Discord first proposed an IPO plan in March 2021. The company is IPOing to capitalize on its rapid growth and expanding user base, which has surged due to its popularity among gamers and the broader online community. The IPO is generating significant interest due to Discord's strong financial performance, unique positioning in the market as a versatile communication platform, and potential for further growth and innovation. Investors are eager to be part of Discord's future, anticipating that its 2024-2025 IPO will enhance its ability to expand services, improve infrastructure, and strengthen its market presence.

I. What is Discord

When did Discord come out

Discord operates in the digital communication industry, specifically focusing on online community engagement. It was founded in 2015 by Jason Citron and Stan Vishnevskiy. The company is headquartered in San Francisco, California.

Source: discord.com/company

How does Discord make money

Discord's business model revolves around a freemium approach. It offers core services like text, voice, and video communication for free, allowing users to create and manage servers at no cost. The platform generates revenue through its premium subscription service, Discord Nitro, which offers enhanced features such as custom emojis, higher upload limits, and improved video quality. Additionally, Discord monetizes through server boosts, enabling users to upgrade server capabilities, and by facilitating ticketed events and member subscriptions, charging a 10% fee on transactions. It currently holds 150 Million monthly active users on 19 Million active servers per week with 4 Billion server conversation minutes daily.

Source: tickernerd.com

Key Customers

Initially targeting gamers, Discord has expanded its user base to include various communities, including educational groups, hobbyist circles, and professional teams. This diverse user base underscores Discord's versatility and appeal beyond gaming.

Who Owns Discord

Discord is privately held, with significant investments from venture capital firms and strategic investors. Notable investors include ARK Venture Fund, Sony Interactive Entertainment, Fidelity Management and Research Company, Tencent, and Greylock Partners.

II. Discord Financials

Discord Revenue Growth and Profitability

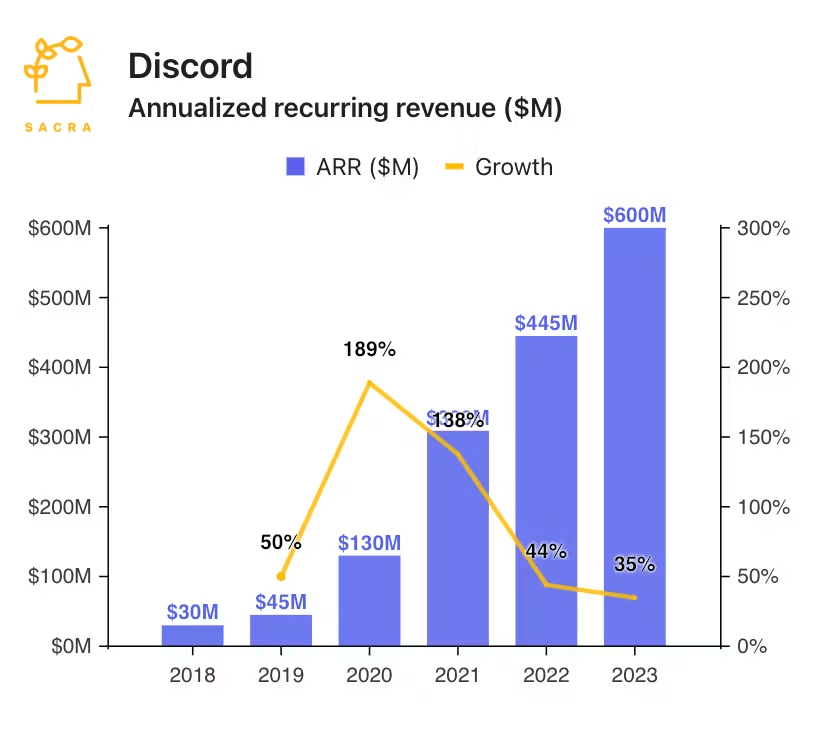

Discord has demonstrated impressive revenue growth over recent years, driven predominantly by its subscription-based revenue model. In 2023, Discord reported $575 million in revenue, marking a 29.2% increase from the $445 million generated in 2022. This growth trajectory underscores the success of Discord's monetization strategies, particularly its Nitro subscription service.

Source: businessofapps.com

Discord's core revenue driver is its Nitro subscription service, which contributes almost entirely to its revenue. Nitro, which offers premium features like enhanced customization, higher-quality video streaming, and increased upload limits, costs between $3 and $10 per month. This service is designed to appeal to both individual users and server owners. The concept of server boosting, where users can contribute to enhancing their favorite servers' functionalities, complements Nitro's subscription model and incentivizes continued user engagement and investment in the platform. In 2023, Discord marked $600M in annually recurring revenue (ARR). This is growing 35% year-over-year.

Source: sacra.com

Despite this robust revenue growth, Discord's profitability remains less clear. With a low average revenue per user (ARPU) of $2.54 compared to giants like Facebook ($45) or Instagram ($35), Discord's business model differs significantly from traditional ad-supported platforms. Instead of generating revenue through targeted ads, Discord relies on user subscriptions and server boosts. This model allows Discord to avoid the pressures associated with ad-based revenue models, such as content moderation influenced by advertisers.

Key Financial Metrics

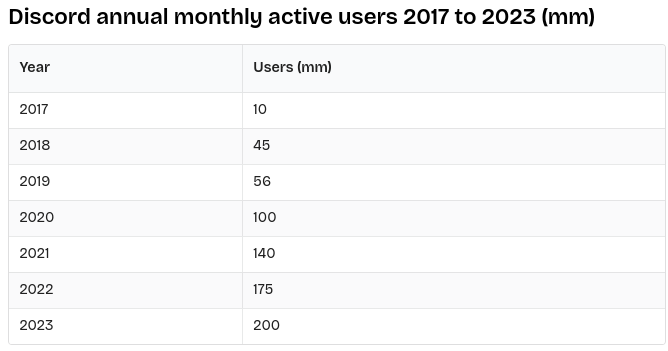

As of 2023, Discord boasts 200 million monthly active users (MAUs), representing a 14.2% increase from 175 million in 2022. This growth is indicative of a robust user engagement strategy and the platform's appeal to a broad audience. Discord's total registered user base reached 560 million in 2023, with 85 million new registrations added during the year.

Source: businessofapps.com

User engagement metrics are also positive. Discord's active servers, a unique feature compared to other messaging platforms, reached 21 million in 2023. This growth in active servers highlights the platform's ability to attract and retain large communities, contributing to its strong user engagement.

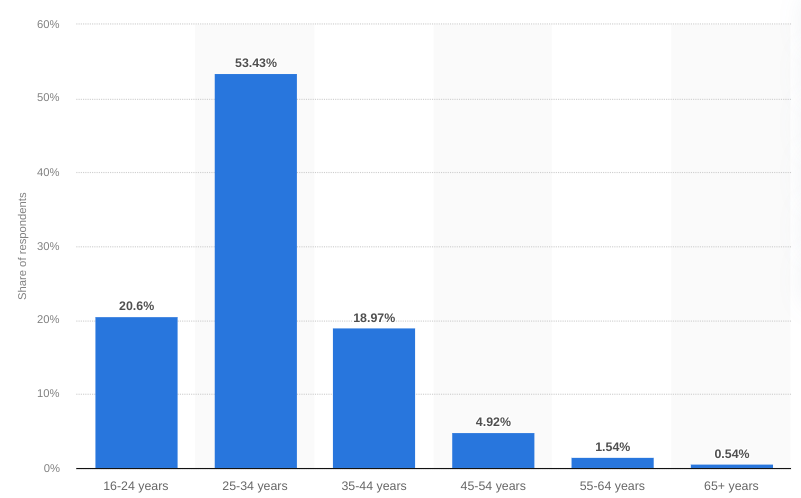

The age demographic of Discord users reveals a predominantly adult user base, with 53.4% between 25 and 34 years old. This demographic distribution suggests that Discord has successfully expanded beyond its initial gaming-focused audience to capture a broader user base. In the first quarter of 2022, over 66% of Discord users were male, but the platform's appeal has increasingly diversified since then.

[Distribution of Discord.com users worldwide as of February 2024, by age group]

Source: statista.com

Market Share and Competitive Position

Discord's market share in the communication and social networking industry is significant. It is estimated to hold a 25.65% market share, ranking second in its category, according to 6sense.com. This position is a testament to its strong presence and competitive edge in the market.

Discord Competitors

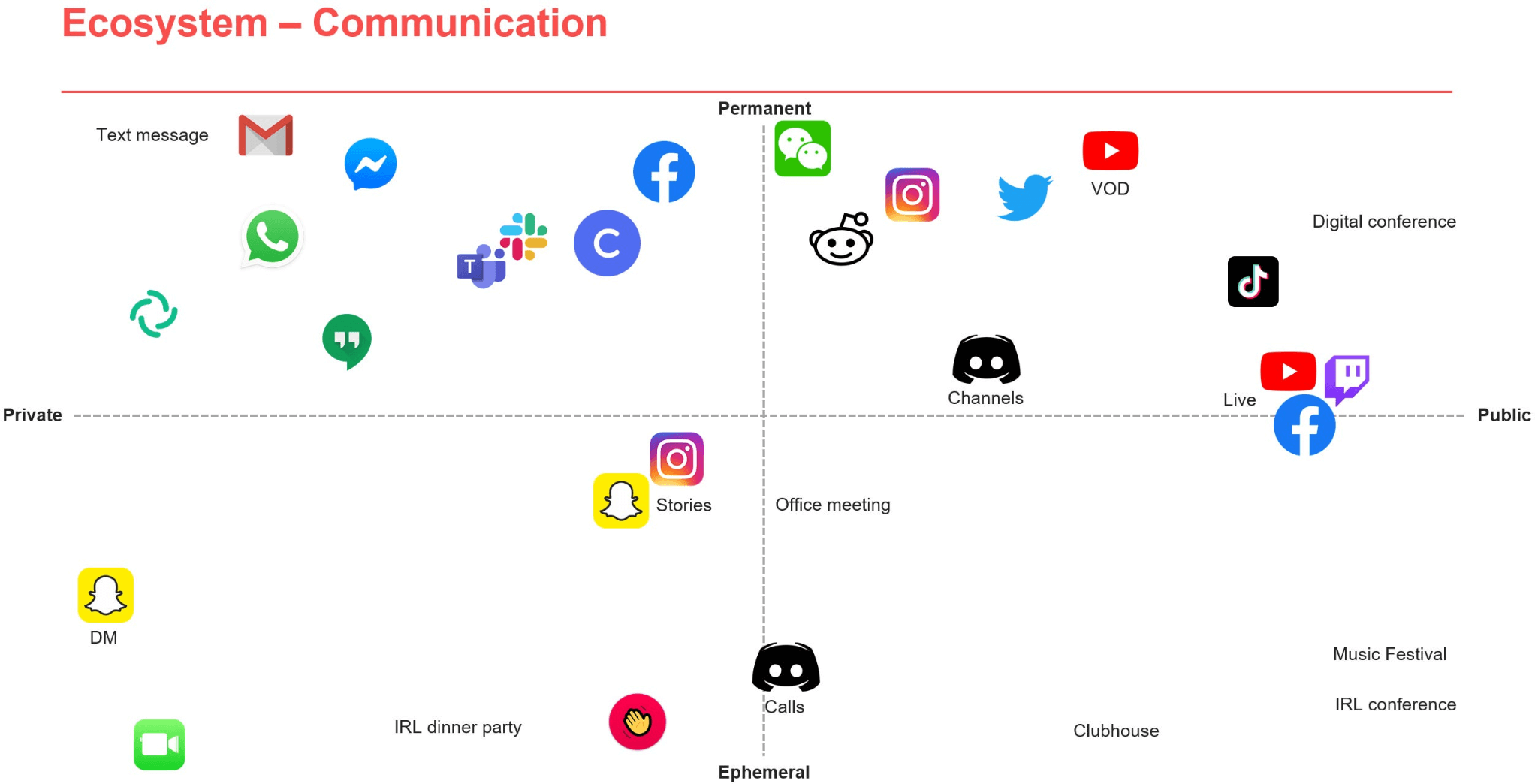

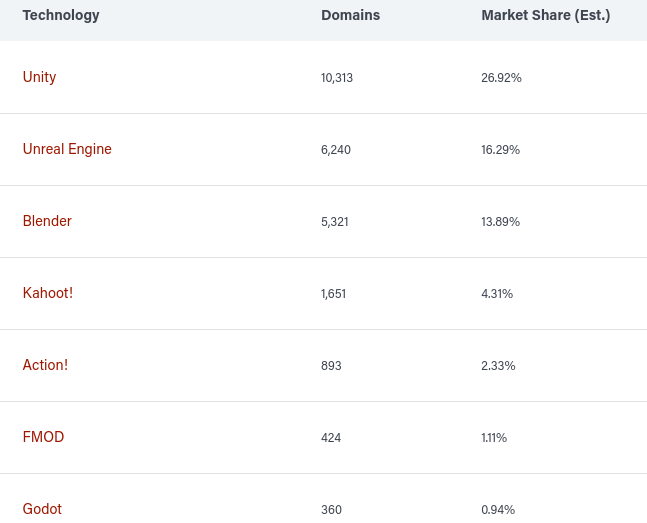

Discord's primary competitors include platforms like Slack, Teams, and various gaming-focused communication tools. In the context of game development and communication tools, Discord's primary competitors are Unity (26.92% market share), Unreal Engine (16.29%), and Blender (13.89%). While Discord is not directly comparable to these tools, its role in the gaming community and its communication features place it in a competitive position against these platforms.

Source: 6sense.com

Discord's strategy of offering free core services while charging for premium features has proven effective. The platform's freemium model attracts a large user base, and the monetization through Nitro subscriptions and server boosts provides a scalable revenue model. Additionally, recent moves to allow creators to monetize their servers through ticketed events and member subscriptions reflect Discord's adaptability and focus on enhancing its revenue streams.

III. Discord IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

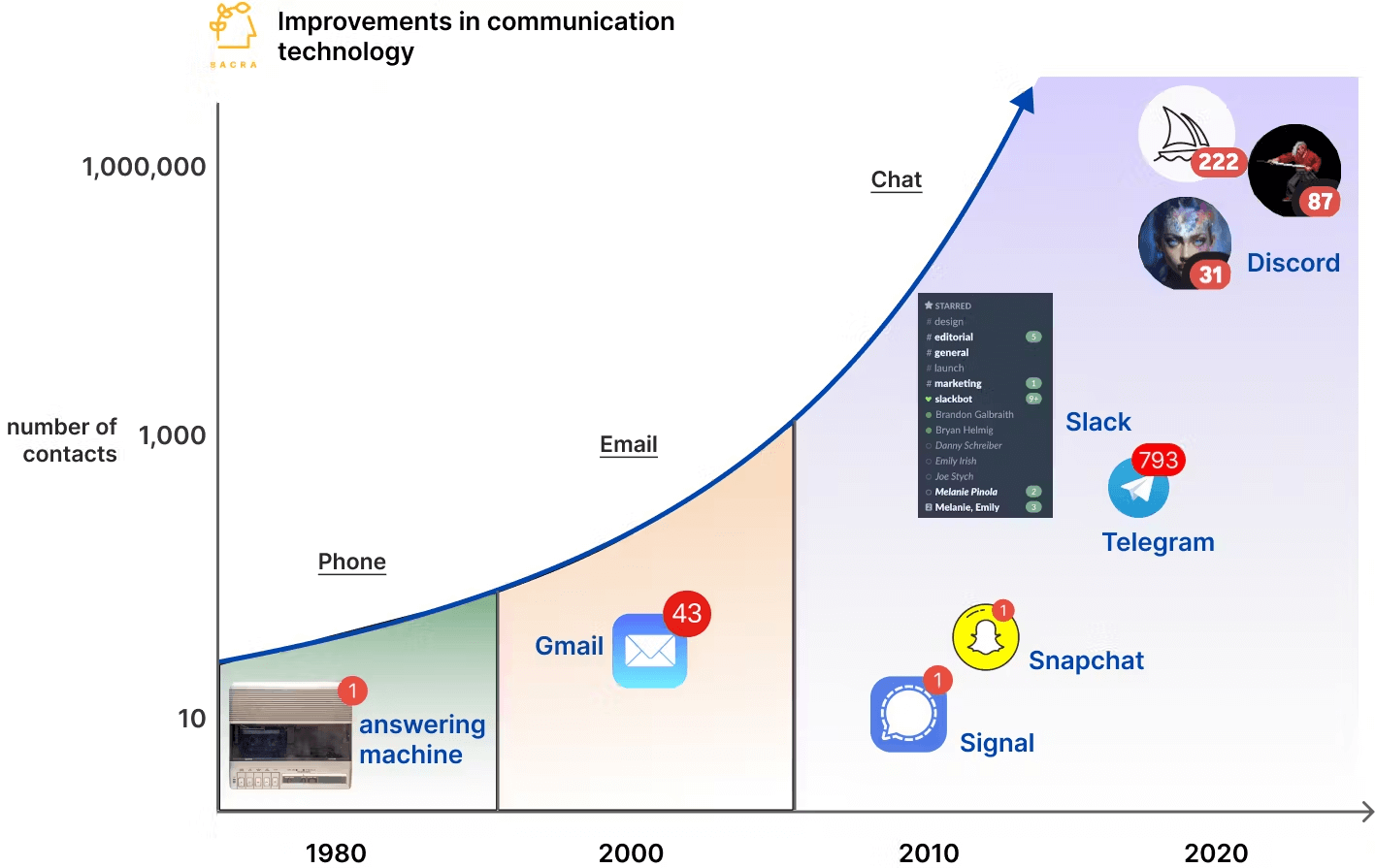

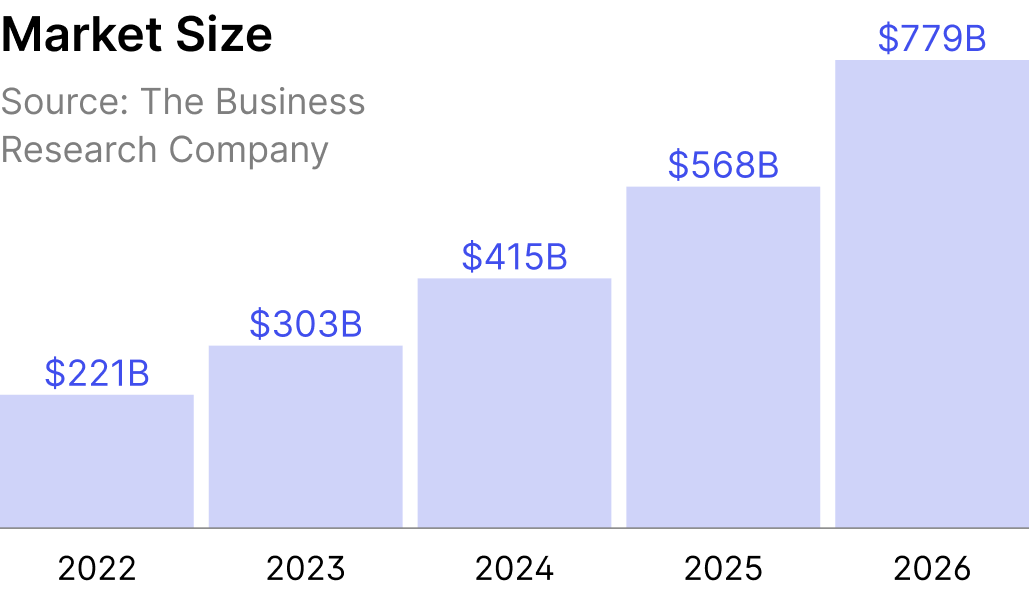

The total addressable market (TAM) for online communication platforms is vast. In 2010, the Internet had about 2 billion users, with only 17% participating in online communities. By 2024, the number of online users has increased to approximately 5 billion, with 76% engaging in online communities. This suggests a substantial market for platforms like Discord, which has captured a growing share of the market despite its relatively low penetration compared to giants like Facebook.

Source: sacra.com

Additionally, Discord has experienced substantial user growth, reaching 150 million monthly active users (MAUs) as of 2022. This represents a significant increase from earlier figures, indicating strong engagement. In comparison, Telegram reported around 700 million MAUs by the end of 2022, but Discord's user base is notably engaged with its core functionalities, including chat, voice, and video capabilities.

Discord's revenue model is primarily subscription-based, with its Nitro service driving significant income. In 2022, Discord generated approximately $445 million in revenue. This represents a notable revenue scale compared to Telegram, which reported less than $10 million in revenue. Discord's Nitro subscription is priced at $9.99 per month or $99.99 annually, providing enhanced features to users. The company is also exploring additional revenue streams such as advertising and microtransactions, which could further boost its revenue.

Further, Discord's revenue growth has been robust, with a compound annual growth rate (CAGR) of approximately 30% over the past three years. This contrasts with Telegram's slower monetization pace, despite its larger user base. Discord's revenue per user is significantly higher, showcasing its effectiveness in monetizing its user base through subscriptions and premium services.

Discord has a clear path for growth given the increasing global internet population and the rising popularity of online communities. The potential market size for communication platforms remains large, with Discord's user base and revenue still expanding.

Source: dizraptor.app

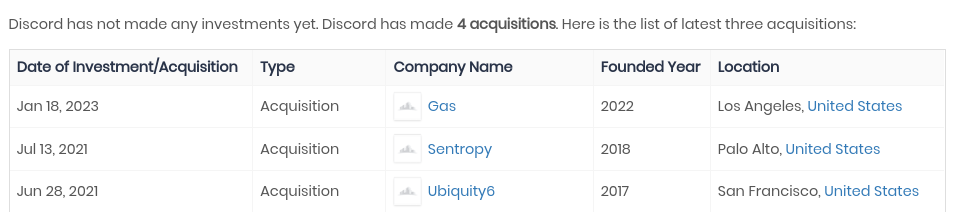

The company is well-positioned to capture a significant share of this market, particularly as it explores new monetization strategies. As of now, the company has executed 4 acquisitions to boost its market lead.

Source: tracxn.com

Moreover, Discord's expansion into AI and its focus on niche communities could further enhance its growth prospects. The integration of AI tools and partnerships with various platforms could drive new user acquisition and engagement. As Discord continues to innovate and diversify its revenue streams, it is likely to see continued growth.

B. Weaknesses & Risks

Competitive Pressure

Discord faces competition from established platforms like Slack, Teams, and Zoom, which have larger user bases and more mature revenue models. Slack's acquisition price of $27.7 billion and Teams' 300 million MAUs highlight the competitive intensity in the space. Discord must continuously innovate to maintain its competitive edge.

- Slack: Acquired by Salesforce for $27.7 billion in 2021, Slack reported over 2.3 million daily active users (DAUs) shortly after its launch, with a per-seat pricing model of $7 per user per month.

- Microsoft Teams: Part of the Microsoft 365 suite, Teams has seen rapid adoption, with over 300 million monthly active users as of early 2024.

- Zoom: Known for its video conferencing capabilities, Zoom reported over 300 million daily meeting participants in 2024.

Despite its strong user engagement, Discord's revenue per user is relatively low compared to competitors. For example, Slack's revenue model generates significant income per user, driven by its per-seat pricing. Discord must find ways to enhance its monetization strategies to match the revenue potential of its competitors.

Dependence on Trends: Discord's reliance on trends such as gaming and crypto can be a double-edged sword. While these trends have fueled growth, shifts in user preferences or market dynamics could impact Discord's relevance.

IV. Discord IPO Details

A. Discord IPO Date

As of mid-2024, Discord has not yet announced a specific date for its Initial Public Offering (IPO). While there has been significant speculation regarding a potential IPO, the company remains privately held. Market conditions and internal strategic decisions have influenced the timing of this event, with current forecasts suggesting that if an IPO does occur, it may not happen until late 2024 or even 2025.

B. Discord Valuation

Estimated Valuation Range for the IPO

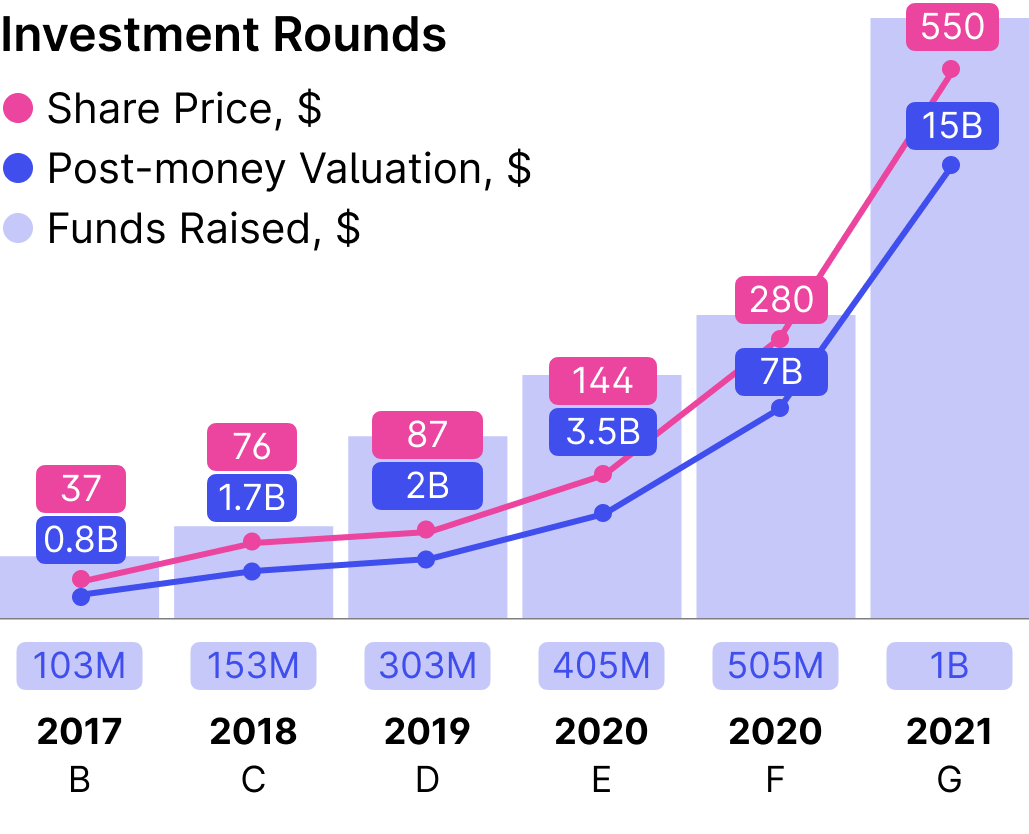

Discord's most recent valuation stands at $15 billion as of 2021. This valuation was achieved during a funding round led by Dragoneer Investment Group. Given the company's growth trajectory and market conditions, estimates for an IPO valuation range between $15 billion to $20 billion. However, this is contingent on several factors, including market sentiment and financial performance at the time of the IPO. The current secondary market price is around $9.7B valuation and provides a 36% discount to the last round. Back in 2021 Discord rejected a $12B purchase offer from Microsoft, focusing on its own growth and the potential entry into the stock market at some point. It is valued at a 25x multiple on current revenue based on last valued at $15.2B.

Major Funding Rounds & Total Funding

Since November 2013, Discord has undergone several major funding rounds (over 11 rounds), with total funding nearing $1 billion ($922 million). Key funding rounds include:

- May 2021: Funding amount undisclosed. This round involved Sony as a key investor.

- September 2021: $500 million, post-money valuation at $15 billion. Major investors included Dragoneer Investment Group, Baillie Gifford, Coatue, Fidelity Investments, and Franklin Templeton India.

- March 2022: Funding amount undisclosed. Investors included Flat Capital and Dragoneer Investment Group.

Source: dizraptor.app

Cumulatively, Discord's funding history shows substantial growth:

- 2012: $1 million

- 2013: $9 million

- 2016: $29 million

- 2017: $80 million

- 2018: $280 million

- 2020: $480 million

- 2021: $980 million

This funding has enabled Discord to expand its platform and enhance its offerings significantly.

C. Share Structure & Analyst Opinions

Number of Shares to be Offered & Pricing of Shares

Details about the number of shares to be offered and their pricing have not been publicly disclosed yet. Typically, such information is revealed closer to the IPO date in the company's prospectus (S-1 filing). Market expectations suggest that Discord's IPO could follow the footsteps of other high-profile tech companies, offering a significant portion of shares to raise substantial capital while retaining considerable control within the company.

Analyst Perspectives and Ratings

Analyst opinions on Discord's potential IPO are generally positive, given the company's robust user base and revenue growth. Analysts emphasize Discord's unique market position and strong community engagement as key strengths. However, they also highlight potential risks such as market competition and the need for sustainable monetization strategies. Discord's ability to diversify its revenue streams without compromising user experience will be crucial.

V. How to Trade Discord IPO & Discord Stock

Getting Discord IPO Shares

To acquire Discord IPO shares, you first need to open an account with a brokerage that participates in IPOs. Ensure you meet any minimum investment requirements and express interest in the IPO through your broker. Allocations are often limited and based on demand, so being an active investor can improve your chances. Subscription details, such as pricing and the number of shares offered, are disclosed in the company's prospectus closer to the IPO date.

Discord IPO Trading Strategies

- Pre-IPO: Research Discord's financials, market position, and growth prospects. Review the IPO prospectus for detailed information on share pricing and allocation. Consider market conditions and compare with similar tech IPOs for potential performance insights.

- Post-IPO: Monitor early trading volumes and Discord stock price movements. Initial volatility is common, so strategies like setting limit orders or waiting for stabilization may be prudent. Analyze long-term prospects based on post-IPO financial performance and market reception.

Ways to Trade Discord Stock

- ETFs (Exchange-Traded Funds): If available, ETFs holding Discord stock offer diversified exposure to its performance along with other tech stocks.

- Options: Provides strategies for hedging or speculating on Discord stock price movements, such as call or put options depending on market outlook.

- CFDs (Contracts for Difference): Allows trading on price movements without owning shares. Offers flexibility in trading long or short positions, with leverage options.

- VSTAR Platform: Trade Discord stock along with other assets like FX, indices, and commodities. VSTAR offers low trading fees, deep liquidity, and a user-friendly interface. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) and provides access to a wide range of financial instruments with features beneficial for both novice and experienced traders.