Databricks first proposed an IPO plan in February 2022. The decision to IPO stems from its ambition to raise capital for expansion, enhance brand visibility, and provide liquidity to early investors and employees. Databricks' IPO, expected in 2024, has garnered substantial interest due to its leading role in the data analytics and AI sectors, driven by its open-source platform and cloud-based solutions, which are increasingly vital in modern data-driven enterprises. The street is attracted by its strong growth potential in data management and AI applications across various industries.

I. What is Databricks

Databricks is a company operating in the data analytics and artificial intelligence (AI) space, specializing in unified data analytics solutions. It was founded in 2013 by Ali Ghodsi, Andy Konwinski, Ion Stoica, Matei Zaharia, Patrick Wendell, and Reynold Xin. The company is headquartered in San Francisco, California, USA.

What does Databricks do

Databricks provides a unified analytics platform that supports data engineering, data science, and machine learning (ML) tasks.

Source: gartner.com

The platform is built on Apache Spark, an open-source distributed computing system, and extends its capabilities to offer a collaborative workspace where data teams can manage their entire data lifecycle—from data preparation and integration to model training and deployment. Databricks leads the Gartner Magic Quadrant 2024 ahead of Google and Microsoft.

Key components of Databricks' platform include:

- Databricks Workspace: A collaborative environment for data engineers, data scientists, and analysts to work together with shared notebooks and data sets.

- Databricks Runtime: Optimized runtime environments for Apache Spark that include enhancements and optimizations for performance and scalability.

- Databricks SQL Analytics: A service that allows users to run traditional SQL queries directly on data lakes, bridging the gap between data lakes and data warehouses.

- MLflow: An open-source platform for managing the ML lifecycle, enabling reproducibility, experimentation, and deployment of ML models.

- Delta Lake: An open-source storage layer that brings ACID transactions to data lakes, improving data reliability and enabling scalable data pipelines.

Key Customers

Databricks serves 599 major clients across various industries, including finance, healthcare, retail, technology, and more. These clients are distributed geographically. There are 265 major clients in North America, 12 in Middle East and Africa, 52 in LatAm, 142 in Europe and 77 in Asia Pacific. Some notable customers include AT&T, Block, Rivian, Walgreens, Mercedes-Benz, Shell, Siemens, Toyota, Warner Bros. Discovery. These organizations leverage Databricks' platform to process large volumes of data, derive insights, and build scalable AI applications.

Source: databricks.com

Who Owns Databricks

As of the latest information, Databricks remains a privately held company. Its ownership is primarily distributed among its founders, early investors, and employees. The company has raised significant funding rounds from venture capital firms and private equity investors, reflecting its strategic growth in the data analytics market. Major investors are BlackRock, CapitalG, TigerGlobal, Fidelity, Microsoft, and Andreessen Horowitz.

Source: databricks.com

II. Databricks Financials

Databricks Revenue Growth and Profitability

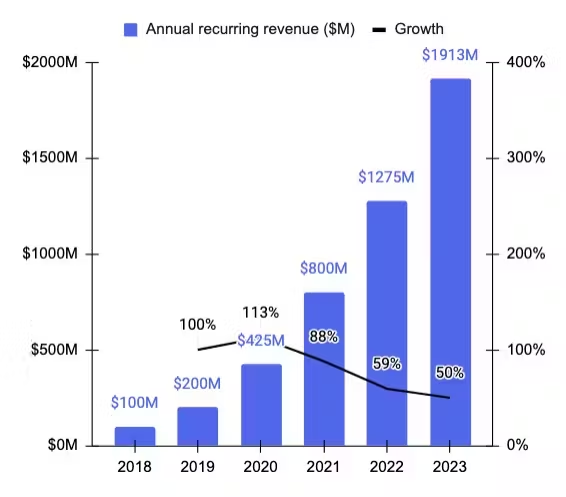

Databricks has demonstrated robust revenue growth, with a notable 50% increase to $1.6 billion in 2023, culminating in a valuation of approximately $43 billion after a $500 million capital raise. This growth is indicative of strong market demand for its data warehousing and analytics solutions, augmented by recent acquisitions like MosaicML, which enhance its AI capabilities. Databricks projects sales growth of above 60% to hit $2.4 billion in annualized revenue for H1 fiscal 2025.

Source: sacra.com

Profitability metrics reveal an impressive 80% gross margin on subscription products, underscoring its efficient monetization strategies despite substantial investments in AI research and development.

Key Financial Metrics

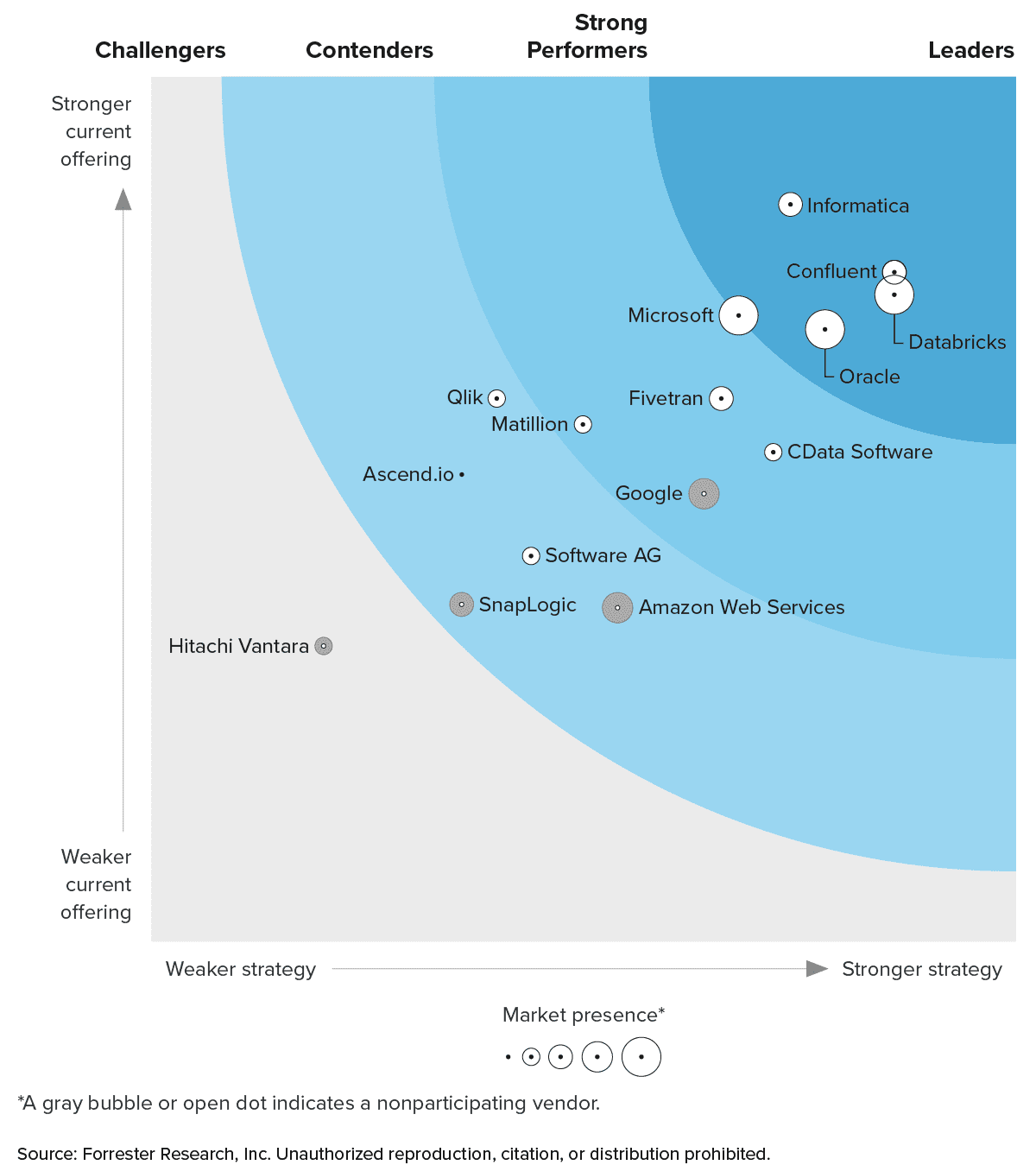

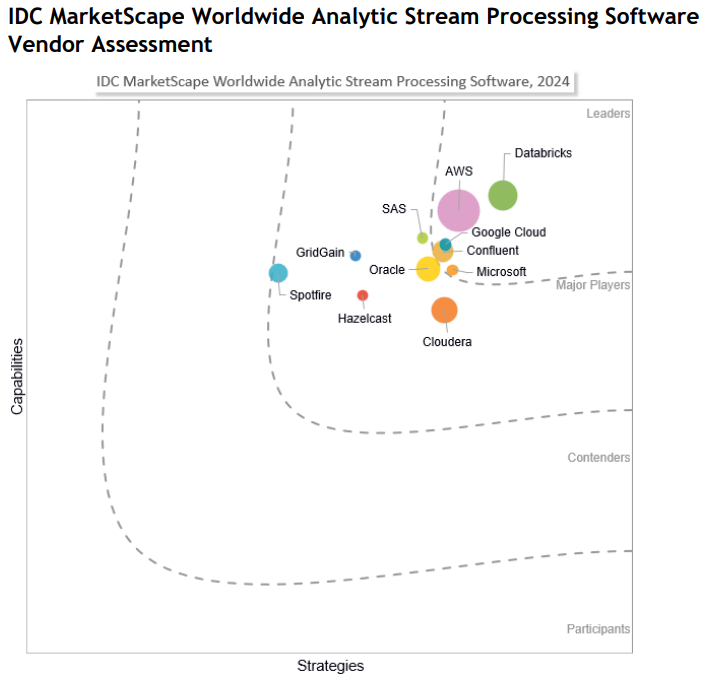

Customer Base and Growth: Databricks' ability to attract and retain enterprise clients is pivotal. The company’s data warehousing offerings hit $100 million in ARR during April 2024. The acquisition of MosaicML strengthens its AI and other offerings, allowing customers to customize AI models for data analysis, which likely contributes to client retention and top-line growth. For instance, under the Forrester Wave cloud data pipelines, Q4 2023 and IDC marketscape worldwide analytic stream processing software vendor assessment 2024, the company placed as a leader.

Source: forrester.com

Source: IDC MarketScape

As per IDC, the worldwide event stream processing market may hit a 30% CAGR from 2022 to 2027.

Customer Retention Rates: Databricks' emphasis on AI integration and customizable solutions suggests a strategic focus on enhancing customer retention. The introduction of DBRX, an open-source large language model, further incentivizes client engagement by enabling broader adaptation and innovation within customer environments.

Market Share: Databricks' valuation and strategic partnerships, including Nvidia's investment and collaborative efforts in AI model acceleration, underscore its market leadership ambitions.

III. Databricks IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

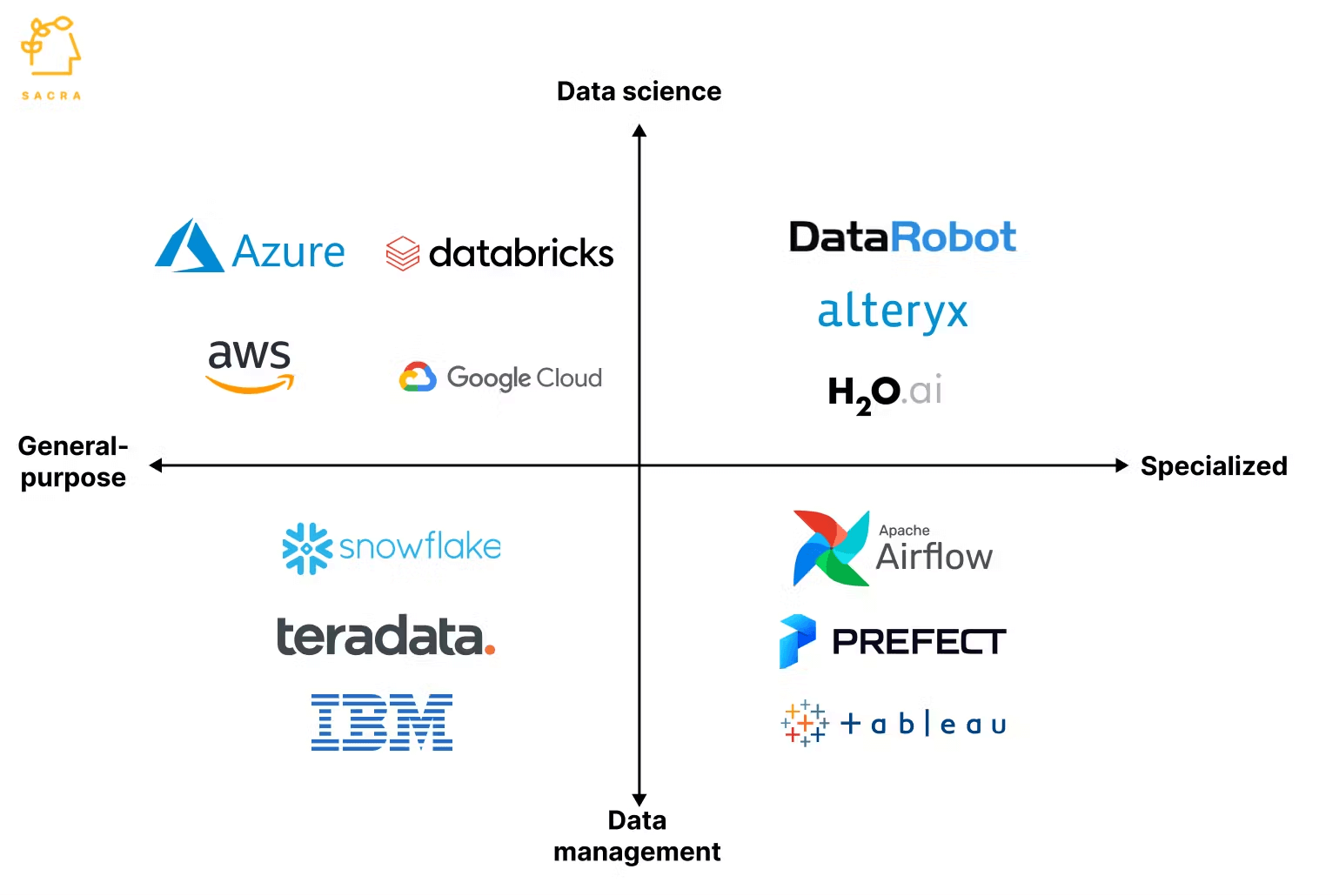

Databricks, poised for an IPO, operates in the intersection of data management and AI, a sector increasingly vital in the digital economy. Its primary competitors include Microsoft Azure, Amazon AWS, Snowflake and Google Cloud, each offering robust data warehousing and analytics solutions. Databricks differentiates itself through its Lakehouse architecture, which integrates the best of data lakes and warehouses, allowing for scalable data processing and analytics. The company's recent ventures into large language models (LLMs), particularly the open-source DBRX model, bolster its AI capabilities, potentially widening its market appeal beyond traditional data analytics.

Source: sacra.com

Databricks distinguishes itself with a comprehensive suite of tools encompassing data storage, security, organization, and advanced analytics, bolstered by proprietary AI advancements like DBRX. Unlike competitors with closed-source models, DBRX's open-source nature fosters collaboration and customization, potentially accelerating adoption and innovation across industries.

Future Growth Opportunities

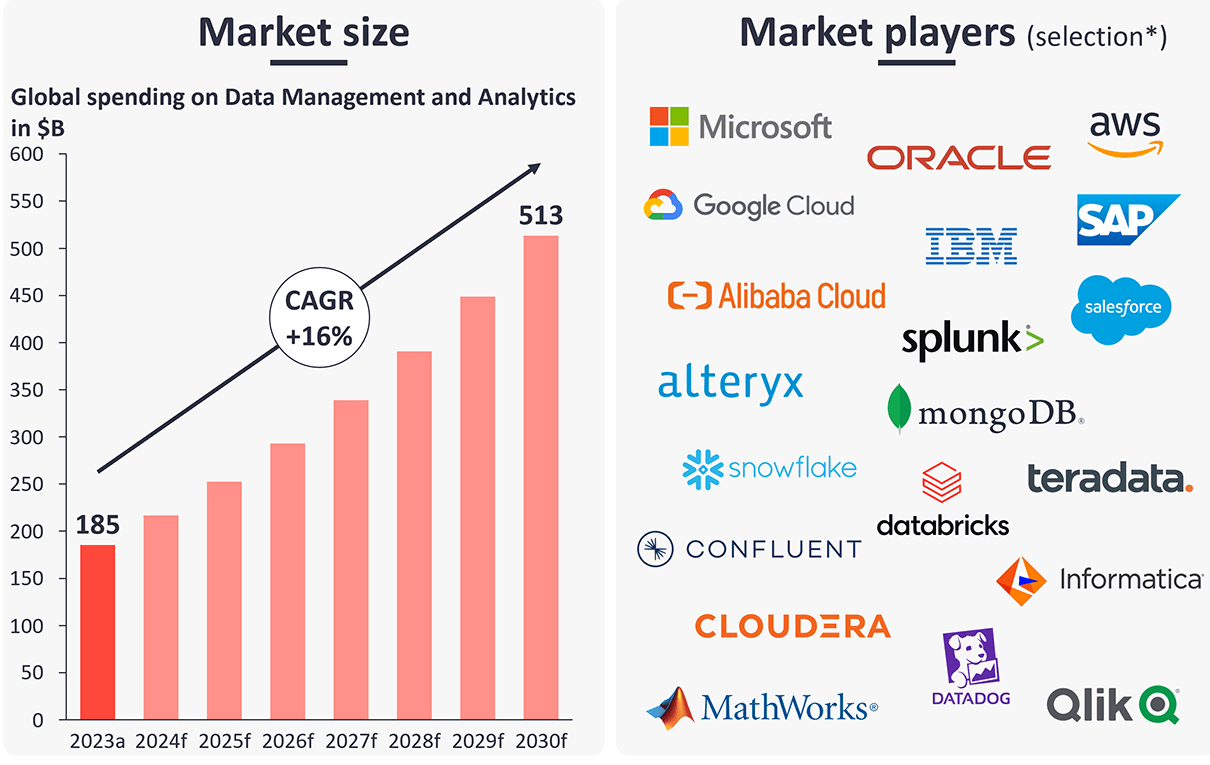

The AI-driven data analytics market is projected to expand significantly, driven by increasing data volumes and the demand for sophisticated AI solutions. As per futuremarketinsights.com, the AI analytics market may have a solid CAGR of 22.60% till 2034. Whereas, iot-analytics.com projects the CAGR to be 16% (2023-2030) to hit a market size of $513 billion by 2030. Databricks stands to benefit from this trend, leveraging its established market presence and technological advancements. The open-source nature of DBRX enhances its attractiveness, fostering community-driven innovation and potentially accelerating adoption among enterprises seeking customizable AI solutions. Strategic acquisitions, such as MosaicML, further enhance Databricks' AI capabilities, positioning it to capitalize on the growing demand for tailored AI applications in data management.

Source: iot-analytics.com

B. Weaknesses & Risks

While Databricks holds a strong market position and robust growth prospects, several risks and weaknesses merit consideration:

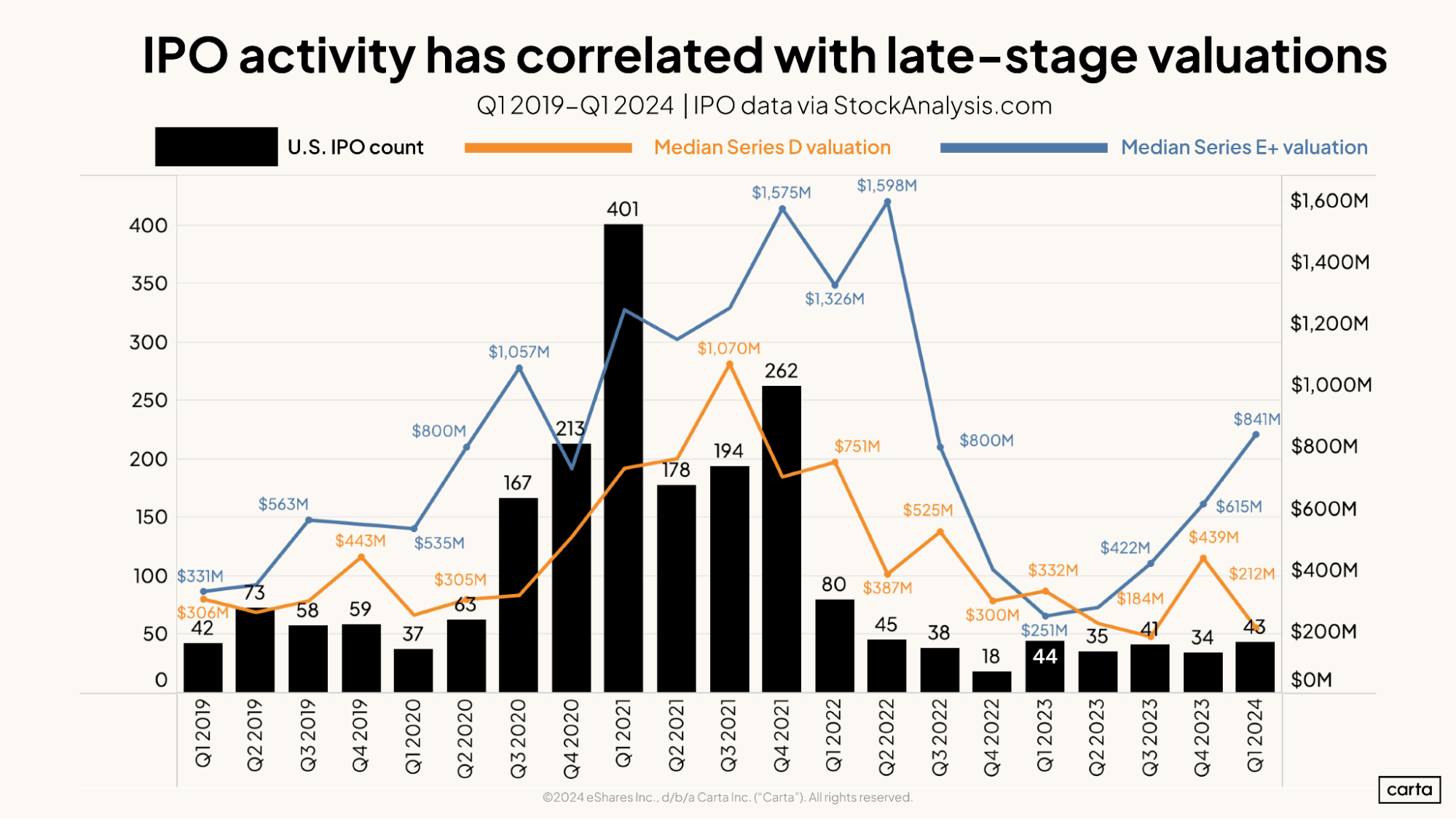

Market Volatility and Economic Conditions: The timing of Databricks' IPO amidst market fluctuations and economic uncertainties could impact investor sentiment and valuation expectations.

Source: carta.com

Competition and Technological Advancements: Intense competition from established players like Snowflake and Google Cloud, along with rapid technological advancements in AI and data analytics, pose challenges.

Execution Risks: Integrating acquisitions like MosaicML successfully and scaling operations to meet growing customer demands without compromising service quality could strain resources and impact profitability.

IV. Databricks IPO Details

A. Databricks IPO Date

While specific dates can vary due to market conditions and regulatory approvals, the expected timeline typically includes several key stages:

Filing: Databricks files its IPO prospectus (Form S-1) with the SEC, providing detailed financial information and plans.

Roadshow: The company conducts a roadshow where it presents its business to potential investors.

Databricks Pricing: Databricks and its underwriters determine the IPO price range based on investor feedback.

Trading debut: Shares begin trading on the chosen stock exchange, often the NASDAQ or NYSE.

For Databricks, these steps typically span several months from filing to trading commencement, with variations based on market conditions and regulatory processes.

B. Databricks Valuation

Company reports suggest Databricks could target a valuation over $43 billion and the price per share that exceeds $73.50, although this can change based on investor sentiment and market dynamics closer to the IPO date.

Source: databricks.com

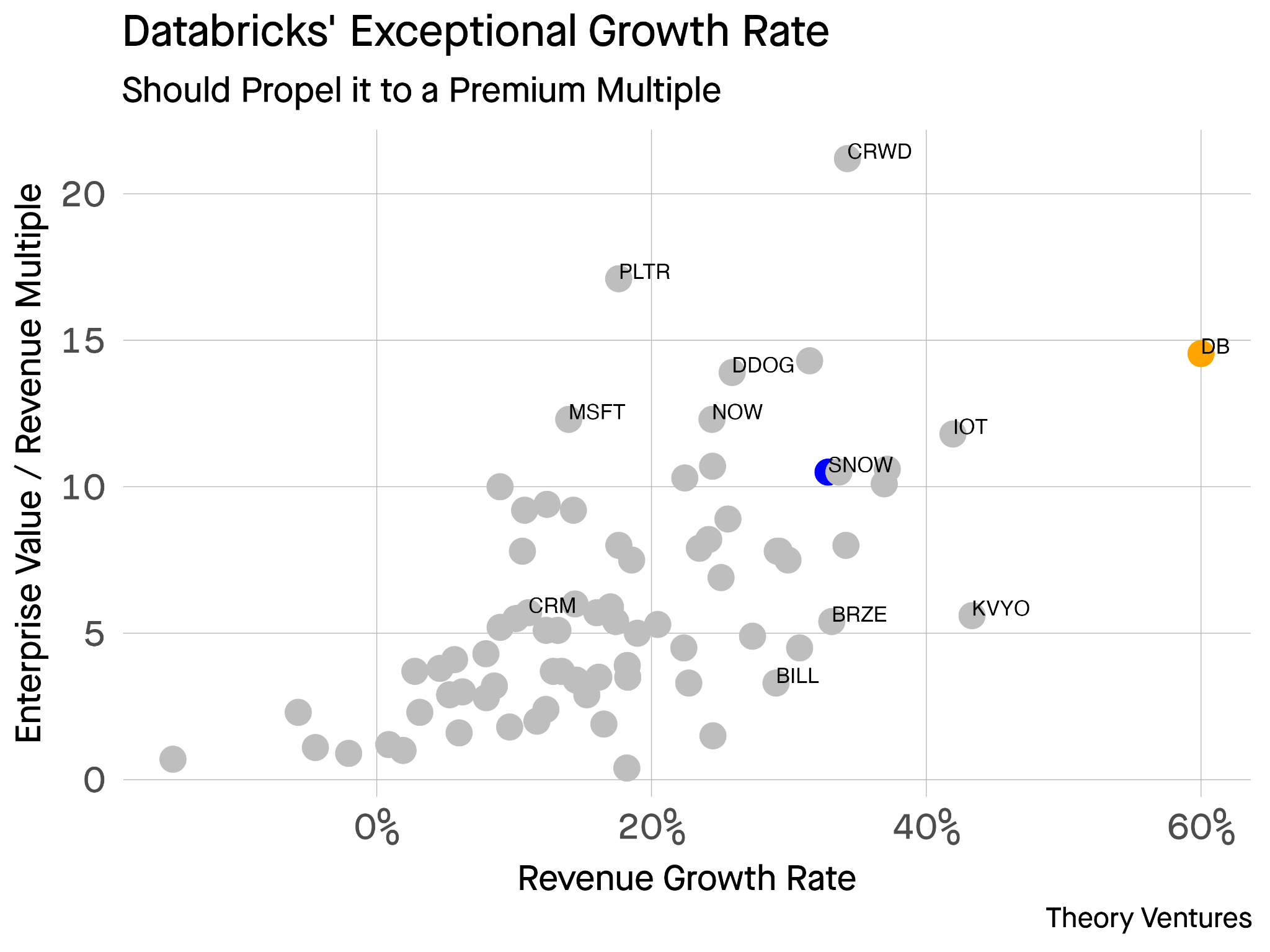

The IPO timing aligns strategically with favorable market conditions for AI-driven enterprises, despite broader economic fluctuations. Analysts project a valuation range between $32 billion (conservative) and $57 billion (optimistic), contingent on 2024 revenue forecasts and market reception. Factors influencing valuation include sustained revenue growth rates, competitive dynamics against peers like Snowflake, and market sentiment towards AI technologies.

C. Funding History and IPO Proceeds

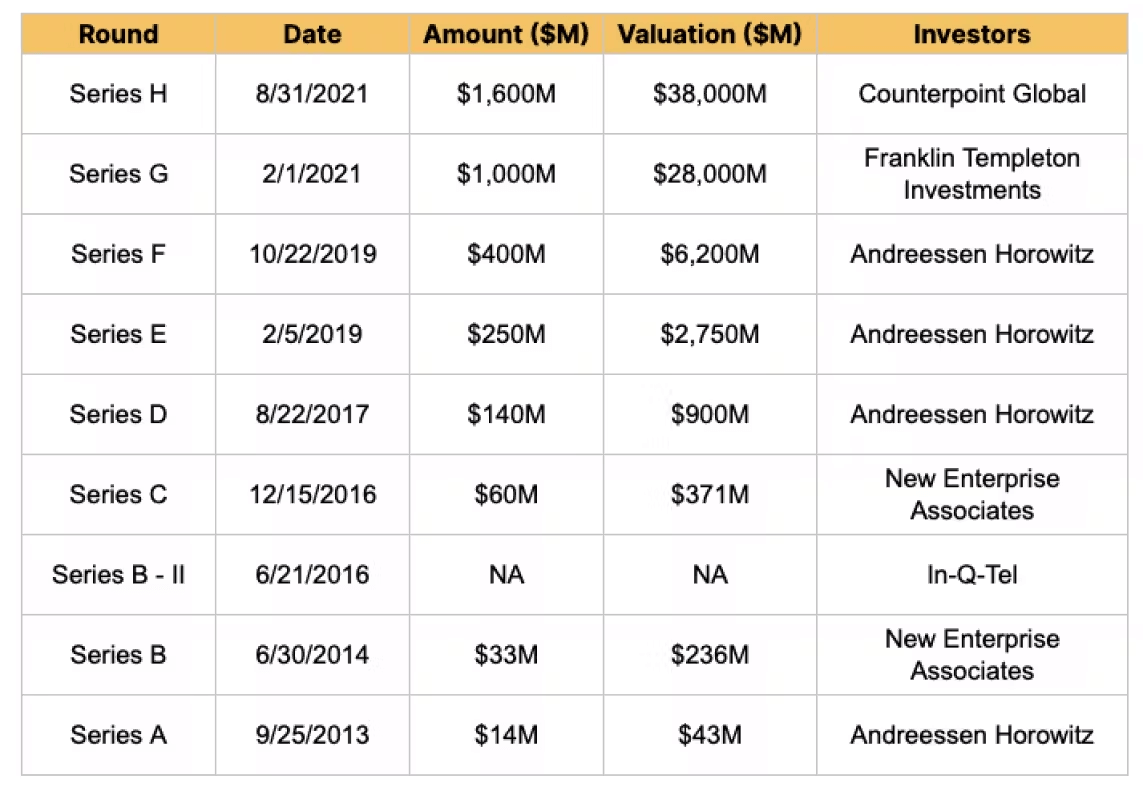

Databricks has raised substantial capital through various funding rounds. Notable funding rounds include:

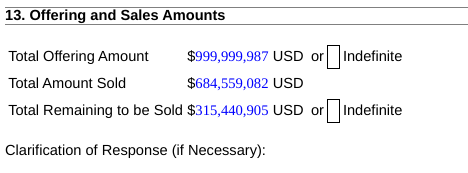

September 2023 saw Databricks' most recent private investor round. At a $43 billion value, $685 million was raised in the investment round.

Source: SEC fillings

Series H (2021): Raised $1.6 billion, valuing the company at $38 billion.

Total Funding: Cumulative funding exceeds $3 billion, with major investors including Andreessen Horowitz, Franklin Templeton, and others.

Expected IPO Proceeds: While the exact amount Databricks aims to raise in its IPO hasn't been disclosed, it's expected to further bolster its financial position to fund growth initiatives, potentially raising several billion dollars.

Source: sacra.com

D. Share Structure and Market Capitalization

Details on Databricks' share structure and IPO pricing will be outlined in its prospectus. Typically, the IPO involves issuing new shares and possibly some existing shares held by early investors or employees. The pricing per share will be determined based on investor demand and financial metrics disclosed during the roadshow. The expected market capitalization post-IPO would align with the valuation range mentioned earlier, reflecting market reception. Fundamentally, based on valuation multiples, at 15-20 EV/Sales ratio with $2.4 billion in sales the company can be valued at $36-48 billion as of now.

Source: tomtunguz.com

E. Analyst Opinions on Databricks IPO

Databricks has a strong market position in cloud-based data analytics, citing its robust customer base and innovative products. Concerns may include competitive pressures, dependency on cloud infrastructure providers, and potential market volatility affecting tech stocks.

The investment recommendation is‘Buy the stock’based on current valuation, growth prospects, and competitive analysis.

V. How to Trade Databricks IPO

Getting IPO Shares

To participate in the Databricks IPO and acquire shares, you typically need to follow these steps:

- Open an Account: Choose a brokerage platform that offers access to IPOs and open an account. Ensure your account is funded adequately for potential purchases.

- Submit Interest: Many brokers allow clients to indicate interest in upcoming IPOs. Make sure to submit your interest in Databricks shares.

- Allocation: If your broker allocates shares to you, you'll receive them at the IPO price before they start trading on the open market.

Short-Term CFD Trading vs. Long-Term Investing

Short-Term CFD Trading: Trading Databricks stock through Contracts for Difference (CFDs) with platforms like VSTAR offers several benefits:

- Leverage: Amplify your exposure with leverage, potentially increasing profits (but also risks).

- Flexibility: Trade on short notice and capitalize on Databricks stock price movements regardless of market direction.

- Cost Efficiency: Lower transaction costs compared to traditional stock trading.

Long-Term Investing: Investing in Databricks for the long term involves:

- Buy and Hold Strategy: Purchasing shares directly through an IPO or on the open market with the intention of holding for an extended period.

- Potential Growth: Benefit from potential long-term capital appreciation and dividends.

- Less Volatility Exposure: Compared to CFD trading, which can be more volatile due to leverage.

Benefits of Trading Databricks Stock CFD with VSTAR

- Institutional Level Trading Experience: VSTAR offers tight spreads and fast order execution, crucial for CFD trading.

- Regulated Platform: Being regulated by CySEC ensures adherence to European financial standards, offering security and transparency.

- Range of Markets: Access not only Databricks but also a wide range of other assets including currencies, indices, and commodities.

Other Ways to Participate

Aside from direct stock or CFD trading, investors can consider:

- ETFs: Exchange-traded funds that include Databricks among their holdings.

- Options: Derivative contracts that offer the right, but not the obligation, to buy Databricks shares at a predetermined price.

- Indirect Investment: Invest in funds or portfolios that hold Databricks shares.

- Participate in Secondary Markets: Buy shares once they start trading publicly.

- Follow Insiders and Institutions: Monitor buying or selling activity from company insiders or large institutional investors for potential insights.

FAQs

1. Is Databricks going to IPO?

Databricks is expected to go public, possibly in late 2024 or 2025, depending on market conditions.

2. Will Databricks go public on Reddit?

While Databricks has been discussed on Reddit, it will not go public on the platform. IPOs are typically conducted through stock exchanges.

3. What is Databricks IPO stock symbol?

The stock symbol for Databricks has not yet been announced.

4. What is the next big IPO?

Some of the anticipated big IPOs include Stripe, Cerebras, Discord, Shein, and Turo.