- Ample Supply: Global natural gas market well-stocked with expanded LNG capacities and high storage levels in Europe and the U.S.

- Lower Prices: LNG futures consistently below last year’s prices due to surplus storage in Europe, driving prices down by over 50%.

- Risk Factors: Unplanned supply outages, geopolitical tensions, or severe weather could disrupt market stability and trigger price surges.

- Balancing Uncertainties: Despite a well-supplied market, unforeseen events pose short-term bullish sentiments amidst predominantly bearish price outlook.

Entering the 2023–24 winter, the global natural gas market reveals a tale of abundance and risks. Ample supplies, propelled by expanded LNG capacities and surplus storage in key regions, have slashed prices by over 50%. However, lurking beneath this surplus lie uncertainties—potential supply disruptions, geopolitical tensions, and weather extremes. This analysis deciphers a well-stocked market balancing on a tightrope, where unforeseen events threaten to disrupt price stability.

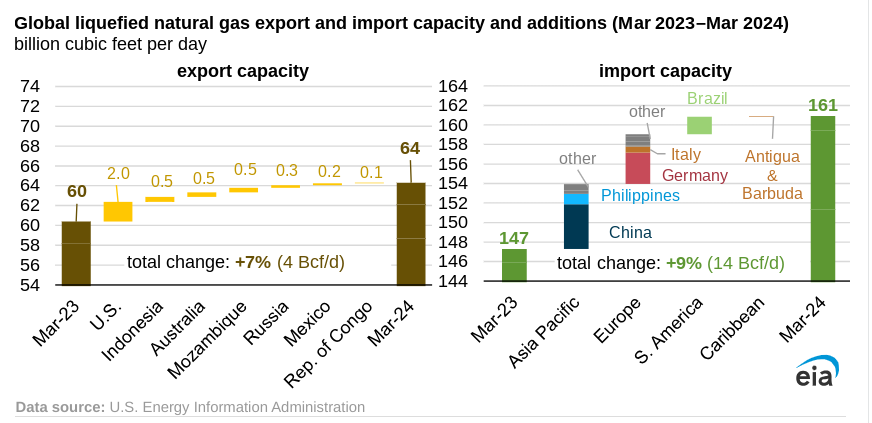

Analytical Interpretation of U.S. Energy Information Administration (EIA) Data

The recent EIA data unveils a comprehensive snapshot of the global natural gas market for the 2023–24 winter season, emphasizing key aspects related to supply, storage, price trends, and potential risks influencing the price of CFDs on Natural Gas.

Supply and Storage Dynamics

Expanded LNG Capacities:

The EIA data highlights a substantial increase in both LNG export and import capacities globally, projecting an additional 4.0 Bcf/d of LNG export capacity available during the upcoming winter. The reactivation of Freeport LNG in the U.S. has already augmented global LNG exports by 2.0 Bcf/d this year, significantly enhancing global market liquidity.

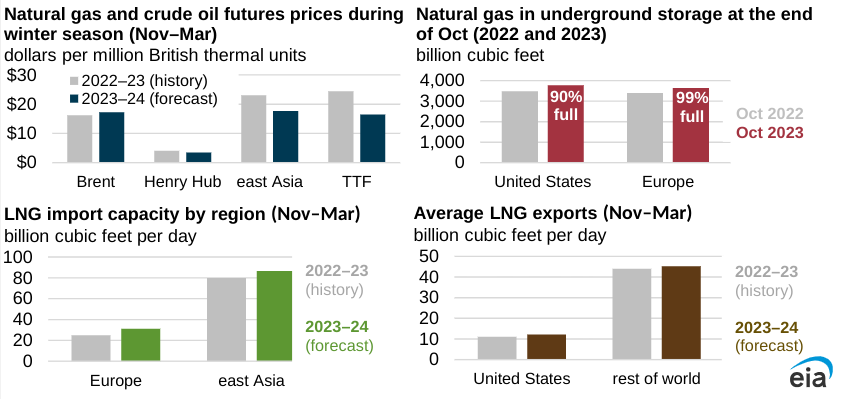

Storage Levels in Key Regions:

Europe: Natural gas storage inventories in Europe stand at nearly 99% of capacity, totaling 3,657 Bcf as of October 31, 2023, providing a robust supply buffer for the winter ahead. This volume represents 65 days of consumption at peak five-year winter usage rates and 84 days at rates seen last winter, indicating surplus storage levels compared to previous periods.

United States: Notably, U.S. storage inventories exceed last year's levels by 8% as of October 27, 2023, further reinforcing the notion of a well-supplied market.

Source: EIA.gov

Price Trends and Market Sentiment

Price Movement:

LNG front-month futures prices have consistently trended lower than the previous year due to the considerable increase in natural gas storage inventories in Europe. This decline in prices is observable in both East Asia and at the Title Transfer Facility (TTF) in Europe, where prices have dropped by more than 50%, averaging close to $15.00 per MMBtu.

Price Drivers:

The primary driver behind the downward trend in prices is the surplus storage inventories in Europe, influencing market sentiments and leading to a bearish price direction for natural gas futures.

Source: EIA.gov

Potential Risks and Price Implications

Demand-Supply Balance Risks:

Demand Surges: Unexpected spikes in demand or unplanned supply outages have the potential to disrupt the delicate balance between supply and demand, influencing both price and global gas balances.

China's Demand: The pace of China's natural gas demand recovery remains uncertain and stands as a key variable that could impact global market dynamics.

Weather Conditions: Severe cold spells in Europe or Asia during the winter months could swiftly escalate global LNG spot prices due to heightened demand for gas, potentially leading to price spikes.

Supply Disruptions:

Production Outages: Unplanned production outages from major natural gas suppliers like the U.S. or Norway, geopolitical tensions affecting supply chains in the Middle East, or further reduction in pipeline exports from Russia through Ukraine are potential factors that could tighten supply, driving prices upward.

Unforeseen Events: Other unforeseen events, such as worker strikes at Australian LNG facilities or other unplanned outages disrupting global supplies, pose additional risks to market stability.

Implications on Price of CFDs on Natural Gas (Focus on Price Direction)

Bearish Factors

Ample Supply and Storage:

The robust storage levels in Europe and the U.S., coupled with expanded LNG capacities globally, suggest a well-supplied market scenario.

The surplus storage inventories in Europe, contributing to consistently lower LNG futures prices, indicate a prevailing bearish sentiment in the market.

Historical Price Trends:

The trend of lower prices for LNG futures compared to the previous year could persist, influencing market participants and contributing to sustained downward pressure on prices.

Bullish Factors

Supply Disruptions and Weather Events:

Unplanned supply outages or geopolitical tensions affecting major natural gas suppliers could swiftly tighten supply, leading to short-term price spikes.

Severe and prolonged cold weather in Europe or Asia during the winter months might significantly elevate demand for natural gas, particularly LNG, potentially causing price surges due to increased competition for spot LNG cargoes.

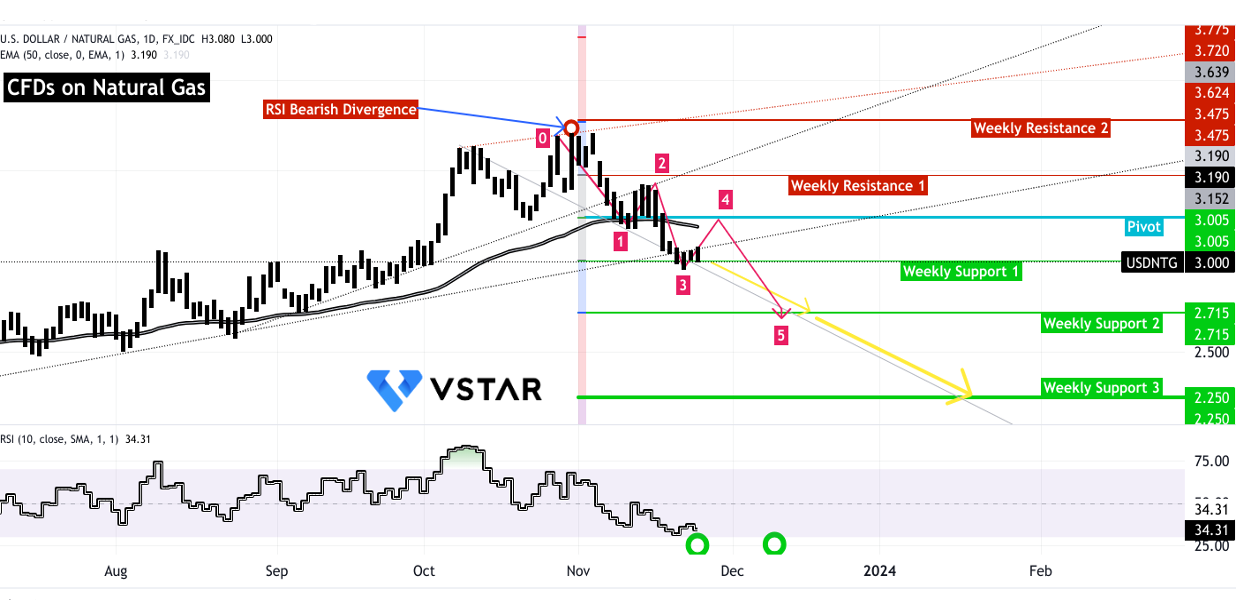

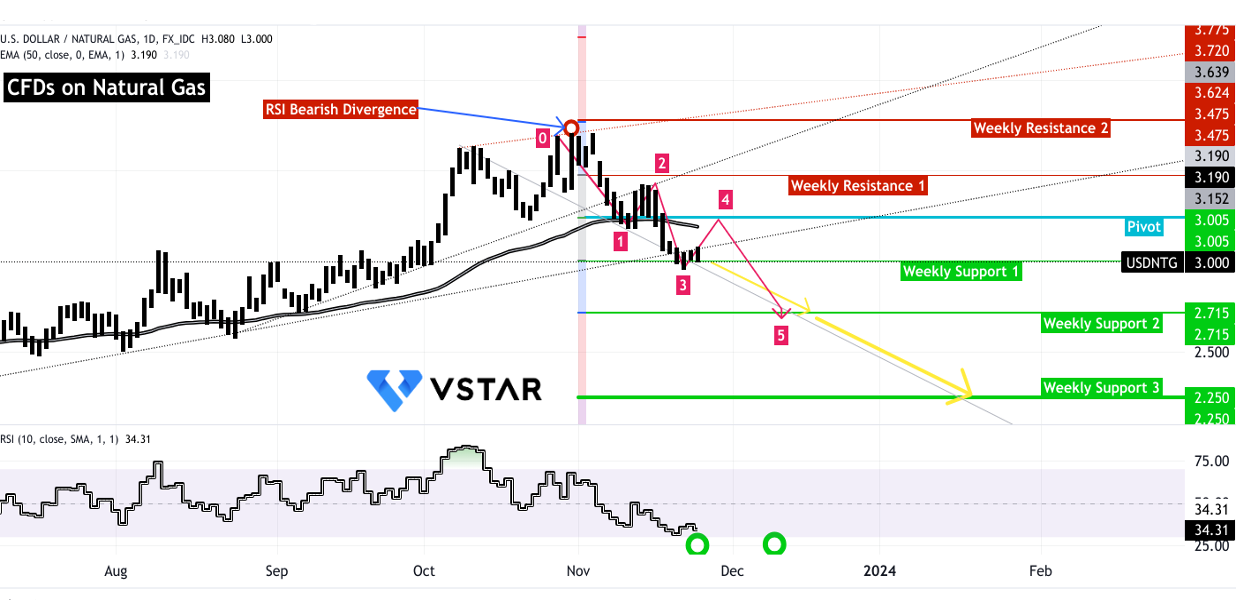

Natural Gas (NG) Technical Take

The ongoing downtrend in the price of natural gas CFDs, according to Elliott Wave theory, suggests a continuation into December, targeting a weekly support of 2.715 for the final impulsive wave. Potential supply-side volatility might drive prices down to $2.250 in early 2024. A minor upside movement could test the pivot level at $3.245 to establish a change in polarity, yet any demand-side volatility might push prices to encounter resistance levels at $3.775 and $3.475. The current RSI at 34 indicates oversold conditions. However, to establish a sustained bullish trend in prices, RSI may necessitate the formation of a bullish divergence, potentially prolonging the downside trend.

Source: tradingview.com

Overall Natural Gas Price Direction Analysis

The analysis points towards a predominantly bearish outlook for the price of CFDs on Natural Gas in the 2023–24 winter season. The surplus storage inventories, expanded LNG capacities, and historically lower prices create a scenario where downward pressure on prices is expected to persist.

However, the market remains susceptible to sudden changes due to potential risks, including supply disruptions or extreme weather events. Any unforeseen geopolitical tensions, production outages, or severe cold spells in key consuming regions could swiftly alter the market dynamics and lead to short-term bullish sentiments, causing price spikes.

In conclusion, while the current EIA data indicates a well-supplied global natural gas market, the presence of various risk factors necessitates a careful monitoring approach. These risks could quickly transform the market landscape and influence the price direction of CFDs on Natural Gas in the short term, requiring continuous assessment and adaptation of trading strategies accordingly.