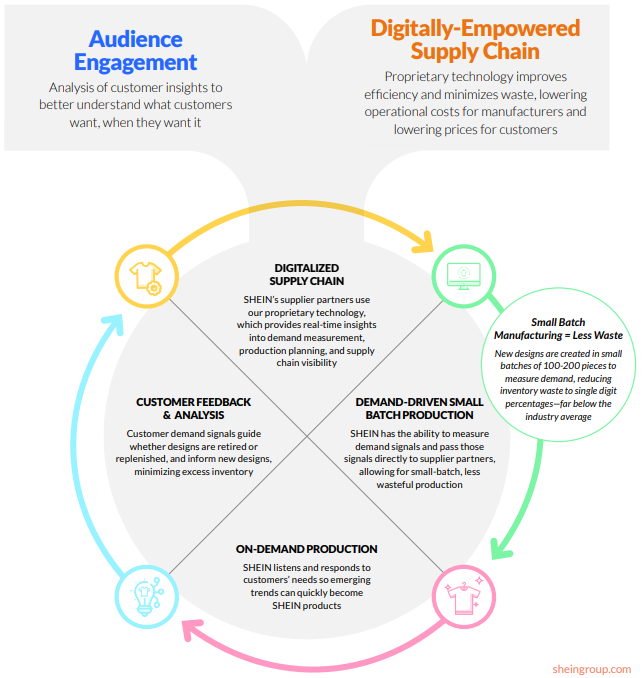

Shein's business model (international B2C) revolves around leveraging digital platforms to swiftly deliver the latest fashion trends at affordable prices (fast fashion). This model is underpinned by a vertically integrated supply chain that spans design, manufacturing, and distribution. The company excels in rapid production cycles, enabling it to bring new designs from concept to market in remarkably short periods. Shein's business model, known as "test and repeat," involves producing small batches of clothing, typically 50-100 units per item. If an item sells well, Shein quickly manufactures more; if not, it is discontinued. Shein's turnaround time is just 25 days, exemplifying its extreme fast-fashion model. This model, being rolled out in regions like Brazil, the U.S., and Mexico, empowers local businesses and offers real-time market insights through Shein's platform.

Shein primarily operates through its e-commerce platform. It is expanding its model globally, incorporating a marketplace that offers third-party products alongside its own. This expansion aims to localize its supply chain and to increase product variety and support local economies by partnering with suppliers in regions like Brazil, the U.S., and Turkey. Shein also supports independent designers through its SHEIN X incubator program, which has invested $55 million since 2021 to help 3,000 designers develop and market their creations.

Source: sheingroup.com

Key Customers

Shein's target demographic comprises primarily young adults aged 18-35 (GenZ as the largest target consumer), particularly women seeking trendy fashion items at affordable prices. The brand resonates with fashion-forward individuals who value variety and frequent updates to their wardrobe without the high costs typically associated with fast-changing fashion trends. Targeting Gen Z consumers, Shein heavily relies on social media marketing, particularly TikTok. Influencers and celebrities with large followings promote Shein's affordable products, often through "haul" videos showcasing multiple inexpensive items. This social media-centric strategy effectively engages younger audiences and drives sales.

Who Owns Shein: Ownership Structure

Shein's ownership details are relatively opaque. The company operates under the umbrella of Nanjing Niuwang Information Technology Co., Ltd., which oversees its global operations. While major investors are Tiger Global Management, JAFCO Asia, Sequoia Capital China, and IDG Capital.

II. Shein Financials

Shein Revenue Growth

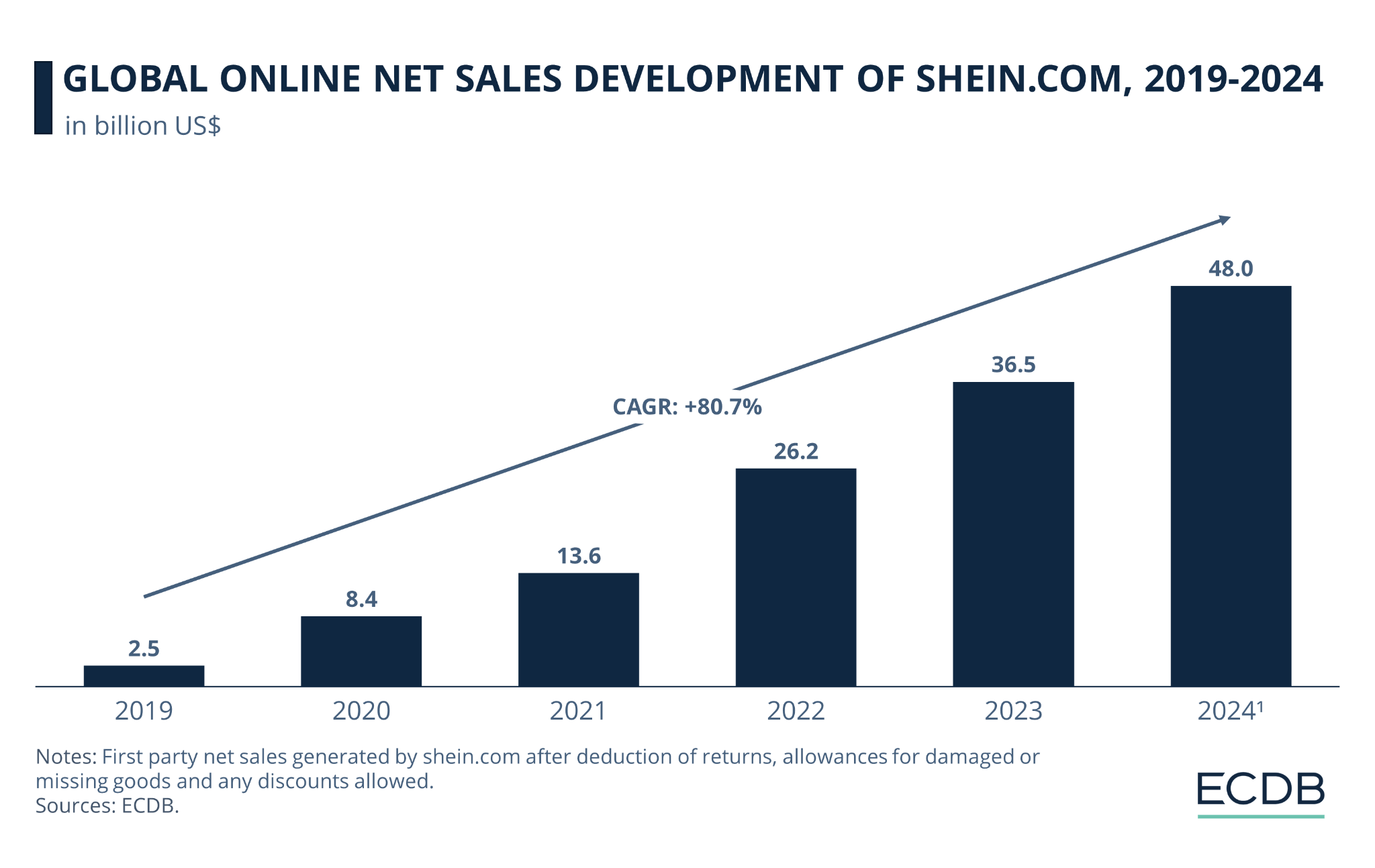

Shein's revenue growth from 2016 to 2023 is staggering, rising from $0.61 billion in 2016 to $32.5 billion in 2023. This represents a compound annual growth rate (CAGR) of approximately 92.6%. A key inflection point occurred in 2020 when revenue tripled from $3.15 billion in 2019 to $9.81 billion. This surge can be attributed to the increased demand for online shopping during the COVID-19 pandemic. The trend continued with revenues reaching $15.7 billion in 2021, $22.7 billion in 2022, and $32.5 billion in 2023, surpassing H&M's revenue and positioning Shein to potentially overtake Inditex in 2024. The company boosted its online net sales of $2.5 billion in 2019 to hit $48 billion by 2024.

Source: ecommercedb.com

Profitability and Margins

Shein's net income has seen significant growth, especially in the past year. In 2023, Shein reported a net income of $2 billion, a 185% increase from $700 million in 2022. This sharp rise in profitability is notable given that net income decreased from $1.1 billion in 2021 to $700 million in 2022, indicating improved cost management and operational efficiency in 2023. The 2023 net income margin stands at approximately 6.15%, which is impressive for a company in the highly competitive fast fashion industry.

Key Financial Metrics

Shein's user base has expanded dramatically, growing from 2.8 million users in 2017 to 88.8 million in 2023. This growth is partly driven by Shein's aggressive market penetration in regions like Brazil, Mexico, and the U.S., which have become its largest markets. The U.S., in particular, saw user growth from 0.49 million in 2017 to 17.3 million in 2023, making it Shein's largest market by revenue. The rapid increase in users underscores Shein's successful marketing strategies, leveraging social media and influencer partnerships to attract a younger demographic.

Market Share in the Fast Fashion Industry: Shein competes fiercely with other fast fashion giants like Zara, Temu, and H&M for market share. While specific market share data can vary, Shein's rapid growth suggests it has carved out a significant portion of the online fast fashion market. The following market share metrics reflect Shein's competitive positioning and growth trajectory within the broader US fast fashion retail industry:

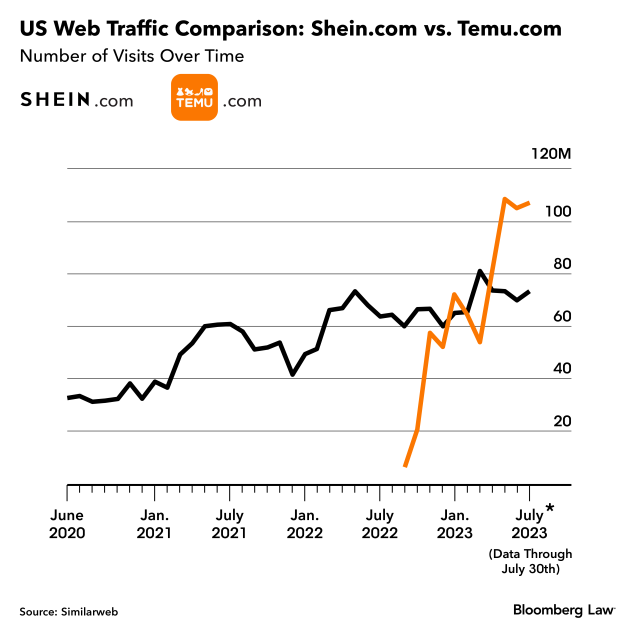

Source: Bloomberg.com

Shein's mobile app has been a critical component of its strategy. The app was the most downloaded fashion shopping app in 2023 and the second most downloaded shopping app overall, behind Temu. Download numbers increased from 48.4 million in 2018 to 238 million in 2023, reflecting Shein's growing popularity and its ability to engage with consumers through digital platforms.

III. Shein IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

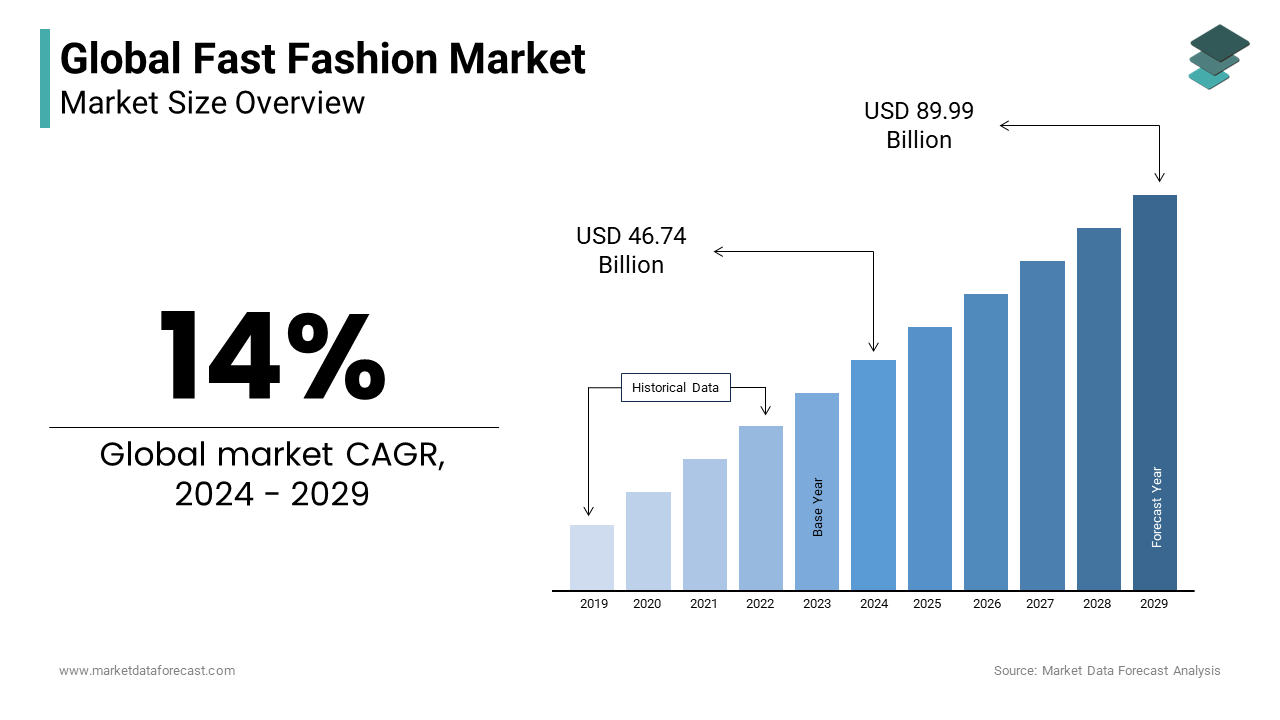

The global fast fashion market is projected to grow significantly, from USD 46.74 billion in 2024 to USD 89.99 billion by 2029, with a CAGR of 14%. This growth is driven by the increasing demand for trendy, affordable clothing, especially among younger consumers. As the market expands, companies like Shein, which operate on an ultra-fast fashion model, stand to benefit immensely.

Source: marketdataforecast.com

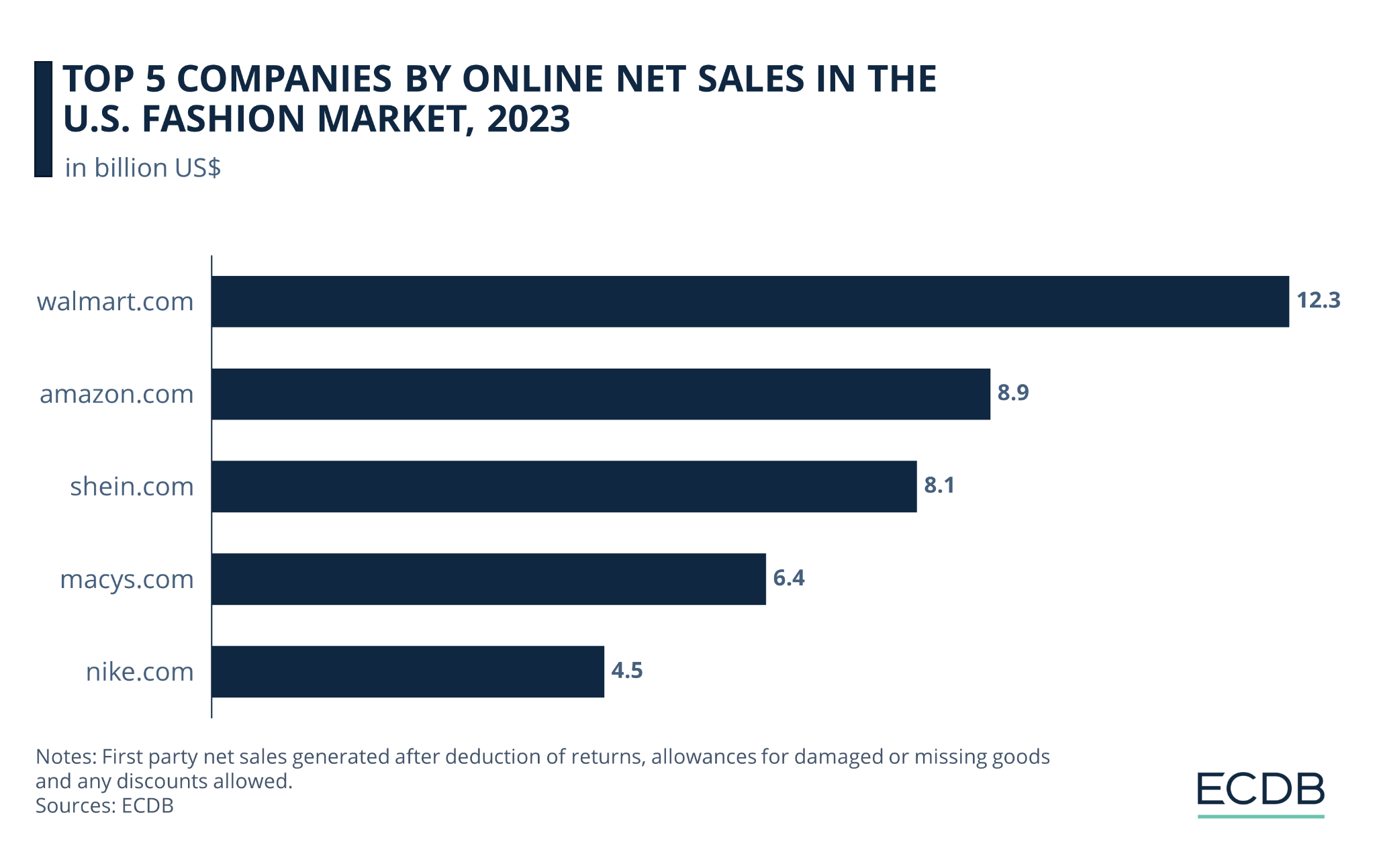

Shein's competitive edge lies in its ultra-fast fashion model, which allows the company to quickly turn around trendy styles at low prices. Unlike traditional fast fashion retailers like Zara and H&M, Shein operates without physical stores, reducing overhead costs and enabling it to offer competitive pricing. The company works closely with third-party manufacturers, primarily in China, to produce a high volume of new styles daily. This strategy has helped Shein capture a significant market share, especially in the US, where it overtook Zara and H&M during the COVID-19 pandemic and is currently countering US giants like Walmart, Amazon, and Macy's.

Source: ecommercedb.com

Major Competitors

Temu: A rising competitor, Temu offers similar pricing and variety, focusing on ultra-fast fashion. Temu's aggressive pricing strategy has sparked an antitrust battle with Shein in the US courts, highlighting the intense competition in this sector.

Source: Bloomberg.com

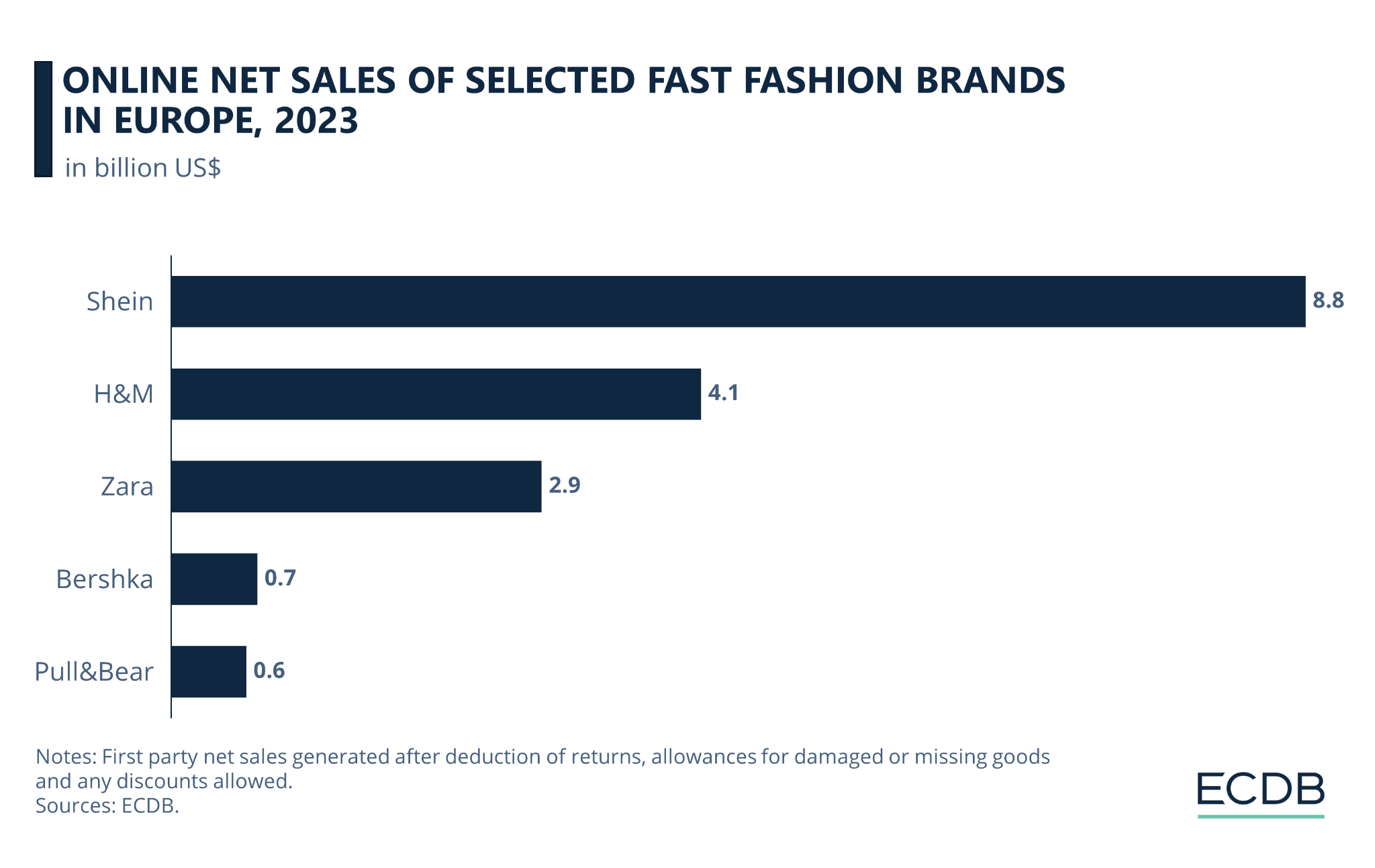

Zara and H&M: These brands are Shein's primary competitors in the fast fashion industry. They offer a hybrid model of online and offline sales, with a well-established brand presence. However, their production cycles are slower compared to Shein's, making it challenging to compete on the speed of trend adoption and price.

Future Growth Opportunities

Geographical Expansion: Shein has successfully penetrated several markets, including Europe, where it leads in countries like Portugal and Spain. Continued expansion into new markets presents significant growth opportunities.

Source: ecommercedb.com

B. Weaknesses & Risks

Legal and Regulatory Risks: Shein is currently embroiled in multiple legal battles, including an antitrust case with Temu and a copyright infringement lawsuit with H&M. These legal issues could result in significant financial liabilities and operational disruptions.

Ethical and Environmental Concerns: Shein has faced widespread criticism for labor practices and environmental impact. Increasing scrutiny from consumers and regulators could lead to stricter regulations and potential boycotts, impacting profitability.

Dependence on Third-Party Manufacturers: Relying heavily on third-party manufacturers, primarily in China, poses risks related to supply chain disruptions, quality control, and political tensions.

IV. Shein IPO Details

A. Shein IPO Date

Shein is expected to go public in 2024 through a London based IPO, with specific timing dependent on market conditions and regulatory approvals.

Source: cnbc.com

B. Shein Valuation

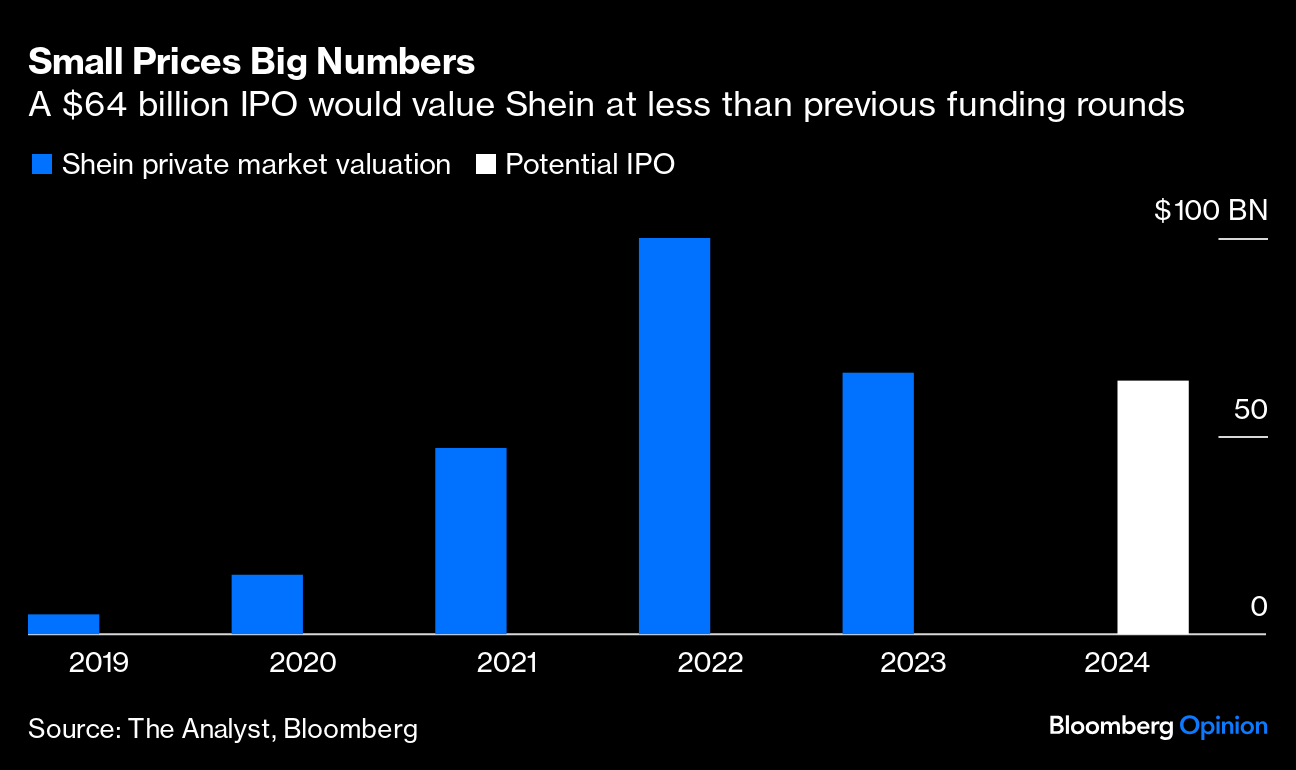

As of recent reports, Shein's valuation has fluctuated significantly:

2019: $5 billion

2020: $15 billion

2021: $47 billion

2022: $100 billion (rumored pre-IPO valuation)

2023: $64 billion

Source: Bloomberg.com

This volatility reflects market sentiment and operational challenges, including regulatory scrutiny and geopolitical tensions.

C. Funding History and IPO Expectations

Shein has raised substantial capital ($3.2 billion) through 4 funding rounds, although exact figures can vary based on confidentiality and market disclosures. Major rounds have contributed to its growth trajectory, leading up to its current valuation and IPO preparations.

Source: tracxn.com

D. Analyst Opinions on Shein IPO

Analyst perspectives on Shein IPO have been mixed due to concerns over supply chain practices and regulatory challenges. While some analysts view Shein's market disruption positively, others caution about risks associated with its operational model and geopolitical factors.

E. Market Dynamics and Strategic Decisions

Shein's decision to file confidentially for a London IPO underscores its strategic response to regulatory challenges in the U.S., particularly concerning allegations of forced labor in its supply chain. This move suggests Shein's efforts to mitigate risks and diversify its investor base amid geopolitical tensions.

V. How to Trade Shein IPO & Shein Stock

Getting Shein IPO Shares

- Open a brokerage account like VSTAR that offers access to IPOs.

- Ensure your account meets the brokerage's criteria for IPO participation, which may include minimum account balances or trading history.

- Submit an indication of interest (IOI) for Shein IPO shares when available.

Shein IPO CFD Trading

Trading Shein's IPO via Contracts for Difference (CFDs) with VSTAR offers several benefits:

- Leverage: Allows traders to gain larger exposure with a smaller capital outlay.

- Flexibility: Trade both rising and falling markets.

- No Ownership: Trade on Shein stock price movements without owning the actual shares, reducing the complexities of share ownership.

Other Ways to Trade Shein Stock

Post-IPO, Shein stock can be traded through:

- ETFs: Invest in ETFs that include Shein shares as part of their portfolio, offering diversification.

- Options: Use options to speculate on price movements or hedge existing positions.

- Secondary Markets: Purchase shares from other investors once Shein is publicly traded.