Klarna has become a prominent e-commerce and digital payment solutions industry player, which has recently come to the attention of many investors for its transformative approach to customer transactions. The company was founded in 2005 as a simple payment solution platform that gradually transformed into a robust financial technology company. Since its inception, it has progressed under the visionary leadership of Sebastian Siemiatkowski, CEO and co-founder of the company.

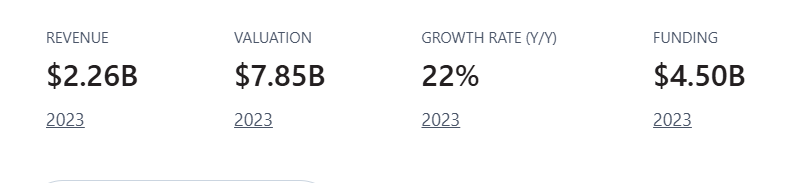

In 2023, the company reported a valuation of $6.7 billion. With rapidly expanding operations, the company hinted at an IPO that sparked notable investor attraction. Diversifying into various sectors, like financial planning, personal savings, and e-commerce marketing, highlights Klarna's capability and adaptability to deliver customer desires.

As Klarna continues to expand and innovate, it has already placed itself as one of the frontline companies in the fintech industry, reshaping the future of digital payment solutions and redefining customer experiences in the e-commerce sector. The anticipation of the Klarna IPO highlights its pivotal role and dynamic growth in the emerging global digital finance and retail industry. We will evaluate Klarna's IPO potentiality, enlightening several unavoidable factors like Klarna revenue growth potential, valuation, performance, limitations, funding, etc.

I. What is Klarna

Klarna is a leading financial technology company founded in 2005 as a simple payment solution platform. The founders are Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. The company is headquartered in Stockholm, Sweden, and aims to simplify online shopping for consumers.

According to its website, the company expanded in the U.S. in 2019 and has its American headquarters in Columbus, Ohio. Klarna operates to make online payment easier, smoother, and safer. Since its inception, the company has become a prominent player in the Fintech industry.

Key Statistics

- Klarna is a part of The Klarna Group.

- Total active consumers: 85,000,000

- Total number of merchants: 575,000

- Number of transactions per day: 2,500,000

- Number of employees: 3,800

Core Services And Business Model

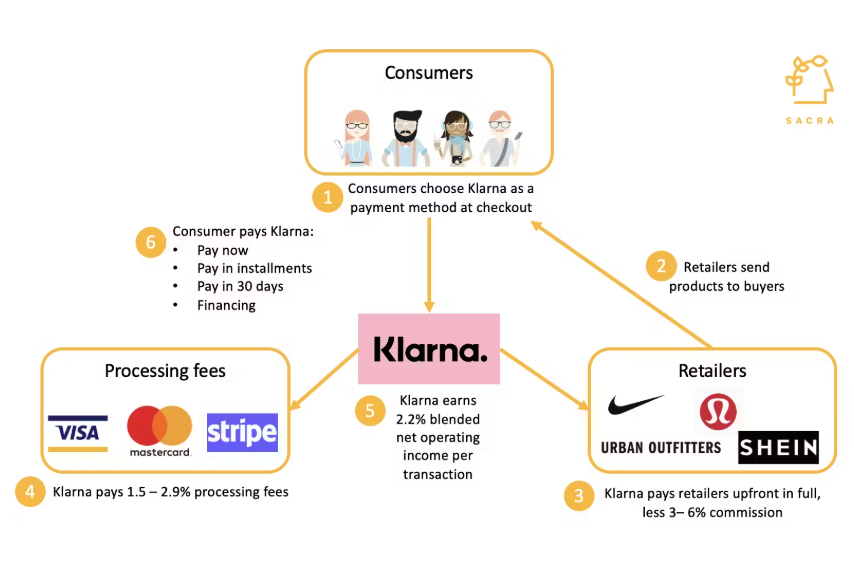

Klarna's core business model is the "Buy Now, Pay Later” (BNPL) service, which enables consumers to purchase their desired product and split the payments in a scheduled manner without any additional charges, interests, or fees. Klarna offers its consumers immediate or deferred payment options besides personal finance tools, such as budgeting features and savings accounts.

Klarna provides enhanced e-commerce tools to retailers, including payment solutions and consumer engagement analytics, to maintain stable relationships between retailers and their consumers.

Key Customers

Klarna provides services to over 85 million customers and 575,000 retailers in twenty-six countries. The company's key customers include international brands like Nike, IKEA, H&M, and ASOS. This extensive network makes Klarna a key player in the e-commerce, online retail, and digital payment solution sectors.

Ownership

Klarna is a privately owned company that is part of the Klarna group. Ownership is distributed among founders, employees, and many institutional and strategic investors. Significant company stakeholders include Bestseller Group, Sequoia Capital, Visa, Silver Lake, Dragoneer, Atomico, Permira, and Ant Group.

Strong financial backing from these financial institutes drives Klarna's ability to expand rapidly and innovate in the fintech sector, gaining weight among other competitors.

II. Klarna Financials

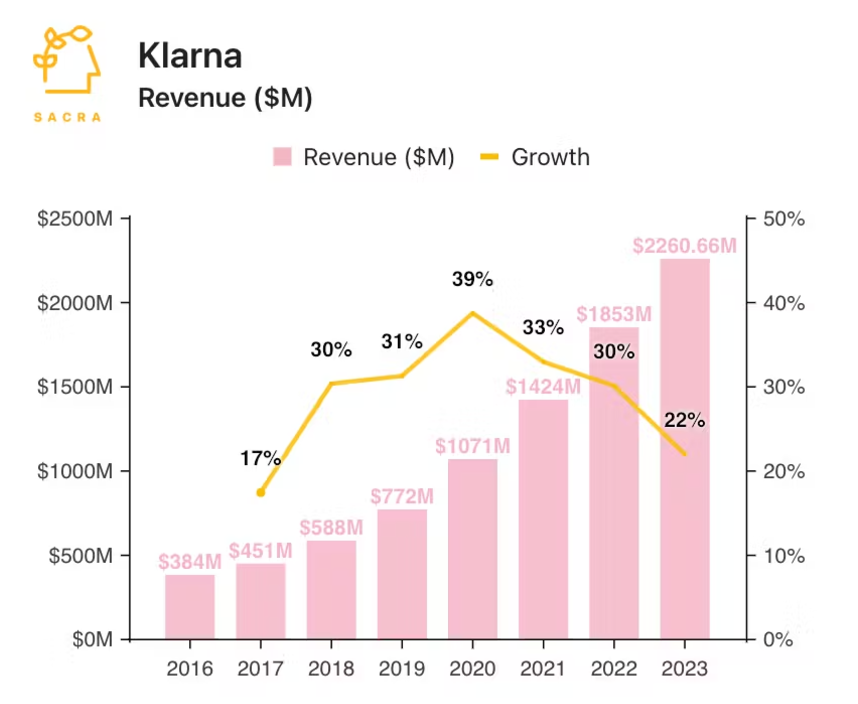

Klarna has already posted robust growth and adaptability in the “Buy Now, Pay Later” (BNPL) sector, which drives itself as a prominent player in the industry. The company report revealed that Klarna made substantial growth in 2023 through expanding its operation in Europe and the United States.

In the United States, the company's gross merchandise volume (GMV) increased 17% year over year, associated with a 71% surge in user base.

Klarna's revenue for 2023 is $2.1 billion, a 22% increase from 2021 when it was $1.7 billion. A significant revenue surge indicates the company's potential and reflects gradual progress. Klarna posted impressive gross merchandise volume (GMV) growth, processing $92 billion in GMV over 2023, which surged by 17% compared to 2022.

Klarna uses artificial intelligence (AI) to enhance user experiences, optimize checkout processes, and recommend products. In 2010, it developed a mobile app to improve services, boosting its revenue growth.

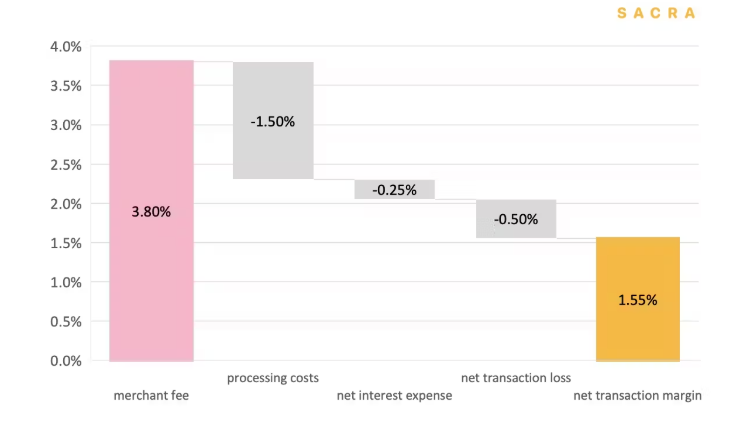

According to company data and Sacra estimations, Klarna makes a net transaction margin of $1.55 for every $100 gross merchandise volume (GMV). However, the company faced challenges and profitability concerns due to increasing credit losses and aggressive expansion strategies, which have been recovering. After facing the challenge, Klarna made a $155 million net income for Q4 2023 for the first time since 2019.

For the whole year 2023, Karna decreased its operating cost by approximately 76% to $395 million, compared to 2022, when the amount was $1.65 billion. The credit loss rate also improved during this period; in Q4 2023, it was 0.78%, a notable improvement compared to 2022, as the figure was 96% then.

Klarna's performance improved as the year passed, as more of its customer base paid back their debts. Consumer credit losses declined in 2023 by 32% YoY, to SEK 3,8bn (€340m) compared to SEK 5,6bn (€500m) in 2022.

Key Financial Metrics

Klarna replaces traditional checkouts by integrating them with websites. The platform uses AI-driven credit checks that allow customers to purchase products with minimum price frictions. In the meantime, while managing customer payments, merchants benefit as Klarna usually pays them upfront, assuming all credit risks.

Klarna's strong presence in the BNPL (buy now pay later) space, as it serves over 150 million users around the globe and processes approximately two million transactions daily, highlights its impressive expansion and adaptation.

The core product offerings include several options, such as

- Pay Now: Immediate, one-time payment

- Pay in 30 days: Full payment within 30 days

- Pay in 3: Three interest-free installments over 60 days

- Pay in 4: Four interest-free installments over 6 weeks

- Financing: 6 to 36 monthly installments with interest

Since the beginning period, Klarna continued to expand in various sectors alongside the BNPL, such as

- Klarna Card: A physical Visa card enables company payment options for in-store purchases.

- Klarna App: An extensive online shopping platform with attractive features like delivery tracking, price drop notifications, and carbon footprint insights.

- AI Shopping Assistant: An artificial intelligence (AI)- driven tool that helps users compare prices across multiple retailers alongside finding products.

III. Klarna IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

Most revenues Klarna comes from retail partners' fees as it made approx. 70% of revenue from BNPL in the fiscal year 2023, as merchants share profits with the platform driven by the BNPL financing method that attracts customers. The company posted a YoY revenue growth of $2.2 billion, which marks a 22% increase, and in the meantime, gross profit surged by 60%.

These enhancements came in a high interest-rate environment, which sparks consumers' attention compared to high credit card rates, for instance, as the platform doesn't charge extra if payment isn't made on time. Klarna currently has significant competitors like Affirm, Afterpay, and PayPal Credit.

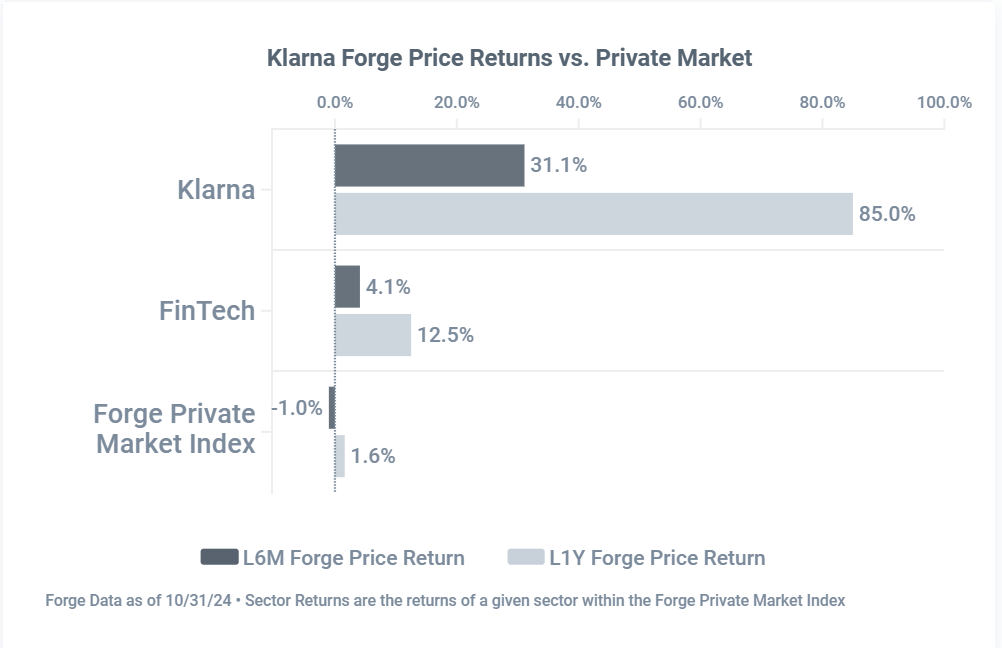

Klarna's forge price is $370, usually calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, and indications of interest (IOIs) on Forge, a venture-backed, late-stage company. The chart above outperformed both the Forge Private Market Index and the FinTech sector, which is the sector the company usually belongs to. All data includes performance over the past twelve months, reflecting potential growth in upcoming days.

Klarna uses AI tools to enhance its customer services and help retailers improve customer interaction. It's a very positive policy from the company that reflects growth potentiality and adaptability capacity. Klarna has partnerships with many major platforms, including Lightspeed, Adobe Commerce, Verifone, BigCommerce, Salesforce Commerce Cloud, Bold Commerce, Stripe, and Citcon. These partnerships give boosts to expand the company's reach to many customers.

B. Weaknesses & Risks

Klarna IPO has some issues related to regional and structural challenges, which the CEO marked as a “tech brain drain” in Europe is a notable concern. In Europe, company compensation is less attractive than in the United States. For instance, company employees in Europe own a 10% stake, whereas in the United States, it stands at approx—20%, so the benefits are lucrative and accessible in the U.S.

When expanding into the United States, Klarna faces competitive pressure from established players such as Affirm and Afterpay. Keeping an edge through this competition will be challenging for the company to overcome. Again, when expanding to markets like Asia or South America, the company will face unpredictable challenges, as it is facing in Europe and the United States.

Although the company overcame operation costs through AI tools, credit loss recovery is still alarming for the company to grow sustainably in the upcoming years. However, despite these obstacles, Klarna focuses on going public through an IPO and strategically navigating these issues.

IV. Klarna IPO Details

A. Klarna IPO Date

There is no exact date for Klarna's IPO at the time of writing, but many suggestions suggest it could occur as soon as Q1 2025. Karna plans to list on the U.S. exchange in New York. The IPO has sparked investors' attention due to the company's recent development, performance, and attractive service offerings. The company offers profitable services for individual users and retailers through its BNPL dominance.

B. Klarna Valuation

The valuation soared to $45.6 billion in 2021, driven mainly by rapid expansion in the United States and the dominance of the BNPL space. However, it declined by $6.7 billion in 2022 due to funding challenges and microeconomic pressures. However, the profitability in Q2 2023 sparked investors' attention again as Klarna hinted at a potential IPO and renowned confidence. The estimated valuation for Klarna's IPO is around $20 billion, whereas the latest report reveals the valuation amount is $14.6, yet the amount is nearly one-third of the 2021 peak of $45.6 billion.

Major Funding Rounds & Total Funding

Klarna has raised $4.19B in funding from 21 rounds and $800M from the les\test round held on 11 July 2022. The company currently has 131 investors from many regions

Let's check all funding rounds and details at a glance:

|

Funding Date |

Funding Round |

Funding Amount |

Investors |

|

11 July 2022 |

Series H |

$800M |

Sequoia Capital, Silver Lake, Mubadala, CommBank, CPP Investments, Bestseller Group, Adit Ventures, WestCap, Founders |

|

10 June 2021 |

Series H |

$639M |

SoftBank Vision Fund, Adit Ventures, WestCap, Sequoia Capital, Silver Lake, Permira, Dragoneer Investment Group, Honeycomb Investment Trust |

|

20 May 2021 |

Series H |

$6M |

Mindrock Capital, Grigory Trubkin |

|

29 March 2021 |

Series H |

$14.5M |

Wallenstam |

|

1 March 2021 |

Series H |

$1B |

Macy's, Sequoia Capital, BlackRock, Visa, Silver Lake, Ant Group, TCV, Snoop Dogg |

|

6 October 2020 |

Series G |

Undisclosed |

Macy's |

|

15 September 2020 |

Series G |

$650M |

Silver Lake, BlackRock, HMI Capital Management, Ant Group, BESTSELLER, CommBank, Permira, Dragoneer Investment Group, Sequoia Capital, GIC |

|

4 March 2020 |

Series F |

Undisclosed |

Ant Group |

|

30 January 2020 |

Series F |

$200M |

CommBank |

|

6 August 2019 |

Series F |

$460M |

Dragoneer Investment Group, CommBank, HMI Capital Management, BlackRock, Merian Global Investors, Första AP-fonden, IPGL |

|

1 June 2019 |

Grant (prize money) |

$56K |

European Union |

|

1 April 2019 |

Series E |

$100M |

- |

|

17 January 2019 |

Angel |

Undisclosed |

Snoop Dogg |

|

8 October 2018 |

Series E |

$20.1M |

H&M Group Ventures |

|

21 July 2017 |

Series E |

Undisclosed |

Permira |

|

7 March 2017 |

Series E |

$5.11M |

Creandum, Permira |

|

27 June 2016 |

Conventional Debt |

$35.3M |

- |

|

14 March 2014 |

Series E |

$125M |

Sequoia Capital, General Atlantic, Atomico, IVP |

|

8 December 2011 |

Series D |

$155M |

General Atlantic, DST Global |

|

5 May 2010 |

Series B |

$9.54M |

Sequoia Capital |

|

30 March 2010 |

Series A |

$2.2M |

Öresund |

C. Share Structure & Analyst Opinions

There has yet to be an official report on Klarna's IPO that contains details like share price, share numbers, etc. The company has many partners or investors, including Sequoia Capital, Silver Lake Partners, and SoftBank Vision Fund. However, as the expected valuation is $20 billion, the share numbers and valuation must be equivalent.

There is no official analysis report on Klarna's IPO analysis. Still, many financial experts reckon this IPO is a potential investment that highlights several company strengths, including rapid expansion, adapting capabilities, growth potential, performance, and progress in recent years.

V. How to Invest in Klarna IPO & Klarna Stock

Where to Buy Klarna IPO Shares

At the initial step, investors must check on the IPO release platform when they decide to participate in an IPO. FinTech magazine reveals that Goldman Sachs would be a leading bank offering Klarna an IPO. So, investors must sign up with Goldman Sachs or other financial institutes, including banks, brokerages, or financial institutes and validate their account to enable full investment features.

Klarna IPO Trading Strategies

Once Klarna's stock becomes publicly available, investors can implement several approaches to optimize returns:

- Momentum Trading: Leverage market enthusiasm and initial investor sentiment by tracking rapid price changes shortly after the IPO. High interest in Klarna's fintech dominance could drive volatility, presenting short-term profit opportunities.

- Short-Term Trading: Engage in day trading or swing trading to benefit from potential price oscillations during Klarna's early trading days as market dynamics stabilize post-listing.

- Long-Term Holding: Given Klarna's strong market position in Buy Now, Pay Later (BNPL), technological advancements, and expansion into emerging regions, holding its stock may offer substantial long-term growth potential as its global reach deepens.

Ways to Trade Klarna Stock

- ETFs: Gain indirect exposure to Klarna by investing in exchange-traded funds centered on fintech, e-commerce, or digital payment sectors. This strategy provides diversification and mitigates individual stock risk.

- Options Trading: Utilize options contracts to secure pricing for future trades. This method can help manage risk effectively while benefiting from post-IPO price volatility.

- CFD Trading: Explore Contracts for Difference (CFDs) for speculative trading. These allow you to capitalize on Klarna stock price movements without owning the stock. CFD platforms like VSTAR enable investors to take long or short positions, adding flexibility for varying market conditions.

Investors should consider their risk tolerance and financial objectives when choosing a strategy and stay informed about Karna's financial performance and broader industry trends.